Asia Pacific Building Insulation Materials Market- Industry Overview, Size, Share, Growth Trends, Research Insights, and Forecast (2025–2032)

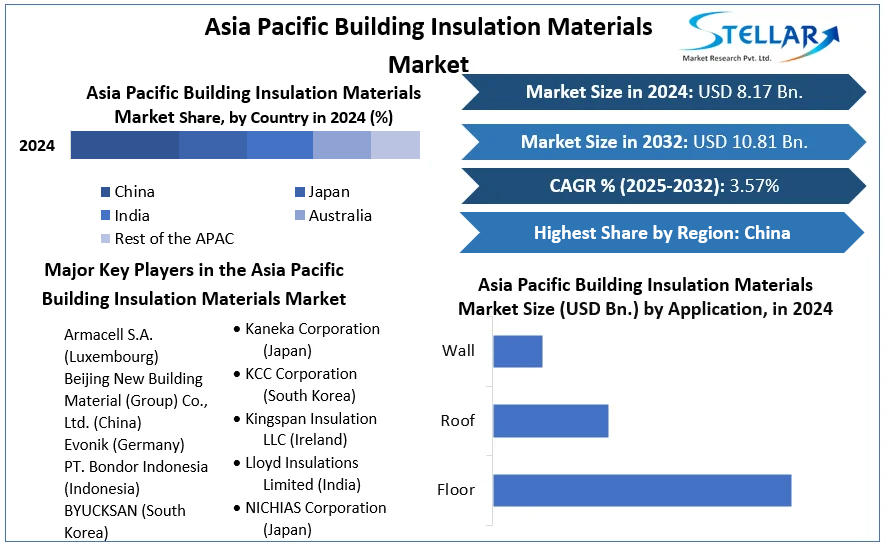

Asia Pacific Building Insulation Materials Market size was valued at US$ 8.17 Bn. in 2024 and the total revenue is expected to grow at CAGR of 3.57% through 2025 to 2032, reaching nearly US$ 10.81 Bn. by 2032.

Format : PDF | Report ID : SMR_1244

Asia Pacific Building Insulation Materials Market Definition

Building Insulation materials are used in the construction industry to prevent heat, electricity, or sound from passing through electrical appliances and building materials. The insulation materials market is essentially classified in three broad categories, including thermal insulation, electrical insulation, and heat insulation. The proper installation of high-quality insulation materials is the key to a successful insulation system. Insulation is an important technology for reducing energy usage and preventing heat gain/loss in buildings. It acts as a heat barrier and is necessary for keeping homes warm in the winter and cool in the summer. The appropriate level and type of insulation are influenced by the weather. The thermal conductivity of insulating materials is typically less than 0.1 W/mK. Insulation materials include polyurethane foam, mineral wool, polyethylene, polyvinyl chloride, expanded polystyrene, and extruded polystyrene. These materials exist solely to save energy while also protecting and providing comfort to occupants.

A structure serves as an environmental divider. It divides the inside from the outside. Residential insulation is a critical technique for lowering energy consumption in homes by limiting heat absorption and loss via the building envelope. Insulation materials used in residential construction include polyurethane foam and extruded polystyrene. Increased demand for thermal insulators in residential, non-residential, and industrial buildings has resulted from rising global temperatures and significant climatic changes over the last few decades, in order to save energy and provide comfort for inhabitants.

To get more Insights: Request Free Sample Report

Asia Pacific Building Insulation Materials Market Dynamics

Market Drivers

- Strong Economies and housing market in the region – Vietnam, South Korea, Indonesia, Japan, Thailand, Australia & New Zealand, India, China, and the Rest of Asia-Pacific are all included in the Asia-Pacific building insulation market growth analysis. In the medium- to long-term future, China's construction market is expected to expand significantly. The country's industry has seen significant sales growth, thanks to technological breakthroughs and increasing market circumstances. Furthermore, the sector provides foreign and domestic enterprises considerable growth prospects in terms of investment opportunities and product distribution. Improved economic conditions and the involvement of new firms are likely to outline creative market dynamics as new market trends emerge in China's building industry. India's building market, on the other hand, is expected to grow significantly in the following decade. The private sector's strong backing and consistent government help for infrastructural development, including residential and commercial buildings throughout the country, are largely responsible for the country's progress. As a result, these factors are expected to play a key role in driving building insulation market growth in Asia-Pacific over the forecast period.

