Asia Pacific Calcium Aluminate Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

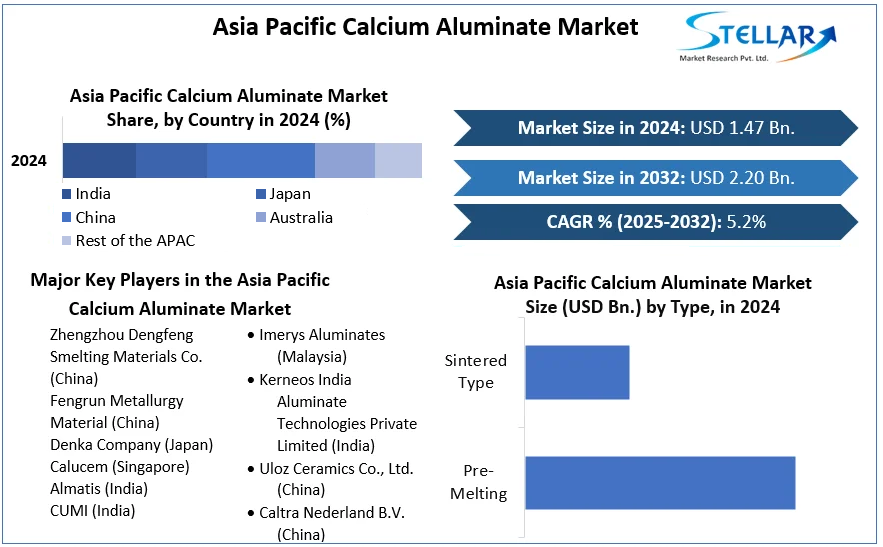

Asia Pacific Calcium Aluminate Market size was valued at USD 1.47 Billion in 2024 and the total Asia Pacific Calcium Aluminate Market size is expected to grow at a CAGR of 5.2% from 2025 to 2032, reaching nearly USD 2.20 Billion by 2032.

Format : PDF | Report ID : SMR_2496

Asia Pacific Calcium Aluminate Market Overview

Calcium aluminate is a type of specialty cement primarily composed of calcium oxide (CaO) and aluminum oxide (Al?O?). It is known for its high refractoriness and rapid strength development, making it a crucial material in various industrial applications, including refractories, construction, and water treatment.

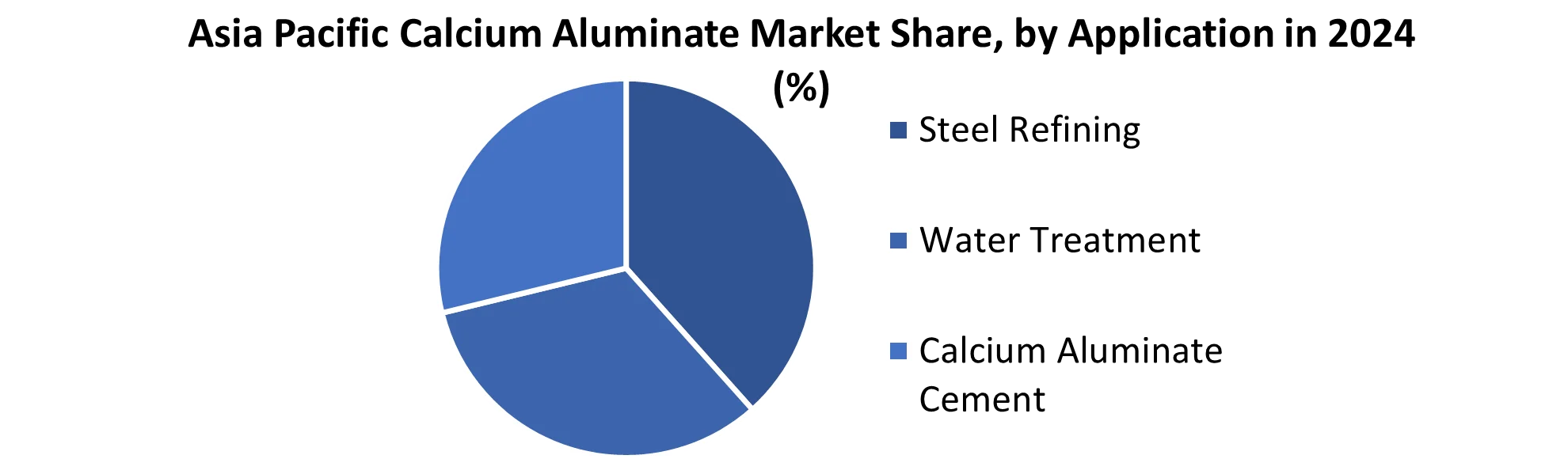

The Asia-Pacific calcium aluminate market is characterized by robust growth and significant potential, driven by the region's booming construction and industrial sectors. The availability of raw materials, particularly bauxite, across countries like China, India, and Vietnam, enhances the market's geographical reach and supply capabilities. Demand for calcium aluminate is primarily fueled by its extensive use in the refractory industry, which supports the steel and cement sectors. Additionally, its application in water treatment processes, owing to its chemical stability and resistance to high temperatures, further bolsters demand.

The market has shown strong performance, with steady growth rates driven by increasing infrastructure projects and industrial activities in the region. The demand-supply dynamics are favourable, with ample raw material availability and growing consumer awareness about the benefits of calcium aluminate products. Major consuming countries include China, India, Japan, and South Korea, each contributing significantly to regional revenue. In terms of product segments, calcium aluminate cement and clinker are the most prominent, catering to various industrial needs.

The Asia-Pacific region, led by China, dominates the global calcium aluminate market, accounting for a substantial share of the total revenue. China alone held a significant portion of the market in 2024, driven by its expansive construction and manufacturing industries. Other notable contributors include India and Japan, where the material's applications in infrastructure and water treatment are particularly prominent. The Asia-Pacific calcium aluminate Industry is poised for continued growth, supported by strong industrial demand, favorable economic conditions, and extensive raw material availability. The region's leading position in global calcium aluminate consumption highlights its critical role in supporting various industrial processes, from refractory production to water treatment solutions. As industries evolve and new applications for calcium aluminate emerge, the market is expected to maintain a robust growth trajectory.

To get more Insights: Request Free Sample Report

Asia Pacific Calcium Aluminate Market Dynamics

Emerging Trends in the Asia-Pacific Calcium Aluminate Market

The Asia-Pacific calcium aluminate market has been witnessing significant growth driven by several key trends. One of the most notable is the increasing demand for calcium aluminate cement (CAC) in high-temperature applications, particularly in the steel and refractory industries. This is largely owed to CAC's superior properties, such as rapid setting and high resistance to chemical attack, making it an ideal material for monolithic refractories used in steel production.

Another critical trend is the shift towards sustainable construction practices. As environmental regulations tighten and the push for eco-friendly building materials grows, calcium aluminate is gaining traction owed to its lower carbon footprint compared to traditional Portland cement. This trend is especially prominent in countries like China and India, where rapid urbanization and infrastructure projects are driving the demand for durable and sustainable construction materials.

- For example, the development of CAC 40, which contains 40% alumina, is particularly beneficial in applications requiring enhanced thermal resistance. This has led to its increased use in specialized construction products such as non-shrink grouts and self-leveling floors.

These trends not only highlight the dynamic nature of the market but also point towards a robust growth trajectory for the calcium aluminate market in the Asia-Pacific region. This growth is further supported by strategic mergers and acquisitions, such as Cementos Molins' recent acquisition of Calucem, which is expected to bolster its product portfolio and market presence.

Table: Import Export Data for Asia pacific Calcium Aluminate Market

|

Aspect |

Details |

|

Total Import Value |

USD 670,673 |

|

Average Import Price |

$0.40 Per Unit |

|

Top Importing Countries |

India, United States, and Russia |

|

Largest Exporter |

China (70.03 % of total imports) |

|

Second Largest Exporter |

Japan (27.42% of total Imports) |

Market Drivers in the Asia-Pacific Calcium Aluminate Market

The Asia-Pacific calcium aluminate market has been witnessing robust growth, driven by several key factors. The expanding construction and infrastructure sectors across the region are a significant driver, particularly in countries like China and India, which are undergoing rapid urbanization and industrialization. The demand for calcium aluminate in refractory materials, crucial for the steel and cement industries, is also rising owed to the region's increasing steel production capacities. Additionally, the market is bolstered by the growing water treatment industry, where calcium aluminate's properties are utilized for treating industrial wastewater and municipal water supplies. The region's favourable economic policies and investments in industrial development further support market growth, attracting global players and encouraging local manufacturers to expand their operations. With these factors, the Asia-Pacific calcium aluminate market is poised for sustained growth in the coming years.

Challenges in the Asia-Pacific Calcium Aluminate Market

The Asia-Pacific calcium aluminate market faces significant challenges that hinder its growth trajectory. A major challenge is the competition from substitute materials such as aluminum slag, which offer similar properties at a potentially lower cost. This availability of alternatives puts pressure on calcium aluminate manufacturers to innovate and differentiate their products to maintain market share.

Additionally, the volatility in raw material prices, particularly bauxite, which is a critical input in calcium aluminate production. Fluctuations in the prices of bauxite lead to unpredictability in production costs, affecting the profitability of manufacturers. Moreover, the fragmented nature of the market, with numerous small and medium-sized players, leads to intense competition, which erode margins.

These challenges underscore the need for strategic planning and innovation to overcome the hurdles in the Asia-Pacific calcium aluminate market and capitalize on emerging opportunities.

Asia Pacific Calcium Aluminate Market Segment Analysis

By Application, the Pre-Melting segment dominates the market, accounting for approximately XX% of the total market share in 2024. This type is widely used owed to its superior properties, such as high purity, rapid setting, and excellent strength development, making it ideal for high-performance refractory and specialty cement applications.

- Companies like Almatis and Imerys Aluminates are key players in this segment, providing a range of high-quality pre-melted calcium aluminate products.

The Sintered segment held around XX% of the market share in 2024. Sintered calcium aluminate is preferred in applications requiring lower cost materials with adequate performance characteristics. This type finds extensive use in the production of ordinary Portland cement and as a raw material in the metallurgy and ceramics industries. The growing construction activities and demand for high-performance materials are expected to drive the growth of both segments in the Asia-Pacific region.

- Major players such as Zhengzhou Dengfeng Smelting Materials Co., Ltd., and Shandong Zhongye New Material Technology Co., Ltd. contribute significantly to this segment.

Asia Pacific Calcium Aluminate Market Regional Analysis

The Asia-Pacific calcium aluminate market has been witnessing robust growth, driven by the region's expanding construction and infrastructure development sectors. The market's performance is marked by a strong demand for high-quality materials, particularly in countries like China, India, and Japan, which are leading the region's dominance.

China, accounting for nearly 40% of the market share, has been the largest consumer and producer of calcium aluminate in the region in 2024. This dominance is supported by the country's extensive construction projects, including residential, commercial, and infrastructure developments, where calcium aluminate's superior properties are highly sought after.

India's market is also growing rapidly, with a XX% share in 2024, fueled by government initiatives to modernize infrastructure and boost industrial output. Key players like Almatis and Kerneos India Aluminate Technologies Private Limited are prominent in the Indian market, providing advanced calcium aluminate solutions.

Japan, with a market share of around 15% in 2024, focuses on high-end applications in the ceramics and specialty cements industries, leveraging the country's technological advancements. The overall Asia-Pacific market is expected to continue its upward trajectory, supported by increasing investments in construction, urbanization, and industrialization across these key countries.

Asia Pacific Calcium Aluminate Market Competitive Landscape

The Asia-Pacific calcium aluminate market is characterized by a diverse competitive landscape, featuring both established multinational corporations and emerging regional players. Key companies like Almatis (India), Denka Company (Japan), and Imerys Aluminates (Malaysia) dominate the market with extensive product portfolios, advanced manufacturing technologies, and significant market shares. These companies leverage their strong R&D capabilities and extensive distribution networks to maintain a competitive edge. On the other hand, emerging companies such as Zhengzhou Dengfeng Smelting Materials Co. (China) and Fengrun Metallurgy Material (China) are rapidly gaining traction owed to their focus on niche applications and cost-effective solutions. These companies are increasingly investing in innovation and expanding their production capacities to capture a larger share of the market.

Almatis, a leading player in the calcium aluminate market, boasts a comprehensive product range, including high-purity alumina-based materials used in various industrial applications such as refractories, ceramics, and specialty chemicals. With headquarters in India, Almatis has a robust global presence, supported by state-of-the-art production facilities and strong financial performance, with revenues exceeding USD 1 billion annually. The company’s extensive R&D efforts have led to continuous product innovation, reinforcing its market leadership.

