Global Feed Market (2026–2032) Market Size, Growth Trends & Key Players

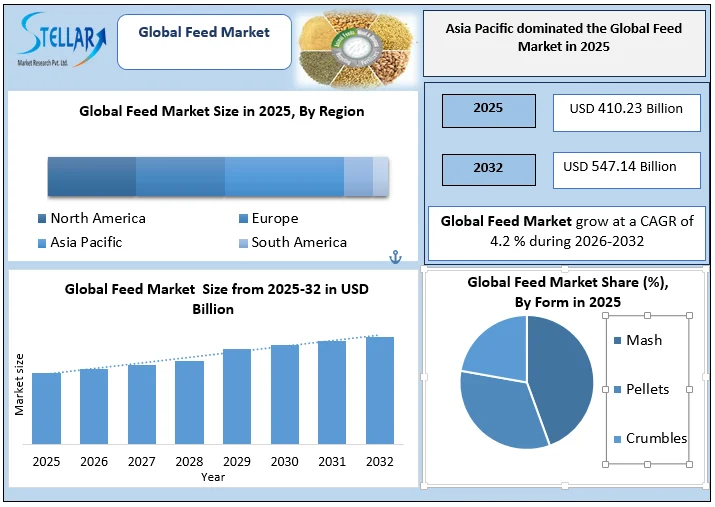

The Global Feed Market is expected to reach USD 547.14 billion by 2032, driven by rising livestock production, increasing demand for high-quality animal nutrition, and expanding commercial farming activities. The Feed Market analysis covers key growth trends, regional performance, major drivers and restraints, leading manufacturers, and innovations in feed formulation and production technologies across poultry, ruminant, swine, and aquaculture sectors.

Format : PDF | Report ID : SMR_2896

Global Feed Market Overview:

The Global Feed Market in 2025 plays a crucial role in ensuring food security and supporting animal protein production worldwide. Feed represents 60–70% of total production costs in commercial livestock and poultry farming, making it the most important factor influencing animal performance, health, and farm profitability across the agri-food value chain.

In 2025, global feed production is at around 1.35–1.40 billion metric tonnes, driven by the rising demand for meat, milk, eggs, and farmed fish. Poultry feed accounted for the largest share of total volume, followed by feed for pigs, ruminants, aquaculture, and pets. Market growth in volume terms is closely linked to population growth, rapid urbanization, and changing food habits, especially higher consumption of animal-based protein. In addition, the shift toward intensive and commercial farming systems is increasing the use of compound and nutritionally balanced feed.

Key Highlights of the Global Feed Market (2025)

- Booming Market Valuation: The global feed industry surges to USD 410.23 billion in 2025, reflecting rising global demand for meat, milk, eggs, and aquaculture products.

- Record Production Scale: Over 1.35 billion metric tonnes of feed produced annually, with compound feed dominating as the backbone of modern animal nutrition.

- Poultry Leads the Pack: Poultry feed nearly 28% of total global feed volume, underscoring the sector’s dominance in fulfilling protein needs worldwide.

- Asia-Pacific Powerhouse: The region accounts for over 40% of global feed production, driven by China, India, Vietnam, and Indonesia, making it the epicentre of feed demand and innovation.

- Next-Gen Growth Segments: Pet feed, aquafeed, and speciality functional feeds are rapidly expanding, fueled by urbanisation, rising disposable incomes, and demand for high-quality, health-focused animal nutrition.

To get more Insights: Request Free Sample Report

Feed Market: Volume, Demand and Supply (2025)

Global Production and Supply Landscape

Global feed production in 2025 was nearly 1.35–1.40 billion metric tonnes, with compound feed accounting for more than 75% of manufactured feed output. The increasing preference for compound feed is driven by its nutritional consistency, higher productivity outcomes, improved traceability, and compliance with feed safety standards.

