Asia Pacific Bubble Tea Market Outlook by Size, Share, Revenue Analysis and Market Growth Forecast (2025-2032)

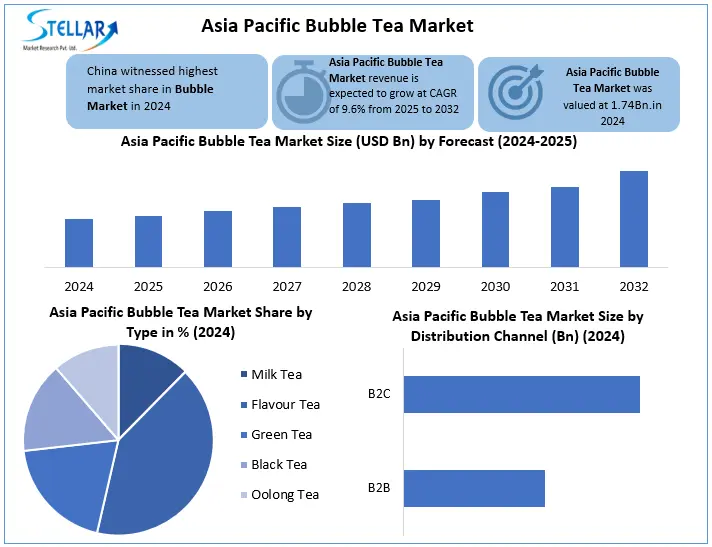

Asia Pacific Bubble Tea Market was valued at USD 1.74 Bn. in 2024 and the total Asia Pacific Bubble Tea Market revenue is expected to grow at CAGR of 9.6% from 2025-2032 and reaching nearly USD 3.63 Bn. by 2032.

Format : PDF | Report ID : SMR_2888

Asia pacific Bubble Tea Market Overview:

Bubble tea (also known as pearl milk tea, bubble milk tea, tapioca milk tea, Boba tea, or Boba) is a tea-based drink most often containing chewy tapioca balls, milk, and Flavoring. It originated in Taiwan in the early 1980s and spread to other countries where there is a large East Asian diaspora population.

The Asia Pacific Bubble Tea Market has emerged as the global epicentre for growth, accounting for nearly 40% to 59% of global revenue. In 2024. Countries like China, Indonesia, Thailand, Vietnam, and India are driving this surge due to rising disposable incomes, urbanisation, and evolving consumer tastes. China led with its vast non-alcoholic beverage sector in 2024, with bubble tea as a central category. Dominated by younger consumers aged 18–35, the demand is heavily shaped by lifestyle trends, social media influence, and a preference for innovative flavours. Black tea remains the dominant base, while fruit-based and taro flavours are rapidly gaining popularity. Additionally, the shift toward healthier alternatives, including low-sugar, plant-based milk, and herbal variants, reflects changing health-conscious behaviours. Franchise-based expansion has been a major growth enabler.

To get more Insights: Request Free Sample Report

Asia Pacific Bubble Tea Industry Dynamics:

Innovation in Flavours and ingredients to boost the Asia Pacific Bubble Tea Market

With the growing awareness of sugar content, lactose intolerance and the general brands of bubbles Tea in Asia they are actively innovating to offer healthier alternatives without compromising taste or appeal. A major change in the inclusion of non-dairy milk options, such as almond milk, oat milk, soy milk and coconut milk that meets lactose intolerant consumers, vegan and health conscious. To reduce sugar intake, many points of sale now use natural sweeteners such as Stevia, agave syrup, honey or monk fruits instead of refined sugar or high fructose corn syrup. These alternatives are especially attractive to diabetic or calorie aware customers. Popular bubble tea chains such as Gong Cha and Coco have also introduced low calorie and sugar versions, allowing customers to customize sweet levels (for example, 0%, 30%, 50%, 100%) and choose "mild" versions of classic beverages. Increase in functional ingredients further increased the health appeal of bubble tea. Addictions like collagen (for skin and joint health) probiotics (for digestive health) and fibre-rich ingredients chia seeds, basil seeds and aloe Vera are increasingly presented in menus. These innovations reflect a broader trend in relation to wellbeing-oriented consumption, allowing bubble tea to remain a popular and adaptable choice of drinks in a health awareness market.

Geographic expansion in emerging countries to create opportunities in the Asia Pacific Bubble Tea Market

Geographic expansion in emerging countries of Southeast Asia, Vietnam, Philippines and Indonesia, offers another important growth revenue. These markets are seeing an available income, urbanisation and a growing youth population with a fashion drinks appetite. Location and leveraging the flavours of social media trends help marketers penetrate these newer markets effectively. The rapid growth of digital platforms and food delivery applications has created opportunities. The integration of bubble tea offers into mobile order systems, loyalty applications and e-commerce platforms allows for greater customer involvement and convenience. Brands also benefit from collaborations with online influencers and communities to increase brand visibility and loyalty. Sustainability and ecological practices are becoming important differentiators. Offering biodegradable packaging, reusable cups and environmentally conscious operations resonate strongly with younger consumers, especially in countries where environmental awareness is growing.

Supply Chain Interruption to restrain the Asia pacific Bubble tea market Growth

Supply chain also impacts APAC bubble tea markets especially key ingredients tapioca pearls which are often imported from specific regions. Factors climate change, geopolitical tensions or logistics problems (as seen during COVID-19 pandemic) lead to scarcity, price volatility and delays in product availability. Increasing operating costs, including labour prices, rent and ingredients affect small and medium sized bubble tea companies, especially those operating under franchise models in high-cost urban areas. Maintaining profitability while keeping prices attractive to young consumers remains a delicate balance.

Asia pacific Bubble Tea market segmentation:

Based on Ingredients the Asia Pacific Bubble Tea Market is segmented into Black Tea, Green Tea, Oolong Tea and White Tea. Black Tea segment dominated the market in 2024 and is expected to hold the largest share during the forecast period. widespread availability and versatility. Black tea's robust taste pairs well with various toppings and flavourings which makes it a popular base for classic and innovative bubble tea recipes. Black tea’s health benefits like antioxidants and moderate caffeine content further enhances its appeal. As consumers nowadays continues to seek familiar yet customizable beverages black to remains a staple driving significant market demand and growth in the bubble tea industry.

Based on Flavour the Asia Pacific Bubble Tea Market is segmented into Original Flavour, Coffee Flavour, Fruit Flavour, Chocolate Flavour and others. Fruit Flavour Segment Dominated the market in 2024 and is expected to hold largest share during the forecast period. Fruit flavours lead a part of the industry in the Asia Pacific Bubble Tea Market which reflects the choice of consumers for inspirational and vibrant taste experiences. With a wide range of options including strawberries, mango, passion fruit and litchi, the flavour of the fruit gives a spectrum of sweetness and blurry corresponding to different varieties. Their natural appeal adjusts with increasing demand for healthy drinks, as there is often less sugar and artificial additives than in other options with the taste of fruit. Fruit-flavoured bubble tea is versatile, easily complementing different types of tea bases and toppings, making it the mainstay in the bubble tea industry.

Based on distribution channel the Asia Pacific Bubble Tea Market Segmented into Business to Business and Business to customer. Business to customer segment dominated the market in 2024 and is expected to hold largest share during the forecast period. This development has been attributed to the widespread presence of bubble tea outlets, cafes, quick service restaurants and growing penetration of e-commerce and food distribution platforms dedicated to this development. The growing popularity of bubble tea among youth demographics, especially Gen Z and Millennials has led to high footfalls in retail places and a strong demand for ready-to-drink variants. Consumer demand for convenience, adaptable taste options, and blind attractive drinks has further strengthened the B2C distribution model

Asia Pacific Bubble Tea Market Country Analysis

China dominated the Asia Pacific Bubble Tea Market in 2024 and is expected to hold largest market share during the forecast period. driven by a combination of cultural relevance, consumer demographics, and rapid innovation. As the world's most populous country, China offers an enormous and youthful consumer base that actively seeks out trendy and customizable food and beverage options. Bubble tea has become a cultural phenomenon, especially among millennials and Gen Z consumers who view it as both a fashionable beverage and a social experience. China’s urbanization and evolving lifestyle preferences have further fuelled demand. The rise of café culture, coupled with increasing disposable incomes, has led to a significant shift toward premium and experiential beverage. This trend has supported the explosive growth of domestic bubble tea giants such as Heytea, Nayuki, Mixue, Bingcheng, and Coco, which collectively operate tens of thousands of outlets across the country.

Asia Pacific Bubble Tea Market Competitive Landscape

Chatime and Coco Frosh Tea & Juice are prominent players in the Asia Pacific Bubble Tea Market especially in the Asia Pacific region, who are known for their technical-powered innovations. Chhatime has introduced AR-based app features, smart browing systems and plant-based options, while the supply chain also to adapt AI for adaptation and also to strengthen the loyalty programs.

Meanwhile, Cocoa focuses on smart technology and wellness trends, launches its "smart cup" with IOT sensor to track freshness and expand into functional tea. The brand also uses automatic broking systems, mobile ordering and virtual affects to attach young consumers. Both brands lead to privatisation, health-conscious products and change towards digital integration, which remain competitive between increasing urbanisation and consumer demand.

Key Takeaways in Asia Pacific Bubble Tea Market

- Gong?Cha (Seoul, South Korea) reported a 78?% drop in operating profit in its South Korean market (KRW?3.4?Bn.), in 11/04/2024. Despite maintaining around 800 stores, due to rising competition and shifting consumer preferences.

- As of May 2024, Chatime (Taichung, Taiwan) boasts over 2,500 outlets worldwide (38 countries), remaining one of the largest bubbles?tea franchises globally and recently marking growth in Canada with 7 locations as of May 2024.

- In March 2025 the Alley (Taichung, Taiwan) has launched partnerships and flagship café expansions (e.g., at Landmark Plaza Taichung), targeting younger consumers via trendy mall placements and sustainable green plaza initiatives.

|

Asia Pacific Bubble Tea Market Scope |

|

|

Market Size in 2024 |

USD 1.74 Bn. |

|

Market Size in 2032 |

USD 3.63 Bn. |

|

CAGR (2025-2032) |

9.6% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Ingredient Black Tea Green Tea Oolong Tea White Tea |

|

By Flavour Original Flavour Coffee Flavour Fruit Flavour Chocolate Flavour Others |

|

|

By Distribution Channel Business-to-Customer Business to Business |

|

|

Country’s Covered |

China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific |

Asia pacific Bubble tea industry Players

- Gong Cha (Seoul, South Korea)

- CoCo Fresh Tea & Juice (New Taipei City, Taiwan)

- Koi Thé (Taipei, Taiwan)

- Chatime (Taichung, Taiwan)

- The Alley (Taichung, Taiwan)

- Tiger Sugar (Taichung, Taiwan)

- YiFang Taiwan Fruit Tea (Taipei, Taiwan)

Frequently Asked Questions

The Black Tea segment dominated due to its versatility and health benefits.

Consumers prefer vibrant, natural flavours that often have less sugar and additives.

They are focusing on tech integration and health-conscious products, like smart cups.

1. Asia Pacific Bubble Tea Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Asia Pacific Bubble Tea Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. End-user Segment

2.3.4. Revenue (2023)

2.3.5. Company Headquarter

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Bubble Tea Import Export Analysis

2.6. Mergers and Acquisitions Details

3. Asia Pacific Bubble Tea Market: Dynamics

3.1. Wire and Cables Market Trends

3.2. Wire and Cables Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. By Flavour Roadmap

3.6. Regulatory Landscape

4. Asia Pacific Bubble Tea Market Size and Forecast by Segmentation (Value in USD Million) (2024-2032)

4.1. Asia Pacific Bubble Tea Market Size and Forecast, By Ingredient (2024-2032)

4.1.1. Black Tea

4.1.2. Green Tea

4.1.3. Oolong Tea

4.1.4. White Tea

4.2. Asia Pacific Bubble Tea Market Size and Forecast, By Flavour (2024-2032)

4.2.1. Original Flavour

4.2.2. Coffee Flavour

4.2.3. Fruit Flavour

4.2.4. Chocolate Flavour

4.2.5. Others

4.3. Asia Pacific Bubble Tea Market Size and Forecast, By Distribution Channel (2024-2032)

4.3.1. Business-to-Customer

4.3.2. Business to Business

4.4. Asia Pacific Bubble Tea Market Size and Forecast, by Country (2024-2032)

4.4.1. China

4.4.2. S Korea

4.4.3. Japan

4.4.4. India

4.4.5. Australia

4.4.6. Indonesia

4.4.7. Vietnam

4.4.8. Thailand

4.4.9. Philippines

4.4.10. Malaysia.

4.4.11. Rest of Asia Pacific

5. Company Profile: Key Players

5.1. Gong Cha (Seoul, South Korea)

5.1.1. Company Overview

5.1.2. Business Portfolio

5.1.3. Financial Overview

5.1.4. SWOT Analysis

5.1.5. Strategic Analysis

5.1.6. Recent Developments

5.2. CoCo Fresh Tea & Juice (New Taipei City, Taiwan)

5.3. Koi Thé (Taipei, Taiwan)

5.4. Chatime (Taichung, Taiwan)

5.5. The Alley (Taichung, Taiwan)

5.6. Tiger Sugar (Taichung, Taiwan)

5.7. YiFang Taiwan Fruit Tea (Taipei, Taiwan)

6. Key Findings

7. Industry Recommendations

8. Asia Pacific Bubble Tea Market: Research Methodology