Cultivated Meat Market Global analysis and forecast for the period 2026-2032

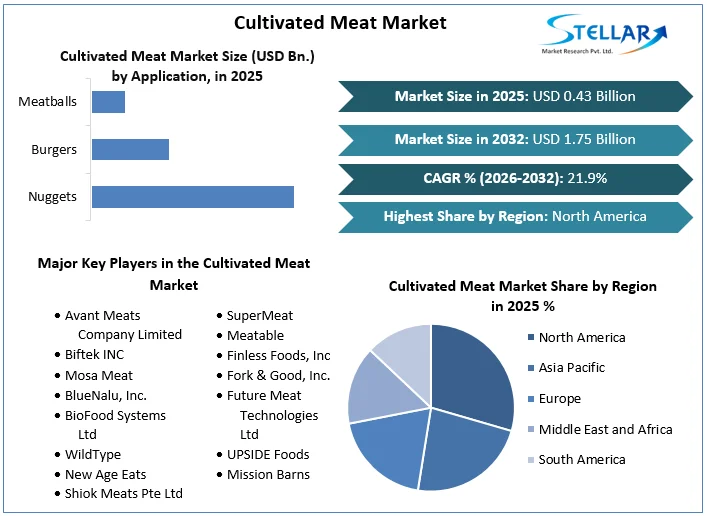

The Global Cultivated Meat Market was valued at US$ 0.43 Bn. in the year 2025 and is expected to reach US$ 1.75 Bn. by 2032 with a growing CAGR of 21.9% over the forecast period of 2026-2032.

Format : PDF | Report ID : SMR_2393

Cultivated Meat Market Overview:

Cultivated meat, also known as cultured meat, is genuine animal meat (including seafood and organ meats) that is produced by cultivating animal cells directly. This production method eliminates the need to raise and farm animals for food. Cultivated meat is made of the same cell types that can be arranged in the same or similar structure as animal tissues, thus replicating the sensory and nutritional profiles of conventional meat.

The cultivated meat market is revolutionizing the food industry by offering genuine animal meat products grown from cultivated animal cells, without the need for traditional animal farming. This innovative approach addresses various consumer concerns, including animal welfare, environmental sustainability, and ethical considerations related to meat production. Technological advancements, such as bioprinting and optimized cell growth techniques, are pivotal in replicating the texture, taste, and nutritional profiles of conventional meat. Companies like Aleph Farms and MeaTech are utilizing 3D bioprinting to create structured meat products, enhancing consumer acceptance by mimicking traditional meat cuts.

Regionally, North America leads the cultivated meat market, driven by environmental awareness and favourable regulatory frameworks. The Asia Pacific region is expected to experience a rapid compound annual growth rate.

In 2024, over 170 companies focused on cultivated meat up from 166 in 2022, with 88 additional companies involved through investments, partnerships, or dedicated business lines. In 2024, 10 new cultivated meat production facilities opened, with more announced or under construction. Believer Meats started building a 200,000-square-foot facility in North Carolina, totalling around 21 facilities globally. Major food companies expanded into cultivated meat and dairy. JBS began building a cultivated meat center in Brazil.

To get more Insights: Request Free Sample Report

Cultivated Meat Market Dynamics:

Cultivated Meat Market Trend:

Technological advancements in cultivated meat include bioprinting and cell growth optimization.

Bioprinting involves using 3D printing technology to create complex meat structures that replicate traditional cuts of meat. This process layers cultured cells to form tissues with a texture and appearance similar to conventional meat. By precisely controlling the placement of muscle, fat, and connective tissue, bioprinting can produce products that are more appealing to consumers.

- For instance, companies like Aleph Farms and MeaTech are leveraging 3D bioprinting to create steaks and other structured meat products, aiming to provide an authentic culinary experience. This technological innovation is significant because it addresses one of the major consumer concerns regarding cultivated meat texture. As bioprinting technology advances, it is expected to lead to broader acceptance and cultivated meat market growth.

Cell Growth Optimization involves improving the efficiency of cultivating meat cells through advancements in cell culture media and bioreactor design. Cell culture media, which provides the nutrients necessary for cell growth, is being refined to reduce costs and improve cell proliferation rates. Meanwhile, bioreactors, which are vessels used to grow cells in controlled environments, are becoming more sophisticated, allowing for better scalability and efficiency. Companies like Mosa Meat and Memphis Meats are pioneering these advancements. Improved cell growth techniques can significantly reduce production costs and time, making cultivated meat more economically viable and accessible. This optimization is crucial for scaling production to meet market demand, ultimately driving down prices and making cultivated meat a competitive alternative to conventional meat.

Cultivated Meat Market Driver:

Concerns for animal welfare are driving increased demand for non-slaughter meat alternatives such as cultivated meat.

Growing concerns about animal welfare and the ethical implications of meat consumption are pivotal in driving the demand for cultivated meat. Traditional livestock farming involves practices that many consumers find troubling, including cramped living conditions, routine use of antibiotics, and the slaughtering process itself. Cultivated meat, produced by cultivating animal cells in a controlled environment, offers a solution that avoids these ethical dilemmas.

This shift in consumer preferences is significantly impacting the cultivated meat market. As awareness of the suffering involved in conventional meat production rises, more people are seeking humane alternatives. This demand is not only influencing individual purchasing decisions but also encouraging food companies and restaurants to explore and invest in cultivated meat products.

- For instance, Eat Just's cultivated chicken, which was first approved for sale in Singapore, demonstrates how regulatory approval can drive market acceptance. Additionally, companies like Mosa Meat and Memphis Meats are working to scale up production and reduce costs, making cultivated meat more accessible to a broader audience.

Cultivated Meat Market Opportunity:

Investment and Partnerships in the Cultivated Meat Market.

The cultivated meat market is attracting substantial investment from venture capital firms, food tech accelerators, and established food companies. For example, companies like Memphis Meats and Mosa Meat have secured significant funding from investors, including Bill Gates, Richard Branson, and major food corporations like Tyson Foods and Cargill. These investments are crucial for driving research and development, scaling up production facilities, and reducing production costs. As a result, the market is seeing accelerated technological advancements and a quicker path to commercialization. Increased funding also supports regulatory approval processes, allowing companies to navigate complex food safety regulations more efficiently.

Strategic partnerships with food manufacturers, retailers, and restaurants are essential for the cultivated meat market to scale production and distribution. For instance, Future Meat Technologies partnered with Nestlé to explore cultivated meat applications, while JUST (now Eat Just) collaborated with restaurants to introduce cultivated chicken to consumers in Singapore. Such collaborations provide cultivated meat companies with the necessary infrastructure, market access, and consumer reach. By leveraging the established networks and expertise of traditional food companies, cultivated meat startups can more effectively market their products, ensuring broader consumer acceptance and penetration into mainstream food markets. These investment and partnership activities are pivotal in transforming the cultivated meat market from niche to mainstream, enhancing product availability, and driving market growth.

Cultivated Meat Market Challenge:

Scaling cultivated meat requires maintaining quality, optimizing bioreactors, and streamlining production for efficiency and consistency.

Scaling up production of cultivated meat from lab-scale to commercial-scale involves overcoming several technical and operational challenges. One key challenge is ensuring consistent quality throughout larger production volumes. In lab-scale settings, control over growth conditions and media composition is precise but harder to maintain at scale. Bioreactor technology must be optimized for large-scale operations to ensure efficient nutrient distribution and waste removal without compromising product quality. Successfully scaling production is crucial for meeting consumer demand and achieving cost competitiveness with traditional meat. Efficient scaling can lower production costs, making cultivated meat more accessible in the market. It also enables companies to fulfill larger orders and expand cultivated meat market reach, potentially disrupting the conventional meat industry.

- Example, Companies like Memphis Meats and Mosa Meat are pioneers in scaling cultivated meat production. Memphis Meats has focused on developing scalable bioreactor systems that support efficient cell growth and nutrient supply, critical for consistent quality at commercial levels. Mosa Meat has worked on optimizing cell culture techniques to achieve large-scale production capabilities, aiming to bring cultivated meat to market at competitive prices. Overcoming the scaling challenge is essential for cultivated meat to become a viable and sustainable alternative to traditional meat, impacting consumer choices and the broader food industry landscape.

Cultivated Meat Market Segment Analysis:

By Application, the Cultivated Meat Market is segmented into Nuggets, Burgers and Meatballs. Burgers held the largest market share at approximately XX% of revenue in 2025. The cultivated burger market is expected to see an increase in popularity as more consumers choose sustainable and ethical meat substitutes. Startups and important figures in the industry are exploring cultivated meat burgers as a way to lessen the environmental effects of conventional meat production, with hopes that this innovation will also help advance the sector.

It is estimated that the meatballs segment will experience the highest compound annual growth rate (CAGR) of 49.5% during the forecasted timeframe. Consumers buy large quantities of processed meat products like meatballs from supermarkets. Furthermore, the increasing recognition of the potential health advantages of lab-grown meats has expanded the customer market of the sector. The rising desire for clean meats and substitutes, along with the increasing popularity of meatballs, is expected to boost the cultivated meatball sector's expansion in the foreseeable future.

By Source, the Cultivated Meat Market is segmented into Poultry, Beef, Seafood and Pork. Poultry is the dominating segment in terms of revenue, accounting for more than XX% of the market share in 2025. In the last 50 years, there has been a rise in chicken consumption in North America. Over 8 billion chickens are killed for consumption in the U.S. annually, making it the most popular meat. Worldwide, over 50 billion chickens are annually bred for consumption. The increase in startups and new market players investing in cellular agriculture technology for creating poultry products is benefiting the growth of the poultry industry.

It is estimated that pork will experience a compounded annual growth rate (CAGR) of 56.3% between 2026 and 2032. The USDA categorizes pork as red meat and it is widely consumed globally. The rise in demand for pork alternatives was driven by the pandemic, shedding light on the risks and vulnerabilities of the animal-centric food supply chain. The growth of the pork industry is also credited to the rising amount of new and existing companies in the field exploring the use of cell-cultivated meat made from pig cells.

End user categorizes the global cultivated meat market into Household and Food Services. The market is dominated by the food services segment in 2025. Food services are increasingly looking to incorporate cultivated meat as a rising number of consumers are seeking plant-based and sustainable options. In addition, cultivated meat provides an opportunity to offer meat-like products that appeal to both meat-eaters and vegetarians/vegans, satisfying a broader customer base.

Moreover, many consumers are concerned about animal welfare and the ethical implications of meat production. Cultivated meat offers a solution by providing meat without the need for raising and slaughtering animals. Food services can capitalize on this by offering ethically produced meat alternatives. For instance, in August 2023, UPSIDE Foods, a cultivated meat, poultry, and seafood company opened the reservation at Bar Crenn. This is further expected to create a demand in the food services segment.

Cultivated Meat Market Regional Insights:

North America held the majority of the cultivated meat market with a percentage exceeding XX% in 2025. Rising interest in environmentally friendly meat and poultry options, along with the presence of major industry leaders in the area, is fueling the expansion. A number of U.S based companies like Fork & Goode and BlueNalu are gradually investing into cell-agriculture technologies to develop lab-grown meats in the area. Moreover, positive governmental regulations for lab-grown meat in the area are driving the need for synthetic chicken products. The USDA and FDA have jointly agreed to regulate the production of poultry and meat products derived from cultured cells of poultry and livestock.

The Asia Pacific region is expected to experience a rapid compound annual growth rate of 52.9% between 2026 and 2032. Factors like consistent meat consumption and increasing disposable income in the area are contributing to the market's growth. Per capita beef consumption increased in the Asia Pacific region, as reported by the Food and Agricultural Organization (FAO). Moreover, the increase in funding for lab-created seafood is fueling the expansion of the cultivated meat market. Furthermore, supportive governmental programs in locations like Singapore and China are aiding the expansion of the lab-grown meat sector.

Cultivated Meat Market Competitive Landscape:

Mosa Meat and Future Meat Technologies are prominent players in the cultivated meat market, both pioneering advancements in sustainable protein production. Mosa Meat gained initial recognition for introducing the world's first cultivated beef burger, showcasing their early leadership in the industry. Their strategy revolves around continual innovation and efficiency improvements in production processes to drive down costs and enhance scalability. Recent developments highlight their ongoing commitment to R&D, aimed at refining their product offerings and scaling up operations to meet growing demand for sustainable protein alternatives.

In contrast, Future Meat Technologies focuses on developing scalable production systems designed to bring cultivated meat to market at competitive prices. Their strategic focus includes leveraging advanced biotechnology and engineering to optimize production efficiency. Recent expansions in production capabilities and strategic partnerships underscore their efforts to accelerate market entry and establish a robust presence in the cultivated meat sector. Both companies share a commitment to technological innovation and cost-effective production methods, aiming to revolutionize the global food industry with sustainable, lab-grown meat alternatives.

Overall, Mosa Meat and Future Meat Technologies represent significant drivers of innovation in the cultivated meat market, each contributing unique strengths in product development, scalability, and market strategy to shape the future of sustainable food production.

Cultivated Meat Market Scope

|

Cultivated Meat Market |

|

|

Market Size in 2025 |

USD 0.43 Bn. |

|

Market Size in 2032 |

USD 1.75 Bn. |

|

CAGR (2026-2032) |

21.9% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Cultivated Meat Market Segments |

By Source Poultry Beef Seafood Pork |

|

By Application Nuggets Burgers Meatballs |

|

|

By End User Household Food Services |

|

|

Regional Scope |

North America (United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Russia, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa ( South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Cultivated Meat Market Key Players:

Biftek INC

Mosa Meat

BlueNalu, Inc.

BioFood Systems Ltd

WildType

New Age Eats

Shiok Meats Pte Ltd

Meatable

Finless Foods, Inc

Fork & Good, Inc.

Future Meat Technologies Ltd

UPSIDE Foods

Mission Barns

Frequently Asked Questions

North America is expected to dominate the Cultivated Meat Market during the forecast period.

The Cultivated Meat Market size is expected to reach USD 1.75 billion by 2032.

The major top players in the Cultivated Meat Market are Avant Meats Company Limited; Biftek INC; Mosa Meat; BlueNalu, Inc.; BioFood Systems Ltd ;WildType ; New Age Eats; Shiok Meats Pte Ltd; SuperMeat; Meatable; Finless Foods, Inc.; Fork & Good, Inc.; Future Meat Technologies Ltd; UPSIDE Foods; Mission Barns.

Growing Consumer Awareness and Demand for Sustainable Food, Animal Welfare Concerns, Regulatory Support and Approvals are the driving factors of Cultivated Meat Market.

1. Cultivated Meat Market: Research Methodology

2. Cultivated Meat Market: Executive Summary

3. Cultivated Meat Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Cultivated Meat Market: Dynamics

4.1. Market Driver

4.2. Market Trends

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Regulatory Landscape by Region

4.8.1. North America

4.8.2. Europe

4.8.3. Asia Pacific

4.8.4. Middle East and Africa

4.8.5. South America

5. Cultivated Meat Market Size and Forecast by Segments (by Value in USD Million)

5.1. Cultivated Meat Market Size and Forecast, by Source (2025-2032)

5.1.1. Poultry

5.1.2. Beef

5.1.3. Seafood

5.1.4. Pork

5.2. Cultivated Meat Market Size and Forecast, by End User (2025-2032)

5.2.1. Household

5.2.2. Food Services

5.3. Cultivated Meat Market Size and Forecast, by Application(2025-2032)

5.3.1. Nuggets

5.3.2. Burgers

5.3.3. Meatballs

5.4. Cultivated Meat Market Size and Forecast, by Region (2025-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Cultivated Meat Market Size and Forecast (by Value in USD Million )

6.1. North America Cultivated Meat Market Size and Forecast, by Source (2025-2032)

6.1.1. Poultry

6.1.2. Beef

6.1.3. Seafood

6.1.4. Pork

6.2. North America Cultivated Meat Market Size and Forecast, by End User (2025-2032)

6.2.1. Household

6.2.2. Food Services

6.3. North America Cultivated Meat Market Size and Forecast, by Application(2025-2032)

6.3.1. Nuggets

6.3.2. Burgers

6.3.3. Meatballs

6.4. North America Cultivated Meat Market Size and Forecast, by Country (2025-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Cultivated Meat Market Size and Forecast (by Value in USD Million )

7.1. Europe Cultivated Meat Market Size and Forecast, by Source (2025-2032)

7.1.1. Poultry

7.1.2. Beef

7.1.3. Seafood

7.1.4. Pork

7.2. Europe Cultivated Meat Market Size and Forecast, by End User (2025-2032)

7.2.1. Household

7.2.2. Food Services

7.3. Europe Cultivated Meat Market Size and Forecast, by Application(2025-2032)

7.3.1. Nuggets

7.3.2. Burgers

7.3.3. Meatballs

7.4. Europe Cultivated Meat Market Size and Forecast, by Country (2025-2032)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Cultivated Meat Market Size and Forecast (by Value in USD Million )

8.1. Asia Pacific Cultivated Meat Market Size and Forecast, by Source (2025-2032)

8.1.1. Poultry

8.1.2. Beef

8.1.3. Seafood

8.1.4. Pork

8.2. Asia Pacific Cultivated Meat Market Size and Forecast, by End User (2025-2032)

8.2.1. Household

8.2.2. Food Services

8.3. Asia Pacific Cultivated Meat Market Size and Forecast, by Application(2025-2032)

8.3.1. Nuggets

8.3.2. Burgers

8.3.3. Meatballs

8.4. Asia Pacific Cultivated Meat Market Size and Forecast, by Country (2025-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa Cultivated Meat Market Size and Forecast (by Value in USD Million)

9.1. Middle East and Africa Cultivated Meat Market Size and Forecast, by Source (2025-2032)

9.1.1. Poultry

9.1.2. Beef

9.1.3. Seafood

9.1.4. Pork

9.2. Middle East and Africa Cultivated Meat Market Size and Forecast, by End User (2025-2032)

9.2.1. Household

9.2.2. Food Services

9.3. Middle East and Africa Cultivated Meat Market Size and Forecast, by Application(2025-2032)

9.3.1. Nuggets

9.3.2. Burgers

9.3.3. Meatballs

9.4. Middle East and Africa Single-Use Filtration Assembly Market Size and Forecast, by Country (2025-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Cultivated Meat Market Size and Forecast (by Value in USD Million)

10.1. South America Cultivated Meat Market Size and Forecast, by Source (2025-2032)

10.1.1. Poultry

10.1.2. Beef

10.1.3. Seafood

10.1.4. Pork

10.2. South America Cultivated Meat Market Size and Forecast, by End User (2025-2032)

10.2.1. Household

10.2.2. Food Services

10.3. South America Cultivated Meat Market Size and Forecast, by Application(2025-2032)

10.3.1. Nuggets

10.3.2. Burgers

10.3.3. Meatballs

10.4. South America Cultivated Meat Market Size and Forecast, by Country (2025-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. Avant Meats Company Limited

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. GE Biftek INC

11.3. Mosa Meat

11.4. BlueNalu, Inc.

11.5. BioFood Systems Ltd

11.6. WildType

11.7. New Age Eats

11.8. Shiok Meats Pte Ltd

11.9. SuperMeat

11.10. Meatable

11.11. Finless Foods, Inc

11.12. Fork & Good, Inc.

11.13. Future Meat Technologies Ltd

11.14. UPSIDE Foods

11.15. Mission Barnss

12. Key Findings

13. Industry Recommendations