Aramid Paper Market Global Industry Analysis and Forecast (2026-2032)

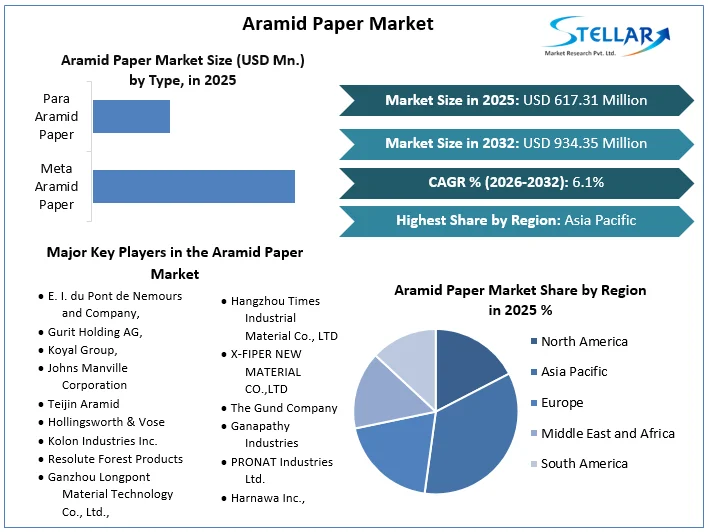

The Aramid Paper Market size was valued at USD 617.31 Mn. in 2025 and the Aramid Paper revenue is expected to grow at a CAGR of 6.1% from 2026 to 2032, reaching nearly USD 934.35 Mn. by 2032.

Format : PDF | Report ID : SMR_2232

Aramid Paper Market Overview:

Aramid paper, known for its high strength, stiffness, and heat resistance, finds extensive use in applications such as discontinuous reinforcement in polymer matrix composites, elastomers for power transmission belts and tires, and protective gear in defense sectors. The global aramid paper market is poised for substantial growth driven by increasing demand across various industries. Industries like aerospace, automotive, telecommunications, and electronics are significant consumers, contributing to market growth.

Geographically, the market shows dynamic growth, with Asia-Pacific emerging as a key region thanks to rising demand from the electrical and electronics sector and the growing aerospace and defense industries. North America and Europe also play crucial roles, driven by technological advancements and stringent regulatory standards. Distribution channels for aramid paper include direct sales, distributors, and online platforms, catering to diverse industrial needs.

Aramid paper manufacturers offer in various forms such as sheets and rolls, tailored to specific applications based on width and thickness requirements. Key players in the aramid paper market are focusing on innovation to enhance product offerings and increase their market presence. This strategic approach aims to meet increasing demand, improve market performance, and sustain competitive advantage in the global marketplace.

To get more Insights: Request Free Sample Report

Aramid Paper Market Dynamics:

Aramid Paper Market Drivers

High-Performance of Para-Aramid Paper to drive the Aramid Paper Market

The development of high-performance all-para-aramid paper, achieved through innovative impregnation of heterocyclic aramid into poly (p-phenylene terephthalamide) microfiber/nanofiber-based paper, revolutionizes specialty honeycomb material production. This advanced method enhances mechanical strength and thermal stability, crucial for demanding applications like aerospace and automotive industries.

With superior bonding capabilities and enhanced structural integrity, these papers exhibit exceptional tensile strength up to 128.5 MPa and internal bond strength of 356.1 J/m², significantly surpassing conventional counterparts. Also, their innate thermal stability and flame retardancy make them ideal for stringent safety standards. This technological leap underscores their pivotal role in driving market growth, catering to growing global industrial needs.

Advancements in Polymer Chemistry and Spinning Technologies Driving Aramid Paper Market

The aramid paper market is driven by innovations in polymer chemistry, spinning technologies, and applications in high-performance sectors, promising continued growing and versatility in industrial applications. Commercial aramids, such as flexible chain homo- and copolymers of MPDI type, dissolved in solvents like NMP and DMAc, enabling dry spinning into yarns. Similarly, copolymers of certain p-aramids, like Teijin's Technora, maintain solubility through polymerization, facilitating direct dry spinning from solution.

In contrast, PPTA (p-phenylene terephthalamide)) requires dissolution in strong acids or highly polar solvents with inorganic salts to form anisotropic solutions. This process involves polymer crystallization from solvent, followed by granule formation, solvent recovery, and subsequent spinning into yarns using concentrated H2SO4 solutions. The resulting yarns, composed of thousands of fine filaments, exhibit diameters averaging 12 μm and are crucial in applications demanding high tensile strength and heat resistance.

Additionally, aramid papers integrate fibrids and short fibers (floc) to improve mechanical properties, making them ideal for aerospace components requiring superior compression, shear, and fatigue resistance. Recent advancements in aramid films and fibrids further grow their utility in electrical insulation and composite materials, underscoring their growing significance across various industries.

Aramid Paper Market opportunities.

Development of new aramid fiber types

The development of new aramid fiber types holds transformative potential for the aramid paper market. Enhanced functionalities such as increased strength, superior heat resistance, and improved electrical insulation grow its application scope, from high-performance electrical components to fire-resistant building materials. Lightweight variants benefit aerospace and automotive sectors, aiming for fuel efficiency through reduced weight. Sustainable iterations derived from bio-based materials or enhanced recyclability address environmental concerns, boosting attractiveness to eco-conscious industries. Advances in fiber production technology also promise cost efficiencies, enhancing competitiveness against traditional materials. With these innovations, aramid paper stands poised for significant growth, fostering new applications and reinforcing its role across diverse sectors.

Aramid Paper Market Challenges

Addressing Non-Biodegradability and Promoting Eco-Friendly Practices Challenges in the Aramid Paper Market

Non-biodegradable materials present significant obstacles to global sustainability initiatives and Aramid Paper industry. They contribute to waste accumulation in landfills and the environment, exacerbate pollution through improper disposal methods, and pose threats to wildlife ecosystems. Concerns also arise from the depletion of non-renewable resources and challenges in establishing a circular economy for effective recycling and reuse.

To address these issues, advancing biodegradable alternatives such as bioplastics and compostable products, improving micro plastic recycling technologies, and educating consumers on responsible consumption and waste management are essential steps towards fostering a sustainable future. These efforts aim to promote innovation, enhance environmental awareness, and ensure long-term ecological health.

Aramid Paper Market Segment Analysis:

By Type, para-aramid paper holds a dominant market share, exceeding XX% globally, thanks to its critical role in the aramid paper segment Para-aramid paper offers exceptional properties, such as high strength and stiffness for mechanical support and dimensional stability, heat resistance for thermal insulation, and flame retardancy for safety-critical applications. These attributes make it indispensable in electrical insulation, composites, and fire-resistant materials.

Advancements in the aramid paper market include improved processing techniques like wet-laid papermaking, which allow for tailored fiber orientation and better product consistency. Integrating nanoparticles into para-aramid paper enhances its strength, thermal conductivity, and flame retardancy for specific applications. Additionally, applying functional coatings improve electrical properties of aramid paper, water resistance, and adhesion, broadening the paper's functionality and expanding its use across various high-performance applications.

Para-aramid paper is indispensable across a spectrum of high-demand applications. It serves as a leading material for electrical insulation in transformers, motors, generators, and high-voltage cables, renowned for its superior dielectric properties. In composites, it supports the aerospace industry with lightweight, heat-resistant components, enhances automotive performance with fire-resistant panels, and reinforces construction materials for fire resistance and structural integrity. Additionally, para-aramid paper plays a vital role in protective apparel such as firefighter gear and ballistic vests, providing exceptional heat resistance and puncture protection. Its versatility and reliability underscore its critical role in ensuring safety and performance across various global industries.

