US Blood Glucose Monitoring System Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

The US Blood Glucose Monitoring System Market size was valued at USD 16.07 Bn. in 2024 and the total US Blood Glucose Monitoring System revenue is expected to grow at a CAGR of 13.2% from 2025 to 2032, reaching nearly USD 43.34 Bn. in 2032.

Format : PDF | Report ID : SMR_1629

US Blood Glucose Monitoring System Market Overview-

Blood glucose drives the body and derives from breaking down food. Insulin release is encouraged by rising levels and facilitating cellular energy use. Monitoring blood glucose is crucial for managing diabetes, especially for type-1 diabetics and those using insulin. Meters and continuous glucose monitoring systems help timely interventions. Hyperglycemia symptoms arise from high levels, while hypoglycemia requires swift attention, especially for diabetics.

- In the US, around 1.6 million people have Type 1 diabetes, while about 30.3 million adults have Type 2 diabetes.

- Type 1 diabetes patients perform 4-10 daily fingerstick tests, whereas Continuous Glucose Monitoring (CGM) users obtain 288 readings per day.

The report analyses the US Blood Glucose Monitoring System market and covers trends, technological advancements, and potential disruptions that shape the market. It assesses market size, growth, economic factors, regulations, and commercial drivers. The competitive landscape is analyzed, highlighting differentiation among key operators and drawing on historical data, industry insights, and the report forecasts sector. The economic downturn prompted this analysis and revealed the US Blood Glucose Monitoring System industry's resilience challenges. The report aims to equip stakeholders with crucial, concise information for informed decision-making in this dynamic sector. The targeted audiences include People with Healthcare professionals, Secondary Audiences, Government agencies, policymakers, and pharmaceutical companies in the US Blood Glucose Monitoring System industry.

To get more Insights: Request Free Sample Report

US Blood Glucose Monitoring System Market Dynamics:

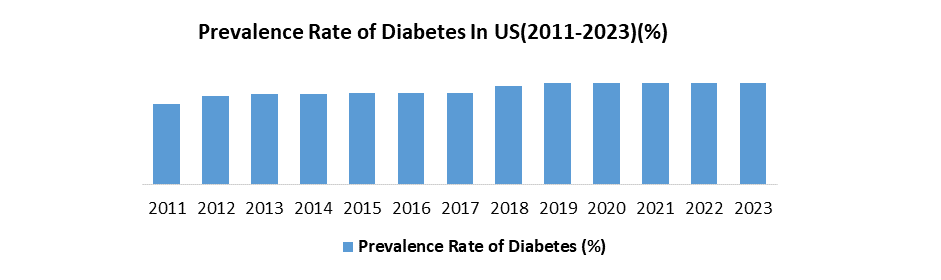

Rising Incidence of Diabetes to Drive the US Blood Glucose Monitoring System Market

Growing diabetes prevalence boosts the need for blood sugar monitoring, increasing the Blood Glucose Monitoring System market for glucose devices. This surge spurs innovation, with increasing R&D investment for precise, user-friendly, and cost-effective tools. Increased competition ensues as more companies join, potentially lowering prices and enhancing features. Job opportunities flourish in industrial, distribution, and healthcare sectors linked to these devices.

Rising diabetes cases strain healthcare systems, resulting in increased costs thanks to increased demand for treatment and monitoring. Unequal access to affordable devices and treatment exacerbates health disparities. The commercialization of healthcare raises ethical concerns surrounding pricing, access, and potential exploitation of vulnerable populations.

In the US Blood Glucose Monitoring System Market Advancements like continuous glucose monitoring (CGM) promise improved disease management and reduced finger pricking, yet affordability and accessibility remain key considerations. The heightened focus on blood sugar levels triggers anxiety for some with diabetes. The growing diabetes incidence poses opportunities and challenges, urging responsible and equitable use of technology to benefit individuals and healthcare systems.

US Blood Glucose Monitoring System Market Segment Analysis

Based on Product, the Continuous glucose monitoring system segment held the largest market share of about 93% in the US Blood Glucose Monitoring System Market in 2024. According to the STELLAR analysis, the segment is further expected to grow at a CAGR of 13.4% during the forecast period. It stands out as the dominant segment within the US Blood Glucose Monitoring System Market thanks to its rapid technological advancement and growing adoption of smart devices with data connectivity and integration.

Continuous Glucose Monitor system offers tangible benefits. They improve glycaemic control by providing real-time glucose readings, leading to improved A1c levels and reduced hypoglycemia. Patients find empowerment through informed decisions on diet, exercise, and medication, resulting in better self-management and quality of life. A continuous Glucose Monitor system also eliminates the inconvenience of frequent finger pricks, making monitoring more adherent. Technological advancements, such as alarms and mobile app integration, enhance the user experience. The growing Blood Glucose Monitoring System Market, driven by increased diabetes prevalence and insurance coverage, reflects the positive trajectory of diabetes management.

In the Blood Glucose Monitoring System Market higher cost of CGMs in comparison to traditional glucose meters poses a barrier to accessibility, particularly for individuals lacking sufficient insurance coverage. Additionally, users experience discomfort due to the regular insertion and replacement of CGM sensors. The continuous stream of data generated by CGMs overwhelms patients, highlighting the need for education and support to interpret and utilize the information effectively. Integration with electronic health records remains inconsistent, creating communication gaps with healthcare providers and limiting data sharing and collaboration. Also, concerns about the security and privacy of CGM data necessitate the implementation of robust safeguards and comprehensive patient education to address these issues.

Continuous glucose monitoring systems are gaining prominence in the US blood glucose monitoring market and promising improved diabetes management. Challenges like cost, user experience, data management, and integration with healthcare systems are addressed for broader adoption and optimal impact on patients and the healthcare system.

US Blood Glucose Monitoring System Market Scope:

|

US Blood Glucose Monitoring System Market |

|

|

Market Size in 2024 |

USD 16.07 Billion |

|

Market Size in 2032 |

USD 43.34 Billion |

|

CAGR (2025-2032) |

13.2% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope

|

By Product

|

|

By Testing Site

|

|

|

By Indication

|

|

|

By End-User

|

|

Leading Key Players in the US Blood Glucose Monitoring System Market

- Abbott Laboratories

- Roche Diagnostics

- Johnson & Johnson (LifeScan)

- Medtronic

- Dexcom

- Becton, Dickinson and Company (BD)

- Ascensia Diabetes Care

- AgaMatrix

- Nipro Diagnostics

- Sinocare Inc.

Frequently Asked Questions

High costs and Limited reimbursement are expected to be the major restraining factors for the US Blood Glucose Monitoring System market growth.

The US Blood Glucose Monitoring System Market size was valued at USD 16.07 Billion in 2024 and the total US Blood Glucose Monitoring System revenue is expected to grow at a CAGR of 13.2 % from 2025 to 2032, reaching nearly USD 43.34 Billion By 2032.

1. US Blood Glucose Monitoring System Market: Research Methodology

1.1 Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Up Approach

1.3. Market Breakdown and Data Triangulation

1.4. Research Assumption

2. US Blood Glucose Monitoring System Market Executive Summary

2.1. Market Overview

2.2. Market Size (2024) and Forecast (2025 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments

3. US Blood Glucose Monitoring System Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Business Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2024)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Developments and Innovations

4. US Blood Glucose Monitoring System Market: Dynamics

4.1. US Blood Glucose Monitoring System Market Trends

4.2. US Blood Glucose Monitoring System Market Drivers

4.3. US Blood Glucose Monitoring System Market Restraints

4.4. US Blood Glucose Monitoring System Market Opportunities

4.5. US Blood Glucose Monitoring System Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Regulatory Landscape

5. US Blood Glucose Monitoring System Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032)

5.1. US Blood Glucose Monitoring System Market Size and Forecast, by Product (2024-2032)

5.1.1. Self-monitoring system

5.1.2. Continuous glucose monitoring system

5.2. US Blood Glucose Monitoring System Market Size and Forecast, by Testing Site (2024-2032)

5.2.1. Fingertip testing

5.2.2. Alternate site testing

5.3. US Blood Glucose Monitoring System Market Size and Forecast, by Indication (2024-2032)

5.3.1. Type-I diabetes

5.3.2. Type-II diabetes

5.4. US Blood Glucose Monitoring System Market Size and Forecast, by End-User (2024-2032)

5.4.1. Hospitals

5.4.2. Clinics

5.4.3. Homecare

6. Company Profile: Key Players

6.1. Abbott Laboratories

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.3.1. Total Revenue

6.1.3.2. Segment Revenue

6.1.3.3. Regional Revenue

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Roche Diagnostics

6.3. Johnson & Johnson (LifeScan)

6.4. Medtronic

6.5. Dexcom

6.6. Becton, Dickinson and Company (BD)

6.7. Ascensia Diabetes Care

6.8. AgaMatrix

6.9. Nipro Diagnostics

6.10. Sinocare Inc.

7. Key Findings

8. Industry Recommendations

8.1. Strategic Recommendations

8.2. Future Outlook