Webtoons Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

Webtoon Market was valued at USD 10.57 Bn in 2024, and its total revenue is expected to grow at a CAGR of 27.3% from 2025 to 2032, reaching nearly USD 72.90 Bn by 2032.

Format : PDF | Report ID : SMR_2751

Webtoons Market Overview

A webtoon is a type of digital comic that originated in South Korea and is read vertically by scrolling down on a computer or smartphone, accessible anywhere and practically free of charge, each episode takes less than five minutes to read.

Webtoons Market encompasses the creation, distribution, and monetization of serialized digital comics, driven by increasing smartphone usage and content consumption trends. Demand is high among Gen Z and millennials, while views is boosted by self-publishing platforms and creator funding programs. North America dominated the Webtoons Market due to strong smartphone penetration, rising acceptance of comic-based digital entertainment, and major investments in original English-language content. By removing the conventional expenses related to physical publishing and creating new revenue sources through creative monetization strategies, including tipping schemes, ad-supported content, and premium memberships, the digital comics revolution has reduced barriers to creators' entry. Mobile app readers are the dominant, driving engagement through episodic content consumption and microtransaction models.

November 2024- DC GO, a new line of vertical-scroll webtoons available on DC Universe Infinite (DCUI), the company's digital subscription service, was introduced by DC Comics.

To get more Insights: Request Free Sample Report

Webtoons Market Dynamics

Globalization and Technological Advancements to Boost the Webtoons Market Growth

The rise in mobile-based subscriptions, online operations, has expanded and is available on a variety of entertainment platforms that include digital comics, action comics, series, and other readables, boosting the webtoon market. Over 72% of webtoon readers consume content via mobile devices. As digital comics have significantly decreased the requirement for purchasing drawing supplies like drawing pens and screen tone, webtoons are creating massive growth opportunities.

- Naver Webtoon reported 72 Bn monthly active users (MAUs) globally in 2023, with over 50% of its traffic coming from outside South Korea

Webtoons feature images that are placed vertically, allowing users to scroll from top to bottom. This enables designers to show a single, huge image on a tablet or mobile device. The major organisations in the webtoon market are forced by increased rivalry to concentrate on developing new online series and material to draw in notable clients. With numerous platforms providing localised versions of well-known games, webtoons gains a global audience. To draw in and keep readers, platforms are spending money on creating and purchasing original webtoon material.

- Kakao Entertainment allocated $500 million in 2023 for webtoon and web novel production.

Market Saturation and Quality Gaps to Restrain the Webtoons Market Growth

Several sites and authors are delivering comparable content in the fiercely competitive webtoon market. It's difficult for newcomers to get noticed and draw readers due to market saturation and competition.

- With over 10 million webtoons uploaded globally, new creators struggle to gain visibility.

Webtoons are only accessible through online platforms, and most of their content is so short, there aren't enough episodes to produce a print version. Readers are not satisfied with the level and quality of webtoon tales as of the industry's specialised nature, which results in amateur illustrators working in webtoon programs.

- Less than 5% of amateur webtoon artists achieve monetization, leading to high dropout rates.

Webtoons Market Segmentation

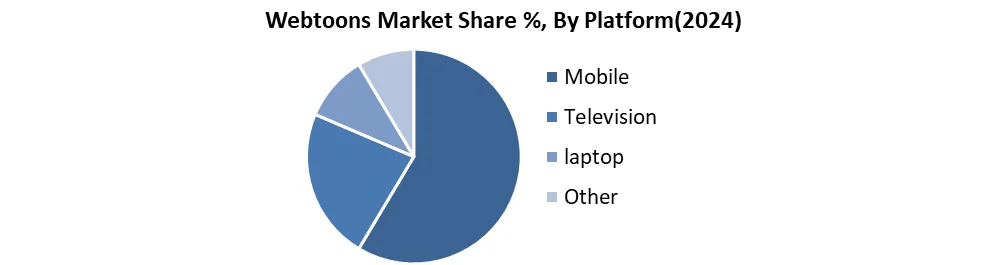

Based on the Platform, Webtoon Market is segmented into mobile, laptop, television, other, with mobile segment as a dominant platform in 2024 and is expected to hold largest market share during forecast period. Dominance is due to accessibility, ease of use, and compatibility of mobiles for webtoon format. A vertical scrolling form of webtoons makes it ideal for smartphone displays and provides a simple and engaging user experience. Readers now prefer a mobile webtoon due to the increasing usage of smartphones globally, high-speed internet, and app-based platforms for webtoons. The content is easily accessible while on the go, making it perfect for casual reading. Alternatively, a mobile device offers portability and format optimisation. Webtoon viewing is less common on platforms like laptops and televisions. Thus, mobile remains a main platform driving the growth of the webtoon industry.

Based on Type, Webtoon Market is segmented into comedy, action, romance, horror, and other, with romance segment as a dominant type in 2024 and is expected to hold largest Webtoons market share during forecast period. The readership of a romance webtoon is vast and devoted, particularly among the younger audiences and female readers, makes up a sizable portion of the webtoon user base. Strong reader engagement and enduring loyalty are produced by these stories, frequent emphasis on character growth, relatable emotional experiences, and interpersonal relationships. Furthermore, cliffhanger serialisation is common in romance webtoons, which promotes regular readership and improved retention rates. Additionally, the genre is trendy in many cultures, which makes it very flexible and profitable in international markets. Because of this, romance remains the most popular genre in terms of both audience demand and the volume of content produced.

Webtoons Market Regional Analysis

North America is the Dominating Region for the Webtoons Market

The growing popularity of digital comics and the ease of access to online content, North America held the largest revenue share, dominating the webtoons market. People now gather information more easily while on the go due to the popularity of smartphones and tablets, and webtoons and their creators became more well. Major media organisations and publishers have also stepped up their support and investment in the sector, which has fueled Webtoon's market expansion and drawn in new viewers.

Webtoons are produced in large quantities in South Korea, and their content is gaining popularity. Media adaptations are the outcome of platforms' collaboration with the entertainment industry, which has further expanded the webtoon market. The popularity of digital comics, the country's growing youth population, and the increasing use of smartphones and the internet are all driving growth in the webtoon industry in South Korea.

Webtoons Market Competitive Landscape

In the webtoons market, platforms with varying economic strategies and strategic advantages engage in intense competition. Although Webtoon (Naver Webtoon) dominates the market with its vast library of original and user-generated material, its algorithm-driven discovery mechanism provides a challenge to aspiring artists. Tapas Media has made a name for itself by offering independent creators flexible monetization alternatives like tipping and micropayments, even if it lacks the resources for high-budget original films. Radish is unique in that it blends web novels and comics, particularly in the romance and drama categories, even if its structure differs from that of standard webtoons.

WEBCOMICS has rapidly grown by adapting Asian content for global audiences, but its heavy reliance on translations rather than original intellectual property limits its competitive advantage. Lezhin Comics is the industry leader in premium adult-oriented content thanks to its membership model, but its specialisation restricts its appeal to a larger audience. Tappytoon, which specialises in licensing popular Korean manhwa for Western readers, directly competes with Webtoon's own translated content. Manta Comics' binge-friendly membership model has helped it become more popular, even though its content library is still less than that of industry heavyweights. Despite placing a strong emphasis on creator empowerment and varied material, Inkr Comics struggles with discoverability compared to its better-funded rivals. The market is constantly evolving as platforms balance monetization strategies, author support, and content quality to attract readers and artists in this fiercely competitive sector.

|

Webtoons Market Scope |

|

|

Market Size in 2024 |

USD 10.57 Bn. |

|

Market Size in 2032 |

USD 72.90 Bn. |

|

CAGR (2025-2032) |

27.3% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Comedy Action Romance Horror Others |

|

By Platform Mobile laptop Television Other |

|

|

By Monetization Model Subscription Model Advertising Model |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and the Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Webtoons Market

North America

- Tapas Media – United States (San Francisco, CA)

- Radish– United States (Los Angeles, CA)

- WEBCOMICS– United States

- Inkr Comics – United States

- Spottoon– United States

- Stela – United States

Europe

- Webtoon EU– France

- Izneo– France

Asia-Pacific

- Naver Webtoon (South Korea)

- KakaoPage (South Korea)

- Lezhin Comics (South Korea)

- Toomics (South Korea)

- Bilibili Comics (China)

- Tencent Comics (China)

- Piccoma (Japan)

- MangaPlus by Shueisha– Japan

- Comico (Japan)

- Boomtoon (South Korea)

- Mr. Blue (South Korea)

- Manta (South Korea)

- Tappytoon (South Korea)

- Webtoon – South Korea

- Lezhin Comics– South Korea (Seoul)

- Tappytoon – South Korea (Seoul)

- Manta Comics – South Korea (Seoul)

- Toomics– South Korea (Seoul)

Middle East & Africa

- Webtoon MENA– United Arab Emirates

South America

- Webtoon LATAM – Mexico

Frequently Asked Questions

North America holds the largest revenue share (25% in 2024), followed by Asia-Pacific (led by South Korea and China).