Aramid Paper Market Regional Insight:

The aramid paper market is geographically diverse, with Asia Pacific leading the way, holding over XX% of the global market share in the year 2025. This dominance is fueled by rapid industrialization in countries like China, India, and South Korea, where the automotive, electronics, and construction sectors heavily utilize aramid paper for its lightweight and fire-resistant properties. Additionally, investments in upgrading electrical grids and stringent safety regulations in construction and electrical sectors drive the demand for aramid paper as an essential insulation material.

- China leads in the Asia Pacific region thanks to its booming manufacturing sector in automotive, electronics, and construction. These industries heavily consume aramid paper for its lightweight and fire-resistant properties. Large-scale government infrastructure projects, especially in power grids and transportation, drive significant demand for electrical insulation materials. Additionally, stringent safety regulations in construction and electrical sectors further boost the demand for aramid paper in China.

- Japan is a key player in the aramid paper market thanks to its mature, technologically advanced industrial base, particularly in aerospace and electronics. Japanese companies focus on innovation, actively developing high-performance aramid paper grades, driving a strong domestic market for advanced applications. Additionally, Japan's stringent quality standards across various industries necessitate the use of reliable and high-performance materials like aramid paper, further solidifying its market position.

- North America and Europe are emerging region with their well-established industrial bases, are poised for steady growth in the aramid paper market. This growth is driven by ongoing demand for high-performance materials across various applications, including automotive, aerospace, and electrical insulation. The regions' commitment to innovation and stringent safety regulations further bolster the adoption of aramid paper, ensuring their continued significance in the global market.

Aramid Paper Market Competitive Landscape:

The global aramid paper market is highly competitive, with major companies innovating cost-effective, advanced products to meet increasing demand and drive growth. Key strategies, such as technical partnerships and mergers and acquisitions, are crucial for gaining a competitive edge and achieving market leadership. Major players are continuously enhancing their product offerings and growing their market reach to dominate the aramid paper industry.

The aramid paper market is dominated by DuPont (Nomex®), the industry standard for aramid fibers and papers. DuPont's strengths include a comprehensive product portfolio for diverse applications, strong brand recognition, global presence, and ongoing product innovation. In contrast, Teijin Aramid (Twaron) is a major emerging player with a growing footprint, especially in Asia Pacific. It is known for its focus on innovation, high-performance products, and competitive pricing. Key drivers include increased demand for electrical insulation, lightweight composites for aerospace and automotive, and stringent safety regulations. Other prominent competitors include Yantai Tayho Advanced Materials, Kolon Industries, and Owens Corning, focusing on product innovation, pricing, and market growth.

Aramid Paper Market Scope:

|

Aramid Paper Market |

|

|

Market Size in 2025 |

USD 617.31 Mn. |

|

Market Size in 2032 |

USD 934.35 Mn. |

|

CAGR (2026-2032) |

6.1 % |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Type Meta Aramid Paper Para Aramid Paper |

|

By Application Electrical Insulation Honeycomb Cores Ballistic Protection Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Aramid Paper Market Key Players:

- E. I. du Pont de Nemours and Company,

- Gurit Holding AG,

- Koyal Group,

- Johns Manville Corporation

- Teijin Aramid

- Hollingsworth & Vose

- Kolon Industries Inc.

- Resolute Forest Products

- Ganzhou Longpont Material Technology Co., Ltd.,

- Hangzhou Times Industrial Material Co., LTD

- X-FIPER NEW MATERIAL CO.,LTD

- The Gund Company

- Ganapathy Industries

- PRONAT Industries Ltd.

- Harnawa Inc.,

- Kumtek.

- Chevron Phillips Chemical Company

- XXX, Inc.

Frequently Asked Questions

Competition from Alternative Materials and High Cost are challenges of the Aramid Paper Market.

The Market size was valued at USD 617.31 Million in 2025 and the total Market revenue is expected to grow at a CAGR of 6.1 % from 2026 to 2032, reaching nearly USD 934.35 Million.

