Financial Advisory Services Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

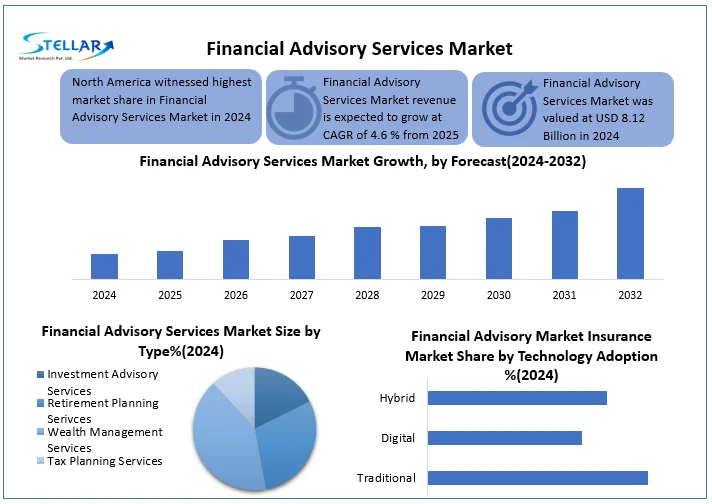

Financial Advisory Service Market was valued at USD 90.18 Billion in 2024. The Total Financial Advisory Services Market revenue is expected to grow by CAGR 5.7% from 2025 to 2032 and reach nearly USD 130.51 Billion in 2032.

Format : PDF | Report ID : SMR_2762

Financial Advisory Services Market Overview

Financial advisors are the process of providing guidance and recommendations to customers about their financial decisions. Financial advisors use their expertise and knowledge to help customers make informed decisions about their investment, retirement plan, taxes, insurance and other financial matters. Financial advisory section covers the revenue generated by this service by both financial institutions and advisors, and it includes property under the number of financial advisors, per advisory average revenue and management (AUM).

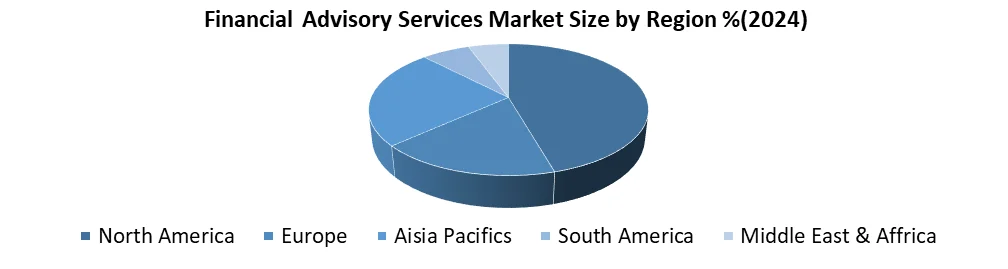

Global Financial Advisory Services Market growth is primarily driven by increasing demand for personalized wealth management, tax optimization, and retirement planning services, especially among high-net-worth individuals (HNWIs). According to Capgemini’s World Wealth Report 2024, the global HNWI population rose by 5.1%, boosting demand for tailored advisory services. Technological advancements such as AI integration, robo-advisory tools, and hybrid advisory platforms are transforming the Financial Advisory Services Market, offering scalable and efficient client solutions. Key opportunities lie in expanding digital-first financial services, particularly targeting Millennials and underbanked regions where digital infrastructure is surpassing traditional financial systems. The shift toward hybrid models is enabling real-time portfolio management and personalized insights at lower costs, enhancing client experience and retention. North America leads the market in 2024, supported by a strong HNWI base, advanced fintech adoption, and mature financial ecosystems.

Trade and tariff changes increase economic uncertainty, driving demand for financial advisory services. Clients seek help with risk management, tax planning, and global investment strategies. Advisors also face more complex regulatory environments, especially in cross-border operations.

To get more Insights: Request Free Sample Report

Financial Advisory Services Market Dynamics

Rising Demand for Personalized Wealth Management to Drive the Financial Advisory Services Market Growth

A major driver in the Financial Advisory Services Market is the increasing demand for personal money management solutions. As the global wealth increases, especially high-net-worth individuals (HNWIS) and large-scale rich classes, customized financial planning, tax adaptation, and investment advisory services. According to Capgemini's World Wealth Report 2024, the global HNWI population increased by 5.1%, while their total funds increased by 4.7%. the demand for retirement plan services increased by 6.3% year after year. Financial advisory firms are also adopting advanced technologies to provide more personalized, data-operated financial solutions to integrate 38% AI-based devices in 2024. The aging population and complex market conditions further promote the need for strategic funds and property schemes.

Growing Digital Preference to Boosts Growth in the Financial Advisory Services Market

Increasing preference for digital financial advice, especially among young generations, is changing the financial advisory services market. In 2024, according to industry surveys, more than 60% of Millennials globally preferred to receive financial guidance through digital platforms. This change is powered by adopting comprehensive smartphones, demand for 24/7 access to financial data, and alternative specialist support to self-directed investment towards investment. Deloite's 2024 report states that the hybrid consultant enhances AI devices with firms - human advisors to implement models - 30% high customer engagement and strong retention rates have been experienced. These platforms enable automation, real -time portfolio tracking and personal recommendations, reduce costs and expand access. As the digital-origin population increases, the financial advisory market firm that user-friendly apps, Robo-recommended platforms, and safe digital digital infrastructure are well deployed to redeem this trend. The model also opens new opportunities in areas with underbank where digital access is beating traditional financial infrastructure.

Regulatory Challenges to impact Growth in Financial Advisory Services Market

Developing regulatory structures and compliance requirements is shaping the Financial Advisory Services Market Industry. Governments worldwide are implementing strict rules for the safety of consumers and ensure the integrity of financial markets. These rules are increasing the need for financial advisors to stay up-to-date with the latest regulatory changes and adopt strong compliance measures. Increasing focus on transparency, disclosure and fidous responsibilities is increasing the demand for professional financial advisory services market.

Financial Advisory Services Market Segment Analysis

Based on Type, the segment divided into Investment Advisory Services, Retirement Planning Services, Wealth Management Services, Tax Planning Services. The Wealth Management Services Segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period.This dominance is powered by rich customers looking for high-net-forth individuals (HNWIS) and wide, personal management of their assets. Wealth Management Investment provides a holistic approach in combination with advice, tax plan, estate planning and retirement strategies, appealing to customers targeting long -term financial security and heritage schemes.the increase in global funds and the complexity of financial portfolio is the demand for fuel fuel for integrated solutions that provide money management services. According to recent Financial Advisory Services market reports, money management exceeds 40% of the total Financial Advisory Services market share in 2024, which reflects its important role in widely addressing diverse customer requirements compared to other special segments such as retirement plan or tax advice.

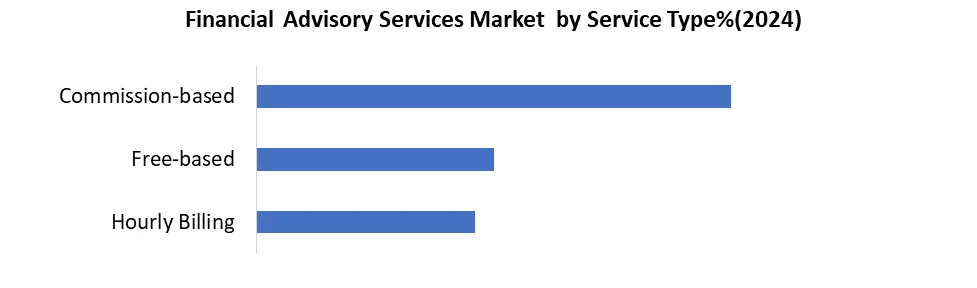

Based on Service Type, segmented into the hourly billing, free-based, and commission-based. The commission-based segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period. This model remains popular as it aligns the compensation of the advisor with the customer's investment performance, encouraging advisors to maximize returns. Many customers, especially in money management and investment advisors, prefer this structure as it can reduce advance costs. the Commission-based model is widely adopted by traditional advisory firms and brokerage services, which have established customer base. While fees-based and hour billing models are increasing due to transparency and increasing demand for fixed costs, commission-based in encouraging its entry and performance remains-based, which accounting for the largest part of the Financial Advisory Services market revenue.

Based on Technology Adoption, the market is segmented into traditional, digital, hybrid.

The traditional segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period.This approach combines the personal expertise of traditional face-to-face advisors with convenience and efficiency of digital platforms. Customers benefit from advice supported by advanced technology such as AI-operated Analytics and Robo-Hellow, while offering real-time portfolio management and cost-affect solutions. The hybrid model addresses the needs of both the technology-loving young investors seeking digital access and older customers who give importance to human contacts. As a result, it captures a comprehensive customer base, drives high -adopting rates. Industry reports show that hybrid services for the largest Financial Advisory Services market share in 2024 reflect the increasing demand for flexible and integrated advisory experiences.

Financial Advisory Services Market Regional Analysis

North America region dominated the market in 2024 & is expected to hold largest share during the forecast period.The leadership is powered by Capgemini's World Wealth Report 2024, operated by a high concentration of high-net-world individuals (HNWIS), hosting more than American 7.6 million HNWI alone. The region benefits from a mature financial ecosystem, strong regulatory structures and advanced technical infrastructure. North American firms lead to the adoption of hybrid advisory platforms, combining AI-operated equipment with human expertise to provide customized financial solutions. Increased financial literacy, increasing the requirements of retirement plans, and promoting strong investment culture among the young population. These factor ranks North America in 2024 as the most attractive and innovative sector in the global financial advisory services market.

Financial Advisory Services Market Competitive Landscape

Morgan Stanley and Bank of America Meril Lynch (Bofa Merryl) are two major players in the Financial Advisory Services Market, each availing each different competitive strength. Morgan Stanley has maintained a prominent place in client assets with more than $ 4.8 trillion, inspired by focusing on high-net-global and institutional customers with strong digital tools such as wealthdesk. Strategic acquisitions such as ETrade and Eaton Vance have increased its digital and investment capabilities.

Meanwhile, Bofa Merrill commands more than $ 3.7 trillion in assets of $ 3.7 trillion under its Money Management Division, which benefits from deep integration of Bank of America with retail and corporate banking weapons. Merrill Lynch's hybrid advisory model, supported by platforms such as Merryl Age and AI Tools, enables it to serve both prosperous and mass market clients. While Morgan focuses on Stanley Elite, Personal Advisor, Bofa Merryl Excel, which are in Skelable, Bank-Employed Services. Both firms face challenges from Fintech disruptives, but remain highly competitive through innovation and scale.

Key Development Advisory Services Market

In February 15, 2024, Morgan Stanley in the United States enhanced its WealthDesk hybrid advisory platform by integrating AI-driven financial planning tools, boosting scalability and personalization for high-net-worth clients.

In March 8, 2024, HSBC Wealth Management in Hong Kong launched a hybrid robo-advisory platform targeting affluent Millennials and Gen Z investors. This initiative aims to expand market reach by combining digital tools with human advisory expertise.

In January 22, 2024, Barclays Wealth in the United Kingdom introduced an AI-enabled digital advisory tool as part of its hybrid wealth management services. This development enhanced digital engagement and automated investment decision-making, providing clients with more efficient and personalized financial advice.

|

The Financial Advisory Services Market Scope |

||

|

Market Size in 2024 |

USD 90.18 Billion |

|

|

Market Size in 2032 |

USD 130.51 Billion |

|

|

CAGR (2025-2032) |

5.7% |

|

|

Historic Data |

2019-2024 |

|

|

Base Year |

2024 |

|

|

Forecast Period |

2025-2032 |

|

|

Segments |

By Type Investment Advisory Services Retirement Planning Services Wealth Management Services Tax Planning Services |

|

|

By Service Type hourly billing free-based commission-based |

||

|

By Technology Adoption Traditional Digital Hybrid |

||

|

|

||

|

Regional Scope |

North America- US, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

|

Key Players Financial Advisory Services Market

North America

- Morgan Stanley (USA)

- Bank of America Merrill Lynch (USA)

- Charles Schwab Corporation (USA)

- Edward Jones (USA)

- Vanguard Group (USA)

- Raymond James Financial (USA)

- Wells Fargo Advisors (USA)

- JP Morgan Private Bank (USA)

- Fidelity Investments (USA)

- Goldman Sachs Group, Inc. (USA)

Europe

- UBS Group AG (Switzerland)

- Credit Suisse Group AG (Switzerland)

- Deutsche Bank Wealth Management (Germany)

- BNP Paribas Wealth Management (France)

- Barclays Wealth and Investment Management (UK)

- Rothschild & Co (France/UK)

- Allianz Global Investors (Germany)

- Societe Generale Private Banking (France)

Asia-Pacific

- Nomura Holdings, Inc. (Japan)

- Macquarie Group (Australia)

- HSBC Private Banking (Hong Kong/UK)

- ANZ Private (Australia)

- ICICI Securities (India)

- Kotak Wealth Management (India)

- Bank of China International (China)

South America

- BTG Pactual Wealth Management (Brazil)

- Banco Santander Private Banking (Brazil/Global)

- Bradesco Private Bank (Brazil)

Middle East & Africa

- Emirates NBD Private Banking (UAE)

- QNB Private Banking (Qatar)

- Investec Wealth & Investment (South Africa)

Frequently Asked Questions

Rising global wealth, especially among high-net-worth individuals, is increasing demand for personalized financial planning and investment advice.

Wealth management services dominate with over 40% of the market share in 2024.

The hybrid advisory model, combining digital tools and human advisors, holds the largest market share.

Morgan Stanley and Bank of America Merrill Lynch are leading players in the market.

1. Financial Advisory Services Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Financial Advisory Services Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. End-user Segment

2.4.4. Revenue (2024)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Financial Advisory Services Market: Dynamics

3.1. Financial Advisory Services Market Trends by Region

3.1.1. North America Financial Advisory Services Market Trends

3.1.2. Europe Financial Advisory Services Market Trends

3.1.3. Asia Pacific Financial Advisory Services Market Trends

3.1.4. Middle East and Africa Financial Advisory Services Market Trends

3.1.5. South America Financial Advisory Services Market Trends

3.2. Financial Advisory Services Market Dynamics

3.2.1. Global Financial Advisory Services Market Drivers

3.2.2. Global Financial Advisory Services Market Restraints

3.2.3. Global Financial Advisory Services Market Opportunities

3.2.4. Global Financial Advisory Services Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Middle East and Africa

3.5.5. South America

3.6. Key Opinion Leader Analysis for Financial Advisory Services Industry

4. Financial Advisory Services Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

4.1.1. Investment Advisory Services

4.1.2. Retirement Planning Services

4.1.3. Wealth Management Services

4.1.4. Tax Planning Services

4.2. Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

4.2.1. Hourly Billing

4.2.2. Free-Based

4.2.3. Commission-based

4.3. Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

4.3.1. Traditional

4.3.2. Digital

4.3.3. Hybrid

4.4. Financial Advisory Services Market Size and Forecast, by Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Financial Advisory Services Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

5.1. North America Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

5.1.1. Investment Advisory Services

5.1.2. Retirement Planning Services

5.1.3. Wealth Management Services

5.1.4. Tax Planning Services

5.2. North America Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

5.2.1. Hourly Billing

5.2.2. Free-based

5.2.3. Commission-based

5.3. North America Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

5.3.1. Traditional

5.3.2. Digital

5.3.3. Hybrid

5.4. North America Financial Advisory Services Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

5.4.1.1.1. Investment Advisory Services

5.4.1.1.2. Retirement Planning Services

5.4.1.1.3. Wealth Management Services

5.4.1.1.4. Tax Planning Services

5.4.1.2. United States Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

5.4.1.2.1. Hourly Billing

5.4.1.2.2. Free-based

5.4.1.2.3. Commission-based

5.4.1.3. United States Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

5.4.1.3.1. Traditional

5.4.1.3.2. Digital

5.4.1.3.3. Hybrid

5.4.2. Canada

5.4.2.1. Canada Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

5.4.2.1.1. Investment Advisory Services

5.4.2.1.2. Retirement Planning Services

5.4.2.1.3. Wealth Management Services

5.4.2.1.4. Tax Planning Services

5.4.2.2. Canada Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

5.4.2.2.1. Hourly Billing

5.4.2.2.2. Free-based

5.4.2.2.3. Commission-based

5.4.2.3. Canada Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

5.4.2.3.1. Traditional

5.4.2.3.2. Digital

5.4.2.3.3. Hybrid

5.4.2.4. Mexico Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

5.4.2.4.1. Investment Advisory Services

5.4.2.4.2. Retirement Planning Services

5.4.2.4.3. Wealth Management Services

5.4.2.4.4. Tax Planning Services

5.4.2.5. Mexico Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

5.4.2.5.1. Hourly Billing

5.4.2.5.2. Free-based

5.4.2.5.3. Commission-based

5.4.2.6. Mexico Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

5.4.2.6.1. Traditional

5.4.2.6.2. Digital

5.4.2.6.3. Hybrid

6. Europe Financial Advisory Services Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

6.1. Europe Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

6.2. Europe Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

6.3. Europe Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

6.4. Europe Financial Advisory Services Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

6.4.1.2. United Kingdom Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

6.4.1.3. United Kingdom Financial Advisory Services Market Size and Forecast, End-User (2024-2032)

6.4.2. France

6.4.2.1. France Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

6.4.2.2. France Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

6.4.2.3. France Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

6.4.3.2. Germany Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

6.4.3.3. Germany Financial Advisory Services Market Size and Forecast, End-User (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

6.4.4.2. Italy Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

6.4.4.3. Italy Financial Advisory Services Market Size and Forecast, End-User (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

6.4.5.2. Spain Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

6.4.5.3. Spain Financial Advisory Services Market Size and Forecast, End-User (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

6.4.6.2. Sweden Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

6.4.6.3. Sweden Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

6.4.7. Austria

6.4.7.1. Austria Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

6.4.7.2. Austria Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

6.4.7.3. Austria Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

6.4.8.2. Rest of Europe Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

6.4.8.3. Rest of Europe Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

7. Asia Pacific Financial Advisory Services Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

7.1. Asia Pacific Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

7.2. Asia Pacific Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

7.3. Asia Pacific Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

7.4. Asia Pacific Financial Advisory Services Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

7.4.1.2. China Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

7.4.1.3. China Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

7.4.2.2. S Korea Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

7.4.2.3. S Korea Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

7.4.3.2. Japan Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

7.4.3.3. Japan Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

7.4.4. India

7.4.4.1. India Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

7.4.4.2. India Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

7.4.4.3. India Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

7.4.5.2. Australia Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

7.4.5.3. Australia Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

7.4.6.2. Indonesia Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

7.4.6.3. Indonesia Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

7.4.7. Philippines

7.4.7.1. Philippines Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

7.4.7.2. Philippines Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

7.4.7.3. Philippines Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

7.4.8.2. Malaysia Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

7.4.8.3. Malaysia Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

7.4.9.2. Vietnam Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

7.4.9.3. Vietnam Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

7.4.10. Thailand

7.4.10.1. Thailand Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

7.4.10.2. Thailand Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

7.4.10.3. Thailand Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

7.4.11.2. Rest of Asia Pacific Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

7.4.11.3. Rest of Asia Pacific Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

8. Middle East and Africa Financial Advisory Services Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

8.1. Middle East and Africa Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

8.2. Middle East and Africa Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

8.3. Middle East and Africa Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

8.4. Middle East and Africa Financial Advisory Services Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

8.4.1.2. South Africa Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

8.4.1.3. South Africa Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

8.4.2.2. GCC Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

8.4.2.3. GCC Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

8.4.3.2. Nigeria Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

8.4.3.3. Nigeria Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

8.4.4.2. Rest of ME&A Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

8.4.4.3. Rest of ME&A Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

9. South America Financial Advisory Services Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

9.1. South America Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

9.2. South America Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

9.3. South America Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

9.4. South America Financial Advisory Services Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

9.4.1.2. Brazil Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

9.4.1.3. Brazil Financial Advisory Services Market Size and Forecast, End-User (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

9.4.2.2. Argentina Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

9.4.2.3. Argentina Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

9.4.3. Rest of South America

9.4.3.1. Rest of South America Financial Advisory Services Market Size and Forecast, By Type (2024-2032)

9.4.3.2. Rest of South America Financial Advisory Services Market Size and Forecast, By Service Type (2024-2032)

9.4.3.3. Rest of South America Financial Advisory Services Market Size and Forecast, By Technology Adoption (2024-2032)

10. Company Profile: Key Players

10.1. Morgan Stanley

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Development

10.2. Bank of America Merrill Lynch

10.3. Charles Schwab Corporation

10.4. Edward Jones

10.5. Vanguard Group

10.6. Raymond James Financial

10.7. Wells Fargo Advisors

10.8. JP Morgan Private Bank

10.9. Fidelity Investments

10.10. Goldman Sachs Group, Inc.

10.11. UBS Group AG

10.12. Credit Suisse Group AG

10.13. Deutsche Bank Wealth Management

10.14. BNP Paribas Wealth Management

10.15. Barclays Wealth and Investment Management

10.16. Rothschild & Co

10.17. Allianz Global Investors

10.18. Societe Generale Private Banking

10.19. Nomura Holdings, Inc.

10.20. Macquarie Group

10.21. HSBC Private Banking

10.22. ANZ Private

10.23. ICICI Securities

10.24. Kotak Wealth Management

10.25. Bank of China International

10.26. BTG Pactual Wealth Management

10.27. Banco Santander Private Banking

10.28. Bradesco Private Bank

10.29. Emirates NBD Private Banking

10.30. QNB Private Banking

10.31. Investec Wealth & Investment

11. Key Findings

12. Analyst Recommendations

13. Financial Advisory Services Market: Research Methodology