Pancake and Waffle Mix Market -Share, Size and Forecast (2025-2032)

Pancake and Waffle Mix Market size was valued at USD 571.08 Million in 2024 and the market is expected to grow at a CAGR of 4.44% from 2025 to 2032

Format : PDF | Report ID : SMR_2641

Pancake and Waffle Mix Market Overview:

Pancake and waffle mixes are similar but not identical; pancake mix creates soft, fluffy pancakes, while waffle mix typically contains more fat and sugar for a crispier, golden-brown waffle texture.

Typically, those mixes comprise a combination of flour, sugar, baking powder, salt, and, on occasion, powdered milk and eggs. Users typically only want to add liquid elements, along with water, milk, or eggs, to the dry mix to create a batter appropriate for making pancakes or waffles.

The pancake and waffle mix market has experienced steady growth in recent years, which is inspired by increasing consumers' demand for practicality, ready-to-eat breakfast options. As modern lifestyle increases rapidly, more consumers easily become clear foods, and pancake and waffle mixes are perfect for this need. The market includes a variety of product types, ranging from traditional mixtures to gluten-free, organic, and protein-rich alternatives, food for health-conscious consumers. This diversification continued with increasing cooking trends at home, especially after the COVID-19 pandemic, which encouraged more people to prepare food at home.

In addition, the global expansion of Western breakfast culture has a positive impact on the market, especially in emerging economies where urbanization and disposable income are increased. The brands also benefit from online platforms and attractive packaging to improve access and consumer appeal. Provides new opportunities for innovation producers in taste, material, and fortifications with nutrients such as fiber and protein. As a result, stable pancake and waffle mix marks are expected to maintain a staggering upward, which is supported by the development of dietary preferences and focus on the plant without compromising taste or quality.

To get more Insights: Request Free Sample Report

Pancake and Waffle Mix Market Dynamics:

Growing Demand for Convenient Breakfast Options

The demand for convenient breakfast options has increased as individuals want quick and simple food to accommodate their busy schedules. Pancake and Waffle Mix have become popular options, providing a simple solution for warm, homemade snacks without comprehensive preparation. This trend is particularly clear between working professionals and students, who often have limited time in the morning. The extensive Breakfast Food Market reflects this change, leading to a significant increase in ready-to-eats and on-a-go products. For example, the global ready-to-eat and on-a-go breakfast food market is estimated to increase the mixed annual growth rate (CAGR) by 6.9% in the coming years, emphasizing convenience in food options.

This increasing preference has also faced challenges in solving quick breakfast, such as the U.S. Record-high egg prices contributing to increasing demand, as restaurants and fast-food chains expand their breakfast offerings. Additionally, health concerns have come to light, which, due to the recent memory of a popular pancake and waffle mix, highlight the need for vigilance in product safety, due to an undeclared milk allergen.

Rise In At-Home Cooking Trends

In recent years, the cooking tendency at home has seen significant growth, which is driven by changing consumer preferences for large-scale, healthy, cost-effective, and adaptable food. The COVID-19 epidemic acted especially as a catalyst, encouraging people to develop culinary skills and to experiment with easy cuisine, including pancakes and waffles. This innings has continued the post-pandemic era, as many people now get comfort and creativity in preparing their breakfast. Ready-to-use pancakes and waffle mixes have the correct balance of facilities and control, enabling users to enjoy fresh, hot food without the trouble of preparing batter with scratches. According to a 2024 report by the Food Business News, the sale of breakfast mix was seen in North America alone, showing a strong and constant consumer interest in homemade morning meals. This trend is expected to remain, especially when brands offer cleaner labels, premium content, and innovation with health-centred variants.

Opportunities: E-Commerce and D2C Channels

The growth of online shopping and direct-to-consumer (D2C) strategies has opened new avenues for pancake and waffle mix brands to connect directly with their target audience. By taking advantage of e-commerce platforms and their own branded websites, companies can bypass traditional retail channels and reduce overhead costs by gaining better control over customer data and experiences. This digital shift allows creative offerings such as membership-based delivery, customised product bundles and analogous propaganda based on personal purchase behaviour. These individual approaches not only promote customer loyalty but also enable brands to adapt to market trends and consumer reactions, eventually enhancing permanent growth.

Sustainability and Clean Labeling

Consumers nowadays pay greater attention to the environmental and fitness outcomes of their procurement, which gives a sturdy choice to manufacturers that includes balance and transparency. In pancake and waffle mix markets, this fashion is the demand for eco-friendly packaging answers such as biodegradable or recycled materials, as well as better cloth from the obligation that supports moral farming practices. Additionally, shopkeepers are actively seeking out products with easy labels, which are made without artificial components, artificial tastes, or preservatives. This conscious procurement conduct not only helps public welfare, but also suggests the preference to make contributions to a healthy planet, which aligns manufacturers with those values, which is a competitive facet in the marketplace.

Challenges: Short Shelf Life of Natural Ingredients

As the consumer's demand leads to organic and preservative-free pancakes and waffle mixes, manufacturers are facing significant obstacles in maintaining product freshness and stability. Natural ingredients, while healthy and more conscious buyers, deteriorate rapidly due to the absence of synthetic preservatives. This limits the shelf life of products, causing logical challenges in transport, storage, and retail performance. According to a recent report by Food Navigator, many biological food producers are now investing in advanced packaging technologies and cold chain logistics to have cold chain logistics. However, these solutions often increase production and distribution costs, which can affect pricing and overall competition in the market.

Recent Development

In February 2025, Quaker Oats released a recall for 10,000 boxes of Pearl Milling Company's original pancake and waffle mix, which caused risk to individuals with milk allergies due to undisclosed milk. Recall was classified by the FDA as a class I, which reflects a reasonable possibility that the use of the product can cause serious health consequences or death. Consumers with milk allergies were advised to avoid the product.

Nella's introduced a Cassava Pancake and Waffle Mix in May 2024, offering a gluten-free alternative and reflecting the trend towards diverse and health-focused products.

Top of Form

Bottom of Form

Pancake and Waffle Mix Market Regional Analysis:

North America has been the dominant region especially in 2024. In United States and Canada, the demand for pancake and waffle mix remains strong. It is largely due to the convenience that these products offer for quick food preparation, aligning with a sharp lifestyle prevalent in these countries. Additionally, a strong breakfast culture in the US contributes significantly to the dominance of the market in the region.

Asia-Pacific region, the market is emerging as a prominent player in the East-Mix region. Factors such as changing lifestyle, a growing working population and limited time for cooking have led to the increasing demand for easily prepared foods, including pancakes and waffle mixes. Focusing on Japan, the price of the Pancake and Waffle Mix Market was 3.35 million in 2024 and is expected to increase by 2032 to 4.27 million USD, reflecting a mixed annual growth rate is 3.12% (CAGR). The popularity of various pancake types, such as Hotcake, Doriyaki, Creeps, and Okonomiyaki, increases this demand. However, the growing number of consumers vigilant to health creates a challenge, as traditional mixtures often contain materials and preservatives that go to avoid demographic.

Europe also has a significant portion of the pancake and waffle mix market. Waffles, in particular, have become integral for European breakfast, brunch and dessert menus. The availability of a preservative-free and natural flavored combination provides the choice of this field for healthy food options.

Pancake and Waffle Mix Market Segment Analysis:

By Type, The pancake continues to lead the mixing segment, which is widely familiar and supported by its widely familiar and cultural acceptance in various global regions. In many homes around the world, and is favored by sweet cuisine for its versatility. This popularity has especially inspired the demand for strong retail and food items in North America and Europe. On the other hand, Waffle Mix is ??continuously gaining ground by increasing the growing influence of Western breakfast traditions and the expansion of cafe culture globally. Waffle is rapidly gaining popularity in the brunch menu, food delivery platform, and quick-service restaurant, which attracts a small consumer base. This change is supported by innovations in the mixture of yoga’s, including protein-rich, gluten-free and pet-friendly variants, that appeal to health-conscious and courageous eaters.

Preparation and adaptation for dietary trends, gluten-free, whole grains, or protein-rich options are equally important in homes and food items. On the other hand, waffles are gaining mixing popularity, especially in urban centres, and for young consumers, the breakfast and western-inspired food experiences have been designed. The increasing influence of social media food trends and the expansion of breakfast-centred restaurant chains have contributed to the increasing demand for waffle products. Together, both mixed consumers are developed with preferences, showing innovation in taste, nutrition, and convenience.

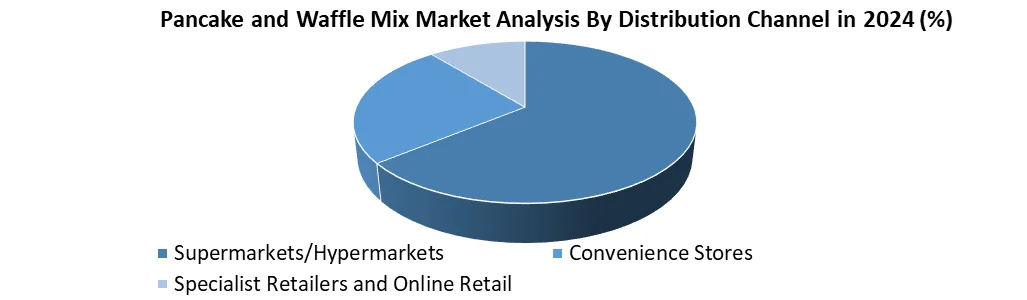

By Distribution Channel, Supermarkets and Hypermarkets dominate the landscape due to their comprehensive product variety, brand appearance, and established consumer trust. These retail giants act as a one-stop solution for customers who are looking to detect different mixing options from standard offerings to health-oriented options such as low-carb or organic versions. Their broad geographical appearance, regular promotion, and shelf visibility make them a favourite option for both established brands and new market entrants that aim for the sale of high-trunk.

Conversely, convenience stores meet the requirement of quick and easy access to pancakes and waffle mixes, especially in urban settings where consumers often seek solutions for a time-saving breakfast. These stores typically stock up on the best-selling or fastest-selling variants, which are ideal for on-the-go shoppers. Meanwhile, experts are emerging as retailers and online platforms with dynamic sales routes. They attract health-conscious or niche-market consumers by offering unique, premium, or allergen-free mixes that cannot be easily available in traditional outlets. Digital spaces, in particular, have opened up new development opportunities for artisans and small-scale producers, allowing them to reach the target audience through curated marketing and subscription models

Pancake and Waffle Mix Market Competitive Landscape:

The presence of both global veterans and regional players in the Pancake and Waffle Mix Market is a competitive landscape, which makes every effort to attract the attention of the consumer through innovation, taste diversity, and health-centred offerings. In North America, brands such as Crustiaz, Kodiaq cake, and pearl milling companies dominate with strong brand recognition and widespread distribution. European companies such as Oatkar and Nestle contribute through diverse product lines and emphasise quality. Meanwhile, in the Asia-Pacific region, firms such as Nisshin Saffun and ITC are receiving traction by catering to local tastes and dietary preferences. With the increasing demand for convenience foods and healthy options, players are investing rapidly in product improvement and digital marketing to establish their foothold in this developed market.

|

Pancake and Waffle Mix Market Scope |

|

|

Market Size in 2024 |

USD 571.08 Mn. |

|

Market Size in 2032 |

USD 808.14 Mn. |

|

CAGR (2025-2032) |

4.44% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Pancake Mix Waffle Mix |

|

By Distribution Channel Supermarkets and Hypermarkets Convenience Stores Specialist Retailers and Online Retail |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Pancake and Waffle Mix Key Players:

North America

- Aunt Jemima (Pearl Milling Company) (Chicago, Illinois, USA)

- Krusteaz (Continental Mills) (Seattle, Washington, USA)

- Hungry Jack (Smucker Foods of Canada Corp.) (Orrville, Ohio, USA)

- Kodiak Cakes (Park City, Utah, USA)

- Betty Crocker (General Mills) (Minneapolis, Minnesota, USA)

Europe

- Dr. Oetker (Bielefeld, Germany)

- Nestlé S.A. (Vevey, Switzerland)

- Doves Farm Foods Ltd. (Hungerford, England, UK)

- Alara Wholefoods Ltd. (London, UK)

Asia-Pacific

- Nisshin Seifun Group Inc. (Tokyo, Japan)

- Morinaga & Co., Ltd. (Tokyo, Japan)

- ITC Limited (Aashirvaad) (Kolkata, India)

- Marico Ltd. (Saffola) (Mumbai, India)

Latin America

- Bimbo Group (Mexico City, Mexico)

- Alimentos La Moderna (Toluca, Mexico)

Middle East & Africa

- Pillsbury (Licensed to General Mills MEA) (Dubai, UAE)

- Tiger Brands (Johannesburg, South Africa)

Frequently Asked Questions

Major drivers include the rising demand for convenient breakfast options, increased at-home cooking trends, and the expansion of Western breakfast culture in emerging markets.

Supermarkets and hypermarkets lead the market due to their wide product variety, brand visibility, and trusted customer base.

The main challenge is the short shelf life of products made with natural ingredients and without preservatives, which impacts storage and distribution.

E-commerce and D2C strategies enable cost-efficient reach, personalized offerings, and better customer engagement, driving brand growth and innovation.

North America leads in market size, while Asia-Pacific is emerging rapidly due to urbanization, changing lifestyles, and a growing working population

1. Pancake and Waffle Mix Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Pancake and Waffle Mix Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. End-user Segment

2.4.4. Revenue (2024)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Pancake and Waffle Mix Market: Dynamics

3.1. Pancake and Waffle Mix Market Trends by Region

3.1.1. North America Pancake and Waffle Mix Market Trends

3.1.2. Europe Pancake and Waffle Mix Market Trends

3.1.3. Asia Pacific Pancake and Waffle Mix Market Trends

3.1.4. Middle East and Africa Pancake and Waffle Mix Market Trends

3.1.5. South America Pancake and Waffle Mix Market Trends

3.2. Pancake and Waffle Mix Market Dynamics

3.2.1. Global Pancake and Waffle Mix Market Drivers

3.2.2. Global Pancake and Waffle Mix Market Restraints

3.2.3. Global Pancake and Waffle Mix Market Opportunities

3.2.4. Global Pancake and Waffle Mix Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Trade Analysis

3.5.1. Top 10 Importing Countries

3.5.2. Top 10 Exporting Countries

3.6. Technology Analysis

3.7. Pricing Analysis

3.7.1. Average Selling Price Trend of key players, By Type

3.7.2. Average Selling Price Trend, by Region

3.8. Regulatory Landscape by Region

3.8.1. North America

3.8.2. Europe

3.8.3. Asia Pacific

3.8.4. Middle East and Africa

3.8.5. South America

3.9. Key Opinion Leader Analysis for Pancake and Waffle Mix Industry

4. Pancake and Waffle Mix Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

4.1. Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

4.1.1. Pancake Mix

4.1.2. Waffle Mix

4.2. Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

4.2.1. Supermarkets and Hypermarkets

4.2.2. Convenience Stores

4.2.3. Others

4.3. Pancake and Waffle Mix Market Size and Forecast, by Region (2024-2032)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia Pacific

4.3.4. Middle East and Africa

4.3.5. South America

5. North America Pancake and Waffle Mix Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. North America Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

5.1.1. Pancake Mix

5.1.2. Waffle Mix

5.2. North America Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

5.2.1. Supermarkets and Hypermarkets

5.2.2. Convenience Stores

5.2.3. Specialist Retailers and Online Retail

5.3. North America Pancake and Waffle Mix Market Size and Forecast, by Country (2024-2032)

5.3.1. United States

5.3.1.1. United States Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

5.3.1.1.1. Pancake Mix

5.3.1.1.2. Waffle Mix

5.3.1.2. United States Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

5.3.1.2.1. Supermarkets and Hypermarkets

5.3.1.2.2. Convenience Store

5.3.1.2.3. Specialist Retailers and Online Retail

5.3.1.3. Canada Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

5.3.1.3.1. Pancake Mix

5.3.1.3.2. Waffle Mix

5.3.1.4. Canada Pancake and Waffle Mix Market Size and Forecast, By Type Type (2024-2032)

5.3.1.4.1. Supermarkets and Hypermarkets

5.3.1.4.2. Convenience Store

5.3.1.4.3. Specialist Retailers and Online Retail

5.3.2. Mexico

5.3.2.1. Mexico Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

5.3.2.1.1. Pancake Mix

5.3.2.1.2. Waffle Mix

5.3.2.2. Mexico Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

5.3.2.2.1. Supermarkets and Hypermarkets

5.3.2.2.2. Convenience Store

5.3.2.2.3. Specialist Retailers and Online Retail

6. Europe Pancake and Waffle Mix Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

6.1. Europe Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

6.2. Europe Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

6.3. Europe Pancake and Waffle Mix Market Size and Forecast, by Country (2024-2032)

6.3.1. United Kingdom

6.3.1.1. United Kingdom Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

6.3.1.2. United Kingdom Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

6.3.2. France

6.3.2.1. France Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

6.3.2.2. France Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

6.3.3. Germany

6.3.3.1. Germany Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

6.3.3.2. Germany Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

6.3.4. Italy

6.3.4.1. Italy Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

6.3.4.2. Italy Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

6.3.5. Spain

6.3.5.1. Spain Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

6.3.5.2. Spain Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

6.3.6. Sweden

6.3.6.1. Sweden Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

6.3.6.2. Sweden Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

6.3.7. Austria

6.3.7.1. Austria Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

6.3.7.2. Austria Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

6.3.8. Rest of Europe

6.3.8.1. Rest of Europe Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

6.3.8.2. Rest of Europe Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

7. Asia Pacific Pancake and Waffle Mix Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

7.1. Asia Pacific Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

7.2. Asia Pacific Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

7.3. Asia Pacific Pancake and Waffle Mix Market Size and Forecast, by Country (2024-2032)

7.3.1. China

7.3.1.1. China Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

7.3.1.2. China Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

7.3.2. S Korea

7.3.2.1. S Korea Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

7.3.2.2. S Korea Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

7.3.3. Japan

7.3.3.1. Japan Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

7.3.3.2. Japan Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

7.3.4. India

7.3.4.1. India Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

7.3.4.2. India Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

7.3.5. Australia

7.3.5.1. Australia Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

7.3.5.2. Australia Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

7.3.6. Indonesia

7.3.6.1. Indonesia Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

7.3.6.2. Indonesia Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

7.3.7. Malaysia

7.3.7.1. Malaysia Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

7.3.7.2. Malaysia Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

7.3.8. Vietnam

7.3.8.1. Vietnam Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

7.3.8.2. Vietnam Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

7.3.9. Taiwan

7.3.9.1. Taiwan Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

7.3.9.2. Taiwan Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

7.3.9.3. Taiwan Pancake and Waffle Mix Market Size and Forecast, By Packaging Material (2024-2032)

7.3.10. Rest of Asia Pacific

7.3.10.1. Rest of Asia Pacific Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

7.3.10.2. Rest of Asia Pacific Pancake and Waffle Mix Market Size and Forecast, By

8. Middle East and Africa Pancake and Waffle Mix Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

8.1. Middle East and Africa Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

8.2. Middle East and Africa Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

8.3. Middle East and Africa Pancake and Waffle Mix Market Size and Forecast, By Packaging Material (2024-2032)

8.4. Middle East and Africa Pancake and Waffle Mix Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

8.4.1.2. South Africa Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

8.4.2.2. GCC Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.2.3. GCC Pancake and Waffle Mix Market Size and Forecast, By Packaging Material (2024-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

8.4.3.2. Nigeria Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

8.4.4.2. Rest of ME&A Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

9. South America Pancake and Waffle Mix Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

9.1. South America Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

9.2. South America Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

9.3. South America Pancake and Waffle Mix Market Size and Forecast, by Country (2024-2032)

9.3.1. Brazil

9.3.1.1. Brazil Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

9.3.1.2. Brazil Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

9.3.2. Argentina

9.3.2.1. Argentina Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

9.3.2.2. Argentina Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

9.3.3. Rest Of South America

9.3.3.1. Rest Of South America Pancake and Waffle Mix Market Size and Forecast, By Type (2024-2032)

9.3.3.2. Rest Of South America Pancake and Waffle Mix Market Size and Forecast, By Distribution Channel (2024-2032)

10. Company Profile: Key Players

10.1. Aunt Jemima (Pearl Milling Company) (Chicago, Illinois, USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Aunt Jemima (Pearl Milling Company) (Chicago, Illinois, USA)

10.3. Krusteaz (Continental Mills) (Seattle, Washington, USA)

10.4. Hungry Jack (Smucker Foods of Canada Corp.) (Orrville, Ohio, USA)

10.5. Kodiak Cakes – (Park City, Utah, USA)

10.6. Betty Crocker (General Mills) (Minneapolis, Minnesota, USA)

10.7. Dr. Oetker (Bielefeld, Germany)

10.8. Nestlé S.A. (Vevey, Switzerland)

10.9. Doves Farm Foods Ltd. (Hungerford, England, UK)

10.10. Alara Wholefoods Ltd. (London, UK)

10.11. Nisshin Seifun Group Inc. (Tokyo, Japan)

10.12. Morinaga & Co., Ltd. (Tokyo, Japan)

10.13. ITC Limited (Aashirvaad) (Kolkata, India)

10.14. Marico Ltd. (Saffola) (Mumbai, India)

10.15. Bimbo Group Mexico City, Mexico)

10.16. Alimentos La Moderna (Toluca, Mexico)

10.17. Pillsbury (Licensed to General Mills MEA) (Dubai, UAE)

10.18. Tiger Brands (Johannesburg, South Africa)

11. Key Findings

12. Analyst Recommendations

13. Pancake and Waffle Mix Market: Research Methodology