Guar Gum Market Size, Share, Trend Analysis and Forecast (2025-2032)

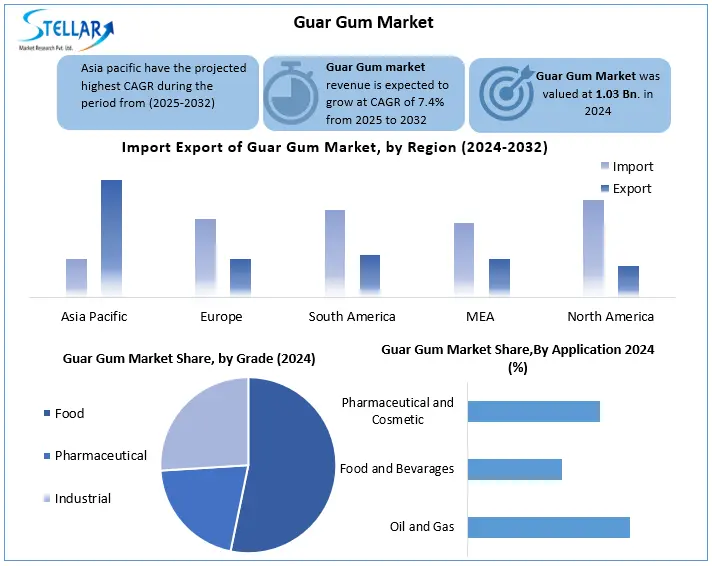

The Guar Gum Market size was valued at USD 1.03 Billion in 2024 and total Guar Gum Revenue is expected to grow at a CAGR 7.4% from 2025 to 2032, reach nearly USD 1.82 Billion

Format : PDF | Report ID : SMR_2828

Guar Gum Market Overview:

Guar gum is a novel agrochemical processed from the endosperm of the cluster bean. It is most commonly used in the form of guar gum powder food, pharmaceuticals, paper, fabrics, explosives, oil well drilling and additive in the cosmetics industry. Industrial dysfunction programs of guar gum are possible due to the ability to create hydrogen bonding with water molecules. Thus, it is mainly used as thick and stabilizers. It is also beneficial in controlling many health problems such as diabetes, intestinal activity, heart disease and colon cancer.

This article focuses on the health benefits of production, process, composition, properties, food programs and guar gum. The food and drug Administration (FDA) recognized Guar gum as safe for consumption in specified amounts in various food products. Guar gum is generally low in calories and chiefly composed of soluble fibre.it has protein content of 5 to 6 %

The guar gum market is ready for continuous growth, boosts natural additives in the food industry, increasing the ongoing development in the oil and gas sector and the demand for increasing of applications in pharmaceuticals and cosmetics. However, stakeholders should be aware of the challenges such as price fluctuations and regulatory considerations to maintain market speed.

According to the Agricultural and Processed Food Products Export Development Authority (APEDA), in the fiscal year 2023–24, India exported 417,674.38 metric tons of guar gum, valued at USD 541.65 million.

The global trade and tariff landscape for guar gum is shaped by India's dominant role as the leading exporter, accounting for approximately 78% of global exports. In 2023, India exported around 169,130 metric tons of guar gum, with the United States, Russia, and China collectively importing 81% of this volume.

To get more Insights: Request Free Sample Report

Guar Gum Market Dynamics:

Consumer Increasing Concern for Health and Nutrition Care to Boost the Guar Gum Market

The natural component guar gum improves glucose tolerance and reduces serum LDL cholesterol and triglycerides in other health benefits. For this reason, natural gums are being used quickly in the food industry. According to a research report from the National Institute of Agricultural Marketing (NIAM), the industrial application of GUI has undergone significant changes over time. Initially, the food industry was the main client, responsible for about 50% of total consumption. However, with the increase in oil and gas area, especially in hydraulic fracture operations (braking), demand mobility has changed.

Currently, the oil drilling industry consumes about 65-65% of guar gum, while the food industry's share has dropped to 20%. Other industries, including textiles, paper, explosives, pharmaceuticals and water treatment, are responsible for the remaining 15-20% of the demand for consumption for guar gum is growing to create an encapsulated flavour because it is a thicker with a great binding property. Apart from the food industry, guar gum runs the market in other industries such as oil and other industries like gas, mining, explosives, textiles, medicines and water treatment.

