Asia Pacific Lime Market Outlook by Size Share Revenue Analysis and Industry Growth Forecast (2025-2032)

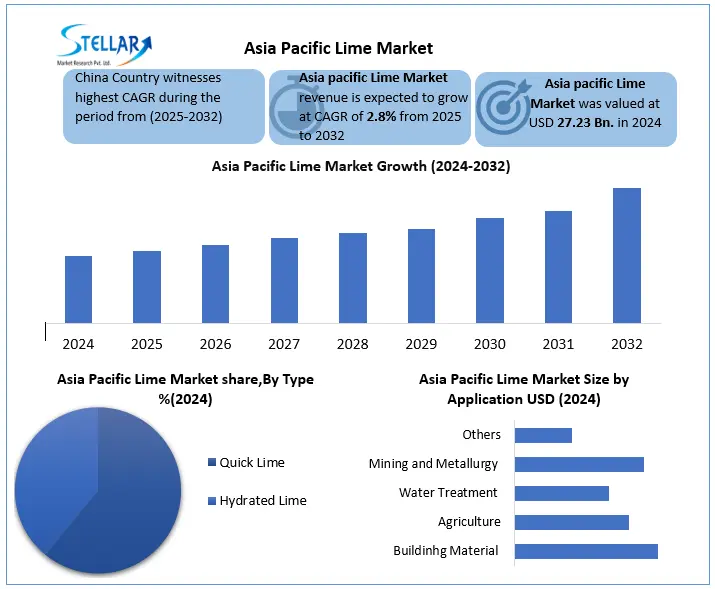

Asia Pacific Lime Market was valued at USD 27.73 Bn. in 2024 and total Asia Pacific Lime Market revenue is expected to grow at 2.8% reaching nearly USD 34.59 Bn. from 2025 to 2032.

Format : PDF | Report ID : SMR_2876

Asia Pacific Lime Market overview:

The Asia Pacific lime market has been experiencing strong growth, driven by rapid urbanization and infrastructure development across the region. As the world's fastest growing market for lime products the sector is expanding at about 5% annually with China and India accounting for the majority of both production and consumption. These two countries dominate the market due to their massive construction sectors and cement manufacturing industries which heavily rely on lime as a key raw material. Several important trends are shaping the industry's development. Many producers are now adopting advanced technologies like AI-powered kiln systems particularly in India's Rajasthan region where most of the country's limestone reserves are located. These technological upgrades are delivering noticeable improvements, with energy efficiency gains of 15-20% and emission reductions around 12%. At the same time digital tools are being implemented to streamline supply chains, helping companies cut logistics expenses by 8-10%. The Asia-Pacific region, growing at 5.1% CAGR, leads demand, with Africa's urban population set to double by 2032 emerging as the next growth frontier. To compete new entrants must navigate 15-20% higher capital costs for sustainable technologies even as 65% of construction firms now prioritize low-carbon materials.

The Asia Pacific lime market is shaped significantly by trade policies and tariff regulations across key producing and consuming countries such as China, India, Japan, Australia, and Southeast Asian nations. China, as a leading producer and exporter of lime, benefits from lower production costs and free trade agreements within ASEAN and RCEP (Regional Comprehensive Economic Partnership).

To get more Insights: Request Free Sample Report

Asia pacific Lime Market Dynamics:

Cement Industry Expansion in Asia Pacific to drive the Asia Pacific Lime Market Growth

The Asia Pacific region has become the powerhouse of global cement production, responsible for more than 60% of the world's output. This massive industry relies heavily on lime or limestone as its primary raw material making the lime market a critical component of the countries construction increases. Cement manufacturing requires limestone to be heated at extremely high temperatures around 1450°C in a process called calcination which produces clinker the key ingredient in cement. Since lime calcium oxide makes up about 80% of clinker, the cement industry’s growth directly fuels lime demand. The cement industry’s growth in Asia Pacific is inseparable from lime demand. As long as construction boost in China, India, and Southeast Asia, lime will remain a strategic resource but sustainability innovations will shape its future.

Green and Sustainable Lime Production to create opportunity in the Asia Pacific Lime Market

The lime industry is under increasing pressure to reduce its environmental footprint while meeting growing demand from construction, steel, and chemical sectors. Sustainable lime production is no longer optional it’s a competitive necessity for long-term growth. Below is a detailed breakdown of the key technologies, strategies and opportunities in eco-friendly lime manufacturing. The Asia Pacific lime market is at an inflection point, where sustainability is no longer just an environmental consideration but a major business opportunity. With growing regulatory pressure shifting customer preferences and technological advancements green lime production is emerging as a key differentiator that unlock new revenue streams while future-proofing businesses. Alternative fuels (biomass, hydrogen) Already cutting 30% of CO? emissions in Thai and Japanese plants. AI-driven kiln optimization Reducing energy use by 15-20%, making green lime more cost-competitive.