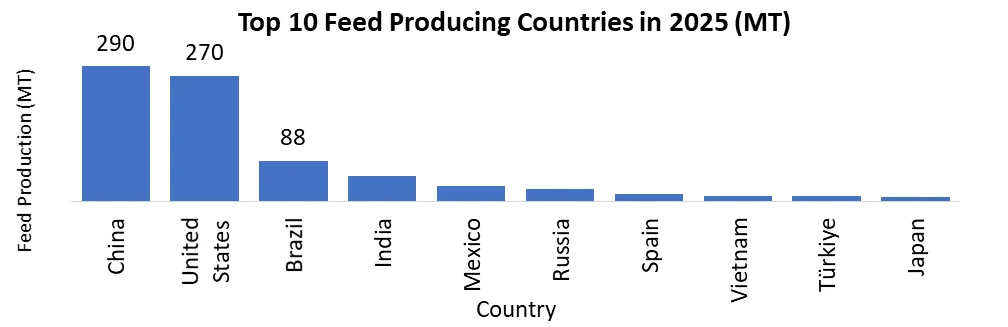

Feed production is geographically concentrated. The top feed-producing countries in 2025 include:

- China: 290 Million MT

- United States: 270 Million MT

- Brazil: 88 Million MT

- India: 55 Million MT

- Mexico, Russia, Spain, Vietnam, Türkiye, and Japan

The top 10 countries contribute over 65% of global feed production, while China, the U.S., Brazil, and India alone account for more than half of total global output, underscoring strong supply-side concentration and scale advantages.

Demand Fundamentals: Feed demand in 2025 is underpinned by:

- Rapid growth in poultry meat and egg consumption due to affordability and efficiency

- Rising dairy consumption in Asia and Africa

- Gradual normalization of swine feed demand following African Swine Fever (ASF) disruptions

- Expansion of aquaculture production, especially in Asia-Pacific and South America

- Sustained growth in pet food demand, driven by pet humanization and premium nutrition trends

Feed Market Dynamics

Rising Global Protein Consumption and Productivity Focus

The primary growth driver of the feed market is the steady increase in global consumption of animal protein, particularly poultry, dairy, and seafood. In 2025, poultry remains the most widely consumed animal protein due to its short production cycle, competitive pricing, and lower environmental footprint.

To meet demand while managing costs, producers are increasingly reliant on compound feed formulations that enhance feed conversion ratios (FCR), improve weight gain, and reduce disease-related losses. In developing regions, the transition from traditional feeding practices to commercial compound feed continues to accelerate, driving growth in the organized feed sector.

Raw Material Price Volatility and Compliance Costs

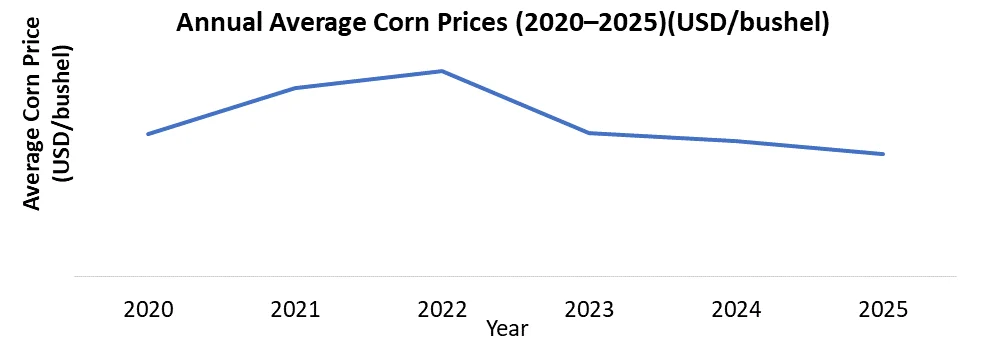

Despite strong demand, feed manufacturers face margin pressure from volatile prices of key raw materials, including corn, soybean meal, wheat, and oilseed by-products. Climate variability, geopolitical tensions, logistics disruptions, and currency fluctuations continue to impact procurement costs and supply stability.

In parallel, increasing regulatory scrutiny related to feed safety, antibiotic usage, mycotoxin control, contaminants, and sustainability compliance is raising production and operational costs. These challenges disproportionately affect small and unorganised feed producers, limiting their ability to compete on quality and scale.

Opportunity: Functional Nutrition and Sustainable Feed Innovation

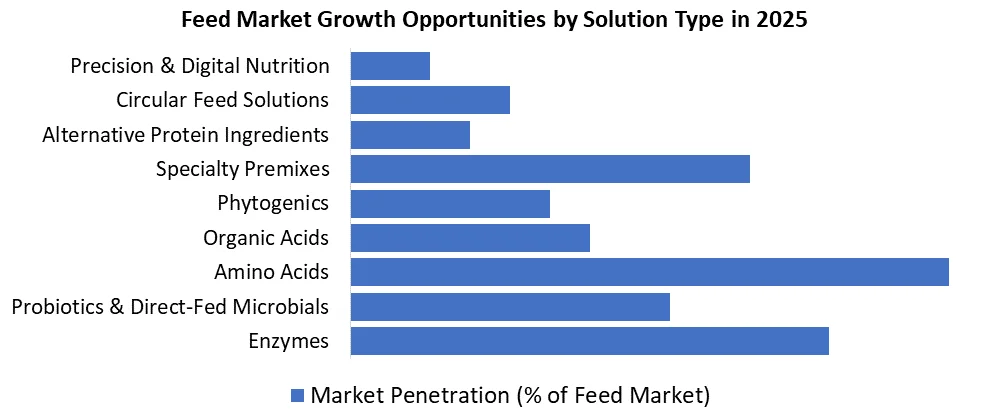

The strongest opportunity in the feed market lies in value-added nutrition solutions, such as enzymes, probiotics, amino acids, organic acids, phytogenics, and specialty premixes. These solutions improve nutrient utilization, gut health, immunity, and overall animal performance while supporting sustainability objectives.

Additional growth opportunities include:

- Alternative protein ingredients (insect meal, algae, microbial proteins)

- Circular feed solutions using agro-industrial by-products

- Precision nutrition and digital feed formulation technologies

Regional Analysis

Asia-Pacific domianted its position as the largest and most influential region in 2025, accounting for over 40% of global feed production. Growth is led by China, India, Vietnam, Indonesia, and Japan, supported by large livestock populations, expanding poultry and aquaculture sectors, and export-oriented animal protein industries.

North America, led by the United States, has a highly consolidated feed market. Demand is stable and focused on high-quality beef, poultry, dairy, and pet feeds, with strong emphasis on nutrition optimization, feed additives, traceability, and sustainability-driven formulations.

Europe continues to emphasise feed safety, animal welfare, and environmental sustainability. While overall volume growth is moderate, demand for premium, functional, and specialty feeds remains strong, particularly in dairy, poultry, and pet nutrition segments.

Africa is witnessing rising adoption of commercial poultry and dairy feed, especially in South Africa, Egypt, Nigeria, and Morocco. South America, led by Brazil and Mexico, continues to expand feed production to support export-driven poultry, pork, and aquaculture industries.

Competitive Landscape

Leading participants in the global feed market include Cargill, Archer Daniels Midland (ADM), Nutreco, Charoen Pokphand Foods (CPF), and ForFarmers. Over the past five years, these companies have focused on capacity expansion, supply chain integration, nutrition innovation, and sustainability-oriented product development.

- Cargill emphasises sustainable feed solutions and regional expansion

- ADM focuses on premix growth and integrated nutrition platforms

- Nutreco invests in aquafeed innovation and alternative ingredients

- CPF leverages a vertically integrated feed-to-food model across Asia

- ForFarmers prioritizes portfolio optimization and high-value European markets

Recent Industry Developments

- Alltech (2024): Advanced circular economy initiatives and gut-health feed products to reduce antibiotic dependency

- Cargill (2023–2024): Expanded enzyme-based feed solutions in partnership with BASF

Feed Market Scope

|

Global Feed Market |

|||

|

Report Coverage |

Details |

||

|

Base Year: |

2025 |

Forecast Period: |

2026-2032 |

|

Historical Data: |

2020 to 2025 |

Market Size in 2025: |

USD 410.23 Billion |

|

Forecast Period 2026 to 2032 CAGR: |

4.2% |

Market Size in 2032: |

USD 547.14 Billion |

|

Feed Market Segment Analysis |

By Ingredients |

Cereals Cakes & Meals By-Products |

|

|

By Additives |

Amino Acid Phosphates Vitamins Acidifiers Carotenoids Enzymes Mycotoxin Detoxifiers Flavors & Sweeteners Antibiotics Minerals Antioxidants Non-Protein Nitrogen Preservatives Phytogenic Probiotics |

||

|

By Livestock |

Poultry Broilers Layers Breeders Ruminants Calves Dairy Cattle Beef Cattle Other Ruminants Swine Starters Growers Sows Aquatic Animals Pets and Others |

||

|

By Form |

Mash Pellets Crumbles |

||

|

By Source |

Synthetic Natural |

||

Feed Market Key Players

- Cargill, Incorporated

- Charoen Pokphand Group (CP Group)

- New Hope Group

- ADM Animal Nutrition

- Land O’Lakes, Inc.

- Nutreco N.V.

- Alltech, Inc.

- ForFarmers N.V.

- De Heus Animal Nutrition

- Guangdong Haid Group Co., Ltd.

- Wen’s Food Group

- Muyuan Foodstuff Co., Ltd.

- BRF S.A.

- Tyson Foods (Feed Division)

- JA Zen-Noh

- Tongwei Group

- Twins Group (Shuangbaotai Group)

- NongHyup Feed Inc.

- East Hope Group

- WH Group

- Japfa Ltd.

- Godrej Agrovet Limited

- Feed One Co., Ltd.

- Weston Milling Animal Nutrition

- Smithfield Foods (Feed Operations)

- Perdue Farms (Feed Operations)

- Mountaire Farms (Feed Operations)

- Koch Foods (Feed Operations)

- Arab Company for Livestock Development (ACOLID)

- Kent Nutrition Group

Frequently Asked Questions

Poultry feed is the largest segment, accounting for approximately xx.xx % of global feed volume, due to high meat consumption and superior feed conversion efficiency.

The leading feed-producing countries are China, the United States, Brazil, India, and Mexico, accounting for over 60% of global feed production.

Key growth drivers include rising global animal protein consumption, urbanization, dietary shifts, intensification of livestock farming, and increased adoption of commercial compound feed in developing regions.

1. Feed Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Feed Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Headquarter

2.2.3. Product Segment

2.2.4. End-User Segment

2.2.5. Revenue Details in 2025

2.2.6. Market Share (%)

2.2.7. Growth Rate (%)

2.2.8. Return on Investment (%)

2.2.9. Technological Capabilities

2.2.10. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Feed Market: Dynamics

3.1. Feed Market Trends

3.2. Feed Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Feed Additives Industry Value Chain Analysis

4.1. Raw Material Sourcing and Supplier Landscape

4.2. Manufacturing Process and Cost Structure Overview

4.3. Role of Distributors and Feed Premix Companies

4.4. Integration of Value Chain Across Regions

4.5. Margin Analysis at Each Value Chain Stage

4.6. Key Bottlenecks and Optimization Opportunities

5. Regulatory and Policy Framework

5.1. Global Feed Additives Regulatory Overview

5.2. United States Feed Additives Regulations and Compliance

5.3. European Union Feed Safety and Approval Process

5.4. Regulatory Landscape in Asia-Pacific Markets

5.5. Impact of Regulations on Product Innovation

5.6. Future Regulatory Trends and Policy Changes

6. Technological Advancements and Innovation Trends

6.1. Advancements in Enzyme and Probiotic Technologies

6.2. Precision Nutrition and Customized Feed Solutions

6.3. Microencapsulation and Controlled Release Technologies

6.4. Use of Biotechnology in Feed Additives Development

6.5. Digitalization and Automation in Feed Manufacturing

6.6. R&D Investments and Innovation Pipeline

7. Pricing Analysis

7.1. Global Feed Additives Pricing Structure Overview in 2025

7.2. Product-Wise Price Comparison Across Regions

7.3. Impact of Raw Material Cost Fluctuations

7.4. Regional Pricing Differences and Margins

7.5. Influence of Regulations on Pricing

7.6. Pricing Forecast and Trend Analysis

8. Supply Chain and Distribution Analysis

8.1. Raw Material Availability and Procurement Trends

8.2. Manufacturing Capacity and Utilization Rates

8.3. Logistics, Storage, and Transportation Challenges

8.4. Role of Distributors and Premix Manufacturers

8.5. Organized vs Unorganized Supply Chain Structure

8.6. Supply Chain Risk Assessment

9. Demand and Supply Analysis

9.1. Global Demand Trends by Livestock Type

9.2. Regional Demand-Supply Gap Assessment

9.3. Country-Wise Production and Consumption Analysis

9.4. Import-Export Trends of Feed Additives

9.5. Impact of Feed Industry Growth on Supply

9.6. Future Demand and Supply Outlook

10. Investment and Expansion Analysis

10.1. Capital Investments in Feed Additives Industry

10.2. Capacity Expansion and New Plant Announcements

10.3. Mergers and Acquisitions Activity Analysis

10.4. Government Support and Subsidy Programs

10.5. Foreign Direct Investment Trends

10.6. Return on Investment and Profitability Outlook

11. Sustainability and ESG Analysis

11.1.1. Environmental Impact of Feed Additives Production

11.1.2. Adoption of Natural and Organic Feed Additives

11.1.3. Carbon Footprint Reduction Initiatives

11.1.4. Animal Welfare and Ethical Nutrition Practices

11.1.5. ESG Compliance and Reporting Standards

11.1.6. Sustainability-Driven Market Opportunities

12. Feed Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’MT) (2025-2032)

12.1. Feed Market Size and Forecast, By Ingredients (2025-2032)

12.1.1. Cereals

12.1.2. Cakes & Meals

12.1.3. By-Products

12.2. Feed Market Size and Forecast, By Additives (2025-2032)

12.2.1. Amino Acid

12.2.2. Phosphates

12.2.3. Vitamins

12.2.4. Acidifiers

12.2.5. Carotenoids

12.2.6. Enzymes

12.2.7. Mycotoxin Detoxifiers

12.2.8. Flavors & Sweeteners

12.2.9. Antibiotics

12.2.10. Minerals

12.2.11. Antioxidants

12.2.12. Non-Protein Nitrogen

12.2.13. Preservatives

12.2.14. Phytogenic

12.2.15. Probiotics

12.3. Feed Market Size and Forecast, By Livestock (2025-2032)

12.3.1. Poultry

12.3.1.1. Broilers

12.3.1.2. Layers

12.3.1.3. Breeders

12.3.2. Ruminants

12.3.2.1. Calves

12.3.2.2. Dairy Cattle

12.3.2.3. Beef Cattle

12.3.2.4. Other Ruminants

12.3.3. Swine

12.3.3.1. Starters

12.3.3.2. Growers

12.3.3.3. Sows

12.3.4. Aquatic Animals

12.3.5. Pets and Others

12.4. Feed Market Size and Forecast, By Form (2025-2032)

12.4.1. Mash

12.4.2. Pellets

12.4.3. Crumbles

12.5. Feed Market Size and Forecast, By Source (2025-2032)

12.5.1. Synthetic

12.5.2. Natural

12.6. Feed Market Size and Forecast, By Region (2025-2032)

12.6.1. North America

12.6.2. Europe

12.6.3. Asia Pacific

12.6.4. Middle East and Africa

12.6.5. South America

13. North America Feed Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’MT) (2025-2032)

13.1. North America Feed Market Size and Forecast, By Ingredients (2025-2032)

13.2. North America Feed Market Size and Forecast, By Additives (2025-2032)

13.3. North America Feed Market Size and Forecast, By Livestock (2025-2032)

13.4. North America Feed Market Size and Forecast, By Form (2025-2032)

13.5. North America Feed Market Size and Forecast, By Source (2025-2032)

13.6. North America Feed Market Size and Forecast, by Country (2025-2032)

13.6.1. United States

13.6.2. Canada

13.6.3. Mexico

14. Europe Feed Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’MT) (2025-2032)

14.1. Europe Feed Market Size and Forecast, By Ingredients (2025-2032)

14.2. Europe Feed Market Size and Forecast, By Additives (2025-2032)

14.3. Europe Feed Market Size and Forecast, By Livestock (2025-2032)

14.4. Europe Feed Market Size and Forecast, By Form (2025-2032)

14.5. Europe Feed Market Size and Forecast, By Source (2025-2032)

14.6. Europe Feed Market Size and Forecast, by Country (2025-2032)

14.6.1. United Kingdom

14.6.2. France

14.6.3. Germany

14.6.4. Italy

14.6.5. Spain

14.6.6. Sweden

14.6.7. Russia

14.6.8. Rest of Europe

15. Asia Pacific Feed Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’MT) (2025-2032)

15.1. Asia Pacific Feed Market Size and Forecast, By Ingredients (2025-2032)

15.2. Asia Pacific Feed Market Size and Forecast, By Additives (2025-2032)

15.3. Asia Pacific Feed Market Size and Forecast, By Livestock (2025-2032)

15.4. Asia Pacific Feed Market Size and Forecast, By Form (2025-2032)

15.5. Asia Pacific Feed Market Size and Forecast, By Source (2025-2032)

15.6. Asia Pacific Feed Market Size and Forecast, by Country (2025-2032)

15.6.1. China

15.6.2. S Korea

15.6.3. Japan

15.6.4. India

15.6.5. Australia

15.6.6. Indonesia

15.6.7. Malaysia

15.6.8. Philippines

15.6.9. Thailand

15.6.10. Vietnam

15.6.11. Rest of Asia Pacific

16. Middle East and Africa Feed Market Size and Forecast (by Value in USD Billion and Volume in 000’MT) (2025-2032)

16.1. Middle East and Africa Feed Market Size and Forecast, By Ingredients (2025-2032)

16.2. Middle East and Africa Feed Market Size and Forecast, By Additives (2025-2032)

16.3. Middle East and Africa Feed Market Size and Forecast, By Livestock (2025-2032)

16.4. Middle East and Africa Feed Market Size and Forecast, By Form (2025-2032)

16.5. Middle East and Africa Feed Market Size and Forecast, By Source (2025-2032)

16.6. Middle East and Africa Feed Market Size and Forecast, by Country (2025-2032)

16.6.1. South Africa

16.6.2. GCC

16.6.3. Egypt

16.6.4. Nigeria

16.6.5. Rest of ME&A

17. South America Feed Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’MT) (2025-2032)

17.1. South America Feed Market Size and Forecast, By Ingredients (2025-2032)

17.2. South America Feed Market Size and Forecast, By Additives (2025-2032)

17.3. South America Feed Market Size and Forecast, By Livestock (2025-2032)

17.4. South America Feed Market Size and Forecast, By Form (2025-2032)

17.5. South America Feed Market Size and Forecast, By Source (2025-2032)

17.6. South America Feed Market Size and Forecast, by Country (2025-2032)

17.6.1. Brazil

17.6.2. Argentina

17.6.3. Colombia

17.6.4. Chile

17.6.5. Rest Of South America

18. Company Profile: Key Players

18.1. Cargill, Incorporated

18.1.1. Company Overview

18.1.2. Business Portfolio

18.1.3. Financial Overview

18.1.4. SWOT Analysis

18.1.5. Strategic Analysis

18.1.6. Recent Developments

18.2. Charoen Pokphand Group (CP Group)

18.3. New Hope Group

18.4. ADM Animal Nutrition

18.5. Land O’Lakes, Inc.

18.6. Nutreco N.V.

18.7. Alltech, Inc.

18.8. ForFarmers N.V.

18.9. De Heus Animal Nutrition

18.10. Guangdong Haid Group Co., Ltd.

18.11. Wen’s Food Group

18.12. Muyuan Foodstuff Co., Ltd.

18.13. BRF S.A.

18.14. Tyson Foods (Feed Division)

18.15. JA Zen-Noh

18.16. Tongwei Group

18.17. Twins Group (Shuangbaotai Group)

18.18. NongHyup Feed Inc.

18.19. East Hope Group

18.20. WH Group

18.21. Japfa Ltd.

18.22. Godrej Agrovet Limited

18.23. Feed One Co., Ltd.

18.24. Weston Milling Animal Nutrition

18.25. Smithfield Foods (Feed Operations)

18.26. Perdue Farms (Feed Operations)

18.27. Mountaire Farms (Feed Operations)

18.28. Koch Foods (Feed Operations)

18.29. Arab Company for Livestock Development (ACOLID)

18.30. Kent Nutrition Group

18.31. Others

19. Key Findings

20. Analyst Recommendations

21. Feed Market: Research Methodology