Zhengzhou Dengfeng Smelting Materials Co. represents an emerging force within the industry. Based in China, this company specializes in producing calcium aluminate clinker and calcium aluminate cement, focusing primarily on the regional market. While it lacks the global reach of Almatis, Zhengzhou Dengfeng has made significant strides in the domestic market, driven by the growing demand for high-quality refractory materials in China’s booming construction and steel industries. The company's strategic focus on cost efficiency and localized production has allowed it to achieve steady sales growth, positioning it as a formidable competitor in the Asia-Pacific region. Although its revenue figures are not as high as those of Almatis, Zhengzhou Dengfeng's market share is rapidly increasing, highlighting its potential as a rising player in the industry.

|

Asia Pacific Calcium Aluminate Market |

|

|

Market Size in 2024 |

USD 1.47 Bn. |

|

Market Size in 2032 |

USD 2.20 Bn. |

|

CAGR (2025-2032) |

5.2% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type

|

|

By Application

|

|

|

Countries Scope: |

China, S Korea, Japan, India, Australia, ASEAN, New Zealand, Taiwan, and Rest of Asia Pacific |

Asia Pacific Calcium Aluminate Market Key Players

- Zhengzhou Dengfeng Smelting Materials Co. (China)

- Fengrun Metallurgy Material (China)

- Denka Company (Japan)

- Calucem (Singapore)

- Almatis (India)

- CUMI (India)

- Henan Suntek International Co., Ltd. (China)

- Imerys Aluminates (Malaysia)

- Kerneos India Aluminate Technologies Private Limited (India)

- Uloz Ceramics Co., Ltd. (China)

- Caltra Nederland B.V. (China)

- Shandong Zhongye New Material Technology Co., Ltd. (China)

- Hebei Cangzhou New Century Foreign Trade Co., Ltd. (China)

- Other Players

Frequently Asked Questions

Ans: The challenges for the Asia-Pacific calcium aluminate market include fluctuating raw material costs and stringent environmental regulations impacting production processes.

Ans. The Market size was valued at USD 1.47 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 5.2% from 2025 to 2032, reaching nearly USD 2.20 Billion.

Ans. The segments covered are Type, and Application.

Asia Pacific Calcium Aluminate Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

1. Asia Pacific Calcium Aluminate Market: Research Methodology

2. Asia Pacific Calcium Aluminate Market: Executive Summary

3. Asia Pacific Calcium Aluminate Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Asia Pacific Calcium Aluminate Market: Dynamics

4.1. Market Trends

4.2. Market Drivers

4.3. Market Opportunities

4.4. Market Challenges

4.5. PORTER’s Five Forces Analysis

4.6. PESTLE Analysis

4.7. Strategies for New Entrants to Penetrate the Market

4.8. Regulatory Landscape

5. Asia Pacific Calcium Aluminate Market Size and Forecast by Segments (by Value USD Billion)

5.1. Asia Pacific Calcium Aluminate Market Size and Forecast, by Type (2024-2032)

5.1.1. Pre-Melting

5.1.2. Sintered Type

5.2. Asia Pacific Calcium Aluminate Market Size and Forecast, by End-User (2024-2032)

5.2.1. Steel Refining

5.2.2. Water Treatment

5.2.3. Calcium Aluminate Cement

5.3. Asia Pacific Calcium Aluminate Market Size and Forecast, by Country (2024-2032)

5.3.1. China

5.3.2. S Korea

5.3.3. Japan

5.3.4. India

5.3.5. Australia

5.3.6. ASEAN

5.3.6.1. Indonesia

5.3.6.2. Vietnam

5.3.6.3. Laos

5.3.6.4. Brunei

5.3.6.5. Thailand

5.3.6.6. Myanmar

5.3.6.7. Philippines

5.3.6.8. Cambodia

5.3.6.9. Singapore

5.3.6.10. Malaysia.

5.3.7. New Zealand

5.3.8. Taiwan

5.3.9. Rest of Asia Pacific

6. Company Profile: Key players

6.1. Zhengzhou Dengfeng Smelting Materials Co. (China)

6.1.1. Company Overview

6.1.2. Financial Overview

6.1.3. Business Portfolio

6.1.4. SWOT Analysis

6.1.5. Business Strategy

6.1.6. Recent Developments

6.2. Fengrun Metallurgy Material (China)

6.3. Denka Company (Japan)

6.4. Calucem (Singapore)

6.5. Almatis (India)

6.6. CUMI (India)

6.7. Henan Suntek International Co., Ltd. (China)

6.8. Imerys Aluminates (Malaysia)

6.9. Kerneos India Aluminate Technologies Private Limited (India)

6.10. Uloz Ceramics Co., Ltd. (China)

6.11. Caltra Nederland B.V. (China)

6.12. Shandong Zhongye New Material Technology Co., Ltd. (China)

6.13. Hebei Cangzhou New Century Foreign Trade Co., Ltd. (China)

6.14. Others Players

7. Key Findings

8. Industry Recommendation