- Contribution by Key Players – Asia Pacific is the region with many key players in the market and the contribution by them has been massive for the market in the region. For example - Beijing New Construction Material (Group) Co Ltd is a Chinese building materials manufacturer and distributor. It also makes decorative materials, as well as novel building materials and other items. The company's operations include investments in the building materials industry, home loans, and a variety of other ventures.

- Government Efforts for the growth of the market - An increase in building licences for non-residential and residential buildings in the country is expected to boost the sector's growth even further. Government measures focused at promoting the residential segment, similar to urbanisation trends, play a critical role in driving market expansion in South Korea. The construction sector is expected to rise in response to the Japanese government's efforts to reinvigorate the economy by focusing on infrastructural development. Furthermore, the government is expected to make major investments in game-related infrastructure. Furthermore, the country's expanding population is expected to boost demand for residential construction, which will impact demand for building insulation products. As a result, as previously indicated, these reasons are propelling the building insulation market in Japan to new heights in the next years. In Indonesia, the country's desire for commercial institutions such as hotels, retail malls, and restaurants is increasing. Furthermore, due to the allocation of Special Economic Zones, Indonesia is a desirable site for investors (SEZ). As a result, the government provides special money and tax incentives for new development projects on a regular basis. As a result, these factors are associated with the growth of the Asia-Pacific building insulation market over the forecast period.

Market Restraints

- Covid-19 Impact on Construction Industry in Asia Pacific - The pandemic of COVID-19 wreaked havoc on the market for building insulation materials. Construction efforts for both the residential and commercial segments were halted or cancelled as a result of global lockdowns enacted to prevent the spread of the COVID-19 pandemic. The upkeep of older structures has also been put off. The supply chain, on the other hand, was disrupted, making it difficult to transport people, resources, and money in order to restore the global building insulation materials market's growth. Especially in the region of Asia Pacific where most of the countries are developing where construction and urbanization are at their peek but slowed down due to covid.

Asia Pacific Building Insulation Materials Market Segment Analysis

By Product, the Asia Pacific Building Insulation Materials Market is segmented as Expanded Polystyrene (EPS), Extruded Polystyrene (XPS), Mineral Wool, Others. Expanded Polystyrene dominates the Building Insulation Materials Market with the market share of 47.6% in 2024. It's a sort of insulation with outstanding features like sound absorption, light weight, and earthquake resistance. Insulation of pipe to prevent heat gain, condensation, or frost formation on water and air conditioning lines is one of the most common uses. Extruded Polystyrene has the market share of 35.5% in 2024 because of its water resistance, capacity to decrease moisture-related damages, and energy-saving capabilities Its capacity to inhibit microbial or fungal growth in the insulated region should also aid growth. Mineral wool has the market the market share of 16% in 2024 because of the product's outstanding characteristics, such as fire resistance, effective heat barrier, environmental compatibility, and dimensional stability Mineral wool's growth is predicted to be driven by its growing use in thermal barrier applications over the projection period. Other materials such as PU foam and PIR foam has the market share of 4.4% in 2024.

By Application, the Asia Pacific Building Insulation Materials Market is segmented as Roof, Wall, Floor. Wall segment dominates the Asia Pacific Building Insulation Materials Market with the market share of 39.5% in 2024. In 2024, it was employed in high-end architecture and maintained excellent energy efficiency standards in both residential and commercial buildings. Walls are crucial in achieving a building's energy consumption goals and the tropical conditions in Asia Pacific region helps eminently to keep the buildings cool and less humid. Roof Segment has the market share of 31% in 2024. Demand for insulation materials is likely to expand as the importance of satisfying thermal construction criteria grows, owing to the availability of company sites throughout Asia Pacific, particularly in emerging economies, and because insulation materials are so important in the market. Floor segment has the market share of 29.5% in 2024 as a result of increased demand to minimise the energy costs of HVAC applications Basement, garage, cantilever, and crawl space floors all use thermal insulation. Market expansion is likely to be driven by increasing product penetration for floor insulation in extremely cold locations.

The objective of the report is to present a comprehensive analysis of the Asia Pacific Building Insulation Materials Market to the stakeholders in the industry. The report provides trends that are most dominant in the Asia Pacific Building Insulation Materials Market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Asia Pacific Building Insulation Materials Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Asia Pacific Building Insulation Materials Marke report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Asia Pacific Building Insulation Materials Market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Asia Pacific Building Insulation Materials Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Asia Pacific Building Insulation Materials Market. The report also analyses if the Asia Pacific Building Insulation Materials Market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Asia Pacific Building Insulation Materials Market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Asia Pacific Building Insulation Materials Market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Asia Pacific Building Insulation Materials Market is aided by legal factors.

Asia Pacific Building Insulation Materials Market Scope

|

Asia Pacific Building Insulation Materials Market |

|

|

Market Size in 2024 |

USD 8.17 Bn. |

|

Market Size in 2032 |

USD 10.81 Bn. |

|

CAGR (2025-2032) |

3.57% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

by Product

|

|

by Application

|

|

|

Country Scope |

|

Asia Pacific Building Insulation Materials Market Key Players

- Armacell S.A. (Luxembourg)

- Beijing New Building Material (Group) Co., Ltd. (China)

- Evonik (Germany)

- PT. Bondor Indonesia (Indonesia)

- BYUCKSAN (South Korea)

- Huamei Energy-saving Technology Group Co., Ltd. (China)

- Johns Manville (U.S.)

- Kaneka Corporation (Japan)

- KCC Corporation (South Korea)

- Kingspan Insulation LLC (Ireland)

- Lloyd Insulations Limited (India)

- NICHIAS Corporation (Japan)

- ROCKWOOL International A/S (Denmark)

- U.P. Twiga Fiberglass Limited (India)

- GAF (U.S.)

Frequently Asked Questions

The Asia Pacific Building Insulation Materials Market is studied from 2024 to 2032.

The Asia Pacific Building Insulation Materials Market is growing at a CAGR of 3.57% during forecasting period 2025-2032.

Asia Pacific region held the highest share in 2024.

1. Asia Pacific Building Insulation Materials Market: Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Asia Pacific Building Insulation Materials Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. Asia Pacific Building Insulation Materials Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

4. Asia Pacific Building Insulation Materials Market: Dynamics

4.1. Asia Pacific Building Insulation Materials Market Trends

4.2. Asia Pacific Building Insulation Materials Market Drivers

4.3. Asia Pacific Building Insulation Materials Market Restraints

4.4. Asia Pacific Building Insulation Materials Market Opportunities

4.5. Asia Pacific Building Insulation Materials Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Value Chain Analysis

4.9. Technological Roadmap

4.10. Regulatory Landscape

5. Asia Pacific Building Insulation Materials Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. Asia Pacific Building Insulation Materials Market Size and Forecast, by Product (2024-2032)

5.1.1. Expanded Polystyrene (EPS)

5.1.2. Extruded Polystyrene (XPS)

5.1.3. Mineral Wool

5.1.4. Others

5.2. Asia Pacific Building Insulation Materials Market Size and Forecast, by Application (2024-2032)

5.2.1. Floor

5.2.2. Roof

5.2.3. Wall

5.3. Asia Pacific Building Insulation Materials Market Size and Forecast, by Country (2024-2032)

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Australia

5.3.6. ASEAN

5.3.7. Rest of APAC

6. Company Profile: Key Players

6.1. Armacell S.A. (Luxembourg)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Beijing New Building Material (Group) Co., Ltd. (China)

6.3. Evonik (Germany)

6.4. PT. Bondor Indonesia (Indonesia)

6.5. BYUCKSAN (South Korea)

6.6. Huamei Energy-saving Technology Group Co., Ltd. (China)

6.7. Johns Manville (U.S.)

6.8. Kaneka Corporation (Japan)

6.9. KCC Corporation (South Korea)

6.10. Kingspan Insulation LLC (Ireland)

6.11. Lloyd Insulations Limited (India)

6.12. NICHIAS Corporation (Japan)

6.13. ROCKWOOL International A/S (Denmark)

6.14. U.P. Twiga Fiberglass Limited (India)

6.15. GAF (U.S.)

7. Key Findings

8. Analyst Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook