Lactic Acid Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

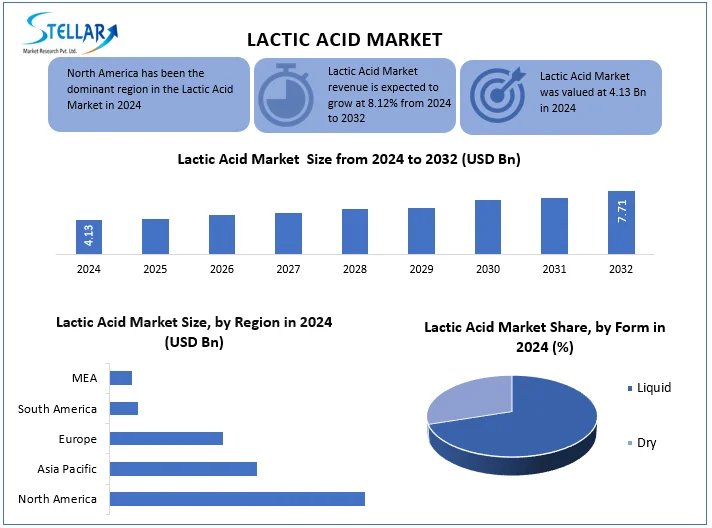

Lactic Acid Market is rising at a CAGR of 8.12% and is valued at USD 4.13 Bn. in 2024, fueled by eco-packaging and skincare innovation, reaching nearly USD 7.71 Bn. by 2032

Format : PDF | Report ID : SMR_2768

Lactic Acid Market Overview

Lactic Acid is a natural organic acid widely used in food, pharmaceutical, cosmetic industries as a preservative, pH regulator and skin-conditioning agent. It is produced through fermentation of carbohydrates and serves as key ingredient in biodegradable plastics and cleaning products, aligning with sustainable business practices. Its multifunctional properties make it a valuable component in health conscious and eco-friendly markets.

The lactic acid market is experiencing growth by increasing demand for natural and durable materials in industries like food and drinks, cosmetics and bioplastics. The increasing preference of consumers for clean-labelled products and environmentally friendly options has adopted a patron, flavour enhancer and biodegradable polymer as raw materials. The drug field also contributes to expansion, using lactic acid in drugs and medical applications.

Government regulations and plastic waste promoting green chemistry were reduced, leading to an increase in market. Major players are investing in R&D to increase production efficiency and expand applications, which is ensuring the progression of the stable market in the coming years.

Tariffs are impact the lactic acid market by increasing production costs and final product prices, especially when imposed on key raw materials or imported goods. Higher tariffs may disrupt supply chains, reduce competitiveness in global markets, and lead to shifts in sourcing strategies.

To get more Insights: Request Free Sample Report

Lactic Acid Market Dynamics

Growing Cosmetics & Personal Care Industry to Drive Lactic Acid Market Growth

Lactic acid, an alpha-hydroxy acid (AHA), is mainly found in milk and has been adopted in cosmetic and skincare therapy since ancient times. In recent times, it has been used as pH adjustment, humectant, skin conditioning agent and exfoliator in many individual care and cosmetic products. Its ability to smooth and illuminate the skin, making it a favourite option in the cosmetics industry, by reducing the appearance of wrinkles, fine lines and dark spots. Acid is used in hair products, as it can strengthen weak hair. Rising per capita income, in collaboration with consumer awareness, is estimated to promote cosmetics and the adoption of personal care products.

Also, rapidly growing individual advertisements, famous social impressive and social media users are supporting cosmetic products, which is expected to promote sales of cosmetic products along with personal care through online platforms. Many e-commerce businesses and online stores, like Amazon and Alibaba, have simplified the purchasing of items as a result of an increase in personal care and adoption of cosmetic products.

For example, L'Oreal recorded a 47.2% increase in sales of e-commerce in the first quarter of FY2021, accounting for 26.8% of the total sales. In addition, increasing social media effects, rapid digitalisation and creative online marketing are estimated to increase demand for personal care products. Therefore, such factors are estimated to increase the lactic acid market development.

High Production Costs Restrain Lactic Acid Market

One of the major restraints in the lactic acid market is high production cost, which limits its widespread adoption compared to synthetic options. The fermentation process, which depends on feedstock, like corn or sugarcane, includes expensive raw materials, energy-intensive purification stages and expensive enzymes or microorganisms. The prices of agricultural commodities further affect the rapid production expenses. While the goal of improving progression efficiency in biotechnology is to reduce the overall cost structure remains an obstacle, especially for value-sensitive markets. Companies are investing in R&D to develop cost-effective fermentation techniques to customise strains and increase competition.

Recently example, Corbion invested in a new lactic acid production facility in Thailand, aimed at improving cost efficiency through advanced fermentation technology and local sugarcane sourcing.

Electric & Hybrid Models are an Opportunity for the Lactic Acid Market

The growing popularity of lactic acid in individual care products presents an opportunity in the lactic acid market, inspired by its effectiveness as a soft exfoliant, moisturiser and anti-ageing component. With increasing consumer demand for clean, natural skincare, brands are including lactic acid in serum, peel and cream, mainly in products that target acne, hyperpigmentation and sensitive skin. This trend is extended by social media effects and a dermatologist's recommendations, which are adopted in both professional and home treatment. Change towards vegetarian and cruelty-free formulations aligns with lactic acid's plant-based origin, making it a favourite option over synthetic options. As a result, cosmetic and individual care companies are expanding their lactic acid-based product lines, creating growth opportunities for suppliers.

A recent example is the Ordinary launch of a new lactic acid-based serum in 2024, which went viral on social media for its brightening and exfoliating benefits.

Lactic Acid Market Regional Analysis

North America leads lactic acid market, with its strong PLA (polylactic acid) production, stringent stability policies and the largest part due to advanced industrial applications. The region dominated the area with strict restrictions on single-use plastic (eg, California laws) and biodegradable options for major corporations, driving of lactic acid-related bioplastics. Drug sector of North America depends a lot on lactic acid for drugs, exploitative stitches and regenerative treatment, while cosmetics take advantage of this in anti-ageing and exfoliating products.

The food and beverage area moves forward, in which lactic acid is used as a natural preservative in clean-labelled products. Strong R&D investment by prominent players like NatureWorks and Corbion, in collaboration with the USDA bioPreferred program encouragement, strengthens the lactic acid market leadership. Although the Asia-Pacific is growing rapidly, the U.S. maintains its edge through technological innovation and high-value applications.

Lactic Acid Market Segment Analysis

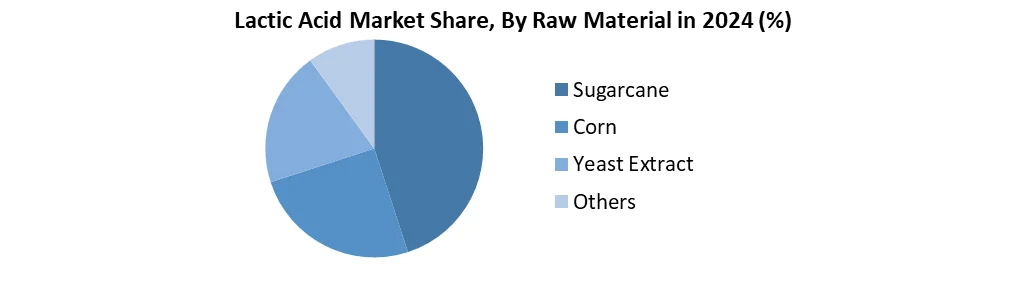

Based on Raw Materials, lactic acid market is segmented in sugarcane, corn, yeast extract and others.

The sugarcane segment is estimated to lead lactic acid market during the forecast period by widespread availability of biomass materials. There are abundant resources adopted as feedstocks by harvesting residues and sugarcane bugs. Along with the increasing adoption of sugarcane in food and biochemical industries, the growth of the segment will be promoted, along with increasing bioplastic development.

Yeast extract segment is estimated to grow at a constant rate during the forecast period. Saccharomyces, including Saccharomyces cerevisiae, can tolerate low pH and grow on mineral media, which helps in producing 2-hydroxypantoic acid to reduce acid purification. The pH regulators in food and beverage industry will encourage market growth during the review period, enhancing pH regulators, acidulants and pH regulators and correlated products in microbial activity.

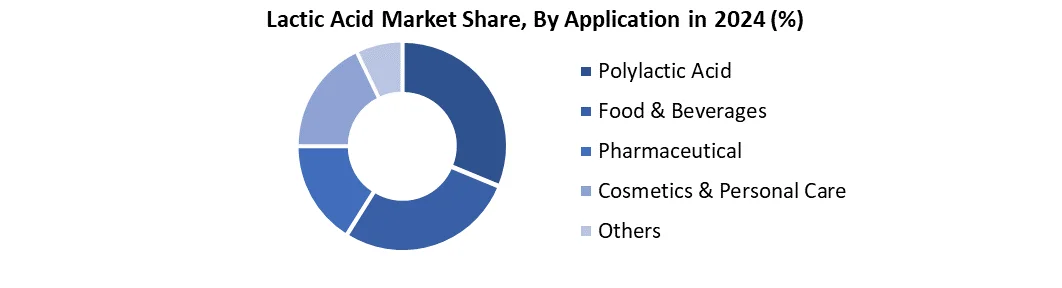

Based on Application, lactic acid market is segmented in application, polylactic acid, food & beverages, pharmaceutical, cosmetics & personal care and others.

Polylactic acid dominates the lactic acid market due to widespread use of biodegradable plastic, shifting away from stringent environmental rules and petroleum-based polymers. The food and beverage field follows closely, taking advantage of lactic acid as a preservative, pH regulator and taste enhancer, especially in dairy and fermented products. Meanwhile, the pharmaceutical industry depends on lactic acid for drugs and surgical stitches, while cosmetics employ it in exfoliators and moisturisers. PLA's dominance stems from its scalability in packaging, textiles and 3D printing, supported by government incentives for sustainable materials. The growth of this section has been further enhanced by corporate commitments to circular economy practices, beating top applications in other industries.

Lactic Acid Market Competitive Landscape

global lactic acid market is highly competitive, dominated by some major players from North America, Europe and the Asia-Pacific regions. Leading companies like Cargill, Corbion N.V., and Henan Jindan take advantage of advanced technologies and strong distribution networks to maintain their leadership in the lactic acid market. The industry is characterised by continuous innovation in permanent production methods and expanding applications in food, pharmaceuticals and biodegradable plastic. Emerging players in Asia are also receiving traction, intensifying competition and increasing lactic acid markets worldwide.

Key Industry Developments in the Lactic Acid Market

- In April 2025, Musushino Chemical (Japan) achieved a 20% reduction in production time and a 15% increase in yield for de-lactic acid through a new fermentation process, to increase efficiency in eco-friendly applications.

- In December 2024, BASF introduced a new grade of lactic acid designed for natural preservation in cosmetics, offering extended antimicrobial efficacy while meeting clean label requirements.

|

Lactic Acid Market Scope |

|

|

Market Size in 2024 |

USD 4.13 Bn. |

|

Market Size in 2032 |

USD 7.71 Bn. |

|

CAGR (2024-2032) |

8.12% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

by Raw Material Sugarcane Corn Yeast Extract Others |

|

by Form Liquid Dry |

|

|

by Application Polylactic Acid Food & Beverages Pharmaceutical Cosmetics & Personal Care Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East South America – Brazil, Argentina, Rest of South America |

Key Players in the Lactic Acid Market

North America

- Cargill, Incorporated (United States)

- NatureWorks LLC (United States)

- Spectrum Chemical Mfg. Corp. (United States)

- Danimer Scientific (United States)

- The Dow Chemical Company (United States)

- Vigon International, Inc. (United States)

- DuPont de Nemours Inc. (United States)

Europe

- Corbion N.V. (Netherlands)

- BASF SE (Germany)

- Thyssenkrupp AG (Germany)

- Galactic S.A. (Belgium)

- Futerro Group (Belgium)

- Jungbunzlauer Suisse AG (Switzerland)

- ProAgro GmbH (Austria)

- CELLULAC (United Kingdom)

Asia Pacific

- Henan Jindan Lactic Acid Technology Co., Ltd. (China)

- Foodchem International Corporation (China)

- COFCO Biochemical (China)

- Musashino Chemical (China) Co., Ltd. (China)

- Musashino Chemical Laboratory, Ltd. (Japan)

- TEIJIN Ltd. (Japan)

- Godavari Biorefineries (India)

- Vaishnavi Bio Tech (India)\

Frequently Asked Questions

According to the lactic acid market revenue forecast, the market is expected to grow at a compounded annual growth rate (CAGR) of over 8.12% during the forecast till 2032.

By Application, the polylactic acid is the leading segment in the lactic acid market.

The increasing demand from the food & beverage and cosmetics & personal care industries will drive the lactic acid market.

The top lactic acid companies in 2024 include Cargill, Incorporated, Corbion N.V., Henan Jindan Lactic Acid Technology Co., Ltd., NatureWorks LLC, Galactic S.A., BASF SE, and Musashino Chemical Laboratory, Ltd.

1. Lactic Acid Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Lactic Acid Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Lactic Acid Market: Dynamics

3.1. Lactic Acid Market Trends

3.2. Lactic Acid Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Lactic Acid Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

4.1.1. Sugarcane

4.1.2. Corn

4.1.3. Yeast Extract

4.1.4. Others

4.2. Lactic Acid Market Size and Forecast, By Form (2024-2032)

4.2.1. Liquid

4.2.2. Dry

4.3. Lactic Acid Market Size and Forecast, By Application (2024-2032)

4.3.1. Polylactic Acid

4.3.2. Food & Beverages

4.3.3. Pharmaceutical

4.3.4. Cosmetics & Personal Care

4.3.5. Others

4.4. Lactic Acid Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Lactic Acid Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

5.1. North America Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

5.1.1. Sugarcane

5.1.2. Corn

5.1.3. Yeast Extract

5.1.4. Others

5.2. North America Lactic Acid Market Size and Forecast, By Form (2024-2032)

5.2.1. Liquid

5.2.2. Dry

5.3. North America Lactic Acid Market Size and Forecast, By Application (2024-2032)

5.3.1. Polylactic Acid

5.3.2. Food & Beverages

5.3.3. Pharmaceutical

5.3.4. Cosmetics & Personal Care

5.3.5. Others

5.4. North America Lactic Acid Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

5.4.1.1.1. Sugarcane

5.4.1.1.2. Corn

5.4.1.1.3. Yeast Extract

5.4.1.1.4. Others

5.4.1.2. United States Lactic Acid Market Size and Forecast, By Form (2024-2032)

5.4.1.2.1. Liquid

5.4.1.2.2. Dry

5.4.1.3. United States Lactic Acid Market Size and Forecast, By Application (2024-2032)

5.4.1.3.1. Polylactic Acid

5.4.1.3.2. Food & Beverages

5.4.1.3.3. Pharmaceutical

5.4.1.3.4. Cosmetics & Personal Care

5.4.1.3.5. Others

5.4.2. Canada

5.4.2.1. Canada Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

5.4.2.1.1. Sugarcane

5.4.2.1.2. Corn

5.4.2.1.3. Yeast Extract

5.4.2.1.4. Others

5.4.2.2. Canada Lactic Acid Market Size and Forecast, By Form (2024-2032)

5.4.2.2.1. Liquid

5.4.2.2.2. Dry

5.4.2.3. Canada Lactic Acid Market Size and Forecast, By Application (2024-2032)

5.4.2.3.1. Polylactic Acid

5.4.2.3.2. Food & Beverages

5.4.2.3.3. Pharmaceutical

5.4.2.3.4. Cosmetics & Personal Care

5.4.2.3.5. Others

5.4.3. Mexico

5.4.3.1. Mexico Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

5.4.3.1.1. Sugarcane

5.4.3.1.2. Corn

5.4.3.1.3. Yeast Extract

5.4.3.1.4. Others

5.4.3.2. Mexico Lactic Acid Market Size and Forecast, By Form (2024-2032)

5.4.3.2.1. Liquid

5.4.3.2.2. Dry

5.4.3.3. Mexico Lactic Acid Market Size and Forecast, By Application (2024-2032)

5.4.3.3.1. Polylactic Acid

5.4.3.3.2. Food & Beverages

5.4.3.3.3. Pharmaceutical

5.4.3.3.4. Cosmetics & Personal Care

5.4.3.3.5. Others

6. Europe Lactic Acid Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

6.1. Europe Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

6.2. Europe Lactic Acid Market Size and Forecast, By Form (2024-2032)

6.3. Europe Lactic Acid Market Size and Forecast, By Application (2024-2032)

6.4. Europe Lactic Acid Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

6.4.1.2. United Kingdom Lactic Acid Market Size and Forecast, By Form (2024-2032)

6.4.1.3. United Kingdom Lactic Acid Market Size and Forecast, By Application (2024-2032)

6.4.2. France

6.4.2.1. France Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

6.4.2.2. France Lactic Acid Market Size and Forecast, By Form (2024-2032)

6.4.2.3. France Lactic Acid Market Size and Forecast, By Application (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

6.4.3.2. Germany Lactic Acid Market Size and Forecast, By Form (2024-2032)

6.4.3.3. Germany Lactic Acid Market Size and Forecast, By Application (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

6.4.4.2. Italy Lactic Acid Market Size and Forecast, By Form (2024-2032)

6.4.4.3. Italy Lactic Acid Market Size and Forecast, By Application (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

6.4.5.2. Spain Lactic Acid Market Size and Forecast, By Form (2024-2032)

6.4.5.3. Spain Lactic Acid Market Size and Forecast, By Application (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

6.4.6.2. Sweden Lactic Acid Market Size and Forecast, By Form (2024-2032)

6.4.6.3. Sweden Lactic Acid Market Size and Forecast, By Application (2024-2032)

6.4.7. Russia

6.4.7.1. Russia Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

6.4.7.2. Russia Lactic Acid Market Size and Forecast, By Form (2024-2032)

6.4.7.3. Russia Lactic Acid Market Size and Forecast, By Application (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

6.4.8.2. Rest of Europe Lactic Acid Market Size and Forecast, By Form (2024-2032)

6.4.8.3. Rest of Europe Lactic Acid Market Size and Forecast, By Application (2024-2032)

7. Asia Pacific Lactic Acid Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

7.1. Asia Pacific Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

7.2. Asia Pacific Lactic Acid Market Size and Forecast, By Form (2024-2032)

7.3. Asia Pacific Lactic Acid Market Size and Forecast, By Application (2024-2032)

7.4. Asia Pacific Lactic Acid Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

7.4.1.2. China Lactic Acid Market Size and Forecast, By Form (2024-2032)

7.4.1.3. China Lactic Acid Market Size and Forecast, By Application (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

7.4.2.2. S Korea Lactic Acid Market Size and Forecast, By Form (2024-2032)

7.4.2.3. S Korea Lactic Acid Market Size and Forecast, By Application (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

7.4.3.2. Japan Lactic Acid Market Size and Forecast, By Form (2024-2032)

7.4.3.3. Japan Lactic Acid Market Size and Forecast, By Application (2024-2032)

7.4.4. India

7.4.4.1. India Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

7.4.4.2. India Lactic Acid Market Size and Forecast, By Form (2024-2032)

7.4.4.3. India Lactic Acid Market Size and Forecast, By Application (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

7.4.5.2. Australia Lactic Acid Market Size and Forecast, By Form (2024-2032)

7.4.5.3. Australia Lactic Acid Market Size and Forecast, By Application (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

7.4.6.2. Indonesia Lactic Acid Market Size and Forecast, By Form (2024-2032)

7.4.6.3. Indonesia Lactic Acid Market Size and Forecast, By Application (2024-2032)

7.4.7. Malaysia

7.4.7.1. Malaysia Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

7.4.7.2. Malaysia Lactic Acid Market Size and Forecast, By Form (2024-2032)

7.4.7.3. Malaysia Lactic Acid Market Size and Forecast, By Application (2024-2032)

7.4.8. Philippines

7.4.8.1. Philippines Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

7.4.8.2. Philippines Lactic Acid Market Size and Forecast, By Form (2024-2032)

7.4.8.3. Philippines Lactic Acid Market Size and Forecast, By Application (2024-2032)

7.4.9. Thailand

7.4.9.1. Thailand Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

7.4.9.2. Thailand Lactic Acid Market Size and Forecast, By Form (2024-2032)

7.4.9.3. Thailand Lactic Acid Market Size and Forecast, By Application (2024-2032)

7.4.10. Vietnam

7.4.10.1. Vietnam Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

7.4.10.2. Vietnam Lactic Acid Market Size and Forecast, By Form (2024-2032)

7.4.10.3. Vietnam Lactic Acid Market Size and Forecast, By Application (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

7.4.11.2. Rest of Asia Pacific Lactic Acid Market Size and Forecast, By Form (2024-2032)

7.4.11.3. Rest of Asia Pacific Lactic Acid Market Size and Forecast, By Application (2024-2032)

8. Middle East and Africa Lactic Acid Market Size and Forecast (by Value in USD Billion) (2024-2032

8.1. Middle East and Africa Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

8.2. Middle East and Africa Lactic Acid Market Size and Forecast, By Form (2024-2032)

8.3. Middle East and Africa Lactic Acid Market Size and Forecast, By Application (2024-2032)

8.4. Middle East and Africa Lactic Acid Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

8.4.1.2. South Africa Lactic Acid Market Size and Forecast, By Form (2024-2032)

8.4.1.3. South Africa Lactic Acid Market Size and Forecast, By Application (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

8.4.2.2. GCC Lactic Acid Market Size and Forecast, By Form (2024-2032)

8.4.2.3. GCC Lactic Acid Market Size and Forecast, By Application (2024-2032)

8.4.3. Egypt

8.4.3.1. Egypt Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

8.4.3.2. Egypt Lactic Acid Market Size and Forecast, By Form (2024-2032)

8.4.3.3. Egypt Lactic Acid Market Size and Forecast, By Application (2024-2032)

8.4.4. Nigeria

8.4.4.1. Nigeria Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

8.4.4.2. Nigeria Lactic Acid Market Size and Forecast, By Form (2024-2032)

8.4.4.3. Nigeria Lactic Acid Market Size and Forecast, By Application (2024-2032)

8.4.5. Rest of ME&A

8.4.5.1. Rest of ME&A Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

8.4.5.2. Rest of ME&A Lactic Acid Market Size and Forecast, By Form (2024-2032)

8.4.5.3. Rest of ME&A Lactic Acid Market Size and Forecast, By Application (2024-2032)

9. South America Lactic Acid Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032

9.1. South America Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

9.2. South America Lactic Acid Market Size and Forecast, By Form (2024-2032)

9.3. South America Lactic Acid Market Size and Forecast, By Application (2024-2032)

9.4. South America Lactic Acid Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

9.4.1.2. Brazil Lactic Acid Market Size and Forecast, By Form (2024-2032)

9.4.1.3. Brazil Lactic Acid Market Size and Forecast, By Application (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

9.4.2.2. Argentina Lactic Acid Market Size and Forecast, By Form (2024-2032)

9.4.2.3. Argentina Lactic Acid Market Size and Forecast, By Application (2024-2032)

9.4.3. Colombia

9.4.3.1. Colombia Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

9.4.3.2. Colombia Lactic Acid Market Size and Forecast, By Form (2024-2032)

9.4.3.3. Colombia Lactic Acid Market Size and Forecast, By Application (2024-2032)

9.4.4. Chile

9.4.4.1. Chile Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

9.4.4.2. Chile Lactic Acid Market Size and Forecast, By Form (2024-2032)

9.4.4.3. Chile Lactic Acid Market Size and Forecast, By Application (2024-2032)

9.4.5. Rest Of South America

9.4.5.1. Rest Of South America Lactic Acid Market Size and Forecast, By Raw Material (2024-2032)

9.4.5.2. Rest Of South America Lactic Acid Market Size and Forecast, By Form (2024-2032)

9.4.5.3. Rest Of South America Lactic Acid Market Size and Forecast, By Application (2024-2032)

10. Company Profile: Key Players

10.1. Cargill, Incorporated (United States)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. NatureWorks LLC (United States)

10.3. Spectrum Chemical Mfg. Corp. (United States)

10.4. Danimer Scientific (United States)

10.5. The Dow Chemical Company (United States)

10.6. Vigon International, Inc. (United States)

10.7. DuPont de Nemours Inc. (United States)

10.8. Corbion N.V. (Netherlands)

10.9. BASF SE (Germany)

10.10. Thyssenkrupp AG (Germany)

10.11. Galactic S.A. (Belgium)

10.12. Futerro Group (Belgium)

10.13. Jungbunzlauer Suisse AG (Switzerland)

10.14. ProAgro GmbH (Austria)

10.15. CELLULAC (United Kingdom)

10.16. Henan Jindan Lactic Acid Technology Co., Ltd. (China)

10.17. Foodchem International Corporation (China)

10.18. COFCO Biochemical (China)

10.19. Musashino Chemical (China) Co., Ltd. (China)

10.20. Musashino Chemical Laboratory, Ltd. (Japan)

10.21. TEIJIN Ltd. (Japan)

10.22. Godavari Biorefineries (India)

10.23. Vaishnavi Bio Tech (India)

11. Key Findings

12. Industry Recommendations

13. Lactic Acid Market: Research Methodology