Clinical Trials Market Industry Analysis and Forecast (2026-2032)

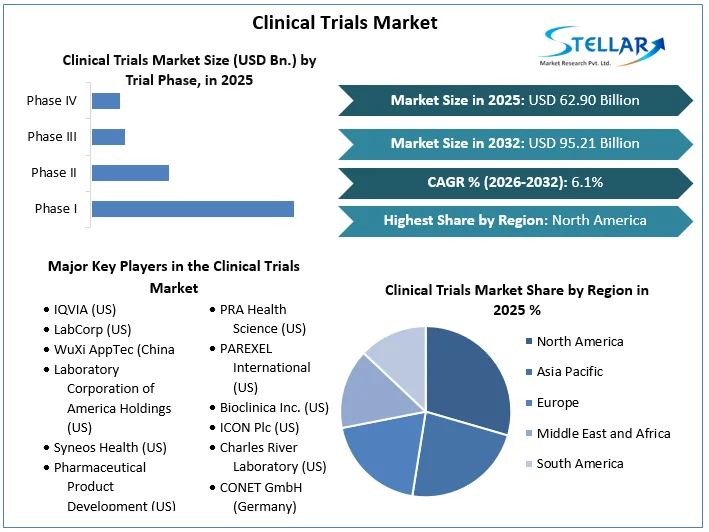

Clinical Trials Market size was valued at US $ 62.90 Billion in 2025 and the total Market revenue is expected to grow at 6.1% through 2026 to 2032, reaching nearly US $ 95.21 Billion.

Format : PDF | Report ID : SMR_802

Clinical Trials Market Overview:

Clinical Trials Market report examines the market’s growth drivers as well as its segments (Application, Technology and Region). Data has been provided by market participants, and regions (North America, APAC, Europe, MEA, and South America). This market study takes an in-depth look at all of the significant advancements that are currently occurring across all industry sectors. To provide key data analysis for the historical period (2020-2025), statistics, and presentations are used. The report examines the Clinical Trials Market Drivers, Restraints, Opportunities, and Challenges. This SMR report includes investor recommendations based on a detailed analysis of the current competitive landscape of the Clinical Trials Market.

The Covid 19 Pandemic manifested in scenarios that made regulatory agencies such as the Food and Drug Administration(FDA), European Medicines Agency(EMA), National Institute of Health(NIH), China’s National Medical Products Administration and others, drastically change the methods of conducting medical trials. The difficulties encountered in launching and coordinating clinical studies were not new, but the problems and constraints that long plagued clinical trial research became much more apparent. As the pandemic spread across the globe, drug agencies rushed to develop and test their vaccines in order to save lives. New guidelines were issued in order to circumvent the time required for the deployment of the vaccines, which otherwise would have taken months or years, and would have resulted in heavy losses of lives.

Many pharmaceutical and biotechnology giants also joined the venture of developing vaccines to curb the impact of the pandemic. The rapid commercialisation and infrastructure growth needed concrete medical data to lay down the direction for expansion, for which these companies looked to gather data through outsourcing clinical trials to CROs, further boosting the Clinical Trials Market.

Virtual Trials implemented because of global lockdowns contributed to the inclusion of an even-diverse set of participants as compared to traditional trials. This was because more prospective participants preferred to recuperate in the comfort of their homes. This boosted the participation in decentralised trials, as local caregivers could now monitor and service participants, increasing the overall geographical reach of the trials, and making them even more inclusive.

The growth of the Clinical Trials Market is further boosted by the significant research and development undertaken by pharmaceutical companies and the inculcation of remote monitoring through modern devices. An example could be employing a smartwatch to track someone's heart rate or oxygen saturation levels, a video telemedicine visit, or a phone or video call in which participants report how they are responding to an experimental treatment.

To get more Insights: Request Free Sample Report

Clinical Trials Market Dynamics:

The increasing need for coordination and collaboration in research is the key factor that would contribute to the growth of the Clinical Trials Market during the forecast period. The pandemic highlighted the need for quick mobilization and integration of distributed resources by facilitating international collaboration to provide conclusive and integrative evidence. The investment in large-scale clinical trials and consolidated funding towards master protocols needed in trials, imperative to implement seamless data sharing, credit allocation and government and commercial interest, will lead to significant growth of the Clinical Trials Market.

Strategic relationships and collaborations among pharmaceutical firms, academic institutes and Contract Research Organizations (CROs) have aided in the effective management of COVID-19 around the world. This has opened up new avenues for small and major clinical research service providers to increase their market, leading to the growth of the Clinical Trials Market.

Increased focus on Orphan and Rare Diseases:

An orphan disease is a disease which affects less than 200,000 individuals globally. Examples of such diseases are Hamburger Disease, acromegaly etc. Because of the limited profits that can be made from producing drugs for these diseases which are limited by a small user base, pharmaceutical companies shied away from the tentative aspects, making disease management in these cases very difficult. Government legislature around the globe has recently been providing incentives and tax credits to pharmaceutical and biologics manufacturers to promote drug development and therefore increase clinical trials for orphaned and rare diseases, leading to the growth of the Clinical Trials Market.

Advancement in wearable Technology:

Modern wearable consumer electronics come with a host of advanced, reliable and accurate sensors that can be used by medical professionals to monitor their patients remotely. The technology is also being used in decentralized medical trials, where changes in vitals in response to a lifestyle change or drug activity, are remotely tracked by researchers over a period of time. This has led to significant changes in the methodology of conducting trials, as wearables allow for continuous monitoring of patients who are no longer limited geographically. Further, this has led to cost-saving due to the removal of office space and medical staff needed for the collection of test samples or conducting ECG and other tests required for the trials. For example, the Heartline trial used smartphones and smartwatches to track the heartbeat pattern of users to alert them of Atrial Fibrillation.

Bioanalytical Testing, the need of the hour:

The highly competitive market for testing relies on quick and accurate analytics that will be able to quickly deploy the product by making tested products meet the regulatory mandates. This is needed in order to get the approval of the different bodies which are needed to authenticate the product for market production. The diverse and stringent CMC requirements, therefore, pose a huge problem before drugs can reach the market phase and therefore robust analytics are required for the speedy development of drugs to start the associated revenue cycles, which would lead to the growth of the Clinical Trials Market.

Researchers are also looking at Artificial Intelligence and Deep Learning Algorithms to improve the further optimize the drug development process. This is done by applying these algorithms for tasks such as analyzing vast amounts of data and patient profiling and identification for Clinical Trials.

Clinical Trials Market Segment Analysis:

Based on the Trial Phase, the Clinical Trials Market is segmented into Phase I, Phase II, Phase III and Phase IV segments. Phase III trials held the largest market share of about 49.1% in the year 2025. This can be attributed to the large scale of testing conducted in this segment and the significant cost of testing per study required which can average up to USD $ 19 Mn. Phase III segment provides pharmaceutical companies and regulatory agencies such as the Food and Drug Administration (FDA) with a thorough grasp of the drug's efficacy and side effects. Phase III is divided into two parts: Phase IIIa and IIIb. Phase IIIa studies are designed to gather statistical evidence on drug safety and efficacy in order to expedite the approval procedure. Phase IIIb studies are conducted before authorisation and are not designed for regulatory submissions. Phase II is extremely important in clinical trials, especially in oncology trials. According to the FDA, around 33.0 per cent of drugs are now undergoing Phase II testing.

Based on Service Type, the Clinical Trials Market is segmented into Protocol Designing, Site Identification, Patient Recruitment, Laboratory Services, Bioanalytical Testing, Analytical Testing, Clinical Trial Supply & Logistic Services, Decentralized Clinical Services, Clinical Trial Data Management Services, Medical Device Testing Services, and other services. The Clinical Trial Data Management segment dominated the market in the year 2023. This is because the optimum analysis of research data is critical for the fast deployment of the drug to the production phase. As a result many CROs offer trial data management services to pharmaceutical manufacturers and biopharmaceutical companies to handle the vast amounts of unclean and distributed data optimally leading to the growth of the segment within the Clinical Trials Market.

Based on the Therapy Area, the Clinical Trials Market is segmented into Oncology, Infectious Diseases, Cardiology, Neurology, Women’s Health, Genetic Diseases, Immunology, and Others. The Oncology segment dominates the global Clinical Trials Market in 2025 holding a market share of about 23% and is forecasted to reach a market size of USD 23 Bn. by the year 2032. This is because of the increasing number of instances of cancer caused because of environmental pollution and the deterioration of lifestyle changes. The increase in CRO services in the Oncology segment will also contribute to the growth of the Clinical Trials Market during the forecast period. The Cardiology Segment is forecasted to grow significantly during the forecast period.

Clinical Trials Market Regional Outlook:

North America region held the largest market share in the Global Clinical Trials Market in 2025 at approximately 50%. The market is driven by the investment in research and development and the application of new and emerging technologies for clinical trials. In countries such as the United States of America, the support of the federal government drives the demand for the clinical trials market. Multiple programmes launched by the FDA have supported the fast track development of clinical trials leading to the growth of the Clinical Trials Market. Programs are deployed to employ different ways of providing treatment to patients as soon as possible by conducting fast-tracked clinical trials in an integrated and collaborative manner. The presence of a significant geriatric population and the various chronic disorders associated with ageing will further boost the growth of the Clinical Trials Market in the region.

The Clinical Trials Market for the Asia Pacific region Is expected to grow the most during the forecast period this can be attributed to a wide Patient pool facilitating the growth of the clinical trials market. The region also hosts many pharmaceutical and biotechnology firms which have grown significantly during the Covid 19 pandemic leading to the growth of the Clinical Trials Market. Pharmaceutical and Biotechnology firms prefer the Asia Pacific region because of the larger patient pool, as well as the fast track procedures for clinical trials employed in the region, laying down the precedent for further growth of the clinical trials market in the region.

The report provides Porter’s Five Forces Model that will aid enterprise decision makers to develop their long-term strategies and marketing positions. It identifies the key competitors, their positioning and how their products perform and are perceived by the customers. Through expert analysts’ opinion, the report provides consultation on the difficulty of entering the market for new players.

Further the report provides PESTEL Analysis which will help the company tailor the overall strategies for market activities. The analysis takes into consideration various environmental variables that are crucial for the development of the market position of the company such as government funding and other political variables. Therefore, this analysis helps the stakeholder evaluate the challenges and opportunities in a holistic way.

Clinical Trials Market Scope:

|

Clinical Trials Market |

|

|

Market Size in 2025 |

USD 62.90 Bn. |

|

Market Size in 2032 |

USD 95.21 Bn. |

|

CAGR (2026-2032) |

6.1% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

By Trial Phase

|

|

By Service Type

|

|

|

|

By Therapy Area

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Clinical Trials Market Key Players:

- IQVIA (US)

- LabCorp (US)

- WuXi AppTec (China)

- Laboratory Corporation of America Holdings (US)

- Syneos Health (US)

- Pharmaceutical Product Development (US)

- PRA Health Science (US)

- PAREXEL International (US)

- Bioclinica Inc. (US)

- ICON Plc (US)

- Charles River Laboratory (US)

- CONET GmbH (Germany)

- FGK Clinical Research (Germany)

- BG ClinicalS Ltd (France)

- ClinSearch (France)

Frequently Asked Questions

North America region contributes the most to the Clinical Trials Market.

The key players in the Clinical Trials Market are IQVIA and LabCorp from the United States of America

1. Clinical Trials Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market breakdown and Data Triangulation

1.4. Assumptions

2. Clinical Trials Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Clinical Trials Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Developments and Innovations

3.5. Clinical Trials Industry Ecosystem

3.5.1. Ecosystem Analysis

3.5.2. Role of the Companies in the Ecosystem

4. Clinical Trials Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape

4.9.1. Market Regulation by Region

4.9.1.1. North America

4.9.1.2. Europe

4.9.1.3. Asia Pacific

4.9.1.4. Middle East and Africa

4.9.1.5. South America

4.9.2. Impact of Regulations on Market Dynamics

4.9.3. Government Schemes and Initiatives

5. Clinical Trials Market Size and Forecast by Segments (by Value USD Million)

5.1. Clinical Trials Market Size and Forecast, By Trial Phase (2025-2032)

5.1.1. Phase I

5.1.2. Phase II

5.1.3. Phase III

5.1.4. Phase IV

5.2. Clinical Trials Market Size and Forecast, By Service Type (2025-2032)

5.2.1. Protocol Designing

5.2.2. Site Identification

5.2.3. Patient Recruitment

5.2.4. Laboratory Services

5.2.5. Bioanalytical Testing

5.2.6. Analytical Testing

5.2.7. Clinical Trial Supply & Logistic Services

5.2.8. Decentralized Clinical Services

5.2.9. Clinical Trial Data Management Services

5.2.10. Medical Device Testing Services

5.2.11. Other Services

5.3. Clinical Trials Market Size and Forecast, By Therapy Area (2025-2032)

5.3.1. Oncology

5.3.2. Infectious Disease

5.3.3. Cardiology

5.3.4. Neurology

5.3.5. Women’s Health

5.3.6. Genetic Diseases

5.3.7. Immunology

5.3.8. Others

5.4. Clinical Trials Market Size and Forecast, by Region (2025-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Clinical Trials Market Size and Forecast (by Value USD Million)

