Cardiotonic Agents Market Analysis: By Drug Type, By Application, Segment Forecasts, 2025-2032

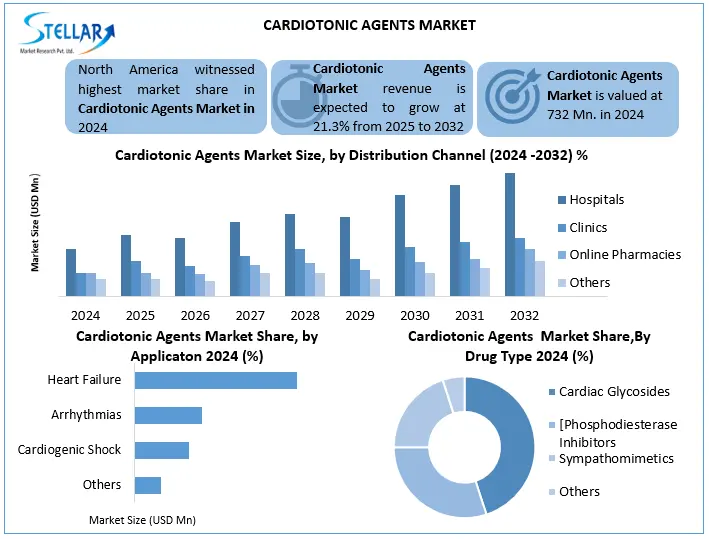

The Global Cardiotonic Agents Market was valued at USD 732 Mn in 2024. Its total industry revenue is expected to grow by 21.3% from 2025 to 2032, reaching nearly USD 3430.82 Mn in 2032.

Format : PDF | Report ID : SMR_2831

Cardiotonic Agents Market Overview

Cardiotonic agents are drugs that increase the heart's capacity to pump blood, resulting in stronger heartbeats. Their primary purpose is to increase the heart's efficiency to cure problems, including heart failure and irregular heart rhythms. Dobutamine, a stimulant that targets heart receptors, milrinone, which acts by altering specific enzymes, and digoxin, a plant-based medication, are common varieties. These medications function in various ways. Others trigger stress-response pathways, while others raise calcium levels in heart cells. Their common objective is to enhance blood circulation by assisting the heart in pumping more efficiently. They are frequently prescribed by doctors when the heart is too weak or unstable to beat normally on its own.

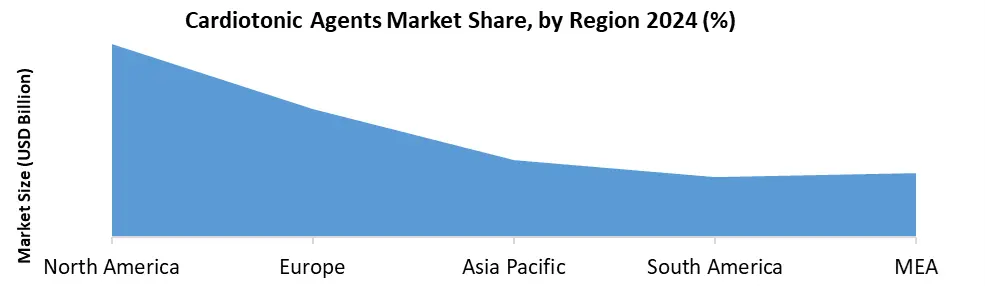

The global cardiotonic agents market is steadily increasing, driven by the cases of heart disease, increasing with the requirement of a chronic population, and better heart failure treatments. Medical and new drug remedies are also helping to run this increase. However, challenges remain, including probable side effects from strict rules for long-term use and drug approval. North America and Europe currently lead the market, due to heavy investment in strong healthcare systems and research, while Asia-Pacific is quickly catching up due to a better medical facilities and rising heart disease rates. Major pharmaceutical companies are expanding their reach through partnerships and innovative treatments to remain competitive in this developed market.

