Medical Imaging Market: Size, Share, Trends, Dynamics, Key Players and Forecast 2025-2032

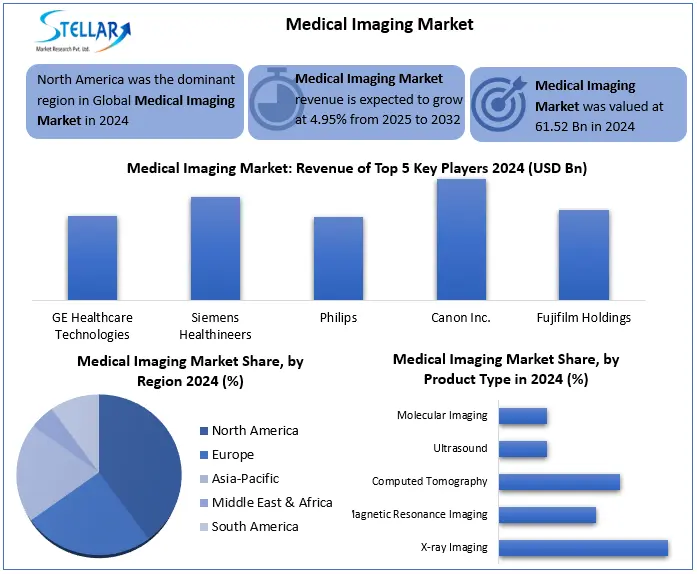

The Medical Imaging Market was valued at USD 41.80 Bn in 2024 and is expected to grow at a CAGR of 4.95% from 2025 to 2032, reaching nearly USD 61.52 Bn by 2032.

Format : PDF | Report ID : SMR_2820

Medical Imaging Market Overview:

Medical imaging is the technique and process of imaging the interior of a body for clinical analysis and medical intervention, as well as visual representation of the function of some organs or tissues for diagnostic, treatment, and monitoring purposes.

Medical imaging includes X-ray equipment, computed tomography (CT) and ultrasound. The medical imaging market is seeing a strong growth due to the increasing need for technology progression such as early and accurate disease diagnosis, aging population, and artificial intelligence in medical imaging.

These drivers are estimated to increase the market during the forecast period. One of the major forces running market growth is an increasing phenomenon of chronic conditions such as heart diseases, cancer and neurological diseases.

The North America is dominant in the medical imaging market. the U.S. has previously imposed tariffs of up to 25% on certain Chinese medical imaging components, which increased production costs for American companies and healthcare providers.

To get more Insights: Request Free Sample Report

Medical Imaging Market Dynamics

Rising Prevalence of Chronic Diseases to fuel Medical Imaging Market

According to the Disease Control and Prevention Center (CDC), about 80% of the elderly in the United States suffer from a chronic condition. According to Globocaine 2020, about 18.1 million new cancer cases were diagnosed globally in 2020. The need for precise and initial diagnosis of diseases to improve the results of treatment increases the demand for medical imaging equipment. In addition, rapid technology progression, clinical accuracy and efficiency are increasing, including AI-operated imaging, portable imaging solutions and hybrid imaging technology. This increasing demand compels manufacturers to innovate quicker and provide cheaper, more accessible solutions globally. With chronic diseases on the rise due to aging populations, medical imaging is becoming the foundation of contemporary preventive healthcare.

The High Cost of Medical Imaging Devices to Restraint for The Medical Imaging Market.

The high cost of medical imaging equipment makes them less accessible due to these high costs in low and moderate-income countries, combined with the cost of maintenance, negatively affects market development. In addition, strict government regulatory guidelines on medical imaging equipment increase the cost and expand the approval deadline, slowing down innovation and adoption. Due to the increasing demand for cost -effective medical imaging equipment, the adoption of renewed medical devices is increasing, limiting the growth of medical imaging market in the forecast period.

