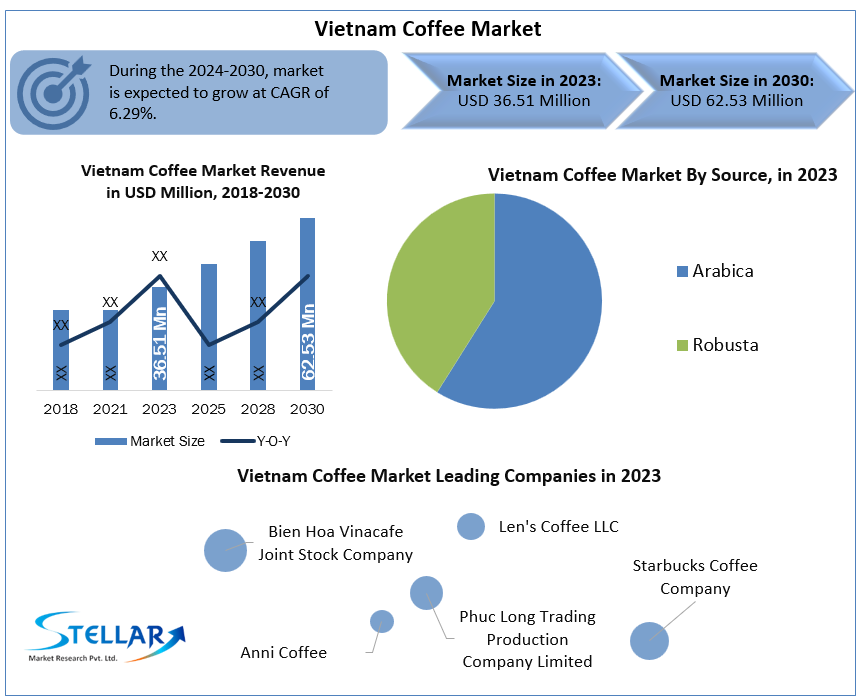

Vietnam Coffee Market: Industry Analysis and Forecast (2024-2030) by Source, Type, Process, and Region.

Vietnam Coffee Market size is volume at 36.51 million 60 kilograms in 2023. Coffee will encourage a great deal of transformation in Beverage Sector in Vietnam.

Format : PDF | Report ID : SMR_125

Vietnam Coffee Market Definition:

Coffee is a brewed beverage made from roasted coffee beans, which are the fruit seeds of certain types of coffee. Grains are separated from the coffee berries to obtain a stable raw product, unroasted green coffee. The seeds are then roasted into a consumable product. Vietnam coffee market report by Stellar Market Research is analysed and studied considering the segment analysis based on the source, type, process and geography.

To get more Insights: Request Free Sample Report

Vietnam Coffee Market Dynamics:

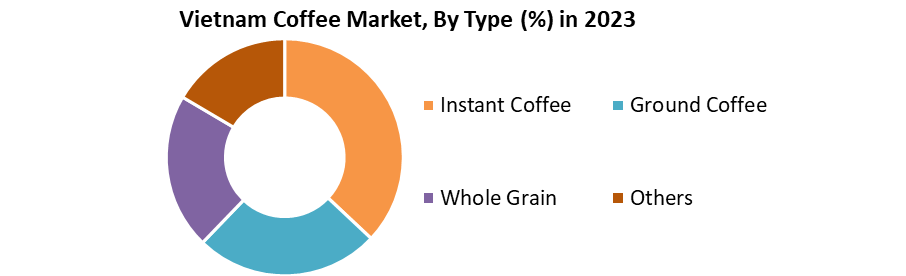

In Vietnam, Busy lifestyles and long hours fuel convenient packaging formats for coffee, and consumers have begun to switch from freshly ground coffee to instant coffee blends. Vietnam has recorded a constant consumption of soluble coffee per capita in Millennials compared to other Asian countries and shows constant Vietnam coffee market growth.

Coffee is very cheap in Vietnam and is a popular drink for Vietnamese. Coffee prices on the streets of Vietnam are as low as $ 0.5, which is affordable for all classes of society. Coffee ranks second only to rice in terms of the value of agricultural products exported from Vietnam and contains Robusta varieties due to the high yield of fruits on the market.

Vietnam is the second-largest coffee producer in the world market and is, therefore, an important trading center on the market. With the influence of French colonialism and a population of about 98 million in 2020, the country's population growth is a major driver of the growth of Vietnam coffee market.

The presence of international grocery chains and retailers such as Starbucks promotes the domestic coffee market. The country is heavily dependent on the agricultural sector, and recent shifts have become secondary and tertiary factors in the economy with rapid digitization has also advanced the country's development. These factors have brought about a fast pace of life in the country, and this changing lifestyle has recently expanded the Vietnam coffee market.

Vietnam's coffee culture is ingrained in history when the French brought coffee to Vietnam in the 19th century and the government launched a large coffee production program after the Vietnam War. In the process of population growth, there was a shift to coffee powders such as Nestle and Trung Nguyen. The market share of foreign companies has increased, companies with some foreign investment make up 60 -65% of all coffee exported annually. These factors pose a potential threat to domestic coffee growers who need more government support to stay competitive with foreign players. The surge in retail associations, availability of tea, stricter rules, and uncertainties in the weather are restraining the growth of the Vietnam coffee market.

The growing demand for coffee is mainly due to the growing demand from teens and young adults who prefer the convenience of instant products to ground coffee, and coffee makers offer 2 in 1, 3 in 1, and 4 in 1 instant products.

Only 10% of the coffee produced in Vietnam is consumed domestically and the remaining 90% is used as green coffee for export. An increasingly busy lifestyle and long working hours are expected to increase the appreciation for the convenience of this type of product and increase overall coffee production and consumption. Manufacturers continue to bring more flavourful products to the Vietnam coffee market that meet the traditional tastes of Vietnamese consumers.

With an increasingly busy lifestyle and long working hours, Coffee will be further appreciated and more consumers will switch from freshly ground coffee or instant standard coffee to instant coffee blends. Manufacturers continue to bring more flavourful products, Vietnamese coffee drinkers prefer roasted and ground coffee because it is full-bodied and has an original flavor.

Increase in the cafe culture of the younger generation, followed by an increase in disposable income, an increase in innovative packaging, an increase in urbanization, an increase in demand for coffee. E-commerce retail sales, reduced soda consumption, increased employee demographics, the rise of the hospitality industry, the rise of changing labor culture in the corporate industry, improving living standards. These factors are driving the growth of the Vietnam coffee market.

Vietnam Coffee Market Segment Analysis:

By Source, Robusta dominated the Vietnam coffee market with a 78 % share in 2023. Vietnam has become the world's largest producer of Robusta. Coffee, the type that accounts for about 94% of national coffee. Vietnam has created a unique brand of high-strength Robusta growth that has increased the profitability of coffee growers. Vietnam irrigates Robusta crops, but other producers believe that the yield of Robusta coffee is too low to irrigate.

Vietnamese farmers also use significant amounts of fertilizers to maximize their ovaries and practice pruning. And they further catalyzed yield growth by planting improved tree species. The result is a dense single cultivation of the world's highest-yielding Robusta trees. Vietnam is also the most profitable coffee-producing country in the world, as Robusta trees have more beans per hectare than Arabica trees.

The objective of the report is to present a comprehensive analysis of the Vietnam Coffee market to the stakeholders in the industry. The report provides trends that are most dominant in the Vietnam Coffee market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Vietnam Coffee Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Vietnam Coffee market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Vietnam Coffee market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Vietnam Coffee market. The report also analyses if the Vietnam Coffee market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Vietnam Coffee market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Coffee market. Understanding the impact of the surrounding environment and the influence of ecological concerns on the Vietnam Coffee market is aided by legal factors.

Vietnam Coffee Market Scope:

|

Vietnam Coffee Market |

|

|

Market Size in 2023 |

USD 36.51 Mn. |

|

Market Size in 2030 |

USD 62.53 Mn. |

|

CAGR (2024-2030) |

7.99% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Source

|

|

By Type

|

|

|

By Process

|

|

Vietnam Coffee Market Key Players:

- Nestle

- Bien Hoa Vinacafe Joint Stock Company

- Len's Coffee LLC

- Starbucks Coffee Company

- Phuc Long Trading Production Company Limited

- Anni Coffee

- Highlands Coffee

Frequently Asked Questions

1. Vietnam Coffee Market: Research Methodology

2. Vietnam Coffee Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Vietnam Coffee Market: Dynamics

3.1. Vietnam Coffee Market Trends

3.2. Vietnam Coffee Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Technological Roadmap

3.6. Value Chain Analysis

3.7. Regulatory Landscape

4. Vietnam Coffee Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Tonnes) (2024-2030)

4.1. Vietnam Coffee Market Size and Forecast, by Source (2024-2030)

4.1.1. Arabica

4.1.2. Robusta

4.2. Vietnam Coffee Market Size and Forecast, by Type (2024-2030)

4.2.1. Instant Coffee

4.2.2. Ground Coffee

4.2.3. Whole Grain

4.2.4. Others

4.3. Vietnam Coffee Market Size and Forecast, by Process (2024-2030)

4.3.1. Caffeinated

4.3.2. Decaffeinated

5. Vietnam Coffee Market: Competitive Landscape

5.1. SMR Competition Matrix

5.2. Competitive Landscape

5.3. Key Players Benchmarking

5.3.1. Company Name

5.3.2. Product Segment

5.3.3. End-user Segment

5.3.4. Revenue (2023)

5.3.5. Company Locations

5.4. Market Structure

5.4.1. Market Leaders

5.4.2. Market Followers

5.4.3. Emerging Players

5.5. Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1. Nestle

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Bien Hoa Vinacafe Joint Stock Company

6.3. Len's Coffee LLC

6.4. Starbucks Coffee Company

6.5. Phuc Long Trading Production Company Limited

6.6. Anni Coffee

6.7. Highlands Coffee

7. Key Findings

8. Industry Recommendations