Automotive Cyber Security Market Global Industry Analysis and Forecast (2026-2032) by Offering, Form, Security Type, Application, Propulsion Type, Vehicle Autonomy, Vehicle Type and Region

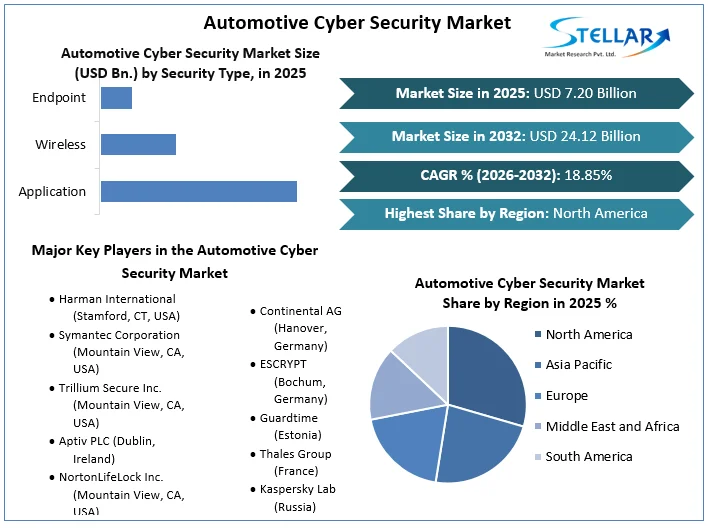

Global Automotive Cyber Security Market size was valued at USD 7.20 Bn. in 2025 and is expected to reach USD 24.12 Bn. by 2032, at a CAGR of 18.85%.

Format : PDF | Report ID : SMR_2387

Automotive Cyber Security Market Overview

Cybersecurity in the realm of road vehicles involves safeguarding automotive electronic systems, communication networks, control algorithms, software, users, and underlying data from malicious attacks, unauthorized access, manipulation, or damage. The growing popularity of electric cars (EV) and autonomous cars (AV) has led to strong growth in the global automotive cyber security market. Due to increased connectivity and expansion, major manufacturers such as Tesla, Waymo, and traditional car manufacturers have been forced to strengthen their cyber security measures. To protect the car’s systems and data, they implemented comprehensive plans that included over-the-air updates, rigorous testing, and dedicated cyber security teams.

Major investments in the automotive cyber security market have been driven by regulatory requirements, as evidenced by ECE Regulations No. 155 and 156. These investments were made to meet strict cybersecurity standards. With significant investments from IT companies and automakers, North America dominated the market and promoted collaboration between intrusion detection systems, secure communication protocols, and cyber security companies and automakers.

The automotive cyber security market has been dominated by software solutions that offered scalability and flexibility to protect software and vehicles. Simultaneously, hardware solutions for physical protection of automotive electronics, such as hardware security modules and protected gateway modules, became more popular. Rapid development was also seen in cloud-based cyber security services, which made it possible to improve remote monitoring and wireless fleet updating.

Overall, innovation, compliance, and thoughtful partnerships will drive the automotive cyber security market. These initiatives have played an important role in strengthening the security of connected and autonomous cars around the world, creating strong defenses against evolving cyber threats and laying the groundwork for future secure car technologies.

To get more Insights: Request Free Sample Report

Automotive Cyber Security Market Trend

The Evolving Landscape of Automotive Cybersecurity in the Era of Connected Vehicles

Electric cars (EVs) and autonomous vehicles (AVs) are becoming more common, and this had a major impact on how the automotive industry approaches cybersecurity giving rise to the automotive cyber security market. Features such as over-the-air updates, remote diagnostics and autonomous driving are made possible by advanced software systems and network connectivity of these cars. However, increased connectivity also means a larger attack surface for cybercriminals, which requires strong cybersecurity protections. In response, Manufacturers are making significant investments in cybersecurity to protect communications networks, safety-critical systems, and vehicles within the Automotive Cyber Security Market.

For example, Tesla has been proactive in enhancing its cybersecurity measures. The company regularly releases over-the-air (OTA) updates to not only improve vehicle performance but also to address identified vulnerabilities. To ensure the integrity of the systems, they have established dedicated cyber security teams and participate in rigorous testing and validation procedures.

- In 2022, Tesla's cybersecurity team was recognized for its rigorous testing protocols, which include penetration testing and vulnerability assessments to safeguard vehicle data and communication networks.

Similarly, autonomous car companies like Waymo and Cruise prioritize cybersecurity during development.

For example, Waymo, emphasizes a multi-layered approach to cybersecurity that includes authentication, encryption and continuous vehicle system monitoring to detect and neutralize potential threats.

- In 2023, Waymo implemented a layered security framework that includes encryption, authentication, and continuous monitoring of its vehicle systems. This approach aims to detect and mitigate potential threats in real-time, thereby enhancing the safety of its autonomous operations.

Collaborations between automakers and cybersecurity firms are becoming more common.

For instance,

- In 2022, Ford announced collaborations aimed at integrating advanced security measures into its vehicles, focusing on protecting against cyber threats that could compromise vehicle operation and passenger safety. This partnership strategy reflects a growing trend among automakers to leverage external expertise in cybersecurity.

Overall, the widespread use of connected cars has accelerated significant developments in the automotive cyber security market. In an increasingly digital automotive market, automakers are taking proactive measures to address vulnerabilities and strengthen their defenses to ensure the safety, reliability, and privacy of connected vehicles.

Automotive Cyber Security Market Dynamics

The Impact of Stringent Regulations on the Global Automotive Cyber Security Market

Stringent regulations have been the major driver of the global automotive cyber security market. Globally, governments and regulators have been working harder to create and enforce cybersecurity regulations specifically for automakers. The purpose of this legislation is to protect cars from cyber-attacks, protect data and maintain the overall safety of cars.

To avoid fines and maintain their position in the Automotive Cyber Security Market, car manufacturers have been under increasing pressure to comply with these laws. Complying with the requirements required significant investment in cyber security procedures, technology, and safeguards. This included implementing strong cyber security frameworks, conducting regular audits and assessments, and incorporating secure software techniques into vehicle design and production.

For instance,

- In July 2022, the United Nations Economic Commission for Europe (UNECE) implemented Regulations No. 155 and 156, which set cybersecurity requirements for vehicle manufacturers. These regulations mandate that new vehicle types must comply with specific cybersecurity management systems (CSMS) and software update management systems (SUMS). By 2023, more manufacturers, including major players like Mercedes-Benz and Volkswagen, began receiving Certificates of Compliance (CoC) for their cybersecurity measures, showcasing their adherence to these regulations.

Global regulatory environments varied, but all aimed to improve the automotive industry's cybersecurity resilience. For example, laws such as the EU Cyber ??Security Act and the General Data Protection Regulation (GDPR) set strict guidelines for cyber security and data protection in Europe. Similarly, in the United States, the National Highway Traffic Safety Administration (NHTSA) and frameworks such as the Cybersecurity Maturity Model Certification (CMMC) have required automotive cybersecurity protections.

For instance,

- In 2023, the European Union's Cyber Resilience Act (CRA) gained prominence as a horizontal regulation affecting all products with digital elements, including automotive products. This act aims to establish a minimum level of cybersecurity protection across various sectors, reinforcing the need for automakers to invest in robust cybersecurity frameworks to comply with new standards and protect consumer data.

Along with the requiring compliance, these requirements also had a cultural impact that made cybersecurity a top priority in the automotive industry. It has encouraged closer collaboration between automakers, technology providers and cybersecurity organizations to find creative solutions that not only meet regulatory requirements, but also improve the overall cybersecurity posture.

The Shortage of Skilled Cybersecurity Professionals in the Automotive Industry

One of the biggest challenges faced by the global Automotive Cyber Security Market has been the lack of qualified cybersecurity experts with experience in automotive cybersecurity. Protecting cars from cyber-attacks requires expertise in car systems, communication protocols, software security and cutting-edge technologies such as connected cars and autonomous driving.

The need for cybersecurity information has increased due to rapid technological advances in the automotive industry, which includes the integration of IoT devices, AI-based systems, and over-the-air updates. Automakers and cybersecurity companies struggled to find and retain skilled workers who could understand and successfully solve these complex problems.

To strengthen car security measures against cyber threats, car manufacturers such as Mercedes-Benz, BMW, and Volkswagen have increased their cyber security teams. These groups focus on creating secure software architectures, testing security holes, and putting encryption guidelines into practice to protect the car's data and functions.

For instance,

In 2022, BMW announced an initiative to bolster its cybersecurity workforce by hiring additional experts to focus on developing secure software architectures and conducting penetration testing. This move reflects the industry's response to the increasing threat landscape and the need for specialized knowledge in automotive systems and communication protocols.

Technology vendors, automakers, and other industries that need cybersecurity expertise are now more competitive due to a shortage of skilled cybersecurity professionals. In addition to raising labor costs, that competition has made it difficult for startups and smaller automakers to attract and retain top employees.

Automotive Cyber Security Market Segment Analysis

Based on Offering, based on the Automotive Cyber Security Market segment software segment held the largest market share in 2025. Software solutions were flexible, scalable, and necessary to secure increasingly complex automotive systems, they were widely used. These solutions covered a wide range of applications, including secure software frameworks, intrusion detection systems (IDS), cryptographic technologies, and secure communication protocols.

The main reason for the popularity of software solutions within the Automotive Cyber Security Market was the ease of updating them to regularly combat new cyber threats. Their flexibility to deploy multiple vehicle types and systems has allowed them to keep up with the rapid development of automotive technology. In addition, software solutions have eliminated the need for significant hardware changes, allowing automakers to implement advanced cybersecurity measures, and reducing the cost and complexity of implementation.

Companies that specialize in providing reliable cyber security software for the automotive industry include BlackBerry QNX, Symantec (now part of Broadcom), and Argus Cyber ????Security (part of Continental AG). The car's critical functions were protected from cyber-attacks, vehicle networks were protected and wireless updates were encrypted by these companies within the Automotive Cyber Security Market.

As manufacturers have increased the number of connected vehicles in their fleets and adopted autonomous driving technology, the demand for software solutions in the Automotive Cyber Security Market has increased dramatically. Automakers had invested in software-based cybersecurity to comply with standards, ensure vehicle safety and protect data, largely due to regulatory constraints.

- In 2022, Tesla reported a significant increase in the adoption of its over-the-air update software, which not only enhanced vehicle performance but also addressed cybersecurity vulnerabilities promptly.

The hardware offerings are expected to grow at fastest rate during the forecast period. Automotive electronics and networks can now be physically protected using hardware solutions such as hardware security modules (HSMs), secure microcontrollers and secure communication modules. Growth has been driven by the need for integrated solutions that combine hardware and software to enhance vehicle cyber security.

- In 2023, Bosch, a leading automotive supplier, announced the development of a new secure gateway module designed to protect vehicle communication networks from cyber threats.

Based on Form, in vehicle cybersecurity system is expected to dominate the market during the forecast period. These technologies were chosen mainly because they provide real-time protection and control of key functions and data being directly integrated into the vehicle's systems. Secure communication protocols, intrusion detection systems (IDS), secure gateways, and secure boot methods are common components of automotive cyber security solutions that protect automotive networks and software from network attacks within the Automotive Cyber Security Market.

Because they offered fast and localized protection, in-car cyber security solutions gained traction and ensured the safe operation of vehicles even when they were disconnected from external networks. This feature was required to protect against remote and physical cyber-attacks on automotive systems. In order to meet legal obligations and consumer expectations regarding vehicle safety and data protection, car manufacturers and cyber security companies have focused on creating and implementing these solutions.

In order to prevent malware and illegal access, Harman's Shield platform, which was introduced in 2022, directly integrated cybersecurity capabilities into car infotainment systems. As demand for integrated cybersecurity measures grew, Continental AG responded by expanding its cybersecurity offering with in-vehicle security solutions that included intrusion detection systems and secure communication modules.

As car manufacturers accelerated the adoption of connected and autonomous vehicles, there was a growing demand for in-vehicle cybersecurity solutions. The ISO/SAE 21434 standard and UNECE Regulation No. 155, among other regulatory requirements for cybersecurity compliance, accelerated adoption. In order to effectively reduce cyber risks, automakers were compelled by these requirements to integrate strong cybersecurity safeguards directly within automobiles.

External cloud services are expected to grow at the fastest rate during the forecast period of the automotive cyber security market. Automakers can remotely monitor and protect automotive software due to external cloud services that provide data storage, analytics and OTA updates.

Companies that use cloud infrastructure such as AWS (Amazon Web Services), Microsoft Azure and Google Cloud to manage scalable and centralized cybersecurity have expanded their offerings to cybersecurity services, especially for the automotive industry. Despite data protection and regulatory compliance challenges, the growth of the segment has been fueled by the need for effective cyber security management across fleets and the increasing connectivity of cars.

Automotive Cyber Security Market Regional Insights

According to SMR analysis, North America dominated the global Automotive Cyber Security Market in 2025. This dominance is due to many important reasons such as the North American automotive sector is strong, with many major automakers and IT companies making significant investments in cybersecurity. Companies in this sector have led the way in creating advanced cyber security solutions that protect cars from cyber-attacks, which has fueled market expansion.

- In 2023, Hyundai Motor America launched its Hyundai Mobility Ventures program to invest in promising mobility startups. One of the first investments was in Upstream Security, highlighting the importance of vehicle cybersecurity for the company.

- In 2022, Ford Motor Company announced a collaboration with Google to develop new cloud-based services and in-vehicle connected experiences. As part of this, Ford is leveraging Google's cybersecurity expertise to improve the security of its vehicles.

- In 2021, General Motors partnered with Upstream Security to enhance its vehicle cybersecurity capabilities. Upstream's cloud-based cybersecurity platform helps detect and prevent cyberattacks on GM's connected vehicles.

The strict legal framework in North America, especially the United States, has forced car manufacturers to adhere to cyber security standards in the Automotive Cyber Security Market. Companies are now forced by the regulatory environment to invest in cyber security solutions, which is driving Automotive Cyber Security Market demand.

The creation of advanced intrusion detection systems, secure over-the-air software updates, and partnerships between automakers and cybersecurity companies to improve vehicle security are some examples of North American leadership in these areas.

Europe is expected to be the fastest growing region in the automotive cyber security market in 2024. Europe's growth has been fueled by the increasing use of connected and self-driving cars, as well as strict data protection laws (such as GDPR) that require strong cyber security. To protect consumer trust in connected vehicle technology, European automakers and technology providers have aggressively invested in cybersecurity solutions to comply with the law.

Automotive Cyber Security Market Competitive Analysis

The competitive landscape in the automotive cyber security market has been shaped by many mergers and acquisitions, partnerships, and new innovations. Acquisitions and mergers were common when large companies wanted to combine technologies and expand their market area.

- In 2021, X Corporation, a major player in the cybersecurity sector, acquired several smaller cybersecurity firms to enhance its threat detection capabilities. This strategy allowed them to integrate advanced technologies specifically tailored for automotive applications, thereby expanding their market reach.

- In 2018, BlackBerry, known for its software solutions, acquired Cylance but the integration of Cylance's AI-driven cybersecurity technology into BlackBerry's QNX platform for automotive systems has been a focal point in 2022 and 2023. This merger has strengthened BlackBerry's position in the Automotive Cyber Security Market, enabling it to provide enhanced security solutions for connected vehicles.

Collaboration was necessary to promote innovation and fight new challenges together. Automakers, cybersecurity companies, and even government agencies are forming partnerships to define guidelines and procedures for safe car connectivity and data security. These partnerships supported technological innovation while ensuring compliance with evolving legal requirements.

- In 2021, Ford announced collaboration with Google which has continued to evolve, focusing on integrating AI and machine learning into Ford's connected vehicle technology. This partnership aims to enhance cybersecurity measures, ensuring that vehicles remain secure against potential cyber threats.

- In 2022, Stellantis partnered with Amazon to leverage cloud technology and AI for developing connected vehicle services. This collaboration includes a focus on cybersecurity, ensuring that data privacy and vehicle security are prioritized in their connected car offerings.

Recent developments have emphasized the development of anomaly detection algorithms, encryption techniques and intrusion detection systems specifically designed for the automotive industry. As a proactive measure to protect connected cars, companies have focused on incorporating artificial intelligence and machine learning into their cyber security solutions to prevent and stop cyber-attacks in real time.

- In 2023, several companies, including Argus Cyber Security, announced advancements in anomaly detection algorithms specifically designed for automotive environments. These algorithms are crucial for identifying unusual behavior in vehicle systems, helping to prevent potential cyberattacks.

- In 2023, Companies like Upstream Security have been at the forefront of integrating AI and machine learning into their cybersecurity solutions. Their platform, which analyzes vehicle data in real-time, helps detect and respond to cyber threats as they occur, significantly enhancing the security of connected vehicles.

Automotive Cyber Security Market Scope

|

Automotive Cyber Security Market |

|

|

Market Size in 2025 |

USD 7.20 Bn. |

|

Market Size in 2032 |

USD 24.12 Bn. |

|

CAGR (2026-2032) |

18.85% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Automotive Cyber Security Market Segments |

By Offering Hardware Software |

|

By Form In-Vehicle External Cloud Services Others |

|

|

By Security Type Application Wireless Endpoint |

|

|

By Application ADAS & Safety Body Control & Comfort Infotainment Telematics BMS & Powertrain Systems Communication Systems Charging Management |

|

|

By Propulsion Type Internal Combustion Engine (ICE) Vehicle Electric Vehicle |

|

|

By Vehicle Autonomy Autonomous Semi-Autonomous Non-Autonomous |

|

|

By Vehicle Type Passenger Vehicle Light Commercial Vehicle Heavy Commercial Vehicle |

|

|

Regional Scope |

North America – United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Russia, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa – South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Automotive Cyber Security Market Key players

North America

- Harman International (Stamford, CT, USA)

- Symantec Corporation (Mountain View, CA, USA)

- Trillium Secure Inc. (Mountain View, CA, USA)

- Aptiv PLC (Dublin, Ireland)

- NortonLifeLock Inc. (Mountain View, CA, USA)

- Ford (Dearborn, MI, USA)

- General Motors (Detroit, MI, USA)

Europe

- Continental AG (Hanover, Germany)

- ESCRYPT (Bochum, Germany)

- Guardtime (Estonia)

- Thales Group (France)

- Kaspersky Lab (Russia)

- Vector Informatik (Stuttgart, Germany)

- BMW (Munich, Germany)

- Audi (Ingolstadt, Germany)

- Volvo Car Group (Gothenburg, Sweden)

Asia Pacific

- Honda Motor Co., Ltd. (Minato, Tokyo, Japan)

- Nissan (Yokohama, Kanagawa, Japan)

- Denso Corporation (Kariya, Aichi, Japan)

- Tata Elxsi (Bangalore, India)

- Trend Micro Inc. (Japan)

Middle East and Africa (MEA)

- GuardKnox Cyber Technologies Ltd. (Hod Hasharon, Israel)

- Argus Cyber Security (Tel Aviv, Israel)

- Karamba Security (Hod Hasharon, Israel)

- Cybellum (Tel Aviv, Israel)

Frequently Asked Questions

The increasing adoption of electric vehicles, which are equipped with advanced connected technologies, has heightened their vulnerability to cyber-attacks. As EVs communicate with other vehicles and infrastructure, the demand for robust cybersecurity solutions to protect sensitive data and maintain vehicle integrity has surged.

The Automotive Cyber Security Market size is expected to reach USD 24.12 Bn. by 2032.

The major top players in the Global Automotive Cyber Security Market are Harman International (Stamford, CT, USA), Symantec Corporation (Mountain View, CA, USA), Trillium Secure Inc. (Mountain View, CA, USA), Aptiv PLC (Dublin, Ireland) and others.

Automotive cybersecurity solutions of Automotive Cyber Security Market primarily consist of hardware and software components designed to protect vehicles from cyber threats. Key components include endpoint security, application security, network security, and cloud security, which work together to safeguard vehicle communication channels, infotainment systems, and various electronic control units (ECUs) from potential attacks.

1. Automotive Cyber Security Market: Research Methodology

2. Automotive Cyber Security Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Global Automotive Cyber Security Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Offering Segment

3.3.3. End-user Segment

3.3.4. Revenue (2025)

3.3.5. Company Headquarter

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Mergers and Acquisitions Details

4. Automotive Cyber Security Market: Dynamics

4.1. Automotive Cyber Security Market Trends

4.2. Automotive Cyber Security Market Dynamics

4.2.1.1. Drivers

4.2.1.2. Restraints

4.2.1.3. Opportunities

4.2.1.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Form Roadmap

4.6. Regulatory Landscape by Region

4.6.1. North America

4.6.2. Europe

4.6.3. Asia Pacific

4.6.4. Middle East and Africa

4.6.5. South America

5. Automotive Cyber Security Market: Global Market Size and Forecast (Value in USD Million) (2025-2032)

5.1. Automotive Cyber Security Market Size and Forecast, By Offering (2025-2032)

5.1.1. Hardware

5.1.2. Software

5.2. Automotive Cyber Security Market Size and Forecast, By Form (2025-2032)

5.2.1. In-Vehicle

5.2.2. External Cloud Services

5.2.3. Others

5.3. Automotive Cyber Security Market Size and Forecast, By Security Type (2025-2032)

5.3.1. Application

5.3.2. Wireless

5.3.3. Endpoint

5.4. Automotive Cyber Security Market Size and Forecast, By Application (2025-2032)

5.4.1. ADAS & Safety

5.4.2. Body Control & Comfort

5.4.3. Infotainment

5.4.4. Telematics

5.4.5. BMS & Powertrain Systems

5.4.6. Communication Systems

5.4.7. Charging Management

5.5. Automotive Cyber Security Market Size and Forecast, By Propulsion Type (2025-2032)

5.5.1. Internal Combustion Engine (ICE) Vehicle

5.5.2. Electric Vehicle

5.6. Automotive Cyber Security Market Size and Forecast, By Vehicle Autonomy (2025-2032)

5.6.1. Autonomous

5.6.2. Semi-Autonomous

5.6.3. Non-Autonomous

5.7. Automotive Cyber Security Market Size and Forecast, By Vehicle Type (2025-2032)

5.7.1. Passenger Vehicle

5.7.2. Light Commercial Vehicle

5.7.3. Heavy Commercial Vehicle

5.8. Automotive Cyber Security Market Size and Forecast, by Region (2025-2032)

5.8.1. North America

5.8.2. Europe

5.8.3. Asia Pacific

5.8.4. Middle East and Africa

5.8.5. South America

6. North America Automotive Cyber Security Market Size and Forecast by Segmentation (Value in USD Million) (2025-2032)

6.1. North America Automotive Cyber Security Market Size and Forecast, By Offering (2025-2032)

6.1.1. Hardware

6.1.2. Software

6.1.3. Guns Needles Localised wires Procedure Tray

6.1.4. Others

6.2. North America Automotive Cyber Security Market Size and Forecast, By Form (2025-2032)

6.2.1. In-Vehicle

6.2.2. External Cloud Services

6.2.3. Others

6.3. North America Automotive Cyber Security Market Size and Forecast, By Security Type (2025-2032)

6.3.1. Application

6.3.2. Wireless

6.3.3. Endpoint

6.4. Automotive Cyber Security Market Size and Forecast, By Application (2025-2032)

6.4.1. ADAS & Safety

6.4.2. Body Control & Comfort

6.4.3. Infotainment

6.4.4. Telematics

6.4.5. BMS & Powertrain Systems

6.4.6. Communication Systems

6.4.7. Charging Management

6.5. Automotive Cyber Security Market Size and Forecast, By Propulsion Type (2025-2032)

6.5.1. Internal Combustion Engine (ICE) Vehicle

6.5.2. Electric Vehicle

6.6. Automotive Cyber Security Market Size and Forecast, By Vehicle Autonomy (2025-2032)

6.6.1. Autonomous

6.6.2. Semi-Autonomous

6.6.3. Non-Autonomous

6.7. Automotive Cyber Security Market Size and Forecast, By Vehicle Type (2025-2032)

6.7.1. Passenger Vehicle

6.7.2. Light Commercial Vehicle

6.7.3. Heavy Commercial Vehicle

6.8. North America Automotive Cyber Security Market Size and Forecast, by Country (2025-2032)

6.8.1. United States

6.8.2. Canada

6.8.3. Mexico

7. Europe Automotive Cyber Security Market Size and Forecast by Segmentation (Value in USD Million) (2025-2032)

7.1. Europe Automotive Cyber Security Market Size and Forecast, By Offering (2025-2032)

7.2. Europe Automotive Cyber Security Market Size and Forecast, By Form (2025-2032)

7.3. Europe Automotive Cyber Security Market Size and Forecast, By Security Type (2025-2032)

7.4. Europe Automotive Cyber Security Market Size and Forecast, By Application (2025-2032)

7.5. Europe Automotive Cyber Security Market Size and Forecast, By Propulsion Type (2025-2032)

7.6. Europe Automotive Cyber Security Market Size and Forecast, By Vehicle Autonomy Type (2025-2032)

7.7. Europe Automotive Cyber Security Market Size and Forecast, By Vehicle Type (2025-2032)

7.8. Europe Automotive Cyber Security Market Size and Forecast, by Country (2025-2032)

7.8.1. United Kingdom

7.8.2. France

7.8.3. Germany

7.8.4. Italy

7.8.5. Spain

7.8.6. Sweden

7.8.7. Russia

7.8.8. Rest of Europe

8. Asia Pacific Automotive Cyber Security Market Size and Forecast by Segmentation (Value in USD Million) (2025-2032)

8.1. Asia Pacific Automotive Cyber Security Market Size and Forecast, By Offering (2025-2032)

8.2. Asia Pacific Automotive Cyber Security Market Size and Forecast, By Form (2025-2032)

8.3. Asia Pacific Automotive Cyber Security Market Size and Forecast, By Security Type (2025-2032)

8.4. Asia Pacific Automotive Cyber Security Market Size and Forecast, By Application (2025-2032)

8.5. Asia Pacific Automotive Cyber Security Market Size and Forecast, By Propulsion Type (2025-2032)

8.6. Asia Pacific Automotive Cyber Security Market Size and Forecast, By Vehicle Autonomy (2025-2032)

8.7. Asia Pacific Automotive Cyber Security Market Size and Forecast, By Vehicle Type (2025-2032)

8.8. Asia Pacific Automotive Cyber Security Market Size and Forecast, by Country (2025-2032)

8.8.1. China

8.8.2. S Korea

8.8.3. Japan

8.8.4. India

8.8.5. Australia

8.8.6. ASEAN

8.8.7. Rest of Asia Pacific

9. Middle East and Africa Automotive Cyber Security Market Size and Forecast by Segmentation (Value in USD Million) (2025-2032)

9.1. Middle East and Africa Automotive Cyber Security Market Size and Forecast, By Offering (2025-2032)

9.2. Middle East and Africa Automotive Cyber Security Market Size and Forecast, By Form (2025-2032)

9.3. Middle East and Africa Automotive Cyber Security Market Size and Forecast, By Security Type (2025-2032)

9.4. Middle East and Africa Automotive Cyber Security Market Size and Forecast, By Application (2025-2032)

9.5. Middle East and Africa Automotive Cyber Security Market Size and Forecast, By Propulsion Type (2025-2032)

9.6. Middle East and Africa Automotive Cyber Security Market Size and Forecast, By Vehicle Autonomy Type (2025-2032)

9.7. Middle East and Africa Automotive Cyber Security Market Size and Forecast, By Vehicle Type (2025-2032)

9.8. Middle East and Africa Automotive Cyber Security Market Size and Forecast, by Country (2025-2032)

9.8.1. South Africa

9.8.2. GCC

9.8.3. Nigeria

9.8.4. Rest of ME&A

10. South America Automotive Cyber Security Market Size and Forecast by Segmentation (Value in USD Million) (2025-2032)

10.1. South America Automotive Cyber Security Market Size and Forecast, By Offering (2025-2032)

10.2. South America Automotive Cyber Security Market Size and Forecast, By Form (2025-2032)

10.3. South America Automotive Cyber Security Market Size and Forecast, By Security Type (2025-2032)

10.4. South America Automotive Cyber Security Market Size and Forecast, By Security Type (2025-2032)

10.5. South America Automotive Cyber Security Market Size and Forecast, By Propulsion Type (2025-2032)

10.6. South America Automotive Cyber Security Market Size and Forecast, By Vehicle Autonomy (2025-2032)

10.7. South America Automotive Cyber Security Market Size and Forecast, By Vehicle Type (2025-2032)

10.8. South America Automotive Cyber Security Market Size and Forecast, by Country (2025-2032)

10.8.1. Brazil

10.8.2. Argentina

10.8.3. Rest Of South America

11. Company Profile: Key Players

11.1. Harman International (Stamford, CT, USA)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Symantec Corporation (Mountain View, CA, USA)

11.3. Trillium Secure Inc. (Mountain View, CA, USA)

11.4. Aptiv PLC (Dublin, Ireland)

11.5. NortonLifeLock Inc. (Mountain View, CA, USA)

11.6. Ford (Dearborn, MI, USA)

11.7. General Motors (Detroit, MI, USA)

11.8. Continental AG (Hanover, Germany)

11.9. ESCRYPT (Bochum, Germany)

11.10. Guardtime (Estonia)

11.11. Thales Group (France)

11.12. Kaspersky Lab (Russia)

11.13. Vector Informatik (Stuttgart, Germany)

11.14. BMW (Munich, Germany)

11.15. Audi (Ingolstadt, Germany)

11.16. Volvo Car Group (Gothenburg, Sweden)

11.17. Honda Motor Co., Ltd. (Minato, Tokyo, Japan)

11.18. Nissan (Yokohama, Kanagawa, Japan)

11.19. Denso Corporation (Kariya, Aichi, Japan)

11.20. Tata Elxsi (Bangalore, India)

11.21. Trend Micro Inc. (Japan)

11.22. GuardKnox Cyber Technologies Ltd. (Hod Hasharon, Israel)

11.23. Argus Cyber Security (Tel Aviv, Israel)

11.24. Karamba Security (Hod Hasharon, Israel)

11.25. Cybellum (Tel Aviv, Israel)

12. Key Findings

13. Industry Recommendations