Environmental Rules and Regulations to hamper Asia Pacific Lime Market Growth

The lime industry faces mounting environmental challenges as one of the most carbon-intensive industrial processes. Traditional production methods are surprisingly polluting - lime manufacturing alone accounts for about 1.5% of industrial CO? emissions, surpassing even the aviation sector's carbon footprint. The core issue lies in conventional kilns that rely on fossil fuels like coal and petroleum coke releasing approximately one ton of carbon dioxide for every ton of lime produced. market forces are driving change as sustainability becomes a business imperative. Recent research shows that 65% of construction firms now actively prioritize low-carbon materials in their projects. Major industrial buyers in the cement and steel sectors traditionally the largest consumers of lime are increasingly demanding sustainable suppliers to meet their own ESG commitments and decarbonisation targets. This shift in procurement practices is transforming lime from a commodity product to one where environmental credentials command premium pricing and market access.

Asia pacific Lime Market Segment Analysis:

Based on Type the Asia Pacific Lime Market is segmented into Quick lime and Hydrated Lime. Quick lime segment dominated the market in 2024 and is expected to hold largest share during the forecast period. Quick lime also known as calcium oxide which plays a significant role in boost the lime Industry. It is a highly flexible and widely used chemical compound in construction materials cement concrete and where it acts as a binding agent. It is also used in the steel industry for the production of high quality steel and steel related products and as a fluxing agent to remove contaminations silica phosphorus and sulphur from iron ore during the steel making process. The alkaline properties of quicklime make it valuable for waste water treatment soil stabilization and pH regulation in industrial processes. The growing construction and steel industries along with the increasing demand for water treatment solutions are accelerating its adoption rate through the global.

Based on Application, the Asia Pasific Lime market is segmented into Building Material, Agriculture, Water Treatment, Mining and Metallurgy and Others. Building Material and construction segment dominated the market in 2024 and is expected to hold largest market share over the forecast period. Lime is a critical raw material in cement production with global cement output reaching 41 Bn. metric tons in 2021 according to the International Energy Agency. Its use in concrete mortar and road construction further solidifies its authority Rapid urbanization particularly in Asia-Pacific and infrastructure investments like the U.S.12 trillion Infrastructure Investment and Jobs drive the demand in global lime market. This segment is adaptable and cost-effectiveness make it indispensable for meeting global housing and infrastructure needs ensuring its continued leadership in the limestone market.

Based On Country

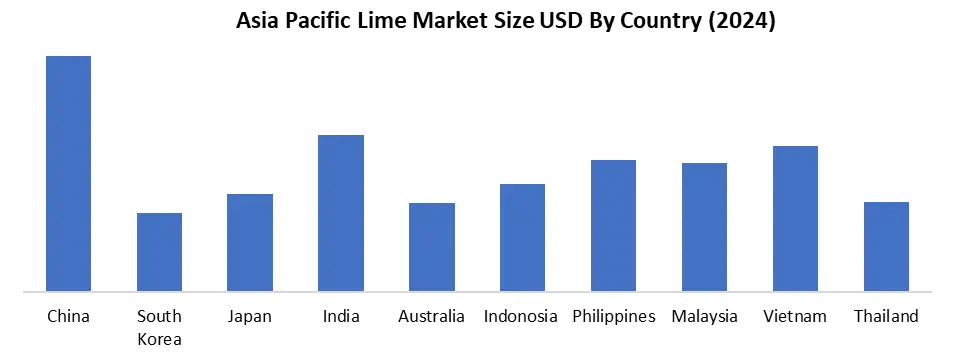

China is the dominated the Asia Pacific Lime Market in 2024 and is expected to hold largest share during the forecast period. China dominates the APAC lime market due to its massive industrial demand, abundant resources, and strategic government policies. As the world's largest cement and steel producer China consumes over 50% of global lime output, primarily for clinker production in cement (60% of demand) and steel purification (20%). The country possesses vast limestone reserves (15% of global deposits) across Guizhou, Guangxi, and Hebei provinces, supporting its 300 million-ton annual lime production more than half the world's total. Government initiatives like the Belt & Road Project drive infrastructure growth, while the Dual Carbon policy pushes green lime technologies like carbon capture and hydrogen kilns. China's competitive advantages include advanced vertical kiln technology, AI-driven efficiency gains (10-15% cost reductions), and economies of scale from concentrated production clusters.

