Car Insurance Aggregator Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

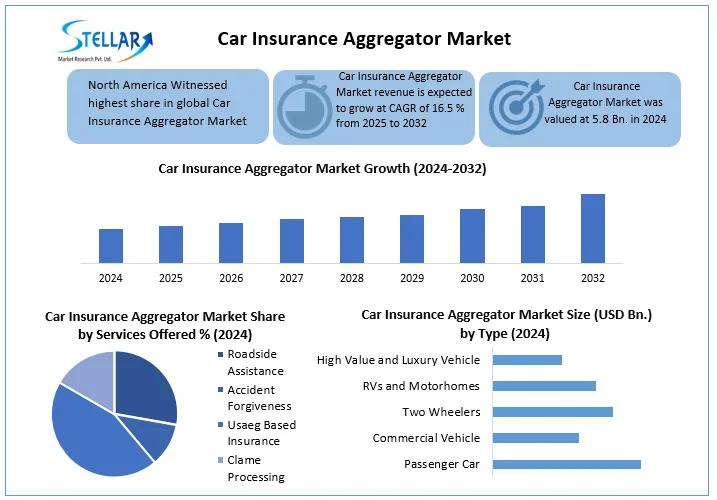

Car Insurance Aggregator Market was valued at USD 5.8 Bn. in 2024 and the total global Car Insurance Aggregator Market revenue is expected to grow at CAGR of 16.5% from 2025-2032 and reaching nearly USD 19.68 Bn. by 2032

Format : PDF | Report ID : SMR_2764

Car Insurance Aggregator Market Overview:

Car Insurance Aggregator is website or online platforms that allow users to compare car insurance policies from different insurance providers in one place. The global Car Insurance Aggregator Market is undergoing a transformative shift, boost by technological innovation and changing consumer demands. Pay-As-You-Drive (PAYD) models powered by telematics and IoT devices are gaining traction over 40% of U.S. insurers now offering usage-based policies. These systems adjust premiums based on real-time driving behaviour reducing costs for safe drivers by 15–30% on average. Digital platforms led by Insurtech startups like Lemonade and Root Insurance are disrupting traditional models.

Global Insurtech funding hit USD 7.9 billion in 2023 with AI-driven claims processing cutting approval times from days to minutes. The rise of autonomous vehicles is reshaping liability with 60% of industry experts anticipating manufacturers will assume most accident liability by 2035, potentially reducing personal auto premiums by 20–40% as human error declines. Sustainability initiatives are accelerating, with 25% of European insurers now offering discounts for EVs or eco-driving The U.S. EV insurance market is forecast to grow 35% annually through 2032. As consumers increasingly seek faster easier and more transparent ways to buy insurance car insurance Aggregator are playing a critical role in transforming the Car Insurance Aggregator Market.

- US-China Trade War: Tariffs on 360 Chinese goods (including auto parts) raised car production costs, impacting insurance premiums.

- EU Carbon Border Tax: New tariffs on high-emission imports (like steel) may increase vehicle prices, affecting insurance valuations.

- USMCA (NAFTA 2.0): Stricter regional auto content rules (75% parts from US/Mexico/Canada) shifted supply chains, altering risk pools for insurers.

To get more Insights: Request Free Sample Report

Car Insurance Aggregator Market Dynamics:

Rising Demand for Convenience and Personalized Insurance Options to Drive the Global Car Insurance Aggregator Market

The global Car Insurance Aggregator Market is experiencing a surge in demand for convenient, on-demand, and hyper-personalised insurance solutions, fuelled by evolving consumer expectations and digital innovation. Over 65% of policyholders now prioritise seamless digital experiences instant quotes mobile claims filing, and real-time policy adjustments, with 80% willing to switch insurers for better user-friendly platforms. Personalised pricing models including Pay-As-You-Drive (PAYD) and behaviour-based premiums are gaining rapid adoption with the telematics-based insurance sector projected to grow at a 24% CAGR. Insurtech startups like Lemonade, Root, and Metromile leverage AI and big data to offer tailored policies attracting 30% more millennial customers than traditional insurers. Embedded insurance is streamlining accessibility, with this niche expected to account for 15% of global auto premiums by 2027.

Intense Competition & Price Wars Impact on Global Car Insurance Aggregator Market

The Car Insurance Aggregator Market faces fierce competition with over 200 platforms. This overcrowding has led to cutthroat price wars, shrinking profit margins. A study found that 60% of users select the cheapest policy listed on aggregator sites, prioritising cost over brand loyalty. As a result, insurers and Aggregator are forced to discount premiums by 10-15% to remain competitive. Traditional insurers like Geico and Progressive are bypassing Aggregator by investing USD 2 Bn. annually in direct digital sales, growing their online channels by 25% YoY (S&P Global). This shift reduces Aggregator’ influence, with 20% of customers now purchasing directly from insurers. Additionally, insurance startups leverage AI to offer instant, low-cost quotes, further pressuring Aggregator. Price comparison sites rely heavily on lead-generation commissions, but insurers are slashing payouts from 15% to 5-8%. With customer acquisition costs soaring, to survive, Aggregator must differentiate through AI-driven personalisation, loyalty rewards, and bundled services or risk consolidation in this global market

Expansion of Digital Distribution Channels is a Significant Opportunity in the Global Car Insurance Aggregator Market

Expansion of Digital Distribution is increases due to use of mobile devices like smartphones and tablets and the adoption of e-commerce, among others, which have created a conducive environment for the growth of digital insurance distribution. In response, car insurance Aggregator have capitalised on this trend by becoming more visible online and creating user-friendly sites where customers get information regarding insurance coverage and buy policies while sitting at home.

The convenience and accessibility offered by these digital distribution channels play a major role in increasing market size because consumers compare rates, purchase policies, and manage their accounts 24/7. The global Car Insurance Aggregator Market industry is expected to grow further due to the ongoing expansion of digital distribution channels.

Car Insurance Aggregator Market Segmentation.

Based on Type the Global Car Insurance Aggregator Market segmented into Passenger Cars, Commercial Vehicles, Two Wheelers, RVs and Motorhomes and High-Value and Luxury Vehicles. Passenger Cars segment dominated the market in 2024 and is expected to hold largest share during the forecast period. This dominance is attributed to massive vehicle ownership mandatory insurance laws in most countries, and higher digital adoption for personal vehicle policies. Aggregator thrive in this segment due to standardized risk models and price-sensitive customers comparing premiums, unlike niche segments like commercial fleets or luxury vehicles. Two-wheelers and commercial vehicles are growing faster driven by emerging markets and gig economy demand.

Based on the Additional Service Offered the Global Car Insurance Aggregator Market is segmented into Roadside Assistance, Accident Forgiveness, Usage-Based Insurance and Claims Processing Assistance. The Usage-Based Insurance segment dominated the Car Insurance Aggregator Market in 2024 and is expected to hold largest share during the forecast period. This dominance stems from the increasing consumer demand for personalized and flexible insurance solutions with over 60% of drivers now favouring pay-as-you-drive models over traditional immovable premiums. The rapid adoption of telematics technology has further fuelled this trend, with 35% of insurers now offering UBI programs that provide discounts of up to 25% for safe driving behaviours. Also the claims processing assistance though essential is increasingly being automated through AI-driven solutions reducing its prominence as a standalone offering. The combination of technological innovation consumer preference for customisation and the potential for cost savings has solidified UBI and telematics-based discounts as the leading value-added services in the Car Insurance Aggregator Market this year.

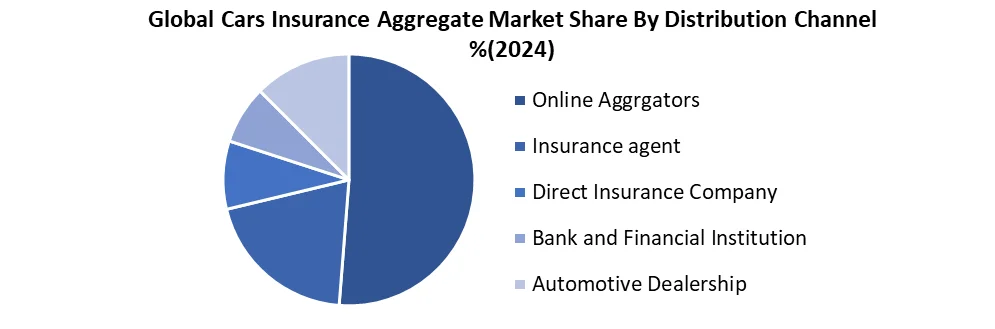

Based on the Distribution Channel, the Global Car Insurance Aggregator Market segmented Online Aggregator, Insurance Agents, Direct Insurance Companies, Banks and Financial Institutions and Automotive Dealerships. Online Aggregator dominated the global car insurance market in 2024 and is expected to hold the largest share during the forecast period. distribution channels, capturing the largest market share. This dominance emerges by several key factors: convenience and price transparency. The COVID-19 pandemic accelerated digital adoption making online platforms the preferred excellent especially among millennials and Gen Z who account for over 60% of aggregator users. While traditional channels like insurance agents 20% share and direct insurers 15% share remain relevant their growth lags due to higher operational costs and less competitive pricing. Emerging markets also saw a surge in bank-affiliated insurance but online Aggregator outpaced them by offering faster quotes instant policy issuance and seamless claims processing features that align with modern consumer expectations.

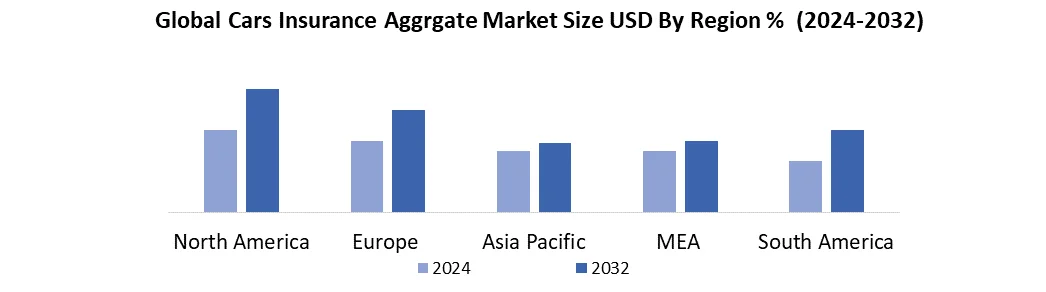

Car Insurance Aggregator Market Regional Analysis:

North America dominated the Global Car Insurance Aggregator Market in 2024 and is expected to hold during the forecast period. The widespread adoption of digital insurance platforms in North America has fundamentally transformed how consumers shop for car insurance. Today, an overwhelming 65% of drivers in the U.S. and Canada turn to online Aggregator like The Zebra and Gabi as their first stop when comparing policies according to J.D. Powers 2024 data. This shift reflects a broader cultural move toward digital-first solutions that prioritise convenience and efficiency. Modern consumers, particularly younger demographics, increasingly instantly compare multiple quotes from their smartphones over traditional in-person or phone interactions with insurance agents. The appeal lies in the transparency and speed these platforms offer within minutes, users see side-by-side comparisons of coverage options and pricing from dozens of insurers without sales pressure. This digital transformation has been accelerated by the pandemic's lasting impact on consumer behaviour, as well as the growing comfort with fintech solutions across all aspects of personal finance.

Car Insurance Aggregator Market Competitive Landscape:

Competitive landscape in Car Insurance Aggregator Market is insurtech and insurance comparison space in the USA features several key players, each with distinct regional strengths and offerings. The Zebra, based in Austin, Texas, is a leading online insurance comparison platform that helps users compare auto, home and renter’s insurance quotes from multiple providers. On the West Coast, Gabi, head quartere in San Francisco, California, differentiates itself by using AI and automation to streamline the insurance shopping experience, focusing on personalized recommendations and policy management. Policy genius operating out of New York City offers a broader range of insurance products including life disability and pet insurance, positioning itself as a one-stop shop for comprehensive coverage needs. In the Midwest Coverage based in Chicago Illinois emphasizes a user-friendly digital platform for comparing life insurance policies catering to customers seeking simplicity and transparency.

Key Developments in Cars Insurance Aggregator Market

- The Zebra – In March 2024, The Zebra expanded its AI-driven insurance comparison tool to include real-time policy adjustments and personalized coverage recommendations.

- Gabi – In February 2024, Gabi launched an automated claims assistance feature, integrating AI to help users file and track claims faster.

- Policygenius – In April 2024, Policygenius introduced a new financial wellness hub, offering educational resources alongside its insurance products.

|

Car Insurance Aggregator Market Scope Table |

|

|

Market Size in 2024 |

USD 5.8 Bn. |

|

Market Size in 2032 |

USD 19.68 Bn. |

|

CAGR (2025-2032) |

16.5% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Passenger Cars Commercial Vehicle Two Wheelers RVs and Motorhomes High Value and Luxury Vehicles |

|

By Additional Service Offered Roadside Assistance Accident Forgiveness Usage Based Insurance Claim Processing |

|

|

By Distribution Channel Online Aggregator Insurance Agent Direct Insurance Company Bank and Financial institution Automotive Dealership |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Car Insurance Aggregator Market Key Players:

North America

- The Zebra (Austin, Texas, USA)

- Gabi (San Francisco, California, USA)

- Policygenius (New York City, USA)

- Coverage (Chicago, Illinois, USA)

- Insurify (Cambridge, Massachusetts, USA)

- Compare.com (Richmond, Virginia, USA)

Europe

- Compare the Market (London, UK)

- Confused.com (Cardiff, UK)

- LeLynx.fr (Paris, France)

- Check24 (Munich, Germany)

- Seguros123 (Madrid, Spain)

- Comparis (Zurich, Switzerland)

Asia-Pacific

- PolicyBazaar (Gurugram, India)

- PasarPolis (Jakarta, Indonesia)

- ZhongAn (Shanghai, China)

- MoneyHero (CompareHero.my) (Singapore)

- iSelect (Melbourne, Australia)

- GoBear (Ho Chi Minh City, Vietnam)

Middle East & Africa

- Nala (Johannesburg, South Africa)

- Hollard Insure (Johannesburg, South Africa)

- Brolly AI (Lagos, Nigeria)

- Inclusivity Solutions (Nairobi, Kenya)

- aYo Holdings (Accra, Ghana)

- Momentum Insure (Cape Town, South Africa)

South America

- Compara Online (Santiago, Chile)

- Mercantil Andina (Buenos Aires, Argentina)

- Minuto Seguros (São Paulo, Brazil)

- Seguro123 (Lima, Peru)

- Terceiros Seguros (Rio de Janeiro, Brazil)

Frequently Asked Questions

Online Aggregator led due to convenience, price transparency, and AI-powered recommendations, with 70% of customers comparing quotes digitally before purchasing.

Price wars and shrinking profit margins force Aggregator to offer 10–15% discounts, while insurers reduce commission payouts from 15% to 5–8%.

Passenger cars lead due to high ownership (1.4 billion globally), mandatory insurance laws, and price-sensitive customers comparing premiums online.

North America dominated due to high digital adoption, with 65% of drivers using online Aggregator like The Zebra for quick, transparent policy comparisons.

1. Global Cars Insurance Aggregate Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Cars Insurance Aggregate Market: Competitive Landscape

2.1. Ecosystem Analysis

2.2. SMR Competition Matrix

2.3. Competitive Landscape

2.4. Key Players Benchmarking

2.4.1. Company Name

2.4.2. Business Segment

2.4.3. End-user Segment

2.4.4. Revenue (2024)

2.4.5. Company Locations

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Global Cars Insurance Aggregate Market: Dynamics

3.1. Global Cars Insurance Aggregate Market Trends by Region

3.1.1. North America Global Cars Insurance Aggregate Market Trends

3.1.2. Europe Global Cars Insurance Aggregate Market Trends

3.1.3. Asia Pacific Global Cars Insurance Aggregate Market Trends

3.1.4. Middle East and Africa Global Cars Insurance Aggregate Market Trends

3.1.5. South America Global Cars Insurance Aggregate Market Trends

3.2. Global Cars Insurance Aggregate Market Dynamics

3.2.1. Global Cars Insurance Aggregate Market Drivers

3.2.2. Global Cars Insurance Aggregate Market Restraints

3.2.3. Global Cars Insurance Aggregate Market Opportunities

3.2.4. Global Cars Insurance Aggregate Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Middle East and Africa

3.5.5. South America

3.6. Key Opinion Leader Analysis for Industry

4. Global Cars Insurance Aggregate Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

4.1. Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

4.1.1. Passenger Cars

4.1.2. Commercial Vehicle

4.1.3. Two Wheelers

4.1.4. RVs and Motorhomes

4.1.5. High Value and Luxury Vehicles

4.2. Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

4.2.1. Roadside Assistance

4.2.2. Accident Forgiveness

4.2.3. Usage Based Insurance

4.2.4. Claim Processing

4.3. Global Cars Insurance Aggregate Market Size and Forecast, By Distribution Channel (2024-2032)

4.3.1. Online Aggregator

4.3.2. Insurance Agent

4.3.3. Direct Insurance Company

4.3.4. Bank and Financial institution

4.3.5. Automotive Dealership

4.4. Global Cars Insurance Aggregate Market Size and Forecast, by Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Global Cars Insurance Aggregate Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

5.1. North America Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

5.1.1. Passenger Cars

5.1.2. Commercial Vehicle

5.1.3. Two Wheelers

5.1.4. RVs and Motorhomes

5.1.5. High Value and Luxury Vehicles

5.2. North America Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

5.2.1. Roadside Assistance

5.2.2. Accident Forgiveness

5.2.3. Usage Based Insurance

5.2.4. Claim Processing

5.3. North America Global Cars Insurance Aggregate Market Size and Forecast, By Distribution Channel (2024-2032)

5.3.1. Online Aggregator

5.3.2. Insurance Agent

5.3.3. Direct Insurance Company

5.3.4. Bank and Financial institution

5.3.5. Automotive Dealership

5.4. North America Global Cars Insurance Aggregate Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

5.4.1.1.1. Passenger Cars

5.4.1.1.2. Commercial Vehicle

5.4.1.1.3. Two Wheelers

5.4.1.1.4. RVs and Motorhomes

5.4.1.1.5. High Value and Luxury Vehicles

5.4.1.2. United States Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

5.4.1.2.1. Roadside Assistance

5.4.1.2.2. Accident Forgiveness

5.4.1.2.3. Usage Based Insurance

5.4.1.2.4. Claim Processing

5.4.1.3. others United States Global Cars Insurance Aggregate Market Size and Forecast, By Distribution Channel (2024-2032)

5.4.1.3.1. Online Aggregator

5.4.1.3.2. Insurance Agent

5.4.1.3.3. Direct Insurance Company

5.4.1.3.4. Bank and Financial institution

5.4.1.3.5. Automotive Dealership

5.4.2. Canada

5.4.2.1. Canada Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

5.4.2.1.1. Passenger Cars

5.4.2.1.2. Commercial Vehicle

5.4.2.1.3. Two Wheelers

5.4.2.1.4. RVs and Motorhomes

5.4.2.1.5. High Value and Luxury Vehicles

5.4.2.2. Canada Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

5.4.2.2.1. Roadside Assistance

5.4.2.2.2. Accident Forgiveness

5.4.2.2.3. Usage Based Insurance

5.4.2.2.4. Claim Processing

5.4.2.3. Canada Global Cars Insurance Aggregate Market Size and Forecast, By Distribution Channel (2024-2032)

5.4.2.3.1. Online Aggregator

5.4.2.3.2. Insurance Agent

5.4.2.3.3. Direct Insurance Company

5.4.2.3.4. Bank and Financial institution

5.4.2.3.5. Automotive Dealership

5.4.2.4. Mexico Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

5.4.2.4.1. Passenger Cars

5.4.2.4.2. Commercial Vehicle

5.4.2.4.3. Two Wheelers

5.4.2.4.4. RVs and Motorhomes

5.4.2.4.5. High Value and Luxury Vehicles

5.4.2.5. Mexico Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

5.4.2.5.1. Roadside Assistance

5.4.2.5.2. Accident Forgiveness

5.4.2.5.3. Usage Based Insurance

5.4.2.5.4. Claim Processing

5.4.2.6. Mexico Global Cars Insurance Aggregate Market Size and Forecast, By Distribution Channel (2024-2032)

5.4.2.6.1. Online Aggregator

5.4.2.6.2. Insurance Agent

5.4.2.6.3. Direct Insurance Company

5.4.2.6.4. Bank and Financial institution

5.4.2.6.5. Automotive Dealership

6. Europe Global Cars Insurance Aggregate Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

6.1. Europe Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

6.2. Europe Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

6.3. Europe Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

6.4. Europe Global Cars Insurance Aggregate Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

6.4.1.2. United Kingdom Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

6.4.1.3. United Kingdom Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

6.4.2. France

6.4.2.1. France Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

6.4.2.2. France Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

6.4.2.3. France Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

6.4.3.2. Germany Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

6.4.3.3. Germany Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

6.4.4.2. Italy Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

6.4.4.3. Italy Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

6.4.5.2. Spain Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

6.4.5.3. Spain Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

6.4.6.2. Sweden Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

6.4.6.3. Sweden Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

6.4.7. Austria

6.4.7.1. Austria Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

6.4.7.2. Austria Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

6.4.7.3. Austria Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

6.4.8.2. Rest of Europe Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

6.4.8.3. Rest of Europe Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

7. Asia Pacific Global Cars Insurance Aggregate Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

7.1. Asia Pacific Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

7.2. Asia Pacific Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

7.3. Asia Pacific Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

7.4. Asia Pacific Global Cars Insurance Aggregate Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

7.4.1.2. China Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

7.4.1.3. China Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

7.4.2.2. S Korea Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

7.4.2.3. S Korea Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

7.4.3.2. Japan Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

7.4.3.3. Japan Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

7.4.4. India

7.4.4.1. India Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

7.4.4.2. India Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

7.4.4.3. India Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

7.4.5.2. Australia Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

7.4.5.3. Australia Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

7.4.6.2. Indonesia Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

7.4.6.3. Indonesia Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

7.4.7. Philippines

7.4.7.1. Philippines Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

7.4.7.2. Philippines Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

7.4.7.3. Philippines Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

7.4.8. Malaysia

7.4.8.1. Malaysia Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

7.4.8.2. Malaysia Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

7.4.8.3. Malaysia Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

7.4.9. Vietnam

7.4.9.1. Vietnam Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

7.4.9.2. Vietnam Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

7.4.9.3. Vietnam Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

7.4.10. Thailand

7.4.10.1. Thailand Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

7.4.10.2. Thailand Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

7.4.10.3. Thailand Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

7.4.11.2. Rest of Asia Pacific Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

7.4.11.3. Rest of Asia Pacific Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

8. Middle East and Africa Global Cars Insurance Aggregate Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

8.1. Middle East and Africa Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

8.2. Middle East and Africa Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

8.3. Middle East and Africa Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

8.4. Middle East and Africa Global Cars Insurance Aggregate Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

8.4.1.2. South Africa Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

8.4.1.3. South Africa Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

8.4.2.2. GCC Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

8.4.2.3. GCC Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

8.4.3. Nigeria

8.4.3.1. Nigeria Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

8.4.3.2. Nigeria Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

8.4.3.3. Nigeria Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

8.4.4.2. Rest of ME&A Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

8.4.4.3. Rest of ME&A Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

9. South America Global Cars Insurance Aggregate Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032)

9.1. South America Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

9.2. South America Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

9.3. South America Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

9.4. South America Global Cars Insurance Aggregate Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

9.4.1.2. Brazil Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

9.4.1.3. Brazil Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

9.4.2.2. Argentina Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

9.4.2.3. Argentina Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

9.4.3. Rest of South America

9.4.3.1. Rest of South America Global Cars Insurance Aggregate Market Size and Forecast, By Type (2024-2032)

9.4.3.2. Rest of South America Global Cars Insurance Aggregate Market Size and Forecast, By Services Offered (2024-2032)

9.4.3.3. Rest of South America Global Cars Insurance Aggregate Market Size and Forecast, Distribution Channel (2024-2032)

10. Company Profile: Key Players

10.1. The Zebra (Austin, Texas, USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Gabi (San Francisco, California, USA)

10.3. Policygenius (New York City, USA)

10.4. Coverage (Chicago, Illinois, USA)

10.5. Insurify (Cambridge, Massachusetts, USA)

10.6. Compare.com (Richmond, Virginia, USA)

10.7. Compare the Market (London, UK)

10.8. Confused.com (Cardiff, UK)

10.9. LeLynx.fr (Paris, France)

10.10. Check24 (Munich, Germany)

10.11. Seguros123 (Madrid, Spain)

10.12. Comparis (Zurich, Switzerland)

10.13. PolicyBazaar (Gurugram, India)

10.14. PasarPolis (Jakarta, Indonesia)

10.15. ZhongAn (Shanghai, China)

10.16. MoneyHero (CompareHero.my) (Singapore)

10.17. iSelect (Melbourne, Australia)

10.18. GoBear (Ho Chi Minh City, Vietnam)

10.19. Nala (Johannesburg, South Africa)

10.20. Hollard Insure (Johannesburg, South Africa)

10.21. Brolly AI (Lagos, Nigeria)

10.22. Inclusivity Solutions (Nairobi, Kenya)

10.23. aYo Holdings (Accra, Ghana)

10.24. Momentum Insure (Cape Town, South Africa)

10.25. ComparaOnline (Santiago, Chile)

10.26. Mercantil Andina (Buenos Aires, Argentina)

10.27. Minuto Seguros (São Paulo, Brazil)

10.28. Seguro123 (Lima, Peru)

10.29. Terceiros Seguros (Rio de Janeiro, Brazil)

11. Key Findings

12. Analyst Recommendations

13. Global Cars Insurance Aggregate Market: Research Methodology