Global Demand for Convenience Food to Drive Guar Gum Market

Global demand for convenience food is increasing Factors such as domestic technologies, prolonged working hours, and increasing consumer income have affected all global demand for convenience food. Guar gum is an essential edible attitude that improves the quality of facilities such as soup, cake, pastry, bread, gravy and snacks. Increase in consumer interest in processed food products is expected to promote the growth of guar gum market in the near future. Increasing preference for low calorie and low-fat foods containing guar gum has helped reduce overall fat content in foods, benefiting the guar gum market. Guar gum is used as a fat option in processed foods. Globally, the consumer demand for convenient food products that is getting fit in its lifestyle, increasing. Manufacturers continue to see food and beverages as the most promising application for guar gum.

Lack Of Innovations and Research Impact on Guar Gum Market

Although Asia is the largest producer of guar and its derivatives, countries such as India and Pakistan lack general research and development facilities dedicated to the guar gum industry. These nations lack reputable R&D associations that focus on guar seed production, the development of industry-specific products, manufacturing & processing technology, and plant & machinery, as well as an adequate distribution infrastructure. Despite the fact that some institutions in the country are focusing on the development of certified seeds, agricultural universities and existing research institutions lack the necessary funds to conduct research on the development of new varieties, the optimization of product processing, and the advancement of technology.

Even farmers who are willing to use certified seeds cannot afford to purchase them. In addition to these factors, the guar industry's human resources would need to be trained in order to develop a skilled workforce. For this purpose, Indian manufacturers must allocate a portion of export tax revenue to the establishment of national-level R&D institutes.

Guar Gum Market Segment Analysis:

Based on Grade the Guar Gum Market is segmented into Food, Pharmaceutical, and Industrial. Food segment dominated the market in 2024 and is expected to hold the largest guar gum market share over the forecast period. Increasing demand for convenient foods, by changing lifestyle, developing eating habits, and increasing disposable income, is a major factor in accelerating this growth. In addition, the increasing selection of low -calorie and low-fat food products have enhanced the use of guar gum as a stable and thickening agent, strengthening its market expansion. To meet this demand, manufacturers are investing in advanced technologies to increase the efficiency and application of the product.

Based on Application the market is segmented into Oil & Gas, Food and Beverages, Pharmaceutical and Cosmetics. Oil & Gas segment dominated the market in 2024 and is expected to hold the largest Guar Gum Market Share over the forecast period. The oil and gas sector represented the global guar gum market. 37.62% mostly due to the North American shale gas boom. The increasing number of research and drilling projects worldwide is expected to lead to the growth of this segment. In the oil and gas industry, GU Dyogic's Guar gum is widely used by its beneficial properties, including gasification, thickening and friction. In this area, oil and shale gas production increased significantly to accelerate the demand for Guar. Significantly, the shell's oil and gas extraction industries represent about 90% of Guar gum produced in India and Pakistan.

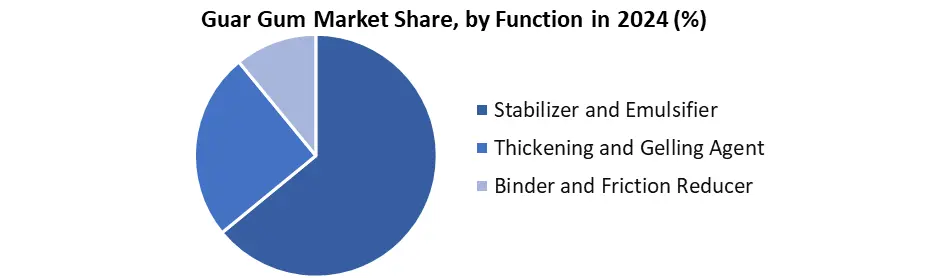

Based on Functions the market is segmented into Stabilizer and Emulsifier, Thickening and Gelling Agent, Binder and Friction Reducer. The stabilizer and Emulsifier segment dominated the Guar Gum Market in 2024 and is expected to hold the largest Guar Gum Market share over the forecast period. In 2024, the stabiliser and emulsifier captured 54.38% of the market share, market share. The segment is expected to grow with a CAGR of 6.9% during the forecast period. Guar gum is used as a stabilizer in ice cream to increase viscosity and shelf life by stabilising ice crystallization during storage. Emulsifiers are used to mix water with essential oils in individual care products. This dominance attributed to the widespread use of guar gum in food and the individual care industries. In food applications, it acts as a stabiliser in products such as ice cream, increases viscosity and prevents crystallisation of ice, causing expansion of shelf life.

