Metalworking Fluids Market Global Industry Analysis and Forecast (2026-2032) by Category, Function, Product, Application, End-Use

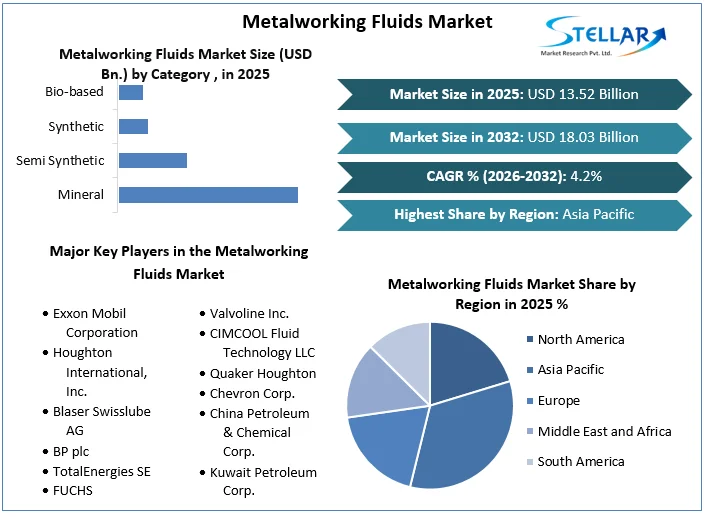

Metalworking Fluids Market size was valued at USD 13.52 Bn. in 2025 and is expected to reach USD 18.03 Bn. by 2032, at a CAGR of 4.2%.

Format : PDF | Report ID : SMR_2381

Metalworking Fluids Market Overview

Metalworking fluids (MWFs) are specialized liquids that are used in metalworking processes such as cutting, grinding, and drilling to lubricate, cool, and clean metal workpieces and cutting tools. They are either water-based or oil-based, and they contain a combination of chemicals and additives that provide various benefits to the metalworking process. MWFs reduce the heat and friction between the cutting tool and the workpiece and help prevent burning and smoking.

The Metalworking Fluids Market experiencing significant growth of XX% every year and is expected to continue its growth. Exxon Mobil Corporation, Houghton International, Inc., Blaser Swisslube AG, BP plc, TotalEnergies SE, and FUCHS are well-established players in the Metalworking Fluids Market. Exxon Mobil Corporation is a global leader in the Metalworking Fluids Market, having a vast product portfolio covering various fluid types and offering a selection of bio-based metalworking fluids, demonstrating their commitment to sustainable solutions in the industry. Asia Pacific dominated the market and held a revenue share of over XX% in 2025. This is due to the increasing demand from the agriculture and construction sectors.

The increasing industrialization and economic development are driving the growth of the heavy machinery industry in countries such as China, India, Japan, etc. in the Metalworking Fluids Market in 2025. The Metalworking Fluids Market is mainly driven by Increased Demand for Automotive Sector and Bio-based Metalworking Fluid, which leads to the rapid growth of Metalworking Fluids Market in the forecasting year 2026-2032. Environmental & Health Hazards from Metal Working Fluids are the main challenge in the Metalworking Fluids Market. Based on Category, Mineral Oil-Based Fluids held the largest share of over XX% in the Metalworking Fluids Market in 2025 because it offer a compelling combination of cost-effectiveness, established performance, and wide availability.

To get more Insights: Request Free Sample Report

Metalworking Fluids Market Dynamics

Metalworking Fluids Market Drivers

Increased Demand for Automotive Sector to Drive Metalworking Fluids Market

The market expansion for metalworking fluids is mainly driven by the rapid growth of the automotive industry, Due to the increasing production of automobiles. Car manufacturing involves extensive metal machining for components like engines, transmissions, chassis, and body panels. Metalworking fluids are essential to this process because they serve as coolants and lubricants to minimize friction and avoid overheating, remove metal chips to maintain cleanliness and enhance surface quality, and shield newly machined surfaces from corrosion while they are being stored or transported.

Performance and fuel efficiency are two things that modern automakers are struggling to manage. This leads to a need for metalworking fluids with a range of machining capabilities. Specialized metalworking fluids (MWFs) are required for reducing weight using high-strength materials such as aluminum and advanced alloys. However, high-performance cars with strong engines need MWFs that tolerate high pressure and temperature. Even though the electric motors in electric cars (EVs) require less machining, metalworking fluids are still needed for the chassis, body construction, and battery manufacture of EVs. The global market for aluminum in the automotive industry is expected to reach over XX million tons by 2027.

- According to Stellar Market Research, Global Aluminum Alloy Market size was valued at USD 145.1 Bn. in 2023 and is expected to reach USD 229.97 Bn. by 2030, at a CAGR of 6.8%.

- In March 2024, the introduction of Russia's first aluminum-coated runway by RUSAL and MASS GROUP signifies a pioneering use of aluminum alloys in aerodrome infrastructure.

Bio-based Metalworking Fluid to Drive Metalworking Fluids Market

Bio-based MWFs are lubricants and coolants typically derived from renewable sources like vegetable oils, esters, or other organic materials. Comparing these fluids to conventional mineral oil-based MWFs, there are some significant environmental benefits such as they are less hazardous, use less energy to produce, and are biodegradable, bio-based MWFs have several environmental benefits. Lower toxicity may increase worker safety and minimize the impact on the environment, biodegradability reduces leak and inappropriate disposal issues, and lower energy consumption helps create a more sustainable production process. Bio-based MWFs are used in various metalworking processes such as Drilling, Milling, Grinding, Tapping, and Threading.

Growing environmental regulations and a focus on sustainability in manufacturing are driving the demand for bio-based MWFs. Firms are looking more and more for environmentally responsible ways to minimize their environmental footprint and comply with requirements. As the performance of bio-based MWFs continues to improve and production costs become more competitive, their adoption rate is expected to rise. This will drive the MWF market's overall expansion. Biobased MWFs have a significantly higher flashpoint than conventional MWFs around 200 degrees higher. This makes them a safer choice for all workspaces, especially those that are tightly enclosed or near open flames.

- According to researchers at the UNI-NABL research facility, MWFs comprise less than 5% of total plant expenditures and impact more than 40% of the plant’s operational budget.

- Straight mineral oil biodegrades between 15% and 35% in the case of an accidental release into the environment without any intervention, while straight vegetable oil biodegrades between 70% and 100%.

Metalworking Fluids Market Challenges

Environmental & Health Hazards from Metal Working Fluids

Major health concerns of improperly managed fluids or when good hygiene practices are not followed include skin irritation, allergic contact dermatitis, irritation of the eyes, nose, and throat, and, occasionally, breathing difficulties such as bronchitis and asthma. Although rare, some workers have contracted hypersensitivity pneumonitis from improperly managed fluids. Hypersensitivity pneumonitis is an allergic reaction in the lungs that may be caused by exposure to certain microbial products. Hypersensitivity pneumonitis is marked by chills, fever, shortness of breath, and a deep cough - similar to a cold.

The use of poorly refined mineral oils has been associated with an increased risk of cancers of the larynx, rectum, pancreas, skin, scrotum, and bladder. Cutting fluids, particularly mineral oils and synthetic oils, have negative effects on the environment. Mineral oils are non-biodegradable and synthetic oils cause pollution. If not disposed of properly, these contaminants drain into the soil and contaminate groundwater. Contaminated groundwater poses a serious threat to human health and aquatic ecosystems.

- According to the National Institute for Occupational Safety and Health (NIOSH) Substantial evidence indicates that workers currently exposed to MWF aerosols have an increased risk of non-malignant respiratory disease and skin diseases. To prevent or greatly reduce the risk of adverse health effects in exposed workers, NIOSH recommends that exposures to MWF aerosols be limited to 0.4 mg/m3 of air for thoracic particulate mass (or 0.5 mg/m3 for total particulate mass) as a time-weighted average (TWA) concentration for up to 10 hr/day during a 40-hr week.

- The Bureau of Labor Statistics (BLS) recorded a rate of 2.2 injuries per 10,000 employees for 25,000 recordable skin disorders, while a rate of 1.7 illnesses per 10,000 employees was reported for 19,600 respiratory ailments.

Metalworking Fluids Market Segment Analysis

Based on Category, Mineral Oil-Based Fluids held the largest share of over XX% in the Metalworking Fluids Market in 2025. Mineral oils are typically petroleum-based oils that often include extreme pressure additives to enhance performance. These fluids are best suited for slower speed, and severe operations that require the good lubricity that the base oil provides. Straight oils also effectively prevent rusting of the workpiece.

Mineral oil-based fluids offer a compelling combination of cost-effectiveness, established performance, and wide availability. For several manufacturers, particularly for applications where cost is a concern, they offer an appealing alternative because they are typically less expensive than synthetic or bio-based alternatives. Their durability and performance qualities have been proven by their long track record of effective application in a variety of metalworking processes. Also, a large global network of suppliers offers mineral oil-based fluids on short notice, which streamlines the procurement process for manufacturers. The world exports most of its mineral oil to Ukraine, Russia, and Vietnam.

- According to Volza’s Global data, Till June 2024, the top 3 exporters of Heavy mineral oil are the European Union with 43,181 shipments followed by Lithuania with 25,286 and India at the 3rd spot with 17,129 shipments and the top 3 importers of Heavy mineral oil are Ukraine with 148,263 shipments followed by Russia with 12,529 and Vietnam at the 3rd spot with 7,102 shipments.

Metalworking Fluids Market Regional Insights

Asia Pacific dominated the market and held a revenue share of over 40.50% in 2024. This is due to the increasing demand from the agriculture and construction sectors. The increasing industrialization and economic development are driving the growth of the heavy machinery industry in countries such as China, India, Japan, etc. According to Volza’s Global Import data, Metalworking fluid import shipments in the World stood at 10.7K, imported by 986 World Importers from 1,294 Suppliers. The top 3 importers of Metalworking fluid are India with 5,864 shipments followed by Russia with 2,262 and Ukraine at the 3rd spot with 720 shipments, Whereas the top 3 exporters of Metalworking fluid are the United States with 2,241 shipments followed by Japan with 1,600 and South Korea at the 3rd spot with 1,214 shipments.

China and India, are projected to dominate the demand for mineral and synthetic MWFs. The market for Metalworking fluids is expected to grow in this region. This is due to the increased requirement for superior lubrication performance in automotive grinding, and machining operations, and infrastructure in the region, such as transportation networks, which make it easier to move raw materials and goods efficiently and contribute to the expansion of the metalworking sector.

North America is projected to grow at the fastest rate in the coming years. This is due to factors including the presence of economically developed nations and the accessibility of better technology than in other areas. The manufacturing of heavy machinery is expected to have a major impact on this market's growth. Forming, processing, bending, and forming are among the procedures used in the production of heavy machinery that use metalworking fluids to give the metal a better shape.

Metalworking Fluids Market Scope

|

Metalworking Fluids Market |

|

|

Market Size in 2025 |

USD 13.52 Bn. |

|

Market Size in 2032 |

USD 18.03 Bn. |

|

CAGR (2026-2032) |

4.2%. |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Metalworking Fluids Market Segments |

by Category

|

|

by Function

|

|

|

by Product

|

|

|

by Application

|

|

|

by End-Use

|

|

Metalworking Fluids Market by Region

North America (United States, Canada, and Mexico)

Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe)

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC)

Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest)

South America (Brazil, Argentina, Rest of South America)

Metalworking Fluids Market Key players

- Exxon Mobil Corporation

- Houghton International, Inc.

- Blaser Swisslube AG

- BP plc

- TotalEnergies SE

- FUCHS

- Valvoline Inc.

- CIMCOOL Fluid Technology LLC

- Quaker Houghton

- Chevron Corp.

- China Petroleum & Chemical Corp.

- Kuwait Petroleum Corp.

Frequently Asked Questions

Asia Pacific region is expected to hold the highest share in the Metalworking Fluids Market.

The market size of the Metalworking Fluids Market by 2032 is expected to reach US $ 18.03 Bn.

The forecast period for the Metalworking Fluids Market is 2026-2032.

The market size of the Metalworking Fluids Market in 2025 was valued at US$ 13.52 Bn.

1. Communication Platform as a Service Market: Research Methodology

2. Metalworking Fluids Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summar

3. Global Communication Platform as a Service Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Product Segment

3.3.3. End-user Segment

3.3.4. Revenue (2025)

3.3.5. Company Headquarter

3.4. Leading Metalworking Fluids Market Companies, by Market Capitalization

3.5. Market Structure

3.5.1. Market Leaders

3.5.2. Market Followers

3.5.3. Emerging Players

3.6. Mergers and Acquisitions Details

4. Communication Platform as a Service Market: Dynamics

4.1. Metalworking Fluids Market Dynamics

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

4.2. PORTER’s Five Forces Analysis

4.3. PESTLE Analysis

4.4. Water Depth Roadmap

4.5. Regulatory Landscape by Region

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. South America

5. Global Communication Platform as a Service Market: Global Market Size and Forecast (Value in USD Billion) (2025-2032)

5.1. Global Metalworking Fluids Market Size and Forecast, By Category (2025-2032)

5.1.1. Mineral

5.1.2. Semi Synthetic

5.1.3. Synthetic

5.1.4. Bio-based

5.2. Global Metalworking Fluids Market Size and Forecast, By Function (2025-2032)

5.2.1. Neat Cutting Oils

5.2.2. Water Cutting Oils

5.2.3. Corrosion Preventive Oils

5.2.4. Straight Oils

5.2.5. Emulsified Oils

5.2.6. Others

5.3. Global Metalworking Fluids Market Size and Forecast, By Product (2025-2032)

5.3.1. Removal Fluids

5.3.2. Protection Fluids

5.3.3. Forming Fluids

5.3.4. Treating Fluids

5.4. Global Metalworking Fluids Market Size and Forecast, By Application (2025-2032)

5.4.1. Construction

5.4.2. Electric & Power

5.4.3. Agriculture

5.4.4. Automobile

5.4.5. Aerospace

5.4.6. Rail

5.4.7. Marine

5.4.8. Healthcare

5.5. Global Metalworking Fluids Market Size and Forecast, By End Use (2025-2032)

5.5.1. Metal Fabrication

5.5.2. Transportation Equipment

5.5.3. Machinery

5.5.4. Others

5.6. Global Metalworking Fluids Market Size and Forecast, by Region (2025-2032)

5.6.1. North America

5.6.2. Europe

5.6.3. Asia Pacific

5.6.4. Middle East and Africa

5.6.5. South America

6. North America Metalworking Fluids Market Size and Forecast by Segmentation (Value in USD Billion) (2025-2032)

6.1. North America Metalworking Fluids Market Size and Forecast, By Category (2025-2032)

6.1.1. Mineral

6.1.2. Semi Synthetic

6.1.3. Synthetic

6.1.4. Bio-based

6.2. North America Metalworking Fluids Market Size and Forecast, By Function (2025-2032)

6.2.1. Neat Cutting Oils

6.2.2. Water Cutting Oils

6.2.3. Corrosion Preventive Oils

6.2.4. Straight Oils

6.2.5. Emulsified Oils

6.2.6. Others

6.3. North America Metalworking Fluids Market Size and Forecast, By Product (2025-2032)

6.3.1. Removal Fluids

6.3.2. Protection Fluids

6.3.3. Forming Fluids

6.3.4. Treating Fluids

6.4. North America Metalworking Fluids Market Size and Forecast, By Application (2025-2032)

6.4.1. Construction

6.4.2. Electric & Power

6.4.3. Agriculture

6.4.4. Automobile

6.4.5. Aerospace

6.4.6. Rail

6.4.7. Marine

6.4.8. Healthcare

6.5. North America Metalworking Fluids Market Size and Forecast, By End Use (2025-2032)

6.5.1. Metal Fabrication

6.5.2. Transportation Equipment

6.5.3. Machinery

6.5.4. Others

6.6. North America Metalworking Fluids Market Size and Forecast, by Region(2025-2032)

6.6.1. United States

6.6.2. Canada

6.6.3. Mexico

7. Europe Metalworking Fluids Market Size and Forecast by Segmentation (Value in USD Billion) (2025-2032)

7.1. Europe Metalworking Fluids Market Size and Forecast, By Category (2025-2032)

7.1.1. Mineral

7.1.2. Semi Synthetic

7.1.3. Synthetic

7.1.4. Bio-based

7.2. Europe Metalworking Fluids Market Size and Forecast, By Function (2025-2032)

7.2.1. Neat Cutting Oils

7.2.2. Water Cutting Oils

7.2.3. Corrosion Preventive Oils

7.2.4. Straight Oils

7.2.5. Emulsified Oils

7.2.6. Others

7.3. Europe Metalworking Fluids Market Size and Forecast, By Product (2025-2032)

7.3.1. Removal Fluids

7.3.2. Protection Fluids

7.3.3. Forming Fluids

7.3.4. Treating Fluids

7.4. Europe Metalworking Fluids Market Size and Forecast, By Application (2025-2032)

7.4.1. Construction

7.4.2. Electric & Power

7.4.3. Agriculture

7.4.4. Automobile

7.4.5. Aerospace

7.4.6. Rail

7.4.7. Marine

7.4.8. Healthcare

7.5. Europe Metalworking Fluids Market Size and Forecast, By End Use (2025-2032)

7.5.1. Metal Fabrication

7.5.2. Transportation Equipment

7.5.3. Machinery

7.5.4. Others

7.6. Europe Metalworking Fluids Market Size and Forecast, by Region (2025-2032)

7.6.1. United Kingdom

7.6.2. France

7.6.3. Germany

7.6.4. Italy

7.6.5. Spain

7.6.6. Sweden

7.6.7. Russia

7.6.8. Rest of Europe

8. Asia Pacific Metalworking Fluids Market Size and Forecast by Segmentation (Value in USD Billion) (2025-2032)

8.1. Asia Pacific Metalworking Fluids Market Size and Forecast, By Category (2025-2032)

8.1.1. Mineral

8.1.2. Semi Synthetic

8.1.3. Synthetic

8.1.4. Bio-based

8.2. Asia Pacific Metalworking Fluids Market Size and Forecast, By Function (2025-2032)

8.2.1. Neat Cutting Oils

8.2.2. Water Cutting Oils

8.2.3. Corrosion Preventive Oils

8.2.4. Straight Oils

8.2.5. Emulsified Oils

8.2.6. Others

8.3. Asia Pacific Metalworking Fluids Market Size and Forecast, By Product (2025-2032)

8.3.1. Removal Fluids

8.3.2. Protection Fluids

8.3.3. Forming Fluids

8.3.4. Treating Fluids

8.4. Asia Pacific Metalworking Fluids Market Size and Forecast, By Application (2025-2032)

8.4.1. Construction

8.4.2. Electric & Power

8.4.3. Agriculture

8.4.4. Automobile

8.4.5. Aerospace

8.4.6. Rail

8.4.7. Marine

8.4.8. Healthcare

8.5. Asia Pacific Metalworking Fluids Market Size and Forecast, By End Use (2025-2032)

8.5.1. Metal Fabrication

8.5.2. Transportation Equipment

8.5.3. Machinery

8.5.4. Others

8.6. Asia Pacific Metalworking Fluids Market Size and Forecast, by Region (2025-2032)

8.6.1. China

8.6.2. S Korea

8.6.3. Japan

8.6.4. India

8.6.5. Australia

8.6.6. ASEAN

8.6.7. Rest of Asia Pacific

9. Middle East and Africa Metalworking Fluids Market Size and Forecast by Segmentation (Value in USD Billion) (2025-2032)

9.1. Middle East and Africa Metalworking Fluids Market Size and Forecast, By Category (2025-2032)

9.1.1. Mineral

9.1.2. Semi Synthetic

9.1.3. Synthetic

9.1.4. Bio-based

9.2. Middle East and Africa Metalworking Fluids Market Size and Forecast, By Function (2025-2032)

9.2.1. Neat Cutting Oils

9.2.2. Water Cutting Oils

9.2.3. Corrosion Preventive Oils

9.2.4. Straight Oils

9.2.5. Emulsified Oils

9.2.6. Others

9.3. Middle East and Africa Metalworking Fluids Market Size and Forecast, By Product (2025-2032)

9.3.1. Removal Fluids

9.3.2. Protection Fluids

9.3.3. Forming Fluids

9.3.4. Treating Fluids

9.4. Middle East and Africa Metalworking Fluids Market Size and Forecast, By Application (2025-2032)

9.4.1. Construction

9.4.2. Electric & Power

9.4.3. Agriculture

9.4.4. Automobile

9.4.5. Aerospace

9.4.6. Rail

9.4.7. Marine

9.4.8. Healthcare

9.5. Middle East and Africa Metalworking Fluids Market Size and Forecast, By End Use (2025-2032)

9.5.1. Metal Fabrication

9.5.2. Transportation Equipment

9.5.3. Machinery

9.5.4. Others

9.6. Middle East and Africa Metalworking Fluids Market Size and Forecast, by Region(2025-2032)

9.6.1. South Africa

9.6.2. GCC

9.6.3. Nigeria

9.6.4. Rest of ME&A

10. South America Metalworking Fluids Market Size and Forecast by Segmentation (Value in USD Million) (2025-2032)

10.1. South America Metalworking Fluids Market Size and Forecast, By Category (2025-2032)

10.1.1. Mineral

10.1.2. Semi Synthetic

10.1.3. Synthetic

10.1.4. Bio-based

10.2. South America Metalworking Fluids Market Size and Forecast, By Function (2025-2032)

10.2.1. Neat Cutting Oils

10.2.2. Water Cutting Oils

10.2.3. Corrosion Preventive Oils

10.2.4. Straight Oils

10.2.5. Emulsified Oils

10.2.6. Others

10.3. South America Metalworking Fluids Market Size and Forecast, By Product (2025-2032)

10.3.1. Removal Fluids

10.3.2. Protection Fluids

10.3.3. Forming Fluids

10.3.4. Treating Fluids

10.4. South America Metalworking Fluids Market Size and Forecast, By Application (2025-2032)

10.4.1. Construction

10.4.2. Electric & Power

10.4.3. Agriculture

10.4.4. Automobile

10.4.5. Aerospace

10.4.6. Rail

10.4.7. Marine

10.4.8. Healthcare

10.5. South America Metalworking Fluids Market Size and Forecast, By End Use (2025-2032)

10.5.1. Metal Fabrication

10.5.2. Transportation Equipment

10.5.3. Machinery

10.5.4. Others

10.6. South America Metalworking Fluids Market Size and Forecast, by Country (2025-2032)

10.6.1. Brazil

10.6.2. Argentina

10.6.3. Rest Of South America

11. Company Profile: Key Players

11.1. Exxon Mobil Corporation

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Houghton International, Inc.

11.3. Blaser Swisslube AG

11.4. BP plc

11.5. TotalEnergies SE

11.6. FUCHS

11.7. Valvoline Inc.

11.8. CIMCOOL Fluid Technology LLC

11.9. Quaker Houghton

11.10. Chevron Corp.

11.11. China Petroleum & Chemical Corp.

11.12. Kuwait Petroleum Corp.

12. Key Findings

13. Industry Recommendations