Floss Picks Market Size, Share, Dynamics and Segment Analysis by Material, Distribution Channel and End-User

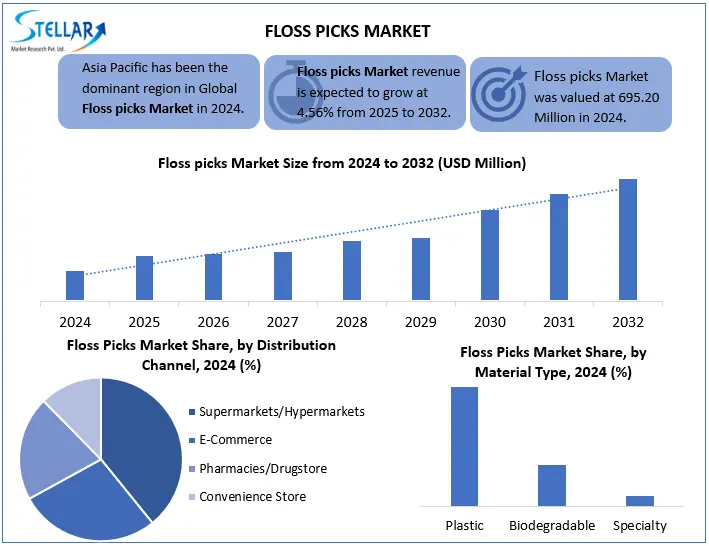

Floss Picks Market Size was valued at USD 695.20 Million in 2024 and it is expected to reach USD 993.19 Million by 2032. The Market CAGR is expected to be around 4.56% during the forecast period (2025-2032)

Format : PDF | Report ID : SMR_2832

Floss Picks Market Overview

A Floss pick is an easy plastic device designed for cleaning between teeth. It has a handle with two prong that keeps a small edge of dental floss, making it easier to remove the dining diet from tight places, which cannot reach a toothbrush. These picks come in various shapes, including curved and straight design, and are available both as a disposable and reusable option. Some modern versions include non-slip handles, built-in tongue cleaner, or better functionality and additional features such as interchangeable heads for complete cleaning. Regular use of floss picks helps in the elimination of plaque buildups, reducing the risk of common dental problems such as cavities, gums and gingivitis. The floss picks market has increased continuously due to increasing oral hygiene awareness in the floss picks market, increase in dental issues and consumer preference for convenient solutions in the floss picks market.

The Covid-19 epidemic initially disrupted the supply chains, but later promoted demand as oral care in the house became a priority. E-commerce growth accelerated sales. Post-pandemic, stability has emerged as a major trend, in which brands focus on biodegradable options and innovative designs such as antibacterial or infused floss picks. In 2024, Major Oral Care Brand has targeted stability and innovation in the Floss Picks Market. Proctor & Gamble (Oral-B), Colgate-Palmolive, and Johnson & Johnson are spending on biodegradable floss picks, adding their product line to address growing demand for ecologically friendly solutions. These permanent products are made of natural silk or cornstarch-based materials, which reduce plastic waste and align with global environmental goals. Brands such as Nudge Clean Permanent Silk Floss, Radius Natural Biodegradable Silk Floss, and TreeBird Pure Silk Eco Floss has emerged as a popular option for health-conscious consumers who are looking for a safe option.

To get more Insights: Request Free Sample Report

Floss Picks Market Dynamics

Increasing Oral Hygiene Awareness to Drive the Floss Picks Market

Increasing emphasis on oral hygiene and preventive dental care is one of the most important factors that inspire the global floss picks market. Along with increasing awareness about glue diseases, cavities, and overall dental health, consumers are adopting Floss picks as a convenient option for traditional dental floss. The global oral care market has expanded considerably, with ease of their use, portability and effectiveness in removing plaque, floss is gaining popularity. The market shifting disposable is inspired by income, especially in developing economies such as China, India and Brazil, where consumers are spending more on individual care products. The rise of e-commerce platforms has also made the floss picks more accessible; E-commerce channels have contributed significantly to the expansion of the market.

Environmental Concerns and Regulatory Pressure: A Major Challenge for Floss Picks Market

Floss picks market also faces the challenges with growing environmental issues to the market of picks and the regulations on single-use plastic becoming tighter. Conventional floss picks are typically composed of non-biodegradable plastic, which contribute to plastic pollution worldwide. Governments and environmental bodies are placing severe restrictions on single-use plastic, compelling manufacturers to invest in durable alternatives like bamboo, cornstarch-based bioplastics and recycled materials. Consumer preferences are also moving towards permanent oral care products, which pressurize the brands to innovate while maintaining the ability. In Europe and North America, where environmental consciousness is high, companies face regulatory obstacles and consumer backlash if they fail to adopt greenery practices.

Floss Picks Market Segment Analysis:

Based on Material Type, the Floss Picks Market is divided into different types such as Plastic Floss Picks, Biodegradable Picks and Specialty Picks depending on the materials used. The most prevalent variety is plastic floss picks, which accounts for over 70% of world sales. They are favored as they are inexpensive, durable and simple to mass-produce. However, their growth is slow because more people worry about plastic waste and some countries ban solo-use plastic. A rapidly growing option is a biodegradable floss picks, made from materials such as bamboo or cornstarch. These environmentally friendly picks are expected to increase 12–15% each year by 2030, especially in places such as Europe and North America where people prefer permanent products and governments have strict environmental rules.

Based on Distribution Channel, the Floss Picks Market is distributed into Supermarkets/ Hypermarkets, E-Commerce, Pharmacies/Drugstores, and Convenience Stores. Supermarkets and hypermarkets currently dominate the market, accounting for approximately 40% of the total sales, as their expanders allow retail place for comprehensive product displays and frequent publicity discounts that attract budget-conscious shopkeepers. E-Commerce has emerged as the fastest growing distribution channel, which promotes this development through convenient home delivery options and popular membership services with e-commerce giants such as Amazon, Walmart and Alibaba that ensure regular product replenishment.

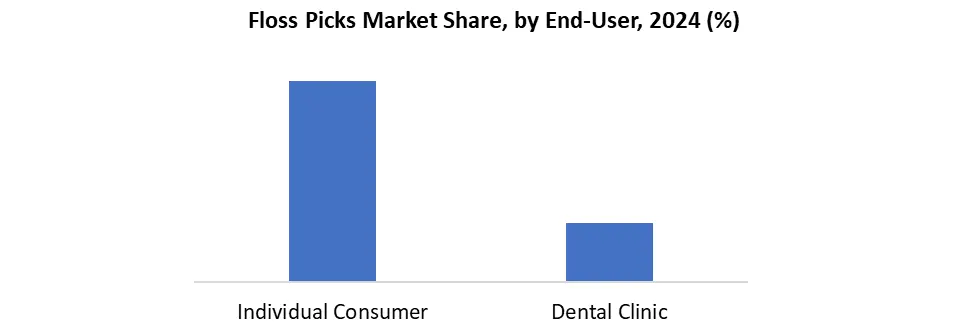

Based on End-User, the Floss Picks Market is segmented into Individual Consumers and Dental Clinics. Individual Consumers dominate the demand, accounting for about 85% of the total sales, because the oral care of the floss picks has become a head in the routine. These individual users usually buy retail channels such as supermarkets or online platforms, prefer convenience and strength. The second section consists of dental professionals and clinics, which is small in the volume, represents a high-value market. Dentists often recommend floss picks to patients as treatment plans or parts of preventive care, causing a professional support effect that affects comprehensive consumer preferences. This professional segment premiums, clinically tested products and often supply sources through special dental distributors.

Floss Picks Market Regional Analysis

The North American region leads the Global Floss Picks Market, which operates with high oral hygiene awareness, strong disposable income and widespread availability of dental care products. The US and Canada are the largest consumers, of which are alone for more than 50% of American regional demand. The Asia-Pacific region is the fastest growing market for floss picks, driven by increasing urbanization, increasing middle class population and increasing awareness about preventive dental care. Countries like China, India, Japan and South Korea are looking for rapid adoption due to e-commerce platforms, influential marketing and expansion of government dental health initiatives. China dominates APAC's consumption of floss picks, while India is experiencing growth due to increasing disposable income and westernization of oral care habits. Europe remains a mature yet as prominent consumers with Germany, UK and France. The demand for this sector is supported by strict oral health rules, high health care standards and a priority for permanent dental products. Changes towards eco-friendly floss picks such as biodegradable and bamboo-based options are re-shaping the market, especially in Scandinavian countries.