To get more Insights: Request Free Sample Report

Cardiotonic Agents Market Dynamics

Rising Prevalence of Heart Failure and Cardiovascular Diseases to Drive Cardiotonic Agents Market

Heart failure and the growing prevalence of heart diseases (CVD) are the major drivers of demand for cardiotonic agents globally. Along with an aging population, sedentary lifestyle, high blood pressure, diabetes, and obesity, the incidence of heart failure and other heart conditions continues to rise. According to the World Health Organization (WHO), heart disease remains a major cause of death around the world, accounting for about 18 Mn deaths annually. This growing patient pool requires effective medicinal intervention, which includes cardiotonic drugs such as digoxin, milrinone, and dobutamine, which increase cardiac output and manage symptoms in both chronic and acute settings. Additionally, better clinical abilities and heart disease have been detected before more awareness, further expanding the patient population for these treatments. As healthcare systems prefer heart failure management programs, demand for cardiotonic agents is expected to increase continuously, especially in areas with high CVD burden such as North America, Europe, and rapidly, Asia-Pacific.

- American Heart Association (AHA) updated its heart failure management guidelines, recommending close monitoring for poisoning risks, emphasizing role of cardiotonic agents like Digoxin in specific patient subgroups.

- European Society of Cardiology (ESC) introduced new protocols for acute heart failure management by expanding use of phosphodiesterase inhibitors (eg, milrinone) in hospital settings under acute hemodynamic monitoring.

- Ministry of Health of India launched national heart failure registry in 2024 to track results of treatment and optimize the use of cardiotonic agents therapy in its overburdened public health system.

The High Cost to Restrain the Cardiotonic Therapies Limits Accessibility in Developing Regions

In low and middle-income countries (LMICS), where out-of-pocket expenses predominate and healthcare resources are constrained, the high cost of cardiotonic agents therapy is a major barrier to access. Novel phosphodiesterase inhibitors and intravenous inotropes are examples of advanced cardiotonic medications that frequently have high price tags because of patent protection, complex production procedures, and little competition. Many patients in sub-Saharan Africa, South Asia, and portions of Latin America are still unable to afford new and more effective medicines, even while the standard option (such as digoxin) provides some relief. Even when available, rapid heart failure management and high hospitalization costs, IV therapy such as Milrinone is required. Further Strain Resource. This economic inequality increases global health, as delayed treatment in patients from developing countries, sub-sector care, or dependence on chronic treatments. Without price reforms, local generic production, or an international funding initiative in cardiotonic agents market.

Development of Safe and More Effective Drugs Research Focuses on Reducing Side Effects and Improving Drug Efficacy

The development of safe and more effective cardiotonic agents are an important priority in heart research, driven by the need to reduce adverse effects such as arrhythmia. Stress is associated with current treatments. Pharmaceutical companies are investing in novel drug formulations, including targeted inotropes and calcium sensitizers, which increase heart function with low risk. Molecular biology and accurate therapy have enabled the design of advanced drugs that act selectively on myocardial cells without disrupting electrolyte balance. Clinical trials are also searching for combination remedies to improve efficacy by reducing the dosage of individual agents. Additionally, biologics and gene-based treatments are emerging as possible successes for refractory heart failure. Regulatory agencies are supporting fast-track approval for candidates who promise to meet the needs of the patients. As the research progresses, the purpose of the next generation of cardiotonic agents are to improve patient outcomes by reducing hospitalized and long-term complications.

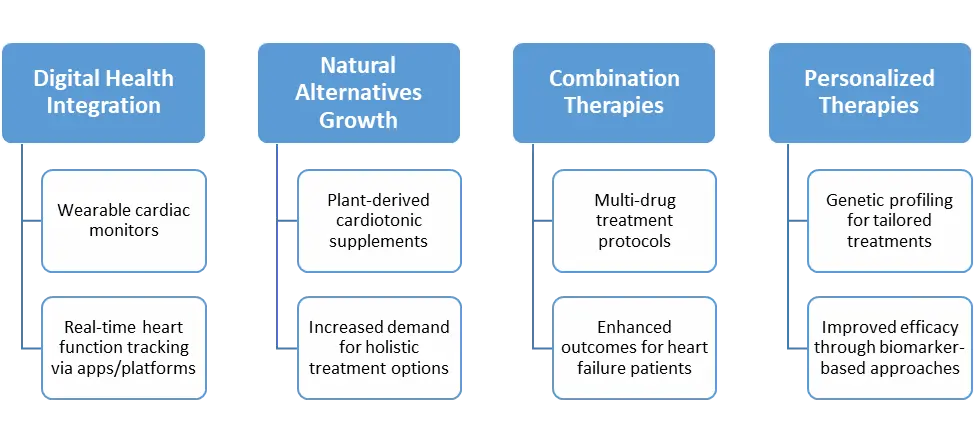

Cardiotonic Agents Market Trends

Cardiotonic Agents Market Segment Analysis

Based on Drug Type, Cardiac glycosides (eg, digoxin) historically dominates due to their prolonged use in treatment of heart failure and atrial fibrillations. His ability to increase myocardial contractility makes them a preferred choice for chronic management while reducing heart rate. However, phosphodiesterase inhibitors (eg, milrinone) are receiving traction in acute care settings due to their rapid action and effectiveness in severe heart failure. Sympathy agents (eg, dobutamine) are mainly used due to their powerful inotropic effects in short-term, significant care scenarios, although their use is limited by side effects such as arrhythmias. While new and targeted therapy is emerging, cardiac glycosides are prominent in outpatient settings due to established efficacy, cost-efficiency and comprehensive clinical familiarity.

Based on Application, Heart failure dominates a market application section of cardiotonic agents, mainly due to increasing global proliferation of aging population, high blood pressure, and diabetes related to diabetes. Cardiotonic agents, such as digoxin and milrinone, are widely determined to improve cardiac outputs and manage symptoms in chronic and acute heart failure patients. While arrhythmia and cardiogenic shock also increase demand, their treatment often requires a combination of remedies, including antiarrhythmic and vasopressors instead of cardiotonics agents. Increased attention on heart failure management in both hospital and outpatient settings strengthens its leading position. Additionally, the ongoing research in advanced heart failure treatments ensures continuous dominance in this section compared to other applications.

Based on Distribution Channel, Hospitals dominate the market distribution channel section of cardiotonic agents, mainly because these drugs are often administered in acute and intensive care settings, like heart failure, emergency, and post-operative cardiac care. Needs close medical supervision, intravenous administration (eg, milrinone, dobutamine), and dose adjustment, making hospitals the primary point of use. While clinics meet patients requiring oral drugs to treat chronic heart failure, and online pharmacies are receiving traction for refills, hospital emergency care, intensive monitoring, and their infrastructure remains the largest channel due to their infrastructure for high patient flow with severe heart conditions. Additionally, the increasing hospital recruitment rate for heart-related diseases further strengthens this dominance.

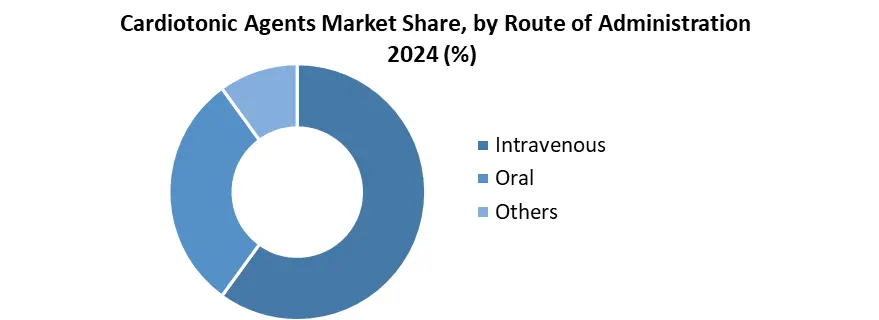

Based on Route of Administration, Intravenous (IV) administration dominates route of administration segment for cardiotonic agents, like dobutamine and milrinone, are used mainly in acute and intensive care settings, like heart failure exercises, cardiogenic shock, and post-cardiac surgery. IV route action and accurate dosage ensure a rapid start of titration, which is important in emergency scenarios. While oral administration (eg, digoxin) is used for chronic cardiovascular failure management, its slow absorption and variable bioavailability have limited its dominance in immediate care. The increasing prevalence of the serious heart condition requires to be hospitalized, further strengthening the IV administration as a major route, although oral formulations are important for long-term outpatient therapy.

Cardiotonic Agents Market Regional Analysis

North America is the dominant region in the Global Cardiotonic Agents Market, as high circulation of cardiovascular diseases, strong adoption of advanced healthcare infrastructure and innovative remedies. U.S. The largest market share holds, which is inspired by increasing cases of heart failure, a growing slightly medical population and significant investment in heart drug development. Such as, favorable reimbursement policies and the presence of major drug players further strengthen the leading position of North America market.

Cardiotonic Agents Market Competitive Landscape

The cardiotonic agents market features a competitive landscape dominated by major pharmaceutical players like Pfizer, Novartis, and GSK, which leverage their strong cardiovascular drug portfolios and global reach. The company’s focus on innovative drug development, strategic acquisitions, and geographic expansions to maintain market leadership, particularly in high-demand regions like North America and Europe. Meanwhile, generic manufacturers like Teva and Novartis AG play a crucial role in increasing accessibility through cost-effective alternatives. Market also sees competition from specialized players like Fresenius Kabi, which provides critical IV formulations for acute care. Key strategies include R&D investments in next-generation cardiotonics, partnerships with biotech firms, and expansion into emerging markets with rising cardiovascular disease burdens.

Additionally, the shift toward precision medicine and digital health integration is reshaping treatment approaches. While the market remains moderately consolidated, pricing pressures from generics and increasing demand for advanced therapies drive continuous evolution among competitors.

|

Cardiotonic Agents Market Scope |

|

|

Market Size in 2024 |

USD 732 Mn. |

|

Market Size in 2032 |

USD 3430.82 Mn. |

|

CAGR (2025-2032) |

21.3 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Drug Type Cardiac Glycosides Sympathomimetic Agents Phosphodiesterase Inhibitor Others |

|

By Application Heart Failure Arrhythmias Cardiogenic Shock Others |

|

|

By Distribution Channel Hospitals Clinics Online Pharmacies Others |

|

|

By Route of Administration Oral Intravenous Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, Indonesia, Malaysia, Thailand, Vietnam, Philippines, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Cardiotonic Agents Market

North America

- Pfizer Inc. (New York, USA)

- Amgen Inc. (California, USA)

- Bristol-Myers Squibb (New York, USA)

- Gilead Sciences (California, USA)

- Eli Lilly and Company (Indiana, USA)

- Merck & Co., Inc. (New Jersey, USA)

- Knight Therapeutics (Montreal, Canada)

Europe

- Novartis AG (Basel, Switzerland)

- GlaxoSmithKline (GSK) (London, UK)

- Bayer AG (Leverkusen, Germany)

- Sanofi S.A. (Paris, France)

- Boehringer Ingelheim (Ingelheim, Germany)

- AstraZeneca (Cambridge, UK)

- Fresenius Kabi (Bad Homburg, Germany)

Asia-Pacific

- Takeda Pharmaceutical Company (Tokyo, Japan)

- Daiichi Sankyo (Tokyo, Japan)

- Sun Pharmaceutical Industries Ltd. (Mumbai, India)

- Dr. Reddy’s Laboratories (Hyderabad, India)

- CSPC Pharmaceutical Group (Shijiazhuang, China)

- Yuhan Corporation (Seoul, South Korea)

- CSL Limited (Melbourne, Australia)

Middle East & Africa

- Teva Pharmaceutical Industries Ltd. (Tel Aviv, Israel)

- Aspen Pharmacare (Durban, South Africa)

- Julphar (Gulf Pharmaceutical Industries) (Ras Al Khaimah, UAE)

South America

- EMS Pharma (São Paulo, Brazil)

- Elea Phoenix (Buenos Aires, Argentina)

- Recalcine S.A. (Santiago, Chile)

Frequently Asked Questions

Slower absorption limits use to chronic outpatient care.

Aging population, robust healthcare systems (Germany, UK, France), and CVD prevalence.

Increasing heart failure/CVD cases due to aging populations, diabetes, and obesity.

1. Cardiotonic Agents Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Cardiotonic Agents Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Cardiotonic Agents Market: Dynamics

3.1. Cardiotonic Agents Market Trends

3.2. Cardiotonic Agents Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis For the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Cardiotonic Agents Market: Global Market Size and Forecast by Segmentation (by Value in USD Mn) (2025-2032)

4.1. Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

4.1.1. Cardiac Glycosides

4.1.2. Sympathomimetic Agents

4.1.3. Phosphodiesterase Inhibitor

4.1.4. Others

4.2. Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

4.2.1. Heart Failure

4.2.2. Arrhythmias

4.2.3. Cardiogenic Shock

4.2.4. Others

4.3. Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

4.3.1. Oral

4.3.2. Intravenous

4.3.3. Others

4.4. Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

4.4.1. Hospitals

4.4.2. Clinics

4.4.3. Online Pharmacies

4.4.4. Others

4.5. Cardiotonic Agents Market Size and Forecast, By Region (2025-2032)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. South America

5. North America Cardiotonic Agents Market Size and Forecast by Segmentation (by Value in USD Mn) (2025-2032)

5.1. North America Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

5.1.1. Cardiac Glycosides

5.1.2. Sympathomimetic Agents

5.1.3. Phosphodiesterase Inhibitor

5.1.4. Others

5.2. North America Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

5.2.1. Heart Failure

5.2.2. Arrhythmias

5.2.3. Cardiogenic Shock

5.2.4. Others

5.3. North America Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

5.3.1. Oral

5.3.2. Intravenous

5.3.3. Others

5.4. North America Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

5.4.1. Hospitals

5.4.2. Clinics

5.4.3. Online Pharmacies

5.4.4. Others

5.5. North America Cardiotonic Agents Market Size and Forecast, by Country (2025-2032)

5.5.1. United States

5.5.1.1. United States Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

5.5.1.1.1. Cardiac Glycosides

5.5.1.1.2. Sympathomimetic Agents

5.5.1.1.3. Phosphodiesterase Inhibitor

5.5.1.1.4. Others

5.5.1.2. United States Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

5.5.1.2.1. Heart Failure

5.5.1.2.2. Arrhythmias

5.5.1.2.3. Cardiogenic Shock

5.5.1.2.4. Others

5.5.1.3. United States Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

5.5.1.3.1. Oral

5.5.1.3.2. Intravenous

5.5.1.3.3. Others

5.5.1.4. United States Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

5.5.1.4.1. Hospitals

5.5.1.4.2. Clinics

5.5.1.4.3. Online Pharmacies

5.5.1.4.4. Others

5.5.2. Canada

5.5.2.1. Canada Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

5.5.2.1.1. Cardiac Glycosides

5.5.2.1.2. Sympathomimetic Agents

5.5.2.1.3. Phosphodiesterase Inhibitor

5.5.2.1.4. Others

5.5.2.2. Canada Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

5.5.2.2.1. Heart Failure

5.5.2.2.2. Arrhythmias

5.5.2.2.3. Cardiogenic Shock

5.5.2.2.4. Others

5.5.2.3. Canada Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

5.5.2.3.1. Oral

5.5.2.3.2. Intravenous

5.5.2.3.3. Others

5.5.2.4. Canada Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

5.5.2.4.1. Hospitals

5.5.2.4.2. Clinics

5.5.2.4.3. Online Pharmacies

5.5.2.4.4. Others

5.5.3. Mexico

5.5.3.1. Mexico Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

5.5.3.1.1. Cardiac Glycosides

5.5.3.1.2. Sympathomimetic Agents

5.5.3.1.3. Phosphodiesterase Inhibitor

5.5.3.1.4. Others

5.5.3.2. Mexico Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

5.5.3.2.1. Heart Failure

5.5.3.2.2. Arrhythmias

5.5.3.2.3. Cardiogenic Shock

5.5.3.2.4. Others

5.5.3.3. Mexico Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

5.5.3.3.1. Oral

5.5.3.3.2. Intravenous

5.5.3.3.3. Others

5.5.3.4. Mexico Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

5.5.3.4.1. Hospitals

5.5.3.4.2. Clinics

5.5.3.4.3. Online Pharmacies

5.5.3.4.4. Others

6. Europe Cardiotonic Agents Market Size and Forecast by Segmentation (by Value in USD Mn) (2025-2032)

6.1. Europe Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

6.2. Europe Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

6.3. Europe Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

6.4. Europe Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

6.5. Europe Cardiotonic Agents Market Size and Forecast, by Country (2025-2032)

6.5.1. United Kingdom

6.5.1.1. United Kingdom Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

6.5.1.2. United Kingdom Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

6.5.1.3. United Kingdom Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

6.5.1.4. United Kingdom Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

6.5.2. France

6.5.2.1. France Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

6.5.2.2. France Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

6.5.2.3. France Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

6.5.2.4. France Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

6.5.3. Germany

6.5.3.1. Germany Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

6.5.3.2. Germany Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

6.5.3.3. Germany Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

6.5.3.4. Germany Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

6.5.4. Italy

6.5.4.1. Italy Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

6.5.4.2. Italy Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

6.5.4.3. Italy Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

6.5.4.4. Italy Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

6.5.5. Spain

6.5.5.1. Spain Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

6.5.5.2. Spain Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

6.5.5.3. Spain Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

6.5.5.4. Spain Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

6.5.6. Sweden

6.5.6.1. Sweden Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

6.5.6.2. Sweden Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

6.5.6.3. Sweden Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

6.5.6.4. Sweden Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

6.5.7. Russia

6.5.7.1. Russia Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

6.5.7.2. Russia Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

6.5.7.3. Russia Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

6.5.7.4. Russia Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

6.5.8. Rest of Europe

6.5.8.1. Rest of Europe Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

6.5.8.2. Rest of Europe Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

6.5.8.3. Rest of Europe Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

6.5.8.4. Rest of Europe Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

7. Asia Pacific Cardiotonic Agents Market Size and Forecast by Segmentation (by Value in USD Mn) (2025-2032)

7.1. Asia Pacific Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

7.2. Asia Pacific Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

7.3. Asia Pacific Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

7.4. Asia Pacific Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

7.5. Asia Pacific Cardiotonic Agents Market Size and Forecast, by Country (2025-2032)

7.5.1. China

7.5.1.1. China Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

7.5.1.2. China Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

7.5.1.3. China Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

7.5.1.4. China Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

7.5.2. S Korea

7.5.2.1. S Korea Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

7.5.2.2. S Korea Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

7.5.2.3. S Korea Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

7.5.2.4. S Korea Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

7.5.3. Japan

7.5.3.1. Japan Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

7.5.3.2. Japan Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

7.5.3.3. Japan Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

7.5.3.4. Japan Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

7.5.4. India

7.5.4.1. India Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

7.5.4.2. India Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

7.5.4.3. India Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

7.5.4.4. India Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

7.5.5. Australia

7.5.5.1. Australia Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

7.5.5.2. Australia Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

7.5.5.3. Australia Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

7.5.5.4. Australia Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

7.5.6. Indonesia

7.5.6.1. Indonesia Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

7.5.6.2. Indonesia Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

7.5.6.3. Indonesia Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

7.5.6.4. Indonesia Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

7.5.7. Malaysia

7.5.7.1. Malaysia Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

7.5.7.2. Malaysia Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

7.5.7.3. Malaysia Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

7.5.7.4. Malaysia Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

7.5.8. Philippines

7.5.8.1. Philippines Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

7.5.8.2. Philippines Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

7.5.8.3. Philippines Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

7.5.8.4. Philippines Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

7.5.9. Thailand

7.5.9.1. Thailand Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

7.5.9.2. Thailand Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

7.5.9.3. Thailand Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

7.5.9.4. Thailand Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

7.5.10. Vietnam

7.5.10.1. Vietnam Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

7.5.10.2. Vietnam Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

7.5.10.3. Vietnam Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

7.5.10.4. Vietnam Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

7.5.11. Rest of Asia Pacific

7.5.11.1. Rest of Asia Pacific Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

7.5.11.2. Rest of Asia Pacific Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

7.5.11.3. Rest of Asia Pacific Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

7.5.11.4. Rest of Asia Pacific Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

8. Middle East and Africa Cardiotonic Agents Market Size and Forecast (by Value in USD Mn) (2025-2032

8.1. Middle East and Africa Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

8.2. Middle East and Africa Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

8.3. Middle East and Africa Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

8.4. Middle East and Africa Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

8.5. Middle East and Africa Cardiotonic Agents Market Size and Forecast, by Country (2025-2032)

8.5.1. South Africa

8.5.1.1. South Africa Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

8.5.1.2. South Africa Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

8.5.1.3. South Africa Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

8.5.1.4. South Africa Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

8.5.2. GCC

8.5.2.1. GCC Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

8.5.2.2. GCC Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

8.5.2.3. GCC Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

8.5.2.4. GCC Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

8.5.3. Egypt

8.5.3.1. Egypt Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

8.5.3.2. Egypt Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

8.5.3.3. Egypt Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

8.5.3.4. Egypt Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

8.5.4. Nigeria

8.5.4.1. Nigeria Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

8.5.4.2. Nigeria Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

8.5.4.3. Nigeria Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

8.5.4.4. Nigeria Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

8.5.5. Rest of ME&A

8.5.5.1. Rest of ME&A Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

8.5.5.2. Rest of ME&A Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

8.5.5.3. Rest of ME&A Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

8.5.5.4. Rest of ME&A Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

9. South America Cardiotonic Agents Market Size and Forecast by Segmentation (by Value in USD Mn) (2025-2032

9.1. South America Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

9.2. South America Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

9.3. South America Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

9.4. South America Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

9.5. South America Cardiotonic Agents Market Size and Forecast, by Country (2025-2032)

9.5.1. Brazil

9.5.1.1. Brazil Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

9.5.1.2. Brazil Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

9.5.1.3. Brazil Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

9.5.1.4. Brazil Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

9.5.2. Argentina

9.5.2.1. Argentina Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

9.5.2.2. Argentina Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

9.5.2.3. Argentina Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

9.5.2.4. Argentina Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

9.5.3. Colombia

9.5.3.1. Colombia Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

9.5.3.2. Colombia Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

9.5.3.3. Colombia Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

9.5.3.4. Colombia Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

9.5.4. Chile

9.5.4.1. Chile Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

9.5.4.2. Chile Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

9.5.4.3. Chile Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

9.5.4.4. Chile Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

9.5.5. Rest Of South America

9.5.5.1. Rest Of South America Cardiotonic Agents Market Size and Forecast, By Drug Type (2025-2032)

9.5.5.2. Rest Of South America Cardiotonic Agents Market Size and Forecast, By Application (2025-2032)

9.5.5.3. Rest Of South America Cardiotonic Agents Market Size and Forecast, By Route of Administration (2025-2032)

9.5.5.4. Rest Of South America Cardiotonic Agents Market Size and Forecast, By Distribution Channel (2025-2032)

10. Company Profile: Key Players

10.1. Pfizer Inc. (New York, USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Amgen Inc. (California, USA)

10.3. Bristol-Myers Squibb (New York, USA)

10.4. Gilead Sciences (California, USA)

10.5. Eli Lilly and Company (Indiana, USA)

10.6. Merck & Co., Inc. (New Jersey, USA)

10.7. Knight Therapeutics (Montreal, Canada)

10.8. Novartis AG (Basel, Switzerland)

10.9. GlaxoSmithKline (GSK) (London, UK)

10.10. Bayer AG (Leverkusen, Germany)

10.11. Sanofi S.A. (Paris, France)

10.12. Boehringer Ingelheim (Ingelheim, Germany)

10.13. AstraZeneca (Cambridge, UK)

10.14. Fresenius Kabi (Bad Homburg, Germany)

10.15. Takeda Pharmaceutical Company (Tokyo, Japan)

10.16. Daiichi Sankyo (Tokyo, Japan)

10.17. Sun Pharmaceutical Industries Ltd. (Mumbai, India)

10.18. Dr. Reddy’s Laboratories (Hyderabad, India)

10.19. CSPC Pharmaceutical Group (Shijiazhuang, China)

10.20. Yuhan Corporation (Seoul, South Korea)

10.21. CSL Limited (Melbourne, Australia)

10.22. Teva Pharmaceutical Industries Ltd. (Tel Aviv, Israel)

10.23. Aspen Pharmacare (Durban, South Africa)

10.24. Julphar (Gulf Pharmaceutical Industries) (Ras Al Khaimah, UAE)

10.25. EMS Pharma (São Paulo, Brazil)

10.26. Elea Phoenix (Buenos Aires, Argentina)

10.27. Recalcine S.A. (Santiago, Chile)

11. Key Findings

12. Industry Recommendations

13. Cardiotonic Agents Market: Research Methodology