Chitosan Market - Global Industry Analysis and Forecast (2025-2032)

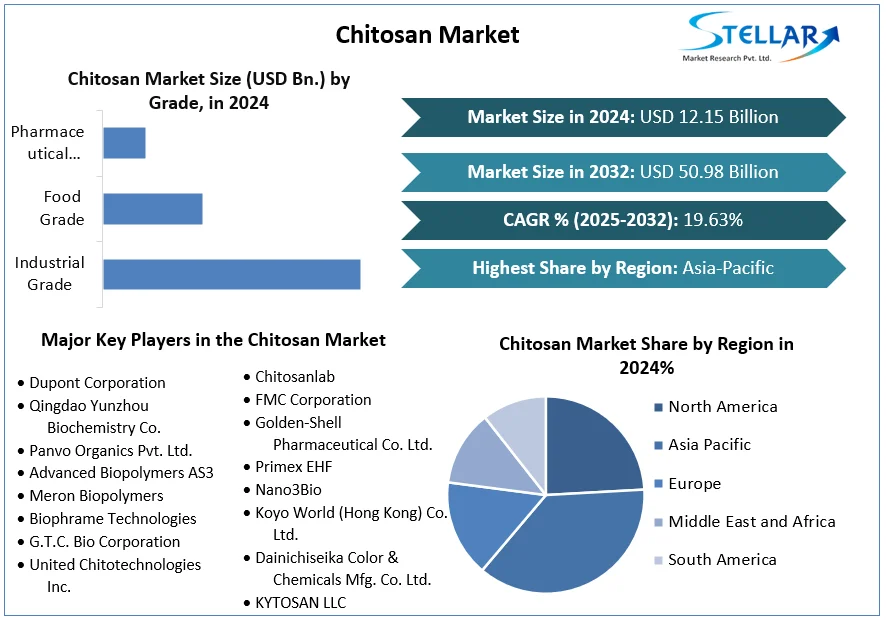

The global Chitosan Market size was valued at USD 12.15 Billion in 2024. The market is expected to grow at a CAGR of 19.63 % during the forecast period from 2025-2032, reaching nearly USD 50.98 Billion by 2032.

Format : PDF | Report ID : SMR_2458

Chitosan Market Overview

Chitosan is a sugar that comes from the outer shell of shellfish, including crab, lobster, and shrimp, which is used in medicine and drug manufacturing. Chitosan is a fibrous material that reduce fat and cholesterol of the body that absorbs from foods. It also helps blood clot when applied to wounds. People use chitosan for high blood pressure, high cholesterol, obesity, wound healing, and many other purposes.

The Chitosan market is expected to grow during the forecasting period of 2025-2032, due to the increasing demand for the cosmetics industry and rising usage of the wastewater management industry. The easy availability of its raw material, derived from waste product from the fishery industry, is one of the key factors driving chitosan demand. The growing demand for skin care products, especially among women and teenagers, is anticipated to have a positive impact on the product market during the forecast period.

The Chitosan market is divided into regions, such as North America, Europe, Asia Pacific, Middle East and Africa, and South America. Asia Pacific region dominated the chitosan market in 2024, due to the increasing demand for chitosan in aquaculture applications, such as shrimp farming and fish feed additives. North America is expected to hold a significant market share in the chitosan market because of its key players, rising demand for cosmetics in the US, and growing awareness of water treatment.

The major key players of the Chitosan marker are Dupont Corporation, Golden-Shell Pharmaceutical Co. Ltd., Primex EHF, Advanced Biopolymers AS, Heppe Medical Chitosan GmbH, G.T.C. Bio Corporation, and others. Pandalus borealis shrimp shells are the key ingredient in Primex’s products and the power for the chitosan factory, comes from the pure source of the North Atlantic Ocean.

The chitosan market is segmented into grade, source, application, and region. By source, the market is classified into shrimp, squid, crab, krill, and others. By grade, the market is segmented into industrial grade, food grade, and pharmaceutical grade. By application, the market is divided into water treatment, biomedical and pharmaceutical, cosmetics, food and beverage, and others. Chitosan can be used in veterinary medicine delivery to give antibiotics, anaesthetics, analgesics, antiparasitics, and other medications. Drug delivery, vaccine development, and diagnostics can all benefit from the usage of nanoparticles. Furthermore. Chitosan can help in replacing natural molecules for potentially toxic compounds, and boost the market growth of the chitosan market.

To get more Insights: Request Free Sample Report

Chitosan Market Dynamics

Drivers

Growing healthcare industry driving the market growth.

Chitosan plays an important role in biomedical applications because of its unique properties that make it perfect for a range of medical applications. Because of its biocompatibility and biodegradability, chitosan is safe to use in wound care. When applied, it not only boosts healing but also acts as a natural antibiotic, reducing the risk of infection. Its ability to form films and gels is very useful in creating dressings that maintain a moist wound environment, which is necessary for faster healing. Because of chitosan's mucoadhesive properties, a drug delivery system that can effectively adhere to mucosal surfaces has the potential to improve drug absorption and the bioavailability of medications. This holds particular importance in the development of controlled-release drug formulations, as chitosan can be customized to release drugs at a specific rate, improving therapeutic outcomes. The market for chitosan-based biomedical products is increasing because of the growing healthcare industry, particularly in developing regions where there is a growing investment in advanced medical technologies and infrastructure. The aging population and rising prevalence of chronic diseases are two further factors driving this adoption, as they both raise the need for innovative, effective medical treatments and devices. Ongoing research and development initiatives that continue to uncover new ways to use its properties for medical use, drive the Chitosan market growth significantly.

Increasing water treatment driving the market growth

Chitosan’s exceptional ability to bond with heavy metals, organic pollutants, and other impurities has made it a critical material in water treatment applications. The structure of chitosan, which has an amino group that can chelate or form complexes with metal ions, effectively removing them from water, provides the basis for this capacity. Chitosan is used as a natural clotting or soft in water purification processes, where it helps suspended particles aggregate and become easier to filter out. It is a useful method for maintaining clean and safe water supplies because of its efficiency in compelling a wide range of pollutants, such as dyes and other organic pollutants, as well as toxic metals like lead, mercury, and cadmium. The adoption of chitosan in water treatment is driven by the increasing strict environmental regulations all over the world. The demand for efficient and eco-friendly treatment solutions has increased as a result of Governments and regulatory bodies enforcing stricter limits on the allowable levels of pollutants in water, particularly in industrial effluents.

As chitosan offers a biodegradable and non-toxic alternative to traditional chemical treatments, industries such as mining, textile manufacturing, and wastewater treatment plants are increasingly turning to chitosan-based technologies to meet these regulatory requirements. Furthermore, the use of chitosan in water purification is being further pushed by the global emphasis on sustainable development and the protection of water resources. Effective water treatment systems that can collect and recycle water from diverse sources are becoming more and more necessary as freshwater shortage becomes a pressing issue in many regions of the world. Chitosan is an attractive option for governments and industries because of its ability to treat both industrial wastewater and drinking water in a way that is consistent with these global sustainability goals. The increasing awareness of chitosan's benefits in water treatment and the ongoing development of advanced chitosan-based filtration and adsorption technologies are expected to drive significant growth in this market segment.

Opportunities

Favorable regulatory frameworks and increasing awareness of its health benefits

The chitosan market is expected to increase significantly due to the favorable regulatory frameworks in developed countries and increasing awareness of its health benefits. Regulations are beginning to loosen and promote the use of chitosan in regions such as North America and Europe, as a result of regulatory bodies recognizing chitosan market potential in various applications, such as food additives, pharmaceuticals, and water treatment. Simultaneously, there is a growing demand for natural, sustainable, and bio-based products due to the consumer’s increased health-consciousness. Chitosan, which is made from chitin in crustacean shells, is becoming more and more common in nutritional supplements and nutraceuticals because it offers several health benefits, including improving digestive health, reducing cholesterol levels and promoting weight loss. This regulatory support and consumer awareness fosters a strong environment for the chitosan market to grow, offering significant opportunities for companies within this market.

Challenges

Lack of raw material availability hindering the market growth.

The availability of crustacean shells, mostly from shrimp, crabs, and other shellfish, is linked to the production of chitosan. These shells are a by-product of the seafood industry, and the market for the chitosan is significantly impacted by the seasonal and regional variations in their supply. Crustacean harvesting is frequently seasonal, impacted by several variables, including water temperature and pollution levels, and fishing regulations. Major crustacean shell-producing regions, such as Southeast Asia and parts of North America, experience fluctuations in supply due to natural changes like monsoons or overfishing, which reduce the availability of raw materials for chitosan production. Furthermore, the supply chain can disrupted by trade restrictions or geopolitical issues, which makes it difficult for manufacturers to maintain consistent production levels. These supply chain disruptions contribute to the increased costs, due to these manufacturers can seek alternative sources or invest in storage facilities to supply shells during periods of abundance. The consistency and efficiency of chitosan removal processes are impacted by the quality and type of crustacean shells, which can differ based on the region and species. Competition for raw materials from other industries, like manufacturing of fertilizer or animal feed, may also drive up prices further. Because of this, the chitosan industry remains dependent on the availability and cost of crustacean shells, which makes it necessary to carefully monitor the supply chain and consider diversification strategies to maintain long-term sustainability.

Chitosan Market Segment Analysis

Based on source, the market is segmented into shrimps, squid, prawns, crabs and others. The shrimp segment is expected to held the largest market share in 2024. Shrimps are in high demand in the market because the primary source of glucosamine is chitosan, which is derived from shrimp shells. Glucosamine is used in the treatment of osteoarthritis, joint pain and many other conditions. Chitosan is an environmentally friendly, biocompatible, and antibacterial polyelectrolyte biomaterial made from shrimp shells, which is used in chromatography, water treatment, and in cosmetics.

Based on application, the market is segmented into water treatment, medical & pharmaceutical, agrochemicals, cosmetics, food & beverage and others. The water treatment segment dominated the chitosan market in 2024, because of the wide use of chitosan in water treatment due to its properties such as biodegradability, bioactivity, biocompatibility, non-toxicity and adsorption. Chitosan has many attractive properties, such as hydrophobicity, biocompatibility, biodegradability, non-toxicity, and the presence of highly reactive amino (–NH2) and hydroxyl (–OH) groups in its pillar, making it an effective material that works well as an adsorbent to remove wastewater pollutants. Additionally, chitosan demand is expected to rise in the forecasting period as countries around the globe focus on wastewater treatment to minimize pollution.

Chitosan Market Import –Export Analysis

Chitosan imports are affected by the availability of raw materials, primarily derived from shrimp and crab shells. Countries lacking abundant marine resources, such as those in Europe and parts of Asia, heavily rely on imports to meet their demand. In 2024, United States imported around 560+ shipments of chitosan, primarily from Asian countries like China, Japan, and India. These countries have established themselves as leading suppliers due to their large fisheries and advanced extraction technologies.

Asia-Pacific region dominates the market in exports market of chitosan. The region's vast access to raw materials, combined with advanced extraction and processing technologies, has allowed countries like China, India, and Japan to become leading exporters. India exports most of its Chitosan to South Korea, Japan and Vietnam and is the 2nd largest exporter of Chitosan in the World. These exports primarily consist of specialized or higher-grade chitosan products used in niche applications such as biomedical and pharmaceutical industries. China, with its vast marine resources and developed processing facilities, is the largest exporter of chitosan. In 2024, China exported over 1400+ shipments of chitosan, accounting for nearly 40% of the global export volume. India and Japan follow as significant exporters, each contributing approximately 25% and 15% of the global exports, respectively.

Chitosan Market Regional Insights

Asia-Pacific region held the largest market share in 2024 and is expected to continue it during the forecasting period 2025-2032, due to the abundance of raw materials provided by coastal areas, raising demand for skin care products and organic farming. The use of chitosan in the aquaculture industry is one of the main factors driving the market growth in China. China is the world's largest producer of seafood and in the agriculture of shrimp and fish, chitosan is used as the natural alternative for antibiotics. The chitosan market is growing due to the increasing demand for organic farming in India. It has been demonstrated that chitosan, a natural fertilizer and soil conditioner, improves plant growth and increases crop yields. The use of chitosan in agriculture is expected to grow as increasing demand for organic produce continues to rise in India. The production of agricultural-grade chitosan is the primary focus of the major market players in Thailand. Growing investments in municipal wastewater treatment and the increasing use of bio-derived chemicals in the industry are expected to drive the demand during the forecast period.

North America is expected to show growth during the forecast period of 2025-2032, due to the rising awareness about water treatment, and growing demand for cosmetics. The increasing demand from various industries such as biomedical, pharmaceuticals, personal care, water and wastewater treatment, agricultural chemicals, and more are also driving the market growth in this region. In the coming years, the increasing demand for biocompatible and biodegradable materials is expected to drive Chitosan market growth. The market of chitosan has tremendous growth potential because of the region's growing obesity and overweight issues as well as the rise in health consciousness. A strong healthcare infrastructure and rising healthcare costs are also major factors driving the regional market growth. Moreover, the market has significantly contributed to the growing use of Chitosan as a food preservative and stabilizer. In addition, the growing use of Chitosan in juice clarification, beverage thickening, and food product packaging, is expected to drive the demand for chitosan in this region.

Chitosan Market Competitive Analysis

The major key players of the Chitosan marker are the Dupont Corporation, Golden-Shell Pharmaceutical Co. Ltd., Primex EHF, Advanced Biopolymers AS, Heppe Medical Chitosan GmbH, G.T.C. Bio Corporation, and others. DuPont Corporation is one of the leading companies in chemicals and materials sector, is positioning itself strategically in the chitosan market, which is gaining traction due to its applications in biomedicine, agriculture, and water treatment. As a company with a strong focus on innovation and sustainability, DuPont is leveraging its extensive research and development capabilities to explore novel uses of chitosan, particularly in creating bio-based and environmentally friendly solutions.

Primex EHF is a key player in the global chitosan market, particularly known for its focus on high-quality, sustainable products derived from marine sources. The company operates primarily in the pharmaceutical, agricultural, and cosmetic sectors, leveraging its Icelandic origins to highlight its commitment to environmentally friendly and traceable supply chains.

- On 4 July 2024 – Primex Iceland, a leading marine biotechnology company focused on innovative wound healing solutions, has announced the publication of full clinical trial results of its proprietary ChitoCare medical Wound Healing Gel in the British Medical Journal (BMJ) Open Diabetes Research & Care.

|

Chitosan Market Scope |

|

|

Market Size in 2024 |

USD 12.15 Billion |

|

Market Size in 2032 |

USD 50.98 Billion |

|

CAGR (2025-2032) |

19.63 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Grade

|

|

By Source

|

|

|

By Application

|

|

Key Regions

- North America (United States, Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Rest of Europe)

- Asia Pacific (China, S Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, Rest of Asia Pacific)

- Middle East and Africa (South Africa, GCC, Egypt, Nigeria, Rest of MEA)

- South America (Brazil, Mexico, Rest of South America)

Key Players

- Dupont Corporation

- Qingdao Yunzhou Biochemistry Co.

- Panvo Organics Pvt. Ltd.

- Advanced Biopolymers AS3

- Meron Biopolymers

- Biophrame Technologies

- G.T.C. Bio Corporation

- United Chitotechnologies Inc.

- Heppe Medical Chitosan GmbH

- KitoZyme S.A.

- Foodchem International Corporation

- Chitosanlab

- FMC Corporation

- Golden-Shell Pharmaceutical Co. Ltd.

- Primex EHF

- Nano3Bio

- Koyo World (Hong Kong) Co. Ltd.

- Dainichiseika Color & Chemicals Mfg. Co. Ltd.

- KYTOSAN LLC

- Agratech International, Inc.

- Novamatrix,

- Vietnam Food

Frequently Asked Questions

Dupont Corporation, Golden-Shell Pharmaceutical Co. Ltd., Advanced Biopolymers AS, Heppe Medical Chitosan GmbH, G.T.C. Bio Corporation and others are the key major players of the Chitosan Market

) The global Chitosanmarket is expected to grow with a CAGR of 19.63 % over the forecast period.

Ans) Asia Pacific is the leading region of the Chitosan market with the largest market share in 2024.

1. Chitosan Market: Research Methodology

2. Chitosan Market: Competitive Landscape

2.1. Stellar Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Consolidation of the Market

3. Chitosan Market: Dynamics

3.1. Market Trends

3.2. Market Drivers

3.3. Market Restraints

3.4. Market Opportunities

3.5. Market Challenges

3.6. Regulatory Landscape by Region

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Middle East and Africa

3.6.5. South America

3.7. Porter and pestle analysis

4. Chitosan Market Size and Forecast by Segments (by Value USD Billion)

4.1. Chitosan Market Size and Forecast, by Grade Type (2024-2032)

4.1.1. Industrial Grade

4.1.2. Food Grade

4.1.3. Pharmaceutical Grade

4.2. Chitosan Market Size and Forecast, by Source (2024-2032)

4.2.1. Shrimps

4.2.2. Squid

4.2.3. Prawns

4.2.4. Crabs

4.2.5. Other Sources

4.3. Chitosan Market Size and Forecast, by Application (2024-2032)

4.3.1. Water Treatment

4.3.2. Medical & Pharmaceutical

4.3.3. Agrochemicals

4.3.4. Cosmetics

4.3.5. Food & Beverage

4.3.6. Others

4.4. Chitosan Market Size and Forecast, by Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Chitosan Market Size and Forecast (by Value USD Billion)

5.1. North America Chitosan Market Size and Forecast, by Grade Type (2024-2032)

5.1.1. Industrial Grade

5.1.2. Food Grade

5.1.3. Pharmaceutical Grade

5.2. North America Chitosan Market Size and Forecast, by Source (2024-2032)

5.2.1. Shrimps

5.2.2. Squid

5.2.3. Prawns

5.2.4. Crabs

5.2.5. Other Sources

5.3. North America Chitosan Market Size and Forecast, by Application (2024-2032)

5.3.1. Water Treatment

5.3.2. Medical & Pharmaceutical

5.3.3. Agrochemicals

5.3.4. Cosmetics

5.3.5. Food & Beverage

5.3.6. Others

5.4. North America Chitosan Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.2. Canada

5.4.3. Mexico

6. Europe Chitosan Market Size and Forecast (by Value USD Billion)

6.1. Europe Chitosan Market Size and Forecast, by Grade Type (2024-2032)

6.1.1. Industrial Grade

6.1.2. Food Grade

6.1.3. Pharmaceutical Grade

6.2. Europe Chitosan Market Size and Forecast, by Source (2024-2032)

6.2.1. Shrimps

6.2.2. Squid

6.2.3. Prawns

6.2.4. Crabs

6.2.5. Other Sources

6.3. Europe Chitosan Market Size and Forecast, by Application (2024-2032)

6.3.1. Water Treatment

6.3.2. Medical & Pharmaceutical

6.3.3. Agrochemicals

6.3.4. Cosmetics

6.3.5. Food & Beverage

6.3.6. Others

6.4. Europe Chitosan Market Size and Forecast, by Country (2024-2032)

6.4.1. UK

6.4.2. France

6.4.3. Germany

6.4.4. Italy

6.4.5. Spain

6.4.6. Sweden

6.4.7. Austria

6.4.8. Rest of Europe

7. Asia Pacific Chitosan Market Size and Forecast (by Value USD Billion)

7.1. Asia Pacific Chitosan Market Size and Forecast, by Grade Type (2024-2032)

7.1.1. Industrial Grade

7.1.2. Food Grade

7.1.3. Pharmaceutical Grade

7.2. Asia Pacific Chitosan Market Size and Forecast, by Source (2024-2032)

7.2.1. Shrimps

7.2.2. Squid

7.2.3. Prawns

7.2.4. Crabs

7.2.5. Other Sources

7.3. Asia Pacific Chitosan Market Size and Forecast, by Application (2024-2032)

7.3.1. Water Treatment

7.3.2. Medical & Pharmaceutical

7.3.3. Agrochemicals

7.3.4. Cosmetics

7.3.5. Food & Beverage

7.3.6. Others

7.4. Asia Pacific Chitosan Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.2. S Korea

7.4.3. Japan

7.4.4. India

7.4.5. Australia

7.4.6. Indonesia

7.4.7. Malaysia

7.4.8. Vietnam

7.4.9. Taiwan

7.4.10. Bangladesh

7.4.11. Pakistan

7.4.12. Rest of Asia Pacific

8. Middle East and Africa Chitosan Market Size and Forecast (by Value USD Billion)

8.1. Middle East and Africa Chitosan Market Size and Forecast, by Grade Type (2024-2032)

8.1.1. Industrial Grade

8.1.2. Food Grade

8.1.3. Pharmaceutical Grade

8.2. Middle East and Africa Chitosan Market Size and Forecast, by Source (2024-2032)

8.2.1. Shrimps

8.2.2. Squid

8.2.3. Prawns

8.2.4. Crabs

8.2.5. Other Sources

8.3. Middle East and Africa Chitosan Market Size and Forecast, by Application (2024-2032)

8.3.1. Water Treatment

8.3.2. Medical & Pharmaceutical

8.3.3. Agrochemicals

8.3.4. Cosmetics

8.3.5. Food & Beverage

8.3.6. Others

8.4. Middle East and Africa Chitosan Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.2. GCC

8.4.3. Egypt

8.4.4. Nigeria

8.4.5. Rest of MEA

9. South America Chitosan Market Size and Forecast (by Value USD Billion)

9.1. South America Chitosan Market Size and Forecast, by Grade Type (2024-2032)

9.1.1. Industrial Grade

9.1.2. Food Grade

9.1.3. Pharmaceutical Grade

9.2. South America Chitosan Market Size and Forecast, by Source (2024-2032)

9.2.1. Shrimps

9.2.2. Squid

9.2.3. Prawns

9.2.4. Crabs

9.2.5. Other Sources

9.3. South America Chitosan Market Size and Forecast, by Application (2024-2032)

9.3.1. Water Treatment

9.3.2. Medical & Pharmaceutical

9.3.3. Agrochemicals

9.3.4. Cosmetics

9.3.5. Food & Beverage

9.3.6. Others

9.4. South America Chitosan Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.2. Mexico

9.4.3. Rest of South America

10. Company Profile: Key players

10.1. Dupont Corporation

10.1.1. Financial Overview

10.1.2. Business Portfolio

10.1.3. SWOT Analysis

10.1.4. Business Strategy

10.1.5. Recent Developments

10.2. Qingdao Yunzhou Biochemistry Co.

10.3. Panvo Organics Pvt. Ltd.

10.4. Advanced Biopolymers AS3

10.5. Meron Biopolymers

10.6. Biophrame Technologies

10.7. United Chitotechnologies Inc.

10.8. Heppe Medical Chitosan GmbH

10.9. KitoZyme S.A.

10.10. Foodchem International Corporation

10.11. Chitosanlab

10.12. FMC Corporation

10.13. Golden-Shell Pharmaceutical Co. Ltd.

10.14. Primex EHF

10.15. Nano3Bio

10.16. Koyo World (Hong Kong) Co. Ltd.

10.17. Dainichiseika Color & Chemicals Mfg. Co. Ltd.

10.18. KYTOSAN LLC

10.19. Agratech International, Inc.

10.20. Novamatrix

10.21. G.T.C. Bio Corporation

10.22. Vietnam Food

11. Key Findings

12. Industry Recommendations