Competitive Landscape in Floss Picks Market

The Global Floss Picks Market is highly competitive, with leaders such as Procter & Gamble (Oral-B), Colgate-Palmolive, Prestige Consumer Healthcare (Dental Smart), Sunstar Americas (GUM), Dr. Fresh (recently acquired by Arm & Hammer), and The Humble Co. holds large market share. Procter & Gamble and Colgate-Palmolive are leaders in the industry, with strong brand reputation, broad retail reach, and ongoing product innovation. A significant change in consumer tastes has fueled demand for sustainable floss picks, such as biodegradable and plant-based ones, as sustainability emerges as a primary buying consideration. Companies such as The Humble Co. and Dr. Tung's have been able to ride this wave through their eco-friendly products.

Recent developments in the market are flavored variations and ergonomic shapes designed to make the experience better for users. Companies are also establishing partnerships with dental professionals to authenticate product credibility and raise awareness of oral health. The emergence of e-commerce sites such as Amazon has drastically increased market coverage, making floss picks widely available to many. Emerging market growth, especially Asia-Pacific, is taking off with rising disposable incomes and greater emphasis on oral care.

|

Floss Picks Market Scope |

|

|

Market Size in 2024 |

USD 695.20 Million |

|

Market Size in 2032 |

USD 993.19 Million |

|

CAGR (2025-2032) |

4.56% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Material Type Plastic Floss Picks Biodegradable Picks Specialty Picks |

|

By Distribution Channel Supermarkets/Hypermarkets E-Commerce Pharmacies/Drugstores Convenience Stores |

|

|

By End User Individual Consumers Dental Clinics |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Floss Picks Market

North America

- Procter & Gamble (USA)

- Colgate-Palmolive (USA)

- Prestige Consumer Healthcare (USA)

- Ranir (USA)

- Eco-DenT (USA)

- Dr. Tung’s (USA)

- Flaus (USA)

- Quip (USA)

- Cocofloss (USA)

- Hello Products (USA)

- Radius (USA)

- Johnson & Johnson (USA)

- Wowe Lifestyle (USA)

- Dental Lace (USA)

- Listerine (Kenvue) (USA)

Europe

- Sunstar (Switzerland)

- Dr. Wild & Co. AG (Switzerland)

- The Humble Co. (Sweden)

- Nature's Cart (UK)

- Georganics (UK)

- Bambuu Brush (UK)

- Truthbrush (UK)

- DM (dm-drogerie markt) (Germany)

- Rossmann (Germany)

Asia-Pacific

- Noosa Basics (Australia)

- Macleods Pharmaceuticals (India)

- Dr. Fresh (India/USA)

South America

- Surya Brasil (Brazil)

Middle East & Africa

- Saudi Dental Products Co. (Saudi Arabia)

- Dentek (USA)

Frequently Asked Questions

Key companies include, Procter & Gamble (Oral-B, USA) Colgate-Palmolive (USA) Sunstar (GUM, Switzerland), and The Humble Co. (Sweden).

In countries like India and Brazil, floss picks are gaining traction due to rising middle-class populations, urbanization, and increased focus on preventive healthcare.

North America leads globally, driven by high dental hygiene awareness and strong retail distribution. However, Asia-Pacific is the fastest-growing region due to urbanization and increasing healthcare spending.

Higher costs of sustainable materials, Competition from water flossers and interdental brushes, Regulatory bans on single-use plastics in Europe and North America this are the challenges that market face.

1. Floss Picks Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Floss Picks Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. End-user Segment

2.4.4. Revenue (2024)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Floss Picks Market: Dynamics

3.1. Floss Picks Market Trends by Region

3.1.1. North America Floss Picks Market Trends

3.1.2. Europe Floss Picks Market Trends

3.1.3. Asia Pacific Floss Picks Market Trends

3.1.4. Middle East and Africa Floss Picks Market Trends

3.1.5. South America Floss Picks Market Trends

3.2. Floss Picks Market Dynamics

3.2.1. Floss Picks Market Drivers

3.2.2. Floss Picks Market Restraints

3.2.3. Floss Picks Market Opportunities

3.2.4. Floss Picks Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Middle East and Africa

3.5.5. South America

3.6. Key Opinion Leader Analysis for Floss Picks Industry

4. Floss Picks Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

4.1. Floss Picks Market Size and Forecast, By Material Type (2025-2032)

4.1.1. Plastic Floss Picks

4.1.2. Biodegradable Picks

4.1.3. Specialty Picks

4.2. Floss Picks Market Size and Forecast, By End User (2025-2032)

4.2.1. Individual Consumers

4.2.2. Dental Clinics

4.3. Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

4.3.1. Supermarkets/Hypermarkets

4.3.2. E-Commerce

4.3.3. Pharmacies/Drugstores

4.3.4. Convenience Stores

4.4. Floss Picks Market Size and Forecast, By Region (2025-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Floss Picks Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

5.1. North America Floss Picks Market Size and Forecast, By Material Type (2025-2032)

5.1.1. Plastic Floss Picks

5.1.2. Biodegradable Picks

5.1.3. Specialty Picks

5.2. North America Floss Picks Market Size and Forecast, By End User (2025-2032)

5.2.1. Individual Consumers

5.2.2. Dental Clinics

5.3. North America Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

5.3.1. Supermarkets/Hypermarkets

5.3.2. E-Commerce

5.3.3. Pharmacies/Drugstores

5.3.4. Convenience Stores

5.4. North America Floss Picks Market Size and Forecast, by Country (2025-2032)

5.4.1. United States

5.4.1.1. United States Floss Picks Market Size and Forecast, By Material Type (2025-2032)

5.4.1.1.1. Plastic Floss Picks

5.4.1.1.2. Biodegradable Picks

5.4.1.1.3. Specialty Picks

5.4.1.2. United States Floss Picks Market Size and Forecast, By End User (2025-2032)

5.4.1.2.1. Individual Consumers

5.4.1.2.2. Dental Clinics

5.4.1.3. United States Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

5.4.1.3.1. Supermarkets/Hypermarkets

5.4.1.3.2. E-Commerce

5.4.1.3.3. Pharmacies/Drugstores

5.4.1.3.4. Convenience Stores

5.4.2. Canada

5.4.2.1. Canada Floss Picks Market Size and Forecast, By Material Type (2025-2032)

5.4.2.1.1. Plastic Floss Picks

5.4.2.1.2. Biodegradable Picks

5.4.2.1.3. Specialty Picks

5.4.2.2. Canada Floss Picks Market Size and Forecast, By End User (2025-2032)

5.4.2.2.1. Individual Consumers

5.4.2.2.2. Dental Clinics

5.4.3. Canada Floss Picks Market Size and Forecast, By Distribution Channel Industry (2025-2032)

5.4.3.1.1. Supermarkets/Hypermarkets

5.4.3.1.2. E-Commerce

5.4.3.1.3. Pharmacies/Drugstores

5.4.3.1.4. Convenience Stores

5.4.4. Mexico

5.4.4.1. Mexico Floss Picks Market Size and Forecast, By Material Type (2025-2032)

5.4.4.1.1. Plastic Floss Picks

5.4.4.1.2. Biodegradable Picks

5.4.4.1.3. Specialty Picks

5.4.4.2. Mexico Floss Picks Market Size and Forecast, By End User (2025-2032)

5.4.4.2.1. Individual Consumers

5.4.4.2.2. Dental Clinics

5.4.4.3. Mexico Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

5.4.4.3.1. Supermarkets/Hypermarkets

5.4.4.3.2. E-Commerce

5.4.4.3.3. Pharmacies/Drugstores

5.4.4.3.4. Convenience Stores

6. Europe Floss Picks Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

6.1. Europe Floss Picks Market Size and Forecast, By Material Type (2025-2032)

6.2. Europe Floss Picks Market Size and Forecast, By End User (2025-2032)

6.3. Europe Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

6.4. Europe Floss Picks Market Size and Forecast, by Country (2025-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Floss Picks Market Size and Forecast, By Material Type (2025-2032)

6.4.1.2. United Kingdom Floss Picks Market Size and Forecast, By End User (2025-2032)

6.4.1.3. United Kingdom Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.2. France

6.4.2.1. France Floss Picks Market Size and Forecast, By Material Type (2025-2032)

6.4.2.2. France Floss Picks Market Size and Forecast, By End User (2025-2032)

6.4.2.3. France Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.3. Germany

6.4.3.1. Germany Floss Picks Market Size and Forecast, By Material Type (2025-2032)

6.4.3.2. Germany Floss Picks Market Size and Forecast, By End User (2025-2032)

6.4.3.3. Germany Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.4. Italy

6.4.4.1. Italy Floss Picks Market Size and Forecast, By Material Type (2025-2032)

6.4.4.2. Italy Floss Picks Market Size and Forecast, By End User (2025-2032)

6.4.4.3. Italy Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.5. Spain

6.4.5.1. Spain Floss Picks Market Size and Forecast, By Material Type (2025-2032)

6.4.5.2. Spain Floss Picks Market Size and Forecast, By End User (2025-2032)

6.4.5.3. Spain Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.6. Sweden

6.4.6.1. Sweden Floss Picks Market Size and Forecast, By Material Type (2025-2032)

6.4.6.2. Sweden Floss Picks Market Size and Forecast, By End User (2025-2032)

6.4.6.3. Sweden Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.7. Austria

6.4.7.1. Austria Floss Picks Market Size and Forecast, By Material Type (2025-2032)

6.4.7.2. Austria Floss Picks Market Size and Forecast, By End User (2025-2032)

6.4.7.3. Austria Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Floss Picks Market Size and Forecast, By Material Type (2025-2032)

6.4.8.2. Rest of Europe Floss Picks Market Size and Forecast, By End User (2025-2032)

6.4.8.3. Rest of Europe Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

7. Asia Pacific Floss Picks Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

7.1. Asia Pacific Floss Picks Market Size and Forecast, By Material Type (2025-2032)

7.2. Asia Pacific Floss Picks Market Size and Forecast, By End User (2025-2032)

7.3. Asia Pacific Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

7.4. Asia Pacific Floss Picks Market Size and Forecast, by Country (2025-2032)

7.4.1. China

7.4.1.1. China Floss Picks Market Size and Forecast, By Material Type (2025-2032)

7.4.1.2. China Floss Picks Market Size and Forecast, By End User (2025-2032)

7.4.1.3. China Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.2. S Korea

7.4.2.1. S Korea Floss Picks Market Size and Forecast, By Material Type (2025-2032)

7.4.2.2. S Korea Floss Picks Market Size and Forecast, By End User (2025-2032)

7.4.2.3. S Korea Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.3. Japan

7.4.3.1. Japan Floss Picks Market Size and Forecast, By Material Type (2025-2032)

7.4.3.2. Japan Floss Picks Market Size and Forecast, By End User (2025-2032)

7.4.3.3. Japan Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.4. India

7.4.4.1. India Floss Picks Market Size and Forecast, By Material Type (2025-2032)

7.4.4.2. India Floss Picks Market Size and Forecast, By End User (2025-2032)

7.4.4.3. India Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.5. Australia

7.4.5.1. Australia Floss Picks Market Size and Forecast, By Material Type (2025-2032)

7.4.5.2. Australia Floss Picks Market Size and Forecast, By End User (2025-2032)

7.4.5.3. Australia Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Floss Picks Market Size and Forecast, By Material Type (2025-2032)

7.4.6.2. Indonesia Floss Picks Market Size and Forecast, By End User (2025-2032)

7.4.6.3. Indonesia Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.7. Philippines

7.4.7.1. Philippines Floss Picks Market Size and Forecast, By Material Type (2025-2032)

7.4.7.2. Philippines Floss Picks Market Size and Forecast, By End User (2025-2032)

7.4.7.3. Philippines Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Floss Picks Market Size and Forecast, By Material Type (2025-2032)

7.4.8.2. Malaysia Floss Picks Market Size and Forecast, By End User (2025-2032)

7.4.8.3. Malaysia Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Floss Picks Market Size and Forecast, By Material Type (2025-2032)

7.4.9.2. Vietnam Floss Picks Market Size and Forecast, By End User (2025-2032)

7.4.9.3. Vietnam Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.10. Thailand

7.4.10.1. Thailand Floss Picks Market Size and Forecast, By Material Type (2025-2032)

7.4.10.2. Thailand Floss Picks Market Size and Forecast, By End User (2025-2032)

7.4.10.3. Thailand Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Floss Picks Market Size and Forecast, By Material Type (2025-2032)

