Vehicle Subscription Market - Global Industry Analysis and Forecast (2025-2032)

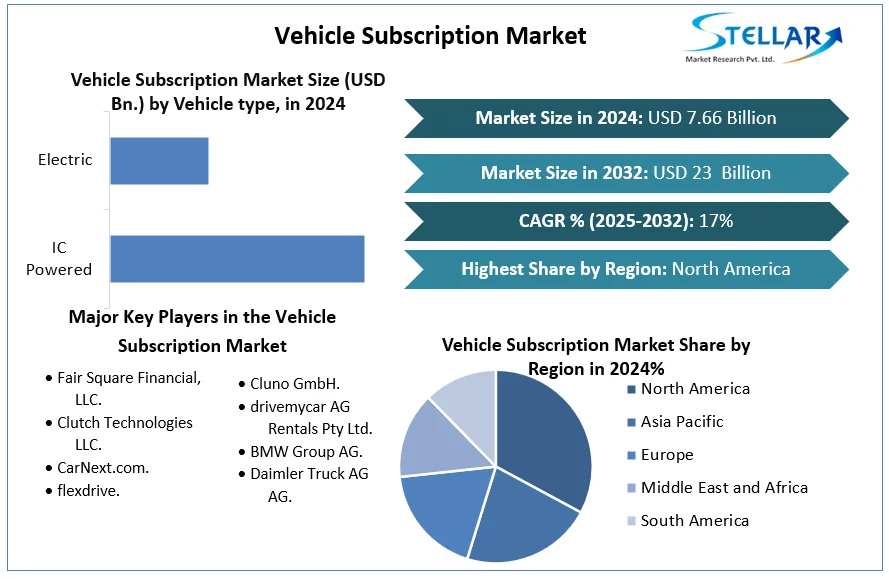

Vehicle Subscription Market was valued at USD 7.66 billion in 2024. Global Market size is estimated to grow at a CAGR of 17%.

Format : PDF | Report ID : SMR_2513

Vehicle Subscription Market Definition:

Vehicle subscriptions allow customers the option of buying or leasing a vehicle on a recurring basis. Some subscriptions include insurance and maintenance; others allow subscribers to switch between vehicles throughout their subscription term. Industry observers consider vehicle subscriptions as an alternative to purchasing or leasing a vehicle.

Further, the Vehicle Subscription market is segmented by Vehicle type, Subscription type, Service provider, End-User, and geography. Based on Vehicle type, the Vehicle Subscription market is segmented under IC Powered Vehicle and Electric Vehicle. Based on the Subscription type, the Vehicle Subscription market is segmented under 1 to 6 months, 6 to 12 months, and more than 12 months. Based on Service provider, the Vehicle Subscription market is segmented under OEMs, Mobility, and Independent. Based on End-User, the Vehicle Subscription market is segmented under Business and Private. By geography, the market covers the following regions: North America, Europe, Asia-Pacific, South America, and Middle East & Africa. For each segment, the market sizing and forecasts have been done on the basis of value (in USD Billion).

To get more Insights: Request Free Sample Report

Vehicle Subscription Market Dynamics:

Increased demand by consumers for vehicle leasing services, along with strict government regulations that control emissions by vehicles, are contributing to the increase in the penetration of subscription service providers in the vehicle subscription market. In developing countries, the rapid increase in disposable incomes of consumers is boosting the growth of the market. You can also expect other factors such as increasing population, rapid urbanization, and industrialization to further boost the market's growth.

One of the major restraints on the growth of the Vehicle Subscription Market is the well-established vehicle leasing, rental, and sharing market, as well as the long-term development of flexible leasing models and improved ride-hailing features offered by service providers.

Technological developments and increasing customer preference for vehicle subscription services over car ownership are expected to offer huge opportunities for the growth of the vehicle subscription market. A self-drive car rental company, Zoomcar, plans to increase the percentage of electric cars in its fleet from 2 to 5 % to 30-35 % in the forecasted years.

In the car subscription market, renowned players are launching new Vehicle Types with new technologies and several price offers. Professionals, marketers, and knowledge workers are offering a wide range of software solutions that offer multiple advanced features. Also, these well-established international players and emerging players spread across the local and international markets.

There will be major challenges to the growth of the vehicle subscription market due to the prevalence of leasing, rental, and sharing models and the introduction of more flexible leasing models.

Vehicle Subscription Market COVID-19 Insights:

As a consequence, business models are being redesigned extensively to align with current business dynamics and respond appropriately to all the challenges that have emerged as a result of COVID-19 and its implications. The global vehicle subscription market is aggressively identifying new opportunities to recover from the COVID-19 impact and reverse the financial vulnerability imposed by mobility restrictions. Furthermore, industry players are emphasizing the emergence of new Vehicle Type portfolios as well as technological advancements to meet the challenges and opportunities offered by the COVID-19 issue.

Vehicle Subscription Market Segment Analysis:

By Vehicle Type, the Vehicle Subscription Market is segmented into IC Powered Vehicle and Electric Vehicle. The IC Powered Vehicle segment has the highest market share in 2024. It is because there is widespread availability of fuel stations across the world to supply IC-powered vehicles with fuel. Also, the electric vehicles segment is expected to grow at a CAGR of 26.8% over the upcoming years due to an increase in the penetration of electric vehicle sales. This is because of an increase in electrical mobility. Additionally, government investments to promote electric vehicles will positively impact the growth of the vehicle subscription market.

By Subscription Period, the Vehicle Subscription Market is segmented into 1 to 6 months, 6 to 12 months, and more than 12 months. The 1 to 6 months segment has the highest market share in 2024. As a rule of thumb, the employer segment usually hires vehicles during their vacations, which increases demand for the 1 to 6 month subscription period.

By Service Provider, Vehicle Subscription Market is segmented into Mobility, OEMs, and Independent. The OEM segment has the highest market share in 2024. Customers can choose from a variety of vehicle models during their subscription period. Because mobility providers (mobile service providers) are early adopters of vehicle subscription models, OEMs (original equipment manufacturers) have adapted subscription models in recent years, individually and with Service Provider companies' assistance.

By End-User, the Vehicle Subscription Market is segmented into Business and Private. The Business segment has the highest market share in 2024. Because of the key factors such as no traditional financing, no long-term maintenance issues, 24x7 roadside assistance, and car repair capabilities, the subscription vehicle is gaining traction as an alternative to traditional alternatives such as car ownership and leasing that incur significant costs.

Vehicle Subscription Market Regional Insights:

North America has the highest market share in 2024. As evidenced by the rapid growth of OEMs, mobility providers, and Service Provider firms, these trends are present across the United States and Canada. Further, the presence of tech companies like Fair Financial Corporation, Open Road Auto Group, Face Drive Inc., and more such multinational firms and research and development institutes in the region has contributed to technological advancements. Additionally, M&A activity is enhancing the feasibility of the projector market in the region.

Asia Pacific region is expected to witness significant growth during the forecast period. Increase population, urbanization, industrialization, and improvement in living standards will result in a boost in vehicle sales in rapidly developing countries such as China and India. Further, the introduction of monthly vehicle subscription packages will allow more middle-class people in the region to own four-wheelers at a more affordable monthly rate that covers all maintenance costs excluding fuel.

Vehicle Subscription Market Recent Development:

- On 14th Oct 2021, CarNext, one of Europe's most popular used car marketplaces, has been acquired by Constellation Automotive Group, Europe's largest vertically integrated digital used car marketplace, with a presence across 22 countries in Europe. The combined business creates Europe's largest digital used car marketplace, selling 2.5 million cars annually for more than €21 billion in GMV.

- On 21st Feb 2021, The UK-based online used-car company, Cazoo, announced that it has acquired Cluno, the German leader in car subscription services. This is an important step in the company's expansion into Europe.

Vehicle Subscription Market Key Players Insights:

The market is characterized by the existence of a number of well-known firms. These companies control a large portion of the market, have a wide Vehicle type portfolio, and have a global presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations.

The market's major companies have a significant impact because most of them have extensive global networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the global market, key players in the market, particularly in North America and Europe, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

The objective of the report is to present a comprehensive analysis of the Global Vehicle Subscription market to the stakeholders in the industry. The report provides trends that are most dominant in the Global Vehicle Subscription market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Global Vehicle Subscription Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Global Vehicle Subscription market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Global Vehicle Subscription market. The report studies factors such as company size, market share, market growth, revenue, Vehicle type Typeion volume, and profits of the key players in the Global Vehicle Subscription market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their Vehicle type quality is in the Global Vehicle Subscription market. The report also analyses if the Global Vehicle Subscription market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Global Vehicle Subscription market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Global Vehicle Subscription market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Global Vehicle Subscription market is aided by legal factors.

Vehicle Subscription Market Scope:

|

Vehicle Subscription Market Scope |

|

|

Market Size in 2024 |

USD 7.66 Bn. |

|

Market Size in 2032 |

USD 23 Bn. |

|

CAGR (2025-2032) |

17% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

by Vehicle type

|

|

by Subscription Period

|

|

|

by Service Provider

|

|

|

by End-User

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Vehicle Subscription Market Key Players:

- Fair Square Financial, LLC.

- Clutch Technologies LLC.

- CarNext.com.

- flexdrive.

- Cluno GmbH.

- drivemycar AG Rentals Pty Ltd.

- BMW Group AG.

- Daimler Truck AG AG.

Frequently Asked Questions

North America region is expected to hold the highest share in the Vehicle Subscription Market.

1. Vehicle Subscription Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Vehicle Subscription Market: Competitive Landscape

2.1. MMR Competition Matrix

2.2. Competitive Landscape

2.3. Market share analysis of major players

2.4. Products specific analysis

2.5. Key Players Benchmarking

2.5.1. Company Name

2.5.2. Product Segment

2.5.3. Headquarter

2.5.4. End-user Segment

2.5.5. Innovation & R&D Investment

2.5.6. Revenue (2024)

2.5.7. Market Share (%)

2.5.8. Global Reach

2.6. Market Structure

2.6.1. Market Leaders

2.6.2. Market Followers

2.6.3. Emerging Players

2.7. Mergers and Acquisitions Details

3. Market Size Estimation Methodology

3.1.1. Bottom-Up Approach

3.1.2. Top-Down Approach

4. Market Dynamics

4.1. Vehicle Subscription Market Trends

4.2. Vehicle Subscription Market Dynamics

4.2.1.1. Drivers

4.2.1.2. Restraints

4.2.1.3. Opportunities

4.2.1.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.3.1. Threat of New Entrants

4.3.2. Threat of Substitutes

4.3.3. Bargaining Power of Suppliers

4.3.4. Bargaining Power of Buyers

4.3.5. Intensity of Competitive Rivalry

4.4. PESTLE Analysis

4.5. Regulatory Landscape By Region

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. South America

4.6. Analysis of Government Schemes and Initiatives For the Vehicle Subscription Industry

4.7. Vehicle Subscription Market Industry Ecosystem

4.7.1. Key players in the Vehicle Subscription Industry ecosystem

4.7.2. Role of companies in the Vehicle Subscription Industry ecosystem

5. Technological Analysis

6. Customer Preferences in Vehicle Subscription

7. Vehicle Subscription Market: Global Market Size and Forecast By Segmentation (By Value USD) (2024-2032)

7.1. Vehicle Subscription Market Size and Forecast, Vehicle type (2024-2032)

7.1.1. IC Powered

7.1.2. Electric

7.2. Vehicle Subscription Market Size and Forecast, By Subscription Period (2024-2032)

7.2.1. 1 to 6 months

7.2.2. 6 to 12 months

7.2.3. More than 12 months

7.3. Vehicle Subscription Market Size and Forecast, By Service Provider (2024-2032)

7.3.1. OEM

7.3.2. Mobility

7.3.3. Independent

7.4. Vehicle Subscription Market Size and Forecast, By End-User (2024-2032)

7.4.1. Private

7.4.2. Business

7.5. Vehicle Subscription Market Size and Forecast, By Region (2024-2032)

7.5.1. North America

7.5.2. Europe

7.5.3. Asia Pacific

7.5.4. South America

7.5.5. MEA

8. North America Vehicle Subscription Market Size and Forecast By Segmentation (By Value USD Bn) (2024-2032)

8.1. North America Vehicle Subscription Market Size and Forecast, Vehicle type (2024-2032)

8.1.1. IC Powered

8.1.2. Electric

8.2. North America Vehicle Subscription Market Size and Forecast, By Subscription Period (2024-2032)

8.2.1. 1 to 6 months

8.2.2. 6 to 12 months

8.2.3. More than 12 months

8.3. North America Vehicle Subscription Market Size and Forecast, By Service Provider (2024-2032)

8.3.1. OEM

8.3.2. Mobility

8.3.3. Independent

8.4. North America Vehicle Subscription Market Size and Forecast, By End-User (2024-2032)

8.4.1. Private

8.4.2. Business

8.5. North America Vehicle Subscription Market Size and Forecast, By Country (2024-2032)

8.5.1. United States

8.5.1.1. United States Vehicle Subscription Market Size and Forecast, Vehicle type (2024-2032)

8.5.1.2. United States Vehicle Subscription Market Size and Forecast, By Subscription Period (2024-2032)

8.5.1.3. United States Vehicle Subscription Market Size and Forecast, By Service Provider (2024-2032)

8.5.1.4. United States Vehicle Subscription Market Size and Forecast, By End-User (2024-2032)

8.5.2. Canada

8.5.2.1. Canada Vehicle Subscription Market Size and Forecast, Vehicle type (2024-2032)

8.5.2.2. Canada Vehicle Subscription Market Size and Forecast, By Subscription Period (2024-2032)

8.5.2.3. Canada Vehicle Subscription Market Size and Forecast, By Service Provider (2024-2032)

8.5.2.4. Canada Vehicle Subscription Market Size and Forecast, By End-User (2024-2032)

8.5.3. Mexico

8.5.3.1. Mexico Vehicle Subscription Market Size and Forecast, Vehicle type (2024-2032)

8.5.3.2. Mexico Vehicle Subscription Market Size and Forecast, By Subscription Period (2024-2032)

8.5.3.3. Mexico Vehicle Subscription Market Size and Forecast, By Service Provider (2024-2032)

8.5.3.4. Mexico Vehicle Subscription Market Size and Forecast, By End-User (2024-2032)

9. Europe Vehicle Subscription Market Size and Forecast By Segmentation (By Value USD) (2024-2032)

9.1. Europe Vehicle Subscription Market Size and Forecast, Vehicle type (2024-2032)

9.2. Europe Vehicle Subscription Market Size and Forecast, By Subscription Period (2024-2032)

9.3. Europe Vehicle Subscription Market Size and Forecast, By Service Provider (2024-2032)

9.4. Europe Vehicle Subscription Market Size and Forecast, By End-User (2024-2032)

9.5. Europe Vehicle Subscription Market Size and Forecast, By Country (2024-2032)

9.5.1. United Kingdom

9.5.2. France

9.5.3. Germany

9.5.4. Italy

9.5.5. Spain

9.5.6. Sweden

9.5.7. Russia

9.5.8. Rest of Europe

10. Asia Pacific Vehicle Subscription Market Size and Forecast By Segmentation (By Value USD) (2024-2032)

10.1. Asia Pacific Vehicle Subscription Market Size and Forecast, Vehicle type (2024-2032)

10.2. Asia Pacific Vehicle Subscription Market Size and Forecast, By Subscription Period (2024-2032)

10.3. Asia Pacific Vehicle Subscription Market Size and Forecast, By Service Provider (2024-2032)

10.4. Asia Pacific Vehicle Subscription Market Size and Forecast, By End-User (2024-2032)

10.5. Asia Pacific Vehicle Subscription Market Size and Forecast, By Country (2024-2032)

10.5.1. China

10.5.2. Japan

10.5.3. South Korea

10.5.4. India

10.5.5. Australia

10.5.6. Malaysia

10.5.7. Thailand

10.5.8. Vietnam

10.5.9. Indonesia

10.5.10. Philippines

10.5.11. Rest of Asia Pacific

11. Middle East and Africa Vehicle Subscription Market Size and Forecast By Segmentation (By Value USD) (2024-2032)

11.1. Middle East and Africa Vehicle Subscription Market Size and Forecast, Vehicle type (2024-2032)

11.2. Middle East and Africa Vehicle Subscription Market Size and Forecast, By Subscription Period (2024-2032)

11.3. Middle East and Africa Vehicle Subscription Market Size and Forecast, By Service Provider (2024-2032)

11.4. Middle East and Africa Vehicle Subscription Market Size and Forecast, By End-User (2024-2032)

11.5. Middle East and Africa Vehicle Subscription Market Size and Forecast, By Country (2024-2032)

11.5.1. South Africa

11.5.2. GCC

11.5.3. Nigeria

11.5.4. Egypt

11.5.5. Turkey

11.5.6. Rest of ME&A

12. South America Vehicle Subscription Market Size and Forecast by Segmentation (by Value in USD) (2024-2032)

12.1. South America Vehicle Subscription Market Size and Forecast, Vehicle type (2024-2032)

12.2. South America Vehicle Subscription Market Size and Forecast, By Subscription Period (2024-2032)

12.3. South America Vehicle Subscription Market Size and Forecast, By Service Provider (2024-2032)

12.4. South America Vehicle Subscription Market Size and Forecast, By End-User (2024-2032)

12.5. South America Vehicle Subscription Market Size and Forecast, by Country (2024-2032)

12.5.1. Brazil

12.5.2. Argentina

12.5.3. Colombia

12.5.4. Chile

12.5.5. Peru

12.5.6. Rest Of South America

13. Company Profile: Key Players

13.1. Fair Square Financial, LLC.

13.1.1. Company Overview

13.1.2. Business Portfolio

13.1.3. Financial Overview

13.1.4. SWOT Analysis (Technological strengths and weaknesses)

13.1.5. Strategic Analysis (Recent strategic moves)

13.1.6. Recent Developments

13.2. Clutch Technologies LLC.

13.3. CarNext.com.

13.4. flexdrive.

13.5. Cluno GmbH.

13.6. drivemycar AG Rentals Pty Ltd.

13.7. BMW Group AG.

13.8. Daimler Truck AG AG.

14. Analyst Recommendations

14.1. Attractive Opportunities for Players in the Vehicle Subscription Market

14.2. Future Outlooks

15. Vehicle Subscription Market: Research Methodology