The Use of Artificial Intelligence and Machine Learning in Medical Imaging to Boost Medical Imaging Market

Medical imaging market offers several opportunities for development, especially with the use of artificial intelligence and machine learning in medical imaging. It improves clinical accuracy and reduces the pressure of the charge on the radiologist. Increasing teleradiology services is another opportunity, which can improve remote understanding of medical images and healthcare access. In addition, technological progress in 3D and 4D imaging technologies, which are changing clinical imaging and surgical schemes, are creating new possibilities for medical imaging applications in the healthcare sector. These are occasions that increase the development of medical imaging markets.

Medical Imaging Market Segment Analysis

Based on Product, The Medical Imaging Market is segmented into X-ray, magnetic resonance imaging, computed tomography, ultrasound, and molecular imaging. The X-ray segment held a dominant medical imaging market share in 2024. Digital radiography X ray is more accessible and portable with better image quality. Progress such as digital radiography and portable X-ray machines has made X-rays faster, more accessible and better in image quality. Modern Xray systems with AI software are able to see fractures and tumors precisely, which further helps doctors to easy diagnose and informed decision. In addition, their use in regular screening such as mammography is important in initial disease identification and help of public health results.

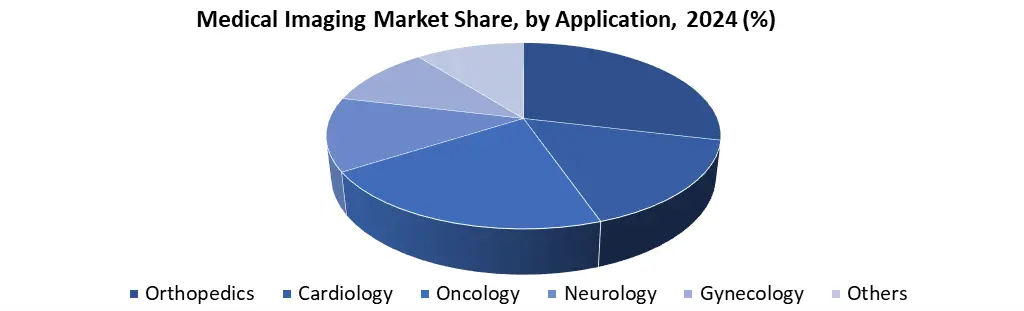

Based on Application, the Medical Imaging Market is segmented into Cardiology, Oncology, Orthopedics, Neurology, Gynecology, and others. The orthopedic segment dominated the market in 2024. Due to increasing incidence of fractures, joint disorders, and musculoskeletal conditions and increasing incidents of sports injuries among the population, demand for X-rays and MRI devices increases. In addition, the growing advancement of technology for effective and rapid participation of orthopedic injuries increases segmented development. The oncology segment is estimated to increase at a higher rate in the forecast period 2024-2032 due to increasing cancer cases and expanding the demand for initial diagnosis. Outside oncology, medical imaging is also contributing to gastroenterology, pulmonology and urology, performing its increasing value in other medical specialties.

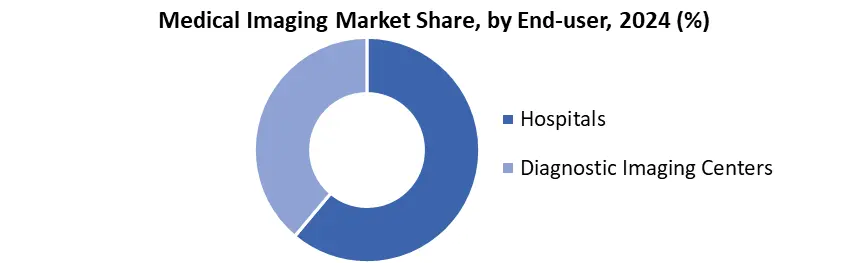

Based on End-user, the Medical Imaging Market is segmented into Hospitals and diagnostic Imaging centers. The Hospital segment dominated the market in 2024 due to high patient volume and availability of advanced imaging infrastructure. In addition, increasing number of cancer and heart diseases increases the demand for medical imaging system in hospitals. Increase advanced systems with better features in hospitals to improve the quality of patient's care. Diagnostic imaging centers are also a growing segment due to the increasing number of these centers in developed and emerging countries, running the oncology application segment.

Medical Imaging Market Regional Analysis

Advanced Health Service is a major field in the medical imaging market due to infrastructure, technology advancement and continuous research and development investments. The rapid increase in the population of old age in the region and the important installation of clinical imaging centers is supporting the development of the medical imaging market. A developed healthcare is expected to increase the US market due to increasing awareness about infrastructure and pre-diagnosis. Healthcare further strengthens market growth in the government support sector through programs and favorable reimbursement policies. Additionally, cooperation between medical institutions and technical companies is accelerating the adoption of AI and advanced imaging system.

Medical Imaging Market Competitive Landscape

Competitive mobility of the medical imaging market is affected by top global and regional companies, focusing on technological innovation, strategic alliances, and comprehending its product offerings to enhance its competitive advantage. Heads in the market are GE Healthcare, Siemens Healthineers, Philips Healthcare, Canon Medical System and Fujifilm Holdings, which keep a stronghold in the medical imaging market. These businesses are innovative-oriented and invest continuously in research and development. Emerging companies of medium-sized also expand based on cost-practical solutions. Strategic alliances and mergers and acquisitions are important in defying competitive landscape.

|

Medical Imaging Market Scope |

|

|

Market Size in 2024 |

USD 41.80 Bn |

|

Market Size in 2032 |

USD 61.52 Bn |

|

CAGR (2025-2032) |

4.95% |

|

Historic Data |

2019-2023 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Product Type X-ray Magnetic Resonance Imaging Computed Tomography Ultrasound Molecular Imaging |

|

By Application Cardiology Oncology Orthopedics Neurology Gynecology Others |

|

|

By End-user Hospitals Diagnostic Imaging Centers |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Medical Imaging Market

North America:

- GE Healthcare (United States)

- Philips Healthcare (United States)

- Siemens Healthineers (United States)

- Canon Medical Systems (United States)

- Esaote (United States)

- Carestream Health (United States)

Asia-Pacific:

- Toshiba Medical Systems (Japan)

- Hitachi Medical Systems (Japan)

- Fujifilm Medical Systems (Japan)

- Samsung Medison (South Korea)

- Mindray (China)

- Shanghai United Imaging Healthcare (China)

- Nihon Kohden (Japan)

Europe:

- Schneider Electric (France)

- Accuray (United Kingdom)

- Medtronic (Ireland)

- Stryker Corporation (Germany)

- Elekta (Sweden)

Middle East and Africa:

- Hologic (United Arab Emirates)

Frequently Asked Questions

The Growing Geriatric Population and Chronic Diseases are Major Drivers for The Medical Imaging Market.

GE HealthCare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems, and Fujifilm Holdings are the key competitors in the Medical Imaging Market.

The Use of Artificial Intelligence and Machine Learning in Medical Imaging is an Opportunity for The Medical Imaging Market.

The X-ray segment type dominates the market.

1. Medical Imaging Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Medical Imaging Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. End-user Segment

2.3.4. Revenue (2024)

2.4. Leading Medical Imaging Market Companies, by Market Capitalization

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Medical Imaging Market: Dynamics

3.1. Medical Imaging Market Trends by Region

3.1.1. North America Medical Imaging Market Trends

3.1.2. Europe Medical Imaging Market Trends

3.1.3. Asia Pacific Medical Imaging Market Trends

3.1.4. Middle East & Africa Medical Imaging Market rends

3.1.5. South America Medical Imaging Market Marke Trends

3.2. Medical Imaging Market Dynamics by Global

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Value Chain Analysis

3.6. Regulatory Landscape by Region

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Middle East & Africa

3.6.5. South America

4. Medical Imaging Market: Global Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032)

4.1. Medical Imaging Market Size and Forecast, By Product Type (2025-2032)

4.1.1. X-ray

4.1.2. Magnetic Resonance Imaging

4.1.3. Computed Tomography

4.1.4. Ultrasound

4.1.5. Molecular Imaging

4.2. Medical Imaging Market Size and Forecast, By Application (2025-2032)

4.2.1. Cardiology

4.2.2. Oncology

4.2.3. Orthopedics

4.2.4. Neurology

4.2.5. Gynecology

4.2.6. Others

4.3. Medical Imaging Market Size and Forecast, By End-user (2025-2032)

4.3.1. Hospitals

4.3.2. Diagnostic Imaging Centers

4.4. Medical Imaging Market Size and Forecast, By Region (2025-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East & Africa

4.4.5. South America

5. North America Medical Imaging Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032)

5.1. North America Medical Imaging Market Size and Forecast, By Product Type (2025-2032)

5.1.1. X-ray

5.1.2. Magnetic Resonance Imaging

5.1.3. Computed Tomography

5.1.4. Ultrasound

5.1.5. Molecular Imaging

5.2. North America Medical Imaging Market Size and Forecast, By Application (2025-2032)

5.2.1. Cardiology

5.2.2. Oncology

5.2.3. Orthopedics

5.2.4. Neurology

5.2.5. Gynecology

5.2.6. Others

5.3. North America Medical Imaging Market Size and Forecast, By End-user (2025-2032)

5.3.1. Hospitals

5.3.2. Diagnostic Imaging Centers

5.4. North America Medical Imaging Market Size and Forecast, by Country (2025-2032)

5.4.1. United States

5.4.1.1. United States Medical Imaging Market Size and Forecast, By Product Type (2025-2032)

5.4.1.1.1. X-ray

5.4.1.1.2. Magnetic Resonance Imaging

5.4.1.1.3. Computed Tomography

5.4.1.1.4. Ultrasound

5.4.1.1.5. Molecular Imaging

5.4.1.2. United States United States Medical Imaging Market Size and Forecast, By Applications (2025-2032)

5.4.1.2.1. Cardiology

5.4.1.2.2. Oncology

5.4.1.2.3. Orthopedics

5.4.1.2.4. Others

5.4.1.3. United States Medical Imaging Market Size and Forecast, By End-user (2025-2032)

5.4.1.3.1. Hospitals

5.4.1.3.2. Diagnostic Imaging Centers

5.4.2. Canada

5.4.2.1. Canada Medical Imaging Market Size and Forecast, By Product Type (2025-2032)

5.4.2.1.1. X-ray

5.4.2.1.2. Magnetic Resonance Imaging

5.4.2.1.3. Computed Tomography

5.4.2.1.4. Ultrasound

5.4.2.1.5. Molecular Imaging

5.4.2.2. Canada Medical Imaging Market Size and Forecast, By Applications (2025-2032)

5.4.2.2.1. Cardiology

5.4.2.2.2. Oncology

5.4.2.2.3. Orthopedics

5.4.2.2.4. Neurology

5.4.2.2.5. Gynecology

5.4.2.2.6. Others

5.4.2.3. Canada Medical Imaging Market Size and Forecast, By End-user (2025-2032)

5.4.2.3.1. Hospitals

5.4.2.3.2. Diagnostic Imaging Centers

5.4.3. Mexico

5.4.3.1. Mexico Medical Imaging Market Size and Forecast, By Product Type (2025-2032)

5.4.3.1.1. X-ray

5.4.3.1.2. Magnetic Resonance Imaging

5.4.3.1.3. Computed Tomography

5.4.3.1.4. Ultrasound

5.4.3.1.5. Molecular Imaging

5.4.3.2. Mexico Medical Imaging Market Size and Forecast, By Applications (2025-2032)

5.4.3.2.1. Cardiology

5.4.3.2.2. Oncology

5.4.3.2.3. Orthopedics

5.4.3.2.4. Neurology

5.4.3.2.5. Gynecology

5.4.3.2.6. Others

5.4.3.3. Mexico Medical Imaging Market Size and Forecast, By End-user (2025-2032)

5.4.3.3.1. Hospitals

5.4.3.3.2. Diagnostic Imaging Centers

6. Europe Medical Imaging Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032)

6.1. Europe Medical Imaging Market Size and Forecast, By Product Type (2025-2032)

6.2. Europe Medical Imaging Market Size and Forecast, By Applications (2025-2032)

6.3. Europe Medical Imaging Market Size and Forecast, By End-user (2025-2032)

6.4. Europe Medical Imaging Market Size and Forecast, by Country (2025-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Medical Imaging Market Size and Forecast, By Product Type (2025-2032)

6.4.1.2. United Kingdom Medical Imaging Market Size and Forecast, By Applications (2025-2032)

6.4.1.3. United Kingdom Medical Imaging Market Size and Forecast, By End-user (2025-2032)

6.4.2. France

6.4.2.1. France Medical Imaging Market Size and Forecast, By Product Type (2025-2032)

6.4.2.2. France Medical Imaging Market Size and Forecast, By Applications (2025-2032)

6.4.2.3. France Medical Imaging Market Size and Forecast, By End-user (2025-2032)

6.4.3. Germany

6.4.3.1. Germany Medical Imaging Market Size and Forecast, By Product Type (2025-2032)

6.4.3.2. Germany Medical Imaging Market Size and Forecast, By Applications (2025-2032)

6.4.3.3. Germany Medical Imaging Market Size and Forecast, By End-user (2025-2032)

6.4.4. Italy

6.4.4.1. Italy Medical Imaging Market Size and Forecast, By Product Type (2025-2032)

6.4.4.2. Italy Medical Imaging Market Size and Forecast, By Applications (2025-2032)

6.4.4.3. Italy Medical Imaging Market Size and Forecast, By End-user (2025-2032)

6.4.5. Spain

6.4.5.1. Spain Medical Imaging Market Size and Forecast, By Product Type (2025-2032)

6.4.5.2. Spain Medical Imaging Market Size and Forecast, By Applications (2025-2032)

6.4.5.3. Spain Medical Imaging Market Size and Forecast, By End-user (2025-2032)

6.4.6. Sweden

6.4.6.1. Sweden Medical Imaging Market Size and Forecast, By Product Type (2025-2032)

6.4.6.2. Sweden Medical Imaging Market Size and Forecast, By Applications (2025-2032)

6.4.6.3. Sweden Medical Imaging Market Size and Forecast, By End-user (2025-2032)

6.4.7. Austria

6.4.7.1. Austria Medical Imaging Market Size and Forecast, By Product Type (2025-2032)

6.4.7.2. Austria Medical Imaging Market Size and Forecast, By Applications (2025-2032)

6.4.7.3. Austria Medical Imaging Market Size and Forecast, By End-user (2025-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Medical Imaging Market Size and Forecast, By Product Type (2025-2032)

6.4.8.2. Rest of Europe Medical Imaging Market Size and Forecast, By Applications (2025-2032)

6.4.8.3. Rest of Europe Medical Imaging Market Size and Forecast, By End-user (2025-2032)

7. Asia Pacific Medical Imaging Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032)

7.1. Asia Pacific Medical Imaging Market Size and Forecast, By Product (2025-2032)

7.2. Asia Pacific Medical Imaging Market Size and Forecast, By Application (2025-2032)

7.3. Asia Pacific Medical Imaging Market Size and Forecast, By End-user (2025-2032)

7.4. Asia Pacific Medical Imaging Market Size and Forecast, by Country (2025-2032)

7.4.1. China

7.4.1.1. China Medical Imaging Market Size and Forecast, By Product (2025-2032)

7.4.1.2. China Medical Imaging Market Size and Forecast, By Application (2025-2032)

7.4.1.3. China Medical Imaging Market Size and Forecast, By End-user (2025-2032)

7.4.2. S Korea

7.4.2.1. S Korea Medical Imaging Market Size and Forecast, By Product (2025-2032)

7.4.2.2. S Korea Medical Imaging Market Size and Forecast, By Application (2025-2032)

7.4.2.3. S Korea Medical Imaging Market Size and Forecast, By End-user (2025-2032)

7.4.3. Japan

7.4.3.1. Japan Medical Imaging Market Size and Forecast, By Product (2025-2032)

7.4.3.2. Japan Medical Imaging Market Size and Forecast, By Application (2025-2032)

7.4.3.3. Japan Medical Imaging Market Size and Forecast, By End-user (2025-2032)

7.4.4. India

7.4.4.1. India Medical Imaging Market Size and Forecast, By Product (2025-2032)

7.4.4.2. India Medical Imaging Market Size and Forecast, By Application (2025-2032)

7.4.4.3. India Medical Imaging Market Size and Forecast, By End-user (2025-2032)

7.4.5. Australia

7.4.5.1. Australia Medical Imaging Market Size and Forecast, By Product (2025-2032)

7.4.5.2. Australia Medical Imaging Market Size and Forecast, By Application (2025-2032)

7.4.5.3. Australia Medical Imaging Market Size and Forecast, By End-user (2025-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Medical Imaging Market Size and Forecast, By Product (2025-2032)

7.4.6.2. Indonesia Medical Imaging Market Size and Forecast, By Application (2025-2032)

7.4.6.3. Indonesia Medical Imaging Market Size and Forecast, By End-user (2025-2032)

7.4.7. Philippines

7.4.7.1. Philippines Medical Imaging Market Size and Forecast, By Product (2025-2032)

7.4.7.2. Philippines Medical Imaging Market Size and Forecast, By Application (2025-2032)

7.4.7.3. Philippines Medical Imaging Market Size and Forecast, By End-user (2025-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Medical Imaging Market Size and Forecast, By Product (2025-2032)

7.4.8.2. Malaysia Medical Imaging Market Size and Forecast, By Application (2025-2032)

7.4.8.3. Malaysia Medical Imaging Market Size and Forecast, By End-user (2025-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Medical Imaging Market Size and Forecast, By Product (2025-2032)

