Asia Pacific HoReCa Market Growth Driven by Tourism and QSRs

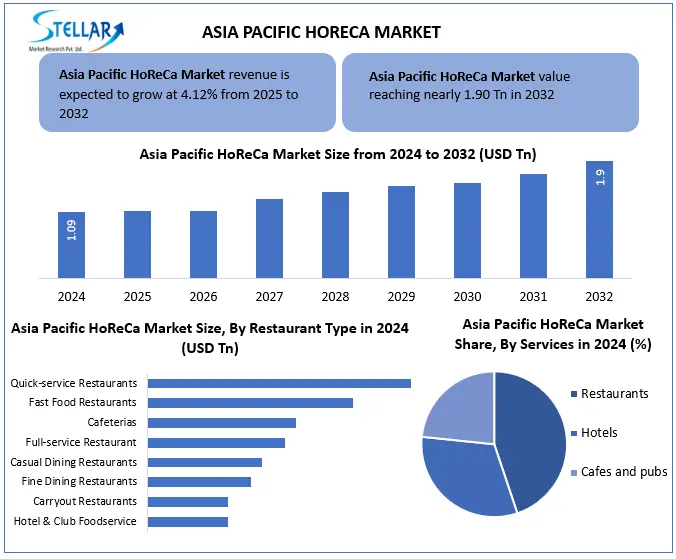

Asia Pacific HoReCa Market was valued at USD 1.09 Tn in 2024 and is expected to reach USD 1.90 Tn by 2032, growing at a CAGR of 4.12%, driven by digital dining.

Format : PDF | Report ID : SMR_2861

Asia Pacific HoReCa Market Overview:

HoReCa is a condiment made from the seeds of HoReCa plants, mixed with water, vinegar, or other liquids. It has a sharp, tangy flavour and is used in cooking, dressings, and sauces. Common varieties include yellow, Dijon, and whole-grain mustard.

The Asia Pacific HoReCa market is experiencing rapid growth due to its vast population, rapid urbanisation, and rising disposable incomes. Countries like China, Japan, and India are at the forefront, with China dominating by its tech-savvy consumer base and booming digital food delivery ecosystem. Japan excels in luxury hospitality and niche dining experiences, while India’s young population fuels growth in quick-service restaurants and cafe culture. Tourism plays a pivotal role, with destinations like Thailand and Singapore attracting record international visitors, further boosting hotel and restaurant demand. The region’s middle-class expansion, coupled with government support for hospitality infrastructure, ensures sustained growth. Also, challenges like labour shortages and supply chain disruptions persist, requiring innovative solutions to maintain momentum.

To get more Insights: Request Free Sample Report

Asia Pacific HoReCa Market Dynamics:

Tourism Revival Powers to boost Asia Pacific HoReCa Market Growth

Rebound of tourism significantly boosted the Asia Pacific HoReCa market, with countries easing visa policies to attract more international visitors. Mega events like Japan Expo 2025 and Thailand's Songkran Festival drive surges in hotel bookings and restaurant traffic. Popular destinations like Bali and Singapore are witnessing record occupancy rates, lifting demand for dining and hospitality services. Government led tourism campaigns, like India's "Incredible India" initiative, further amplify this growth. As travel restrictions fade, the Asia Pacific HoReCa market continues to thrive, supported by both leisure and business travellers.

Navigating Rising Costs and Supply Chain Turbulence to Restrain Asia-Pacific's HoReCa Market

Asia-Pacific heavy reliance on imported ingredients such as dairy, wine, and speciality meats exposes HoReCa businesses to cost fluctuations and delivery delays. Geopolitical tensions, trade restrictions, and logistics bottlenecks (e.g., Red Sea shipping disruptions) further strain supply chains. Also, Australia’s dairy imports and Japan’s wine dependence face rising prices due to currency swings and tariffs. Many operators are now localising sourcing or diversifying suppliers to mitigate risks, though this requires costly adjustments. Smaller cafes and independent restaurants bear the brunt, as they lack bulk-purchasing power.

Recently, Thailand's cheese prices surged 30% by disrupted EU dairy imports, forcing cafes to revise their menus. Meanwhile, Japan's wine tariffs on EU bottles raised costs for high-end hotels and restaurants.

AI Robotics and Smart Payments to create opportunities in the HoReCa Industry

Asia Pacific HoReCa Market is rapidly adopting AI-powered demand forecasting (like Zenput or 7shifts) to optimise inventory and staffing, reducing waste by up to 30%. Kitchen robotics (e.g., Flippy 2 for frying or Miso Robotics’ drink dispensers) automates repetitive tasks, improving the speed and consistency. Contactless payments (via QR codes or NFC) now dominate, with 60% of diners preferring digital menus. IoT sensors monitor fridge temps and equipment health, cutting downtime. Also, high upfront costs and staff training remain barriers for small businesses.

Asia Pacific HoReCa Market Segment Analysis:

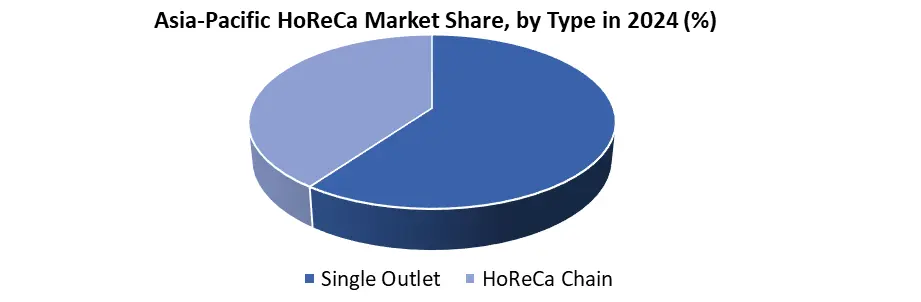

Based on Type, Asia Pacific HoReCa market is segmented into single outlet and HoReCa chain. Single outlet segment held the largest Asia Pacific HoReCa Market share of about 60.78% in the Asia Pacific HoReCa market in 2024. According to the SMR analysis, the segment is further expected to grow at a CAGR of 4.12% during the forecast period. Single outlets excel in fostering a sense of community and personalised customer relationships, a stark contrast to the often-perceived impersonal nature of larger chains. By providing tailored recommendations, engaging with customers on a personal level, and also creating unique atmosphere, single outlets establish themselves as welcoming havens for discerning diners seeking more than just a meal. Dominance of single outlets in the Asia Pacific HoReCA market is a testament to their agility, personalised service, niche expertise, community engagement, and ability to adapt to evolving consumer preferences. These factors enable them to thrive in a dynamic and competitive market, offering unique experiences and culinary delights to diverse customers worldwide, solidifying their position as a cornerstone of the Asia Pacific HoReCa market.

Asia Pacific HoReCa Market Country Insight:

China Led Asia-Pacific HoReCa Market with Digital Innovation and Mass Consumer Demand

China dominated the Asia Pacific HoReCa market in 2024, leveraging its massive domestic consumer base and rapid urbanisation. Country's middle-class expansion fuels demand for both premium dining and budget-friendly QSR chains, while its tech-driven delivery ecosystem (Meituan, Ele.me) sets global benchmarks. Government initiatives like "Digital China" accelerate cashless payments and smart restaurant adoption. International tourism rebounds in key cities (Shanghai, Beijing), complemented by a thriving domestic travel market. Also, Japan and India follow closely—Japan with its luxury hospitality and India via its QSR boom and youthful demographic. China's scale and digital integration make it APAC's undisputed HoReCa leader.

Asia Pacific HoReCa Market Competitive Landscape:

Asia Pacific HoReCa market in 2024 is highly competitive, driven by a mix of regional hospitality giants and fast-growing foodservice chains. Key players such as Shangri-La Group, Taj Hotels, Jollibee Foods Corporation, and some Minor International dominate through strong brand recognition, expanding footprints, and diversified offerings. Asia Pacific HoReCa market is characterised by rapid urbanisation, rising tourism, and also increased demand for international and local cuisines. Companies are also focusing on digital transformation, sustainability, and customer experience to stay competitive in the Asia Pacific HoReCa market.

Recent Development in the Asia Pacific HoReCa Market

|

Company |

Date |

Development |

|

Jollibee Foods Corporation |

July 2, 2024 |

Acquired a 70% stake in South Korea's Compose Coffee for $238 million, expanding its presence in the coffee market. |

|

Taj Hotels |

May 24, 2025 |

India led the Asia-Pacific region in hotel developments during Q1 2025, with 693 hotel projects comprising 88,884 rooms under development, indicating significant expansion in the hospitality sector. |

|

Asia Pacific HoReCa Market Scope |

|

|

Market Size in 2024 |

USD 1.09 Tn. |

|

Market Size in 2032 |

USD 1.90 Tn. |

|

CAGR (2025-2032) |

7.2% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Type Single outlet HoReCa chain |

|

By Services Restaurants Quick-service Restaurants Fast Food Restaurants Cafeterias Full-service Restaurant Casual Dining Restaurants Fine Dining Restaurants Carryout Restaurants Hotels Cafes and pubs |

|

Asia Pacific HoReCa Market Key Players:

- Shangri-La Group (Hong Kong)

- Taj Hotels (India)

- Jollibee Foods Corporation (Philippines)

- Café de Coral (Hong Kong)

- Minor International (Thailand)

- The Indian Hotels Company Limited – IHCL (India)

- BreadTalk Group (Singapore)

- Yoshinoya Holdings (Japan)

- Zensho Holdings (Japan)

- Haidilao International (China)

Frequently Asked Questions

China (digital innovation & mass demand), Japan (luxury hospitality), and India (QSR & café culture).

AI demand forecasting, kitchen robotics, IoT sensors, and digital payments (60% prefer QR/NFC).

Shangri-La Group, Taj Hotels, Jollibee Foods Corporation, and Minor International are the top key players in the Asia Pacific HoReCa market in 2024.

1. Asia Pacific HoReCa Market: Research Methodology

2. Asia Pacific HoReCa Market Introduction

2.1. Study Assumptions and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Asia Pacific HoReCa Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Product Segment

3.3.3. End-user Segment

3.3.4. Revenue (2024)

3.3.5. Company Headquarters

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. HoReCa Import Export Analysis

3.6. Mergers and Acquisitions Details

4. Asia Pacific HoReCa Market: Dynamics

4.1. HoReCa Market Trends

4.2. HoReCa Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.2.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Technology Roadmap

4.6. Regulatory Landscape

5. Asia Pacific HoReCa Market Size and Forecast by Segmentation (Value in USD Trillion) (2024-2032)

5.1. Asia Pacific HoReCa Market Size and Forecast, By Type (2024-2032)

5.1.1. Single outlet

5.1.2. HoReCa chain

5.2. Asia Pacific HoReCa Market Size and Forecast, By Service (2024-2032)

5.2.1. Restaurants

5.2.1.1. Quick-service Restaurants

5.2.1.2. Fast Food Restaurants

5.2.1.3. Cafeterias

5.2.1.4. Full-service Restaurant

5.2.1.5. Casual Dining Restaurants

5.2.1.6. Fine Dining Restaurants

5.2.1.7. Carryout Restaurants

5.2.2. Hotels

5.2.3. Cafes and pubs

5.3. Asia Pacific HoReCa Market Size and Forecast, by Country (2024-2032)

5.3.1. China

5.3.2. S Korea

5.3.3. Japan

5.3.4. India

5.3.5. Australia

5.3.6. Indonesia

5.3.7. Vietnam

5.3.8. Thailand

5.3.9. Philippines

5.3.10. Malaysia.

5.3.11. Rest of Asia Pacific

6. Company Profile: Key Players

6.1. Taj Hotels (India)

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Shangri-La Group (Hong Kong)

6.3. Taj Hotels (India)

6.4. Jollibee Foods Corporation (Philippines)

6.5. Café de Coral (Hong Kong)

6.6. Minor International (Thailand)

6.7. The Indian Hotels Company Limited – IHCL (India)

6.8. BreadTalk Group (Singapore)

6.9. Yoshinoya Holdings (Japan)

6.10. Zensho Holdings (Japan)

6.11. Haidilao International (China)

7. Key Findings

8. Industry Recommendations