Guar Gum Market Regional Analysis:

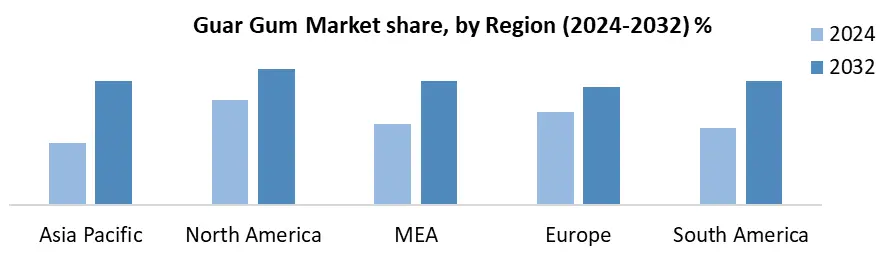

In 2024, North America dominated the global guar gum market, holding a 43.2% share, driven by the expanding oil and gas industry and increasing demand for processed and frozen foods. The U.S. produced approximately 4,600 to 14,000 tonnes of guar between 2019 and 2024, with Texas significantly expanding its guar cultivation from 7,000 acres in 1999 to nearly 50,000 acres. Additionally, the U.S. accounted for 41.2% of global guar gum imports, further solidifying North America’s market position. Meanwhile, India, the largest producer of guar, plays a vital role in the Asia-Pacific region, contributing around 65% of global supply with an annual production of 0.0025 to 0.003 billion tonnes. India’s guar gum exports increased by 10.48% in August to 18,262 tonnes from 16,530 tonnes in July, marking a 42.38% year-over-year growth. Key importers include the U.S. (5,401 tonnes), Russia (3,085 tonnes), Germany (2,535 tonnes), and China (959 tonnes).

Guar Gum Market Competitive Landscape:

The global Guar Gum market is highly competitive, with the main players focused on the strategic partnership with innovation, expansion and strengthens their market status. Hindustan Gums and Chemicals Limited, Vikas WSP Limited, Nilakant Polymer, Lucid Group, Ram Gum India India Limited, Ashland Inc., Kargil Inc. These companies are increasing production capacity, improving process techniques and the development of personalized gum formulations for industries such as oil and gas, food and beverages, pharmaceutical products and cosmetics. Fusion and acquisitions are becoming a common strategy to expand the production portfolio and increase market access. In addition, geographical expansion, durable and ecological process initiatives in high demand regions, such as North America, Europe and Asia Pacific, are gaining strength. With constant R&D investments, technological advances are improving the efficiency and application of guar gum. With increasing demand in various industries, it is expected that the opponent intensifies the formation of the future scenario of the gum market.

|

Guar Gum Market Scope |

|

|

Market Size in 2024 |

USD 1.03 Bn |

|

Market Size in 2032 |

USD 1.82 Bn. |

|

CAGR (2025-2032) |

7.4% |

|

Historic Data |

2020-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Grade Food Pharmaceutical Industrial |

|

By Application Oil and Gas Food and Beverages Pharmaceutical and Cosmetics Other |

|

|

By Functional Stabilizing and Emulsifier Thickening and Gelatine Agent Binder Friction reducing Other |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key players in Guar Gum Market:

North America

- Ingredion Incorporated (USA)

- Cargill, Inc. (USA)

- Ashland Global Holdings Inc. (USA)

- Lucid Group (USA)

- TIC Gums (USA)

- Colonial Chemical, Inc. (USA)

Asia-Pacific

- Hindustan Gums & Chemicals Ltd. (India)

- Vikas WSP Ltd. (India)

- Neelkanth Polymers (India)

- Rama Gum Industries India Ltd. (India)

- Altrafine Gums (India)

- Supreme Gums Pvt. Ltd. (India)

- Jai Bharat Gum & Chemicals Ltd. (India)

- Guar Resources LLC (India/USA)

Europe

- DuPont de Nemours, Inc. (France/USA)

- Nexira (France)

- Ruchi Soya Industries Ltd. (Germany/India)

- ADM (Archer Daniels Midland) (Germany/USA)

- Unipektin Ingredients AG (Switzerland)

Middle East & Africa

- Altrafine Gums (UAE/India)

- Arabian Guar & Derivatives (Saudi Arabia/UAE)

- AfriGum (South Africa)

- Gumpro Drilling Fluids Pvt. Ltd. (UAE/India)

South America

- Cargill Brazil (Brazil)

- DuPont do Brasil (Brazil)

- Ingredion Argentina (Argentina)

- Natural Hydrocolloids (Chile)

- Gum Technology Corporation (Mexico/Brazil)

Frequently Asked Questions

Hindustan Gums & Chemicals Ltd, Vikas WSP Ltd, Neelkanth Polymers, Rama, Gum Industries India Ltd, Altrafine Gums is the Key Vendors in the Guar Gum Markets.

What is The Key Driver of Guar Gum Market?

Growing demand for organic and non-GMO guar gum: There is a growing trend of consumers preferring organic and non-GMO food products, which is driving the demand for organic and non-GMO guar gum.

The Asia-Pacific region dominates the global guar gum market, primarily due to India's leading position in the production and export of guar gum. India is the largest producer and exporter of guar gum in the world.

1. Guar Gum Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Guar Gum Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. End-user Segment

2.4.4. Revenue (2024)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Guar Gum Market: Dynamics

3.1. Guar Gum Market Trends by Region

3.1.1. North America Guar Gum Market Trends

3.1.2. Europe Guar Gum Market Trends

3.1.3. Asia Pacific Guar Gum Market Trends

3.1.4. Middle East and Africa Guar Gum Market Trends

3.1.5. South America Guar Gum Market Trends

3.2. Guar Gum Market Dynamics

3.2.1. Global Guar Gum Market Drivers

3.2.2. Global Guar Gum Market Restraints

3.2.3. Global Guar Gum Market Opportunities

3.2.4. Global Guar Gum Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Trade Analysis

3.5.1. Top 10 Importing Countries

3.5.2. Top 10 Exporting Countries

3.6. Regulatory Landscape by Region

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Middle East and Africa

3.6.5. South America

3.7. Key Opinion Leader Analysis for Lubricants Industry

4. Guar Gum: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

4.1. Guar Gum Market Size and Forecast, By Grade (2025-2032)

4.1.1. Food

4.1.2. Pharmaceutical

4.1.3. Industrial

4.2. Guar Gum Market Size and Forecast, By Application (2025-2032)

4.2.1. Oil and Gas

4.2.2. Food and Beverages

4.2.3. Pharmaceutical and Cosmetics

4.2.4. Other

4.3. Guar Gum Market Size and Forecast, By Functional (2025-2032)

4.3.1. Stabilizing and Emulsifier

4.3.2. Thickening and Gelatine Agent

4.3.3. Binder

4.3.4. Friction reducing

4.3.5. Other

4.4. Guar Gum Market Size and Forecast, by Region (2025-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Guar Gum Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