7.4.9.2. Vietnam Medical Imaging Market Size and Forecast, By Application (2025-2032)

7.4.9.3. Vietnam Medical Imaging Market Size and Forecast, By End-user (2025-2032)

7.4.10. Thailand

7.4.10.1. Thailand Medical Imaging Market Size and Forecast, By Product (2025-2032)

7.4.10.2. Thailand Medical Imaging Market Size and Forecast, By Application (2025-2032)

7.4.10.3. Thailand Medical Imaging Market Size and Forecast, By End-user (2025-2032)

7.4.11. ASEAN

7.4.11.1. ASEAN Medical Imaging Market Size and Forecast, By Product (2025-2032)

7.4.11.2. ASEAN Medical Imaging Market Size and Forecast, By Application (2025-2032)

7.4.11.3. ASEAN Medical Imaging Market Size and Forecast, By End-user (2025-2032)

7.4.12. Rest of Asia Pacific

7.4.12.1. Rest of Asia Pacific Medical Imaging Market Size and Forecast, By Product (2025-2032)

7.4.12.2. Rest of Asia Pacific Medical Imaging Market Size and Forecast, By Application (2025-2032)

7.4.12.3. Rest of Asia Pacific Medical Imaging Market Size and Forecast, By End-user (2025-2032)

8. Middle East and Africa Medical Imaging Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032)

8.1. Middle East and Africa Medical Imaging Market Size and Forecast, By Product Type (2025-2032)

8.2. Middle East and Africa Medical Imaging Market Size and Forecast, By Applications Model (2025-2032)

8.3. Middle East and Africa Medical Imaging Market Size and Forecast, By End-user (2025-2032)

8.4. Middle East and Africa Medical Imaging Market Size and Forecast, by Country (2025-2032)

8.4.1. South Africa

8.4.1.1. South Africa Medical Imaging Market Size and Forecast, By Product Type (2025-2032)

8.4.1.2. South Africa Medical Imaging Market Size and Forecast, By Applications Model (2025-2032)

8.4.1.3. South Africa Medical Imaging Market Size and Forecast, By End-user (2025-2032)

8.4.2. GCC

8.4.2.1. GCC Medical Imaging Market Size and Forecast, By Product Type (2025-2032)

8.4.2.2. GCC Medical Imaging Market Size and Forecast, By Applications Model (2025-2032)

8.4.2.3. GCC Medical Imaging Market Size and Forecast, By End-user (2025-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Medical Imaging Market Size and Forecast, By Product Type (2025-2032)

8.4.3.2. Nigeria Medical Imaging Market Size and Forecast, By Applications Model (2025-2032)

8.4.3.3. Nigeria Medical Imaging Market Size and Forecast, By End-user (2025-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Medical Imaging Market Size and Forecast, By Product Type (2025-2032)

8.4.4.2. Rest of ME&A Medical Imaging Market Size and Forecast, By Applications Model (2025-2032)

8.4.4.3. Rest of ME&A Medical Imaging Market Size and Forecast, By End-user (2025-2032)

9. South America Medical Imaging Market Size and Forecast by Segmentation (by Value USD Bn.) (2025-2032)

9.1. South America Medical Imaging Market Size and Forecast, By Product Type (2025-2032)

9.2. South America Medical Imaging Market Size and Forecast, By Applications (2025-2032)

9.3. South America Medical Imaging Market Size and Forecast, By End-user (2025-2032)

9.4. South America Medical Imaging Market Size and Forecast, by Country (2025-2032)

9.4.1. Brazil

9.4.1.1. Brazil Medical Imaging Market Size and Forecast, By Product Type (2025-2032)

9.4.1.2. Brazil Medical Imaging Market Size and Forecast, By Applications (2025-2032)

9.4.1.3. Brazil Medical Imaging Market Size and Forecast, By End-user (2025-2032)

9.4.2. Argentina

9.4.2.1. Argentina Medical Imaging Market Size and Forecast, By Product Type 2025-2032)

9.4.2.2. Argentina Medical Imaging Market Size and Forecast, By Applications (2025-2032)

9.4.2.3. Argentina Medical Imaging Market Size and Forecast, By End-user (2025-2032)

9.4.3. Rest Of South America

9.4.3.1. Rest Of South America Medical Imaging Market Size and Forecast, By Product Type (2025-2032)

9.4.3.2. Rest Of South America Medical Imaging Market Size and Forecast, By Applications (2025-2032)

9.4.3.3. Rest Of South America Medical Imaging Market Size and Forecast, By End-user (2025-2032)

10. Company Profile: Key Players

10.1 GE Healthcare (United States)

10.1.1 Company Overview

10.1.2 Business Portfolio

10.1.3 Financial Overview

10.1.4 SWOT Analysis

10.1.5 Strategic Analysis

10.1.6 Recent Developments

10.2 Philips Healthcare (United States)

10.3 Siemens Healthineers (United States)

10.4 Canon Medical Systems (United States)

10.5 Esaote (Italy, with a strong presence in North America)

10.6 Carestream Health (United States)

10.7 Toshiba Medical Systems (Japan)

10.8 Hitachi Medical Systems (Japan)

10.9 Fujifilm Medical Systems (Japan)

10.10 Samsung Medison (South Korea)

10.11 Mindray (China)

10.12 Shanghai United Imaging Healthcare (China)

10.13 Nihon Kohden (Japan)

10.14 Schneider Electric (France)

10.15 Accuray (United Kingdom)

10.16 Medtronic (Ireland)

10.17 Stryker Corporation (Germany)

10.18 Elekta (Sweden)

10.19 Hologic (United Arab Emirates)

11. Key Findings & Analyst Recommendations

12. Medical Imaging Markets: Research Methodology