North America Herbal Medicine Market: Global Industry Analysis and Forecast (2025-2032)

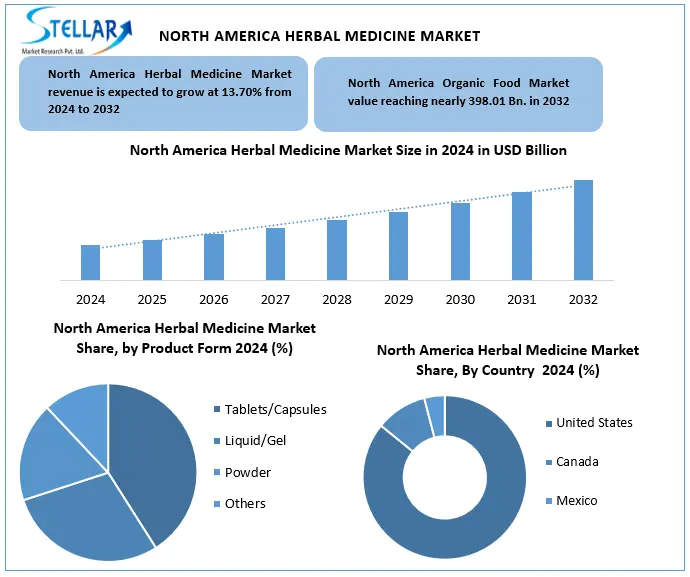

The North America Herbal Medicine Market size was valued at USD 142.50 Bn. in 2024, and the total North America Herbal Medicine Market revenue is expected to grow at a CAGR of 13.70% from 2025 to 2032, reaching nearly USD 398.01 Bn.

Format : PDF | Report ID : SMR_2865

North America Herbal Medicine Market Overview:

Herbal medicine is a branch of traditional medicine that uses of plants or plant-type substances to prevent, diagnose and treat several health conditions. It is based on the therapeutic properties of herbs, which is contain from natural bioactive compounds such as alkaloids, flavonoids, tannins, and essential oils. North America Herbal Medicine Market, mainly the United States country is growing due to rising demand for natural remedies, concerns over synthetic drug side effects and increasing interest in traditional and preventive healthcare, especially after the COVID-19 pandemic. Increasing demand for natural and organic products to driving the North America Herbal Medicine Market.

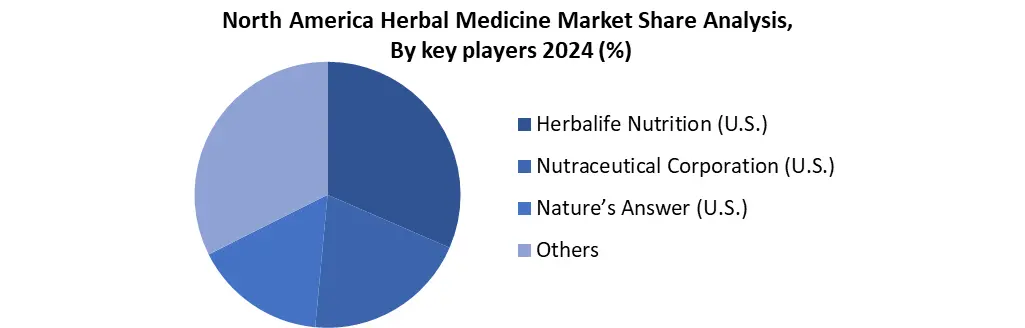

The United States is the largest consumer of herbal medicine in the North America region, accounting for most of the market. The United States dominates the North American herbal Medicine Market in 2024. In addition, in 2024, the North American herbal medicine market is dominated by major key players such as Herbalife Nutrition, Blackmores, Himalaya, Nutraceutical Corporation, and Nature’s Answer. On May 2, 2025, Herbalife Nutrition appointed a former distributor, Stephen Gratziani, as its new CEO, indicating the company's developed American market approach and a leadership change bound to the internal culture.

Herbal Medicine Trade in North America is mostly tariff-free under USMCA, but in 2025, the U.S. Add 25-35% tariffs on some imports, especially from China. Most Canadian and Mexican herbal products are exempted, although the new tariffs have increased cost and disrupted supply chains.

To get more Insights: Request Free Sample Report

North America Herbal Medicine Market Dynamics

Growing Demand for Natural and Organic Products to Drive the North America Herbal Medicine Market

In 2024, 6 out of 10 consumers globally prefer plant-based or natural remedies on synthetic drugs. This change is associated with raising awareness about the side effects associated with chemical-based products, which is a desire for safe and offer more options. More than 70% of Millennial and Gen Z consumers prefer products that are naturally, systematically and morally produced. The prevalence of chronic conditions such as diabetes and arthritis has inspired consumers to seek long-term health benefits and less side effects. Later epidemics, consumer preventive health measures have increased interest in herbal doses.

Partnerships Between Nutraceutical Companies and Health Retailers to Drive the North America Herbal Medicine Market

The strategic partnership between nutraceutical companies and major health retailers greatly expands the reach, visibility and consumer trust. Keeping herbal products in high-quality outlets such as Walmart, CVS, and Whole Foods, these alliances transfer herbal remedies from niche to the mainstream to reach general consumers. Co-branded and private-labelled offerings also fulfil value-sensitive buyers, while joint marketing and welfare campaigns increase consumer awareness and education. This cooperation not only promotes sales but also enhances product quality and regulatory compliance through standards imposed by retailers. Retail environment and placement strategies significantly affect consumer options, making these partnerships a highly effective channel for herbal product visibility and development. Also, data analytics shared by retailers helps analytics-neutralize brands tailor and marketing, based on regional consumer behavior, to increase product-market fit.

Lack of Standardization to Restrain the North America Herbal Medicine Market

The Herbal products often change in composition because of the differences in plant species, growing conditions, harvesting methods and manufacturing strategies. This variability leads to the incompatible level of active ingredients in batches, making it more difficult to guarantee medical effectiveness or safety. Therefore, healthcare providers and consumers hesitate to depend on or use these products regularly. Additionally, regulatory agencies in America require strict evidence of stability and quality for market approval criteria that fail to meet many herbal formulations due to a lack of standardization.

North America Herbal Medicine Market Segmentation

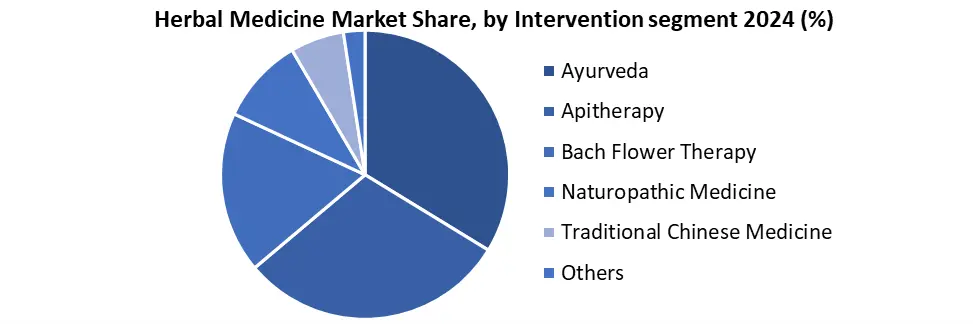

Based on intervention, the North America Herbal Medicine Market is segmented into Ayurveda, Apitherapy, Bach Flower Therapy, Naturopathic Medicine, Traditional Chinese Medicine, Traditional Korean Medicine, Traditional Japanese Medicine, Traditional Mongolian Medicine, traditional Tibetan therapy and Zang Fu. Ayurveda is expected to dominate the global herbal medicine market in the forecast period (2025–2032). Increasing consumer preference for natural, overall health and welfare has created a demand for plant-based measures of Ayurveda.

Based on Product Form, the North America Herbal Medicine Market is segmented into Powder, Liquid/Gel, Tablets/Capsules and Others. The tablet and capsule dominate the herbal medicine market in 2024 and it is expected to dominate in the forecast period (2024-2032). This is mainly because they offer ease of convenience and use, making them preferred by consumers who want quick and simple ways to take herbal treatment. Tablet and capsules provide accurate and standardized doses, which ensure frequent effectiveness and form consumer trust. Also, progress in posterization technologies has increased the efficacy, stability and bioavailability of herbal products in tablets and capsules, which increases their acceptance among health-conscious individuals.

North America Herbal Medicine Market Regional Analysis:

The United States dominates the North America herbal medicine market in 2024

The United States dominates mainly due to its large consumer base, strong regulatory organization and widespread integration of herbal products in retail and human health care systems. Under the Dietary Supplement Health and Education Act (DSHEA), herbal supplements are regulated as a category of drugs, with expeditious Market Entry and Product Innovation without the need for pre-market FDA approval. Opportunity in the United States Herbal Medicine Market centres around premium product development, clinical integration and digital health privatization.

North America Herbal Medicine Market Competitive Landscape:

In 2024, the North America Herbal Medicine Market key players include Herbalife Nutrition, Blackmores, Himalaya, Nutraceutical Corporation and Nature’s Answer, driven by their various product portfolios and comprehensive retail and online distribution. Herbalife Nutrition Limited leads with its extensive product portfolio and strong distribution across digital and retail channels. Its recent innovations, such as the 2024 launch of GLP-1 companion bundles and clean-label lines, demonstrate a focus on personalization and wellness trends. The Himalayas are recognized to combine traditional Ayurvedic practices with modern science, which clinically offers herbal supplements to American consumers for stress, liver and immune health.

Recent Developments:

- In July 18, 2023, Herbalife introduced Herbalife V in North America, a clean-labelled and science-backed product line, which featured USDA organic, non-GMO, vegan and kosher-certified herbal supplements aimed at health-conscious consumers.

- In February 5, 2024, Herbalife Nutrition launched its GLP-1 nutritional product bundles in the United States, designed to support individuals on weight loss drugs, marking a strategic move in personal welfare within the US market.

- In May 2, 2025, Herbalife Nutrition appointed a former distributor, Stephen Gratziani, as its new CEO, indicating the company's developed American market approach and a leadership change bound to the internal culture.

|

The North America Herbal Medicine Market Scope |

|

|

Market Size in 2024 |

USD 142.50 Bn. |

|

Market Size in 2032 |

USD 398.01 Bn. |

|

CAGR (2025-2032) |

13.70% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Intervention Ayurveda Apitherapy Bach Flower Therapy Naturopathic Medicine Traditional Chinese Medicine Others |

|

By Product Form Powder Liquid/Gel Tablets/Capsules Others |

|

|

By Source Barks Leaves Roots Others |

|

|

By Distribution Channel Direct Sales E-sales |

|

North America Herbal Medicine Market Key Players:

North America

- Herbalife Nutrition Ltd. (United States)

- Nature’s Answer / Bio-Botanica Inc. (United States)

- Nutraceutical Corporation (United States)

- Traditional Medicinals Inc. (United States)

- Gaia Herbs Inc. (United States)

- Nature Bounty (United States)

Frequently Asked Questions

The United States is the most dominant market for American Herbal Medicine.

By placing herbal products in high-traffic outlets like Walmart, CVS, and Whole Foods, these alliances move herbal remedies from niche to mainstream, increasing adoption among general consumers.

Growing Demand for Natural and Organic Products and Partnerships Between Nutraceutical Companies and Health Retailers are the drivers of the Herbal Medicine Market.

1. North America Herbal Medicine Market: Research Methodology

2. North America Herbal Medicine Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Global North America Herbal Medicine Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarters

3.2.3. Product Segment

3.2.4. Application Segment

3.2.5. Revenue (2024)

3.2.6. Geographical Presence

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Mergers and Acquisitions Details

4. North America Herbal Medicine Market: Dynamics

4.1. North America Herbal Medicine Market Trends

4.2. North America Herbal Medicine Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Regulatory Landscape by Region

4.6. Key Opinion Leader Analysis for the Global Industry

4.7. Analysis of Government Schemes and Initiatives for Industry

5. North America Herbal Medicine Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

5.1. North America Herbal Medicine Market Size and Forecast, By Intervention (2024-2032)

5.1.1. Ayurveda

5.1.2. Apitherapy

5.1.3. Bach Flower Therapy

5.1.4. Naturopathic Medicine

5.1.5. Traditional Chinese Medicine

5.1.6. Others

5.2. North America Herbal Medicine Market Size and Forecast, By Product Form (2024-2032)

5.2.1. Powder

5.2.2. Liquid/Gel

5.2.3. Tablets/Capsules

5.2.4. Others

5.3. North America Herbal Medicine Market Size and Forecast, By Source (2024-2032)

5.3.1. Barks

5.3.2. Leaves

5.3.3. Roots

5.3.4. Others

5.4. North America Herbal Medicine Market Size and Forecast, By Distribution Channel (2024-2032)

5.4.1. Direct Sales

5.4.2. E-sales

5.5. North America Herbal Medicine Market Size and Forecast, by Country (2024-2032)

5.5.1. United States

5.5.1.1. United States Herbal Medicine Market Size and Forecast, By Intervention (2024-2032)

5.5.1.1.1. Ayurveda

5.5.1.1.2. Apitherapy

5.5.1.1.3. Bach Flower Therapy

5.5.1.1.4. Naturopathic Medicine

5.5.1.1.5. Traditional Chinese Medicine

5.5.1.1.6. Others

5.5.1.2. United States Herbal Medicine Market Size and Forecast, By Product Form (2024-2032)

5.5.1.2.1. Powder

5.5.1.2.2. Liquid/Gel

5.5.1.2.3. Tablets/Capsules

5.5.1.2.4. Others

5.5.1.3. United States Herbal Medicine Market Size and Forecast, By Source (2024-2032)

5.5.1.3.1. Barks

5.5.1.3.2. Leaves

5.5.1.3.3. Roots

5.5.1.3.4. Others

5.5.1.4. United States Herbal Medicine Market Size and Forecast, By Distribution Channel (2024-2032)

5.5.1.4.1. Direct Sales

5.5.1.4.2. E-sales

5.5.2. Canada

5.5.2.1. Canada Herbal Medicine Market Size and Forecast, By Intervention (2024-2032)

5.5.2.1.1. Ayurveda

5.5.2.1.2. Apitherapy

5.5.2.1.3. Bach Flower Therapy

5.5.2.1.4. Naturopathic Medicine

5.5.2.1.5. Traditional Chinese Medicine

5.5.2.1.6. Others

5.5.2.2. Canada Herbal Medicine Market Size and Forecast, By Product Form (2024-2032)

5.5.2.2.1. Powder

5.5.2.2.2. Liquid/Gel

5.5.2.2.3. Tablets/Capsules

5.5.2.2.4. Others

5.5.2.3. Canada Herbal Medicine Market Size and Forecast, By Source (2024-2032)

5.5.2.3.1. Barks

5.5.2.3.2. Leaves

5.5.2.3.3. Roots

5.5.2.3.4. Others

5.5.2.4. Canada Herbal Medicine Market Size and Forecast, By Distribution Channel (2024-2032)

5.5.2.4.1. Direct Sales

5.5.2.4.2. E-sales

5.5.3. Mexico

5.5.3.1. Mexico Herbal Medicine Market Size and Forecast, By Intervention (2024-2032)

5.5.3.1.1. Ayurveda

5.5.3.1.2. Apitherapy

5.5.3.1.3. Bach Flower Therapy

5.5.3.1.4. Naturopathic Medicine

5.5.3.1.5. Traditional Chinese Medicine

5.5.3.1.6. Others

5.5.3.2. Mexico Herbal Medicine Market Size and Forecast, By Product Form (2024-2032)

5.5.3.2.1. Powder

5.5.3.2.2. Liquid/Gel

5.5.3.2.3. Tablets/Capsules

5.5.3.2.4. Others

5.5.3.3. Mexico Herbal Medicine Market Size and Forecast, By Source (2024-2032)

5.5.3.3.1. Barks

5.5.3.3.2. Leaves

5.5.3.3.3. Roots

5.5.3.3.4. Others

5.5.3.4. Mexico Herbal Medicine Market Size and Forecast, By Distribution Channel (2024-2032)

5.5.3.4.1. Direct Sales

5.5.3.4.2. E-sales

6. Company Profile: Key Players

6.1. Herbalife Nutrition Ltd. (United States)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Himalaya Wellness USA (United States)

6.3. Nature’s Answer (USA)

6.4. Nutraceutical Corporation (United States)

6.5. Gaia Herbs (United States)

6.6. NOW Foods (United States)

6.7. Botanic Choice (United States)

6.8. Traditional Medicinals (United States)

6.9. Twinlab (United States)

6.10. Swanson Health Products (United States)

7. Key Findings

8. Analyst Recommendations