Asia pacific Lime Market Competitive Landscape

The Asia Pacific lime market features intense competition among major players leveraging regional advantages. Anhui Conch Cement dominates through its massive production capacity and vertical integration, controlling limestone sources across China while implementing energy-efficient kiln technologies. This Chinese giant benefits from economies of scale allowing competitive pricing that influences regional markets. Also India's Ultra Tech Cement emerges as a formidable challenger capitalizing on the country's construction boom through strategic investments in advanced manufacturing. The company has pioneered AI-driven kiln optimization and sustainable production methods positioning itself as a technology leader. Both players face growing pressure to adopt cleaner production methods as environmental regulations tighten across the region. While Anhui Conch maintains volume superiority Ultra Tech demonstrates faster growth potential through innovation and adaptation to India's infrastructure demands.

Key Developments in APAC Lime Market

- In June 2024 Anhui Conch Cement announced a USD 200 million investment to build a new low carbon cement plant in Vietnam, targeting Southeast Asia’s growing infrastructure demand while reducing reliance on the slowing Chinese Lime market.

- In March 2024, CNBM committed USD 120 million to build China’s first hydrogen powered cement pilot plant in Hebei, reinforcing its leadership in green construction materials for a carbon neutral future.

- In July 2024, Tangshan Jidong Cement unveiled an 80 million upgrade of its Hebei facility with AI-driven energy saving systems, boosting efficiency to meet rising demand in North China’s infrastructure projects

|

Asia Pacific Lime Market Scope |

|

|

Market Size in 2024 |

USD 27.23 Bn. |

|

Market Size in 2032 |

USD 34.59 Bn. |

|

CAGR (2025-2032) |

2.8% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Quick Lime Hydrated Lime |

|

By Application Building Material Agriculture Water Treatment Mining and Metallurgy Others |

|

|

By End-Use Steel & Metallurgy Construction & Infrastructure Environmental Agriculture Paper & Pulp Others |

|

|

Regional Scope |

Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand

|

Key Players in Asia Pacific Lime market

- Anhui Conch Cement (China)

- China National Building Material (CNBM) (China)

- Tangshan Jidong Cement (China)

- Shandong Shanshui Cement Group (China)

- UltraTech Cement (India)

- ACC Limited (India)

- SCG Chemicals (Thailand)

- Taiheiyo Cement Corporation (Japan)

- Ube Material Industries (Japan)

- Lhoist Group (Belgium)

Frequently Asked Questions

Green technologies like AI kilns (15-20% energy savings) and alternative fuels (e.g., hydrogen) are reducing emissions, with 65% of firms prioritizing low-carbon lime.

Anhui Conch Cement (China) leads in volume, while UltraTech Cement (India) excels in AI-driven efficiency and sustainable innovations.

1. Asia Pacific Lime Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Asia Pacific Lime Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. End-user Segment

2.3.4. Revenue (2023)

2.3.5. Company Headquarter

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Lime Import Export Analysis

2.6. Mergers and Acquisitions Details

3. Asia Pacific Lime Market: Dynamics

3.1. Wire and Cables Market Trends

3.2. Wire and Cables Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Technology Roadmap

3.6. Regulatory Landscape

4. Asia Pacific Lime Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

4.1. Asia Pacific Lime Market Size and Forecast, By Product Type (2024-2032)

4.1.1. Quick Lime

4.1.2. Hydrated Lime

4.2. Asia Pacific Lime Market Size and Forecast, By Application (2024-2032)

4.2.1. Building Material

4.2.2. Agriculture

4.2.3. Water Treatment

4.2.4. Mining and Metallurgy

4.2.5. Others

4.3. Asia Pacific Lime Market Size and Forecast, By End-use (2024-2032)

4.3.1. Steel & Metallurgy

4.3.2. Construction & Infrastructure

4.3.3. Environmental Agriculture

4.3.4. Paper & Pulp

4.3.5. Others

4.4. Asia Pacific Asia Pacific Lime Market Size and Forecast, by Country (2024-2032)

4.4.1. China

4.4.2. S Korea

4.4.3. Japan

4.4.4. India

4.4.5. Australia

4.4.6. Indonesia

4.4.7. Vietnam

4.4.8. Thailand

4.4.9. Philippines

4.4.10. Malaysia

4.4.11. Rest of Asia Pacific

5. Company Profile: Key Players

5.1. Anhui Conch Cement (China)

5.1.1. Company Overview

5.1.2. Business Portfolio

5.1.3. Financial Overview

5.1.4. SWOT Analysis

5.1.5. Strategic Analysis

5.1.6. Recent Developments

5.2. China National Building Material (CNBM) (China)

5.3. Tangshan Jidong Cement (China)

5.4. Shandong Shanshui Cement Group (China)

5.5. UltraTech Cement (India)

5.6. ACC Limited (India)

5.7. SCG Chemicals (Thailand)

5.8. Taiheiyo Cement Corporation (Japan)

5.9. Ube Material Industries (Japan)

5.10. Lhoist Group (Belgium)

6. Key Findings

7. Industry Recommendations

8. Asia Pacific Lime Market: Research Methodology