Vacuum Therapy Devices Market: Global Industry Growth by Product Type, Portability, Application and Region Forecast (2024-2032)

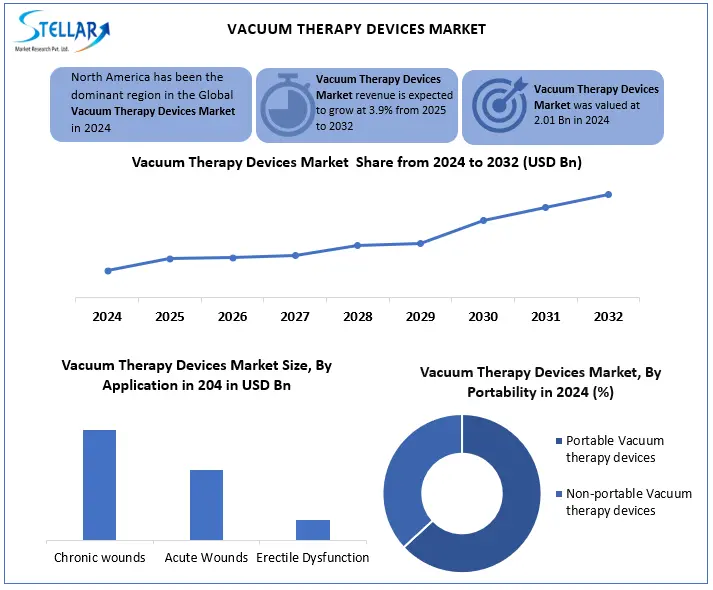

The Vacuum Therapy Devices Market was valued at USD 2.01 Bn in 2024 and is expected to reach USD 2.73 Bn by 2032, at a CAGR of 3.9% during the forecast period.

Format : PDF | Report ID : SMR_2786

Vacuum Therapy Devices Market Overview

The vacuum therapy device, also known as the vacuum tightening device (VCD), is widely used as a safe and effective alternative for medicinal treatment and surgical intervention. These devices are particularly popular among patients looking for a drug-free solution, who contribute to home care settings and clinical use. The vacuum therapy device is experiencing significant growth due to the increasing proliferation of the market for erectile dysfunction (ED), increasing awareness about non-invasive treatment options, and also progress in medical technology.

The market is expanding rapidly, driven by factors such as an ageing male population, increasing health care expenses and increasing sexual medical approval. Battery-operated portable devices, smart sensors and innovation are further enhancing the development of innovative markets such as monitoring systems.

Business policies and regulatory structures is affected the vacuum therapy devices market mainly in areas such as the United States, China and the European Union. U.S. Regulatory bodies such as the Food and Drug Administration (FDA) and the European Medicines Agency (EMA) implemented strict guidelines for medical equipment, which affect the market entry and product approval. Import tariffs and trade agreements, such as USMCA (U.S.-Mexico-CANADA agreement) and regional participation in Asia, also play an important role in determining market access and pricing.

To get more Insights: Request Free Sample Report

Vacuum Therapy Devices Market Dynamics

Growing Awareness of Advanced Wound Care to Drive the Vacuum Therapy Devices Market Expansion

Increasing awareness of advanced wound care solutions and the adoption of vacuum therapy is the major driver for the development of the vacuum therapy device market. Also healthcare professionals and patients are informed more about the benefits of negative pressure wound therapy (NPWT), and the demand for these devices continues to increase. Advanced wound care techniques including vacuum therapy, promote rapid treatment, reducing the risk of infection, and improve the patient's outcomes, making them a favourite option for old and acute wounds. Additionally, increasing cases of diabetes, ulcers and surgical lesions further promoted the requirement for effective wound management solutions. Governments and healthcare organisations are also promoting advanced wound care practices, supporting market expansion. This growing awareness and adoption are expected to lead to significant vacuum therapy device market growth in the coming years.

High cost to Restrain the Vacuum Therapy Devices Market

The high cost of vacuum therapy equipment is an important restraint for market development. These devices include advanced technology and accurate engineering, leading to advanced production and maintenance costs. Additionally, special training and disposable components require further increasing the overall cost. Many healthcare facilities, especially in developing areas, seem to bear these devices that limit their adoption. High prices also discourage individual consumers from purchasing individual consumers or buying home units. As a result, the cost remains a major obstacle, which prohibits the expansion of the vacuum therapy device market globally.

Vacuum Therapy Device Market Expands with Rising Demand for Home Healthcare Solutions

The vacuum therapy device is receiving significant traction in home healthcare because patients prefer convenient, portable and user -friendly devices over traditional clinical remedies. Compact and easily used design manufacturers are creating new opportunities to expand home-based care, allowing patients to get effective treatment outside medical facilities. Rather than medical applications, vacuum therapy is also in high demand in beauty and rehabilitation markets. Treatment such as cellulite reduction and muscle recovery is increasing in development, opening doors to special equipment to suit cosmetic and therapeutic needs. As the targeted demand for non-broad-spectrum solutions increases, manufacturers are focusing on new designs that fulfil both beauty and rehabilitation objectives, which further solidifies vacuum therapy’s place in at-home care.

Vacuum Therapy Devices Market Regional Analysis

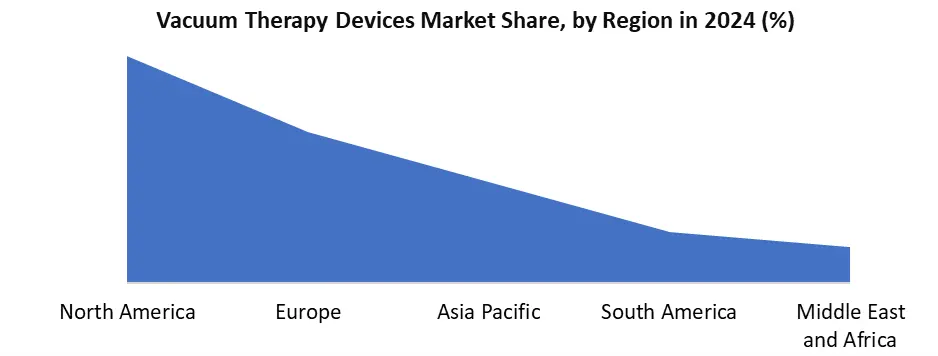

North America is currently dominating the vacuum therapy devices market, mainly due to its advanced healthcare infrastructure, innovative wound care technologies and significant healthcare expenses. The field benefits from major market players, well -installed reimbursement policies, and increasing prevalence of chronic wounds, especially a strong appearance of diabetes foot ulcers and pressure ulcers. Additionally, negative pressure wounds carry forward the growth of the market for the efficacy of wound therapy (NPWT). The government's initiative supporting advanced wound care and the growing elderly population for older wounds also contributes to the leading position of North America.

Vacuum Therapy Devices Market Segment Analysis

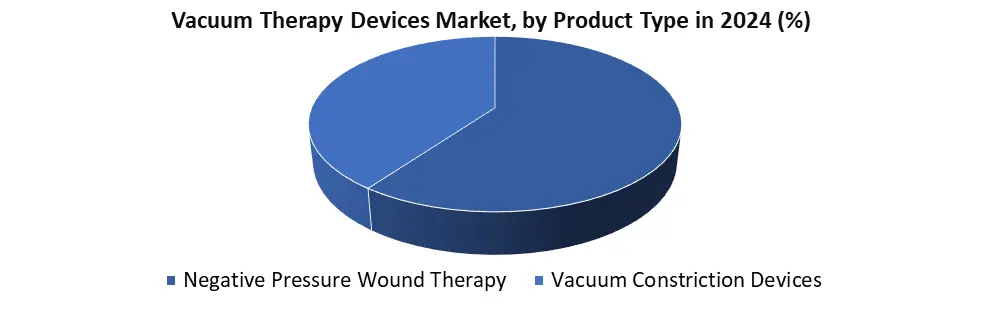

Based on Product Type, the vacuum therapy device market is divided into negative pressure wound therapy and Vacuum Constriction Devices. the negative pressure wound therapy is dominating the market due to widespread use in chronic and acute wound management, including diabetic ulcers, burns and surgical lesions. Increasing prevalence of diabetes, an increase in surgical processes, and a slight medical population drive for negative pressure wound therapy increases. Additionally, progress in portable and disposable negative pressure wound therapy devices increases patient compliance. In contrast, the vacuum constriction devices (VCD) have a niche application in erectile dysfunction treatment, which limits their market share. Thus, the clinical efficacy of negative pressure wound therapy, comprehensive application and technological innovation of vacuum therapy devices strengthen its dominance in the vacuum therapy devices market.

Based on Portability, the vacuum therapy device market is divided into Portable Vacuum therapy devices and Non-portable Vacuum therapy devices. The portable vacuum therapy device segment is currently dominating the vacuum therapy device market due to the increasing demand for home care and ambulatory wound management solutions. These devices provide greater dynamics, ease of use and also cost-effectiveness, making them ideal for surgical care outside chronic wound patients and hospital settings. Increase in diabetes ulcers, pressure injuries and ageing population have promoted further adoption, as patients prefer continuous treatment without hospitalisation for a long time. Additionally, progress in light, battery-operated negative pressure wound therapy system has increased their appeal over the extended wear time. While non-portable devices are important in hospitals and acute care, the change towards decentralised healthcare and distance monitoring strengthens portable device as a major segment.

Vacuum Therapy Devices Market Competitive Landscape

The vacuum therapy device market is dominated by some prominent players such as 3M Company, Smith and Nephew, Cardinal Health, ConvaTec and DeRoyal Industries Inc., which dominate the industry. These companies focus on technological progress, strategic partnership and mergers & acquisitions to strengthen their market status. The increasing demand for cost -effective and portable negative pressure wound therapy systems has accelerated the competition, inspiring the firms to invest in R&D for innovative wound care solutions. Emerging players are also entering the market with disruptive technologies, especially in homecare settings. Regional expansion and strong distribution networks further drive competition, while reimbursement policies and regulatory approvals remain critical success factors. The market remains dynamic, with continuous innovations shaping future growth opportunities.

Recent Developments,

- Smith & Nephew - In 2024, introduced the PICO 14 single-use NPWT system with extended battery life and enhanced portability for home care settings.

- ConvaTec - In 2024, unveiled the Avelle NPWT system with a compact design and smartphone app integration for remote monitoring.

|

Vacuum Therapy Devices Market Scope |

|

|

Market Size in 2024 |

USD 2.01 Bn. |

|

Market Size in 2032 |

USD 2.73 Bn. |

|

CAGR (2024-2032) |

3.9% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Product Type Negative Pressure Wound Therapy Vacuum Constriction Devices |

|

By Portability Portable Vacuum therapy devices Non-portable Vacuum therapy devices |

|

|

By Application Chronic wounds Acute Wounds Erectile Dysfunction |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East South America – Brazil, Argentina, Rest of South America |

Key Players in the Vacuum Therapy Devices Market

North America

- 3M Company (USA)

- Kinetic Concepts Inc. – KCI (USA)

- Cardinal Health Inc. (USA)

- Boston Scientific Corporation (USA)

- Smith & Nephew plc (USA)

- ConvaTec Inc. (USA)

- Medela AG (USA)

- DeRoyal Industries Inc. (USA)

- Genadyne Biotechnologies Inc. (USA)

- Talley Group Ltd. (USA)

- Hollister Incorporated (USA)

Europe

- Mölnlycke Health Care AB (Sweden)

- B. Braun Melsungen AG (Germany)

- Paul Hartmann AG (Germany)

- Lohmann & Rauscher GmbH & Co. KG (Germany/Austria)

- Coloplast A/S (Denmark)

- Iskra Medical (Slovenia)

- ATMOS MedizinTechnik GmbH & Co. KG (Germany)

- 4L Health (UK)

- Vacurect (Netherlands)

Asia Pacific

- INTCO Medical Technology Co., Ltd. (China)

- Augustus Medical Systems Pvt. Ltd. (India)

- Boehringer Laboratories (India)

Middle East & Africa

- Chattanooga – DJO Global / Enovis (USA)

- Coloplast Corp (Denmark)

South America

- EME s.r.l. (Italy)

Frequently Asked Questions

The Global Vacuum Therapy Devices market was USD 2.01 Bn in 2024.

The Global Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

The vacuum therapy devices market is rapidly growing due to the increasing proliferation of the market for erectile dysfunction (ED), increasing awareness about non-invasive treatment options, and progress in medical technology.

The top players in the market are 3M Company, Kinetic Concepts Inc. (KCI), Smith & Nephew plc, Mölnlycke Health Care AB, Cardinal Health Inc., ConvaTec Inc. and B. Braun Melsungen AG.

1. Vacuum Therapy Devices Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Vacuum Therapy Devices Market: Competitive Landscape

2.1. MMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Vacuum Therapy Devices Market: Dynamics

3.1. Vacuum Therapy Devices Market Trends

3.2. Vacuum Therapy Devices Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Vacuum Therapy Devices Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

4.1.1. Negative Pressure Wound Therapy

4.1.2. Vacuum Constriction Devices

4.2. Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

4.2.1. Portable Vacuum therapy devices

4.2.2. Non-portable Vacuum therapy devices

4.3. Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

4.3.1. Chronic wounds

4.3.2. Acute Wounds

4.3.3. Erectile Dysfunction

4.4. Vacuum Therapy Devices Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Vacuum Therapy Devices Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

5.1. North America Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

5.1.1. Negative Pressure Wound Therapy

5.1.2. Vacuum Constriction Devices

5.2. North America Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

5.2.1. Portable Vacuum therapy devices

5.2.2. Non-portable Vacuum therapy devices

5.3. North America Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

5.3.1. Chronic wounds

5.3.2. Acute Wounds

5.3.3. Erectile Dysfunction

5.4. North America Vacuum Therapy Devices Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

5.4.1.1.1. Negative Pressure Wound Therapy

5.4.1.1.2. Vacuum Constriction Devices

5.4.1.2. United States Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

5.4.1.2.1. Portable Vacuum therapy devices

5.4.1.2.2. Non-portable Vacuum therapy devices

5.4.1.3. United States Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

5.4.1.3.1. Chronic wounds

5.4.1.3.2. Acute Wounds

5.4.1.3.3. Erectile Dysfunction

5.4.2. Canada

5.4.2.1. Canada Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

5.4.2.1.1. Negative Pressure Wound Therapy

5.4.2.1.2. Vacuum Constriction Devices

5.4.2.2. Canada Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

5.4.2.2.1. Portable Vacuum therapy devices

5.4.2.2.2. Non-portable Vacuum therapy devices

5.4.2.3. Canada Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

5.4.2.3.1. Chronic wounds

5.4.2.3.2. Acute Wounds

5.4.2.3.3. Erectile Dysfunction

5.4.3. Mexico

5.4.3.1. Mexico Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

5.4.3.1.1. Negative Pressure Wound Therapy

5.4.3.1.2. Vacuum Constriction Devices

5.4.3.2. Mexico Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

5.4.3.2.1. Portable Vacuum therapy devices

5.4.3.2.2. Non-portable Vacuum therapy devices

5.4.3.3. Mexico Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

5.4.3.3.1. Chronic wounds

5.4.3.3.2. Acute Wounds

5.4.3.3.3. Erectile Dysfunction

6. Europe Vacuum Therapy Devices Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

6.1. Europe Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

6.2. Europe Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

6.3. Europe Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

6.4. Europe Vacuum Therapy Devices Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

6.4.1.2. United Kingdom Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

6.4.1.3. United Kingdom Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

6.4.2. France

6.4.2.1. France Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

6.4.2.2. France Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

6.4.2.3. France Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

6.4.3.2. Germany Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

6.4.3.3. Germany Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

6.4.4.2. Italy Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

6.4.4.3. Italy Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

6.4.5.2. Spain Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

6.4.5.3. Spain Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

6.4.6.2. Sweden Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

6.4.6.3. Sweden Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

6.4.7. Russia

6.4.7.1. Russia Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

6.4.7.2. Russia Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

6.4.7.3. Russia Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

6.4.8.2. Rest of Europe Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

6.4.8.3. Rest of Europe Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

7. Asia Pacific Vacuum Therapy Devices Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

7.1. Asia Pacific Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

7.2. Asia Pacific Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

7.3. Asia Pacific Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

7.4. Asia Pacific Vacuum Therapy Devices Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

7.4.1.2. China Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

7.4.1.3. China Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

7.4.2.2. S Korea Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

7.4.2.3. S Korea Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

7.4.3.2. Japan Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

7.4.3.3. Japan Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

7.4.4. India

7.4.4.1. India Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

7.4.4.2. India Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

7.4.4.3. India Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

7.4.5.2. Australia Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

7.4.5.3. Australia Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

7.4.6.2. Indonesia Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

7.4.6.3. Indonesia Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

7.4.7. Malaysia

7.4.7.1. Malaysia Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

7.4.7.2. Malaysia Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

7.4.7.3. Malaysia Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

7.4.8. Philippines

7.4.8.1. Philippines Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

7.4.8.2. Philippines Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

7.4.8.3. Philippines Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

7.4.9. Thailand

7.4.9.1. Thailand Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

7.4.9.2. Thailand Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

7.4.9.3. Thailand Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

7.4.10. Vietnam

7.4.10.1. Vietnam Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

7.4.10.2. Vietnam Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

7.4.10.3. Vietnam Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

7.4.11.2. Rest of Asia Pacific Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

7.4.11.3. Rest of Asia Pacific Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

8. Middle East and Africa Vacuum Therapy Devices Market Size and Forecast (by Value in USD Billion) (2024-2032)

8.1. Middle East and Africa Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

8.2. Middle East and Africa Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

8.3. Middle East and Africa Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

8.4. Middle East and Africa Vacuum Therapy Devices Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

8.4.1.2. South Africa Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

8.4.1.3. South Africa Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

8.4.2.2. GCC Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

8.4.2.3. GCC Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

8.4.3. Egypt

8.4.3.1. Egypt Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

8.4.3.2. Egypt Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

8.4.3.3. Egypt Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

8.4.4. Nigeria

8.4.4.1. Nigeria Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

8.4.4.2. Nigeria Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

8.4.4.3. Nigeria Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

8.4.5. Rest of ME&A

8.4.5.1. Rest of ME&A Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

8.4.5.2. Rest of ME&A Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

8.4.5.3. Rest of ME&A Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

9. South America Vacuum Therapy Devices Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

9.1. South America Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

9.2. South America Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

9.3. South America Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

9.4. South America Vacuum Therapy Devices Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

9.4.1.2. Brazil Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

9.4.1.3. Brazil Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

9.4.2.2. Argentina Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

9.4.2.3. Argentina Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

9.4.3. Colombia

9.4.3.1. Colombia Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

9.4.3.2. Colombia Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

9.4.3.3. Colombia Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

9.4.4. Chile

9.4.4.1. Chile Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

9.4.4.2. Chile Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

9.4.4.3. Chile Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

9.4.5. Rest Of South America

9.4.5.1. Rest Of South America Vacuum Therapy Devices Market Size and Forecast, By Product Type (2024-2032)

9.4.5.2. Rest Of South America Vacuum Therapy Devices Market Size and Forecast, By Portability (2024-2032)

9.4.5.3. Rest Of South America Vacuum Therapy Devices Market Size and Forecast, By Application (2024-2032)

10. Company Profile: Key Players

10.1. 3M Company (USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Kinetic Concepts Inc. – KCI (USA)

10.3. Cardinal Health Inc. (USA)

10.4. Boston Scientific Corporation (USA)

10.5. Smith & Nephew plc (UK; major operations in USA)

10.6. ConvaTec Inc. (USA)

10.7. Medela AG (Switzerland; North American HQ in USA)

10.8. DeRoyal Industries Inc. (USA)

10.9. Genadyne Biotechnologies Inc. (USA)

10.10. Talley Group Ltd. (UK; operations in USA)

10.11. Hollister Incorporated (USA)

10.12. Mölnlycke Health Care AB (Sweden)

10.13. B. Braun Melsungen AG (Germany)

10.14. Paul Hartmann AG (Germany)

10.15. Lohmann & Rauscher GmbH & Co. KG (Germany/Austria)

10.16. Coloplast A/S (Denmark)

10.17. Iskra Medical (Slovenia)

10.18. ATMOS MedizinTechnik GmbH & Co. KG (Germany)

10.19. 4L Health (UK)

10.20. Vacurect (Netherlands)

10.21. INTCO Medical Technology Co., Ltd. (China)

10.22. Augustus Medical Systems Pvt. Ltd. (India)

10.23. Boehringer Laboratories (India)

10.24. Chattanooga – DJO Global / Enovis (USA)

10.25. Coloplast Corp (Denmark)

10.26. EME s.r.l. (Italy)

11. Key Findings

12. Analyst Recommendations

13. Vacuum Therapy Devices Market: Research Methodology