5.1. North America Guar Gum Market Size and Forecast, By Grade (2025-2032)

5.1.1. Food

5.1.2. Pharmaceutical

5.1.3. Industrial

5.2. North America Guar Gum Market Size and Forecast, By Application (2025-2032)

5.2.1. Oil and Gas

5.2.2. Food and Beverages

5.2.3. Pharmaceutical and Cosmetics

5.2.4. Other

5.3. North America Guar Gum Market Size and Forecast, By Functional (2025-2032)

5.3.1. Stabilizing and Emulsifier

5.3.2. Thickening and Gelatine Agent

5.3.3. Binder

5.3.4. Friction reducing

5.3.5. Other

5.4. North America Guar Gum Market Size and Forecast, by Country (2025-2032)

5.4.1. United States

5.4.1.1. United States Guar Gum Market Size and Forecast, By Grade (2025-2032)

5.4.1.1.1. Food

5.4.1.1.2. Pharmaceutical

5.4.1.1.3. Industrial

5.4.1.2. United States Guar Gum Market Size and Forecast, By Application (2025-2032)

5.4.1.2.1. Oil and Gas

5.4.1.2.2. Food and Beverages

5.4.1.2.3. Pharmaceutical and Cosmetics

5.4.1.2.4. Other

5.4.1.3. United States Guar Gum Market Size and Forecast, By Functional (2025-2032)

5.4.1.3.1. Stabilizing and Emulsifier

5.4.1.3.2. Thickening and Gelatine Agent

5.4.1.3.3. Binder

5.4.1.3.4. Friction reducing

5.4.1.3.5. Other

5.4.1.4. Canada Guar Gum Market Size and Forecast, By Grade (2025-2032)

5.4.1.4.1. Food

5.4.1.4.2. Pharmaceutical

5.4.1.4.3. Industrial

5.4.1.5. Canada Guar Gum Market Size and Forecast, By Application (2025-2032)

5.4.1.5.1. Oil and Gas

5.4.1.5.2. Food and Beverages

5.4.1.5.3. Pharmaceutical and Cosmetics

5.4.1.5.4. Other

5.4.2. Canada Guar Gum Market Size and Forecast, By Functional (2025-2032)

5.4.2.1.1. Stabilizing and Emulsifier

5.4.2.1.2. Thickening and Gelatine Agent

5.4.2.1.3. Binder

5.4.2.1.4. Friction reducing

5.4.2.1.5. Other

5.4.3. Mexico

5.4.3.1. Mexico Guar Gum Market Size and Forecast, By Grade (2025-2032)

5.4.3.1.1. Food

5.4.3.1.2. Pharmaceutical

5.4.3.1.3. Industrial

5.4.3.2. Mexico Guar Gum Market Size and Forecast, By Application (2025-2032)

5.4.3.2.1. Oil and Gas

5.4.3.2.2. Food and Beverages

5.4.3.2.3. Pharmaceutical and Cosmetics

5.4.3.2.4. Other

5.4.3.3. Mexico Guar Gum Market Size and Forecast, By Functional (2025-2032)

5.4.3.3.1. Stabilizing and Emulsifier

5.4.3.3.2. Thickening and Gelatine Agent

5.4.3.3.3. Binder

5.4.3.3.4. Friction reducing

5.4.3.3.5. Other

6. Europe Guar Gum Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

6.1. Europe Guar Gum Market Size and Forecast, By Grade (2025-2032)

6.2. Europe Guar Gum Market Size and Forecast, By Application (2025-2032)

6.3. Europe Guar Gum Market Size and Forecast, By Functional (2025-2032)

6.4. Europe Guar Gum Market Size and Forecast, by Country (2025-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Guar Gum Market Size and Forecast, By Grade (2025-2032)

6.4.1.2. United Kingdom Guar Gum Market Size and Forecast, By Application (2025-2032)

6.4.1.3. United Kingdom Guar Gum Market Size and Forecast, By Functional (2025-2032)

6.4.2. France

6.4.2.1. France Guar Gum Market Size and Forecast, By Grade (2025-2032)

6.4.2.2. France Guar Gum Market Size and Forecast, By Application (2025-2032)

6.4.2.3. France Guar Gum Market Size and Forecast, By Functional (2025-2032)

6.4.3. Germany

6.4.3.1. Germany Guar Gum Market Size and Forecast, By Grade (2025-2032)

6.4.3.2. Germany Guar Gum Market Size and Forecast, By Application (2025-2032)

6.4.3.3. Germany Guar Gum Market Size and Forecast, By Functional (2025-2032)

6.4.4. Italy

6.4.4.1. Italy Guar Gum Market Size and Forecast, By Grade (2025-2032)

6.4.4.2. Italy Guar Gum Market Size and Forecast, By Application (2025-2032)

6.4.4.3. Italy Guar Gum Market Size and Forecast, By Functional (2025-2032)

6.4.5. Spain

6.4.5.1. Spain Guar Gum Market Size and Forecast, By Grade (2025-2032)

6.4.5.2. Spain Guar Gum Market Size and Forecast, By Application (2025-2032)

6.4.5.3. Spain Guar Gum Market Size and Forecast, By Functional (2025-2032)

6.4.6. Sweden

6.4.6.1. Sweden Guar Gum Market Size and Forecast, By Grade (2025-2032)

6.4.6.2. Sweden Guar Gum Market Size and Forecast, By Application (2025-2032)

6.4.6.3. Sweden Guar Gum Market Size and Forecast, By Functional (2025-2032)

6.4.7. Austria

6.4.7.1. Austria Guar Gum Market Size and Forecast, By Grade (2025-2032)

6.4.7.2. Austria Guar Gum Market Size and Forecast, By Application (2025-2032)

6.4.7.3. Austria Guar Gum Market Size and Forecast, By Functional (2025-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Guar Gum Market Size and Forecast, By Grade (2025-2032)

6.4.8.2. Rest of Europe Guar Gum Market Size and Forecast, By Application (2025-2032)

6.4.8.3. Rest of Europe Guar Gum Market Size and Forecast, By Functional (2025-2032)

7. Asia Pacific Guar Gum Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

7.1. Asia Pacific Guar Gum Market Size and Forecast, By Grade (2025-2032)

7.2. Asia Pacific Guar Gum Market Size and Forecast, By Application (2025-2032)

7.3. Asia Pacific Guar Gum Market Size and Forecast, By Functional (2025-2032)

7.4. Asia Pacific Guar Gum Market Size and Forecast, by Country (2025-2032)

7.4.1. China

7.4.1.1. China Guar Gum Market Size and Forecast, By Grade (2025-2032)

7.4.1.2. China Guar Gum Market Size and Forecast, By Application (2025-2032)

7.4.1.3. China Guar Gum Market Size and Forecast, By Functional (2025-2032)

7.4.2. S Korea

7.4.2.1. S Korea Guar Gum Market Size and Forecast, By Grade (2025-2032)

7.4.2.2. S Korea Guar Gum Market Size and Forecast, By Application (2025-2032)

7.4.2.3. S Korea Guar Gum Market Size and Forecast, By Functional (2025-2032)

7.4.3. Japan

7.4.3.1. Japan Guar Gum Market Size and Forecast, By Grade (2025-2032)

7.4.3.2. Japan Guar Gum Market Size and Forecast, By Application (2025-2032)

7.4.3.3. Japan Guar Gum Market Size and Forecast, By Functional (2025-2032)

7.4.4. India

7.4.4.1. India Guar Gum Market Size and Forecast, By Grade (2025-2032)

7.4.4.2. India Guar Gum Market Size and Forecast, By Application (2025-2032)

7.4.4.3. India Guar Gum Market Size and Forecast, By Functional (2025-2032)

7.4.5. Australia

7.4.5.1. Australia Guar Gum Market Size and Forecast, By Grade (2025-2032)

7.4.5.2. Australia Guar Gum Market Size and Forecast, By Application (2025-2032)

7.4.5.3. Australia Guar Gum Market Size and Forecast, By Functional (2025-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Guar Gum Market Size and Forecast, By Grade (2025-2032)

7.4.6.2. Indonesia Guar Gum Market Size and Forecast, By Application (2025-2032)

7.4.6.3. Indonesia Guar Gum Market Size and Forecast, By Functional (2025-2032)

7.4.7. Philippines

7.4.7.1. Philippines Guar Gum Market Size and Forecast, By Grade (2025-2032)

7.4.7.2. Philippines Guar Gum Market Size and Forecast, By Application (2025-2032)

7.4.7.3. Philippines Guar Gum Market Size and Forecast, By Functional (2025-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Guar Gum Market Size and Forecast, By Grade (2025-2032)

7.4.8.2. Malaysia Guar Gum Market Size and Forecast, By Application (2025-2032)

7.4.8.3. Malaysia Guar Gum Market Size and Forecast, By Functional (2025-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Guar Gum Market Size and Forecast, By Grade (2025-2032)

7.4.9.2. Vietnam Guar Gum Market Size and Forecast, By Application (2025-2032)

7.4.9.3. Vietnam Guar Gum Market Size and Forecast, By Functional (2025-2032)

7.4.10. Thailand

7.4.10.1. Thailand Guar Gum Market Size and Forecast, By Grade (2025-2032)

7.4.10.2. Thailand Guar Gum Market Size and Forecast, By Application (2025-2032)

7.4.10.3. Thailand Guar Gum Market Size and Forecast, By Functional (2025-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Guar Gum Market Size and Forecast, By Grade (2025-2032)

7.4.11.2. Rest of Asia Pacific Guar Gum Market Size and Forecast, By Application (2025-2032)

7.4.11.3. Rest of Asia Pacific Guar Gum Market Size and Forecast, By Functional (2025-2032)

8. Middle East and Africa Guar Gum Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. Middle East and Africa Guar Gum Market Size and Forecast, By Grade (2025-2032)

8.2. Middle East and Africa Guar Gum Market Size and Forecast, By Application (2025-2032)

8.3. Middle East and Africa Guar Gum Market Size and Forecast, By Functional (2025-2032)

8.4. Middle East and Africa Guar Gum Market Size and Forecast, by Country (2025-2032)

8.4.1. South Africa

8.4.1.1. South Africa Guar Gum Market Size and Forecast, By Grade (2025-2032)

8.4.1.2. South Africa Guar Gum Market Size and Forecast, By Application (2025-2032)

8.4.1.3. South Africa Guar Gum Market Size and Forecast, By Functional (2025-2032)

8.4.2. GCC

8.4.2.1. GCC Guar Gum Market Size and Forecast, By Grade (2025-2032)

8.4.2.2. GCC Guar Gum Market Size and Forecast, By Application (2025-2032)

8.4.2.3. GCC Guar Gum Market Size and Forecast, By Functional (2025-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Guar Gum Market Size and Forecast, By Grade (2025-2032)

8.4.3.2. Nigeria Guar Gum Market Size and Forecast, By Application (2025-2032)

8.4.3.3. Nigeria Guar Gum Market Size and Forecast, By Functional (2025-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Guar Gum Market Size and Forecast, By Grade (2025-2032)

8.4.4.2. Rest of ME&A Guar Gum Market Size and Forecast, By Application (2025-2032)

8.4.4.3. Rest of ME&A Guar Gum Market Size and Forecast, By Functional (2025-2032)

9. South America Guar Gum Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

9.1. South America Guar Gum Market Size and Forecast, By Grade (2025-2032)

9.2. South America Guar Gum Market Size and Forecast, By Application (2025-2032)

9.3. South America Guar Gum Market Size and Forecast, By Functional (2025-2032)

9.4. South America Guar Gum Market Size and Forecast, by Country (2025-2032)

9.4.1. Brazil

9.4.1.1. Brazil Guar Gum Market Size and Forecast, By Grade (2025-2032)

9.4.1.2. Brazil Guar Gum Market Size and Forecast, By Application (2025-2032)

9.4.1.3. Brazil Guar Gum Market Size and Forecast, By Functional (2025-2032)

9.4.2. Argentina

9.4.2.1. Argentina Guar Gum Market Size and Forecast, By Grade (2025-2032)

9.4.2.2. Argentina Guar Gum Market Size and Forecast, By Application (2025-2032)

9.4.2.3. Argentina Guar Gum Market Size and Forecast, By Functional (2025-2032)

9.4.3. Rest of South America

9.4.3.1. Rest of South America Guar Gum Market Size and Forecast, By Grade (2025-2032)

9.4.3.2. Rest of South America Guar Gum Market Size and Forecast, By Application (2025-2032)

9.4.3.3. Rest of South America Guar Gum Market Size and Forecast, By Functional (2025-2032)

10. Company Profile: Key Players

10.1. Hindustan Gums & Chemicals Ltd.

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Vikas WSP Ltd.

10.3. Neelkanth Polymers

10.4. Rama Gum Industries India Ltd.

10.5. Altrafine Gums

10.6. Supreme Gums Pvt. Ltd.

10.7. Jai Bharat Gum & Chemicals Ltd.

10.8. Guar Resources LLC

10.9. Cargill, Inc.

10.10. Ingredion Incorporated

10.11. Ashland Global Holdings Inc.

10.12. Lucid Group

10.13. TIC Gums (An Ingredion Company)

10.14. Colonial Chemical, Inc.

10.15. DuPont de Nemours, Inc.

10.16. Nexira

10.17. Ruchi Soya Industries Ltd.

10.18. ADM (Archer Daniels Midland)

10.19. Unipektin Ingredients AG

10.20. Altrafine Gums (UAE/India)

10.21. Arabian Guar & Derivatives

10.22. AfriGum

10.23. Gumpro Drilling Fluids Pvt. Ltd.

10.24. Cargill Brazil

10.25. DuPont do Brasil

10.26. Ingredion Argentina

10.27. Natural Hydrocolloids

10.28. Gum Technology Corporation

11. Key Findings

12. Analyst Recommendations

13. Guar Gum Market: Research Methodology