Whey Permeate Market Industry Analysis and Forecast (2026-2032)

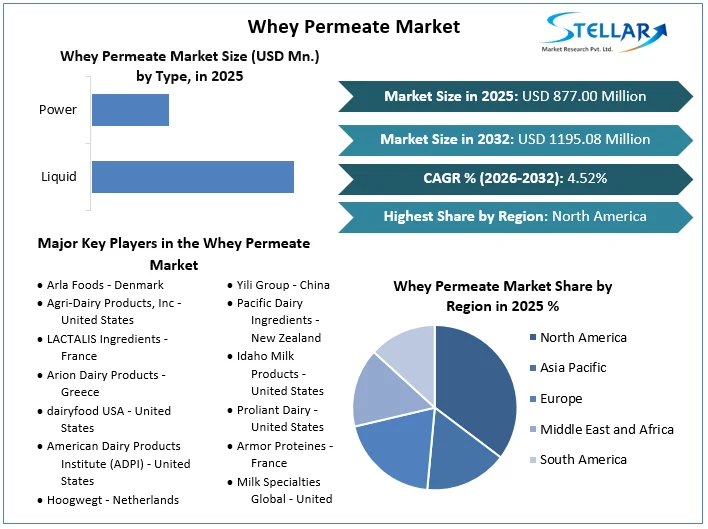

The Whey Permeate Market size was valued at USD 877.00 Mn. in 2025 and the total Whey Permeate Market size is expected to grow at a CAGR of 4.52% from 2026 to 2032, reaching nearly USD 1195.08 Mn. by 2032.

Format : PDF | Report ID : SMR_2024

Whey Permeate Market Overview

The global whey permeate market is expected to grow because of its increasing application in the feed industry and consumption of milk products. However, the growing incidence of lactose intolerance is expected to hinder growth. However, the growing use of whey permeates in confectionery products presents lucrative opportunities for players in the market. Whey permeate, a coproduce of whey protein concentrate and isolate production, is known for its nutritional value and health advantages. It is a complete protein high in essential amino acids and easy to digest.

The market penetration of permeate is driven by the need for protein-rich and healthy food and drinks, particularly in sports nutrition, nutritional supplements, and dietary supplements. Whey Permeate is a fast-dissolving bulking agent suitable for instant soups, sauces, powder beverages, and seasoning. Its mild, appealing flavor is because of its high wettability. Its sweet dairy flavor is ideal for chocolate and confectionery. Its low salty mineral flavor ensures optimal usage at higher dosages. Whey Permeate replaces expensive filler ingredients like pure lactose and whey powder, making it a cost-efficient dairy substitute for lactose, sweet whey powder, and demineralized whey powder in various food applications.

To get more Insights: Request Free Sample Report

Whey Permeate Market Dynamics:

The whey permeate market is driven by the increasing demand for functional foods and beverages, driven by health consciousness and chronic disease prevalence. This demand is driven by the versatility of whey permeate, which enhances the nutritional profile of food products while improving taste and texture. Whey permeate is cost-effective and sustainable, as it is a by-product of cheese and whey protein concentrate manufacturing, making it an affordable option for food manufacturers. Using whey permeate as a partial replacement for lactose in ice cream reduces costs by XX% without compromising quality. Also, whey permeate reduces waste in the dairy industry, contributing to a more sustainable food production system. As consumers become more environmentally conscious, the demand for sustainable ingredients like whey permeate is expected to increase.

The demand for whey protein in bodybuilding supplements is increasing because of the growing interest in fitness among young people. The market is also driven by increased demand for sports nutrition and new-born nutrition. As the sports nutrition market expands, volume growth for whey proteins is expected to outpace value growth. Major food and beverage players are expected to enter the protein snacks and shakes market because of consumer attention to rich protein diets. Fortified breakfast cereals and snacks offer great prospects for protein in the market.

Whey permeate has several advantages; however, the market is restricted by customer lack of knowledge and perception as well as some food makers' views. There are possibilities that not as much demand for items containing whey permeates if consumers are aware of its nutritional benefits. Also, because whey permeate is a by-product, some food makers consider it to be a subpar or low-quality ingredient. The use of whey permeate in specific food applications is hampered by this concept. Industry participants should concentrate on informing customers and food makers about the advantages and adaptability of whey permeate to get past this restriction.

The whey permeate market offers several opportunities because of its inflexibility in numerous industries, including food and beverage, pharmaceuticals, and animal feed. As a by-product of cheese making, it makes even with customer preferences for viable and natural components. Its lactose- and mineral-rich nutritional composition makes it an essential component of functional foods and sports nutrition. Improvements in processing technologies have improved its functionality and flavour profile, making it possible for product innovation. The growing implementation of whey permeate in animal feed, mostly in regions with a growing livestock industry, contributes to market growth. Generally, the whey permeate market is composed for growth.

Whey Permeate Market Segment Analysis:

Based on application, the whey permeate market is segmented into categories such as Food & Beverages, Personal Care & Cosmetics, Infant Nutrition, animal feed, and others. As of 2025, the food and beverage segment held the biggest market share. It is expected that this share are increase significantly for the projection period 2026 to 2032. Whey permeate is a fat-free carbohydrate that is utilized in chocolate and confectionery items, as well as a bulk sweetener. Whey permeate is used as a low-cost substitute for pricey milk solids without compromising food flavor or texture or requiring adjustments to processing conditions. The numerous benefits of whey permeate are going to keep driving the market of whey permeate in the food and beverage sector.

Type, The powder segment holds a major share of the whey permeate market. Compared to its counterpart, powder permeate has several benefits, including a longer shelf life, easier storage, and a lower cost of transportation. These elements influence the chosen option of food producers, particularly those with a global presence. Power whey permeates demand grows even more by the ease with which it are be used for food applications such as bread goods and snack dairy products. Also, the longer shelf life of powdered whey permeate reduces the danger of spoiling and gives inventory manager’s greater flexibility.

Whey Permeate Market Regional Insight:

North America dominated the Whey Permeate market in 2025, and this trend likely are continue for the remainder of the projection. The International Dairy Federation states that one of the main whey permeate producers is North America. Whey permeate is most often utilized in animal feed in North America. Whey permeates growing applications in the feed industry and is expected to fuel the market's significant growth throughout the forecast period 2026 to 2032. The growing use of whey permeate as a substitute for sodium decrease, the existence of numerous market players in the region, and the developing applications of whey permeate in the feed industry are important factors contributing to North America's enormous offer.

More money has been invested in research and development than production by suppliers of milk and whey. Discovering the unique potential, nourishment, and practical benefits of whey and milk permeate is the goal of this project. Its innovations are widely used as an inexpensive, flavour-enhancing ingredient in final products including animal feed, food, and beverages. Also, the expected permeability of an important achievement in the US permeate-producing procedure has enabled a consistent and high-quality permeate stockpile from the nation.

Whey Permeate Market Competitive Landscape:

- In 2024, Arla Foods pledges more than £300m to five UK sites on the day of Farm to sFork Summit the UK Farm to Fork Summit in Downing Street, Britain’s biggest dairy company has given a major boost to UK manufacturing and the future of British dairy by pledging to invest tens of millions in its production sites. From Scotland to the West Country, new investments at four of Arla’s sites bring its total UK investment commitments in 2024 to over £300 million.

- In 2023, Westland’s Resident Director, Zhiqiang Li, spoke about the global market advantage that both Westland and Yili gained from Yili’s investment in the new lactoferrin plant. launch of the lactoferrin program is secure Westland as one of the world’s leading producers of highly prized bioactive ingredients,” Li told invited guests. “The investment also signals Yili’s commitment to take the global lead in the high-value bioactive dairy ingredients sector.”

|

Whey Permeate Market Scope |

|

|

Market Size in 2025 |

USD 877.00 Mn. |

|

Market Size in 2032 |

USD 1195.08 Mn. |

|

CAGR (2026-2032) |

4.52 % |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Type Liquid Power |

|

By Application Food & Beverages Personal Care & Cosmetics Infant Nutrition Animal Feed Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Whey Permeate Market

- Arla Foods - Denmark

- Agri-Dairy Products, Inc - United States

- LACTALIS Ingredients - France

- Arion Dairy Products - Greece

- dairyfood USA - United States

- American Dairy Products Institute (ADPI) - United States

- Hoogwegt - Netherlands

- Yili Group - China

- Pacific Dairy Ingredients - New Zealand

- Idaho Milk Products - United States

- Proliant Dairy - United States

- Armor Proteines - France

- Milk Specialties Global - United States

- Agropur Ingredients LLC. - Canada

- MILEI GmbH - Germany

- Melkweg Holland BV - Netherlands

- ThinkUSAdairy - United States

- XX.inc

Frequently Asked Questions

North America is expected to lead the Whey Permeate Market during the forecast period.

An analysis of profit trends and projections for companies in the Whey Permeate Market is included, offering insights into factors driving profitability, cost management strategies, and financial performance metrics.

The Whey Permeate Market size was valued at USD 877.00 Billion in 2025 and the total Whey Permeate Market size is expected to grow at a CAGR of 4.52% from 2026 to 2032, reaching nearly USD 1195.08 Billion by 2032.

The segments covered in the market report are by Type, and by Application.

1. Whey Permeate Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market breakdown and Data Triangulation

1.4. Assumptions

2. Whey Permeate Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Whey Permeate Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovation

4. Whey Permeate Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

4.10.1. Market Regulation by Region

4.10.1.1. North America

4.10.1.2. Europe

4.10.1.3. Asia Pacific

4.10.1.4. Middle East and Africa

4.10.1.5. South America

4.10.2. Impact of Regulations on Market Dynamics

4.10.3. Government Schemes and Initiatives

5. Whey Permeate Market Size and Forecast by Segments (by Value USD Million)

5.1. Whey Permeate Market Size and Forecast, By Type (2025-2032)

5.1.1. Liquid

5.1.2. Powder

5.2. Whey Permeate Market Size and Forecast, By Application (2025-2032)

5.2.1. Food & Beverages

5.2.2. Personal Care & Cosmetics

5.2.3. Infant Nutrition

5.2.4. Animal Feed

5.2.5. Others

5.3. Whey Permeate Market Size and Forecast, by Region (2025-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Whey Permeate Market Size and Forecast (by Value USD Million)

6.1. North America Whey Permeate Market Size and Forecast, By Type (2025-2032)

6.1.1. Liquid

6.1.2. Powder

6.2. North America Whey Permeate Market Size and Forecast, By Application (2025-2032)

6.2.1. Food & Beverages

6.2.2. Personal Care & Cosmetics

6.2.3. Infant Nutrition

6.2.4. Animal Feed

6.2.5. Others

6.3. North America Whey Permeate Market Size and Forecast, by Country (2025-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Whey Permeate Market Size and Forecast (by Value USD Million)

7.1. Europe Whey Permeate Market Size and Forecast, By Type (2025-2032)

7.2. Europe Whey Permeate Market Size and Forecast, By Application (2025-2032)

7.3. Europe Whey Permeate Market Size and Forecast, by Country (2025-2032)

7.3.1. UK

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific Whey Permeate Market Size and Forecast (by Value USD Million)

8.1. Asia Pacific Whey Permeate Market Size and Forecast, By Type (2025-2032)

8.2. Asia Pacific Whey Permeate Market Size and Forecast, By Application (2025-2032)

8.3. Asia Pacific Whey Permeate Market Size and Forecast, by Country (2025-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Bangladesh

8.3.11. Pakistan

8.3.12. Rest of Asia Pacific

9. Middle East and Africa Whey Permeate Market Size and Forecast (by Value USD Million)

9.1. Middle East and Africa Whey Permeate Market Size and Forecast, By Type (2025-2032)

9.2. Middle East and Africa Whey Permeate Market Size and Forecast, By Application (2025-2032)

9.3. Middle East and Africa Whey Permeate Market Size and Forecast, by Country (2025-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Egypt

9.3.4. Nigeria

9.3.5. Rest of ME&A

10. South America Whey Permeate Market Size and Forecast (by Value USD Million)

10.1. South America Whey Permeate Market Size and Forecast, By Type (2025-2032)

10.2. South America Whey Permeate Market Size and Forecast, By Application (2025-2032)

10.3. South America Whey Permeate Market Size and Forecast, by Country (2025-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest of South America

11. Company Profile: Key players

11.1. Arla Foods - Denmark

11.1.1. Company Overview

11.1.2. Product Portfolio

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc.)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Agri-Dairy Products, Inc - United States

11.3. LACTALIS Ingredients - France

11.4. Arion Dairy Products - Greece

11.5. dairyfood USA - United States

11.6. American Dairy Products Institute (ADPI) - United States

11.7. Hoogwegt - Netherlands

11.8. Yili Group - China

11.9. Pacific Dairy Ingredients - New Zealand

11.10. Idaho Milk Products - United States

11.11. Proliant Dairy - United States

11.12. Armor Proteines - France

11.13. Milk Specialties Global - United States

11.14. Agropur Ingredients LLC. - Canada

11.15. MILEI GmbH - Germany

11.16. Melkweg Holland BV - Netherlands

11.17. ThinkUSAdairy - United States

11.18. XX.inc

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook