Membrane Materials Recycling and Upcycling Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

Membrane Materials Recycling and Upcycling Market was estimated at USD 205 Mn in 2024 and is expected to grow at a CAGR of 7.6% from 2025 to 2032, reaching nearly USD 368.34 Mn by 2032.

Format : PDF | Report ID : SMR_2733

Membrane Materials Recycling and Upcycling Market Overview:

Membrane material recycling refers to processing waste membranes to produce new materials or raw materials for manufacturing and Upcycling involves repurposing waste materials, including membranes, into new products that are of higher quality.

Membrane material recycling market is growing by increasing environmental awareness and a shift towards sustainable pharmaceutical and water treatment processes. Recycled membranes maintain up to 85% of original performance, depending on the application and regeneration method. By recycling a membrane module instead of landfilling, it prevents Co2 emissions up to 12 kg, underlining environmental benefits. Chemical cleaning and a regeneration techniques dominate membrane material recycling market, accounting for over 40% of recycling-related revenue in 2024. Europe accounts for over 38% of the global membrane recycling market, by its progressive regulations, EU circular economy policies, and support from programs like Horizon Europe, which funds R&D in sustainable membrane technologies. Over 1.4 million end-of-life membrane modules are discarded globally every year, generating more than 32,000 tons of non-biodegradable waste provides an opportunity for the market.

To get more Insights: Request Free Sample Report

Membrane Materials Recycling and Upcycling Market Dynamics

Increasing emphasis on environmental stability to fuel the membrane materials recycling and upcycling market.

Growing focus on protecting the environment is a key factor driving membrane material recycling and upcycling market. Governments and industry around world are adopting circular economy principles to reduce waste and maximize resource efficiency. Additionally, awareness about the environmental hazards generated by refusal of membrane material, especially polymer people have motivated industries to seek responsible settlement and reuse solutions. Economic benefits of recycling, such as cost savings and extended lives of materials, also encourage adoption in various fields, especially water remedies and pharmaceuticals.

The membrane materials recycling and upcycling market faces some restraints related to the complexity of recycling membrane materials

Growing focus on protecting the environment is a key factor driving membrane material recycling and upcycling market. Governments and industry around world are adopting circular economy principles to reduce waste and maximize resource efficiency. Additionally, awareness about the environmental hazards generated by refusal of membrane material, especially polymer people have motivated industries to seek responsible settlement and reuse solutions. Economic benefits of recycling, such as cost savings and extended lives of materials, also encourage adoption in various fields, especially water remedies and pharmaceuticals.

Development of innovative recycling and upcycling technologies is an opportunity for membrane materials recycling and upcycling market

Membrane materials recycling and upcycling market is set to grow steadily by several emerging opportunities. A major region of potential lies in a development of innovative recycling and upcycling technologies, like solvent based separation, advanced chemical regeneration, and bio assisted cleaning technology. These innovations ability to improve recovery efficiency and purity of the recycled membrane, making them more attractive to re use in high pressure applications. Also, increase in public and private investment in the initiative of a circular economy is opening funding channels to create a modular, scalable recycling system for established players.

Membrane Materials Recycling and Upcycling Market Segment Analysis:

Based on Material Type, membrane materials recycling and upcycling market is segmented in polymeric membranes, ceramic membranes, metallic membranes, and others. polymeric membranes segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2025-2032). Polymeric membranes segment accounted for over 65% of total market share in 2024, and it is expected to maintain its lead through 2032, with a forecasted CAGR of 8.6%. Also, dominance is by its 30–50% cheaper than ceramic or metallic alternatives. It is lightweight reducing transportation and installation cost. Recovery rate of polymeric membranes (especially RO and UF membranes) during recycling is typically 70–80%, compared to 30–40% for ceramic membranes. With over 1.2 million polymeric membrane modules reaching end-of-life annually, they account for largest share of recyclable membrane waste globally.

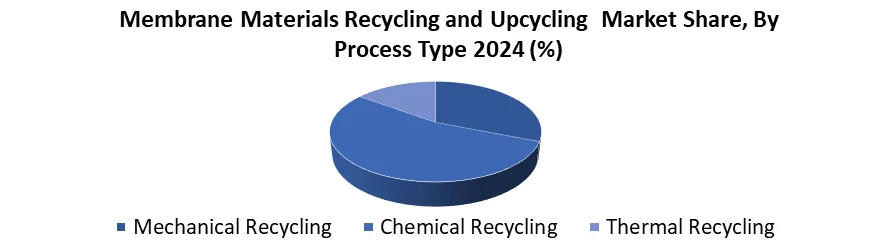

Based on Process Type, membrane materials recycling and upcycling market is segmented into mechanical recycling, chemical recycling, thermal recycling. chemical recycling segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2025-2032). Chemical recycling membrane is most effective way to restore permeability and selectiveness, often achieving recovery of up to 85–90% of original membrane performance. It removes a organic and inorganic fouling and biofilms. Chemical recycling reduces the need for frequent membrane replacement, saving users 30–40% in operational costs. It also supports low environmental footprints by reducing plastic waste and landfill volumes. effective chemical recycling of membranes can cut CO2 emissions related to membrane manufacturing by up to 20–30%.

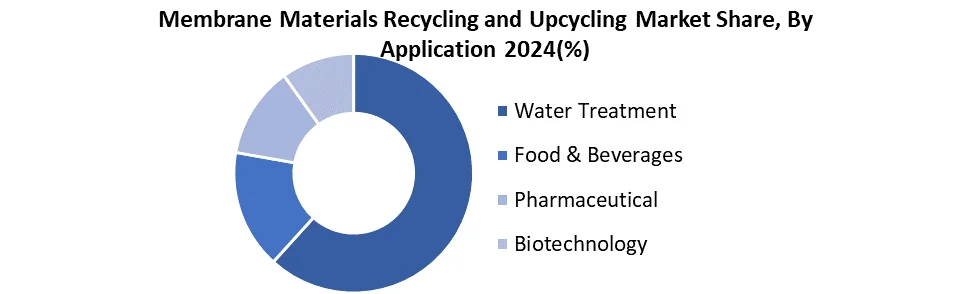

Based on Application, membrane materials recycling and upcycling market is segmented into water treatment, food and beverage processing, pharmaceutical, biotechnology, and others. The water treatment segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period (2025-2032). The dominance is by their more than 70% of the global installed membranes are in water treatment, including desalination, Wastewater Reuse and drinking Water Treatment. For example, a single 100 MLD (million liters/day) desalination plant may use 10,000–15,000 RO membranes, which require a periodic replacement every 5–7 years. This creates a huge and recurring waste stream suitable for recycling and regeneration. Cost pressures on water utilities also play a key role, as recycling reduces membrane-related operating costs by up to 40%.

Membrane Materials Recycling and Upcycling Market Regional Analysis:

Europe region dominated market in 2024 and is expected to hold largest market share over the forecast period (2025-2032)

Europe dominance is largely by its strong regulatory structures of the region, well developed infrastructure for waste management, and a strong push for circular economy implementation. Germany, Netherlands, and Sweden have been important investors in green infrastructure, including water treatment, recycling, and installation of recycling facilities for pharmaceutical membranes employed in pharma. Under the strict environmental regulations of the European Union, particularly the waste outline guidelines and guidelines like the Green Deal program, are strong forces pushing for the development of the market.

Membrane Materials Recycling and Upcycling Market Competitive Landscape

The membrane materials recycling and upcycling market is still in its early stage, and dominating with high number of startups and top technology companies by relatively less large players in the competitive landscape. Various top membrane makers such as DuPont Water Solutions, Veolia Water Technologies, and Lanxess are moving towards recycling and regeneration offerings. They provide value-added offerings to increase the membrane lifespan and ensure stability. These players leverage existing customer bases, robust R&D infrastructures, and global distribution channels to extend recycling offerings to overall membrane lifecycle management. These companies are offering value-added offerings, such as membrane cleaning, regeneration, renovation, and upscaling solutions that aim to increase the membrane lifeline by 30–50% and reduce operating costs by 20–35% for the end users.

Recent Developments in the membrane materials recycling and upcycling market

- In September 5, 2024, Evonik introduced the SEPURAN Green G5X 11, a high-capacity biogas membrane designed for upgrading biogas to renewable natural gas (RNG) in large-scale projects. This membrane offers double the capacity of its predecessor, aiming to enhance cost-efficiency and sustainability in biogas upgrading processes.

- February 12, 2025, MacroCycle Technologies, focusing on upcycling PET and polyester textile waste, raised USD 6.5 million in seed funding. The company plans to scale its pilot reactor to full production, aiming to produce high-quality recycled PET for use in various industries, including textiles and packaging.

|

Membrane Materials Recycling and Upcycling Market Scope |

|

|

Market Size in 2024 |

USD 205 Mn |

|

Market Size in 2032 |

USD 368.34 Mn |

|

CAGR (2025-2032) |

7.6% |

|

Historic Data |

2019-2023 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Material Type Polymeric Membranes Ceramic Membranes Metallic Membranes Others |

|

By Process Type Mechanical Recycling Chemical Recycling Thermal Recycling |

|

|

By Application Water Treatment Food and Beverages Pharmaceutical Biotechnology |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Membrane Materials Recycling and Upcycling Market

North America

- DuPont Water Solutions (USA)

- Koch Separation Solutions (USA)

- Evoqua Water Technologies (USA)

- Hydranautics – A Nitto Group Company (USA)

- SUEZ Water Technologies & Solutions (USA)

- Membrane Specialists LLC (USA)

- Pure Aqua, Inc. (USA)

- Synder Filtration (USA)

Europe

- Veolia Water Technologies (France)

- LANXESS (Germany)

- Pentair (UK)

- ROPUR AG (Switzerland)

- NX Filtration (Netherlands)

- REMPOR Membrane Solutions (UK)

- Aquaporin (Denmark)

- Berghof Membranes (Germany)

- Water-Link (Belgium)

Asia-Pacific

- LG Chem (South Korea)

- Woongjin Chemical (South Korea)

- Mitsubishi Chemical Corporation (Japan)

- Beijing Origin Water Technology (China)

- Litree Purifying Technology Co., Ltd. (China)

- Thermax Limited (India)

- Permionics Membranes (India)

- Memstar (Singapore)

Frequently Asked Questions

Increasing emphasis on environmental stability to fuel the membrane materials recycling and upcycling market.

DuPont Water Solutions, Veolia Water Technologies, and LANXESS are the key competitors in the market.

Development of innovative recycling and upcycling technologies is an opportunity for membrane materials recycling and upcycling market.

The polymeric membrane segment dominated the membrane materials Recycling and upcycling market.

1. Membrane Materials Recycling and Upcycling Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Membrane Materials Recycling and Upcycling Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. End-user Segment

2.3.4. Revenue (2024)

2.4. Leading Membrane Materials Recycling and Upcycling Market Companies, by Market Capitalization

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Membrane Materials Recycling and Upcycling Market: Dynamics

3.1. Membrane Materials Recycling and Upcycling Market Trends by Region

3.1.1. North America Membrane Materials Recycling and Upcycling Market Trends

3.1.2. Europe Membrane Materials Recycling and Upcycling Market Trends

3.1.3. Asia Pacific Membrane Materials Recycling and Upcycling Market Trends

3.1.4. Middle East & Africa Membrane Materials Recycling and Upcycling Market Trends

3.1.5. South America Membrane Materials Recycling and Upcycling Market Market Trends

3.2. Membrane Materials Recycling and Upcycling Market Dynamics by Global

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Value Chain Analysis

3.6. Regulatory Landscape by Region

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Middle East & Africa

3.6.5. South America

4. Membrane Materials Recycling and Upcycling Market: Global Market Size and Forecast by Segmentation (by Value USD Mn) (2024-2032)

4.1. Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

4.1.1. Polymeric Membranes

4.1.2. Ceramic Membranes

4.1.3. Metallic Membranes

4.1.4. Others

4.2. Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Type (2024-2032)

4.2.1. Mechanical Recycling

4.2.2. Chemical Recycling

4.2.3. Thermal Recycling

4.3. Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

4.3.1. Water Treatment

4.3.2. Food and Beverages

4.3.3. Pharmaceutical

4.3.4. Biotechnology

4.4. Membrane Materials Recycling and Upcycling Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East & Africa

4.4.5. South America

5. North America Membrane Materials Recycling and Upcycling Market Size and Forecast by Segmentation (by Value USD Mn) (2024-2032)

5.1. North America Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

5.1.1. Polymeric Membranes

5.1.2. Ceramic Membranes

5.1.3. Metallic Membranes

5.1.4. Others

5.2. North America Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Type (2024-2032)

5.2.1. Mechanical Recycling

5.2.2. Chemical Recycling

5.2.3. Thermal Recycling

5.3. North America Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

5.3.1. Water Treatment

5.3.2. Food and Beverages

5.3.3. Pharmaceutical

5.3.4. Biotechnology

5.4. North America Membrane Materials Recycling and Upcycling Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

5.4.1.1.1. Polymeric Membranes

5.4.1.1.2. Ceramic Membranes

5.4.1.1.3. Metallic Membranes

5.4.1.1.4. Others

5.4.1.2. United States Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Types (2024-2032)

5.4.1.2.1. Mechanical Recycling

5.4.1.2.2. Chemical Recycling

5.4.1.2.3. Thermal Recycling

5.4.1.3. United States Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

5.4.1.3.1. Water Treatment

5.4.1.3.2. Food and Beverages

5.4.1.3.3. Pharmaceutical

5.4.1.3.4. Biotechnology

5.4.2. Canada

5.4.2.1. Canada Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

5.4.2.1.1. Polymeric Membranes

5.4.2.1.2. Ceramic Membranes

5.4.2.1.3. Metallic Membranes

5.4.2.1.4. Others

5.4.2.2. Canada Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Types (2024-2032)

5.4.2.2.1. Mechanical Recycling

5.4.2.2.2. Chemical Recycling

5.4.2.2.3. Thermal Recycling

5.4.2.3. Canada Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

5.4.2.3.1. Water Treatment

5.4.2.3.2. Food and Beverages

5.4.2.3.3. Pharmaceutical

5.4.2.3.4. Biotechnology

5.4.3. Mexico

5.4.3.1. Mexico Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

5.4.3.1.1. Polymeric Membranes

5.4.3.1.2. Ceramic Membranes

5.4.3.1.3. Metallic Membranes

5.4.3.1.4. Others

5.4.3.2. Mexico Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Types (2024-2032)

5.4.3.2.1. Mechanical Recycling

5.4.3.2.2. Chemical Recycling

5.4.3.2.3. Thermal Recycling

5.4.3.3. Mexico Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

5.4.3.3.1. Water Treatment

5.4.3.3.2. Food and Beverages

5.4.3.3.3. Pharmaceutical

5.4.3.3.4. Biotechnology

6. Europe Membrane Materials Recycling and Upcycling Market Size and Forecast by Segmentation (by Value USD Mn) (2024-2032)

6.1. Europe Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

6.2. Europe Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Types (2024-2032)

6.3. Europe Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

6.4. Europe Membrane Materials Recycling and Upcycling Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

6.4.1.2. United Kingdom Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Types (2024-2032)

6.4.1.3. United Kingdom Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

6.4.2. France

6.4.2.1. France Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

6.4.2.2. France Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Types (2024-2032)

6.4.2.3. France Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

6.4.3.2. Germany Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Types (2024-2032)

6.4.3.3. Germany Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

6.4.4.2. Italy Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Types (2024-2032)

6.4.4.3. Italy Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

6.4.5.2. Spain Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Types (2024-2032)

6.4.5.3. Spain Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

6.4.6.2. Sweden Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Types (2024-2032)

6.4.6.3. Sweden Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

6.4.7. Austria

6.4.7.1. Austria Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

6.4.7.2. Austria Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Types (2024-2032)

6.4.7.3. Austria Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

6.4.8.2. Rest of Europe Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Types (2024-2032)

6.4.8.3. Rest of Europe Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

7. Asia Pacific Membrane Materials Recycling and Upcycling Market Size and Forecast by Segmentation (by Value USD Mn) (2024-2032)

7.1. Asia Pacific Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

7.2. Asia Pacific Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Type (2024-2032)

7.3. Asia Pacific Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

7.4. Asia Pacific Membrane Materials Recycling and Upcycling Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

7.4.1.2. China Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Type (2024-2032)

7.4.1.3. China Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

7.4.2.2. S Korea Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Type (2024-2032)

7.4.2.3. S Korea Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

7.4.3.2. Japan Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Type (2024-2032)

7.4.3.3. Japan Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

7.4.4. India

7.4.4.1. India Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

7.4.4.2. India Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Type (2024-2032)

7.4.4.3. India Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

7.4.5.2. Australia Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Type (2024-2032)

7.4.5.3. Australia Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

7.4.6.2. Indonesia Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Type (2024-2032)

7.4.6.3. Indonesia Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

7.4.7. Philippines

7.4.7.1. Philippines Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

7.4.7.2. Philippines Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Type (2024-2032)

7.4.7.3. Philippines Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

7.4.8.2. Malaysia Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Type (2024-2032)

7.4.8.3. Malaysia Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

7.4.9.2. Vietnam Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Type (2024-2032)

7.4.9.3. Vietnam Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

7.4.10. Thailand

7.4.10.1. Thailand Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

7.4.10.2. Thailand Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Type (2024-2032)

7.4.10.3. Thailand Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

7.4.11. ASEAN

7.4.11.1. ASEAN Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

7.4.11.2. ASEAN Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Type (2024-2032)

7.4.11.3. ASEAN Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

7.4.12. Rest of Asia Pacific

7.4.12.1. Rest of Asia Pacific Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

7.4.12.2. Rest of Asia Pacific Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Type (2024-2032)

7.4.12.3. Rest of Asia Pacific Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

8. Middle East and Africa Membrane Materials Recycling and Upcycling Market Size and Forecast by Segmentation (by Value USD Mn) (2024-2032)

8.1. Middle East and Africa Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

8.2. Middle East and Africa Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Types Model (2024-2032)

8.3. Middle East and Africa Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

8.4. Middle East and Africa Membrane Materials Recycling and Upcycling Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

8.4.1.2. South Africa Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Types Model (2024-2032)

8.4.1.3. South Africa Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

8.4.2.2. GCC Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Types Model (2024-2032)

8.4.2.3. GCC Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

8.4.3.2. Nigeria Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Types Model (2024-2032)

8.4.3.3. Nigeria Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

8.4.4.2. Rest of ME&A Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Types Model (2024-2032)

8.4.4.3. Rest of ME&A Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

9. South America Membrane Materials Recycling and Upcycling Market Size and Forecast by Segmentation (by Value USD Mn.) (2024-2032)

9.1. South America Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

9.2. South America Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Types (2024-2032)

9.3. South America Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

9.4. South America Membrane Materials Recycling and Upcycling Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

9.4.1.2. Brazil Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Types (2024-2032)

9.4.1.3. Brazil Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

9.4.2.2. Argentina Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Types (2024-2032)

9.4.2.3. Argentina Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

9.4.3. Rest Of South America

9.4.3.1. Rest Of South America Membrane Materials Recycling and Upcycling Market Size and Forecast, By Material Type (2024-2032)

9.4.3.2. Rest Of South America Membrane Materials Recycling and Upcycling Market Size and Forecast, By Process Types (2024-2032)

9.4.3.3. Rest Of South America Membrane Materials Recycling and Upcycling Market Size and Forecast, By Application (2024-2032)

10. Company Profile: Key Players

10.1 Du Pont Water Solutions (USA)

10.1.1 Company Overview

10.1.2 Business Portfolio

10.1.3 Financial Overview

10.1.4 SWOT Analysis

10.1.5 Strategic Analysis

10.1.6 Recent Development

10.2 Koch Separation Solutions (USA)

10.3 Evoqua Water Technologies (USA)

10.4 Hydranautics – A Nitto Group Company (USA)

10.5 SUEZ Water Technologies & Solutions (USA)

10.6 Membrane Specialists LLC (USA)

10.7 Pure Aqua, Inc. (USA)

10.8 Synder Filtration (USA)

10.9 Veolia Water Technologies (France)

10.10 LANXESS (Germany)

10.11 Pentair (UK)

10.12 ROPUR AG (Switzerland)

10.13 NX Filtration (Netherlands)

10.14 REMPOR Membrane Solutions (UK)

10.15 Aquaporin (Denmark)

10.16 Berghof Membranes (Germany)

10.17 Water-Link (Belgium)

10.18 LG Chem (South Korea)

10.19 Woongjin Chemical (South Korea)

10.20 Mitsubishi Chemical Corporation (Japan)

10.21 Beijing Origin Water Technology (China)

10.22 Litree Purifying Technology Co., Ltd. (China)

10.23 Thermax Limited (India)

10.24 Permionics Membranes (India)

10.25 Memstar (Singapore)

11. Key Findings & Analyst Recommendations

12. Membrane Materials Recycling and Upcycling Markets: Research Methodology