Chocolate Confectionery Market Size Product Innovation, Premiumization Trends, Distribution Analysis and Forecast (2026–2032 )

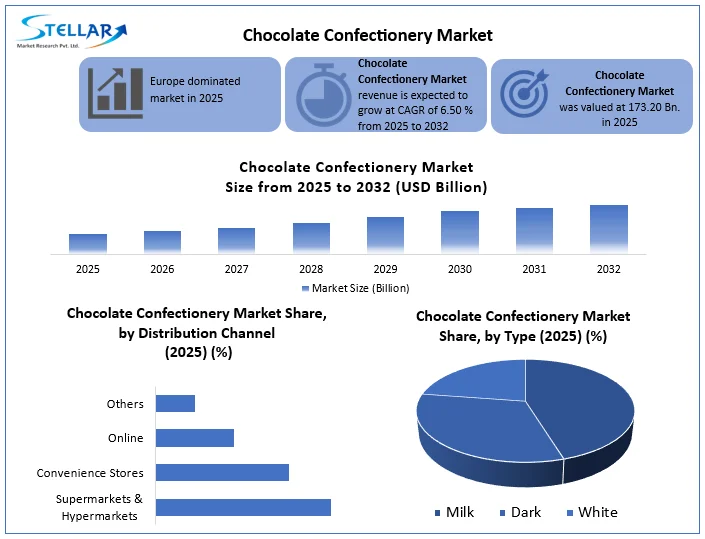

Chocolate Confectionery Market was valued at USD 173.20 Billion in 2025, and the total revenue is expected to grow at a CAGR of 6.50 % from 2025 to 2032, reaching USD 269.15 Billion by 2032.

Format : PDF | Report ID : SMR_2891

The global chocolate confectionery market is currently undergoing a structural transformation, evolving from a volume-driven commodity sector into a high-value, experience-centric economy. The growth is primarily fueled by a "dual-track" expansion: emerging markets (Asia-Pacific and South America) are seeing rapid volume growth due to rising disposable incomes, while mature markets (Europe and North America) are shifting toward premiumization and functional innovation. Despite historic cocoa price volatility, which peaked above USD 10,000 per tonne in 2024 before stabilizing in early 2025, the industry remains resilient as consumers increasingly view chocolate as an "affordable luxury" and a staple for emotional well-being.

Key Market Insights (2025):

|

Strategic Pillar |

Key Market Insight |

SMR Consulting Takeaway |

|

Consumer Ethos |

The rise of "Conscious Indulgence"; 56% of consumers now prioritize ethical sourcing and low-sugar. |

Brands must pivot to "Better-for-You" (BFY) labels to maintain Gen Z and Millennial loyalty. |

|

Product Frontier |

Surge in Dark and Functional Chocolate (+8.1% CAGR); demand for adaptogen-infused (Ashwagandha/Reishi) truffles. |

Functional efficacy (mood/immunity) is no longer niche; it is a core competitive requirement. |

|

Regional Engine |

Asia-Pacific was the fastest-growing region; Europe held the largest revenue hub (XX%). |

"Mental and Physical Availability" in urban India and China is the primary scale opportunity. |

|

Retail Evolution |

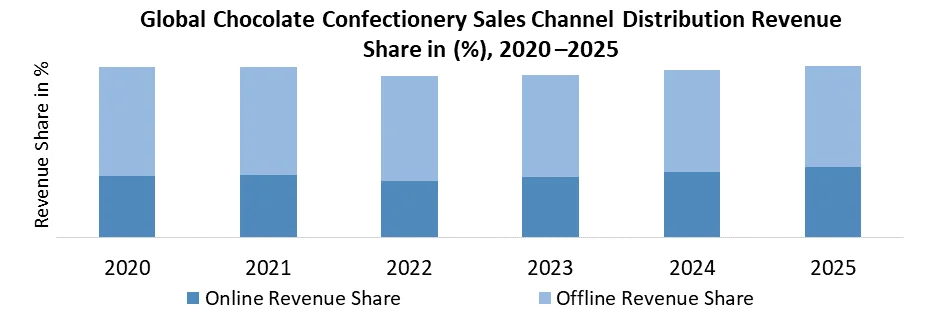

Digital-First / D2C growth; e-commerce is bypassing traditional "checkout aisle" impulse buys. |

AI-driven personalization and subscription models are replacing traditional brick-and-mortar loyalty. |

|

Supply Moat |

Blockchain-backed Supply Chain Transparency to combat cocoa price volatility and labor ethics. |

Ethical transparency is the new "Insurance Policy" against regulatory and reputational risk. |

|

Flavor Trend |

"Newstalgia" & Botanical Blends; fusion of classic flavors with hibiscus, matcha, or umami notes. |

Multi-sensory "Limited Edition" drops are the primary tool for driving short-term revenue spikes. |

To get more Insights: Request Free Sample Report

Top Market Trend:

Health & Wellness: The Rise of "Permissible Indulgence”

The most dominant trend for 2025 was the "Permissible Indulgence" movement, where chocolate is being radically reformulated from a sugary treat into a functional wellness partner. This shift is a direct response to the global health crisis highlighted by the International Diabetes Federation (IDF) 2025 Atlas, which reports that 589 million adults (1 in 9) are now living with diabetes a figure projected to hit 853 million by 2050.

As a result, Sugar-Free Chocolate is no longer a niche diet product but a primary growth engine, given the 22% surge in demand in 2025. Manufacturers are moving beyond simple "no-sugar" claims to integrate functional efficacy, with 34% of consumers now specifically seeking chocolates fortified with probiotics, adaptogens, or plant-based proteins. By 2026, dark chocolate, with its lower glycemic index and high antioxidant content, has solidified its status as a "doctor-approved" luxury, growing at a 5.34% CAGR and effectively capturing a market of health-conscious consumers who refuse to compromise between medical necessity and sensorial pleasure.

Chocolate Confectionery Market Dynamics:

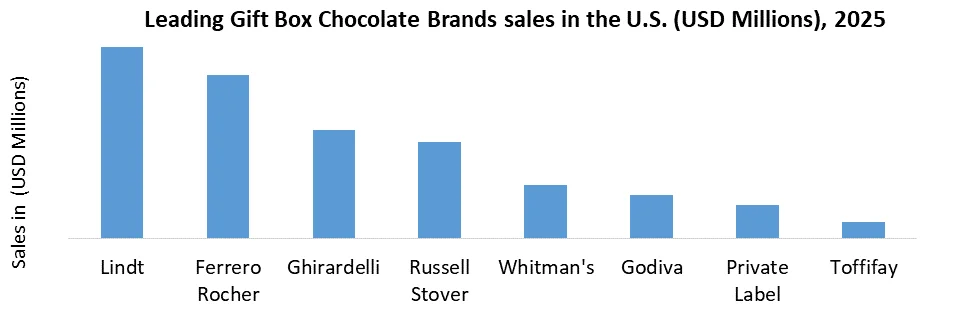

Evolution of Seasonal Gifting and Hyper-Personalization to drive the Market Growth

The global chocolate sector has undergone a profound structural shift, transitioning from a commodity-based snack industry to a sophisticated "Social Currency" ecosystem. Chocolate is now an indispensable anchor for cultural and religious festivities including Christmas, Easter, Diwali, and Valentine’s Day where it serves as a primary vehicle for social connection. Leading manufacturers are capitalizing on this by pivoting toward Hyper-Personalization and "Direct-to-Consumer" (D2C) digital strategies. For instance, Mars Wrigley has scaled its "My M&Ms" digital platform, allowing consumers to print photographs, logos, or bespoke messages directly onto lentils for weddings and social events. Similarly, in Mexico, the premium Turin brand has launched specialized digital storefronts to capture the burgeoning "at-home" celebration economy. This "treat culture," particularly among Millennials and Gen Z, leverages luxury-tier packaging and limited-edition releases to maintain high-margin pricing power even amidst fluctuating raw material costs.

Volatile Cocoa Prices & Climate Stress to hinder Market Growth

The global chocolate supply chain is currently facing its most severe structural crisis in decades. The "cocoa belt" in West Africa, which accounted for approximately 60–70% of global supply, has been destabilized by extreme weather anomalies. In late 2024 and throughout 2025, the region swung from record-breaking precipitation (leading to Black Pod disease) to intense, climate-induced heatwaves. These conditions have fundamentally disrupted the delicate flowering and pod-development cycles of cacao trees. Consequently, manufacturers are grappling with a triple-threat of supply scarcity, historic cost inflation, and "demand destruction" as consumers pull back from rising retail prices. To maintain margins, the industry has turned to "Shrinkflation" (reducing bar size while maintaining price) and "Skimpflation" (reformulating recipes to use more vegetable fats/fillers and less cocoa butter).

Numeric Insights & Supply Chain Metrics:

- The "Margin Squeeze": Major players like Hershey reported a 15.2% decline in net sales in 2025 as a direct result of volume losses stemming from price hikes.

- Structural Pivot: The industry is moving toward "Cocoa-Light" innovation. For example, Nestlé introduced techniques to utilize 30% more of the cocoa fruit (including previously discarded pulp) to offset bean shortages.

- Risk Mitigation: Procurement teams are now shifting focus from West Africa toward emerging hubs in Ecuador and Brazil to diversify geographic risk and ensure supply-chain resilience

Digitization of Chocolate Retail & Omnichannel Ecosystem Integration to create Opportunity in the Chocolate Confectionery Market

The most significant structural opportunity for 2026 lies in the Digitization of Retail, which has successfully transitioned chocolate from a physical impulse buy at the checkout counter to an "Intentional Digital Indulgence." High-growth brands are now pivoting to a Direct-to-Consumer (D2C) first model, leveraging digital ecosystems to bypass traditional retail bottlenecks and capture high-value consumer data. This shift is particularly potent in emerging markets and among younger demographics, where the "online-to-offline" delivery model is becoming the standard. By integrating AI-driven suggestion engines and 15-minute delivery partnerships, the industry is effectively replicating the sensory "impulse" trigger in a virtual environment, allowing for higher frequency of purchase and brand loyalty.

Chocolate Confectionery Market: Segment Analysis

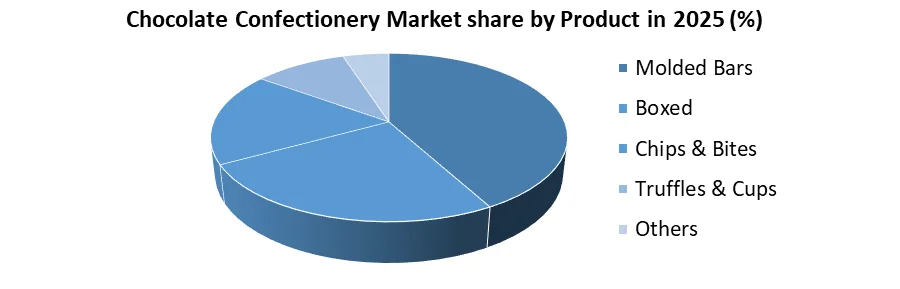

By Product: In 2025, molded bars held the largest share of the Chocolate Confectionery Market, driven by their widespread daily consumption, affordability, and strong brand availability. Their convenience, longer shelf life, and broad flavor variety support high demand across all age groups and retail channels. Boxed chocolates remained a key segment for gifting and premium occasions, driven by seasonal demand and special event purchases. Chips & bites appealed to on-the-go snacking and younger demographics seeking convenience and shareable formats. Truffles & cups capture the premium and indulgence segment with richer flavors and specialty fillings. The others category represents niche products such as artisanal, filled novelties, and region-specific confectionery, contributing to market breadth and innovation opportunities.

Chocolate Confectionery Market Regional Analysis:

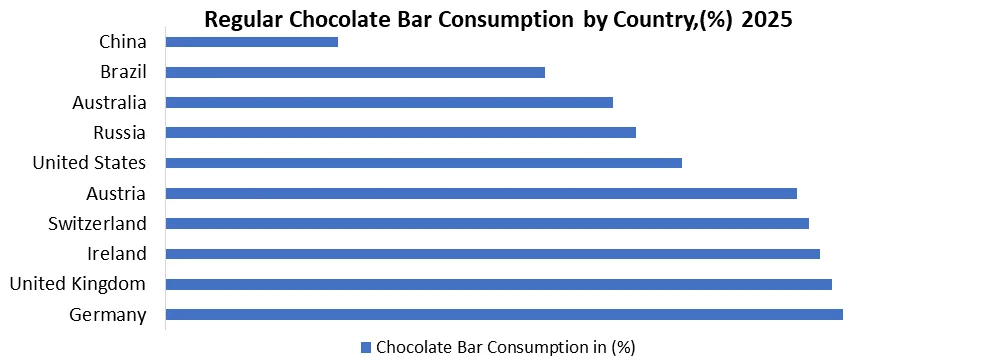

The global chocolate confectionery market was defined by a significant geographic divide between high-volume legacy markets and high-growth emerging frontiers. From a revenue perspective, Europe secured the position of the largest regional market, accounting over 40% of total global revenue as of 2025. This dominance was anchored by a deep-rooted chocolate culture in countries like Switzerland, Germany, and the UK, which fuel a high global average per capita consumption of 1.21kg in 2025. While Europe led in total value, the United States stood as the single largest country-level revenue generator, to produce USD 54.04 billion in 2025.

In contrast, the Asia-Pacific region was the fastest-accelerating market, characterized by a digital-first surge where online revenue is growing at nearly double the rate of physical retail. While the global average revenue per user (ARPU) was USD 19.33, the European and North American markets maintain a much higher spend-per-transaction due to the rapid adoption of premium and "Better-for-You" products.

Competitive Landscape: Strategic Consolidation & Ecosystem Dominance

The global chocolate confectionery market is characterized by a highly consolidated Tier-1 structure, where a few global titans Mars Inc., Ferrero Group, Mondelez International, Nestlé S.A., and The Hershey Company collectively command over 60% of the global market share.

In the competitive arena has shifted from a "Price-War" environment to a "Capabilities-War." Market leaders are currently realigning their Systems (Digital D2C) and Staff (Sustainability Officers) to maintain profitability against rising cocoa costs. The landscape is currently bifurcated: Tier-1 players are leveraging economies of scale and deep distribution networks to dominate emerging markets, while "Local companies" and artisanal brands are capturing high-margin growth in mature markets through premiumization and functional innovation.

Top 5 Player Strategic Matrix:

|

Player |

Strategic Positioning |

Core 2026 Initiative |

Competitive Advantage |

|

Mars Inc. |

Omnichannel Leader |

Scaling "My M&Ms" and D2C ecosystems for hyper-personalization. |

Unmatched digital infrastructure and emerging market penetration. |

|

Ferrero Group |

Premium Specialist |

Aggressive expansion of "Gift-Box" dominance (Ferrero Rocher). |

Strongest brand equity in the "Social Currency" and Gifting segment. |

|

Mondelez Int. |

Portfolio Diversifier |

Integration of "Adjacent Snacking" (e.g., Clif Bar/KIND) for wellness. |

Dominance in the "On-the-Go" and Biscuits-Chocolate fusion category. |

|

Nestle S.A. |

Sustainability Pioneer |

"Income Accelerator" programs for cocoa farmers; 100% ethical sourcing. |

Leadership in ESG-driven consumer trust and "Bean-to-Bar" transparency. |

|

Hershey's |

Domestic Powerhouse |

Expanding "Better-for-You" (BFY) sugar-free and dark chocolate lines. |

Dominant market share in North America and seasonal impulse retail. |

Chocolate Confectionery Market Scope

|

Chocolate Confectionery Market |

|||

|

This Report Covers |

Details |

||

|

Base Year: |

2025 |

Forecast Period: |

2026-2032 |

|

Historical Data: |

2020 to 2025 |

Market Size in 2025: |

USD 173.20 Bn |

|

Forecast Period 2026 to 2032 CAGR: |

6.50 % |

Market Size in 2032: |

USD 269.15 Bn |

|

Chocolate Confectionery Market Segments Covered: |

By Type |

Milk Dark White |

|

|

By Product |

Boxed Molded Bars Chips & Bites Truffles & Cups Others |

||

|

By Price point |

Economy Mid-range Luxury |

||

|

By Distribution Channel |

Supermarkets & Hypermarkets Convenience Stores Online Others |

||

Chocolate Confectionery Market, by region

North America (United States, Canada and Mexico)

Europe (UK, France, Germany, Italy, Spain, Sweden, Russia and Rest of Europe)

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, and Rest of APAC)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (South Africa, GCC, Egypt, Nigeria, Rest of MEA)

Chocolate Confectionery industry key Players

- Mars, Incorporated (USA)

- Mondelez International (USA)

- Ferrero Group (Italy)

- Nestle S.A. (Switzerland)

- The Hershey Company (USA)

- Chocoladefabriken Lindt & Sprüngli AG (Switzerland)

- Barry Callebaut (Switzerland)

- Meiji Holdings Co., Ltd. (Japan)

- Ezaki Glico Co., Ltd. (Japan)

- Pladis Global (UK)

- August Storck KG (Germany)

- Perfetti Van Melle (Italy/Netherlands)

- Arcor Group (Argentina)

- Lotte Confectionery (South Korea)

- General Mills (USA)

- Orion Corporation (South Korea)

- Morinaga & Company (Japan)

- Cargill, Inc. (USA)

- Amul (GCMMF) (India)

- Y?ld?z Holding / Ülker (Turkey)

- Roshen Confectionery Corporation (Ukraine)

- United Confectioners (Russia)

- Godiva Chocolatier (Belgium/USA)

- Chocolaterie Guylian (Belgium)

- Cloetta AB (Sweden)

- Fazer Group (Finland)

- ITC Limited (Fabelle) (India)

- Venchi (Italy)

- Tootsie Roll Industries (USA)

- Grupo Bimbo (Mexico)

Frequently Asked Questions

In 2025, the Europe region dominated the Chocolate Confectionery market, accounting for approximately 37-39% of global revenue in 2025, driven by high per capita consumption.

The Chocolate Confectionery market was valued at USD 173.20 Billion in 2025 and is expected to grow at 6.50 % CAGR, reaching USD 269.15 Billion by 2032.

The report covers Type, Product, Price point, Distribution Channel, and Region.

The biggest challenges for the Chocolate Confectionery market include volatile cocoa prices driven by West African crop shortages, stringent sustainability regulations (like EUDR).

1. Chocolate Confectionery Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Chocolate Confectionery Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Headquarter

2.2.3. Product Portfolio

2.2.4. Market Share (%)

2.2.5. Revenue, (2025)

2.2.6. Profit Margin (%)

2.2.7. Growth Rate (%)

2.2.8. Y-O-Y (%)

2.2.9. Patents

2.2.10. Sales Channels

2.2.11. Customer Engagement Metrics

2.2.12. New Product Innovation Rate

2.2.13. Quality Consistency Index

2.2.14. Certifications

2.2.15. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Chocolate Confectionery Market: Dynamics

3.1. Chocolate Confectionery Market Trends

3.2. Chocolate Confectionery Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Chocolate Confectionery Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Tons) (2025-2032)

4.1. Chocolate Confectionery Market Size and Forecast, By Type (2025-2032)

4.1.1.1. Milk

4.1.1.2. Dark

4.1.1.3. White

4.2. Chocolate Confectionery Market Size and Forecast, By Product (2025-2032)

4.2.1. Boxed

4.2.2. Molded Bars

4.2.3. Chips & Bites

4.2.4. Truffles & Cups

4.2.5. Others

4.3. Chocolate Confectionery Market Size and Forecast, By Price point (2025-2032)

4.3.1. Economy

4.3.2. Mid-range

4.3.3. Luxury

4.4. Chocolate Confectionery Market Size and Forecast, By Distribution Channel (2025-2032)

4.4.1. Supermarkets & Hypermarkets

4.4.2. Convenience Stores

4.4.3. Online

4.4.4. Others

4.5. Chocolate Confectionery Market Size and Forecast, By Region (2025-2032)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. South America

5. North America Chocolate Confectionery Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Tons) (2025-2032)

5.1. North America Chocolate Confectionery Market Size and Forecast, By Type (2025-2032)

5.2. North America Chocolate Confectionery Market Size and Forecast, By Product (2025-2032)

5.3. North America Chocolate Confectionery Market Size and Forecast, By Price point (2025-2032)

5.4. North America Chocolate Confectionery Market Size and Forecast, By Distribution Channel (2025-2032)

5.5. North America Chocolate Confectionery Market Size and Forecast, by Country (2025-2032)

5.5.1. United States

5.5.2. Canada

5.5.3. Mexico

6. Europe Chocolate Confectionery Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Tons) (2025-2032)

6.1. Europe Chocolate Confectionery Market Size and Forecast, By Type (2025-2032)

6.2. Europe Chocolate Confectionery Market Size and Forecast, By Product (2025-2032)

6.3. Europe Chocolate Confectionery Market Size and Forecast, By Price point (2025-2032)

6.4. Europe Chocolate Confectionery Market Size and Forecast, By Distribution Channel (2025-2032)

6.5. Europe Chocolate Confectionery Market Size and Forecast, by Country (2025-2032)

6.5.1. United Kingdom

6.5.1.1. United Kingdom Chocolate Confectionery Market Size and Forecast, By Type (2025-2032)

6.5.1.2. United Kingdom Chocolate Confectionery Market Size and Forecast, By Product (2025-2032)

6.5.1.3. United Kingdom Chocolate Confectionery Market Size and Forecast, By Price point (2025-2032)

6.5.1.4. United Kingdom Chocolate Confectionery Market Size and Forecast, By Distribution Channel (2025-2032)

6.5.2. France

6.5.3. Germany

6.5.4. Italy

6.5.5. Spain

6.5.6. Sweden

6.5.7. Russia

6.5.8. Rest of Europe

7. Asia Pacific Chocolate Confectionery Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Tons) (2025-2032)

7.1. Asia Pacific Chocolate Confectionery Market Size and Forecast, By Type (2025-2032)

7.2. Asia Pacific Chocolate Confectionery Market Size and Forecast, By Product (2025-2032)

7.3. Asia Pacific Chocolate Confectionery Market Size and Forecast, By Price point (2025-2032)

7.4. Asia Pacific Chocolate Confectionery Market Size and Forecast, By Distribution Channel (2025-2032)

7.5. Asia Pacific Chocolate Confectionery Market Size and Forecast, by Country (2025-2032)

7.5.1. China

7.5.2. S Korea

7.5.3. Japan

7.5.4. India

7.5.5. Australia

7.5.6. Indonesia

7.5.7. Malaysia

7.5.8. Philippines

7.5.9. Thailand

7.5.10. Vietnam

7.5.11. Rest of Asia Pacific

8. Middle East and Africa Chocolate Confectionery Market Size and Forecast (by Value in USD Billion, Volume in Tons) (2025-2032)

8.1. Middle East and Africa Chocolate Confectionery Market Size and Forecast, By Type (2025-2032)

8.2. Middle East and Africa Chocolate Confectionery Market Size and Forecast, By Product (2025-2032)

8.3. Middle East and Africa Chocolate Confectionery Market Size and Forecast, By Price point (2025-2032)

8.4. Middle East and Africa Chocolate Confectionery Market Size and Forecast, By Distribution Channel (2025-2032)

8.5. Middle East and Africa Chocolate Confectionery Market Size and Forecast, by Country (2025-2032)

8.5.1. South Africa

8.5.2. GCC

8.5.3. Egypt

8.5.4. Nigeria

8.5.5. Rest of ME&A

9. South America Chocolate Confectionery Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Tons) (2025-2032)

9.1. South America Chocolate Confectionery Market Size and Forecast, By Type (2025-2032)

9.2. South America Chocolate Confectionery Market Size and Forecast, By Product (2025-2032)

9.3. South America Chocolate Confectionery Market Size and Forecast, By Price point (2025-2032)

9.4. South America Chocolate Confectionery Market Size and Forecast, By Distribution Channel (2025-2032)

9.5. South America Chocolate Confectionery Market Size and Forecast, by Country (2025-2032)

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Colombia

9.5.4. Chile

9.5.5. Rest Of South America

10. Company Profile: Key Players

10.1. Mars, Incorporated (USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Mondel?z International (USA)

10.3. Ferrero Group (Italy)

10.4. Nestlé S.A. (Switzerland)

10.5. The Hershey Company (USA)

10.6. Chocoladefabriken Lindt & Sprüngli AG (Switzerland)

10.7. Barry Callebaut (Switzerland)

10.8. Meiji Holdings Co., Ltd. (Japan)

10.9. Ezaki Glico Co., Ltd. (Japan)

10.10. Pladis Global (UK)

10.11. August Storck KG (Germany)

10.12. Perfetti Van Melle (Italy/Netherlands)

10.13. Arcor Group (Argentina)

10.14. Lotte Confectionery (South Korea)

10.15. General Mills (USA)

10.16. Orion Corporation (South Korea)

10.17. Morinaga & Company (Japan)

10.18. Cargill, Inc. (USA)

10.19. Amul (GCMMF) (India)

10.20. Y?ld?z Holding / Ülker (Turkey)

10.21. Roshen Confectionery Corporation (Ukraine)

10.22. United Confectioners (Russia)

10.23. Godiva Chocolatier (Belgium/USA)

10.24. Chocolaterie Guylian (Belgium)

10.25. Cloetta AB (Sweden)

10.26. Fazer Group (Finland)

10.27. ITC Limited (Fabelle) (India)

10.28. Venchi (Italy)

10.29. Tootsie Roll Industries (USA)

10.30. Grupo Bimbo (Mexico)

10.31. Others

11. Key Findings

12. Analyst Recommendations

13. Chocolate Confectionery Market: Research Methodology