Electric Vehicle Battery Market Powering the Future of Sustainable Mobility

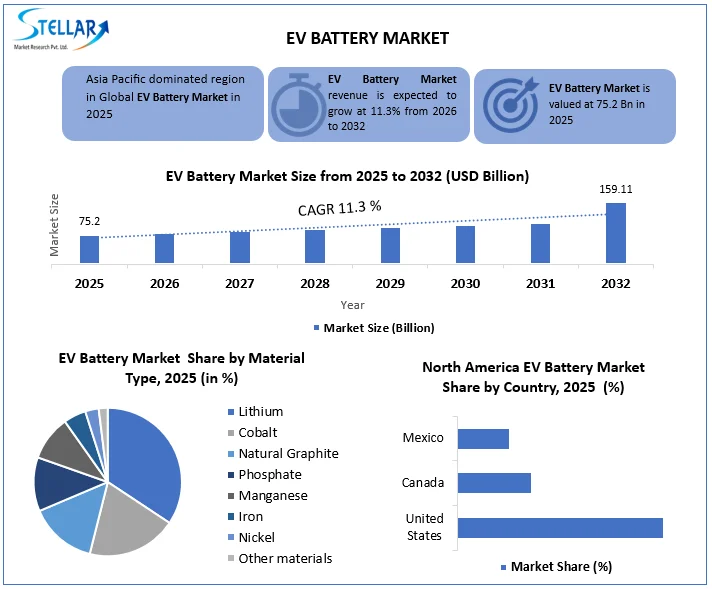

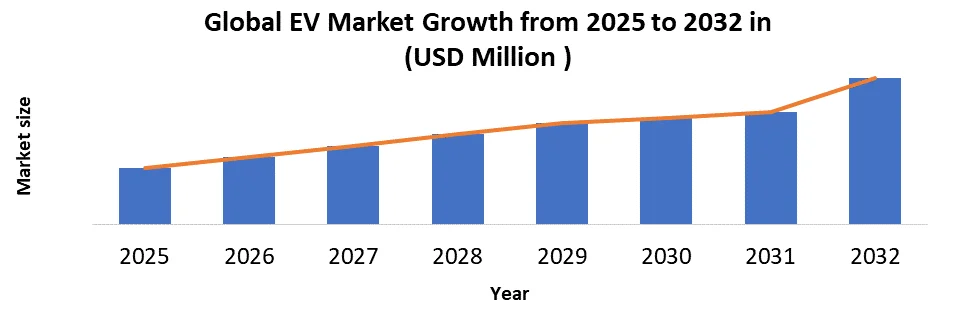

Global EV Battery Market to reach USD 159.11 Bn by 2032 from USD 75.2 Bn in 2025 at a CAGR of 11.3%.

Format : PDF | Report ID : SMR_2899

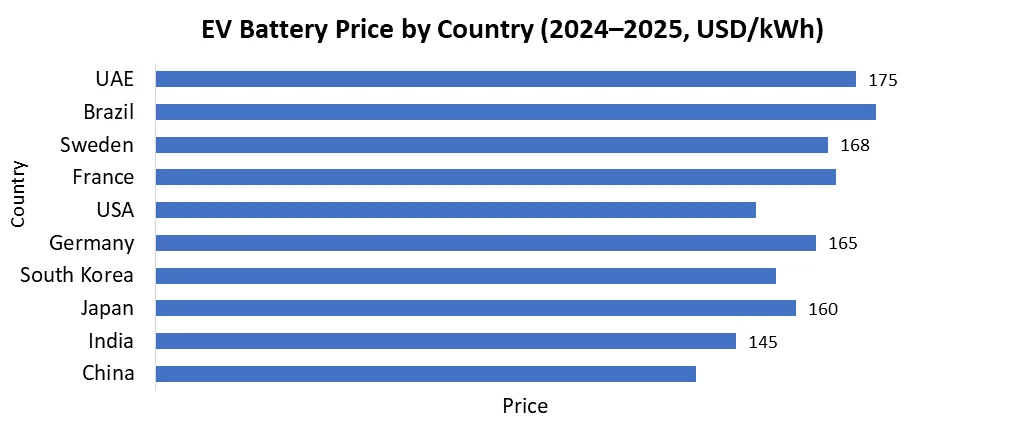

The global electric vehicle (EV) battery market has evolved from a niche energy storage segment into a core pillar of the global automotive and energy transition ecosystem. In 2018, EV battery demand of nearly 120 GWh, driven primarily by early EV adoption in China, Europe, and select U.S. states. During this phase, limited charging infrastructure, high battery costs averaging above USD 1,100 per kWh, and early-stage lithium-ion technology constrained large-scale deployment.

By 2025, the EV battery market is expected to expand, supported by a sharp rise in global battery demand to approximately 900 GWh, reflecting the highest CAGR. This acceleration was driven by aggressive electrification policies, battery cost reductions of nearly 70% since 2015, and large-scale adoption of lithium iron phosphate (LFP) and nickel manganese cobalt (NMC) chemistries. China alone accounted for nearly 65% of global EV battery demand, exceeding 600 GWh, while the U.S. and Germany followed with approximately 180 GWh and 120 GWh, respectively.

The global EV battery market is projected to reach USD 159.11 billion by 2032, with annual battery demand expected to surpass 2,200 GWh, expanding at a CAGR of 11.3% from 2025 onward. Future growth will be supported by solid-state battery commercialization, the entry of sodium-ion batteries for cost-sensitive EV segments, and localized battery manufacturing initiatives under the U.S. Inflation Reduction Act (IRA), the EU Battery Regulation, and India’s Production Linked Incentive (PLI) scheme.

Key Highlights:

EV batteries are the primary demand driver for lithium in the global EV battery market by 2030, with lithium demand for EV batteries ranging from 2.5–3.1 Mt/year. EV battery material supply uncertainty creates a wide supply-demand imbalance, swinging from 25% surplus to 42% deficit, highlighting high battery metals market volatility.

Cobalt demand for EV batteries (0.24–0.39 Mt/year) is strongly supported by lithium-ion battery chemistry, but cobalt supply-demand balance could swing from 94% surplus to 35% deficit. This reflects EV battery chemistry shifts, cobalt substitution risks, and evolving EV battery raw material strategies.

Battery-critical minerals including lithium, graphite, and nickel face the highest EV battery material supply risk and battery mineral volatility. In contrast, infrastructure-driven materials such as copper, phosphorus, and manganese show more stable EV battery demand contribution, though they remain scale-sensitive to energy transition infrastructure growth.

To get more Insights: Request Free Sample Report

Global EV Battery Market Dynamics

Accelerating Global Electric Vehicle Adoption to Drive the Electric Vehicle (EV) Battery Market Growth

Rapid EV penetration remains the primary growth driver. Global EV sales crossed 14 million units in 2024, creating proportional growth in battery demand. Fleet electrification, especially in logistics and ride-hailing, increases daily battery utilization above 35% of cycles, improving ROI despite an additional 0.8% annual degradation penalty.

Policy incentives play a decisive role. China’s NEV mandate, Europe’s ICE phase-out by 2035, and U.S. tax credits of up to USD 7,500 per EV directly stimulate battery manufacturing investments exceeding USD 400 billion globally (2021–2024).

Fleet Electrification and High Utilization Economics limit the Market Growth

Battery degradation linked to high-power DC fast charging (DCFC) is a critical operational restraint. Vehicles frequently charging above 100 kW show an estimated 76% SOH after eight years, compared to 88% SOH for low-power charging users. Additionally, thermal stress in hot climates raises degradation rates by 0.4% annually, impacting markets such as India, the Middle East, and Southeast Asia. Supply-side risks, including lithium price volatility (USD 7,000–70,000 per ton between 2020–2023), continue to challenge cost stability.

Declining Battery Costs and Chemistry Innovation boost the Electric Vehicle (EV) Battery growth

The shift toward LFP and sodium-ion batteries presents a major opportunity. Sodium-ion batteries can reduce material costs by 20–30%, particularly for 2W, 3W, and entry-level EVs in India and Southeast Asia. Furthermore, battery recycling and second-life applications could unlock a USD 40+ billion circular economy by 2035.

Electric Vehicle (EV) Battery Market Segment Analysis:

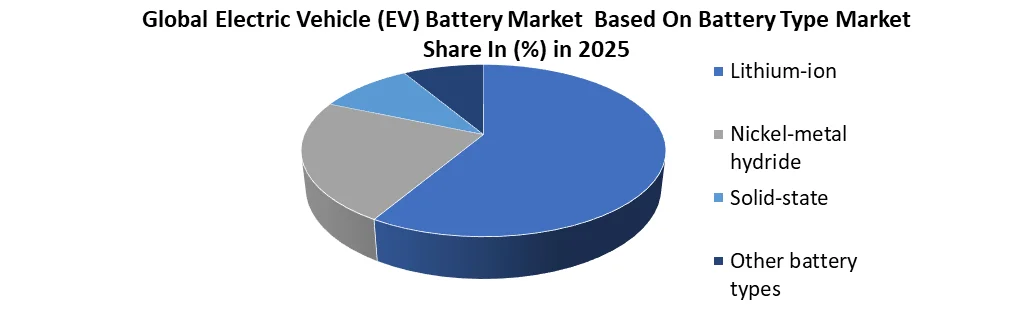

Based On Battery Type, Lithium-ion batteries dominated the EV battery type segment, accounting for over 90% of global EV battery demand in 2025. Their leadership is driven by high energy density, long cycle life, fast charging capability, and declining cost per kWh. Major OEMs prefer lithium-ion chemistries such as LFP, NMC, and NCA, while solid-state and nickel-metal hydride remain niche or pre-commercial.

Electric Vehicle (EV) Battery Market Regional analysis

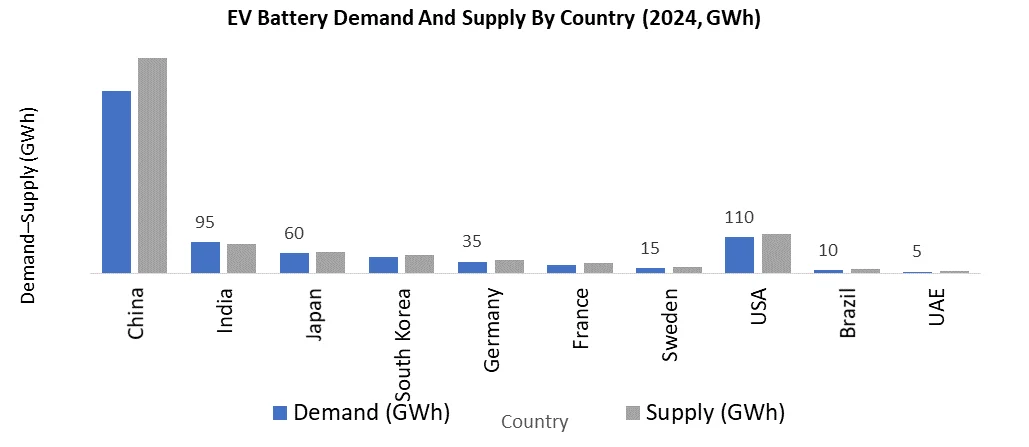

Asia-Pacific dominated the global EV battery market with around xx % market share in 2025, driven by strong manufacturing capacity and high EV adoption in China, Japan, South Korea, and India. China remains the global hub, hosting over 70% of worldwide battery manufacturing capacity, supported by industry leaders such as CATL and BYD and a fully integrated supply chain. India is emerging as a high-growth market, with EV battery demand reaching nearly 95 GWh in 2024, backed by rising electric two-wheeler penetration and government support through USD 2.3 billion under the PLI scheme to promote domestic cell manufacturing.

Europe accounted for approximately xx% of the global market, led by Germany, France, and Sweden, where large-scale gigafactory investments are underway. Regional battery localization policies aim to meet up to 90% of Europe’s EV battery demand by 2030, enhancing supply security.

North America held about xx% market share, supported by the U.S. Inflation Reduction Act, with domestic battery capacity expected to exceed 1,000 GWh by 2030.

Electric Vehicle (EV) Battery Market Competitive Landscape

The global EV battery market is concentrated group of large, technology-driven manufacturers that control capacity expansion, chemistry innovation, and OEM partnerships. CATL (China) leads the market by leveraging its strong position in LFP batteries, early commercialization of sodium-ion technology, and long-term supply contracts with global EV makers. BYD (China) follows a fully vertically integrated strategy, producing batteries in-house to secure supply, lower costs, and support its expanding EV portfolio.

LG Energy Solution (South Korea) focuses on high-nickel cathode chemistries and continues aggressive capacity expansion across the U.S. and Europe to benefit from localization policies. Panasonic Energy (Japan) prioritizes solid-state battery R&D while maintaining a Tesla-centric supply model, whereas Samsung SDI (South Korea) targets the premium EV segment through innovations in thermal safety, energy density, and advanced BMS design.

Key 5-year Strategic Trends include:

- Localization of EV battery supply chains

- Transition toward low- and zero-cobalt chemistries

- Growth of Battery-as-a-Service (BaaS) models

- Deployment of AI-driven battery management systems

From a demand–supply perspective, global EV battery demand reached 900 GWh in 2024, while installed supply capacity stood at 1,200 GWh, resulting in a temporary surplus. China remains a net exporter, whereas Europe and India are demand-heavy and import-dependent. Major consumers include passenger EV owners and fleet operators, while buyers are OEMs such as Tesla, BYD, Tata Motors, and Volkswagen.

EV Battery Market Scope

|

Global EV Battery Market |

|||

|

Report Coverage |

Details |

||

|

Base Year: |

2025 |

Forecast Period: |

2026-2032 |

|

Historical Data: |

2020-2025 |

Market Size in 2025: |

USD 75.2 Billion |

|

Forecast Period 2026 to 2032 CAGR: |

11.3% |

Market Size in 2032: |

USD 159.11Billion |

|

EV Battery Market Segments Covered: |

By Battery Type |

Lithium-ion Nickel-metal hydride Solid-state Others |

|

|

By Battery Form Type |

Cobalt Lithium Natural graphite Manganese Iron Phosphate Nickel Others |

||

|

By Battery Form

|

Prismatic Pouch Cylindrical |

||

|

By Propulsion |

BEV (Battery Electric Vehicle) PHEV (Plug-in Hybrid Electric Vehicle) HEV (Hybrid Electric Vehicle) FCEV (Fuel Cell Electric Vehicle) |

||

|

By Vehicle Type

|

Two-Wheeler Passenger Cars Buses Commercial Light Duty Vehicles Three-Wheeler Four-Wheeler Others |

||

|

By Capacity

|

< 50 kWh 50–100 kWh 100–200 kWh 200 kWh |

||

|

By Method |

Wire bonding Laser bonding Ultrasonic metal welding |

||

|

By Lithium-ion Battery Component |

Positive electrode Negative electrode Electrolyte Separator

|

||

EV Battery Market, by Region

North America (United States, Canada and Mexico)

Europe (UK, France, Germany, Italy, Spain, Sweden, Russia and the Rest of Europe)

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Thailand, Philippines, and Rest of APAC)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (South Africa, GCC, Egypt, Nigeria, Rest of MEA)

EV Battery Key Players

- CALB (China Aviation Lithium Battery)

- Gotion High-Tech

- EVE Energy

- SVOLT Energy Technology

- Sunwoda Electronic

- Farasis Energy

- Envision AESC

- Tianjin Lishen Battery

- REPT Battero (Zhejiang REPT)

- Northvolt

- A123 Systems

- GS Yuasa Corporation

- Hitachi Astemo

- Microvast

- WeLion New Energy

- HiNa Battery Technology

- E-One Moli Energy

- Tesla (In-house Battery Manufacturing)

- Clarios

- Exide Industries

- Electrovaya

- ProLogium Technology

- QuantumScape

- Solid Power

Frequently Asked Questions

Lithium-ion batteries dominate due to their high energy density, long lifecycle, and wide acceptance across passenger and commercial electric vehicles.

Asia-Pacific leads the market, primarily driven by strong manufacturing capacity and high EV production in China, South Korea, and Japan.

Key challenges include raw material supply risks, battery safety concerns, high initial manufacturing costs, and limited recycling infrastructure.

The EV battery market is expected to witness strong growth through 2032, supported by advancements in battery chemistry, solid-state technologies, and expansion of gigafactories.

1. EV Battery Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global EV Battery Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Headquarter

2.2.3. Product Segment

2.2.4. End-User Segment

2.2.5. Revenue Details in 2024

2.2.6. Market Share (%)

2.2.7. Growth Rate (%)

2.2.8. Technological Capabilities

2.2.9. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. EV Battery Market: Dynamics

3.1. EV Battery Market Trends

3.2. EV Battery Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Battery Pack Design

4.1.1. Cell-to-Pack

4.1.2. Cell-to-Chassis

4.1.3. Modular Designs

4.1.4. Thermal Architecture

4.1.5. Safety Design

4.1.6. Lightweight Materials

5. Charging Compatibility

5.1. Fast Charging

5.2. Ultra-Fast Charging

5.3. Charging Degradation Impact

5.4. Charging Standards

5.5. Infrastructure Compatibility

5.6. Wireless Charging

6. Manufacturing Analysis

6.1. Cell Manufacturing

6.2. Module Assembly

6.3. Pack Integration

6.4. Automation Trends

6.5. Quality Standards

6.6. Manufacturing Cost Structure

7. Battery Recycling & Second Life

7.1. Recycling Technologies

7.2. Second-Life EV Batteries

7.3. Regulatory Policies

7.4. Recycling Economics

7.5. Sustainability Impact

7.6. Circular Economy

8. Supply Chain Analysis

8.1. Raw Material Sourcing

8.2. Lithium Supply

8.3. Nickel & Cobalt Supply

8.4. Geopolitical Risks

8.5. Localization Strategies

8.6. Supply Chain Optimization

9. EV Battery Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032)

9.1. EV Battery Market Size and Forecast, By Battery Type (2025-2032)

9.1.1. Lithium-ion

9.1.2. Nickel-metal hydride

9.1.3. Solid-state

9.1.4. Other

9.2. EV Battery Market Size and Forecast, By Battery Form Type (2025-2032)

9.2.1. Cobalt

9.2.2. Lithium

9.2.3. Natural graphite

9.2.4. Manganese

9.2.5. Iron

9.2.6. Phosphate

9.2.7. Nickel

9.2.8. Other

9.3. EV Battery Market Size and Forecast, By Battery Form (2025-2032)

9.3.1. Prismatic

9.3.2. Pouch

9.3.3. Cylindrical

9.4. EV Battery Market Size and Forecast, By Propulsion (2025-2032)

9.4.1. BEV (Battery Electric Vehicle)

9.4.2. PHEV (Plug-in Hybrid Electric Vehicle)

9.4.3. HEV (Hybrid Electric Vehicle)

9.4.4. FCEV (Fuel Cell Electric Vehicle)

9.5. EV Battery Market Size and Forecast, By Vehicle Type (2025-2032)

9.5.1. Two-Wheeler

9.5.2. Passenger Cars

9.5.3. Buses

9.5.4. Commercial Light Duty Vehicles

9.5.4.1. Three-Wheeler

9.5.4.2. Four-Wheeler

9.5.5. Others

9.6. EV Battery Market Size and Forecast, By Capacity (2025-2032)

9.6.1. < 50 kWh

9.6.2. 50–100 kWh

9.6.3. 100–200 kWh

9.6.4. 200 kWh

9.7. EV Battery Market Size and Forecast, By Method (2025-2032)

9.7.1. Wire bonding

9.7.2. Laser bonding

9.7.3. Ultrasonic metal welding

9.8. EV Battery Market Size and Forecast, By Lithium-ion Battery Component (2025-2032)

9.8.1. Positive electrode

9.8.2. Negative electrode

9.8.3. Electrolyte

9.8.4. Separator

9.9. EV Battery Market Size and Forecast, By Region (2025-2032)

9.9.1. North America

9.9.2. Europe

9.9.3. Asia Pacific

9.9.4. Middle East and Africa

9.9.5. South America

10. North America EV Battery Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032)

10.1. North America EV Battery Market Size and Forecast, By Battery Type (2025-2032)

10.2. North America EV Battery Market Size and Forecast, By Battery Form Type (2025-2032)

10.3. North America EV Battery Market Size and Forecast, By Battery Form (2025-2032)

10.4. North America EV Battery Market Size and Forecast, By Propulsion (2025-2032)

10.5. North America EV Battery Market Size and Forecast, By Vehicle Type (2025-2032)

10.6. North America EV Battery Market Size and Forecast, By Capacity (2025-2032)

10.7. North America EV Battery Market Size and Forecast, By Method (2025-2032)

10.8. North America EV Battery Market Size and Forecast, By Lithium-ion Battery Component (2025-2032)

10.9. North America EV Battery Market Size and Forecast, by Country (2025-2032)

10.9.1. United States

10.9.2. Canada

10.9.3. Mexico

11. Europe EV Battery Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032)

11.1. Europe EV Battery Market Size and Forecast, By Battery Type (2025-2032)

11.2. Europe EV Battery Market Size and Forecast, By Battery Form Type (2025-2032)

11.3. Europe EV Battery Market Size and Forecast, By Battery Form (2025-2032)

11.4. Europe EV Battery Market Size and Forecast, By Propulsion (2025-2032)

11.5. Europe EV Battery Market Size and Forecast, By Vehicle Type (2025-2032)

11.6. Europe EV Battery Market Size and Forecast, By Capacity (2025-2032)

11.7. Europe EV Battery Market Size and Forecast, By Method (2025-2032)

11.8. Europe EV Battery Market Size and Forecast, By Lithium-ion Battery Component (2025-2032)

11.9. Europe EV Battery Market Size and Forecast, by Country (2025-2032)

11.9.1. United Kingdom

11.9.2. France

11.9.3. Germany

11.9.4. Italy

11.9.5. Spain

11.9.6. Sweden

11.9.7. Russia

11.9.8. Rest of Europe

12. Asia Pacific EV Battery Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032)

12.1. Asia Pacific EV Battery Market Size and Forecast, By Battery Type (2025-2032)

12.2. Asia Pacific EV Battery Market Size and Forecast, By Battery Form Type (2025-2032)

12.3. Asia Pacific EV Battery Market Size and Forecast, By Battery Form (2025-2032)

12.4. Asia Pacific EV Battery Market Size and Forecast, By Propulsion (2025-2032)

12.5. Asia Pacific EV Battery Market Size and Forecast, By Vehicle Type (2025-2032)

12.6. Asia Pacific EV Battery Market Size and Forecast, By Capacity (2025-2032)

12.7. Asia Pacific EV Battery Market Size and Forecast, By Method (2025-2032)

12.8. Asia Pacific EV Battery Market Size and Forecast, By Lithium-ion Battery Component (2025-2032)

12.9. Asia Pacific EV Battery Market Size and Forecast, by Country (2025-2032)

12.9.1. China

12.9.2. S Korea

12.9.3. Japan

12.9.4. India

12.9.5. Australia

12.9.6. Indonesia

12.9.7. Malaysia

12.9.8. Philippines

12.9.9. Thailand

12.9.10. Vietnam

12.9.11. Rest of Asia Pacific

13. Middle East and Africa EV Battery Market Size and Forecast (by Value in USD Billion and Volume in 000’Units) (2025-2032)

13.1. Middle East and Africa EV Battery Market Size and Forecast, By Battery Type (2025-2032)

13.2. Middle East and Africa EV Battery Market Size and Forecast, By Battery Form Type (2025-2032)

13.3. Middle East and Africa EV Battery Market Size and Forecast, By Battery Form (2025-2032)

13.4. Middle East and Africa EV Battery Market Size and Forecast, By Propulsion (2025-2032)

13.5. Middle East and Africa EV Battery Market Size and Forecast, By Vehicle Type (2025-2032)

13.6. Middle East and Africa EV Battery Market Size and Forecast, By Capacity (2025-2032)

13.7. Middle East and Africa EV Battery Market Size and Forecast, By Method (2025-2032)

13.8. Middle East and Africa EV Battery Market Size and Forecast, By Lithium-ion Battery Component (2025-2032)

13.9. Middle East and Africa EV Battery Market Size and Forecast, by Country (2025-2032)

13.9.1. South Africa

13.9.2. GCC

13.9.3. Egypt

13.9.4. Nigeria

13.9.5. Rest of ME&A

14. South America EV Battery Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032)

14.1. South America EV Battery Market Size and Forecast, By Battery Type (2025-2032)

14.2. South America EV Battery Market Size and Forecast, By Battery Form Type (2025-2032)

14.3. South America EV Battery Market Size and Forecast, By Battery Form (2025-2032)

14.4. South America EV Battery Market Size and Forecast, By Vehicle Typer (2025-2032)

14.5. South America EV Battery Market Size and Forecast, By Propulsion (2025-2032)

14.6. South America EV Battery Market Size and Forecast, By Vehicle Type (2025-2032)

14.7. South America EV Battery Market Size and Forecast, By Capacity (2025-2032)

14.8. South America EV Battery Market Size and Forecast, By Method (2025-2032)

14.9. South America EV Battery Market Size and Forecast, By Lithium-ion Battery Component (2025-2032)

14.10. South America EV Battery Market Size and Forecast, by Country (2025-2032)

14.10.1. Brazil

14.10.2. Argentina

14.10.3. Colombia

14.10.4. Chile

14.10.5. Rest Of South America

15. Company Profile: Key Players

15.1. CALB (China Aviation Lithium Battery)

15.1.1. Company Overview

15.1.2. Business Portfolio

15.1.3. Financial Overview

15.1.4. SWOT Analysis

15.1.5. Strategic Analysis

15.1.6. Recent Development

15.2. Gotion High-Tech

15.3. EVE Energy

15.4. SVOLT Energy Technology

15.5. Sunwoda Electronic

15.6. Farasis Energy

15.7. Envision AESC

15.8. Tianjin Lishen Battery

15.9. REPT Battero (Zhejiang REPT)

15.10. Northvolt

15.11. A123 Systems

15.12. GS Yuasa Corporation

15.13. Hitachi Astemo

15.14. Microvast

15.15. WeLion New Energy

15.16. HiNa Battery Technology

15.17. E-One Moli Energy

15.18. Tesla (In-house Battery Manufacturing)

15.19. Clarios

15.20. Exide Industries

15.21. Electrovaya

15.22. ProLogium Technology

15.23. QuantumScape

15.24. Solid Power

16. Key Findings

17. Analyst Recommendations

18. EV Battery Market: Research Methodology