Two Wheeler Market Global Industry Analysis and Forecast (2026-2032)

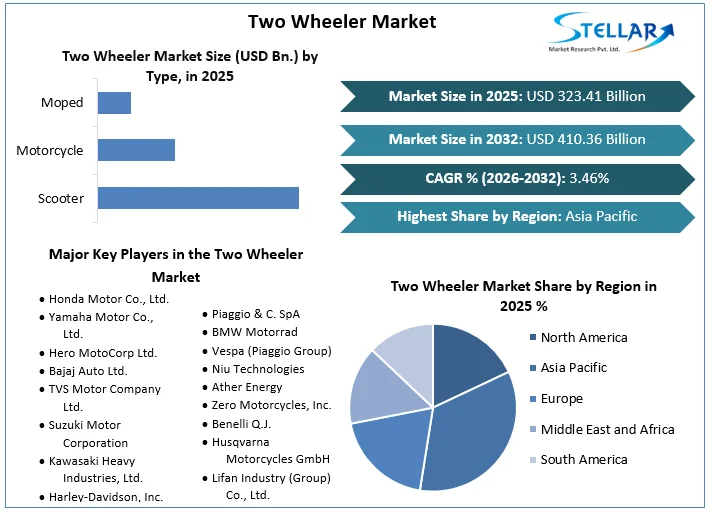

Two Wheeler Market size was valued at USD 323.41 Bn. in 2025 and the total Two Wheeler Market size is expected to grow at a CAGR of 3.46 % from 2026 to 2032, reaching nearly USD 410.36 Bn. by 2032.

Format : PDF | Report ID : SMR_1925

Two Wheeler Market Overview

A two-wheeler, also known as a two-wheeled vehicle, is a type of vehicle that is designed to travel on two wheels. Two-wheelers are commonly used for personal transportation, commuting, and recreational purposes. It comes in various forms, each serving different functions and catering to different consumer preferences.

The Research methodology used to estimate and forecast two-wheeler markets by capturing the revenues of key players and their respective market shares. Various secondary sources, including press releases, annual reports, non-profit organizations, industry associations, government agencies, and customs data, were utilized to gather information valuable for the comprehensive commercial study of the market. The report includes both qualitative and quantitative research, focusing on data interpretation, pattern recognition, and actionable insights. A hierarchical approach is used to study market segments and regions, examining the strategies of top companies in the Two Wheeler sector. With support from a financial backer, the report also provides data on import/export activities, market dynamics, values, costs, earnings, and gross profits.

- The two-wheeler sales in India increased by 9.12 percent Year-on-Year (Y-o-Y) to 17.075 million units in 2023 as the rural market continues to recover, and the overall economy shows strong growth.

To get more Insights: Request Free Sample Report

Two Wheeler Market Dynamics

Factors Driving Market Growth and Consumer Preferences in Two Wheeler Market

The shift to personal mobility has been a major factor boosting the demand for the two wheeler, as customers have been focusing more on convenience rather than luxury has influenced the market growth. Additionally, since the demand for private vehicles is circumstantial, buyers have settled for affordable two-wheeler commute options to avoid pocket strains has propelled the market growth. The growing demand for two-wheelers has brought in a range of high-end options tested for the highest safety standards. Many accessories are available, enabling the rider to drive reasonably high speed with necessary safety equipment has driven the market growth.

Two-wheelers provide the convenience of traveling at one's will, taking narrow roads, and maneuvering effectively to reach the destination on time has boosted the market growth. As compared to the four-wheeler two wheeler costs are lesser resulting in the high demand for the two wheeler. As it empowers the lower income group to also aspire for a better living by owning an asset in the form of a two-wheeler environmentally focused product development is likely to be important for the motorcycle industry. In addition, the rise of the eco-conscious consumer has also seen OEMs and tier-one suppliers in the motorcycle industry needing to include environmentally friendly technologies in the product portfolio has accelerated the market growth.

Factors Influencing the Purchase of Two Wheeler

Design and Manufacturing Challenges of Lithium Batteries for Two-Wheelers

One of the primary design challenges is achieving high energy density. Two-wheelers, unlike cars, have limited space to house batteries. Therefore, the batteries must store enough energy to ensure a decent range without increasing the size or weight significantly. Lithium batteries, while efficient, pose safety risks, particularly in terms of thermal management. Overheating can lead to thermal runaway, potentially causing fires or explosions. Designing batteries that are capable of efficient heat dissipation, especially in the compact space of a two-wheeler, is a significant challenge.

Producing lithium batteries at scale requires stringent quality control to ensure consistency. Minor variations in the manufacturing process can lead to significant differences in battery performance and lifespan. The sourcing of raw materials for lithium batteries, such as cobalt and lithium, raises concerns about sustainability and ethical mining practices. Additionally, the demand for these materials is rapidly increasing, leading to supply chain challenges.

The Surge of Electric Two-Wheelers

A key trend in the two-wheeler industry is the surge in the importance of electric vehicles. With the rise in concerns for environmental sustainability and emission reduction, manufacturers are turning to electric powertrains to address these issues as a result it has created opportunities for many manufacturers in the two wheeler industry. Additionally, rapid developments in battery technology have enhanced the range and reduced the charging times for electric two-wheelers, driving market growth. The rise in electric two-wheelers is propelled by manufacturers incorporating advanced features and technologies in their models, including electronic rider-assistance systems, connectivity features, and smart functionalities.

These innovations not only improve the riding experience but also appeal to tech-savvy consumers, contributing to market growth. Surged demand for electric vehicles, urban mobility solutions, and continuous technological advancements has been fueling the market growth. As the market adapts to evolving consumer preferences and societal trends, it presents substantial opportunities for manufacturers, retailers, and riders in the two wheeler industry.

Two Wheeler Market Segment Analysis

Based on Technology, the ICE segment has dominated the market and is expected to maintain its dominance through the forecast period with an increasing CAGR. Surged in the ICE technology in the two-wheeler industry has been driven by well-established infrastructure, affordability, widespread consumer familiarity, and ongoing technological advancements that enhance performance and efficiency have influenced the market growth. In several regions, particularly in developing countries, the limited disposable income of consumers has made the lower upfront cost of ICE two-wheelers highly appealing. The extensive network of gasoline stations facilitates convenient and quick refueling for these vehicles has boosted the market growth globally.

Additionally, maintenance and repairs are guaranteed by an established network of service facilities and mechanics knowledgeable about ICE technology has increased the demand for the two wheeler market. As it is less expensive compared to electric vehicles and has been influencing the purchase decision of the consumer. It makes it more accessible to a wider range of consumers, particularly in developing nations. Accordingly, advances in engine technology have resulted in decreased emissions and increased fuel efficiency, addressing environmental concerns while preserving the usefulness and adaptability of traditional gasoline-powered motorcycles and scooters has boosted the market growth.

Two Wheeler Market Regional Analysis

Asia Pacific dominated the market and is expected to maintain its dominance through the forecast period with an increasing CAGR. In the fast-paced world of two wheeler, the shift in the consumer preference for advanced two-wheelers has driven the market growth. As technology continues to evolve, the two wheeler industry has been growing rapidly in the Asia Pacific. Owing to its affordability, reliability, and fuel efficiency has driven the market growth. Additionally, rising smartphone connectivity via Bluetooth in two wheelers which allows access to navigation, and music has fuelled the market growth in the region. The dependence on two-wheelers for last-mile connectivity fuels the demand for motorcycles and scooters in the region. Additionally, the rise of food delivery services and e-commerce platforms has further boosted the demand for two-wheelers in Asia Pacific China is the largest producer of two wheeler followed by India.

The 5 biggest exporters of motorcycles are mainland China, Germany, Japan, Thailand and India. Collectively, the 5 major motorcycle exporters generated almost three-fifths (56.6%) of the total value for international motorcycle sales in 2022.

- India exports most of its Indian two wheeler to Colombia, Guatemala, and Tanzania and is the largest exporter of Indian two wheeler in the World.

- The top 3 exporters of Indian two wheeler are India followed by Vietnam and Belgium.

- Vietnam and India to take the lead in sales as the Chinese market saturates faster.

- Indonesia, Thailand, the Philippines, and Vietnam represent over 90% of the two-wheeler sales in Southeast Asia.

Two Wheeler Market Competitive Landscape

- In February 2023, Yamaha Motor announced the launch of the refreshed, feature-packed, 2023 lineup of its 125 CC scooter range including the Fascino 125 Fi Hybrid, Ray ZR 125 Fi Hybrid, and Ray ZR Street Rally 125 Fi Hybrid.

- In December 2023, Hero Motor Corp and Ather Energy entered into a partnership for an interoperable fast-charging network in India. Through this collaboration, EV users will be able to seamlessly use both VIDA and Ather Grids across the country. The combined network will cover 100 cities with over 1900 fast charging points.

- In September 2023, Honda Motorcycle & Scooter India introduced the Activa Limited Edition, offering an unmatched package of sophistication with functional design and superior riding experience.

|

Two Wheeler Market Scope |

|

|

Market Size in 2025 |

USD 323.41 Bn. |

|

Market Size in 2032 |

USD 410.36 Bn. |

|

CAGR (2026-2032) |

3.46 % |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Type

|

|

By Engine Capacity

|

|

|

By Technology

|

|

|

By Fuel Type

|

|

|

By Distribution Channel

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Two Wheeler Market Key Players

- Honda Motor Co., Ltd.

- Yamaha Motor Co., Ltd.

- Hero MotoCorp Ltd.

- Bajaj Auto Ltd.

- TVS Motor Company Ltd.

- Suzuki Motor Corporation

- Kawasaki Heavy Industries, Ltd.

- Harley-Davidson, Inc.

- Royal Enfield (Eicher Motors Ltd.)

- Piaggio & C. SpA

- BMW Motorrad

- Vespa (Piaggio Group)

- Niu Technologies

- Ather Energy

- Zero Motorcycles, Inc.

- Benelli Q.J.

- Husqvarna Motorcycles GmbH

- Lifan Industry (Group) Co., Ltd.

- Loncin Motor Co., Ltd.

- Geely (Zhejiang Geely Holding Group Co., Ltd.)

- XXX Inc.

Frequently Asked Questions

Design and Manufacturing Challenges of Lithium Batteries for Two-Wheelers have restrained the market growth.

The Market size was valued at USD 323.41 Billion in 2025 and the total Market revenue is expected to grow at a CAGR of 3.46 % from 2026 to 2032, reaching nearly USD 410.36 Billion.

The segments covered in the market report are by Type, Engine Capacity, Technology, Fuel Type, and Distribution Channel.

1. Two Wheeler Market: Research Methodology

2. Two Wheeler Market: Executive Summary

3. Two Wheeler Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Two Wheeler Market: Dynamics

5.1. Market Drivers

5.2. Market Trends

5.3. Market Restraints

5.4. Market Opportunities

5.5. Market Challenges

5.6. PORTER’s Five Forces Analysis

5.7. PESTLE Analysis

5.8. Strategies for New Entrants to Penetrate the Market

5.9. Analysis of Government Schemes and Initiatives for the Two Wheeler Industry

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

5.11. Two Wheeler Market Size and Forecast by Segments (by USD Value)

5.11.1. Two Wheeler Market Size and Forecast, by Type (2025-2032)

5.11.1.1. Scooter

5.11.1.2. Motorcycle

5.11.1.3. Moped

5.11.2. Two Wheeler Market Size and Forecast, by Engine Capacity (2025-2032)

5.11.2.1. Below 100cc

5.11.2.2. 101cc to 150cc

5.11.2.3. 151cc to 250cc

5.11.2.4. 251cc to 500cc

5.11.2.5. Above 500cc

5.11.3. Two Wheeler Market Size and Forecast, by Technology (2025-2032)

5.11.3.1. ICE

5.11.3.2. Electric

5.11.4. Two Wheeler Market Size and Forecast, by Fuel type (2025-2032)

5.11.4.1. Gasoline

5.11.4.2. Petrol

5.11.4.3. Diesel

5.11.4.4. Battery

5.11.4.5. Others

5.11.5. Two Wheeler Market Size and Forecast, by Distribution Channel (2025-2032)

5.11.5.1. Online

5.11.5.2. Offline

5.12. Two Wheeler Market Size and Forecast, by Region (2025-2032)

5.12.1. North America

5.12.2. Europe

5.12.3. Asia Pacific

5.12.4. Middle East and Africa

5.12.5. South America

6. North America Two Wheeler Market Size and Forecast (by USD Value)

6.1. North America Two Wheeler Market Size and Forecast, by Type (2025-2032)

6.1.1. Scooter

6.1.2. Motorcycle

6.1.3. Moped

6.2. North America Two Wheeler Market Size and Forecast, by Engine Capacity (2025-2032)

6.2.1. Below 100cc

6.2.2. 101cc to 150cc

6.2.3. 151cc to 250cc

6.2.4. 251cc to 500cc

6.2.5. Above 500cc

6.3. North America Two Wheeler Market Size and Forecast, by Technology (2025-2032)

6.3.1. ICE

6.3.2. Electric

6.4. North America Two Wheeler Market Size and Forecast, by Fuel type (2025-2032)

6.4.1. Gasoline

6.4.2. Petrol

6.4.3. Diesel

6.4.4. Battery

6.4.5. Others

6.5. North America Two Wheeler Market Size and Forecast, by Distribution Channel (2025-2032)

6.5.1. Online

6.5.2. Offline

6.6. North America Two Wheeler Market Size and Forecast, by Country (2025-2032)

6.6.1. United States

6.6.2. Canada

6.6.3. Mexico

7. Europe Two Wheeler Market Size and Forecast (by USD Value)

7.1. Europe Two Wheeler Market Size and Forecast, by Type (2025-2032)

7.1.1. Scooter

7.1.2. Motorcycle

7.1.3. Moped

7.2. Europe Two Wheeler Market Size and Forecast, by Engine Capacity (2025-2032)

7.2.1. Below 100cc

7.2.2. 101cc to 150cc

7.2.3. 151cc to 250cc

7.2.4. 251cc to 500cc

7.2.5. Above 500cc

7.3. Europe Two Wheeler Market Size and Forecast, by Technology (2025-2032)

7.3.1. ICE

7.3.2. Electric

7.4. Europe Two Wheeler Market Size and Forecast, by Fuel type (2025-2032)

7.4.1. Gasoline

7.4.2. Petrol

7.4.3. Diesel

7.4.4. Battery

7.4.5. Others

7.5. Europe Two Wheeler Market Size and Forecast, by Distribution Channel (2025-2032)

7.5.1. Online

7.5.2. Offline

7.6. Europe Two Wheeler Market Size and Forecast, by Country (2025-2032)

7.6.1. UK

7.6.2. France

7.6.3. Germany

7.6.4. Italy

7.6.5. Spain

7.6.6. Sweden

7.6.7. Russia

7.6.8. Rest of Europe

8. Asia Pacific Two Wheeler Market Size and Forecast (by USD Value)

8.1. Asia Pacific Two Wheeler Market Size and Forecast, by Type (2025-2032)

8.1.1. Scooter

8.1.2. Motorcycle

8.1.3. Moped

8.2. Asia Pacific Two Wheeler Market Size and Forecast, by Engine Capacity (2025-2032)

8.2.1. Below 100cc

8.2.2. 101cc to 150cc

8.2.3. 151cc to 250cc

8.2.4. 251cc to 500cc

8.2.5. Above 500cc

8.3. Asia Pacific Two Wheeler Market Size and Forecast, by Technology (2025-2032)

8.3.1. ICE

8.3.2. Electric

8.4. Asia Pacific Two Wheeler Market Size and Forecast, by Fuel type (2025-2032)

8.4.1. Gasoline

8.4.2. Petrol

8.4.3. Diesel

8.4.4. Battery

8.4.5. Others

8.5. Asia Pacific Two Wheeler Market Size and Forecast, by Distribution Channel (2025-2032)

8.5.1. Online

8.5.2. Offline

8.6. Asia Pacific Two Wheeler Market Size and Forecast, by Country (2025-2032)

8.6.1. China

8.6.2. S Korea

8.6.3. Japan

8.6.4. India

8.6.5. Australia

8.6.6. ASEAN

8.6.7. Rest of Asia Pacific

9. Middle East and Africa Two Wheeler Market Size and Forecast (by USD Value)

9.1. Middle East and Africa Two Wheeler Market Size and Forecast, by Type (2025-2032)

9.1.1. Scooter

9.1.2. Motorcycle

9.1.3. Moped

9.2. Middle East and Africa Two Wheeler Market Size and Forecast, by Engine Capacity (2025-2032)

9.2.1. Below 100cc

9.2.2. 101cc to 150cc

9.2.3. 151cc to 250cc

9.2.4. 251cc to 500cc

9.2.5. Above 500cc

9.3. Middle East and Africa Two Wheeler Market Size and Forecast, by Technology (2025-2032)

9.3.1. ICE

9.3.2. Electric

9.4. Middle East and Africa Two Wheeler Market Size and Forecast, by Fuel type (2025-2032)

9.4.1. Gasoline

9.4.2. Petrol

9.4.3. Diesel

9.4.4. Battery

9.4.5. Others

9.5. Middle East and Africa Two Wheeler Market Size and Forecast, by Distribution Channel (2025-2032)

9.5.1. Online

9.5.2. Offline

9.6. Middle East and Africa Two Wheeler Market Size and Forecast, by Country (2025-2032)

9.6.1. South Africa

9.6.2. GCC

9.6.3. Egypt

9.6.4. Rest of ME&A

10. South America Two Wheeler Market Size and Forecast (by USD Value)

10.1. South America Two Wheeler Market Size and Forecast, by Type (2025-2032)

10.1.1. Scooter

10.1.2. Motorcycle

10.1.3. Moped

10.2. South America Two Wheeler Market Size and Forecast, by Engine Capacity (2025-2032)

10.2.1. Below 100cc

10.2.2. 101cc to 150cc

10.2.3. 151cc to 250cc

10.2.4. 251cc to 500cc

10.2.5. Above 500cc

10.3. South America Two Wheeler Market Size and Forecast, by Technology (2025-2032)

10.3.1. ICE

10.3.2. Electric

10.4. Two Wheeler Market Size and Forecast, by Fuel type (2025-2032)

10.4.1. Gasoline

10.4.2. Petrol

10.4.3. Diesel

10.4.4. Battery

10.4.5. Others

10.5. South America Two Wheeler Market Size and Forecast, by Distribution Channel (2025-2032)

10.5.1. Online

10.5.2. Offline

10.6. South America Two Wheeler Market Size and Forecast, by Country (2025-2032)

10.6.1. Brazil

10.6.2. Argentina

10.6.3. Rest of South America

11. Company Profile: Key players

11.1. Honda Motor Co., Ltd.

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. Yamaha Motor Co., Ltd.

11.3. Hero MotoCorp Ltd.

11.4. Bajaj Auto Ltd.

11.5. TVS Motor Company Ltd.

11.6. Suzuki Motor Corporation

11.7. Kawasaki Heavy Industries, Ltd.

11.8. Harley-Davidson, Inc.

11.9. Royal Enfield (Eicher Motors Ltd.)

11.10. Piaggio & C. SpA

11.11. BMW Motorrad

11.12. Vespa (Piaggio Group)

11.13. Niu Technologies

11.14. Ather Energy

11.15. Zero Motorcycles, Inc.

11.16. Benelli Q.J.

11.17. Husqvarna Motorcycles GmbH

11.18. Lifan Industry (Group) Co., Ltd.

11.19. Loncin Motor Co., Ltd.

11.20. Geely (Zhejiang Geely Holding Group Co., Ltd.)

11.21. XXX Ltd.

12. Key Findings

13. Industry Recommendation