Amino Acids Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

Global Amino Acids Market Size was estimated at USD 28.42 Bn in 2024, and it is expected to reach USD 50 Bn in 2032. The market CAGR is expected to be around 7.32% during the forecast period (2025 - 2032)

Format : PDF | Report ID : SMR_2731

Amino Acids Market Overview

Amino acids are essential for the proper functioning of a human organism and form proteins. Nestle incorporated BCAAS (branched-chain amino acids) into their muscle health range products to meet specific nutritional needs. There is growing concern and awareness ache factors such as muscle building, immune function and these components and their relations to basic wellbeing in North America and Europe, for example, where premiumization trends are strong. There are, however, considerable challenges for the industry such as destabilization of the supply chain in primary production regions like China and southeast Asia, which are causing material cost inflation, supply shortages, and increased raw material price fluctuations.

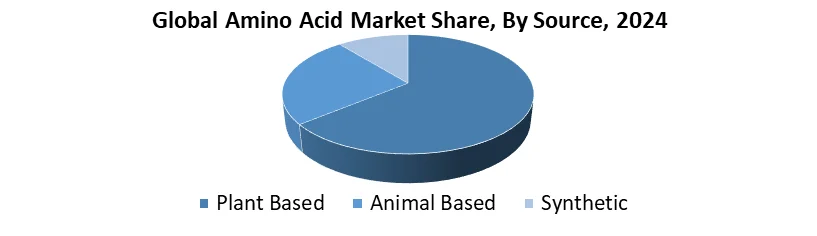

The ongoing synthetic versus plant-derived amino acids discussion also poses a red tape challenge regarding consumer acceptance, especially in markets that support non-GMO and organic products. European Union and U.S. Strict labeling and purity standards complicate market entry. The Amino Acids Market is segmented on the basis of type, source, and end-use industry. In the case of the former, essential amino acids such as leucine and lysine excel in demand, while the latter is dominated by vegetarian and clean-label trends on plant-based amino acids.

In the Asia-Pacific region, the share of animal feed and nutraceuticals is concentrated in China, Japan, and India. North America excels in sports nutrition and pharmaceuticals with the help of AI technologies while Europe shifts focus on permanently augmented and premium grade amino acids for their on-focus regions. Amino Acids major players leading this dynamically competitive Amino Acids Market, such as Ajinomoto Co, Evonik Industries, CJ CheilJedang and others utilize advanced fermentation technologies and strategic expansion to dominate the Amino Acids Market.

To get more Insights: Request Free Sample Report

Amino Acids Market Dynamics

Rising Health Consciousness and Protein Supplement Demand to Drive the Amino Acids Market

In post COVID times, 44% of people have increased their average protein intake which has caused a spike in the demand for protein powder supplements. Immunity-boosting products featuring lysine and tryptophan are key growth catalysts. For instance, the branched-chain amino acids contained in Nestlé’s Muscle Health range enable greater focus on nutrition.

Growing Demand for Health and Nutrition Dosage to Fuel Amino Acids Market growth

With the surge in consumer understanding of amino acids, there has been an increase in the immune boosting, muscle building and overall wellness features boosting demand for the Amino Acids Market. There are emerging trends looking at dietary intake and supplements in a more holistic way post pandemic, highlighting the intake of protein and its derivatives in sports nutrition, as well as functional foods, with the use of branched-chain amino acids (BCAAs), L-glutamine, and L-arginine. Premiumization greatly benefits markets in North America and Europe.

Supply Chain Disruption and Synthetic vs. Natural Sourcing: A Big Challenge for the Amino Acid Market

The Amino Acids industry is facing significant obstacles that disrupt growth. Pricing along with the availability of raw materials like corn and soy, which are the primary source of fermented amino acids, are volatile and fluctuate with the supply chain, most notably in China and Southeast Asia. Compounding the issue is the controversy surrounding synthetic versus plant-based amino acids creating regulatory and consumer trust issues in markets that prefer non-GMO and organic certified products.

Amino Acids Market Segmentation

Based on Type, the amino acid market is segmented into Essential (histidine, isoleucine, leucine, lysine, methionine, phenylalanine, threonine, tryptophan, valine) and non-essential amino acids (glutamate, alanine, arginine, glycine, proline). The significance of essential amino acids in nutrition and dietary supplementation has sustained their dominance in human and animal nutrition, particularly for sports and animal feed. Leucine and lysine, the most demanded amino acids, arise from muscle recovery and livestock growth applications.

Based on source: Plant-based vs. Animal-based vs Synthetic With the growing tendencies of vegetarianism and clean-label products, it is soy and wheat and corn-derived plant based amino acids that lead the market. Animal-sourced amino acids from meat, toenails, and eggs retain their worth in high-protein dietary supplements and pharmaceuticals. Because of their scalability and purity, the pharma and nutraceutical industries are increasing the use of synthetic amino acids derived through fermentation. Their argument in plant-based sources, especially in soybean and wheat rich Asia-Pacific region, strengthens the case.

Based on End Use Industry:

Due to the great need for lysine and methionine in livestock production, the animal feed and nutrition sectors dominate the market. The fastest growth is in food and dietary supplements fueled by sports nutrition and fortified foods. Drug formulation and IV therapy are the main uses of amino acids in pharmaceuticals, while personal care and cosmetics are using them in skincare and haircare.

Amino Acids Regional Analysis

The amino acid market is largely driven by the Asia-Pacific (APAC) region. This region alone accounts for over 36% of the global amino acid market to fulfill the need for animal feeds, life sciences, nutraceuticals, and pharmaceuticals. Increased livestock production in China, Japan, and India, as well as heightened public awareness regarding health and food fortification programs, explain their dominance. The US and Canada are also Amino Acids major players, primarily for sports diet supplements, but the US is experiencing strong growth in pharmaceutical applications. New changes to the market include the APAC’s emphasis on fermentation methods to enhance lysine and methionine production, and investment in AI-controlled amino acid modification in North America.

Amino Acids Market Competitive Landscape

The global amino acid market is very concentrated, with some major players in the market due to their extensive production capabilities, strong R&D investment, and strategic expansion. The Japanese Ajinomoto Co., Inc. dominates the market due to their diverse portfolio that includes food, pharmaceuticals and animal feed. Their dominance stems from vertical integration, control over their supply chain, and proprietary fermentation technology which is used extensively in overseas operations in Asia-Pacific and North America. This is alongside competition from Evonik Industries AG (Germany) and CJ CheilJedang Corp (South Korea) who are both interested in the growing animal feed market.

|

Amino Acids Market Scope |

|

|

Market Size in 2024 |

USD 28.42 Bn. |

|

Market Size in 2032 |

USD 50 Bn. |

|

CAGR (2024-2032) |

6.9% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Essential Amino Acids Non-Essential Amino Acids |

|

By Source Plant-Based Animal-Based Synthetic/Bio-Engineered |

|

|

By End Use Industry Animal Feed & Nutrition Food & Dietary Supplements Pharmaceuticals & Healthcare Personal Care & Cosmetics |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Amino Acids Market Key Players

North America

- Archer Daniels Midland Company (ADM) – USA

- Cargill, Incorporated – USA

- Prinova Group LLC – USA

- Kemin Industries – USA

- Bio-Chem Technology Group Company Limited – USA

- Ajinomoto North America Inc. – USA

Europe

- Evonik Industries AG – Germany

- BASF SE – Germany

- Wacker Chemie AG – Germany

- Amino GmbH – Germany

- Royal DSM N.V. – Netherlands

- Iris Biotech GmbH – Germany

- Novus Europe SA/NV – Belgium

- Adisseo France SAS – France

- Ajinomoto Foods Europe S.A.S. – France

Asia Pacific

- Ajinomoto Co., Inc. – Japan

- CJ CheilJedang Corp. – South Korea

- Daesang Corporation – South Korea

- Kyowa Hakko Bio Co., Ltd. – Japan

- Fufeng Group Company Limited – China

- Meihua Holdings Group Co., Ltd. – China

- Changzhou Yabang Chemical Co., Ltd. – China

- Sichuan Tongsheng Amino Acid Co., Ltd. – China

- Shandong Shouguang Juneng Golden Corn Co., Ltd. – China

- Sumitomo Chemical Co., Ltd. – Japan

- Taiwan Amino Acids Co., Ltd. – Taiwan

South America

- Ajinomoto do Brasil Indústria e Comércio de Alimentos Ltda. – Brazil

- Evonik Brasil Ltda. – Brazil

Middle East & Africa

- Barentz Middle East FZE – UAE

- Adisseo South Africa (Pty) Ltd. – South Africa

Frequently Asked Questions

Asia-Pacific dominates the Amino Acids Market.

By type, by source, by end use industry, these are the main segments of the Amino Acids market.

Global Amino Acids Market Size was estimated at USD 28.42 Bn in 2024, and it is expected to reach USD 50 Bn in 2032.

Supply Chain Disruption and Synthetic vs. Natural Sourcing: A Big Challenge for the Amino Acid Market

1. Amino Acids Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Amino Acids Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. End-user Segment

2.4.4. Revenue (2024)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Amino Acids Market: Dynamics

3.1. Amino Acids Market Trends by Region

3.1.1. North America Amino Acids Market Trends

3.1.2. Europe Amino Acids Market Trends

3.1.3. Asia Pacific Amino Acids Market Trends

3.1.4. Middle East and Africa Amino Acids Market Trends

3.1.5. South America Amino Acids Market Trends

3.2. Amino Acids Market Dynamics

3.2.1. Amino Acids Market Drivers

3.2.2. Amino Acids Market Restraints

3.2.3. Amino Acids Market Opportunities

3.2.4. Amino Acids Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Middle East and Africa

3.5.5. South America

3.6. Key Opinion Leader Analysis for Amino Acids Industry

4. Amino Acids Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

4.1. Amino Acids Market Size and Forecast, By Type (2024-2032)

4.1.1. Essential Amino Acids

4.1.2. Non-Essential Amino Acids

4.2. Amino Acids Market Size and Forecast, By Source (2024-2032)

4.2.1. Plant-Based

4.2.2. Animal-Based

4.2.3. Synthetic/Bio-Engineered

4.3. Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

4.3.1. Animal Feed & Nutrition

4.3.2. Food & Dietary Supplements

4.3.3. Pharmaceuticals & Healthcare

4.3.4. Personal Care & Cosmetics

4.4. Amino Acids Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Amino Acids Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

5.1. North America Amino Acids Market Size and Forecast, By Type (2024-2032)

5.1.1. Essential Amino Acids

5.1.2. Non-Essential Amino Acids

5.2. North America Amino Acids Market Size and Forecast, By Source (2024-2032)

5.2.1. Plant-Based

5.2.2. Animal-Based

5.2.3. Synthetic/Bio-Engineered

5.3. North America Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

5.3.1. Animal Feed & Nutrition

5.3.2. Food & Dietary Supplements

5.3.3. Pharmaceuticals & Healthcare

5.3.4. Personal Care & Cosmetics

5.4. North America Amino Acids Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Amino Acids Market Size and Forecast, By Type (2024-2032)

5.4.1.1.1. Essential Amino Acids

5.4.1.1.2. Non-Essential Amino Acids

5.4.1.2. United States Amino Acids Market Size and Forecast, By Source (2024-2032)

5.4.1.2.1. Plant-Based

5.4.1.2.2. Animal-Based

5.4.1.2.3. Synthetic/Bio-Engineered

5.4.1.3. United States Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

5.4.1.3.1. Animal Feed & Nutrition

5.4.1.3.2. Food & Dietary Supplements

5.4.1.3.3. Pharmaceuticals & Healthcare

5.4.1.3.4. Personal Care & Cosmetics

5.4.2. Canada

5.4.2.1. Canada Amino Acids Market Size and Forecast, By Type (2024-2032)

5.4.2.1.1. Essential Amino Acids

5.4.2.1.2. Non-Essential Amino Acids

5.4.2.2. Canada Amino Acids Market Size and Forecast, By Source (2024-2032)

5.4.2.2.1. Plant-Based

5.4.2.2.2. Animal-Based

5.4.2.2.3. Synthetic/Bio-Engineered

5.4.3. Canada Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

5.4.3.1.1. Animal Feed & Nutrition

5.4.3.1.2. Food & Dietary Supplements

5.4.3.1.3. Pharmaceuticals & Healthcare

5.4.3.1.4. Personal Care & Cosmetics

5.4.4. Mexico

5.4.4.1. Mexico Amino Acids Market Size and Forecast, By Type (2024-2032)

5.4.4.1.1. Essential Amino Acids

5.4.4.1.2. Non-Essential Amino Acids

5.4.4.2. Mexico Amino Acids Market Size and Forecast, By Source (2024-2032)

5.4.4.2.1. Plant-Based

5.4.4.2.2. Animal-Based

5.4.4.2.3. Synthetic/Bio-Engineered

5.4.4.3. Mexico Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

5.4.4.3.1. Animal Feed & Nutrition

5.4.4.3.2. Food & Dietary Supplements

5.4.4.3.3. Pharmaceuticals & Healthcare

5.4.4.3.4. Personal Care & Cosmetics

6. Europe Amino Acids Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

6.1. Europe Amino Acids Market Size and Forecast, By Type (2024-2032)

6.2. Europe Amino Acids Market Size and Forecast, By Source (2024-2032)

6.3. Europe Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

6.4. Europe Amino Acids Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Amino Acids Market Size and Forecast, By Type (2024-2032)

6.4.1.2. United Kingdom Amino Acids Market Size and Forecast, By Source (2024-2032)

6.4.1.3. United Kingdom Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

6.4.2. France

6.4.2.1. France Amino Acids Market Size and Forecast, By Type (2024-2032)

6.4.2.2. France Amino Acids Market Size and Forecast, By Source (2024-2032)

6.4.2.3. France Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Amino Acids Market Size and Forecast, By Type (2024-2032)

6.4.3.2. Germany Amino Acids Market Size and Forecast, By Source (2024-2032)

6.4.3.3. Germany Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Amino Acids Market Size and Forecast, By Type (2024-2032)

6.4.4.2. Italy Amino Acids Market Size and Forecast, By Source (2024-2032)

6.4.4.3. Italy Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Amino Acids Market Size and Forecast, By Type (2024-2032)

6.4.5.2. Spain Amino Acids Market Size and Forecast, By Source (2024-2032)

6.4.5.3. Spain Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Amino Acids Market Size and Forecast, By Type (2024-2032)

6.4.6.2. Sweden Amino Acids Market Size and Forecast, By Source (2024-2032)

6.4.6.3. Sweden Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

6.4.7. Austria

6.4.7.1. Austria Amino Acids Market Size and Forecast, By Type (2024-2032)

6.4.7.2. Austria Amino Acids Market Size and Forecast, By Source (2024-2032)

6.4.7.3. Austria Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Amino Acids Market Size and Forecast, By Type (2024-2032)

6.4.8.2. Rest of Europe Amino Acids Market Size and Forecast, By Source (2024-2032)

6.4.8.3. Rest of Europe Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

7. Asia Pacific Amino Acids Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

7.1. Asia Pacific Amino Acids Market Size and Forecast, By Type (2024-2032)

7.2. Asia Pacific Amino Acids Market Size and Forecast, By Source (2024-2032)

7.3. Asia Pacific Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

7.4. Asia Pacific Amino Acids Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Amino Acids Market Size and Forecast, By Type (2024-2032)

7.4.1.2. China Amino Acids Market Size and Forecast, By Source (2024-2032)

7.4.1.3. China Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Amino Acids Market Size and Forecast, By Type (2024-2032)

7.4.2.2. S Korea Amino Acids Market Size and Forecast, By Source (2024-2032)

7.4.2.3. S Korea Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Amino Acids Market Size and Forecast, By Type (2024-2032)

7.4.3.2. Japan Amino Acids Market Size and Forecast, By Source (2024-2032)

7.4.3.3. Japan Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

7.4.4. India

7.4.4.1. India Amino Acids Market Size and Forecast, By Type (2024-2032)

7.4.4.2. India Amino Acids Market Size and Forecast, By Source (2024-2032)

7.4.4.3. India Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Amino Acids Market Size and Forecast, By Type (2024-2032)

7.4.5.2. Australia Amino Acids Market Size and Forecast, By Source (2024-2032)

7.4.5.3. Australia Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Amino Acids Market Size and Forecast, By Type (2024-2032)

7.4.6.2. Indonesia Amino Acids Market Size and Forecast, By Source (2024-2032)

7.4.6.3. Indonesia Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

7.4.7. Philippines

7.4.7.1. Philippines Amino Acids Market Size and Forecast, By Type (2024-2032)

7.4.7.2. Philippines Amino Acids Market Size and Forecast, By Source (2024-2032)

7.4.7.3. Philippines Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Amino Acids Market Size and Forecast, By Type (2024-2032)

7.4.8.2. Malaysia Amino Acids Market Size and Forecast, By Source (2024-2032)

7.4.8.3. Malaysia Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Amino Acids Market Size and Forecast, By Type (2024-2032)

7.4.9.2. Vietnam Amino Acids Market Size and Forecast, By Source (2024-2032)

7.4.9.3. Vietnam Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

7.4.10. Thailand

7.4.10.1. Thailand Amino Acids Market Size and Forecast, By Type (2024-2032)

7.4.10.2. Thailand Amino Acids Market Size and Forecast, By Source (2024-2032)

7.4.10.3. Thailand Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Amino Acids Market Size and Forecast, By Type (2024-2032)

7.4.11.2. Rest of Asia Pacific Amino Acids Market Size and Forecast, By Source (2024-2032)

7.4.11.3. Rest of Asia Pacific Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

8. Middle East and Africa Amino Acids Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

8.1. Middle East and Africa Amino Acids Market Size and Forecast, By Type (2024-2032)

8.2. Middle East and Africa Amino Acids Market Size and Forecast, By Source (2024-2032)

8.3. Middle East and Africa Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

8.4. Middle East and Africa Amino Acids Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Amino Acids Market Size and Forecast, By Type (2024-2032)

8.4.1.2. South Africa Amino Acids Market Size and Forecast, By Source (2024-2032)

8.4.1.3. South Africa Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Amino Acids Market Size and Forecast, By Type (2024-2032)

8.4.2.2. GCC Amino Acids Market Size and Forecast, By Source (2024-2032)

8.4.2.3. GCC Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Amino Acids Market Size and Forecast, By Type (2024-2032)

8.4.3.2. Nigeria Amino Acids Market Size and Forecast, By Source (2024-2032)

8.4.3.3. Nigeria Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Amino Acids Market Size and Forecast, By Type (2024-2032)

8.4.4.2. Rest of ME&A Amino Acids Market Size and Forecast, By Source (2024-2032)

8.4.4.3. Rest of ME&A Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

9. South America Amino Acids Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

9.1. South America Amino Acids Market Size and Forecast, By Type (2024-2032)

9.2. South America Amino Acids Market Size and Forecast, By Source (2024-2032)

9.3. South America Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

9.4. South America Amino Acids Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Amino Acids Market Size and Forecast, By Type (2024-2032)

9.4.1.2. Brazil Amino Acids Market Size and Forecast, By Source (2024-2032)

9.4.1.3. Brazil Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Amino Acids Market Size and Forecast, By Type (2024-2032)

9.4.2.2. Argentina Amino Acids Market Size and Forecast, By Source (2024-2032)

9.4.2.3. Argentina Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

9.4.3. Rest Of South America

9.4.3.1. Rest Of South America Amino Acids Market Size and Forecast, By Type (2024-2032)

9.4.3.2. Rest Of South America Amino Acids Market Size and Forecast, By Source (2024-2032)

9.4.3.3. Rest Of South America Amino Acids Market Size and Forecast, By End Use Industry (2024-2032)

10. Company Profile: Key Players

10.1. Comvita (New Zealand)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Manuka Health (New Zealand)

10.3. Watson & Son (New Zealand)

10.4. Capilano Honey (Australia)

10.5. Wedderspoon (USA)

10.6. Steens Honey (New Zealand)

10.7. Nature's Way (Australia)

10.8. Kiva (USA)

10.9. Manuka Doctor (UK)

10.10. Happy Valley (New Zealand)

10.11. Arataki Honey (New Zealand)

10.12. WildCape Manuka (New Zealand)

10.13. Australian Amino Acids (Australia)

10.14. Pure Honey (UK)

10.15. Manuka Pharm (Germany)

10.16. Nature's Greatest (UK)

10.17. Manuka Bio (Germany)

10.18. Three Peaks (New Zealand)

10.19. Airborne Honey (New Zealand)

10.20. First Light Honey (New Zealand)

10.21. Manuka South (New Zealand)

10.22. Kora Organics (Australia)

10.23. ManukaGuard (New Zealand)

10.24. Manuka Biotic (New Zealand)

10.25. Amino Acids USA (USA)

10.26. Amino Acids Singapore (Singapore)

10.27. Amino Acids Dubai (UAE)

10.28. Amino Acids Japan (Japan)

10.29. Amino Acids Hong Kong (China)

10.30. Amino Acids Canada (Canada)

11. Key Findings

12. Analyst Recommendations

13. Amino Acids Market: Research Methodology