The segments covered in the market report are by Type, and Application.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Aramid Paper Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Aramid Paper Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovations

4. Aramid Paper Market: Dynamics

4.1. Aramid Paper Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Aramid Paper Market Drivers

4.3. Aramid Paper Market Restraints

4.4. Aramid Paper Market Opportunities

4.5. Aramid Paper Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape by Region

4.10.1. North America

4.10.2. Europe

4.10.3. Asia Pacific

4.10.4. Middle East and Africa

4.10.5. South America

5. Aramid Paper Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

5.1. Aramid Paper Market Size and Forecast, by Type (2025-2032)

5.1.1. Meta Aramid Paper

5.1.2. Para Aramid Paper

5.2. Aramid Paper Market Size and Forecast, by Application (2025-2032)

5.2.1. Electrical Insulation

5.2.2. Honeycomb Cores

5.2.3. Ballistic Protection

5.2.4. Others

5.3. Aramid Paper Market Size and Forecast, by Region (2025-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Aramid Paper Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

6.1. North America Aramid Paper Market Size and Forecast, by Type (2025-2032)

6.1.1. Meta Aramid Paper

6.1.2. Para Aramid Paper

6.2. North America Aramid Paper Market Size and Forecast, by Application (2025-2032)

6.2.1. Electrical Insulation

6.2.2. Honeycomb Cores

6.2.3. Ballistic Protection

6.2.4. Others

6.3. North America Aramid Paper Market Size and Forecast, by Country (2025-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Aramid Paper Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

7.1. Europe Aramid Paper Market Size and Forecast, by Type (2025-2032)

7.2. Europe Aramid Paper Market Size and Forecast, by Application (2025-2032)

7.3. Europe Aramid Paper Market Size and Forecast, by Country (2025-2032)

7.3.1. United Kingdom

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Russia

7.3.8. Rest of Europe

8. Asia Pacific Aramid Paper Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. Asia Pacific Aramid Paper Market Size and Forecast, by Type (2025-2032)

8.2. Asia Pacific Aramid Paper Market Size and Forecast, by Application (2025-2032)

8.3. Asia Pacific Aramid Paper Market Size and Forecast, by Country (2025-2032)

8.3.1. China

8.3.2. India

8.3.3. Japan

8.3.4. South Korea

8.3.5. Australia

8.3.6. ASEAN

8.3.7. Rest of Asia Pacific

9. Middle East and Africa Aramid Paper Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

9.1. Middle East and Africa Aramid Paper Market Size and Forecast, by Type (2025-2032)

9.2. Middle East and Africa Aramid Paper Market Size and Forecast, by Application (2025-2032)

9.3. Middle East and Africa Aramid Paper Market Size and Forecast, by Country (2025-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Egypt

9.3.4. Rest of the Middle East and Africa

10. South America Aramid Paper Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

10.1. South America Aramid Paper Market Size and Forecast, by Type (2025-2032)

10.2. South America Aramid Paper Market Size and Forecast, by Application (2025-2032)

10.3. South America Aramid Paper Market Size and Forecast, by Country (2025-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest Of South America

11. Company Profile: Key Players

11.1. E. I. du Pont de Nemours and Company,

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Gurit Holding AG,

11.3. Koyal Group,

11.4. Johns Manville Corporation

11.5. Teijin Aramid

11.6. Hollingsworth & Vose

11.7. Kolon Industries Inc.

11.8. Resolute Forest Products

11.9. Ganzhou Longpont Material Technology Co., Ltd.,

11.10. Hangzhou Times Industrial Material Co., LTD

11.11. X-FIPER NEW MATERIAL CO.,LTD

11.12. The Gund Company

11.13. Ganapathy Industries

11.14. PRONAT Industries Ltd.

11.15. Harnawa Inc.,

11.16. Kumtek.

11.17. Chevron Phillips Chemical Company

11.18. XXX, Inc.

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook