Camera Market (2026–2032) Market Size, Technology Shifts, Competitive Landscape, and Regional Analysis

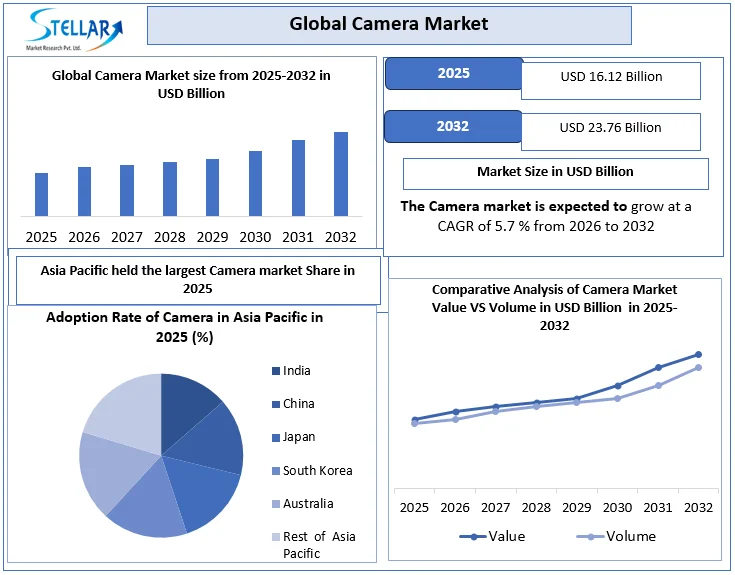

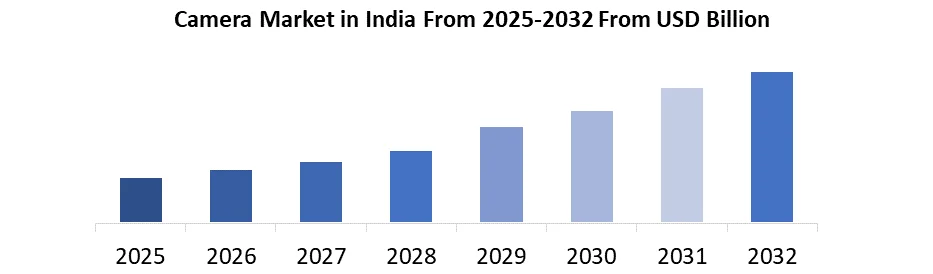

The Global Camera Market was valued at USD 16.12 billion in 2025 and is projected to reach USD 23.76 billion by 2032, growing at a CAGR of 5.7% during the forecast period (2026–2032). Market growth is driven by the transition toward mirrorless and hybrid imaging systems, increasing content creation, and rising adoption of cameras across security, healthcare, and professional imaging applications.

Format : PDF | Report ID : SMR_2894

Camera Market Overview

The camera market is undergoing a structural transition driven by technological convergence, shifting consumer behavior, and expanding non-consumer applications. While traditional DSLR demand remains stable in professional photography, the market is increasingly shaped by mirrorless systems, AI-enabled imaging, and specialized cameras for surveillance, healthcare, and industrial inspection.

Growth is further supported by rising digital content creation, improvements in sensor technology, and increasing integration of cameras into security infrastructure and smart devices. Asia Pacific remains the largest manufacturing and consumption hub, supported by strong electronics ecosystems and expanding surveillance deployments.

To get more Insights: Request Free Sample Report

- In 2025, Sony unveils its ultimate mirrorless lineup, including flagship models like the Alpha 1 II (50 MP, 8K video) and Alpha 9 III (full-frame global shutter, 120 fps), while introducing compact travel-friendly models such as the α7C II and ZV-E1 for creators, solidifying its dominance in high-performance, hybrid imaging systems.

Trend: Rise of Mirrorless & Hybrid Imaging Systems

Mirrorless cameras are increasingly replacing traditional DSLR systems due to their compact form factor, faster autofocus, and superior video performance. Advancements such as on-sensor phase-detection autofocus, in-body image stabilization (IBIS), and 4K–8K video recording are accelerating adoption among professionals and content creators.

In 2025, Sony strengthened its leadership by introducing advanced mirrorless models such as the Alpha 1 II (50 MP, 8K video) and Alpha 9 III featuring full-frame global shutter technology capable of 120 fps, alongside compact creator-focused models like the α7C II and ZV-E1. These launches underscore the industry’s transition toward high-performance hybrid imaging platforms.

Growth of Content Creation & Social Media to Boost Camera Market Growth

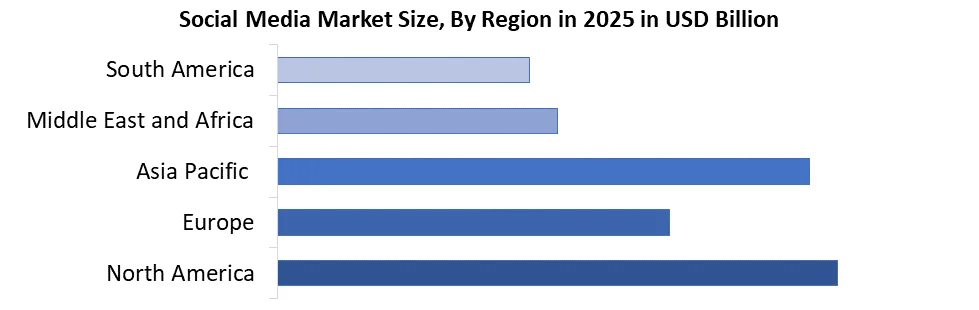

The rapid growth of content creation and social media consumption is a key demand driver for the camera market. According to SMR, 65.7% of the global population was active on social media in 2025, with brands posting an average of 9.5 times per day across platforms.

High-engagement platforms such as TikTok and Instagram have intensified demand for high-quality video content, driving adoption of mirrorless cameras, DSLR cameras, action cameras, and professional video systems. Content creators increasingly seek advanced autofocus, stabilization, and low-light performance, supporting sustained demand beyond smartphone cameras.

Camera Market Opportunity

Specialized Professional & Scientific Imaging Applications

Specialized professional and scientific imaging represents a high-value opportunity within the camera market. Advanced cameras are increasingly used in applications such as fluorescence imaging, gene sequencing, astronomical observation, and industrial diagnostics.

High-speed cameras capable of recording at up to 1,000,000 frames per second and resolutions reaching 4K are essential in research, defense testing, and precision manufacturing. Growing investment in biomedical research, materials science, and security surveillance continues to expand demand for specialized imaging solutions.

Camera Market Restraints

High Cost of Advanced Camera Equipment to Hamper Camera Market

The high cost of advanced camera equipment remains a key restraint for market growth. Premium mirrorless and DSLR cameras utilize high-end sensors, precision optics, and materials such as magnesium and aerospace-grade aluminum alloys, significantly increasing production costs.

Additionally, rapid technological advancements shorten product life cycles, discouraging long-term investment among hobbyists and small studios. These pricing pressures limit broader adoption, particularly in price-sensitive and emerging markets.

Table: Top 7 Most Expensive Cameras in the World 2025

|

Rank |

Camera Model |

Key Features |

|

1 |

Leica 0-Series No. 122 |

1923 rare model, collector's item |

|

2 |

Leica M10-P Safari Edition |

Olive green finish, quiet shutter, limited edition |

|

3 |

Hasselblad H6D-400C MS |

400-megapixel, multi-shot, precision |

|

4 |

Phase One XF IQ4 |

150-megapixel, high dynamic range, medium format |

|

5 |

Sony Alpha 1 |

50.1 MP, 30 fps, 8K video recording |

|

6 |

Canon EOS-1D X Mark III |

20.1 MP, 16 fps, advanced autofocus |

|

7 |

Nikon D6 |

20.8 MP, 14 fps, robust build, fast autofocus |

Camera Market Segment Analysis

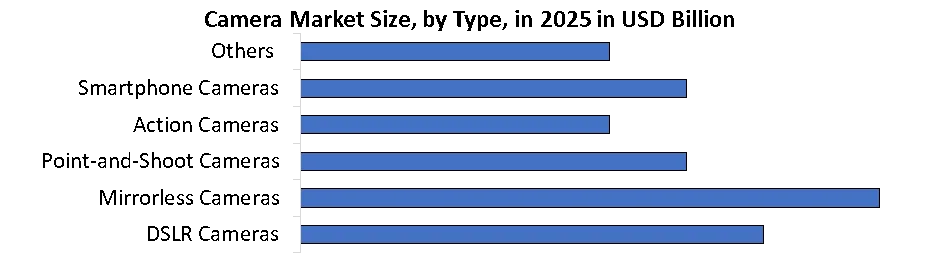

By type, DSLR cameras accounted for a significant share in 2025, supported by continued use in professional photography and institutional applications. However, mirrorless cameras represent the fastest-growing segment, driven by superior video capabilities and compact design.

Smartphone cameras contribute substantially in terms of unit volume but are analyzed separately due to integrated device economics and shorter replacement cycles.

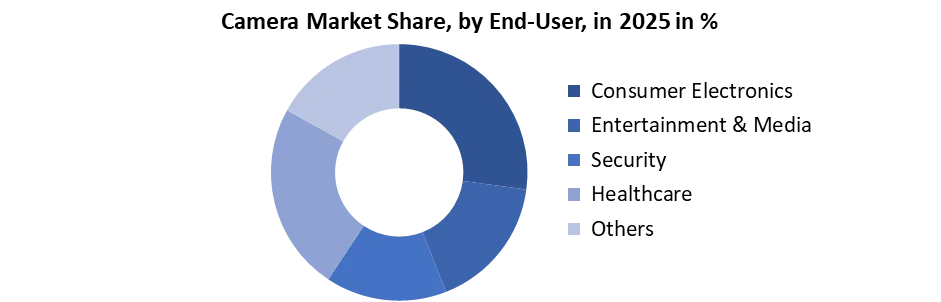

By End-User: Categorized into the Consumer Electronics, Entertainment & Media, Security, Healthcare and Others. Consumer Electronics is expected to dominate the Camera Market over the forecast period (2025-2032). Consumer electronics are driven by the growing demand for digital cameras, DSLR cameras, mirrorless cameras, and smartphone cameras. The rise of security cameras and CCTV cameras also bolsters the security and healthcare sectors. Camera players, such as Canon, Nikon, and Sony, focus on camera accessories, camera lenses, and digital camera reviews to meet consumer and professional needs.

Camera Market Regional Insights

Asia Pacific dominated the global camera market in 2025, driven by strong consumer electronics manufacturing, expanding surveillance deployments, and increasing participation in professional and recreational photography. The region benefits from high demand for DSLR, mirrorless, digital, and CCTV cameras, with continued growth expected due to infrastructure development and rising disposable incomes

Camera Market Competitive Landscape

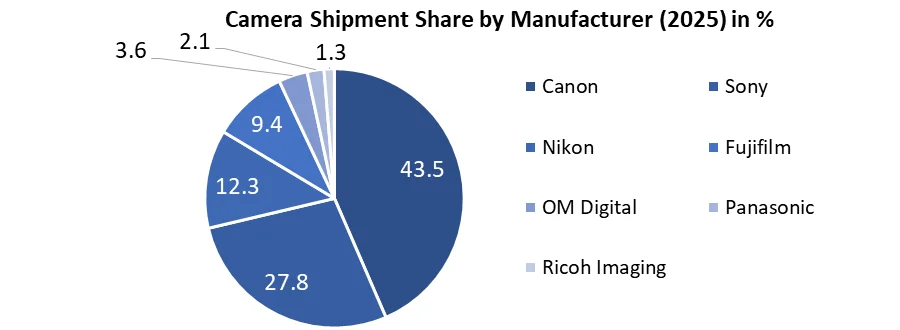

The Camera Market is highly competitive, led by Canon, Nikon, Sony, and Fujifilm. Key factors include innovation, product differentiation, and focus on DSLR, mirrorless cameras, security cameras, and accessories.

Nikon Corporation: In August 2025, Tamron expanded its 18-300mm f/3.5-6.3 Di III-A VC VXD travel zoom lens to Nikon Z DX and Canon RF-S mounts, offering an affordable all-in-one solution for APS-C users at $629.

Global Camera Market Scope

|

Global Camera Market |

|||

|

Report Coverage |

Details |

||

|

Base Year: |

2025 |

Forecast Period: |

2026-2032 |

|

Historical Data: |

2020 to 2025 |

Market Size in 2025: |

USD 16.12 Billion |

|

Forecast Period 2026 to 2032 CAGR: |

5.7% |

Market Size in 2032: |

USD 23.76 Billion |

|

Camera Market Segment Analysis |

By Type |

DSLR Cameras Mirrorless Cameras Point-and-Shoot Cameras Action Cameras Smartphone Cameras Others |

|

|

By Technology |

Digital Cameras Film Cameras 360-Degree Cameras Infrared Cameras Others |

||

|

By Connectivity |

Wi-Fi Enabled Cameras Bluetooth Cameras GPS Cameras |

||

|

By Application |

Personal Use Professional Photography Sports & Action Cameras Surveillance Cameras Medical Imaging Others |

||

|

By Distribution Channel |

Consumer Electronics Entertainment & Media Security Healthcare Others |

||

|

By Application |

Online Retail Offline Retail |

||

Camera Market Key Players

- Canon Inc.

- Nikon Corporation

- Sony Group Corporation

- Fujifilm Holdings Corporation

- Panasonic Corporation

- OM Digital Solutions Corporation

- Olympus Corporation

- Leica Camera AG

- Sigma Corporation

- GoPro

- Pentax

- Hasselblad

- Phase One

- DJI

- Samsung Electronics

- Huawei

- Blackmagic Design

- RED Digital Cinema

- Arri

- JVC

- Kodak

- Ricoh

- Zeiss

- Casio

- Acer

- Toshiba

- Sharp

- Benq

- Vivitar

Frequently Asked Questions

The report covers Type, technology, Connectivity, Application, End-User, Distribution Channel and Region.

Major restraints include the high cost of DSLR and mirrorless cameras, rapid technological advancements, and obsolescence, which deter long-term investments and accessibility for hobbyists.

Asia Pacific is expected to lead due to rising demand for DSLR cameras, mirrorless, smartphone cameras, and technological advancements, coupled with increasing consumer spending.

The Camera Market was valued at USD 16.12 Billion in 2025 and is expected to grow at a 5.7% CAGR, reaching USD 23.76 Billion by 2032.

1. Camera Market: Executive Summary

1.1. Executive Summary

1.1.1. Market Size (2025) & Forecast (2026-2032)

1.1.2. Market Size (Value in USD Billion and Volume in 000’Units) - By Segments, Regions, and Country

2. Camera Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Positioning of Key Players

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Headquarter

2.3.3. Product Segment

2.3.4. End User Segment

2.3.5. Total Company Revenue (2025)

2.3.6. Market Share (%)

2.3.7. Profit Margin (%)

2.3.8. Growth Rate (%)

2.3.9. Geographical Presence

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Mergers and Acquisitions Details

2.6. Recent Developments

2.7. Industry Ecosystem

3. Camera Market: Dynamics

3.1. Camera Market Trends

3.2. Camera Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Key Opinion Leader Analysis for the Camera Market

3.6. Analysis of Government Schemes for the Industry

4. Consumer Preferences and Behavior

4.1.1. Analysis of Consumer Demographics

4.1.1.1. Age Groups and Preferences

4.1.1.2. Income Levels and Spending Behavior

4.1.1.3. Geographic Variations in Camera Preferences

4.1.2. Consumer Purchase Decision-Making Process

4.1.3. Impact of Marketing and Advertising

4.1.4. Post-Purchase Behavior and Customer Satisfaction

5. Technology Trends and Innovations

5.1.1. Camera Sensor Technologies (CMOS, CCD)

5.1.2. AI and Machine Learning in Camera Features

5.1.3. Smart Cameras and IoT Integration

5.1.4. 5G and Camera Performance

5.1.5. Emerging Technologies in Surveillance Cameras

6. Regulatory Framework & Standards

6.1.1. Global Camera Regulations and Standards

6.1.2. Environmental Impact and Sustainability Considerations

6.1.3. Data Privacy and Security in Surveillance Cameras

6.1.4. Compliance with Cybersecurity Standards for Smart Cameras

7. Supply Chain and Distribution Network

7.1.1. Key Suppliers and Manufacturers in the Camera Market

7.1.2. Distribution Channels and Logistics Challenges

7.1.3. Impact of Global Supply Chain Issues on Camera Production

7.1.4. Role of Third-Party Distributors in Camera Sales

8. Camera Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032)

8.1. Camera Market Size and Forecast, By Type (2025-2032)

8.1.1. DSLR Cameras

8.1.2. Mirrorless Cameras

8.1.3. Point-and-Shoot Cameras

8.1.4. Action Cameras

8.1.5. Smartphone Cameras

8.1.6. Others

8.2. Camera Market Size and Forecast, By Technology (2025-2032)

8.2.1. Digital Cameras

8.2.2. Film Cameras

8.2.3. 360-Degree Cameras

8.2.4. Infrared Cameras

8.2.5. Others

8.3. Camera Market Size and Forecast, By Connectivity (2025-2032)

8.3.1. Wi-Fi Enabled Cameras

8.3.2. Bluetooth Cameras

8.3.3. GPS Cameras

8.4. Camera Market Size and Forecast, By Application (2025-2032)

8.4.1. Personal Use

8.4.2. Professional Photography

8.4.3. Sports & Action Cameras

8.4.4. Surveillance Cameras

8.4.5. Medical Imaging

8.4.6. Others

8.5. Camera Market Size and Forecast, By End-User (2025-2032)

8.5.1. Consumer Electronics

8.5.2. Entertainment & Media

8.5.3. Security

8.5.4. Healthcare

8.5.5. Others

8.6. Camera Market Size and Forecast, By Distribution Channel (2025-2032)

8.6.1. Online Retail

8.6.2. Offline Retail

8.7. Camera Market Size and Forecast, By Region (2025-2032)

8.7.1. North America

8.7.2. Europe

8.7.3. Asia Pacific

8.7.4. Middle East and Africa

8.7.5. South America

9. North America Camera Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032)

9.1. North America Camera Market Size and Forecast, by Type (2025-2032)

9.2. North America Camera Market Size and Forecast, by Technology (2025-2032)

9.3. North America Camera Market Size and Forecast, by Connectivity (2025-2032)

9.4. North America Camera Market Size and Forecast, by Application (2025-2032)

9.5. North America Camera Market Size and Forecast, by End-User (2025-2032)

9.6. North America Camera Market Size and Forecast, by Distribution Channel (2025-2032)

9.7. North America Camera Market Size and Forecast, by Country (2025-2032)

9.7.1. United States

9.7.2. Canada

9.7.3. Mexico

10. Europe Camera Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032)

10.1. Europe Camera Market Size and Forecast, by Type (2025-2032)

10.2. Europe Camera Market Size and Forecast, by Technology (2025-2032)

10.3. Europe Camera Market Size and Forecast, by Connectivity (2025-2032)

10.4. Europe Camera Market Size and Forecast, by Application (2025-2032)

10.5. Europe Camera Market Size and Forecast, by End-User (2025-2032)

10.6. Europe Camera Market Size and Forecast, by Distribution Channel (2025-2032)

10.7. Europe Camera Market Size and Forecast, By Country (2025-2032)

10.7.1. United Kingdom

10.7.2. France

10.7.3. Germany

10.7.4. Italy

10.7.5. Spain

10.7.6. Sweden

10.7.7. Russia

10.7.8. Rest of Europe

11. Asia Pacific Camera Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032)

11.1. Europe Camera Market Size and Forecast, by Type (2025-2032)

11.2. Europe Camera Market Size and Forecast, by Technology (2025-2032)

11.3. Europe Camera Market Size and Forecast, by Connectivity (2025-2032)

11.4. Europe Camera Market Size and Forecast, by Application (2025-2032)

11.5. Europe Camera Market Size and Forecast, by End-User (2025-2032)

11.6. Europe Camera Market Size and Forecast, by Distribution Channel (2025-2032)

11.7. Asia Pacific Camera Market Size and Forecast, by Country (2025-2032)

11.7.1. China

11.7.2. S Korea

11.7.3. Japan

11.7.4. India

11.7.5. Australia

11.7.6. Indonesia

11.7.7. Malaysia

11.7.8. Philippines

11.7.9. Thailand

11.7.10. Vietnam

11.7.11. Rest of Asia Pacific

12. Middle East and Africa Camera Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032)

12.1. Middle East and Africa Camera Market Size and Forecast, by Type (2025-2032)

12.2. Middle East and Africa Camera Market Size and Forecast, by Technology (2025-2032)

12.3. Middle East and Africa Camera Market Size and Forecast, by Connectivity (2025-2032)

12.4. Middle East and Africa Camera Market Size and Forecast, by Application (2025-2032)

12.5. Middle East and Africa Camera Market Size and Forecast, by End-User (2025-2032)

12.6. Middle East and Africa Camera Market Size and Forecast, by Distribution Channel (2025-2032)

12.7. Middle East and Africa Camera Market Size and Forecast, By Country (2025-2032)

12.7.1. South Africa

12.7.2. GCC

12.7.3. Nigeria

12.7.4. Rest of ME&A

13. South America Camera Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2025-2032)

13.1. South America Camera Market Size and Forecast, by Type (2025-2032)

13.2. South America Camera Market Size and Forecast, by Technology (2025-2032)

13.3. South America Camera Market Size and Forecast, by Connectivity (2025-2032)

13.4. South America Camera Market Size and Forecast, by Application (2025-2032)

13.5. South America Camera Market Size and Forecast, by End-User (2025-2032)

13.6. South America Camera Market Size and Forecast, by Distribution Channel (2025-2032)

13.7. South America Camera Market Size and Forecast, By Country (2025-2032)

13.7.1. Brazil

13.7.2. Argentina

13.7.3. Colombia

13.7.4. Chile

13.7.5. Rest of South America

14. Company Profile: Key Players

14.1. Canon Inc.

14.1.1. Company Overview

14.1.2. Business Portfolio

14.1.3. Financial Overview

14.1.4. SWOT Analysis

14.1.5. Strategic Analysis

14.2. Nikon Corporation

14.3. Sony Group Corporation

14.4. Fujifilm Holdings Corporation

14.5. Panasonic Corporation

14.6. OM Digital Solutions Corporation

14.7. Olympus Corporation

14.8. Leica Camera AG

14.9. Sigma Corporation

14.10. GoPro

14.11. Pentax

14.12. Hasselblad

14.13. Phase One

14.14. DJI

14.15. Samsung Electronics

14.16. Huawei

14.17. Blackmagic Design

14.18. RED Digital Cinema

14.19. Arri

14.20. JVC

14.21. Kodak

14.22. Ricoh

14.23. Zeiss

14.24. Casio

14.25. Acer

14.26. Toshiba

14.27. Sharp

14.28. Benq

14.29. Vivitar

15. Key Findings

16. Analyst Recommendations

17. Camera Market – Research Methodology