Wood Plastic Composite Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

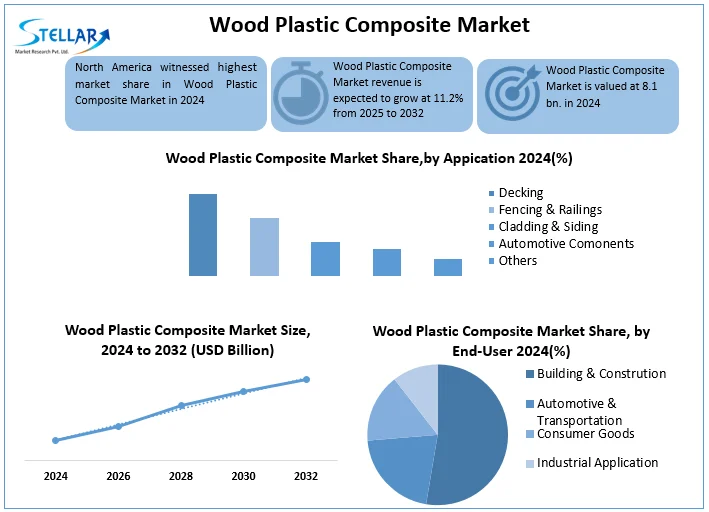

Wood Plastic Composite Market was valued at USD 8.1 billion in 2024. Its total industry revenue is expected to grow by 11.2% from 2025 to 2032, reaching nearly USD 18.94 billion in 2032.

Format : PDF | Report ID : SMR_2760

Wood Plastic Composite Market Overview

Wood Plastic Composite (WPC) is a durable, eco-friendly material made by blending wood fibers with recycled plastics. It resists rot, moisture and insects, making it ideal for outdoor applications like decking, fencing and cladding. Offering the natural look of wood with plastic's longevity, WPC requires minimal maintenance. Its sustainable production using a waste material supports green construction, while its versatility allows use in automotive and furniture industries

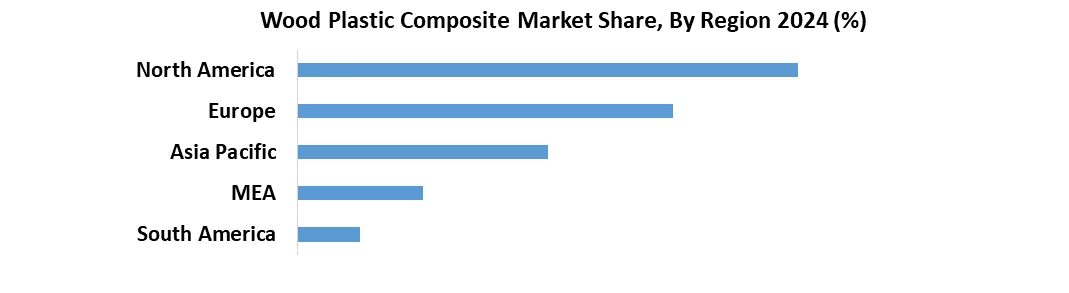

Wood Plastic Composite (WPC) Market is expanding rapidly as sustainable alternative to traditional wood and plastic in construction and manufacturing. It is unique blend of recycled wood fibers and thermoplastics offers superior durability, weather resistance and low maintenance. Dominant applications include decking, fencing, and cladding, with a North America leading adoption by strong construction demand. Asia-Pacific shows fastest growth by urbanization and green building trends. Also, key players like Trex and Fiberon are a innovating with eco-friendly, high-performance WPC solutions. The markets future lies in bio based composites and smart materials, aligning with global sustainability goals. With increasing environmental regulations, WPC is becoming a preferred choice for green construction worldwide.

To get more Insights: Request Free Sample Report

Wood Plastic Composite Market Dynamics

Sustainability and Environmental Regulations to Drive Wood Plastic Composite Market Growth

Rising concerns over a deforestation and plastic waste have increased demand for an eco-friendly alternative like WPC, which used in recycled wood fibers and plastics. Policies like EU Green Deal and EPA regulations promote sustainable materials, further boosting wood plastic composite adoption. Governments worldwide are promoting green construction, where WPC’s durability and low maintenance make it preferred choice. WPC aligns with a circular economy principles by repurposing waste materials. Regulatory and environmental push ensures steady market growth for WPC as sustainable alternative to a traditional wood and plastic.

Limited Load-Bearing Capacity to Restrict the Wood Plastic Composite Applications

Wood plastic composites offers durability and sustainability by lower structural strength compared to solid wood or a steel limits their use in heavy load-bearing applications. They are unsuitable for primary structural framework, like beams, columns, or high-stress flooring, restricting their role to a non-structural uses like decking, cladding and fencing. Limitation stems from its composite nature, blending wood fibers with polymer, which reduces rigidity. As a result, builders often opt for traditional materials in projects requiring high mechanical strength. However, ongoing material innovations aim to enhance WPC’s load-bearing potential for broader construction use.

Green Construction Expansion to Boost the Wood Plastic Composite Demand

Global shift toward a sustainable building practices presents significant opportunities for wood plastic composites (WPC) in green construction. In architects and builders seek eco-friendly alternatives to a traditional material. Recycled content and durability making it ideal for a LEED-certified project, and resistance to moisture, rot, and insects reduces maintenance needs while meeting stringent environmental standards. Also, governments worldwide are a implementing green building codes, further accelerating a WPC adoption in decks, cladding and outdoor structures. With a construction industry prioritizing carbon footprint reduction, it is positioned as a key material in sustainable urban development projects. This trend aligns with a growing consumer preference for environmentally responsible building solutions.

Wood Plastic Composite Market Segment Analysis

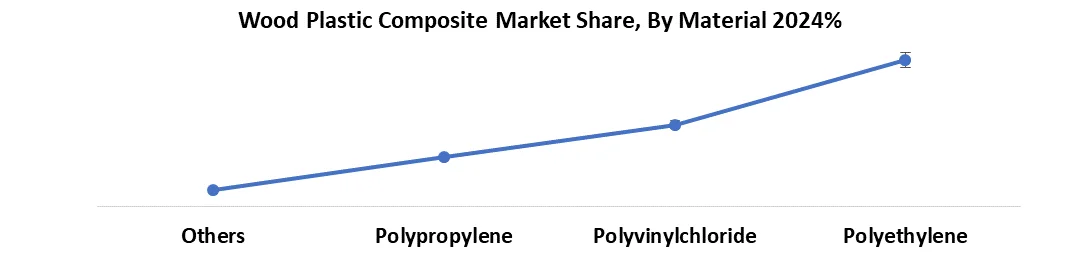

Based on material, wood plastic composite market is segmented in polyethylene, polyvinylchloride, polypropylene and other. Polyethylene dominates in wood plastic composite market due to cost-effectiveness, excellent moisture resistance and ease of processing As most economical option, PE is widely used in a outdoor applications like decking and fencing, where durability and weather resistance are crucial. Its flexibility and impact resistance make it more practical than a rigid alternative like PVC, while its compatibility with recycled materials supports a sustainable production. North America and Europe are a known for their balanced performance and affordability. Though PVC and PP offer specific advantages like fire or heat resistance, they remain less popular by their higher costs and processing challenges. Availability of recycled PE further strengthens its position as a leading material choice in WPC industry.

Based on application, Wood Plastic Composite market is segmented in decking, fencing & railings, cladding & siding, automotive components, furniture & consumer goods and others. Decking dominates wood plastic composite market by widespread use in residential and commercial outdoor spaces. This dominance stems from WPC perfect balance of wood like aesthetics and plastic durability, making it ideal for high-traffic outdoor surfaces. Compared to traditional wood decking, WPC offer superior weather resistance, low maintenance and longer lifespan. Construction is booming in North America and Europe, mainly drives demand by homeowners and builders are a increasingly prefer wood plastic composite over pressure-treated lumber for its splinter free surface, mold resistance, and color retention. Manufacturers continue innovating with a textured, capped, and hybrid WPC decking to enhance slip resistance and durability, further solidifying its market leadership.

Wood Plastic Composite Market Regional Analysis

North America, It is led by U.S. and Canada, holds largest share of global wood plastic composite market by several key factors. The region's strong demand is by their widespread adoption of WPC in residential decking, fencing and outdoor construction, where homeowners and builders prioritize low-maintenance, durable alternatives to traditional wood. Strict environmental regulations and sustainability initiatives further boost WPC usage, as it aligns with green building trends like a LEED certification. Also, a well-established construction industry, high consumer awareness and presence of major WPC manufacturers (e.g., Trex, Fiberon) solidify North America's market leadership. While Asia-Pacific is growing rapidly, North America remains dominant by its advanced market, higher purchasing power and long-standing preference for wood plastic composite in outdoor applications.

Wood Plastic Composite Market Competitive Landscape

Wood Plastic Composite market is highly competitive, with North American player like Trex and Fiberon leading through strong brand presence and innovative decking solutions. European competitors like PolyPlank focus on eco-friendly product meeting strict sustainability standards, while Asian manufacturers like Guangzhou Kindwood compete on cost-effectiveness. Companies are investing heavily in R&D to develop UV-resistant, fire-retardant and bio-based composites to differentiate their offerings. Strategic acquisitions and regional expansions are common tactics to gain market share, mainly in emerging economies. The market sees growing competition from smaller innovators developing advanced hybrid and smart WPC materials. As sustainability becomes paramount, manufacturers using a higher recycled content gain competitive advantage in green construction projects. This dynamic landscape continues to evolve with a technological advancements and shifting consumer preferences toward durable, eco-conscious building materials.

|

Wood Plastic Composite Market Scope |

|

|

Market Size in 2024 |

USD 8.1 Bn. |

|

Market Size in 2032 |

USD 18.94 Bn. |

|

CAGR (2025-2032) |

11.2% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments

|

By Material Polyethylene Polyvinylchloride Polypropylene Other |

|

By Application Decking Fencing & Railings Cladding & Siding Automotive Components Furniture & Consumer Goods Others |

|

|

By End-User Building & Construction Automotive & Transportation Consumer Goods Industrial Applications |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Wood Plastic Composite Market

North America

- Trex Company, Inc. (USA)

- Fiberon LLC (USA)

- Advanced Environmental Recycling Technologies (AERT) (USA)

- Tamko Building Products (USA)

- AZEK Company (USA)

- Universal Forest Products (USA)

- CertainTeed Corporation (USA)

Europe

- Technaro GmbH (Germany)

- PolyPlank AB (Sweden)

- TimberTech Europe (Netherlands)

- Coextruded Technologies (France)

- Brugola OEB Industriale (Italy)

- Fiberon Europe (UK)

- WPC Decking Solutions (Belgium)

Asia-Pacific

- Anhui Guofeng Co., Ltd. (China)

- Nanjing Jufeng Advanced Materials Co., Ltd. (China)

- Seven Trust Co., Ltd. (Japan)

- Shree Oorja Solutions (India)

- WOOSUNG Co., Ltd. (South Korea)

- Green Dot Plastic Products (Malaysia)

- Siam WPC Co., Ltd. (Thailand)

- Guangzhou Kindwood Co., Ltd. (China)

- Weihai Hongda Wood Plastic Technology (China)

Middle East & Africa

- Emirates Composite Materials Company (UAE)

- Saudi Basic Industries Corporation (SABIC) (Saudi Arabia)

- WPC Manufacturing Africa (South Africa)

- Al Strong WPC (Egypt)

South America

- Eucatex SA (Brazil)

- CMPC Celulosa (Chile)

- Plastinova SA (Argentina)

Frequently Asked Questions

Decking (dominant use), fencing, cladding, automotive parts, and furniture.

North America (U.S. & Canada) due to high demand for decking and strict environmental regulations.

LEED-certified projects favor WPC for its recycled content, durability, and low environmental impact.

Trex, Fiberon (North America), PolyPlank (Europe), and Guangzhou Kindwood (Asia).

1. Wood Plastic Composite Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Wood Plastic Composite Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Wood Plastic Composite Market: Dynamics

3.1. Wood Plastic Composite Market Trends

3.2. Wood Plastic Composite Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis For the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Wood Plastic Composite Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

4.1.1. Polyethylene

4.1.2. Polyvinylchloride

4.1.3. Polypropylene

4.1.4. Others

4.2. Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

4.2.1. Decking

4.2.2. Fencing & Railings

4.2.3. Cladding & Siding

4.2.4. Automotive Components

4.2.5. Furniture & Consumer Goods

4.2.6. Others

4.3. Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

4.3.1. Building & Construction

4.3.2. Automotive & Transportation

4.3.3. Consumer Goods

4.3.4. Industrial Applications

4.4. Wood Plastic Composite Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Wood Plastic Composite Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

5.1. North America Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

5.1.1. Polyethylene

5.1.2. Polyvinylchloride

5.1.3. Polypropylene

5.1.4. Others

5.2. North America Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

5.2.1. Decking

5.2.2. Fencing & Railings

5.2.3. Cladding & Siding

5.2.4. Automotive Components

5.2.5. Furniture & Consumer Goods

5.2.6. Others

5.3. North America Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

5.3.1. Building & Construction

5.3.2. Automotive & Transportation

5.3.3. Consumer Goods

5.3.4. Industrial Applications

5.4. North America Wood Plastic Composite Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

5.4.1.1.1. Polyethylene

5.4.1.1.2. Polyvinylchloride

5.4.1.1.3. Polypropylene

5.4.1.1.4. Others

5.4.1.2. United States Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

5.4.1.2.1. Decking

5.4.1.2.2. Fencing & Railings

5.4.1.2.3. Cladding & Siding

5.4.1.2.4. Automotive Components

5.4.1.2.5. Furniture & Consumer Goods

5.4.1.2.6. Others

5.4.1.3. United States Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

5.4.1.3.1. Building & Construction

5.4.1.3.2. Automotive & Transportation

5.4.1.3.3. Consumer Goods

5.4.1.3.4. Industrial Applications

5.4.2. Canada

5.4.2.1. Canada Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

5.4.2.1.1. Polyethylene

5.4.2.1.2. Polyvinylchloride

5.4.2.1.3. Polypropylene

5.4.2.1.4. Others

5.4.2.2. Canada Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

5.4.2.2.1. Decking

5.4.2.2.2. Fencing & Railings

5.4.2.2.3. Cladding & Siding

5.4.2.2.4. Automotive Components

5.4.2.2.5. Furniture & Consumer Goods

5.4.2.2.6. Others

5.4.2.3. Canada Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

5.4.2.3.1. Building & Construction

5.4.2.3.2. Automotive & Transportation

5.4.2.3.3. Consumer Goods

5.4.2.3.4. Industrial Applications

5.4.3. Mexico

5.4.3.1. Mexico Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

5.4.3.1.1. Polyethylene

5.4.3.1.2. Polyvinylchloride

5.4.3.1.3. Polypropylene

5.4.3.1.4. Others

5.4.3.2. Mexico Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

5.4.3.2.1. Decking

5.4.3.2.2. Fencing & Railings

5.4.3.2.3. Cladding & Siding

5.4.3.2.4. Automotive Components

5.4.3.2.5. Furniture & Consumer Goods

5.4.3.2.6. Others

5.4.3.3. Mexico Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

5.4.3.3.1. Building & Construction

5.4.3.3.2. Automotive & Transportation

5.4.3.3.3. Consumer Goods

5.4.3.3.4. Industrial Applications

6. Europe Wood Plastic Composite Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

6.1. Europe Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

6.2. Europe Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

6.3. Europe Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032

6.4. Europe Wood Plastic Composite Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

6.4.1.2. United Kingdom Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

6.4.1.3. United Kingdom Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

6.4.2. France

6.4.2.1. France Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

6.4.2.2. France Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

6.4.2.3. France Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

6.4.3.2. Germany Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

6.4.3.3. Germany Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

6.4.4.2. Italy Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

6.4.4.3. Italy Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

6.4.5.2. Spain Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

6.4.5.3. Spain Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

6.4.6.2. Sweden Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

6.4.6.3. Sweden Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

6.4.7. Russia

6.4.7.1. Russia Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

6.4.7.2. Russia Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

6.4.7.3. Russia Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

6.4.8.2. Rest of Europe Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

6.4.8.3. Rest of Europe Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

7. Asia Pacific Wood Plastic Composite Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

7.1. Asia Pacific Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

7.2. Asia Pacific Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

7.3. Asia Pacific Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

7.4. Asia Pacific Wood Plastic Composite Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

7.4.1.2. China Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

7.4.1.3. China Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

7.4.2.2. S Korea Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

7.4.2.3. S Korea Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

7.4.3.2. Japan Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

7.4.3.3. Japan Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

7.4.4. India

7.4.4.1. India Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

7.4.4.2. India Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

7.4.4.3. India Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

7.4.5.2. Australia Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

7.4.5.3. Australia Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

7.4.6.2. Indonesia Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

7.4.6.3. Indonesia Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

7.4.7. Malaysia

7.4.7.1. Malaysia Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

7.4.7.2. Malaysia Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

7.4.7.3. Malaysia Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

7.4.8. Philippines

7.4.8.1. Philippines Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

7.4.8.2. Philippines Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

7.4.8.3. Philippines Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

7.4.9. Thailand

7.4.9.1. Thailand Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

7.4.9.2. Thailand Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

7.4.9.3. Thailand Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

7.4.10. Vietnam

7.4.10.1. Vietnam Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

7.4.10.2. Vietnam Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

7.4.10.3. Vietnam Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

7.4.11.2. Rest of Asia Pacific Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

7.4.11.3. Rest of Asia Pacific Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

8. Middle East and Africa Wood Plastic Composite Market Size and Forecast (by Value in USD Billion) (2024-2032)

8.1. Middle East and Africa Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

8.2. Middle East and Africa Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

8.3. Middle East and Africa Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

8.4. Middle East and Africa Wood Plastic Composite Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

8.4.1.2. South Africa Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

8.4.1.3. South Africa Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

8.4.2.2. GCC Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

8.4.2.3. GCC Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

8.4.3. Egypt

8.4.3.1. Egypt Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

8.4.3.2. Egypt Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

8.4.3.3. Egypt Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

8.4.4. Nigeria

8.4.4.1. Nigeria Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

8.4.4.2. Nigeria Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

8.4.4.3. Nigeria Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

8.4.5. Rest of ME&A

8.4.5.1. Rest of ME&A Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

8.4.5.2. Rest of ME&A Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

8.4.5.3. Rest of ME&A Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

9. South America Wood Plastic Composite Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032

9.1. South America Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

9.2. South America Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

9.3. South America Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

9.4. South America Wood Plastic Composite Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

9.4.1.2. Brazil Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

9.4.1.3. Brazil Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

9.4.2.2. Argentina Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

9.4.2.3. Argentina Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

9.4.3. Colombia

9.4.3.1. Colombia Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

9.4.3.2. Colombia Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

9.4.3.3. Colombia Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

9.4.4. Chile

9.4.4.1. Chile Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

9.4.4.2. Chile Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

9.4.4.3. Chile Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

9.4.5. Rest Of South America

9.4.5.1. Rest Of South America Wood Plastic Composite Market Size and Forecast, By Material (2024-2032)

9.4.5.2. Rest Of South America Wood Plastic Composite Market Size and Forecast, By Application (2024-2032)

9.4.5.3. Rest Of South America Wood Plastic Composite Market Size and Forecast, By End-User (2024-2032)

10. Company Profile: Key Players

10.1. Trex Company, Inc. (USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Fiberon LLC (USA)

10.3. Advanced Environmental Recycling Technologies (AERT) (USA)

10.4. Tamko Building Products (USA)

10.5. AZEK Company (USA)

10.6. Universal Forest Products (USA)

10.7. CertainTeed Corporation (USA)

10.8. Technaro GmbH (Germany)

10.9. PolyPlank AB (Sweden)

10.10. TimberTech Europe (Netherlands)

10.11. Coextruded Technologies (France)

10.12. Brugola OEB Industriale (Italy)

10.13. Fiberon Europe (UK)

10.14. WPC Decking Solutions (Belgium)

10.15. Anhui Guofeng Co., Ltd. (China)

10.16. Nanjing Jufeng Advanced Materials Co., Ltd. (China)

10.17. Seven Trust Co., Ltd. (Japan)

10.18. Shree Oorja Solutions (India)

10.19. WOOSUNG Co., Ltd. (South Korea)

10.20. Green Dot Plastic Products (Malaysia)

10.21. Siam WPC Co., Ltd. (Thailand)

10.22. Guangzhou Kindwood Co., Ltd. (China)

10.23. Weihai Hongda Wood Plastic Technology (China)

10.24. Emirates Composite Materials Company (UAE)

10.25. Saudi Basic Industries Corporation (SABIC) (Saudi Arabia)

10.26. WPC Manufacturing Africa (South Africa)

10.27. Al Strong WPC (Egypt)

10.28. Eucatex SA (Brazil)

10.29. CMPC Celulosa (Chile)

10.30. Plastinova SA (Argentina)

11. Key Findings & Analyst Recommendations

12. Wood Plastic Composite Market: Research Methodology