Angel Funds Market: Size, Share, Growth Opportunities (2025-2032)

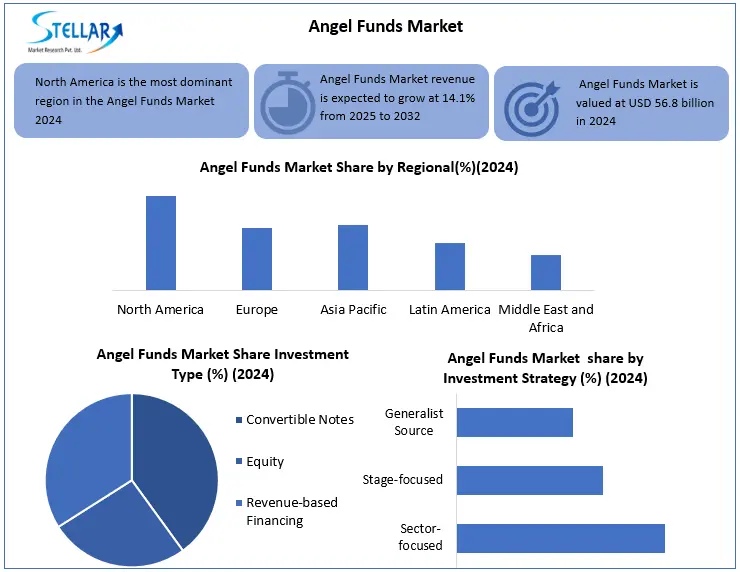

The Angel Funds Market Size Was Valued at USD 56.8 Billion In 2024, and the Total Angel Funds market revenue is expected to grow at a CAGR of 14.1 % from 2025 to 2032, Reaching Nearly USD 163.7 Billion.

Format : PDF | Report ID : SMR_2819

Angel Funds Market Overview:

An Angel Fund is an individual or group of individuals who provide capital for a business startup, typically in exchange for convertible debt or ownership equity. Angel investors are often friends, family, or accredited investors who believe in the business idea and want to support its growth.

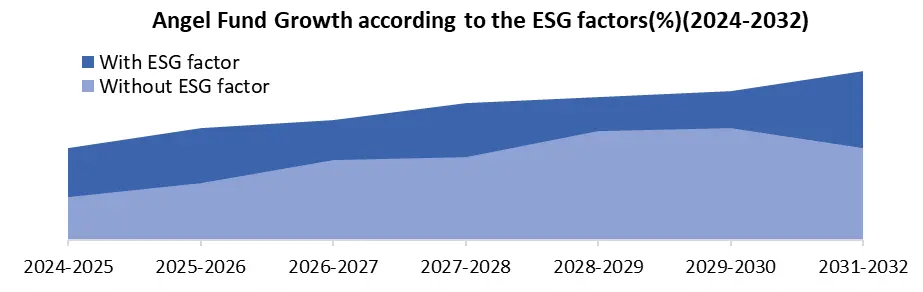

The Angel Funds Market is growing fast due to a lot of new innovations and more startup businesses being created. In this environment, angel investors are very important for offering initial funding, advice and important links to early-stage companies. A main trend in the market nowadays is the greater importance placed on ESG factors. Most business angels now consider ESG factors when they invest, revealing their interest in earning, as well as helping society. While the market is always moving, starting an investment early can be very risky as most startups tend to fail in the end. Yet, doing well can pay off in a big way. For investment, most angel funds tilt towards a single sector and technology leads the way, as it represented 37% of angel funds in 2024.

The flexibility of convertible notes is the reason they are used by many investors. North America is the main contributor to the angel investor market, handling over 70% of global investments this year since its startup ecosystem is fully developed. The industry is filled with different opportunities due to many active angel networks that look for promising ventures.

To get more Insights: Request Free Sample Report

Angel Funds Market Dynamics:

Accelerated Innovation and Start-Up Creation Is Driving the Angel Funds Market

Start-ups that show promise are greatly supported in their development by the initial investment from angel funds. Angel funders take a personal interest when investing in startups. Usually, they show enthusiasm and keenness for helping your company succeed. Building the right connections make it easier to raise money through individual angel funders rather than appealing to VC firms. With more entrepreneurs coming up with great ideas, the requirement for early investment and guidance goes up. Angel investors help by giving important aid to satisfy this need. In 2021, there were 1,100+ angel funding deals in India, a big increase from the 220 recorded in 2012. Contrary to 2013, when only 200,000 individuals were active angel investors, 2015 witnessed the number going up to 300,000, thus more individuals taking part in assisting new businesses

Growing Importance of ESG (Environmental, Social, And Governance) Factors. Creates An Opportunity for Angel Fund Market

The growing importance of ESG factors significantly creates opportunities for the angel fund market. Angel investors are increasingly motivated to support startups that align with environmental, social, and governance principles, seeking both financial returns and positive impact in 50-70%. Surveys indicate that approximately 6 in 10 business angels incorporate ESG criteria into their investment decisions. This trend means angel funds actively target companies addressing climate change, social equity, or ethical governance. Such investor preference fosters a pipeline of innovative, responsible startups seeking early-stage angel capital.

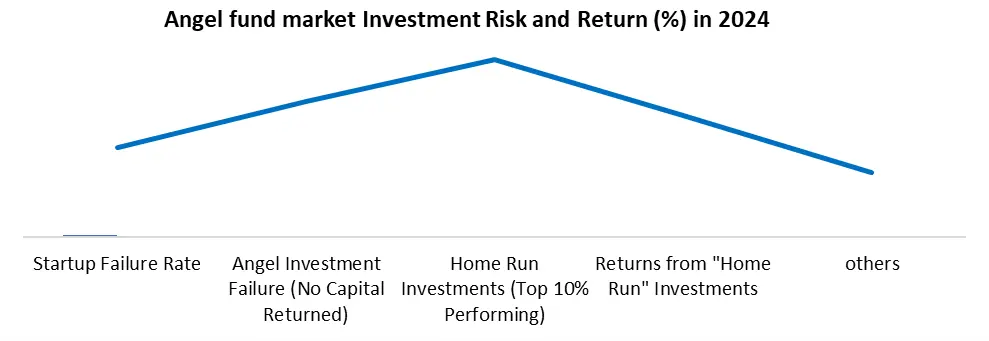

High risk is associated with early-stage investing, creating challenges for the angel fund market

Early-stage investments are inherently risky due to the lack of a proven track record or stable revenue streams. Exit opportunities can be limited, and investors may have to wait 4-7 years before realizing returns through an IPO, acquisition, or other liquidity events. And with all private market investments, early-stage investments are illiquid in nature. Predicting the success of a startup in its infancy can be impossible, leading to a high degree of uncertainty in the early-stage investment landscape. Approximately 70% to 90% of all startups ultimately fail. More specifically, for angel investors, over half of early-stage investments typically fail to return any capital. While a few successful ventures can yield substantial returns (e.g., top 10% may produce 85-90% of total gains).

Angel Fund Market segment analysis:

Based on Investment Strategy Angel Fund Market is segmented into Sector-focused, Generalist Source Solution, Sector-focused segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period. In 2023, sector-targeted angel funds took up about 48% of the total industry. Many investors found the healthcare sector most appealing and technology and consumer goods were not far behind. In the year 2024, the share of technology in angel funds reached 37%, healthcare was around 22% and consumer products stood at 16%, revealing major specialization. AI and defense sectors experienced more applications than before.

Based on Investment Type Angel Fund market is segmented into Convertible Notes, Equity, Revenue-based Financing Convertible Notes segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period. Convertible notes offer flexibility to both investors and startups, as they can be converted into equity at a later date, Angel investors often use convertible notes because they are useful for investing in early-stage companies. They are used as a loan that can eventually be turned into equity, postponing the need to set a company’s value right away. This means that angels can put money into exciting startup businesses promptly.

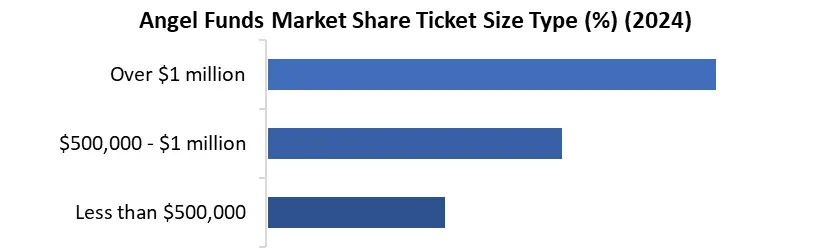

Based on Ticket Size Type Angel Fund market is segmented into Less than $500,000, $500,000 - $1 million, Over $1 million segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period. This market section has three subgroups called "Less than $500,000", "$500,000 - $1 million" and "Over $1 million". Individual angel investments often range from $5,000 to $500,000. While the median deal size for U.S. angel investors has consistently been around $250,000 over the last decade, angel groups can pool resources for larger investments, sometimes exceeding $750,000. This spectrum allows angel funds to support ventures from very early conceptual stages to those requiring more significant initial capital.

Angel Funds Market Regional Analysis:

Rising Startup and Development shows North America Dominated in Angel Fund Market.

North America, especially the US and Canada, has a really mature startup ecosystem. This means tons of innovative ideas, lots of experienced founders, and, crucially, a high concentration of wealthy individuals keen to invest in early-stage companies. In 2024, more than 70% of angel investments globally came from North America. Each year, more than thousands of venture companies in the US receive angel funding. In 2021 alone, over 69,000 companies in the United States were given angel funding. Strong policies, as well as groups of experienced angel investors, are present in the region, filling investors with confidence and encouraging more investments.

Angel Funds Market Competitive Landscape:

The competition in the Angel Funds Industry is very dynamic. While direct mergers and acquisitions between angel funds aren't super common like in big corporate sectors, their portfolio companies often get acquired by larger firms or VCs, which is a key exit strategy. Key Players in this space aren't just individual wealthy investors, but also prominent angel networks and platforms like AngelList, Indian Angel Network (IAN), and Mumbai Angels Network. These groups compete for the most promising startups, offering not just capital but mentorship and connections. Their competitive strategy often involves specializing in niche sectors or offering unique value beyond money. Market rivalry intensity is high for top-tier deals, driving competitive benchmarking on deal terms and post-investment support.

|

Angel Funds Market |

|

|

Market Size in 2024 |

USD 56.8 billion |

|

Market Size in 2032 |

USD 163.7 billion. |

|

CAGR (2024-2032) |

14.1% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Investment Strategy Sector-focused Stage-focused Generalist Source |

|

By Investment Type Convertible Notes Equity Revenue-based Financing |

|

|

By Ticket Size Less than $500,000 $500,000 - $1 million Over $1 million |

|

|

By Investor Type Individual Investors Family Offices Venture Capital Firms Corporate Investors |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and the Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, Taiwan, Philippines, Indonesia, Vietnam, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Angel Fund Market Key Players:

North America

- 500 Global (United States)

- Techstars (United States)

- M13 (United States)

- Life Science Angels (United States)

- New York Angels (United States)

Europe

- Angel Invest (Germany)

- SFC Capital (United Kingdom)

- Cambridge Angels (United Kingdom)

- FiBAN (Finnish Business Angels Network) (Finland)

- Super Capital (France)

Asia Pacific

- XA Network (Singapore)

- Indian Angel Network (IAN) (India)

- East Ventures (Indonesia/Japan)

- Epic Angels (Singapore)

- Mumbai Angels Network. (India)

Middle East and Africa

- Wamda Capital (UAE)

- Flat6Labs (Egypt)

- OQAL Angel Investors Network (Saudi Arabia)

- Angels for Africa (Pan-African)

South America

- NXTP Labs (Argentina)

- Angel Ventures (Mexico)

- Kaszek Ventures (Brazil)

- Monashees (Brazil)

- Bossanova Investimentos (Brazil)

Frequently Asked Questions

Angel funds market is expected to reach a valuation of 56.8 billion USD in 2024

The primary challenge faced in the Angel Fund Market is the high risk associated with early-stage investing, as most startups ultimately fail, leading to a high likelihood of capital loss for investors.

Key applications of Angel Funds include early-stage investments in startups, seed funding, and venture capital.

1. Global Angel Funds Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Angel Funds Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Headquarter

2.2.3. Service Segment

2.2.4. Ticket Size Segment

2.2.5. Revenue (2024)

2.2.6. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Global Angel Funds Market: Dynamics

3.1. Global Angel Funds Market Trends

3.2. Global Angel Funds Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Global Angel Funds Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

4.1.1. Sector-focused

4.1.2. Stage-focused

4.1.3. Generalist Source

4.2. Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

4.2.1. Convertible Notes

4.2.2. Equity

4.2.3. Revenue-based Financing

4.3. Global Angel Funds Market Size and Forecast, By Ticket Size (2024-2032)

4.3.1. Less than $500,000

4.3.2. $500,000 - $1 million

4.3.3. Over $1 million

4.4. Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

4.4.1. Individual Investors

4.4.2. Family Offices

4.4.3. Venture Capital Firms

4.4.4. Corporate Investors

4.5. Global Angel Funds Market Size and Forecast, By Region (2024-2032)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. South America

5. North America Global Angel Funds Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

5.1. North America Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

5.1.1. Sector-focused

5.1.2. Stage-focused

5.1.3. Generalist Source

5.2. North America Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

5.2.1. Convertible Notes

5.2.2. Equity

5.2.3. Revenue-based Financing

5.3. North America Global Angel Funds Market Size and Forecast, By Ticket Size (2024-2032)

5.3.1. Less than $500,000

5.3.2. $500,000 - $1 million

5.3.3. Over $1 million

5.4. North America Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

5.4.1. Individual Investors

5.4.2. Family Offices

5.4.3. Venture Capital Firms

5.4.4. Corporate Investors

5.5. North America Global Angel Funds Market Size and Forecast, by Country (2024-2032)

5.5.1. United States

5.5.1.1. United States Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

5.5.1.1.1. Sector-focused

5.5.1.1.2. Stage-focused

5.5.1.1.3. Generalist Source

5.5.1.2. United States Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

5.5.1.2.1. Convertible Notes

5.5.1.2.2. Equity

5.5.1.2.3. Revenue-based Financing

5.5.1.3. United States Global Angel Funds Market Size and Forecast, By Ticket Size (2024-2032)

5.5.1.3.1. Less than $500,000

5.5.1.3.2. $500,000 - $1 million

5.5.1.3.3. Over $1 million

5.5.1.4. United States Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

5.5.1.4.1. Individual Investors

5.5.1.4.2. Family Offices

5.5.1.4.3. Venture Capital Firms

5.5.1.4.4. Corporate Investors

5.5.2. Canada

5.5.2.1. Canada Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

5.5.2.1.1. Sector-focused

5.5.2.1.2. Stage-focused

5.5.2.1.3. Generalist Source

5.5.2.2. Canada Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

5.5.2.2.1. Convertible Notes

5.5.2.2.2. Equity

5.5.2.2.3. Revenue-based Financing

5.5.2.3. Canada Global Angel Funds Market Size and Forecast, Ticket Size (2024-2032)

5.5.2.3.1. Less than $500,000

5.5.2.3.2. $500,000 - $1 million

5.5.2.3.3. Over $1 million

5.5.2.4. Canada Global Angel Funds Market Size and Forecast, Investor Type (2024-2032)

5.5.2.4.1. Individual Investors

5.5.2.4.2. Family Offices

5.5.2.4.3. Venture Capital Firms

5.5.2.4.4. Corporate Investors

5.5.3. Mexico

5.5.3.1. Mexico Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

5.5.3.1.1. Sector-focused

5.5.3.1.2. Stage-focused

5.5.3.1.3. Generalist Source

5.5.3.2. Mexico Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

5.5.3.2.1. Convertible Notes

5.5.3.2.2. Equity

5.5.3.2.3. Revenue-based Financing

5.5.3.3. Mexico Global Angel Funds Market Size and Forecast, By Ticket Size (2024-2032)

5.5.3.3.1. Less than $500,000

5.5.3.3.2. $500,000 - $1 million

5.5.3.3.3. Over $1 million

5.5.3.4. Mexico Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

5.5.3.4.1. Individual Investors

5.5.3.4.2. Family Offices

5.5.3.4.3. Venture Capital Firms

5.5.3.4.4. Corporate Investors

6. Europe Global Angel Funds Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

6.1. Europe Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

6.2. Europe Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

6.3. Europe Global Angel Funds Market Size and Forecast, By Ticket Size (2024-2032)

6.4. Europe Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

6.5. Europe Global Angel Funds Market Size and Forecast, by Country (2024-2032)

6.5.1. United Kingdom

6.5.1.1. United Kingdom Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

6.5.1.2. United Kingdom Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

6.5.1.3. United Kingdom Global Angel Funds Market Size and Forecast, By Ticket Size (2024-2032)

6.5.1.4. United Kingdom Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

6.5.2. France

6.5.2.1. France Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

6.5.2.2. France Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

6.5.2.3. France Global Angel Funds Market Size and Forecast, By Ticket Size (2024-2032)

6.5.2.4. France Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

6.5.3. Germany

6.5.3.1. Germany Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

6.5.3.2. Germany Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

6.5.3.3. Germany Global Angel Funds Market Size and Forecast, By Ticket Size (2024-2032)

6.5.3.4. Germany Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

6.5.4. Italy

6.5.4.1. Italy Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

6.5.4.2. Italy Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

6.5.4.3. Italy Global Angel Funds Market Size and Forecast, By Ticket Size (2024-2032)

6.5.4.4. Italy Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

6.5.5. Spain

6.5.5.1. Spain Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

6.5.5.2. Spain Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

6.5.5.3. Spain Global Angel Funds Market Size and Forecast, By Ticket Size (2024-2032)

6.5.5.4. Spain Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

6.5.6. Sweden

6.5.6.1. Sweden Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

6.5.6.2. Sweden Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

6.5.6.3. Sweden Global Angel Funds Market Size and Forecast, By Ticket Size (2024-2032)

6.5.6.4. Sweden Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

6.5.7. Russia

6.5.7.1. Russia Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

6.5.7.2. Russia Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

6.5.7.3. Russia Global Angel Funds Market Size and Forecast, By Ticket Size (2024-2032)

6.5.7.4. Russia Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

6.5.8. Rest of Europe

6.5.8.1. Rest of Europe Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

6.5.8.2. Rest of Europe Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

6.5.8.3. Rest of Europe Global Angel Funds Market Size and Forecast, By Ticket Size (2024-2032)

6.5.8.4. Rest of Europe Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

7. Asia Pacific Global Angel Funds Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

7.1. Asia Pacific Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

7.2. Asia Pacific Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

7.3. Asia Pacific Global Angel Funds Market Size and Forecast, By Ticket Size (2024-2032)

7.4. Asia Pacific Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

7.5. Asia Pacific Global Angel Funds Market Size and Forecast, by Country (2024-2032)

7.5.1. China

7.5.1.1. China Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

7.5.1.2. China Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

7.5.1.3. China Global Angel Funds Market Size and Forecast, By Ticket Size (2024-2032)

7.5.1.4. China Global Angel Funds Market Size and Forecast, By China Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

7.5.2. S Korea

7.5.2.1. S Korea Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

7.5.2.2. S Korea Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

7.5.2.3. S Korea Global Angel Funds Market Size and Forecast, By Ticket Size (2024-2032)

7.5.2.4. S Korea Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

7.5.3. Japan

7.5.3.1. Japan Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

7.5.3.2. Japan Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

7.5.3.3. Japan Global Angel Funds Market Size and Forecast, By Ticket Size (2024-2032)

7.5.3.4. Japan Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

7.5.4. India

7.5.4.1. India Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

7.5.4.2. India Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

7.5.4.3. India Global Angel Funds Market Size and Forecast, By Ticket Size (2024-2032)

7.5.4.4. India Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

7.5.5. Australia

7.5.5.1. Australia Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

7.5.5.2. Australia Global Angel Funds Market Size and Forecast, By Investment Type(2024-2032)

7.5.5.3. Australia Global Angel Funds Market Size and Forecast, By Ticket Size(2024-2032)

7.5.5.4. Australia Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

7.5.6. Indonesia

7.5.6.1. Indonesia Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

7.5.6.2. Indonesia Global Angel Funds Market Size and Forecast, By Investment Type(2024-2032)

7.5.6.3. Indonesia Global Angel Funds Market Size and Forecast, By Ticket Size (2024-2032)

7.5.6.4. Indonesia Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

7.5.7. Malaysia

7.5.7.1. Malaysia Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

7.5.7.2. Malaysia Global Angel Funds Market Size and Forecast, By Investment Type(2024-2032)

7.5.7.3. Malaysia Global Angel Funds Market Size and Forecast, By Ticket Size (2024-2032)

7.5.7.4. Malaysia Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

7.5.8. Philippines

7.5.8.1. Philippines Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

7.5.8.2. Philippines Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

7.5.8.3. Philippines Global Angel Funds Market Size and Forecast, By Ticket Size (2024-2032)

7.5.8.4. Philippines Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

7.5.9. Thailand

7.5.9.1. Thailand Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

7.5.9.2. Thailand Global Angel Funds Market Size and Forecast, By Investment Type(2024-2032)

7.5.9.3. Thailand Global Angel Funds Market Size and Forecast, By Ticket Size (2024-2032)

7.5.9.4. Thailand Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

7.5.10. Vietnam

7.5.10.1. Vietnam Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

7.5.10.2. Vietnam Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

7.5.10.3. Vietnam Global Angel Funds Market Size and Forecast, By Ticket Size( 2024-2032)

7.5.10.4. Vietnam Global Angel Funds Market Size and Forecast, By Investor Type ( 2024-2032)

7.5.11. Rest of Asia Pacific

7.5.11.1. Rest of Asia Pacific Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

7.5.11.2. Rest of Asia Pacific Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

7.5.11.3. Rest of Asia Pacific Global Angel Funds Market Size and Forecast, By Ticket Size(2024-2032)

7.5.11.4. Rest of Asia Pacific Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

8. Middle East and Africa Global Angel Funds Market Size and Forecast (by Value in USD Billion) (2024-2032

8.1. Middle East and Africa Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

8.2. Middle East and Africa Global Angel Funds Market Size and Forecast, By Investment Type(2024-2032)

8.3. Middle East and Africa Global Angel Funds Market Size and Forecast, By Ticket Size(2024-2032)

8.4. Middle East and Africa Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

8.5. Middle East and Africa Global Angel Funds Market Size and Forecast, by Country (2024-2032)

8.5.1. South Africa

8.5.1.1. South Africa Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

8.5.1.2. South Africa Global Angel Funds Market Size and Forecast, By Investment Type (2024-2032)

8.5.1.3. South Africa Global Angel Funds Market Size and Forecast, By Ticket Size(2024-2032)

8.5.1.4. South Africa Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

8.5.2. GCC

8.5.2.1. GCC Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

8.5.2.2. GCC Global Angel Funds Market Size and Forecast, By Investment Type(2024-2032)

8.5.2.3. GCC Global Angel Funds Market Size and Forecast, By Ticket Size(2024-2032)

8.5.2.4. GCC Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

8.5.3. Egypt

8.5.3.1. Egypt Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

8.5.3.2. Egypt Global Angel Funds Market Size and Forecast, By Investment Type(2024-2032)

8.5.3.3. Egypt Global Angel Funds Market Size and Forecast, By Ticket Size(2024-2032)

8.5.3.4. Egypt Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

8.5.4. Nigeria

8.5.4.1. Nigeria Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

8.5.4.2. Nigeria Global Angel Funds Market Size and Forecast, By Investment Type(2024-2032)

8.5.4.3. Nigeria Global Angel Funds Market Size and Forecast, By Ticket Size(2024-2032)

8.5.4.4. Nigeria Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

8.5.5. Rest of ME&A

8.5.5.1. Rest of ME&A Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

8.5.5.2. Rest of ME&A Global Angel Funds Market Size and Forecast, By Investment Type(2024-2032)

8.5.5.3. Rest of ME&A Global Angel Funds Market Size and Forecast, By Ticket Size(2024-2032)

8.5.5.4. Rest of ME&A Global Angel Funds Market Size and Forecast, By Event Type(2024-2032)

9. South America Global Angel Funds Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032

9.1. South America Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

9.2. South America Global Angel Funds Market Size and Forecast, By Investment Type(2024-2032)

9.3. South America Global Angel Funds Market Size and Forecast, By Ticket Size(2024-2032)

9.4. South America Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

9.5. South America Global Angel Funds Market Size and Forecast, by Country (2024-2032)

9.5.1. Brazil

9.5.1.1. Brazil Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

9.5.1.2. Brazil Global Angel Funds Market Size and Forecast, By Investment Type(2024-2032)

9.5.1.3. Brazil Global Angel Funds Market Size and Forecast, By Ticket Size(2024-2032)

9.5.1.4. Brazil Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

9.5.2. Argentina

9.5.2.1. Argentina Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

9.5.2.2. Argentina Global Angel Funds Market Size and Forecast, By Investment Type(2024-2032)

9.5.2.3. Argentina Global Angel Funds Market Size and Forecast, By Ticket Size(2024-2032)

9.5.2.4. Argentina Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

9.5.3. Colombia

9.5.3.1. Colombia Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

9.5.3.2. Colombia Global Angel Funds Market Size and Forecast, By Investment Type(2024-2032)

9.5.3.3. Colombia Global Angel Funds Market Size and Forecast, By Ticket Size(2024-2032)

9.5.3.4. Colombia Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

9.5.4. Chile

9.5.4.1. Chile Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

9.5.4.2. Chile Global Angel Funds Market Size and Forecast, By Investment Type(2024-2032)

9.5.4.3. Chile Global Angel Funds Market Size and Forecast, By Ticket Size(2024-2032)

9.5.4.4. Chile Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

9.5.5. Rest Of South America

9.5.5.1. Rest of South America Global Angel Funds Market Size and Forecast, By Investment Strategy (2024-2032)

9.5.5.2. Rest of South America Global Angel Funds Market Size and Forecast, By Investment Type(2024-2032)

9.5.5.3. Rest Of South America Global Angel Funds Market Size and Forecast, By Ticket Size(2024-2032)

9.5.5.4. Rest Of South America Global Angel Funds Market Size and Forecast, By Investor Type (2024-2032)

10. Company Profile: Key Players

10.1. 500 Global

10.1.1. Overview

10.1.2. Business Portfolio

10.1.3. Financial Strategic Analysis

10.1.4. Recent Developments

10.2. Techstars

10.3. M13

10.4. Life Science Angels

10.5. New York Angels

10.6. Angel Invest

10.7. SFC Capital

10.8. Cambridge Angels

10.9. FiBAN (Finnish Business Angels Network)

10.10. Super Capital

10.11. XA Network

10.12. Indian Angel Network (IAN)

10.13. East Ventures

10.14. Epic Angels

10.15. AI Angelclub

10.16. Wamda Capital

10.17. Flat6Labs

10.18. OQAL Angel Investors Network

10.19. Angels for Africa

10.20. NXTP Labs

10.21. Angel Ventures

10.22. Kaszek Ventures

10.23. Monashees

10.24. Bossanova Investimentos

11. Key Findings & Analyst Recommendations

12. Angel Fund Market: Research Methodology