Value Stream Management Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

Value Stream Management Market size is estimated at USD 463.25 Million in 2024 and is expected to reach USD 964.49 Million by 2032, at a CAGR of 9.6% during the forecast period (2024-2032).

Format : PDF | Report ID : SMR_2752

Value Stream Management Market Overview

Value stream management market growth is fuel by widely adopting DevOps and agile methods. Organizations are transferred from traditional development models to continuous delivery pipelines, and VSM solutions have emerged as important enablers, offering real -time visibility and traceability in software life cycle. High-profile enterprises like Adobe and BMW have already demonstrated tangible benefits in cycling optimization and workflow orchestration through VSM framework. Enterprise-wide visibility is another chief driver, as companies want to align IT, business and operation under single value-focused strategy. It has inspired a strong adoption among large enterprises, especially in IT and software development, dominating the market. The segment benefits from agile maturity, technical expertise and rapid ROI. Cloud-based also lead the market, offering spontaneous integration with scalability, real-time updates and remote and hybrid DevOps teams.

Emerging opportunity lies in the SME segment, where vendors such as Flomatika and Allstacks are providing inexpensive, modular solutions to meet growing digital needs. North America holds a large share in the market due to the presence of global VSM leaders such as its take-forward enterprises and Broadcom, Planview and Digital.ai. As the competition intensifies, the market is looking at cloud-country platforms, AI-operated analytics and a change towards user-centered design-VSM is making a strategic investment for organizations that develop digitally developed digitally worldwide.

To get more Insights: Request Free Sample Report

Value Stream Management Market Dynamics:

Rise of DevOps and Agile Practices to Drive Value Stream Management Market

One of the most influential drivers in the Value Stream Management market is to adopt DevOps and agile methodology. As organizations move away from traditional models, they look for continuous distribution pipelines that promote speed, cooperation and adaptability. For example, Adobe implemented a value stream management framework to unite its global development teams under a shared scene of the workflows, which reduced the release time and more responsible product repetitions.

Growing Demand for Enterprise-wide Visibility to Boost Growth of Value Stream Management Market

Enterprises have a growing requirement of cross-functional visibility. In large enterprises, value distribution often spreads many departments - from development and QA to safety, operation and business strategy. Without an integrated system to imagine the flow, track dependence, and measure the results, organizations have to face delays and disabilities. For example, BMW used Value Stream Management in its automotive software division to monitor the flow of value from R&D in its automotive software division, which enabled to make clever and rapid decisions in a highly competitive environment.

Emerging Growth Opportunity: Value Stream Management Solutions for SMEs

A notable opportunity lies in targeting small and medium enterprises (SMEs) with simple and inexpensive price stream management solutions. Historically, price stream management platforms are designed for large enterprises, but SMEs are now undergoing digital changes and demanding visibility in their workflows. This difference is being capitalized by offering vendors such as Flomatika and Allstacks to analog modular, plug-play stream management tool for small outfits. These platforms emphasize ease of use, quick onboarding and meaningful analytics without the requirement of broad configuration or consultation- such as digital maturity grows in all commercial sizes, the SME segment price represents a large extent unused growth limit for stream management providers.

Adoption Barriers to Restrain the Value Stream Management Market Growth

The existing tech stack of an organization involves integrating price stream management - often many disconnected equipment such as Jira, Jenkins, and GitHub, requiring important technical efforts and change management. In addition, price stream management changes are not purely technical. This includes aligning cross-functional teams, transferring the mindset and re-defining KPI. For example, many medium -sized healthcare and manufacturing companies have fought with fragmented IT landscapes that prevent them from realizing the full potential of price stream management. As a result of this complexity, value can be the result of adopting or reducing the stream management platforms.

Value Stream Management Market Segment Analysis:

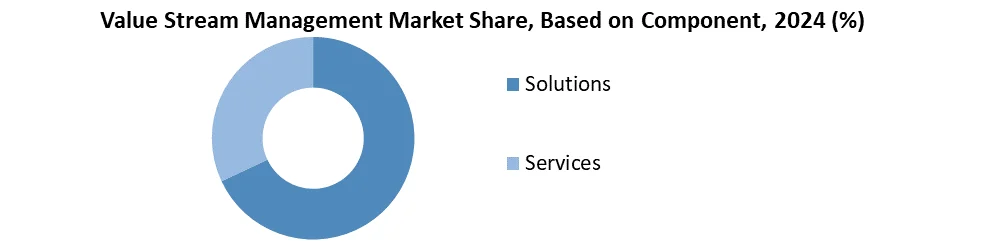

Based on Component, the Value Stream Management market is segmented into solutions and services. Solutions segment is currently commanding the major part of the Value Stream Management Market. In 2024, the solutions segment accounted approximately 68% of the global market share, driven by growing enterprise demand for end-to-end Value Stream Management platforms that unify Agile planning, DevOps integration, and business outcome measurement. Platforms such as Jira Align (Atlassian), Targetprocess (IBM Apptio), and Planview Viz enable real-time visualization of value delivery across cross-functional teams.

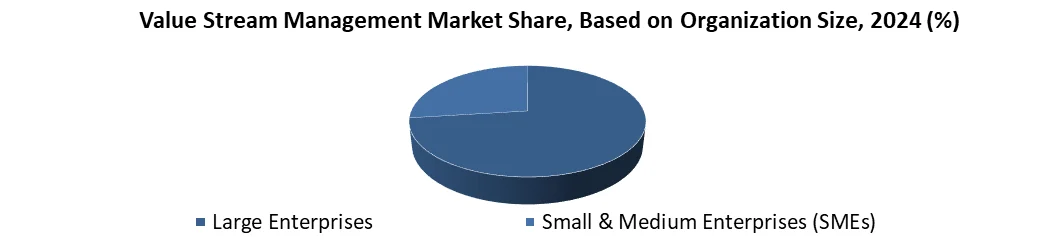

Based on Organization Size, the Value Stream Management industry is classified as large enterprises and small and medium enterprises. Large enterprises accounted for over 70% of global VSM adoption in 2024 due to the complexity of managing multi-geography development teams and digital transformation roadmaps. Firms like Capgemini, SAP, and Siemens are integrating VSM tools to ensure alignment between engineering, operations, and business outcomes. The high cost of platform customization and consulting makes VSM adoption more viable for large enterprises over SMEs

Value Stream Management Market Regional Analysis:

North America held the Dominant position in Value Stream Management Market in 2024

North America is leading the value stream management market, and many imperative players are offering value stream management solutions in this region being the early adopters which have a presence of robust technological infrastructure and advanced technologies. The region structurally contains a high saturation of Fortune 500 technology, finance, healthcare and manufacturing companies and its natural suitability for industries who are typically early and aggressive adopters of Agile and DevOps. These companies are turning to VSM more and more in an effort to close strategic gaps between coding and business impact. Especially in the U.S., the market has witnessed a rapid shift to digital-first operations as CIOs and CTOs focuses on end-to-end visibility and faster cycle time as key performance levers.

The activity of primary providers of VSM platforms like Broadcom, Planview, and Digital.ai has further accelerated innovation and adoption rates in the market. These firms serve domestic markets while also exporting advanced VSM features globally, leveraging their North American headquarters. In addition to having cloud infrastructure, a powerful network of system integrators, DevOps consultants, and Agile coaches strengthen the operational capacity of the region to scale VSM. The competitive environment is also more advanced, supporting modular and niche solutions offered by mid-sized VSM focus firms.

Value Stream Management Market Competitive Landscape:

The Value Stream Management market is led by a mix of large platform providers and niche specialists.

- Planview strengthened its leadership by acquiring Tasktop in 2022, enabling advanced developer flow visualization and enterprise-wide delivery mapping.

- Atlassian continues to dominate in mid-size Agile teams with its Jira Align tool, offering seamless integration with Jira Software, Confluence, and Bitbucket.

- Broadcom's ValueOps suite is expanding into financial services and telecom sectors by integrating portfolio management with software delivery.

- IBM’s acquisition of Apptio in 2023 allowed it to launch a cost-governance-focused VSM suite with AI-based ROI analytics.

- Digital.ai remains a preferred choice for government and defense clients due to its enterprise-grade security and on-premise deployment options.

Key competitive parameters include integration depth (CI/CD, ITSM, GitOps tools), AI/ML capability, real-time visualization, deployment support, security, and pricing transparency. Vendors increasingly offer consulting and training services to assist enterprise-scale transformation. Open-source entrants like GitLab and OpenVSM are also gaining ground among developer-first teams.

Value Stream Management Market Recent Developments

|

Date |

Recent Development |

Region |

|

February-18-2025 |

Planview completed acquisition of Sciforma, a PPM & product development solutions provider, enhancing its European & global portfolio management presence. |

Europe |

|

October-29-2024 |

IBM introduced IBM Targetprocess (Apptio) on Azure Marketplace – its first Apptio product, enabling Agile portfolio & value stream management with Azure DevOps integration. |

North America |

|

May-12-2025 |

Broadcom released ValueOps ConnectALL 3.8.0, the latest update to its flagship integration tool in the ValueOps suite |

Global |

|

Value Stream Management Market Scope |

|

|

Market Size in 2024 |

USD 463.25 Million |

|

Market Size in 2032 |

USD 964.49 Million |

|

CAGR (2024-2032) |

9.6% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Segments |

By Component Solutions Services |

|

By Deployment Type Cloud-based On-Premise |

|

|

By Organization Size Large Enterprises Small & Medium Enterprises (SMEs) |

|

|

By Industry Vertical IT & Software Development Manufacturing Pharmaceuticals & Life Sciences Healthcare Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe - UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific- China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa- South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America- Brazil, Argentina, Rest of South America |

Key Players in the Value Stream Management Market:

North America

- Planview – USA

- Digital.ai – USA

- ServiceNow – USA

- Atlassian – USA

- Broadcom – USA

- IBM – USA

- Microsoft – USA

- GitLab Inc. – USA

- CloudBees, Inc. – USA

- OpenText Corporation – Canada

- Accenture plc – Ireland

- Cognizant Technology Solutions – USA

- Blueprint Software Systems Inc. – Canada

- ConnectALL LLC – USA

- OpsHub Inc. – USA

- ThoughtFocus – USA

Europe

- Capgemini SE – France

- Orbus Software – United Kingdom

- Taskstream – United Kingdom

- Mezzo Labs – United Kingdom

- Siemens AG – Germany

- Nexthink SA – Switzerland

Asia Pacific

- Infosys Ltd. – India

- Tata Consultancy Services – India

- Persistent Systems Ltd. – India

- ThoughtWorks, Inc. – India

- Wipro Limited – India

- HCLTech – India

- EPAM Systems, Inc. - India

- Infosys Equinox – India

Frequently Asked Questions

Implementation challenges and adoption barriers are the restraints in the Value Stream Management Market.

North America is leading the Value Stream Management Market with increasing demand for Value Stream Management Market.

According to SMR, Value Stream Management Market is growing at a CAGR of 9.6%.

IT & Software Development, Manufacturing, Pharmaceuticals & Life Sciences, Healthcare, and Others are the type of industry verticals in the Value Stream Management Market.

1. Value Stream Management Market: Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Value Stream Management Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Service Segment

2.4.3. End-user Segment

2.4.4. Revenue (2024)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Value Stream Management Market: Dynamics

3.1. Value Stream Management Market Trends by Region

3.1.1. North America Value Stream Management Market Trends

3.1.2. Europe Value Stream Management Market Trends

3.1.3. Asia Pacific Value Stream Management Market Trends

3.1.4. Middle East and Africa Value Stream Management Market Trends

3.1.5. South America Value Stream Management Market Trends

3.2. Value Stream Management Market Dynamics

3.2.1. Value Stream Management Market Drivers

3.2.2. Value Stream Management Market Restraints

3.2.3. Value Stream Management Market Opportunities

3.2.4. Value Stream Management Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Middle East and Africa

3.5.5. South America

3.6. Key Opinion Leader Analysis for Value Stream Management Industry

4. Value Stream Management Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

4.1. Value Stream Management Market Size and Forecast, By Component (2024-2032)

4.1.1. Solutions

4.1.2. Services

4.2. Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

4.2.1. Cloud-based

4.2.2. On-Premise

4.3. Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

4.3.1. Large Enterprises

4.3.2. Small & Medium Enterprises (SMEs)

4.4. Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

4.4.1. IT & Software Development

4.4.2. Manufacturing

4.4.3. Pharmaceuticals & Life Sciences

4.4.4. Healthcare

4.4.5. Others

4.5. Value Stream Management Market Size and Forecast, by region (2024-2032)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. South America

5. North America Value Stream Management Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. North America Value Stream Management Market Size and Forecast, By Component (2024-2032)

5.1.1. Solutions

5.1.2. Services

5.2. North America Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

5.2.1. Cloud-based

5.2.2. On-Premise

5.3. North America Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

5.3.1. Large Enterprises

5.3.2. Small & Medium Enterprises (SMEs)

5.4. North America Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

5.4.1. IT & Software Development

5.4.2. Manufacturing

5.4.3. Pharmaceuticals & Life Sciences

5.4.4. Healthcare

5.4.5. Others

5.5. North America Value Stream Management Market Size and Forecast, by Country (2024-2032)

5.5.1. United States

5.5.1.1. United States Value Stream Management Market Size and Forecast, By Component (2024-2032)

5.5.1.1.1. Solutions

5.5.1.1.2. Services

5.5.1.2. United States Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

5.5.1.2.1. Cloud-based

5.5.1.2.2. On-Premise

5.5.1.3. United States Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

5.5.1.3.1. Large Enterprises

5.5.1.3.2. Small & Medium Enterprises (SMEs)

5.5.1.4. United States Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

5.5.1.4.1. IT & Software Development

5.5.1.4.2. Manufacturing

5.5.1.4.3. Pharmaceuticals & Life Sciences

5.5.1.4.4. Healthcare

5.5.1.4.5. Others

5.5.2. Canada

5.5.2.1. Canada Value Stream Management Market Size and Forecast, By Component (2024-2032)

5.5.2.1.1. Solutions

5.5.2.1.2. Services

5.5.2.2. Canada Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

5.5.2.2.1. Cloud-based

5.5.2.2.2. On-Premise

5.5.2.3. Canada Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

5.5.2.3.1. Large Enterprises

5.5.2.3.2. Small & Medium Enterprises (SMEs)

5.5.2.4. Canada Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

5.5.2.4.1. IT & Software Development

5.5.2.4.2. Manufacturing

5.5.2.4.3. Pharmaceuticals & Life Sciences

5.5.2.4.4. Healthcare

5.5.2.4.5. Others

5.5.3. Mexico

5.5.3.1. Mexico Value Stream Management Market Size and Forecast, By Component (2024-2032)

5.5.3.1.1. Solutions

5.5.3.1.2. Services

5.5.3.2. Mexico Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

5.5.3.2.1. Cloud-based

5.5.3.2.2. On-Premise

5.5.3.3. Mexico Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

5.5.3.3.1. Large Enterprises

5.5.3.3.2. Small & Medium Enterprises (SMEs)

5.5.3.4. Mexico Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

5.5.3.4.1. IT & Software Development

5.5.3.4.2. Manufacturing

5.5.3.4.3. Pharmaceuticals & Life Sciences

5.5.3.4.4. Healthcare

5.5.3.4.5. Others

6. Europe Value Stream Management Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

6.1. Europe Value Stream Management Market Size and Forecast, By Component (2024-2032)

6.2. Europe Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

6.3. Europe Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

6.4. Europe Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

6.5. Europe Value Stream Management Market Size and Forecast, by Country (2024-2032)

6.5.1. United Kingdom

6.5.1.1. United Kingdom Value Stream Management Market Size and Forecast, By Component (2024-2032)

6.5.1.2. United Kingdom Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

6.5.1.3. United Kingdom Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

6.5.1.4. United Kingdom Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

6.5.2. France

6.5.2.1. France Value Stream Management Market Size and Forecast, By Component (2024-2032)

6.5.2.2. France Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

6.5.2.3. France Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

6.5.2.4. France Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

6.5.3. Germany

6.5.3.1. Germany Value Stream Management Market Size and Forecast, By Component (2024-2032)

6.5.3.2. Germany Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

6.5.3.3. Germany Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

6.5.3.4. Germany Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

6.5.4. Italy

6.5.4.1. Italy Value Stream Management Market Size and Forecast, By Component (2024-2032)

6.5.4.2. Italy Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

6.5.4.3. Italy Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

6.5.4.4. Italy Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

6.5.5. Spain

6.5.5.1. Spain Value Stream Management Market Size and Forecast, By Component (2024-2032)

6.5.5.2. Spain Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

6.5.5.3. Spain Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

6.5.5.4. Spain Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

6.5.6. Sweden

6.5.6.1. Sweden Value Stream Management Market Size and Forecast, By Component (2024-2032)

6.5.6.2. Sweden Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

6.5.6.3. Sweden Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

6.5.6.4. Sweden Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

6.5.7. Austria

6.5.7.1. Austria Value Stream Management Market Size and Forecast, By Component (2024-2032)

6.5.7.2. Austria Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

6.5.7.3. Austria Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

6.5.7.4. Austria Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

6.5.8. Rest of Europe

6.5.8.1. Rest of Europe Value Stream Management Market Size and Forecast, By Component (2024-2032)

6.5.8.2. Rest of Europe Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

6.5.8.3. Rest of Europe Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

6.5.8.4. Rest of Europe Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

7. Asia Pacific Value Stream Management Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

7.1. Asia Pacific Value Stream Management Market Size and Forecast, By Component (2024-2032)

7.2. Asia Pacific Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

7.3. Asia Pacific Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

7.4. Asia Pacific Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

7.5. Asia Pacific Value Stream Management Market Size and Forecast, by Country (2024-2032)

7.5.1. China

7.5.1.1. China Value Stream Management Market Size and Forecast, By Component (2024-2032)

7.5.1.2. China Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

7.5.1.3. China Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

7.5.1.4. China Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

7.5.2. S Korea

7.5.2.1. S Korea Value Stream Management Market Size and Forecast, By Component (2024-2032)

7.5.2.2. S Korea Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

7.5.2.3. S Korea Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

7.5.2.4. S Korea Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

7.5.3. Japan

7.5.3.1. Japan Value Stream Management Market Size and Forecast, By Component (2024-2032)

7.5.3.2. Japan Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

7.5.3.3. Japan Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

7.5.3.4. Japan Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

7.5.4. India

7.5.4.1. India Value Stream Management Market Size and Forecast, By Component (2024-2032)

7.5.4.2. India Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

7.5.4.3. India Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

7.5.4.4. India Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

7.5.5. Australia

7.5.5.1. Australia Value Stream Management Market Size and Forecast, By Component (2024-2032)

7.5.5.2. Australia Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

7.5.5.3. Australia Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

7.5.5.4. Australia Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

7.5.6. Indonesia

7.5.6.1. Indonesia Value Stream Management Market Size and Forecast, By Component (2024-2032)

7.5.6.2. Indonesia Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

7.5.6.3. Indonesia Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

7.5.6.4. Indonesia Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

7.5.7. Philippines

7.5.7.1. Philippines Value Stream Management Market Size and Forecast, By Component (2024-2032)

7.5.7.2. Philippines Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

7.5.7.3. Philippines Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

7.5.7.4. Philippines Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

7.5.8. Malaysia

7.5.8.1. Malaysia Value Stream Management Market Size and Forecast, By Component (2024-2032)

7.5.8.2. Malaysia Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

7.5.8.3. Malaysia Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

7.5.8.4. Malaysia Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

7.5.9. Vietnam

7.5.9.1. Vietnam Value Stream Management Market Size and Forecast, By Component (2024-2032)

7.5.9.2. Vietnam Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

7.5.9.3. Vietnam Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

7.5.9.4. Vietnam Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

7.5.10. Thailand

7.5.10.1. Thailand Value Stream Management Market Size and Forecast, By Component (2024-2032)

7.5.10.2. Thailand Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

7.5.10.3. Thailand Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

7.5.10.4. Thailand Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

7.5.11. Rest of Asia Pacific

7.5.11.1. Rest of Asia Pacific Value Stream Management Market Size and Forecast, By Component (2024-2032)

7.5.11.2. Rest of Asia Pacific Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

7.5.11.3. Rest of Asia Pacific Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

7.5.11.4. Rest of Asia Pacific Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

8. Middle East and Africa Value Stream Management Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

8.1. Middle East and Africa Value Stream Management Market Size and Forecast, By Component (2024-2032)

8.2. Middle East and Africa Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

8.3. Middle East and Africa Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

8.4. Middle East and Africa Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

8.5. Middle East and Africa Value Stream Management Market Size and Forecast, by Country (2024-2032)

8.5.1. South Africa

8.5.1.1. South Africa Value Stream Management Market Size and Forecast, By Component (2024-2032)

8.5.1.2. South Africa Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

8.5.1.3. South Africa Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

8.5.1.4. South Africa Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

8.5.2. GCC

8.5.2.1. GCC Value Stream Management Market Size and Forecast, By Component (2024-2032)

8.5.2.2. GCC Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

8.5.2.3. GCC Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

8.5.2.4. GCC Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

8.5.3. Nigeria

8.5.3.1. Nigeria Value Stream Management Market Size and Forecast, By Component (2024-2032)

8.5.3.2. Nigeria Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

8.5.3.3. Nigeria Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

8.5.3.4. Nigeria Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

8.5.4. Rest of ME&A

8.5.4.1. Rest of ME&A Value Stream Management Market Size and Forecast, By Component (2024-2032)

8.5.4.2. Rest of ME&A Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

8.5.4.3. Rest of ME&A Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

8.5.4.4. Rest of ME&A Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

9. South America Value Stream Management Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

9.1. South America Value Stream Management Market Size and Forecast, By Component (2024-2032)

9.2. South America Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

9.3. South America Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

9.4. South America Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

9.5. South America Value Stream Management Market Size and Forecast, by Country (2024-2032)

9.5.1. Brazil

9.5.1.1. Brazil Value Stream Management Market Size and Forecast, By Component (2024-2032)

9.5.1.2. Brazil Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

9.5.1.3. Brazil Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

9.5.1.4. Brazil Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

9.5.2. Argentina

9.5.2.1. Argentina Value Stream Management Market Size and Forecast, By Component (2024-2032)

9.5.2.2. Argentina Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

9.5.2.3. Argentina Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

9.5.2.4. Argentina Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

9.5.3. Rest Of South America

9.5.3.1. Rest Of South America Value Stream Management Market Size and Forecast, By Component (2024-2032)

9.5.3.2. Rest Of South America Value Stream Management Market Size and Forecast, By Deployment Type (2024-2032)

9.5.3.3. Rest Of South America Value Stream Management Market Size and Forecast, By Organization Size (2024-2032)

9.5.3.4. Rest Of South America Value Stream Management Market Size and Forecast, By Industry Vertical (2024-2032)

10. Company Profile: Key Players

10.1. Planview

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Digital.ai

10.3. Service Now

10.4. Atlassian

10.5. Broadcom

10.6. IBM

10.7. Microsoft

10.8. GitLab Inc.

10.9. Cloud Bees, Inc.

10.10. OpenText Corporation

10.11. Accenture plc

10.12. Capgemini SE

10.13. Infosys Ltd.

10.14. Cognizant Technology Solutions

10.15. Tata Consultancy Services (TCS)

10.16. Persistent Systems Ltd.

10.17. Thought Works, Inc.

10.18. Wipro Limited

10.19. HCL Tech

10.20. EPAM Systems, Inc.

10.21. Nexthink SA

10.22. Blueprint Software Systems Inc.

10.23. Connect ALL LLC

10.24. Ops Hub Inc.

10.25. Orbus Software

10.26. Task stream

10.27. Mezzo Labs

10.28. Thought Focus

10.29. Infosys Equinox

10.30. Siemens AG

11. Key Findings

12. Analyst Recommendations

13. Value Stream Management Market: Research Methodology