Credit Scoring Market Forecast (2025–2032): Trends, Growth and Opportunities

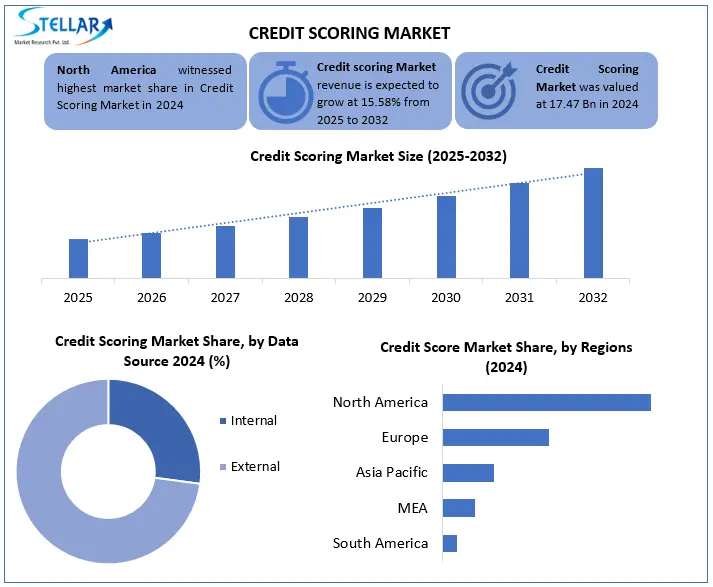

The Credit Scoring Market size was valued at USD 17.47 Bn in 2024 and the total Global Credit Scoring Market revenue is expected to grow at a CAGR of 15.58% from 2025 to 2032, reaching nearly USD 55.64 Bn by 2032.

Format : PDF | Report ID : SMR_2809

Credit Scoring Market Overview

Credit scoring refers to the industry that provides risk evaluation tools to evaluate the credibility of individuals or businesses. This includes reporting services used by scoring models, data analytics and loans, insurers and other financial institutions, which predict the possibility of loan repayment.

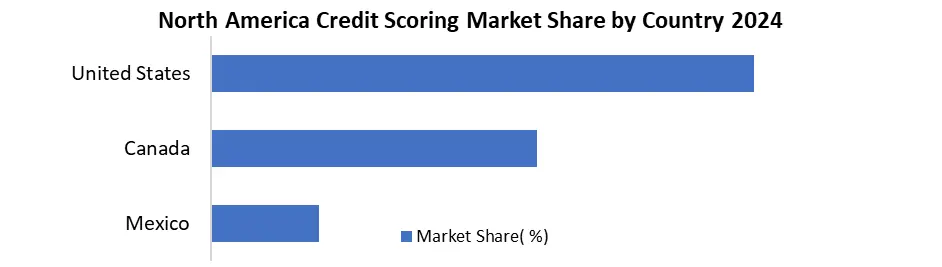

The credit scoring market is experiencing surging demand due to rising digital lending, fintech adoption, and regulatory pushes for financial inclusion, with 67% of lenders now using alternative data (Experian, 2024). United States dominates the global credit scoring market due to its advanced fintech ecosystem, high digital lending penetration, and widespread adoption of AI-driven scoring models. FICO, Experian, Equifax, TransUnion, Vantage Score, Upstart, etc are the major key players in the Credit scoring market. Consumers and businesses actively shape the credit scoring market by generating financial data (loan repayments, utility bills, BNPL usage) that feeds scoring models.

To get more Insights: Request Free Sample Report

Credit Scoring Market Dynamics

Adoption of Alternative Data & AI/ML Models to Boost the Credit Scoring Market

Adopting alternative data and AI/ML models leads to revolution in the credit scoring market by enabling more inclusive and accurate risk assessment. Traditional Credit Bureau excludes about 1.7 billion adults (World Bank, 2021) due to thin or no credit files, but alternative data such as utility payments, hire history, mobile wallet transactions, and even social media behaviour helps lenders evaluate these unqualified sections. The AI/ML models increase the forecast power by analysing the giant dataset, for example, the AI ??lending platform of the upstart reduces the defaults of up to 75% as compared to the traditional model (upstart, 2023), while the expansion boost users see the average FICOOI score of 13 points by incorporating telecom and utility payment.

Bias & Discrimination in Scoring Models to Restrain the Credit Scoring Market

Bias and discrimination in credit scoring models is a significant restraint, with 2024 data revealing persistent disparities. A Consumer Financial Protection Bureau (CFPB) report (2024) found that the AI-operated credit models equally denied black and Hispanic applicants 15–20% higher than white applicants with similar financial profiles. Meanwhile, the 2024 effect study of the upstart showed that while its AI model refused to prime borrowers, yet it demonstrated 5-8% racial bias interval in approval rates.

Blockchain for Decentralized Credit Histories to Create Opportunities in the Credit Scoring Market

Blockchain-based decentralized credit scoring is receiving traction in 2024 as a solution to financial inclusion and fraud reduction. According to the World Economic Forum's 2024 Digital Currency Governance Report, 37% of the central banks are now experimenting with the blockchain credit system, showing 20–30% improvement in loan approval rates for thin-filing borrowers in pilot programs. The DeFi Credit Sector has increased by 400% YoY, with protocol such as Credix and Centrifuge processing more than $ 1.2 billion in on-chain loans by Q2 2024 (Defi Pulse).

Credit Scoring Market Segment Analysis

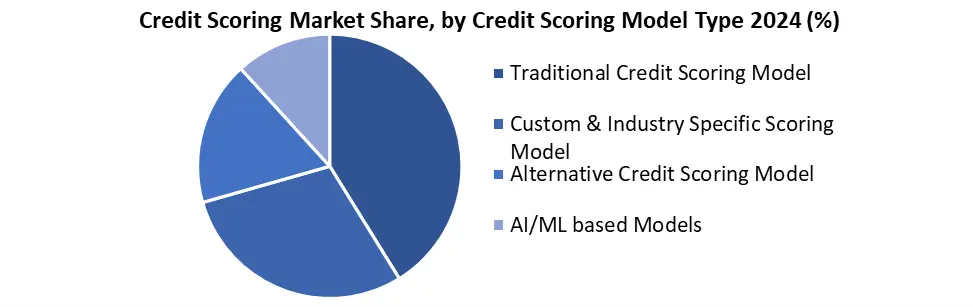

Based on Credit Scoring Model Type, the Credit Scoring Market is segmented into traditional credit scoring model, custom & industry specific scoring model, alternative credit scoring model and AI/ML based models. In 2024, traditional credit scoring models (mainly FICO and convenience score) continue to generate highest revenue in the credit scoring market. Traditional Credit Scoring Models (FICO/Vantage score) mainly maintain dominance due to regulatory entry and institutional inertia, as is documented by American agencies in 2024. The FHFA orders FICO scores for all government -backed mortgage (70%of US loans), while CFPB's enforcement framework explicitly favours traditional models in fair lending cases, creating legal safe harbours.

Based on Data Source, the Credit Scoring Market is segmented into internal and external data source. External data sources dominated the credit scoring market due to regulatory mandate, standardization and comprehensive risk coverage. Since 2024, the report of the government and the Central Bank states that 75% of the European Union Lenders (EBA) and 90% of the Indian Banks (RBI) rely on the external credit bureau (eg, Experian, Equifax) as PSD3 (EU) and RBI's rules and RBI make their use for loan approval. External data provides standardized, audible records in institutions, satisfying anti-mani laundering (AML) and fair lending laws (e.g., U.S. FCRA, GDPR of EU).

Based on the End-User, the credit scoring market is segmented into banks, non-banking financial companies, fintech companies, insurance companies, telecommunications providers, etc. Banks dominated the credit scoring market as the largest end-user segment in 2024, according to the Federal Reserve and European Central Bank for about 65% of the total industry revenue. This dominance stems from the compulsory use of the standardized credit scoring model of the mortgage (mainly FICO and convenience score), and credit cards (CFPB data per 90% per approval dependence) for core lending products.

Credit Scoring Market Regional Analysis

North America dominated the credit Scoring Market in 2024 and is expected to dominate during forecast period (2025-2032)

North America dominated the global credit scoring market due to its depth institutional credit reporting system and comprehensive regulatory structure. According to the US Consumer Financial Bureau (CFPB 2024), more than 90% of American adults have active credit files with major bureau (Experian, Equifax, TransUnion), while the European Union and Asia-Pacific (EBA 2024, RBI 2024) have just 40–60% coverage. This universal adoption requires a FICO score for CFPB enforcement of all government -backed mortgage (70%of US home loans) and Fair Credit Reporting Act (FCRA) from the FHFA mandate, which accepts data collection and dispute solutions.

Credit Scoring Market Competitive Landscape

In 2024, FICO acquired Zetta, a leading Brazilian fintech specializing in alternative credit scoring using non-traditional data such as utility payments, rental history, and e-commerce behaviour. This strategic move strengthens FICO’s Open Banking capabilities in South America, where 40% of the population lacks traditional credit histories. Zetta’s AI-driven platform, which already served over 200 lenders in Brazil, integrate with FICO’s Next-Gen Credit Scoring to enhance financial inclusion. The deal aligns with Brazil’s Open Finance initiative, which mandates data sharing among financial institutions, and positions FICO to dominate Brazil’s rapidly growing digital lending market.

Credit Scoring Market Key Developments

- In March 2025, Equifax debuts Real-Time Global Credit Network: Launched cross-border credit data sharing between US, UK, and Australia for expat borrowers.

- In January 2025, TransUnion launches TruIQ™ AI Platform: Rolled out next-gen AI-driven credit analytics, improving risk prediction accuracy by 18% for APAC lenders.

- In Nov 2024, CRIF acquires Egypt’s I-Score: Bought a strategic stake in Egypt’s premier credit bureau to strengthen MENA presence with hybrid scoring models.

- In September 2024, FICO partners with India’s Yubi: Integrated its scoring models with Yubi’s co-lending platform to serve 10M+ underserved Indian MSMEs.

- In May 2024, Experian acquires Credit Registry Nigeria: Expanded African footprint by taking a majority stake in Nigeria’s largest credit bureau to enhance alternative data scoring.

Credit Scoring Market Scope table

|

Credit Scoring Market Scope |

||

|

Market Size in 2024 |

17.47 Bn. |

|

|

Market Size in 2032 |

55.64 Bn. |

|

|

CAGR (2025-2032) |

15.58% |

|

|

Historic Data |

2019-2024 |

|

|

Base Year |

2024 |

|

|

Forecast Period |

2025-2032 |

|

|

Segments Analysis |

By Scoring Model Type Traditional Credit Scoring Model Custom & Industry Specific Scoring Model Alternative Credit Scoring Model AI/ML Based Models Others |

|

|

By Data Source Internal External |

||

|

By Deployment Mode On-premises Cloud-based |

||

|

By End-Use Banks Non-Banking Financial Companies Fintech Companies Insurance Companies Telecommunication Providers Others |

|

|

|

Regional Scope |

North America: United States, Canada, Mexico Europe: United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe Asia Pacific (APAC): China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC Middle East & Africa (MEA): South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA South America: Brazil, Argentina, Colombia, Chile, Peru, Rest of South America |

|

Credit Scoring Market Key Players

North America

- Fair Isaac Corporation (FICO) (US)

- VantageScore Solutions (US)

- Experian (US)

- Equifax (Canada)

- TransUnion (Canada)

- Buro de Crédito (BC) (Mexico)

Europe

- ClearScore (UK)

- Schufa (Germany)

- Creditsafe (France)

- United Credit Bureau (Russia)

- CRIF (Italy)

Asia Pacific

- People’s Bank of China (PBOC) Credit Reference Center (China)

- Japan Credit Bureau (JCB) (Japan)

- TransUnion CIBIL (India)

- Finosi (Vietnam)

- PT Pefindo Biro Kredit (Indonesia)

Middle East and Africa

- CRC Credit Bureau Limited (Nigeria)

- XDS Credit Bureau (Nigeria)

- Mojood (GCC)

- Emirates Credit Information Company (ECI) (GCC)

South America

- Serasa Experian (Brazil)

- Boa Vista SCPC (Brazil)

- Datacrédito (Colombia)

- CIFIN (Colombia)

Frequently Asked Questions

North America was the leading region in Credit Scoring Market in 2024.

Primary driver for the Credit Scoring Market includes Adoption of Alternative Data & AI/ML Models.

A significant challenge in the Credit Scoring Market is Bias & Discrimination in Scoring Models.

Fair Isaac Corporation (FICO), Vantage Score Solutions, Experian, Equifax, TransUnion, etc are the leading companies in the Credit Scoring Industry.

1. Credit Scoring Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Credit Scoring Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Headquarters

2.2.3. Service Segment

2.2.4. End-User Segment

2.2.5. Revenue (2024)

2.2.6. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Credit Scoring Market: Dynamics

3.1. Credit Scoring Market Trends

3.2. Credit Scoring Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Credit Scoring Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

4.1. Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

4.1.1. Traditional Credit Scoring Model

4.1.2. Custom & Industry Specific Scoring Model

4.1.3. Alternative Credit Scoring Model

4.1.4. AI/ML Based Models

4.1.5. Others

4.2. Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

4.2.1. Internal

4.2.2. External

4.3. Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

4.3.1. On-premises

4.3.2. Cloud-based

4.4. Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

4.4.1. Banks

4.4.2. Non-Banking Financial Companies

4.4.3. Fintech Companies

4.4.4. Insurance Companies

4.4.5. Telecommunication Providers

4.4.6. Others

4.5. Credit Scoring Market Size and Forecast, By Region (2024-2032)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. South America

5. North America Credit Scoring Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

5.1. North America Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

5.1.1. Traditional Credit Scoring Model

5.1.2. Custom & Industry Specific Scoring Model

5.1.3. Alternative Credit Scoring Model

5.1.4. AI/ML Based Models

5.1.5. Others

5.2. North America Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

5.2.1. Internal

5.2.2. External

5.3. North America Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

5.3.1. On-premises

5.3.2. Cloud-based

5.4. North America Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

5.4.1. Banks

5.4.2. Non-Banking Financial Companies

5.4.3. Fintech Companies

5.4.4. Insurance Companies

5.4.5. Telecommunication Providers

5.4.6. Others

5.5. North America Credit Scoring Market Size and Forecast, by Country (2024-2032)

5.5.1. United States

5.5.1.1. United States Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

5.5.1.1.1. Traditional Credit Scoring Model

5.5.1.1.2. Custom & Industry Specific Scoring Model

5.5.1.1.3. Alternative Credit Scoring Model

5.5.1.1.4. AI/ML Based Models

5.5.1.1.5. Others

5.5.1.2. United States Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

5.5.1.2.1. Internal

5.5.1.2.2. External

5.5.1.3. United States Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

5.5.1.3.1. On-premises

5.5.1.3.2. Cloud-based

5.5.1.4. United States Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

5.5.1.4.1. Banks

5.5.1.4.2. Non-Banking Financial Companies

5.5.1.4.3. Fintech Companies

5.5.1.4.4. Insurance Companies

5.5.1.4.5. Telecommunication Providers

5.5.1.4.6. Others

5.5.2. Canada

5.5.2.1. Canada Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

5.5.2.1.1. Traditional Credit Scoring Model

5.5.2.1.2. Custom & Industry Specific Scoring Model

5.5.2.1.3. Alternative Credit Scoring Model

5.5.2.1.4. AI/ML Based Models

5.5.2.1.5. Others

5.5.2.2. Canada Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

5.5.2.2.1. Internal

5.5.2.2.2. External

5.5.2.3. Canada Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

5.5.2.3.1. On-premises

5.5.2.3.2. Cloud-based

5.5.2.4. Canada Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

5.5.2.4.1. Banks

5.5.2.4.2. Non-Banking Financial Companies

5.5.2.4.3. Fintech Companies

5.5.2.4.4. Insurance Companies

5.5.2.4.5. Telecommunication Providers

5.5.2.4.6. Others

5.5.3. Mexico

5.5.3.1. Mexico Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

5.5.3.1.1. Traditional Credit Scoring Model

5.5.3.1.2. Custom & Industry Specific Scoring Model

5.5.3.1.3. Alternative Credit Scoring Model

5.5.3.1.4. AI/ML Based Models

5.5.3.1.5. Others

5.5.3.2. Mexico Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

5.5.3.2.1. Internal

5.5.3.2.2. External

5.5.3.3. Mexico Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

5.5.3.3.1. On-premises

5.5.3.3.2. Cloud-based

5.5.3.4. Mexico Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

5.5.3.4.1. Banks

5.5.3.4.2. Non-Banking Financial Companies

5.5.3.4.3. Fintech Companies

5.5.3.4.4. Insurance Companies

5.5.3.4.5. Telecommunication Providers

5.5.3.4.6. Others

6. Europe Credit Scoring Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

6.1. Europe Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

6.2. Europe Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

6.3. Europe Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

6.4. Europe Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

6.5. Europe Credit Scoring Market Size and Forecast, by Country (2024-2032)

6.5.1. United Kingdom

6.5.1.1. United Kingdom Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

6.5.1.2. United Kingdom Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

6.5.1.3. United Kingdom Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

6.5.1.4. United Kingdom Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

6.5.2. France

6.5.2.1. France Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

6.5.2.2. France Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

6.5.2.3. France Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

6.5.2.4. France Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

6.5.3. Germany

6.5.3.1. Germany Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

6.5.3.2. Germany Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

6.5.3.3. Germany Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

6.5.3.4. Germany Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

6.5.4. Italy

6.5.4.1. Italy Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

6.5.4.2. Italy Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

6.5.4.3. Italy Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

6.5.4.4. Italy Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

6.5.5. Spain

6.5.5.1. Spain Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

6.5.5.2. Spain Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

6.5.5.3. Spain Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

6.5.5.4. Spain Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

6.5.6. Sweden

6.5.6.1. Sweden Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

6.5.6.2. Sweden Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

6.5.6.3. Sweden Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

6.5.6.4. Sweden Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

6.5.7. Russia

6.5.7.1. Russia Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

6.5.7.2. Russia Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

6.5.7.3. Russia Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

6.5.7.4. Russia Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

6.5.8. Rest of Europe

6.5.8.1. Rest of Europe Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

6.5.8.2. Rest of Europe Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

6.5.8.3. Rest of Europe Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

6.5.8.4. Rest of Europe Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

7. Asia Pacific Credit Scoring Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

7.1. Asia Pacific Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

7.2. Asia Pacific Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

7.3. Asia Pacific Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

7.4. Asia Pacific Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

7.5. Asia Pacific Credit Scoring Market Size and Forecast, by Country (2024-2032)

7.5.1. China

7.5.1.1. China Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

7.5.1.2. China Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

7.5.1.3. China Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

7.5.1.4. China Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

7.5.2. S Korea

7.5.2.1. S Korea Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

7.5.2.2. S Korea Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

7.5.2.3. S Korea Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

7.5.2.4. S Korea Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

7.5.3. Japan

7.5.3.1. Japan Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

7.5.3.2. Japan Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

7.5.3.3. Japan Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

7.5.3.4. Japan Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

7.5.4. India

7.5.4.1. India Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

7.5.4.2. India Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

7.5.4.3. India Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

7.5.4.4. India Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

7.5.5. Australia

7.5.5.1. Australia Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

7.5.5.2. Australia Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

7.5.5.3. Australia Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

7.5.5.4. Australia Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

7.5.6. Indonesia

7.5.6.1. Indonesia Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

7.5.6.2. Indonesia Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

7.5.6.3. Indonesia Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

7.5.6.4. Indonesia Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

7.5.7. Malaysia

7.5.7.1. Malaysia Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

7.5.7.2. Malaysia Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

7.5.7.3. Malaysia Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

7.5.7.4. Malaysia Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

7.5.8. Philippines

7.5.8.1. Philippines Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

7.5.8.2. Philippines Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

7.5.8.3. Philippines Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

7.5.8.4. Philippines Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

7.5.9. Thailand

7.5.9.1. Thailand Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

7.5.9.2. Thailand Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

7.5.9.3. Thailand Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

7.5.9.4. Thailand Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

7.5.10. Vietnam

7.5.10.1. Vietnam Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

7.5.10.2. Vietnam Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

7.5.10.3. Vietnam Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

7.5.10.4. Vietnam Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

7.5.11. Rest of Asia Pacific

7.5.11.1. Rest of Asia Pacific Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

7.5.11.2. Rest of Asia Pacific Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

7.5.11.3. Rest of Asia Pacific Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

7.5.11.4. Rest of Asia Pacific Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

8. Middle East and Africa Credit Scoring Market Size and Forecast (by Value in USD Bn) (2024-2032)

8.1. Middle East and Africa Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

8.2. Middle East and Africa Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

8.3. Middle East and Africa Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

8.4. Middle East and Africa Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

8.5. Middle East and Africa Credit Scoring Market Size and Forecast, by Country (2024-2032)

8.5.1. South Africa

8.5.1.1. South Africa Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

8.5.1.2. South Africa Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

8.5.1.3. South Africa Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

8.5.1.4. South Africa Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

8.5.2. GCC

8.5.2.1. GCC Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

8.5.2.2. GCC Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

8.5.2.3. GCC Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

8.5.2.4. GCC Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

8.5.3. Egypt

8.5.3.1. Egypt Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

8.5.3.2. Egypt Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

8.5.3.3. Egypt Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

8.5.3.4. Egypt Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

8.5.4. Nigeria

8.5.4.1. Nigeria Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

8.5.4.2. Nigeria Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

8.5.4.3. Nigeria Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

8.5.4.4. Nigeria Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

8.5.5. Rest of ME&A

8.5.5.1. Rest of ME&A Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

8.5.5.2. Rest of ME&A Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

8.5.5.3. Rest of ME&A Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

8.5.5.4. Rest of ME&A Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

9. South America Credit Scoring Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032)

9.1. South America Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

9.2. South America Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

9.3. South America Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

9.4. South America Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

9.5. South America Credit Scoring Market Size and Forecast, by Country (2024-2032)

9.5.1. Brazil

9.5.1.1. Brazil Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

9.5.1.2. Brazil Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

9.5.1.3. Brazil Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

9.5.1.4. Brazil Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

9.5.2. Argentina

9.5.2.1. Argentina Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

9.5.2.2. Argentina Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

9.5.2.3. Argentina Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

9.5.2.4. Argentina Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

9.5.3. Colombia

9.5.3.1. Colombia Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

9.5.3.2. Colombia Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

9.5.3.3. Colombia Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

9.5.3.4. Colombia Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

9.5.4. Chile

9.5.4.1. Chile Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

9.5.4.2. Chile Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

9.5.4.3. Chile Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

9.5.4.4. Chile Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

9.5.5. Rest Of South America

9.5.5.1. Rest Of South America Credit Scoring Market Size and Forecast, By Scoring Model Type (2024-2032)

9.5.5.2. Rest Of South America Credit Scoring Market Size and Forecast, By Data Source (2024-2032)

9.5.5.3. Rest Of South America Credit Scoring Market Size and Forecast, By Deployment Mode (2024-2032)

9.5.5.4. Rest Of South America Credit Scoring Market Size and Forecast, By End-Use (2024-2032)

10. Company Profile: Key Players

10.1. Fair Isaac Corporation (FICO) (US)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Hy-Bon/EDI

10.3. AEREON Inc.

10.4. Cool Sorption

10.5. Patterson-Kelley

10.6. ProGAS

10.7. Parker Hannifin

10.8. Wärtsilä VOC Recovery

10.9. Dürr AG

10.10. VantageScore Solutions (US)

10.11. Experian (US)

10.12. Equifax (Canada)

10.13. TransUnion (Canada)

10.14. Buro de Crédito (BC) (Mexico)

10.15. ClearScore (UK)

10.16. Schufa (Germany)

10.17. Creditsafe (France)

10.18. United Credit Bureau (Russia)

10.19. CRIF (Italy)

10.20. People’s Bank of China (PBOC) Credit Reference Center (China)

10.21. Japan Credit Bureau (JCB) (Japan)

10.22. TransUnion CIBIL (India)

10.23. Finosi (Vietnam)

10.24. PT Pefindo Biro Kredit (Indonesia)

10.25. CRC Credit Bureau Limited (Nigeria)

10.26. XDS Credit Bureau (Nigeria)

10.27. Mojood (GCC)

10.28. Emirates Credit Information Company (ECI) (GCC)

10.29. Serasa Experian (Brazil)

10.30. Boa Vista SCPC (Brazil)

10.31. Datacrédito (Colombia)

10.32. CIFIN (Colombia)

11. Key Findings

12. Industry Recommendations

13. Credit Scoring Market: Research Methodology