UK Air Purifier Market Size, Share, Growth Trends, Industry Analysis, Key Players, Investment Opportunities and Forecast (2025-2032)

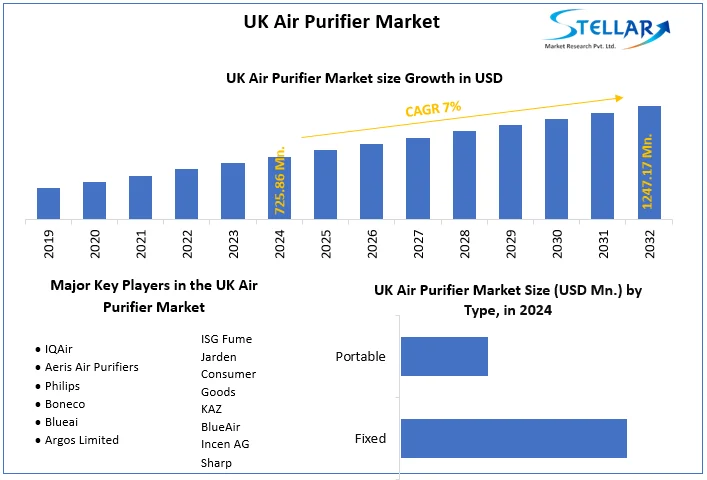

UK Air Purifier Market size was valued at US$ 725.86 Mn. in 2024. Air Purifier will encourage a great deal of transformation in Consumer Durables Market

Format : PDF | Report ID : SMR_237

UK Air Purifier Market Dynamics:

Higher allergies, rising health consciousness, changing climate conditions, rising prevalence of obstructive sleep apnea, increased urbanisation, and the influence of the coronavirus are driving the market in this region.

To get more Insights: Request Free Sample Report

High adoption and maintenance costs, UV technology utilised in air purifiers, ozone emissions, and underperformance are all important concerns that could limit the market's growth in this region.

Air purifiers are machines that can collect and degrade contaminants in the air, such as formaldehyde, pollution, bacteria, allergies, and so on. The UK air purifiers market is expected to be driven by rising levels of air pollution, a growth in the number of households, an increase in the prevalence of lifestyle diseases, and an increase in the number of pet owners, all of which are expected to be fueled by rising disposable income levels. The main sources of air pollution in the UK are vehicular emissions and smoke from coal-fired power stations. The need for air purifiers in the country is increasing as the country's car fleet grows and people become more conscious of the adverse effects of air pollution on human health.

The United Kingdom is one of Europe's largest and most polluted countries, with approximately 29,000 early fatalities due to air pollution each year. In the United Kingdom, air pollution was cited as the primary cause of rising respiratory disease and mortality rates. London is one of Europe's most polluted cities. Various firms are working on launching low-cost air purifiers to fulfil increased demand in the residential segment in order to enhance air purifier penetration in the country. The demand for air purifiers among pet owners is also increasing rapidly in the country, since these purifiers aid in the control of indoor air pollution, odour, and allergies caused by pet dander.

Due to its high filtration effectiveness and capacity to trap microscopic particles, HEPA and activated carbon based air purifiers dominate the country's air purifier market. This technique not only traps but also stops the proliferation and dispersion of airborne particles. In order to eliminate bacteria, pollution, damp odours, and other contaminants, air purifiers are becoming increasingly popular in offices. Due to rising gross disposable family income, an increase in the number of households, and rising air pollution awareness levels among inhabitants, Greater London accounts for the lion's share of the UK air purifiers market.

Amid rising toxicity levels across major cities such as London. Air pollution is a major cause of asthma and lung disease, causing 40,000 premature deaths annually, which is about 8.3% of deaths, while costing around £40 billion each year. These factor is driving the demand of air purifier market.

Companies in this region are increasingly developing new air purifier technologies such as ULPA, SULPA, Plasma cluster Ion technology, Photo Catalytic technology, Ultraviolet Germicidal Irradiation (UVGI), streamer technology, Thermodynamic Sterilizing System (TSS) technology, etc. to meet specific consumer requirements.

UK Air Purifier Market Segment Analysis:

By Technology, HEPA dominated the market with 52 % share in 2024. Due to their higher efficiency and ability to trap small airborne particles in the range of 0.3 microns. Hospitals, research laboratories, households, hotels, aircraft and airports are the key end-users of HEPA. The demand for air purifiers is not restricted to commercial and industrial sectors. An increasing demand for air purifiers is emanating from the residential sectors and cars. Though, these air purifiers were earlier regarded as premium products, companies are now offering low-cost air purifiers mainly targeted at the residential sector.

The objective of the report is to present a comprehensive analysis of the UK Air Purifier market to the stakeholders in the industry. The report provides trends that are most dominant in the UK Air Purifier market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the UK Air Purifier Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the UK Air Purifier market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the UK Air Purifier market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the UK Air Purifier Market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the UK Air Purifier market. The report also analyses if the UK Air Purifier market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the UK Air Purifier market. Economic variables aid in the analysis of economic performance drivers that have an impact on the UK Air Purifier market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the UK Air Purifier market is aided by legal factors.

UK Air Purifier Market Scope:

|

UK Air Purifier Market |

|

|

Market Size in 2024 |

USD 725.86 Mn. |

|

Market Size in 2032 |

USD 1247.17 Mn. |

|

CAGR (2025-2032) |

7 % |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

by Technology

|

|

by Application

|

|

|

by Type

|

|

UK Air Purifier Market Key Players:

Frequently Asked Questions

UK Air Purifier Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

UK Air Purifier Market size was USD 725.86 Mn. in 2024.

1. UK Air Purifier Market: Research Methodology

2. UK Air Purifier Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. UK Air Purifier Market: Dynamics

3.1. UK Air Purifier Market Trends

3.2. UK Air Purifier Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Technological Roadmap

3.6. Value Chain Analysis

3.7. Regulatory Landscape

4. UK Air Purifier Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2024-2032)

4.1. UK Air Purifier Market Size and Forecast, by Technology (2024-2032)

4.1.1. High-efficiency Particulate Air (HEPA)

4.1.2. Activated Carbon

4.1.3. Ionic Filters

4.1.4. Others

4.2. UK Air Purifier Market Size and Forecast, by Application (2024-2032)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.3. UK Air Purifier Market Size and Forecast, by Type (2024-2032)

4.3.1. Fixed

4.3.2. Portable

5. UK Air Purifier Market: Competitive Landscape

5.1. SMR Competition Matrix

5.2. Competitive Landscape

5.3. Key Players Benchmarking

5.3.1. Company Name

5.3.2. Product Segment

5.3.3. End-user Segment

5.3.4. Revenue (2024)

5.3.5. Company Locations

5.4. Market Structure

5.4.1. Market Leaders

5.4.2. Market Followers

5.4.3. Emerging Players

5.5. Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1. IQAir

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Aeris Air Purifiers

6.3. Philips

6.4. Boneco

6.5. Blueai

6.6. Argos Limited

6.7. ISG Fume

6.8. Jarden Consumer Goods

6.9. KAZ

6.10. BlueAir

6.11. Incen AG

6.12. Sharp

7. Key Findings

8. Industry Recommendations