Yogurt Powder Market Industry Analysis and Forecast (2026-2032)

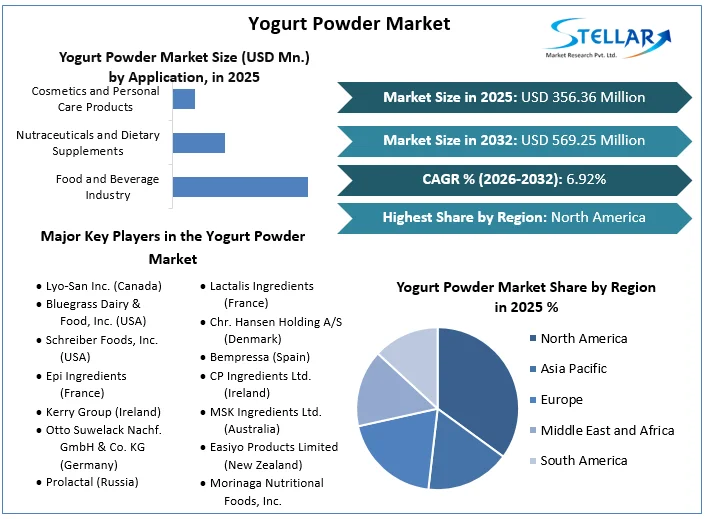

The Yogurt Powder Market size was valued at USD 356.36 Mn in 2025 and the total Yogurt Powder Market revenue is expected to grow at a CAGR of 6.92% from 2026 to 2032, reaching nearly USD 569.25 Mn.

Format : PDF | Report ID : SMR_1951

Yogurt Powder Market Overview

Yogurt powder, often referred to as dehydrated yogurt, is a product made from cultured milk through a process that involves pasteurization, fermentation with yogurt cultures, and spray drying. This powder retains the tart flavor characteristic of fresh yogurt and shares a composition similar to skim milk powder. Yogurt powder is used in various applications where fresh yogurt is impractical, such as confectionery coatings, nutrition bars, dry beverage mixes, and cosmetic products due to its stability and long shelf life of one to two years. The yogurt powder market is experiencing notable growth driven by increasing consumer demand for convenient, shelf-stable dairy products that offer the nutritional and flavor benefits of fresh yogurt without the need for refrigeration.

The Yogurt Powder Market is being propelled by rising awareness of the health benefits associated with yogurt, such as improved digestion, enhanced immune function, and potential weight management properties. Additionally, the growing trend of incorporating yogurt powder into functional foods and beverages, which are designed to offer specific health benefits beyond basic nutrition, is a significant driver. This trend is further supported by the increasing popularity of natural and organic products, as consumers become more health-conscious and environmentally aware.

Several recent developments highlight the dynamic nature of the yogurt powder market. For instance, EPI Ingredients has introduced organic yogurt powder, aligning with the global trend towards organic and sustainable food products. This product is particularly designed to cater to the needs of food industry players in the organic market, offering functional, nutritional, and organoleptic benefits without requiring refrigeration. EPI Ingredients emphasizes the natural yogurt taste and quality of its powder, which is suitable for a wide range of applications, including ice creams, beverages, and bakery products. The company’s commitment to high hygiene standards and fermentation control ensures that their yogurt powder meets the stringent requirements of organic certification.

The FDA's recent decision to allow yogurt manufacturers to claim that consuming yogurt reduce the risk of type 2 diabetes represents a significant opportunity for Yogurt Powder Market growth. This qualified health claim, which is based on limited but credible evidence, provides yogurt producers with a powerful marketing tool to promote their products as part of a diabetes-prevention diet. Companies like Danone are poised to benefit from this regulatory development, as it offers an additional incentive for consumers to incorporate yogurt into their diets.

The acquisition activities in the dairy and enzyme sectors also indicate a strategic alignment towards enhancing product offerings and increasing Yogurt Powder Market reach. For example, Kerry Group's acquisition of part of the lactase enzyme business from Chr. Hansen and Novozymes is set to enhance its capability in biotechnology solutions. This acquisition will enable Kerry to produce lactose-free and sugar-reduced dairy products, catering to the growing segment of consumers with lactose intolerance or those choosing lactose-free options for health reasons.

To get more Insights: Request Free Sample Report

Yogurt Powder Market Dynamics:

Increasing Demand for Natural and Functional Ingredients

The incorporation of natural functional ingredients in yogurt powder formulations enhances its nutritional value and biological activity, driving Yogurt Powder Market growth. Consumers seek products enriched with nutrients like polysaccharides, phenolics, flavonoids, and amino acids for their health benefits. For example, yogurt powder enriched with natural functional ingredients exhibits improved texture, sensory qualities, and biological effects, offering a competitive edge in the market and attracting health-conscious consumers.

The increasing focus on health and wellness among consumers presents a significant opportunity for the Yogurt Powder Market. As consumers become more aware of the health benefits associated with yogurt consumption, including improved digestion, immunity, and weight management, demand for yogurt powder as a versatile and convenient option is expected to rise. For example, the FDA's decision to allow yogurt makers to claim a reduced risk of type 2 diabetes for their products enhances the market's credibility and attracts health-conscious consumers seeking preventive dietary choices.

The introduction of innovative yogurt powder products catering to various dietary needs and preferences drives Yogurt Powder Market growth. For instance, Danone's entry into the yogurt mix-in category with its Remix banner, offering healthy mix-ins with low sugar, high protein, or low-calorie options, expands the usage occasions for yogurt powder beyond traditional applications. Such innovations attract new consumer segments and boost overall Yogurt Powder Market demand.

Increasing Application in Cosmetics and Aromatherapy: The expanding application of yogurt powder in the cosmetics and aromatherapy industries creates new growth opportunities for the market. With its potential to revitalize skin, moisturize deeply, and enhance the nutritive value of skincare products, yogurt powder becomes a sought-after ingredient in creams, moisturizers, and hair care products. For instance, VedaOils' Frozen Yogurt Powder offers dispersibility in water and oil, making it versatile for various cosmetic formulations, thus driving Yogurt Powder Market growth into the non-food sectors.

The growing acceptance of yogurt powder in diverse regions worldwide fuels Yogurt Powder Market growth. As consumer awareness about the benefits of yogurt consumption increases globally, the demand for yogurt powder transcends geographical boundaries. With companies like EPI Ingredients offering organic powdered yogurt tailored to meet specific regional preferences and dietary needs, the market experiences sustained growth and penetration into new territories.

Regulatory approvals and health claims endorsing the health benefits of yogurt powder bolster market growth. For instance, the FDA's decision to allow yogurt makers to claim a reduced risk of type 2 diabetes provides credibility and encourages consumer confidence in yogurt powder products. Such regulatory support fosters Yogurt Powder Market growth by validating the health claims associated with yogurt consumption and driving consumer adoption of yogurt powder as a functional and preventive dietary choice.

Yogurt Powder Market Segment Analysis:

Based on Product, The Yogurt Powder Market is segmented into skimmed, semi-skimmed, and whole yogurt powders. The whole yogurt powder segment dominates the market due to its rich taste and high nutritional content, making it a preferred choice in applications like bakery products, confectionery, and frozen desserts. Whole yogurt powder is anticipated to maintain its dominance owing to its versatile uses and consumer preference for fuller flavor profiles. Skimmed yogurt powder, while less dominant, finds significant application in health-focused products due to its lower fat content, appealing to calorie-conscious consumers and those managing dietary fat intake.

Semi-skimmed yogurt powder, offering a balance between taste and fat content, is steadily gaining adoption in dairy and snack products where moderate fat levels are desired. As health and wellness trends continue to rise, the demand for skimmed and semi-skimmed yogurt powders is expected to grow, with semi-skimmed poised for substantial Yogurt Powder Market growth due to its balanced nutritional profile.

Yogurt Powder Market Regional Insights:

The yogurt powder market is experiencing significant growth across various regions, Dominance in the yogurt powder market is currently observed in North America, particularly in the United States and Canada. This dominance is attributed to factors such as high consumer awareness regarding the health benefits of yogurt, strong distribution networks, and a robust food industry infrastructure. With established players like Lyo-San Inc. North America and increasing demand for convenient food products, North America has maintained its stronghold in the yogurt powder market.

Europe is another key region contributing significantly to the yogurt powder market, driven by countries like Germany, France, and the United Kingdom. The region benefits from a growing demand for functional food products, including yogurt powder, due to rising health consciousness among consumers. The presence of leading dairy companies and technological advancements in food processing further support market growth in Europe.

While North America and Europe dominate the Yogurt Powder Market currently, the Asia-Pacific region is expected to exhibit substantial growth potential in the forecast period. Countries like China, India, and Japan are witnessing an increasing adoption of Western dietary habits, including the consumption of yogurt and yogurt-based products. Furthermore, rising disposable incomes, urbanization, and a growing awareness of health and wellness are driving the demand for yogurt powder in this region. For instance, the Yogurt Powder Market in India is expected to witness significant growth due to the popularity of yogurt-based traditional beverages like lassi and the increasing demand for convenient and nutritious food options among the rapidly growing urban population.

Yogurt Powder Market Competitive Landscape

The acquisition of the Lactase Enzymes Business is poised to significantly drive the growth of the Yogurt Powder Market. With the addition of enzyme technology from the acquired business, the company will expand its capability to produce lactose-free and sugar-reduced dairy products, while maintaining their authentic taste. This innovation addresses the rising demand for lactose-free options due to increased awareness of lactose intolerance and consumer preferences for healthier choices. By offering solutions for lactose-free yogurt powder, Kerry can tap into a broader market segment and meet the needs of health-conscious consumers worldwide. Furthermore, the acquisition enhances the biotechnology solutions portfolio, positioning the company as a key player in providing innovative dairy solutions tailored to evolving consumer preferences and Yogurt Powder Market demands. This strategic move is expected to catalyze growth and innovation in the Yogurt Powder Market, driving its growth and market penetration.

July 14, 2023, EPI Ingredients has introduced an innovative organic powdered yogurt, showcasing Groupe Laïta's CSR approach, Passion du Lait, initiated in 2015. This product aligns with the growing demand for sustainable and ethical food solutions. EPI Ingredients has ensured the organic certification of its production facilities and sourcing of raw materials. The resulting organic yogurt powder offers functional, nutritional, and organoleptic benefits without refrigeration. It can be utilized in a wide range of applications, including ice creams, beverages, infant nutrition, and bakery products. The powder provides natural yogurt taste, quality, and fermentation control for active or inactive flora.

12 December, 2023, Kerry to Acquire Lactase Enzymes Business Kerry Group plc ("Kerry"), a global taste and nutrition company, announced a definitive agreement to acquire part of the global lactase enzyme business from Chr. Hansen Holding A/S and Novozymes A/S on a carve-out basis. This acquisition, subject to European Commission approval, is part of Novozymes and Chr. Hansen's merger process. The deal enhances Kerry's biotechnology solutions, particularly in creating lactose-free and sugar-reduced dairy products. The Lactase Enzymes Business, with NOLA® Products, generated approximately €40 million in revenue in 2022. The €150 million transaction is expected to close in the first half of 2024.

Yogurt Powder Market Scope:

|

Yogurt Powder Market |

|

|

Market Size in 2025 |

USD 356.36 Mn. |

|

Market Size in 2032 |

USD 569.25 Mn. |

|

CAGR (2026-2032) |

6.92 % |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Product Skimmed Semi-Skimmed Whole |

|

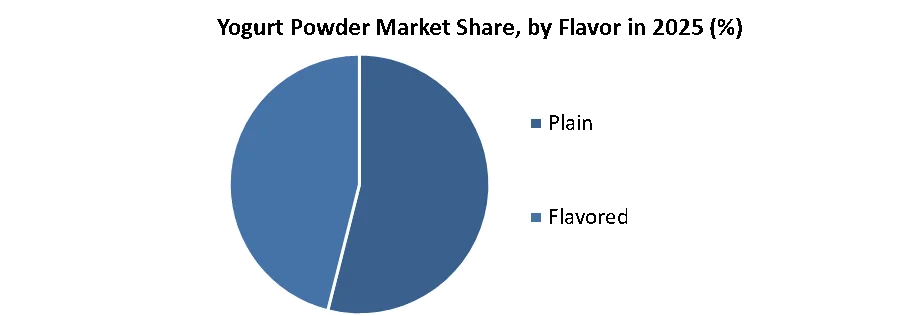

By Flavor Plain Flavored |

|

|

By Application Food and Beverage Industry Nutraceuticals and Dietary Supplements Cosmetics and Personal Care Products |

|

|

By Distribution channel Supermarkets and Hypermarkets, Convenience Stores, Online Retailing, Specialty Stores, Others. |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Yogurt Powder Market Key Players:

North America:

- Lyo-San Inc. (Canada)

- Bluegrass Dairy & Food, Inc. (USA)

- Schreiber Foods, Inc. (USA)

Europe

- Epi Ingredients (France)

- Kerry Group (Ireland)

- Otto Suwelack Nachf. GmbH & Co. KG (Germany)

- Prolactal (Russia)

- Lactalis Ingredients (France)

- Chr. Hansen Holding A/S (Denmark)

- Bempressa (Spain)

- CP Ingredients Ltd. (Ireland)

Asia Pacific

- MSK Ingredients Ltd. (Australia)

- Easiyo Products Limited (New Zealand)

- Morinaga Nutritional Foods, Inc. (Japan)Group (United Kingdom)

Frequently Asked Questions

Increasing Application in Cosmetics and Aromatherapy is a major opportunity for the Yogurt Powder market.

North America is expected to lead the Yogurt Powder Market during the forecast period.

The Yogurt Powder Market size was valued at USD 356.36 Million in 2025 and the total Yogurt Powder Market revenue is expected to grow at a CAGR of 6.92 % from 2026 to 2032, reaching nearly USD 569.25 Million.

The segments covered in the Yogurt Powder Market report are by Product, Flavor, Application, Distribution channel, and Region.

1. Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. Yogurt Powder Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Global Yogurt Powder Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

4. Yogurt Powder Market: Dynamics

4.1. Yogurt Powder Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Yogurt Powder Market Drivers

4.3. Yogurt Powder Market Restraints

4.4. Yogurt Powder Market Opportunities

4.5. Yogurt Powder Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factor

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape by Region

4.10.1. North America

4.10.2. Europe

4.10.3. Asia Pacific

4.10.4. Middle East and Africa

4.10.5. South America

5. Yogurt Powder Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in kilogram) (2025-2032)

5.1. Yogurt Powder Market Size and Forecast, by Product (2025-2032)

5.1.1. Skimmed

5.1.2. Semi-Skimmed

5.1.3. Whole

5.2. Yogurt Powder Market Size and Forecast, by Flavor (2025-2032)

5.2.1. Plain

5.2.2. Flavored

5.3. Yogurt Powder Market Size and Forecast, by Application (2025-2032)

5.3.1. Food and Beverage Industry

5.3.2. Nutraceuticals and Dietary Supplements

5.3.3. Cosmetics and Personal Care Products

5.4. Yogurt Powder Market Size and Forecast, by Distribution Channel (2025-2032)

5.4.1. Supermarkets and Hypermarkets,

5.4.2. Convenience Stores,

5.4.3. Online Retailing,

5.4.4. Specialty Stores,

5.4.5. Others

5.5. Yogurt Powder Market Size and Forecast, by Region (2025-2032)

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

6. North America Yogurt Powder Market Size and Forecast by Segmentation (by Value in USD Million and Volume in kilogram) (2025-2032)

6.1. North America Yogurt Powder Market Size and Forecast, by Product (2025-2032)

6.1.1. Skimmed

6.1.2. Semi-Skimmed

6.1.3. Whole

6.2. North America Yogurt Powder Market Size and Forecast, by Flavor (2025-2032)

6.2.1. Plain

6.2.2. Flavored

6.3. North America Yogurt Powder Market Size and Forecast, by Application (2025-2032)

6.3.1. Food and Beverage Industry

6.3.2. Nutraceuticals and Dietary Supplements

6.3.3. Cosmetics and Personal Care Products

6.4. North America Yogurt Powder Market Size and Forecast, by Distribution Channel (2025-2032)

6.4.1. Supermarkets and Hypermarkets,

6.4.2. Convenience Stores,

6.4.3. Online Retailing,

6.4.4. Specialty Stores,

6.4.5. Others

6.5. North America Yogurt Powder Market Size and Forecast, by Country (2025-2032)

6.5.1. United States

6.5.2. Canada

6.5.3. Mexico

7. Europe Yogurt Powder Market Size and Forecast by Segmentation (by Value in USD Million and Volume in kilogram) (2025-2032)

7.1. Europe Yogurt Powder Market Size and Forecast, by Product (2025-2032)

7.2. Europe Yogurt Powder Market Size and Forecast, by Flavor (2025-2032)

7.3. Europe Yogurt Powder Market Size and Forecast, by Application (2025-2032)

7.4. Europe Yogurt Powder Market Size and Forecast, by Distribution Channel (2025-2032)

7.5. Europe Yogurt Powder Market Size and Forecast, by Country (2025-2032)

7.5.1. United Kingdom

7.5.2. France

7.5.3. Germany

7.5.4. Italy

7.5.5. Spain

7.5.6. Sweden

7.5.7. Austria

7.5.8. Rest of Europe

8. Asia Pacific Yogurt Powder Market Size and Forecast by Segmentation (by Value in USD Million and Volume in kilogram) (2025-2032)

8.1. Asia Pacific Yogurt Powder Market Size and Forecast, by Product (2025-2032)

8.2. Asia Pacific Yogurt Powder Market Size and Forecast, by Flavor (2025-2032)

8.3. Asia Pacific Yogurt Powder Market Size and Forecast, by Application (2025-2032)

8.4. Asia Pacific Yogurt Powder Market Size and Forecast, by Distribution Channel (2025-2032)

8.5. Asia Pacific Yogurt Powder Market Size and Forecast, by Country (2025-2032)

8.5.1. China

8.5.2. S Korea

8.5.3. Japan

8.5.4. India

8.5.5. Australia

8.5.6. Indonesia

8.5.7. Malaysia

8.5.8. Vietnam

8.5.9. Taiwan

8.5.10. Rest of Asia Pacific

9. Middle East and Africa Yogurt Powder Market Size and Forecast by Segmentation (by Value in USD Million and Volume in kilogram) (2025-2032)

9.1. Middle East and Africa Yogurt Powder Market Size and Forecast, by Product (2025-2032)

9.2. Middle East and Africa Yogurt Powder Market Size and Forecast, by Flavor (2025-2032)

9.3. Middle East and Africa Yogurt Powder Market Size and Forecast, by Application (2025-2032)

9.4. Middle East and Africa Yogurt Powder Market Size and Forecast, by Distribution Channel (2025-2032)

9.5. Middle East and Africa Yogurt Powder Market Size and Forecast, by Country (2025-2032)

9.5.1. South Africa

9.5.2. GCC

9.5.3. Nigeria

9.5.4. Rest of ME&A

10. South America Yogurt Powder Market Size and Forecast by Segmentation (by Value in USD Million and Volume in kilogram) (2025-2032)

10.1. South America Yogurt Powder Market Size and Forecast, by Product (2025-2032)

10.2. South America Yogurt Powder Market Size and Forecast, by Flavor (2025-2032)

10.3. South America Yogurt Powder Market Size and Forecast, by Application (2025-2032)

10.4. South America Yogurt Powder Market Size and Forecast, by Distribution Channel (2025-2032)

10.5. South America Yogurt Powder Market Size and Forecast, by Country (2025-2032)

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Rest Of South America

11. Company Profile: Key Players

11.1. Lyo-San Inc. (Canada)

11.1.1. Company Overview

11.1.2. Product Portfolio

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc.)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Bluegrass Dairy & Food, Inc. (USA)

11.3. Schreiber Foods, Inc. (USA)

11.4. Epi Ingredients (France)

11.5. Kerry Group (Ireland)

11.6. Otto Suwelack Nachf. GmbH & Co. KG (Germany)

11.7. Prolactal (Russia)

11.8. Lactalis Ingredients (France)

11.9. Chr. Hansen Holding A/S (Denmark)

11.10. Bempressa (Spain)

11.11. CP Ingredients Ltd. (Ireland)

11.12. MSK Ingredients Ltd. (Australia)

11.13. Easiyo Products Limited (New Zealand)

11.14. Morinaga Nutritional Foods, Inc. (Japan)Group (United Kingdom)

12. Key Findings

13. Analyst Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook