Commercial Drone Market Industry Analysis and Forecast (2026-2032)

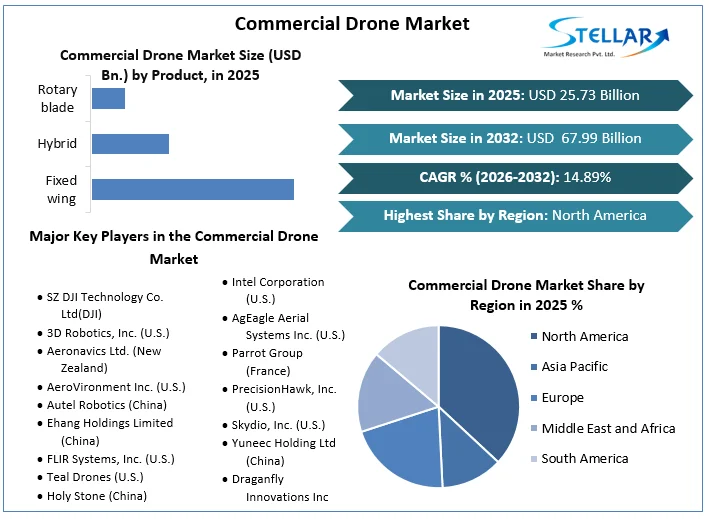

The global Commercial Drone Market size was valued at USD 25.73 Billion in 2025. The market is expected to grow at a CAGR of 14.89 % during the forecast period from 2026-2032, reaching nearly USD 67.99 Billion by 2032.

Format : PDF | Report ID : SMR_2463

Commercial Drone Market Overview

An unmanned vehicle used for commercial purpose is known as a commercial drone. That means builders who use drones to survey construction sites are commercial drone operators. Drones are used by commercially by Professional photographers who fix cameras to drones to take wedding photos or images for newspapers and magazines. Commercial drone operators are farmers, use drones to spray their crops. Commercial drone operations are carried out by the Retail stores that use unmanned aerial vehicles to deliver packages.

Commercial Drone market expected to grow during the forecast period of 2026-2032, driving by the factors like rising demand for for high-end commercial drones for films and photography as well as increased use of drones in delivery and surveys. Drones are used for variety of purpose such as film making and emergency response. These devices are also in high demand in the real estate and construction sectors because of their ability to survey the property, provide continuous accurate project alerts, boost safety and prevent hazardous accidents on construction sites. The past few years have seen a considerable increase in commercial drone market use cases. For market participants such as drone producers and software providers, designing, evaluating, and upgrading solutions for variety markets is a continuous process.

The market is divided into the regions like North America, Europe, Asia Pacific, Middle East and South America. North America dominated the market in 2024, due to the increasing use commercial drone for communication, as well as advancements in drone technology and application. Commercial Drone market in Asia pacific region is driving by the growth in drone production and operation companies across the region.

The SZ DJI Technology Co. Ltd (DJI), 3D Robotics, Inc. , Aeronavics Ltd., AeroVironment Inc., Yuneec Holding Ltd (China), Skydio, Inc., and others are the key players of the commercial drone market. Building companies uses Commercial drones to survey their construction sites, professional photographers use drones with high end cameras to take breath-taking photos that were previously not as easily accessible, and farmers are even using drones to spray crops.

To get more Insights: Request Free Sample Report

Commercial Drone Market Dynamics

Drivers

5G and cloud computing enhance drone efficiency, enabling real-time data, autonomous operations, and scalable fleet management

The integration of 5G delivery models and cloud computing technologies is significantly driving growth in the commercial drone market. The rise of 5G networks enhances the capabilities of drones by enabling real-time data transmission, low-latency communication, and more reliable connections over long distances. This allows for more advanced operations, such as remote monitoring, independent navigation, and HD video streaming, which are critical in industries like agriculture, logistics, and observation. Cloud computing facilitates the processing and storage of the large amounts of data collected by drones. By discharging rigorous computing tasks to the cloud, drones can operate more efficiently with reduced aboard hardware, leading to lighter designs and longer flight times. Moreover, cloud platforms enable adjustable and flexible management of drone fleets, supporting a variety of applications ranging from environmental monitoring to infrastructure surveys. This collaboration between 5G and cloud technologies not only enhances operational efficiency but also opens new approach for innovation and expansion within the commercial drone sector.

Rising demand, technological advancements, and regulatory compliance

The rising demand for commercial drones across various sectors, including supervision, construction, and agriculture, is driving market growth. Drones' ability to efficiently collect data has led to their increased use in the construction industry, further fueling market expansion. The development of drones that adhere to regulatory safety standards, reducing accident risks, is also boosting market growth. Additionally, an increased awareness of the need for skilled drone operators on job sites is driving growth. The demand for advanced, reliable drone designs is contributing to their broader utilization. The potential for drones to be utilized in the entertainment and healthcare industries is expected to further surge market growth in the coming years. Advancements in imaging technologies are anticipated to increase the demand for commercial drones in various high-end applications, supporting industry expansion. The integration of advanced technologies like artificial intelligence (AI) and machine learning (ML) into drones to automate operations, enhance safety, and improve efficiency is set to strengthen market growth. Furthermore, the trend towards smart mobility in drones, aimed at increasing their commercial accessibility, is projected to increase the commercial drone industry's growth shortly.

Opportunities

Advancements in drone technology, AI, and supportive regulations are enabling more advanced applications

Advances in drone technology, such as enhanced battery life, sensor capabilities, and AI integration, are driving more advanced applications across various industries, from aerial photography to accurate agriculture and infrastructure survey. Improved battery technology now allows drones to fly longer, covering larger areas and performing once silly tasks. Enhanced sensors, including LiDAR, high-resolution cameras, and thermal imaging, enable drones to take richer, more accurate data. AI integration further empowers drones to operate independently, handling difficult tasks with minimal human involvement and analyzing collected data to generate valuable business insights. Globally, governments are establishing regulations to safely integrate drone technology into airspace, providing operational frameworks, licensing, and air traffic management. These supportive regulations not only ensure safe drone operations beside manned aircraft but also create a more predictable environment for businesses, encouraging investment in drone technology and encouraging innovation in new commercial drone applications worldwide.

Challenges

The commercial drone market faces several significant challenges that could impact its growth and adoption. One of the primary challenges is the regulatory environment, which is still evolving and varies widely across different regions. Strict regulations, particularly around Beyond Visual Line of Sight (BVLOS) operations, limit the potential of drones in industries like logistics and large-scale survey. Airspace management is another major issue, as the increasing number of drones raises the risk of accident and needs the development of advanced traffic management systems. Security and privacy concerns are also growing, with drones capable of taking large amounts of data, leading to potential misuse and raising public and governmental survey. Additionally, while technological advancements are driving innovation, they also present obstacles related to cost and accessibility, high-end commercial drones and their associated technologies require significant investment, which can be hinder for smaller businesses. Finally, there is the challenge of integrating drones into existing workflows and ensuring they deliver a clear return on investment, which requires businesses to adapt and sometimes review their operational strategies. These challenges, if not properly addressed, could slow the market's growth and limit the broader adoption of commercial drones.

Commercial Drone Market Segment Analysis

By Technology

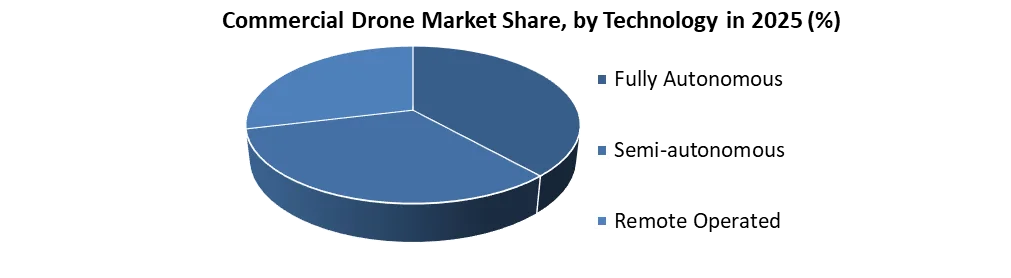

The fully autonomous segment dominated the Commercial Drone Market in 2025 and expected to grow fast during the forecasting period of 2026-2032. As fully autonomous operated drones can perform operations without any human help from take-off to landing, is expected to grow the, market. The use of artificial intelligence, on-board sensors, algorithms, these drones are capable of carrying out these operations fully autonomously. In addition, fully autonomous drones offer the potential for elastic operations. Fully autonomous drones present the possibility of expanding operations. Drones can be used in tandem to cover large areas, working in a coordinated pattern, and carry out essential operation like rescue missions and agriculture surveys, among others. The fully autonomous segment is expected to further fuel the market growth as a result of increasing demand for drones that can fly BVLOS.

The remotely piloted segment expected to grow during the forecasting period of 2026-2032, due to rise in use of applications where real-time human interfere is critical. This segment is characterized by drones that are piloted remotely by operators, often using advanced control systems that allow for accurate planning and decision-making in complex environments. The demand in this segment is driven by the need for high reliability and operational control, often in challenging or risky for environments where automation alone may not enough. As technology advances, this segment is expected to see continued growth, particularly with the integration of advanced features such as enhanced real-time data transmission and more automatic control interfaces.

By Application

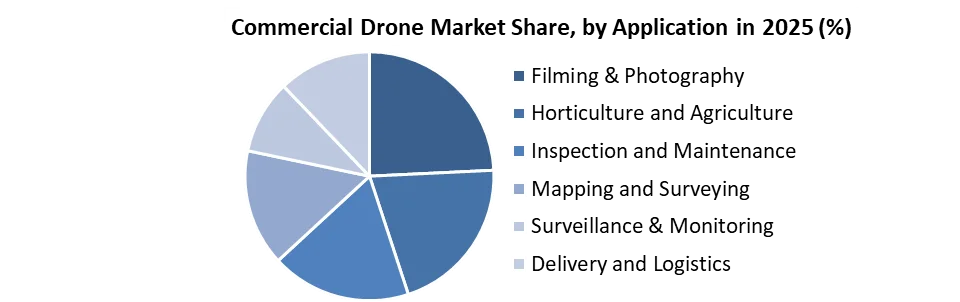

Based on application, film and photography segment is accounted for the largest market share driven by the increasing demand for aerial cinematography and photography, which has revolutionized content creation in both the entertainment and media industries. The ability to capture high-quality aerial footage with ease and at a fraction of the cost of traditional methods, such as helicopters, has made drones necessary in film production, advertising, and event coverage. Leading manufacturers like DJI, Parrot, and Autel Robotics dominate this segment, offering a range of products specifically needed for film and photography professionals.

The commercial drone market in the horticulture and agriculture segment is experiencing rapid growth due to the increasing demand for precision farming and efficient crop management techniques. Drones in this sector are primarily used for tasks such as crop monitoring, soil analysis, planting, irrigation management, and spraying pesticides or fertilizers. This segment's growth is also fueled by the rising awareness of sustainable farming practices and the need to address global food security challenges. Additionally, government support and favorable policies promoting the use of drones in agriculture are contributing to market expansion, particularly in regions like North America, Europe, and Asia-Pacific, where large-scale farming is prevalent.

Commercial Drone Market Regional Insights

North America dominated the commercial drone market with the largest market share in 2025 and is expected to dominate the global market during the forecast period of 2026-2032. The rise in the adoption of commercial drones and the presence of key players in the U.S. are anticipated to fuel market growth in the region. Presence of major existing and emerging market leaders in the region is expected to focus on market growth over the forecast period. The growth and early adoption of commercial drones in the region is supported by government regulations along with a strong presence of drone manufacturers and service providers. Further, it is widely adopted in agriculture for crop monitoring and in infrastructure for survey and maintenance.

- In Aug, 2023 Skydio announced a new family of drones for enterprise and government customers in Skydio X2, new enterprise software capabilities for Skydio 2 and X2, a $100M Series C fundraise, and new team members that bring world-class enterprise go-to-market expertise to Skydio.

Asia pacific region is expected to show the fastest grow during the forecasting period driving by the driven by technological advancements, increased government support, and a surge in demand across various industries. This region is becoming a critical hub for both the development and deployment of commercial drones, with diverse applications ranging from agriculture and infrastructure inspection to logistics and public safety. The region's large and varied agricultural sector is one of the primary drivers, particularly in countries like China, Japan, and India, where drones are increasingly used for crop monitoring, spraying, and precision farming. The region’s rapid urbanization and infrastructure development also fuel demand for drones in construction, surveying, and maintenance tasks. Governments in the Asia-Pacific region is playing a significant role in fostering the growth of the commercial drone market. China leads in this regard, not only as the largest market but also as a major manufacturer and exporter of drones. The Chinese government has implemented supportive policies and invested in drone technology, solidifying the country's position as a global leader. In India, recent regulatory reforms, including the liberalization of drone operations and the establishment of digital sky platforms for registration and flight approvals, have encouraged the adoption of drones in various sectors.

Commercial Drone Market Import- Export Analysis

Exports

China is the world's largest exporter of commercial drones, accounting for approximately 70-80% of global drone exports. In 2023, Chinese drone exports were valued at around USD 3.3 billion. DJI, a Chinese company, alone holds nearly 75% of the global commercial drone market share. The export volume from China is largely driven by consumer drones, although the country is increasingly exporting more advanced commercial drones used in industries like agriculture, construction, and logistics. The United States, while a leader in drone innovation, exported commercial drones’ worth approximately USD 400 million in 2023. The U.S. exports primarily focus on high-end commercial drones with specialized applications such as surveying, mapping, and industrial inspections. Companies like Skydio and Autel Robotics contribute to this export value.

Imports

The United States is one of the largest importers of commercial drones, with imports valued at approximately USD 1.2 billion in 2023. The majority of these imports come from China, given the dominance of Chinese manufacturers in the global market. The U.S. imports a wide range of drones, from consumer models to more advanced commercial systems used in sectors such as real estate, agriculture, and media production. European countries are major importers, with the combined import value across the EU reaching around USD 1.5 billion in 2023. Countries like the UK, Germany, and France are significant markets for imported drones, largely sourced from China. These imports are driven by the growing adoption of drones in sectors like agriculture, construction, and logistics. India is an emerging market for commercial drones, with imports valued at approximately USD 300 million in 2023. The Indian government has been progressively liberalizing drone regulations, leading to an increase in imports, particularly for applications in agriculture, infrastructure, and delivery services.

Commercial Drone Market Competitive landscape

The key players of the Commercial drone market are the SZ DJI Technology Co. Ltd (DJI), 3D Robotics, Inc. , Aeronavics Ltd., AeroVironment Inc., Yuneec Holding Ltd (China), Skydio, Inc., and others.

SZ DJI Technology Co. Ltd dominant player in the global drone market, known for its innovative technology and high-quality products and diverse product portfolio. DJI's focus on continuous innovation, such as advanced AI integration and superior imaging capabilities, further solidifies its leading position. Regulatory challenges and geopolitical tensions also pose risks, potentially impacting DJI's global operations and market strategy. Despite these challenges, DJI continues to lead through continuous innovation, strategic partnerships, and a strong focus on customer experience.

- In April 2024, DJI, a leading drone manufacturer, launched the Mavic 3 Pro, featuring advanced AI-powered obstacle avoidance and extended flight times. These technological advancements are aimed at enhancing the drone’s utility in professional settings, including mapping, surveying, and media production. This allows for better decision-making, improved planning, and proactive problem-solving, thus leading to higher adoption in the market.

Skydio is leading American drone manufacturer, design, assemble, and support drone for use in battleground situational awareness, policing, and survey. Skydio drones are designed for independent operation through the use of computer vision, and can complete fully independent missions with the use of a dock to automatically recharge the drone. Skydio also develops software applications for their drones.

- In February 2024, Skydio, partnered with Aeroarc, an Indian firm, to manufacture Unmanned Aerial Vehicles (UAVs) for defense customers in the Indo-Pacific region. This collaboration aimed to develop, manufacture, deploy, and support Small Uncrewed Aircraft Systems (SUAS) for the Indian defense ministry and other global defense customers.

|

Commercial Drone Market Scope |

|

|

Market Size in 2025 |

USD 25.73 Billion |

|

Market Size in 2032 |

USD 67.99 Billion |

|

CAGR (2026-2032) |

14.89 % |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Analysis |

By Product

|

|

By Technology

|

|

|

By Application

|

|

|

By Propulsion

|

|

|

By End user

|

|

|

By Range

|

|

|

By Weight

|

|

Key Regions

- North America (United States, Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Rest of Europe)

- Asia Pacific (China, S Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, Rest of Asia Pacific)

- Middle East and Africa (South Africa, GCC, Egypt, Nigeria, Rest of MEA)

- South America (Brazil, Mexico, Rest of South America)

Commercial Drone Market Key companies

- SZ DJI Technology Co. Ltd(DJI)

- 3D Robotics, Inc. (U.S.)

- Aeronavics Ltd. (New Zealand)

- AeroVironment Inc. (U.S.)

- Autel Robotics (China)

- Ehang Holdings Limited (China)

- FLIR Systems, Inc. (U.S.)

- Teal Drones (U.S.)

- Holy Stone (China)

- Intel Corporation (U.S.)

- AgEagle Aerial Systems Inc. (U.S.)

- Parrot Group (France)

- PrecisionHawk, Inc. (U.S.)

- Skydio, Inc. (U.S.)

- Yuneec Holding Ltd (China)

- Draganfly Innovations Inc

- Kespry Inc

- SenseFly SA

- Wingtra

Frequently Asked Questions

North America and Asia Pacific are key regions in the Commercial Drone market in 2025.

The SZ DJI Technology Co. Ltd (DJI), 3D Robotics, Inc. , Aeronavics Ltd., AeroVironment Inc., Yuneec Holding Ltd (China), Skydio, Inc., and others are the key players of the commercial drone market.

The Commercial Drone market size is USD 25.73 Billion in 2025.

1. Commercial Drone Market: Research Methodology

2. Commercial Drone Market: Competitive Landscape

2.1. Stellar Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Consolidation of the Market

3. Commercial Drone Market: Executive Summary

4. Commercial Drone Market: Dynamics

4.1. Market Drivers

4.2. Market Restraints

4.3. Market Opportunities

4.4. Market Challenges

4.5. Regulatory Landscape by Region

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. South America

5. Commercial Drone Market Size and Forecast by Segments (by Value USD Billion)

5.1. Commercial Drone Market Size and Forecast, by Product Type (2025-2032)

5.1.1. Fixed wing

5.1.2. Hybrid

5.1.3. Rotary blade

5.2. Commercial Drone Market Size and Forecast, by Technology (2025-2032)

5.2.1. Fully Autonomous

5.2.2. Semi-autonomous

5.2.3. Remote Operated

5.3. Commercial Drone Market Size and Forecast, by Application (2025-2032)

5.3.1. Filming & Photography

5.3.2. Horticulture and Agriculture

5.3.3. Inspection and Maintenance

5.3.4. Mapping and Surveying

5.3.5. Surveillance & Monitoring

5.3.6. Delivery and Logistics

5.3.7. Others

5.4. Commercial Drone Market Size and Forecast, by Propulsion (2025-2032)

5.4.1. Gasoline

5.4.2. Electric

5.4.3. Hybrid

5.5. Commercial Drone Market Size and Forecast, by End User (2025-2032)

5.5.1. Agriculture

5.5.2. Delivery & Logistics

5.5.3. Energy

5.5.4. Media & Entertainment

5.5.5. Real Estate & Construction

5.5.6. Security & Law Enforcement

5.5.7. Others

5.6. Commercial Drone Market Size and Forecast, by Range (2025-2032)

5.6.1. Visual Line of Sight (VLOS)

5.6.2. Extended Visual Line of Sight (EVLOS)

5.6.3. Beyond Visual Line of Sight (BVLOS)

5.7. Commercial Drone Market Size and Forecast, by Weight (2025-2032)

5.7.1. <2 Kg

5.7.2. 2 Kg – 25 kg

5.7.3. 25 Kg – 150 Kg

5.8. Commercial Drone Market Size and Forecast, by Region (2025-2032)

5.8.1. North America

5.8.2. Europe

5.8.3. Asia Pacific

5.8.4. Middle East and Africa

5.8.5. South America

6. North America Commercial Drone Market Size and Forecast (by Value USD Billion)

6.1. North America Commercial Drone Market Size and Forecast, by Product Type (2025-2032)

6.1.1. Fixed wing

6.1.2. Hybrid

6.1.3. Rotary blade

6.2. North America Commercial Drone Market Size and Forecast, by Technology (2025-2032)

6.2.1. Fully Autonomous

6.2.2. Semi-autonomous

6.2.3. Remote Operated

6.3. North America Commercial Drone Market Size and Forecast, by Application (2025-2032)

6.3.1. Filming & Photography

6.3.2. Horticulture and Agriculture

6.3.3. Inspection and Maintenance

6.3.4. Mapping and Surveying

6.3.5. Surveillance & Monitoring

6.3.6. Delivery and Logistics

6.3.7. Others

6.4. North America Commercial Drone Market Size and Forecast, by Propulsion (2025-2032)

6.4.1. Gasoline

6.4.2. Electric

6.4.3. Hybrid

6.5. North America Commercial Drone Market Size and Forecast, by End User (2025-2032)

6.5.1. Agriculture

6.5.2. Delivery & Logistics

6.5.3. Energy

6.5.4. Media & Entertainment

6.5.5. Real Estate & Construction

6.5.6. Security & Law Enforcement

6.5.7. Others

6.6. North America Commercial Drone Market Size and Forecast, by Range (2025-2032)

6.6.1. Visual Line of Sight (VLOS)

6.6.2. Extended Visual Line of Sight (EVLOS)

6.6.3. Beyond Visual Line of Sight (BVLOS)

6.7. North America Commercial Drone Market Size and Forecast, by Weight (2025-2032)

6.7.1. <2 Kg

6.7.2. 2 Kg – 25 kg

6.7.3. 25 Kg – 150 Kg

6.8. North America Commercial Drone Market Size and Forecast, by Country (2025-2032)

6.8.1. United States

6.8.2. Canada

6.8.3. Mexico

7. Europe Commercial Drone Market Size and Forecast (by Value USD Billion)

7.1. Europe Commercial Drone Market Size and Forecast, by Product Type (2025-2032)

7.1.1. Fixed wing

7.1.2. Hybrid

7.1.3. Rotary blade

7.2. Europe Commercial Drone Market Size and Forecast, by Technology (2025-2032)

7.2.1. Fully Autonomous

7.2.2. Semi-autonomous

7.2.3. Remote Operated

7.3. Europe Commercial Drone Market Size and Forecast, by Application (2025-2032)

7.3.1. Filming & Photography

7.3.2. Horticulture and Agriculture

7.3.3. Inspection and Maintenance

7.3.4. Mapping and Surveying

7.3.5. Surveillance & Monitoring

7.3.6. Delivery and Logistics

7.3.7. Others

7.4. Europe Commercial Drone Market Size and Forecast, by Propulsion (2025-2032)

7.4.1. Gasoline

7.4.2. Electric

7.4.3. Hybrid

7.5. Europe Commercial Drone Market Size and Forecast, by End User (2025-2032)

7.5.1. Agriculture

7.5.2. Delivery & Logistics

7.5.3. Energy

7.5.4. Media & Entertainment

7.5.5. Real Estate & Construction

7.5.6. Security & Law Enforcement

7.5.7. Others

7.6. Europe Commercial Drone Market Size and Forecast, by Range (2025-2032)

7.6.1. Visual Line of Sight (VLOS)

7.6.2. Extended Visual Line of Sight (EVLOS)

7.6.3. Beyond Visual Line of Sight (BVLOS)

7.7. Europe Commercial Drone Market Size and Forecast, by Weight (2025-2032)

7.7.1. <2 Kg

7.7.2. 2 Kg – 25 kg

7.7.3. 25 Kg – 150 Kg

7.8. Europe Commercial Drone Market Size and Forecast, by Country (2025-2032)

7.8.1. UK

7.8.2. France

7.8.3. Germany

7.8.4. Italy

7.8.5. Spain

7.8.6. Sweden

7.8.7. Austria

7.8.8. Rest of Europe

8. Asia Pacific Commercial Drone Market Size and Forecast (by Value USD Billion)

8.1. Asia Pacific Commercial Drone Market Size and Forecast, by Product Type (2025-2032)

8.1.1. Fixed wing

8.1.2. Hybrid

8.1.3. Rotary blade

8.2. Asia Pacific Commercial Drone Market Size and Forecast, by Technology (2025-2032)

8.2.1. Fully Autonomous

8.2.2. Semi-autonomous

8.2.3. Remote Operated

8.3. Asia Pacific Commercial Drone Market Size and Forecast, by Application (2025-2032)

8.3.1. Filming & Photography

8.3.2. Horticulture and Agriculture

8.3.3. Inspection and Maintenance

8.3.4. Mapping and Surveying

8.3.5. Surveillance & Monitoring

8.3.6. Delivery and Logistics

8.3.7. Others

8.4. Asia Pacific Commercial Drone Market Size and Forecast, by Propulsion (2025-2032)

8.4.1. Gasoline

8.4.2. Electric

8.4.3. Hybrid

8.5. Asia Pacific Commercial Drone Market Size and Forecast, by End User (2025-2032)

8.5.1. Agriculture

8.5.2. Delivery & Logistics

8.5.3. Energy

8.5.4. Media & Entertainment

8.5.5. Real Estate & Construction

8.5.6. Security & Law Enforcement

8.5.7. Others

8.6. Asia Pacific Commercial Drone Market Size and Forecast, by Range (2025-2032)

8.6.1. Visual Line of Sight (VLOS)

8.6.2. Extended Visual Line of Sight (EVLOS)

8.6.3. Beyond Visual Line of Sight (BVLOS)

8.7. Asia Pacific Commercial Drone Market Size and Forecast, by Weight (2025-2032)

8.7.1. <2 Kg

8.7.2. 2 Kg – 25 kg

8.7.3. 25 Kg – 150 Kg

8.8. Asia Pacific Commercial Drone Market Size and Forecast, by Country (2025-2032)

8.8.1. China

8.8.2. S Korea

8.8.3. Japan

8.8.4. India

8.8.5. Australia

8.8.6. Indonesia

8.8.7. Malaysia

8.8.8. Vietnam

8.8.9. Taiwan

8.8.10. Bangladesh

8.8.11. Pakistan

8.8.12. Rest of Asia Pacific

9. Middle East and Africa Commercial Drone Market Size and Forecast (by Value USD Billion)

9.1. Middle East and Africa Commercial Drone Market Size and Forecast, by Product Type (2025-2032)

9.1.1. Fixed wing

9.1.2. Hybrid

9.1.3. Rotary blade

9.2. Middle East and Africa Commercial Drone Market Size and Forecast, by Technology (2025-2032)

9.2.1. Fully Autonomous

9.2.2. Semi-autonomous

9.2.3. Remote Operated

9.3. Middle East and Commercial Drone Market Size and Forecast, by Application (2025-2032)

9.3.1. Filming & Photography

9.3.2. Horticulture and Agriculture

9.3.3. Inspection and Maintenance

9.3.4. Mapping and Surveying

9.3.5. Surveillance & Monitoring

9.3.6. Delivery and Logistics

9.3.7. Others

9.4. Middle East and Africa Commercial Drone Market Size and Forecast, by Propulsion (2025-2032)

9.4.1. Gasoline

9.4.2. Electric

9.4.3. Hybrid

9.5. Middle East and Africa Commercial Drone Market Size and Forecast, by End User (2025-2032)

9.5.1. Agriculture

9.5.2. Delivery & Logistics

9.5.3. Energy

9.5.4. Media & Entertainment

9.5.5. Real Estate & Construction

9.5.6. Security & Law Enforcement

9.5.7. Others

9.6. Middle East and Africa Commercial Drone Market Size and Forecast, by Range (2025-2032)

9.6.1. Visual Line of Sight (VLOS)

9.6.2. Extended Visual Line of Sight (EVLOS)

9.6.3. Beyond Visual Line of Sight (BVLOS)

9.7. Middle East and Africa Commercial Drone Market Size and Forecast, by Weight (2025-2032)

9.7.1. <2 Kg

9.7.2. 2 Kg – 25 kg

9.7.3. 25 Kg – 150 Kg

9.8. Middle East and Africa Commercial Drone Market Size and Forecast, by Country (2025-2032)

9.8.1. South Africa

9.8.2. GCC

9.8.3. Egypt

9.8.4. Nigeria

9.8.5. Rest of MEA

10. South America Commercial Drone Market Size and Forecast (by Value USD Billion)

10.1. South Commercial Drone Market Size and Forecast, by Product Type (2025-2032)

10.1.1. Fixed wing

10.1.2. Hybrid

10.1.3. Rotary blade

10.2. South America Commercial Drone Market Size and Forecast, by Technology (2025-2032)

10.2.1. Fully Autonomous

10.2.2. Semi-autonomous

10.2.3. Remote Operated

10.3. South America Commercial Drone Market Size and Forecast, by Application (2025-2032)

10.3.1. Filming & Photography

10.3.2. Horticulture and Agriculture

10.3.3. Inspection and Maintenance

10.3.4. Mapping and Surveying

10.3.5. Surveillance & Monitoring

10.3.6. Delivery and Logistics

10.3.7. Others

10.4. South America Commercial Drone Market Size and Forecast, by Propulsion (2025-2032)

10.4.1. Gasoline

10.4.2. Electric

10.4.3. Hybrid

10.5. South America Commercial Drone Market Size and Forecast, by End User (2025-2032)

10.5.1. Agriculture

10.5.2. Delivery & Logistics

10.5.3. Energy

10.5.4. Media & Entertainment

10.5.5. Real Estate & Construction

10.5.6. Security & Law Enforcement

10.5.7. Others

10.6. South America Commercial Drone Market Size and Forecast, by Range (2025-2032)

10.6.1. Visual Line of Sight (VLOS)

10.6.2. Extended Visual Line of Sight (EVLOS)

10.6.3. Beyond Visual Line of Sight (BVLOS)

10.7. South America Commercial Drone Market Size and Forecast, by Weight (2025-2032)

10.7.1. <2 Kg

10.7.2. 2 Kg – 25 kg

10.7.3. 25 Kg – 150 Kg

10.8. South America Commercial Drone Market Size and Forecast, by Country (2025-2032)

10.8.1. Brazil

10.8.2. Mexico

10.8.3. Rest of South America

11. Company Profile: Key players

11.1. SZ DJI Technology Co. Ltd(DJI)

11.1.1. Financial Overview

11.1.2. Business Portfolio

11.1.3. SWOT Analysis

11.1.4. Business Strategy

11.1.5. Recent Developments

11.2. 3D Robotics, Inc. (U.S.)

11.3. Aeronavics Ltd. (New Zealand)

11.4. AeroVironment Inc. (U.S.)

11.5. Autel Robotics (China)

11.6. Ehang Holdings Limited (China)

11.7. FLIR Systems, Inc. (U.S.)

11.8. Teal Drones (U.S.)

11.9. Holy Stone (China)

11.10. Intel Corporation (U.S.)

11.11. AgEagle Aerial Systems Inc. (U.S.)

11.12. Parrot Group (France)

11.13. PrecisionHawk, Inc. (U.S.)

11.14. Skydio, Inc. (U.S.)

11.15. Yuneec Holding Ltd (China)

11.16. Draganfly Innovations Inc

11.17. Kespry Inc

11.18. SenseFly SA

11.19. Wingtra

11.20. Others

12. Key Findings

13. Industry Recommendations