Asia Pacific Amino Acids Market: Asia Pacific Market Size, Market Dynamics and Segment Analysis by Type, Source and End Use Industry

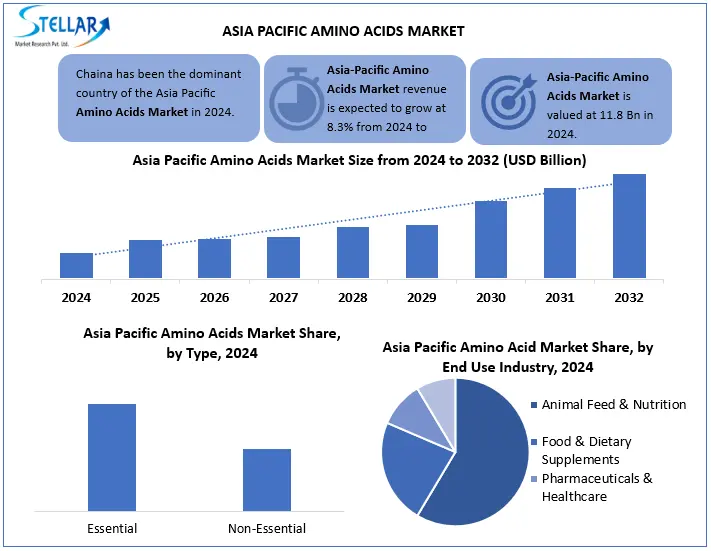

Asia Pacific Amino Acids Market Size was estimated at USD 11.8 Bn in 2024, and it is expected to reach USD 22.33 Bn in 2032. The Market CAGR is expected to be around 8.3% during the forecast period (2025 - 2032)

Format : PDF | Report ID : SMR_2884

Asia Pacific Amino Acids Market Overview

Amino acids are essential for the proper functioning of a human organism and form proteins. A major part of the increase in protein supplement market is due to increased concern for health and fitness. This, in turn, facilitates adopting doses of amino acids in sports nutrition and functional foods. Examples of these include immunity enhancing products such as lysine and tryptophan. Nestle also incorporated BCAAS (branched-chain amino acids) into their muscle health range products to meet specific nutritional needs. There is growing concern and awareness factors such as muscle building, immune function and these components and their relations to basic wellbeing, for example, where premiumization trends are strong.

Countries like China, Japan, South Korea and India are at the forefront of this development, driven by increasing health awareness, dietary supplements and livestock industries. In particular, China dominates the animal fodder segment, while Japan and South Korea focus on special amino acids for high purity, pharmaceutical and welfare applications. The lowering cost of obtaining raw materials, having effective fermentation technologies, and the presence of a significant strong manufacturing base, which reinforces mass production and export activities, all aid the region immensely. Companies such as Ajinomoto Co. Incorporation, CJ Cheiljedang, Daesang Corporation, Kyowa Hakko Bio, and Fufeng Group are strategically positioning themselves in the market by leveraging innovation, R&A, and strategic alliances.

On the other side the industry seems to be challenged with supply chain constraints within China and Southeast Asia, resulting in price volatility and materials shortages. The Asia Pacific region continues to be one of the major zones to still produce and consume amino acid products due to their changing approach with focusing on population growth, per capita income, preventive healthcare, along with nutrition.

To get more Insights: Request Free Sample Report

Asia Pacific Amino Acids Market Dynamics

Rising Health Consciousness and Protein Supplement Demand to Drive the Asia Pacific Amino Acids Market

In post COVID times, 44% of people have increased their average protein intake which has caused a spike in the demand for protein powder supplements. Immunity-boosting products featuring lysine and tryptophan are key growth catalysts. For instance, the branched-chain amino acids contained in Nestlé’s Muscle Health range enable greater focus on nutrition.

Growing Demand for Health and Nutrition Dosage to Fuel the Growth of the Market

With the surge in consumer understanding of amino acids, there has been an increase in the immune boosting, muscle building and overall wellness features boosting demand for the market. There are emerging trends looking at dietary intake and supplements in a more holistic way post pandemic, highlighting the intake of protein and its derivatives in sports nutrition, as well as functional foods, with the use of branched-chain amino acids (BCAAs), L-glutamine, and L-arginine. Premiumization greatly benefits markets in North America and Europe.

Supply Chain Disruption and Synthetic vs. Natural Sourcing: A Big Challenge for the Asia Pacific Amino Acid Market

The industry is facing significant obstacles that can disrupt growth. Pricing along with the availability of raw materials like corn and soy, which are the primary source of fermented amino acids, are volatile and fluctuate with the supply chain, most notably in China and Southeast Asia. Compounding the issue is the controversy surrounding synthetic versus plant-based amino acids creating regulatory and consumer trust issues in markets that prefer non-GMO and organic certified products.

Asia Pacific Amino Acids Market Segment Analysis

Based on Type, Essential vs Non-Essential Amino Acids. The amino acid market is segmented into Essential (histidine, isoleucine, leucine, lysine, methionine, phenylalanine, threonine, tryptophan, valine) and Non-Essential amino acids (glutamate, alanine, arginine, glycine, proline). The significance of essential amino acids in nutrition and dietary supplementation has sustained their dominance in human and animal nutrition, particularly for sports and animal feed. Leucine and lysine, the most demanded amino acids, arise from muscle recovery and livestock growth applications.

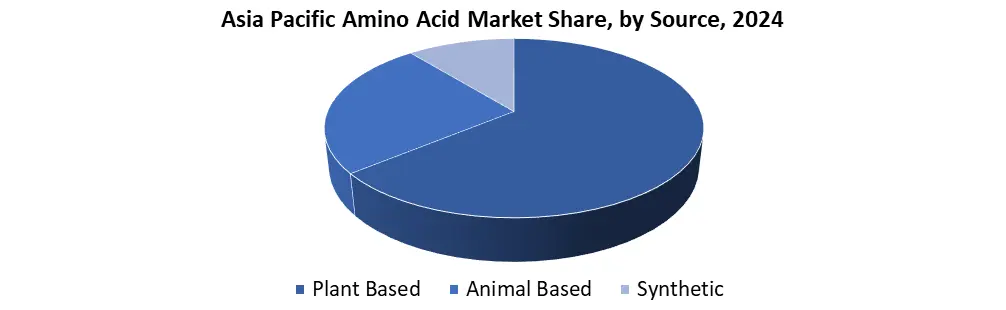

Based on source: Plant-based vs. Animal-based vs Synthetic. With the growing tendencies of vegetarianism and clean-label products, it is soy and wheat and corn-derived plant based amino acids that lead the market. Animal-sourced amino acids from meat, toenails, and eggs retain their worth in high-protein dietary supplements and pharmaceuticals. Because of their scalability and purity, the pharma and nutraceutical industries are increasing the use of synthetic amino acids derived through fermentation. Their argument in plant-based sources, especially in soybean and wheat rich Asia-Pacific region, strengthens the case.

Asia Pacific Amino Acids Market Regional Analysis

The Asia-Pacific Amino Acid market has more than 46% of the market share in Amino acid market globally. China leads the market, holding the largest market share. This dominance is inspired by its mass production capacity, cost-effective manufacturing and high demand from animal feed, food industries, and pharmaceuticals. Japan is the fastest growing leading contributor, known for its advanced biotechnology capabilities and high demand in the pharmaceutical and nutraceutical sector. Ajinomoto Co., Inc. And kyowa hakko bio co., ltd. Companies are global pioneers in amino acids market.

Asia Pacific Amino Acids Market Competitive Landscape

The Asia Pacific market for amino acids is highly competitive, in which Ajinomoto Company, Inc. (Japan), CJ CheilJedang (South Korea), Kyowa Hakko Bio (Japan), Daesang Corporation, and Ediseo (France) and Fufeng Group Company Limited. The leader Ajinomoto with its innovative fermentation technology and extensive applications in food, pharma and animal nutrition. CJ CheilJedang takes second place with emphasis on microbial fermentation to produce lysine. Daesang Corporation, South Korea has a considerable share focus on cost-efficient production of amino acids such as monosodium glutamate (MSG) and functional health ingredients. Japanese biotech innovator Kyowa Hakko Bio Co., Ltd. leads the premium and specialty market of amino acids for pharmaceutical and nutraceutical uses with high purity and clinical-grade compounds. On the other hand, Fufeng Group Company Limited of China has strong price competitiveness because of large-scale production and low cost.

|

Asia Pacific Amino Acids Market Scope |

|

|

Market Size in 2024 |

USD 11.8 Bn. |

|

Market Size in 2032 |

USD 22.33 Bn. |

|

CAGR (2024-2032) |

8.3% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Essential Amino Acids Non-Essential Amino Acids |

|

By Source Plant-Based Animal-Based Synthetic/Bio-Engineered |

|

|

By End Use Industry Animal Feed & Nutrition Food & Dietary Supplements Pharmaceuticals & Healthcare Personal Care & Cosmetics |

|

Asia Pacific Amino Acids Market Key Players

- Ajinomoto Co., Inc. – Japan

- CJ CheilJedang Corp. – South Korea

- Daesang Corporation – South Korea

- Kyowa Hakko Bio Co., Ltd. – Japan

- Fufeng Group Company Limited – China

- Meihua Holdings Group Co., Ltd. – China

- Changzhou Yabang Chemical Co., Ltd. – China

- Sichuan Tongsheng Amino Acid Co., Ltd. – China

- Shandong Shouguang Juneng Golden Corn Co., Ltd. – China

- Sumitomo Chemical Co., Ltd. – Japan

- Taiwan Amino Acids Co., Ltd. – Taiwan

Frequently Asked Questions

China dominates the Amino Acids Market.

Asia Pacific Amino Acids Market Size was estimated at USD 11.8 Bn in 2024, and it is expected to reach USD 22.33 Bn in 2032.

Supply Chain Disruption and Synthetic vs. Natural Sourcing: A Big Challenge for the Amino Acid Market

1. Asia Pacific Amino Acids Market: Research Methodology

2. Asia Pacific Amino Acids Market Introduction

2.1. Study Assumptions and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Asia Pacific Amino Acids Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Product Segment

3.3.3. End-user Segment

3.3.4. Revenue (2023)

3.3.5. Company Headquarter

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Amino Acids Import Export Analysis

3.6. Mergers and Acquisitions Details

4. Asia Pacific Amino Acids Market: Dynamics

4.1. Wire and Cables Market Trends

4.2. Wire and Cables Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technology Roadmap

4.6. Regulatory Landscape

5. Asia Pacific Amino Acids Market Size and Forecast by Segmentation (Value in USD Billion) (2024-2032)

5.1. Asia Pacific Amino Acids Market Size and Forecast, By Type (2024-2032)

5.1.1. Essential Amino Acids

5.1.2. Non-Essential Amino Acids

5.2. Asia Pacific Amino Acids Market Size and Forecast, By Source (2024-2032)

5.2.1. Plant-Based

5.2.2. Animal-Based

5.2.3. Synthetic/Bio-Engineered

5.3. Asia Pacific Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

5.3.1. Animal Feed & Nutrition

5.3.2. Food & Dietary Supplements

5.3.3. Pharmaceuticals & Healthcare

5.3.4. Personal Care & Cosmetic

5.4. Asia Pacific Asia Pacific Amino Acids Market Size and Forecast, by Country (2024-2032)

5.4.1. China

5.4.2. S Korea

5.4.3. Japan

5.4.4. India

5.4.5. Australia

5.4.6. ASEAN

5.4.6.1. Indonesia

5.4.6.2. Vietnam

5.4.6.3. Laos

5.4.6.4. Brunei

5.4.6.5. Thailand

5.4.6.6. Myanmar

5.4.6.7. Philippines

5.4.6.8. Cambodia

5.4.6.9. Singapore

5.4.6.10. Malaysia.

5.4.7. New Zealand

5.4.8. Taiwan

5.4.9. Rest of Asia Pacific

6. Company Profile: Key Players

6.1. Ajinomoto Co., Inc. – Japan

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. CJ CheilJedang Corp. – South Korea

6.3. Daesang Corporation – South Korea

6.4. Kyowa Hakko Bio Co., Ltd. – Japan

6.5. Fufeng Group Company Limited – China

6.6. Meihua Holdings Group Co., Ltd. – China

6.7. Changzhou Yabang Chemical Co., Ltd. – China

6.8. Sichuan Tongsheng Amino Acid Co., Ltd. – China

7. Key Findings

8. Analyst Recommendations