Romance, Action Comedy, Horror, and Others like fantasy/sci-fi.

High competition and market saturation, Limited print potential due to short-form content, Variable content quality from amateur creators.

Naver Webtoon (global leader), KakaoPage (dominant in Korea), Tapas Media (popular in the West), Bilibili/Tencent (leaders in China), Lezhin Comics.

1. Webtoons Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Webtoons Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. End-user Segment

2.3.4. Revenue (2024)

2.4. Leading Webtoons Market Companies, by Market Capitalisation

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Webtoons Market: Dynamics

3.1. Webtoons Market Trends by Region

3.1.1. North America Webtoons Market Trends

3.1.2. Europe Webtoons Market Trends

3.1.3. Asia Pacific Webtoons Market Trends

3.1.4. Middle East & Africa Webtoons Market Trends

3.1.5. South America Webtoons Market Trends

3.2. Webtoons Market Dynamics by Global

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Value Chain Analysis

3.6. Regulatory Landscape by Region

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Middle East & Africa

3.6.5. South America

3.7. Analysis of Government Schemes and Initiatives for the Webtoons Industry

4. Webtoons Market: Global Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

4.1. Webtoons Market Size and Forecast, By Type (2024-2032)

4.1.1. Comedy

4.1.2. Action

4.1.3. Romance

4.1.4. Horror

4.1.5. Others

4.2. Webtoons Market Size and Forecast, By Platform (2024-2032)

4.2.1. Mobile

4.2.2. Laptop

4.2.3. Television

4.2.4. Others

4.3. Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

4.3.1. Subscription Model

4.3.2. Advertising Mode

4.4. Webtoons Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East & Africa

4.4.5. South America

5. North America Webtoons Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

5.1. North America Webtoons Market Size and Forecast, By Type (2024-2032)

5.1.1. Comedy

5.1.2. Action Romance Horror Others

5.1.3. Others

5.2. North America Webtoons Market Size and Forecast, By Platform (2024-2032)

5.2.1. Mobile

5.2.2. Laptop

5.2.3. Television

5.2.4. Others

5.3. North America Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

5.3.1. Subscription Model

5.3.2. Advertising Model

5.4. North America Webtoons Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Webtoons Market Size and Forecast, By Type (2024-2032)

5.4.1.1.1. Comedy

5.4.1.1.2. Action Romance Horror Others

5.4.1.1.3. Others

5.4.1.2. United States United States Webtoons Market Size and Forecast, By Platform (2024-2032)

5.4.1.2.1. Mobile

5.4.1.2.2. Laptop

5.4.1.2.3. Television

5.4.1.2.4. Others

5.4.1.3. United States Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

5.4.1.3.1. Subscription Model

5.4.1.3.2. Advertising Model

5.4.2. Canada

5.4.2.1. Canada Webtoons Market Size and Forecast, By Type (2024-2032)

5.4.2.1.1. Comedy

5.4.2.1.2. Action Romance Horror Others

5.4.2.1.3. Others

5.4.2.2. Canada Webtoons Market Size and Forecast, By Platform (2024-2032)

5.4.2.2.1. Mobile

5.4.2.2.2. Laptop

5.4.2.2.3. Television

5.4.2.2.4. Others

5.4.2.3. Canada Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

5.4.2.3.1. Subscription Model

5.4.2.3.2. Advertising Model

5.4.3. Mexico

5.4.3.1. Mexico Webtoons Market Size and Forecast, By Type (2024-2032)

5.4.3.1.1. Comedy

5.4.3.1.2. Action Romance Horror Others

5.4.3.1.3. Others

5.4.3.2. Mexico Webtoons Market Size and Forecast, By Platform (2024-2032)

5.4.3.2.1. Mobile

5.4.3.2.2. Laptop

5.4.3.2.3. Television

5.4.3.2.4. Others

5.4.3.3. Mexico Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

5.4.3.3.1. Subscription Model

5.4.3.3.2. Advertising Model

6. Europe Webtoons Market Size and Forecast by Segmentation by Segmentation (by Value USD Bn) (2024-2032)

6.1. Europe Webtoons Market Size and Forecast, By Type (2024-2032)

6.2. Europe Webtoons Market Size and Forecast, By Platform (2024-2032)

6.3. Europe Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

6.4. Europe Webtoons Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Webtoons Market Size and Forecast, By Type (2024-2032)

6.4.1.2. United Kingdom Webtoons Market Size and Forecast, By Platform (2024-2032)

6.4.1.3. United Kingdom Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

6.4.2. France

6.4.2.1. France Webtoons Market Size and Forecast, By Type (2024-2032)

6.4.2.2. France Webtoons Market Size and Forecast, By Platform (2024-2032)

6.4.2.3. France Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Webtoons Market Size and Forecast, By Type (2024-2032)

6.4.3.2. Germany Webtoons Market Size and Forecast, By Platform (2024-2032)

6.4.3.3. Germany Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Webtoons Market Size and Forecast, By Type (2024-2032)

6.4.4.2. Italy Webtoons Market Size and Forecast, By Platform (2024-2032)

6.4.4.3. Italy Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Webtoons Market Size and Forecast, By Type (2024-2032)

6.4.5.2. Spain Webtoons Market Size and Forecast, By Platform (2024-2032)

6.4.5.3. Spain Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Webtoons Market Size and Forecast, By Type (2024-2032)

6.4.6.2. Sweden Webtoons Market Size and Forecast, By Platform (2024-2032)

6.4.6.3. Sweden Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

6.4.7. Austria

6.4.7.1. Austria Webtoons Market Size and Forecast, By Type (2024-2032)

6.4.7.2. Austria Webtoons Market Size and Forecast, By Platform (2024-2032)

6.4.7.3. Austria Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Webtoons Market Size and Forecast, By Type (2024-2032)

6.4.8.2. Rest of Europe Webtoons Market Size and Forecast, By Platform (2024-2032)

6.4.8.3. Rest of Europe Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

7. Asia Pacific Webtoons Market Size and Forecast by Segmentation by Segmentation (by Value USD Bn) (2024-2032)

7.1. Asia Pacific Webtoons Market Size and Forecast, By Type (2024-2032)

7.2. Asia Pacific Webtoons Market Size and Forecast, By Platform (2024-2032)

7.3. Asia Pacific Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

7.4. Asia Pacific Webtoons Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Webtoons Market Size and Forecast, By Type (2024-2032)

7.4.1.2. China Webtoons Market Size and Forecast, By Platform (2024-2032)

7.4.1.3. China Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Webtoons Market Size and Forecast, By Type (2024-2032)

7.4.2.2. S Korea Webtoons Market Size and Forecast, By Platform (2024-2032)

7.4.2.3. S Korea Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Webtoons Market Size and Forecast, By Type (2024-2032)

7.4.3.2. Japan Webtoons Market Size and Forecast, By Platform (2024-2032)

7.4.3.3. Japan Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

7.4.4. India

7.4.4.1. India Webtoons Market Size and Forecast, By Type (2024-2032)

7.4.4.2. India Webtoons Market Size and Forecast, By Platform (2024-2032)

7.4.4.3. India Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Webtoons Market Size and Forecast, By Type (2024-2032)

7.4.5.2. Australia Webtoons Market Size and Forecast, By Platform (2024-2032)

7.4.5.3. Australia Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Webtoons Market Size and Forecast, By Type (2024-2032)

7.4.6.2. Indonesia Webtoons Market Size and Forecast, By Platform (2024-2032)

7.4.6.3. Indonesia Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

7.4.7. Philippines

7.4.7.1. Philippines Webtoons Market Size and Forecast, By Type (2024-2032)

7.4.7.2. Philippines Webtoons Market Size and Forecast, By Platform (2024-2032)

7.4.7.3. Philippines Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Webtoons Market Size and Forecast, By Type (2024-2032)

7.4.8.2. Malaysia Webtoons Market Size and Forecast, By Platform (2024-2032)

7.4.8.3. Malaysia Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Webtoons Market Size and Forecast, By Type (2024-2032)

7.4.9.2. Vietnam Webtoons Market Size and Forecast, By Platform (2024-2032)

7.4.9.3. Vietnam Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

7.4.10. Thailand

7.4.10.1. Thailand Webtoons Market Size and Forecast, By Type (2024-2032)

7.4.10.2. Thailand Webtoons Market Size and Forecast, By Platform (2024-2032)

7.4.10.3. Thailand Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Webtoons Market Size and Forecast, By Type (2024-2032)

7.4.11.2. Rest of Asia Pacific Webtoons Market Size and Forecast, By Platform (2024-2032)

7.4.11.3. Rest of Asia Pacific Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

8. Middle East and Africa Webtoons Market Size and Forecast by Segmentation (by Value USD Bn) (2024-2032)

8.1. Middle East and Africa Webtoons Market Size and Forecast, By Type (2024-2032)

8.2. Middle East and Africa Webtoons Market Size and Forecast, By Platform Model (2024-2032)

8.3. Middle East and Africa Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

8.4. Middle East and Africa Webtoons Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Webtoons Market Size and Forecast, By Type (2024-2032)

8.4.1.2. South Africa Webtoons Market Size and Forecast, By Platform Model (2024-2032)

8.4.1.3. South Africa Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Webtoons Market Size and Forecast, By Type (2024-2032)

8.4.2.2. GCC Webtoons Market Size and Forecast, By Platform Model (2024-2032)

8.4.2.3. GCC Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Webtoons Market Size and Forecast, By Type (2024-2032)

8.4.3.2. Nigeria Webtoons Market Size and Forecast, By Platform Model (2024-2032)

8.4.3.3. Nigeria Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Webtoons Market Size and Forecast, By Type (2024-2032)

8.4.4.2. Rest of ME&A Webtoons Market Size and Forecast, By Platform Model (2024-2032)

8.4.4.3. Rest of ME&A Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

9. South America Webtoons Market Size and Forecast by Segmentation by Segmentation (by Value USD Bn.) (2024-2032)

9.1. South America Webtoons Market Size and Forecast, By Type (2024-2032)

9.2. South America Webtoons Market Size and Forecast, By Platform (2024-2032)

9.3. South America Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

9.4. South America Webtoons Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Webtoons Market Size and Forecast, By Type (2024-2032)

9.4.1.2. Brazil Webtoons Market Size and Forecast, By Platform (2024-2032)

9.4.1.3. Brazil Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Webtoons Market Size and Forecast, By Type (2024-2032)

9.4.2.2. Argentina Webtoons Market Size and Forecast, By Platform (2024-2032)

9.4.2.3. Argentina Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

9.4.3. Rest Of South America

9.4.3.1. Rest Of South America Webtoons Market Size and Forecast, By Type (2024-2032)

9.4.3.2. Rest Of South America Webtoons Market Size and Forecast, By Platform (2024-2032)

9.4.3.3. Rest Of South America Webtoons Market Size and Forecast, By Monetization Model (2024-2032)

10. Company Profile: Key Players

10.1 Webtoon (Naver Webtoon)– South Korea

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2 Tapas Media – United States (San Francisco, CA)

10.3 Radish – United States (Los Angeles, CA)

10.4 WEBCOMICS – United States

10.5 Lezhin Comics – South Korea (Seoul)

10.6 Tappytoon – South Korea (Seoul)

10.7 Manta Comics – South Korea (Seoul)

10.8 INKR Comics – United States

10.9 Toomics – South Korea (Seoul)

10.10 Spottoon – United States

10.11 Webtoon EU – France

10.12 MangaPlus by Shueisha – Japan (Tokyo)

10.13 Izneo – France (Paris)

10.14 Stela – United States (San Francisco, CA)

10.15 Naver Webtoon – South Korea

10.16 KakaoPage – South Korea (Seongnam-si, Gyeonggi-do)

10.17 Lezhin Comics – South Korea (Seoul)

10.18 Toomics – South Korea (Seoul)

10.19 Bilibili Comics – China (Shanghai)

10.20 Tencent Comics – China (Shenzhen)

10.21 Piccoma – Japan (Tokyo)

10.22 Comico – Japan (Tokyo)

10.23 Boomtoon – South Korea

10.24 Mr. Blue – South Korea

10.25 Manta – South Korea

10.26 Tappytoon (South Korea) – South Korea

10.27 Webtoon MENA – United Arab Emirates

10.28 Webtoon LATAM – Mexico

11. Key Findings & Analyst Recommendations

12. Webtoons Market: Research Methodology