7.4.11.2. Rest of Asia Pacific Floss Picks Market Size and Forecast, By End User (2025-2032)

7.4.11.3. Rest of Asia Pacific Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

8. Middle East and Africa Floss Picks Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

8.1. Middle East and Africa Floss Picks Market Size and Forecast, By Material Type (2025-2032)

8.2. Middle East and Africa Floss Picks Market Size and Forecast, By End User (2025-2032)

8.3. Middle East and Africa Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

8.4. Middle East and Africa Floss Picks Market Size and Forecast, by Country (2025-2032)

8.4.1. South Africa

8.4.1.1. South Africa Floss Picks Market Size and Forecast, By Material Type (2025-2032)

8.4.1.2. South Africa Floss Picks Market Size and Forecast, By End User (2025-2032)

8.4.1.3. South Africa Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

8.4.2. GCC

8.4.2.1. GCC Floss Picks Market Size and Forecast, By Material Type (2025-2032)

8.4.2.2. GCC Floss Picks Market Size and Forecast, By End User (2025-2032)

8.4.2.3. GCC Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Floss Picks Market Size and Forecast, By Material Type (2025-2032)

8.4.3.2. Nigeria Floss Picks Market Size and Forecast, By End User (2025-2032)

8.4.3.3. Nigeria Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Floss Picks Market Size and Forecast, By Material Type (2025-2032)

8.4.4.2. Rest of ME&A Floss Picks Market Size and Forecast, By End User (2025-2032)

8.4.4.3. Rest of ME&A Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

9. South America Floss Picks Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032)

9.1. South America Floss Picks Market Size and Forecast, By Material Type (2025-2032)

9.2. South America Floss Picks Market Size and Forecast, By End User (2025-2032)

9.3. South America Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

9.4. South America Floss Picks Market Size and Forecast, by Country (2025-2032)

9.4.1. Brazil

9.4.1.1. Brazil Floss Picks Market Size and Forecast, By Material Type (2025-2032)

9.4.1.2. Brazil Floss Picks Market Size and Forecast, By End User (2025-2032)

9.4.1.3. Brazil Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

9.4.2. Argentina

9.4.2.1. Argentina Floss Picks Market Size and Forecast, By Material Type (2025-2032)

9.4.2.2. Argentina Floss Picks Market Size and Forecast, By End User (2025-2032)

9.4.2.3. Argentina Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

9.4.3. Rest Of South America

9.4.3.1. Rest Of South America Floss Picks Market Size and Forecast, By Material Type (2025-2032)

9.4.3.2. Rest Of South America Floss Picks Market Size and Forecast, By End User (2025-2032)

9.4.3.3. Rest Of South America Floss Picks Market Size and Forecast, By Distribution Channel (2025-2032)

10. Company Profile: Key Players

10.1. Procter & Gamble (USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Colgate-Palmolive (USA)

10.3. Sunstar (Switzerland)

10.4. Dr. Wild & Co. AG (Sweden)

10.5. Prestige Consumer Healthcare (USA)

10.6. Ranir (USA)

10.7. Johnson & Johnson (USA)

10.8. The Humble Co. (Sweden)

10.9. Eco-DenT (USA)

10.10. Dr. Tung's (USA)

10.11. Nature's Cart (UK)

10.12. Georganics (UK)

10.13. Wowe Lifestyle (USA)

10.14. Dental Lace (USA)

10.15. Bite (USA)

10.16. Truthbrush (UK)

10.17. Walmart (USA)

10.18. Target (USA)

10.19. CVS Health (USA)

10.20. Boots UK (UK)

10.21. DM (Germany)

10.22. Rossmann (Germany)

10.23. Flaus (USA)

10.24. Quip (USA)

10.25. Cocofloss (USA)

10.26. Listerine (USA)

10.27. Hello Products (USA)

10.28. Radius (USA)

10.29. Bambuu Brush (UK)

10.30. Noosa Basics (Australia)Golden Lady Company (Italy)

11. Key Findings

12. Analyst Recommendations

13. Floss Picks Market: Research Methodology