6.1. North America Clinical Trials Market Size and Forecast, By Trial Phase (2025-2032)

6.1.1. Phase I

6.1.2. Phase II

6.1.3. Phase III

6.1.4. Phase IV

6.2. North America Clinical Trials Market Size and Forecast, By Service Type (2025-2032)

6.2.1. Protocol Designing

6.2.2. Site Identification

6.2.3. Patient Recruitment

6.2.4. Laboratory Services

6.2.5. Bioanalytical Testing

6.2.6. Analytical Testing

6.2.7. Clinical Trial Supply & Logistic Services

6.2.8. Decentralized Clinical Services

6.2.9. Clinical Trial Data Management Services

6.2.10. Medical Device Testing Services

6.2.11. Other Services

6.3. North America Clinical Trials Market Size and Forecast, By Therapy Area (2025-2032)

6.3.1. Oncology

6.3.2. Infectious Disease

6.3.3. Cardiology

6.3.4. Neurology

6.3.5. Women’s Health

6.3.6. Genetic Diseases

6.3.7. Immunology

6.3.8. Others

6.4. North America Clinical Trials Market Size and Forecast, by Country (2025-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Clinical Trials Market Size and Forecast (by Value USD Million)

7.1. Europe Clinical Trials Market Size and Forecast, By Trial Phase (2025-2032)

7.2. Europe Clinical Trials Market Size and Forecast, By Service Type (2025-2032)

7.3. Europe Clinical Trials Market Size and Forecast, By Therapy Area (2025-2032)

7.4. Europe Clinical Trials Market Size and Forecast, by Country (2025-2032)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Clinical Trials Market Size and Forecast (by Value USD Million)

8.1. Asia Pacific Clinical Trials Market Size and Forecast, By Trial Phase (2025-2032)

8.2. Asia Pacific Clinical Trials Market Size and Forecast, By Service Type (2025-2032)

8.3. Asia Pacific Clinical Trials Market Size and Forecast, By Therapy Area (2025-2032)

8.4. Asia Pacific Clinical Trials Market Size and Forecast, by Country (2025-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa Clinical Trials Market Size and Forecast (by Value USD Million)

9.1. Middle East and Africa Clinical Trials Market Size and Forecast, By Trial Phase (2025-2032)

9.2. Middle East and Africa Clinical Trials Market Size and Forecast, By Service Type (2025-2032)

9.3. Middle East and Africa Clinical Trials Market Size and Forecast, By Therapy Area (2025-2032)

9.4. Middle East and Africa Clinical Trials Market Size and Forecast, by Country (2025-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Clinical Trials Market Size and Forecast (by Value USD Million)

10.1. South America Clinical Trials Market Size and Forecast, By Trial Phase (2025-2032)

10.2. South America Clinical Trials Market Size and Forecast, By Service Type (2025-2032)

10.3. South America Clinical Trials Market Size and Forecast, By Therapy Area (2025-2032)

10.4. South America Clinical Trials Market Size and Forecast, by Country (2025-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. IQVIA (US)

11.1.1. Company Overview

11.1.2. Business Segment

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. LabCorp (US)

11.3. WuXi AppTec (China)

11.4. Laboratory Corporation of America Holdings (US)

11.5. Syneos Health (US)

11.6. Pharmaceutical Product Development (US)

11.7. PRA Health Science (US)

11.8. PAREXEL International (US)

11.9. Bioclinica Inc. (US)

11.10. ICON Plc (US)

11.11. Charles River Laboratory (US)

11.12. CONET GmbH (Germany)

11.13. FGK Clinical Research (Germany)

11.14. BG ClinicalS Ltd (France)

11.15. ClinSearch (France)

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook