Tungsten Market Size, Demand and Industrial Applications - 2032

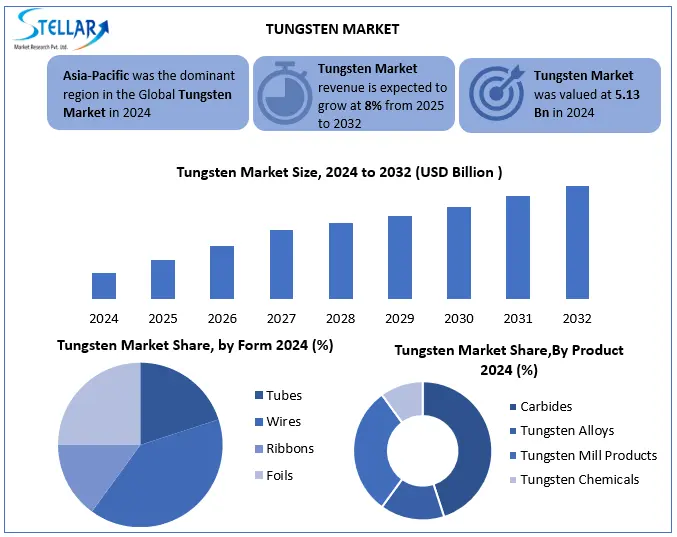

Tungsten Market is growing at 8% CAGR, was at USD 5.13 billion in 2024, driven by rising demand in automotive, mining, and electronics, reaching USD 9.50 billion by 2032

Format : PDF | Report ID : SMR_2788

Tungsten Market Overview:

Tungsten is a high-density, high-melting-point metal widely used across multiple industries for its durability and heat resistance. In Automotive sector, it plays a critical role in production of components like tire studs, ball joints, and high-performance crankshafts. Its application ensures structural integrity and thermal flexibility in the demand, making it a valuable material in both traditional and electric vehicle construction.

A major driver for tungsten market is a growing motor vehicle production, especially in China. According to the China Association of Automobile Manufacturers (CAAM), China manufactured more than 29 million vehicles in 2024, indicating an increase of 3% from the previous year. The increasing use of tungsten scrap for permanent manufacturing is supporting market growth. Another notable driver in the expansion of mining works outside China, especially in Australia and South Korea, is diversifying the supply base. The competitive landscape is led by China, which not only dominates global tungsten production, but also is its largest consumer. Companies in Europe, Australia and South Korea are gradually entering the market, but Chinese players have strategic control. In September 2024, United States Trade Representative imposed a 25% tariff on tungsten imports from China, including carbide and oxide. This step is re-shaping sourcing strategies and encouraging investment in alternative supply chains outside China.

To get more Insights: Request Free Sample Report

Tungsten Market Dynamics:

Rising Demand for Tungsten in Mining Industry to Drive the Tungsten Market

Due to strength, hardness, and toughness, tungsten carbide is very resistant to wear and impact. Mining industries are switching from steel to tungsten carbide because it increases tool life, cost-effectiveness, and productivity. Tungsten is majorly used in a blast hole drilling, haul road maintenance, bulk handling, mineral processing, longwall extraction, roof bolting, and room & pillar extraction. Tungsten carbide is most durable as it deliver 3-5 times more longer tool life and is cost-effective chemical compounds that can be used in the manufacturing process.

Composed of equal amounts of tungsten and carbon, the material is found in powder form and is subsequently shaped through the sintering process. With a high tolerance for heat and pressure, Tungsten Carbide has been used in machines with critical functionality for years, and it is slowly making its way into the mining industry. Tungsten Carbides are used as attachments at the tip to reduce wear on the machine's metallic body, as compared to simply using a metallic body. A tip is less difficult to replace than a down-the-hole drilling unit. The mining industry uses Tungsten Carbides in the form of small button inserts or large attachments.

Rising Adoption of Tungsten in Electrical Application to Drive the Tungsten Market

Tungsten is widely used in electronics and power industries by its low evaporation rate, high plasticity, high melting point (>3,400 degree celcius), and high electron emission ability. Because of its high light rate and long service life, tungsten is widely used in a manufacture of various bulb filaments, like incandescent lamps and halogen lamps. Tungsten wire can also be used in manufacturing of electronic tubes direct hot cathode, gate, and variety of electronic instruments by hot cathode heater. Tungsten's properties make it suitable for TIG welding and other similar materials.

Raw Material Shortage and Supply Chain Disruption to Restrain the Tungsten Market

Manufacturers are facing significant challenges in sourcing raw materials like tungsten, which is essential for power-management circuits and various microchips. These shortages directly affect the production and availability of finished consumer electronics. China's recent decision to restrict tungsten exports controlling over 80% of global tungsten output while simultaneously increasing its own reserves has further strained global supply. With limited access to tungsten in open market, industries dependent on this metal like electronics and automotive are left with few alternatives. This scarcity poses a major constraint on market growth, potentially slowing down production timelines and driving up material costs across key sectors.

Tungsten Market Segment Analysis:

Based on product, tungsten Market is classified into metal alloys, tungsten carbide and mill products and tungsten chemicals. The Tungsten Carbide segment is dominating in 2024 by 45% of total revenue share and the market is expected to grow during the forecast period, due to high tensile strength of the material, which the equipment, bits and gauge, and dying hard. Tungsten carbide is also used in industrial alloys, cemented carbides, ski poles, jewellery and surgical tools. The growth of these end-use applications dominates the demand for tungsten carbide. The mill products segment is expected to view high growth rate. Mill products include electrodes, lighting filaments, electrical and electronic contact, sheets, wires, rods, and so on. During the forecast period, the progress mill in the electronics industry will be the primary driver for Tungsten market development.

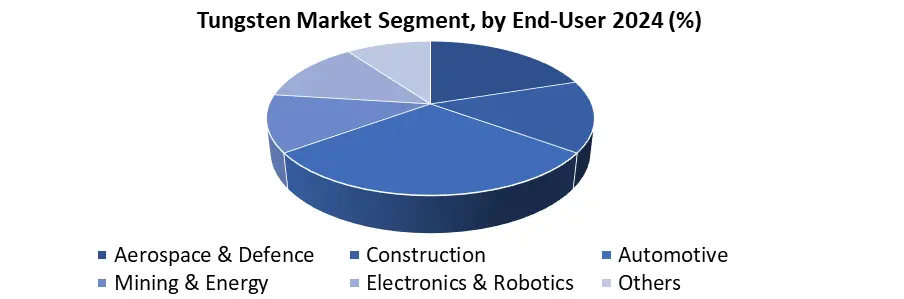

Based on the End-user, tungsten market is divided into Aerospace & Defence, Construction, Automotive, Mining & Energy, Electronics & Robotics. The Automotive segments dominates the market in 2024 by 28% of total revenue share and is expected to grow at during the forecast period, due to the growth of construction activities and infrastructure development (roads and railway). These devices are employed in mining, manufacturing, oil and gas and metallurgy industries. The aerospace component segment is expected to grow at a significant rate. The product is widely used in production like aerospace components such as inertial systems, fluid control systems, rotor blades, propellers, bucking bar, trim weight, aircraft balance weight and many others.

Tungsten Market Regional analysis:

Asia-Pacific dominated the Tungsten Market in 2024

China has the biggest market share and will be the top tungsten user during the projection period. Asia-Pacific is predicted to increase at a modest rate throughout the projection period. Increasing disposable income in emerging nations is driving demand for convenience items, helping the growth of the worldwide tungsten market. Due to extensive use and interchangeable cutting tools, the carbide sector held the greatest market share in 2024. The fastest increase is anticipated for tungsten alloys, particularly as a result of the expansion of the aircraft industry. The demand for mill goods containing tungsten will continue to expand, to its use in electrical and electronic equipment.

- According to Boeing, the expected growth rate of China's commercial aviation market from 2019 to 2038 is broken down by segment. Over that time, China's ground, station, and freight operations market is expected to rise by 5.6 percent.

Tungsten is low-cost metal that, unlike expensive metals, is easy on the pocketbook. Several grades of tungsten carbide are used in jewelleries, which affects pricing. High-quality tungsten with a carbon and nickel, for example, might be more expensive than lower-grade tungsten carbide combinations. Tungsten is a rare metal with the highest melting and boiling points of any element known to man. As a result, all the causes listed above are projected to increase demand for the tungsten market in the Asia-Pacific region in the future.

Tungsten Market Competitive Landscape:

Companies such as Xiamen Tungsten co limited, Buffalo Tungsten Inc., Kennametal Inc. and China Min metals Corporation dominate the market due to product differentiation, financial stability, strategic developments, and diversified regional presence, company invests in R&D 8% of its total revenue. The players are concentrating on supporting research and development. Furthermore, they embrace strategic growth initiatives, such as development, product introduction, joint ventures, and partnerships, to strengthen their market position and capture an extensive customer base.

Tungsten Market Recent Developments:

- 29 May 2024, Mitsubishi Material Corporation (MMC) announced its agreement with the Masan High-Tech Material Corporation (MHT) to acquire all H.C shares. Stark holding GMBH, a major manufacturer of Tungsten, Mishra and Tungsten Carbide Material.

- 15 July 2022, H. C. Stark signed agreements to invest around USD 52 million with Nyobolt, known for the Tungsten-intensive battery business.

- 23 September 2022, Xiamen Tungsten and Chifeng District Gold Mining announced a partnership to develop rare earth materials in Laos.

|

Tungsten Market Scope |

|

|

Market Size in 2024 |

USD 5.13 Bn. |

|

Market Size in 2032 |

USD 9.50 Bn. |

|

CAGR (2024-2032) |

8% |

|

Historic Data |

2018-2023 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segments |

By Form Foils Ribbons Wires Tubes |

|

By Product Carbides Tungsten Alloys Tungsten Mill Products Tungsten Chemicals |

|

|

By End user Aerospace & Defence Construction Automotive Mining & Energy Electronics & Robotics Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia-Pacific Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America

|

Leading Players in the Tungsten Market are:

North America

- Global Tungsten & Powders Corp. (USA)

- Kennametal Inc. (USA)

- Buffalo Tungsten Inc. (USA)

- Allegheny Technologies Inc (USA)

- Elmet Technologies (USA)

- Midwest Tungsten Service (US

Europe

- Plansee SE (Austria)

- Treibacher Industry AG (Austria)

- H.C. Starck Tungsten GmbH (Germany)

- Sandvik AB (Sweden)

- Eurotungstene (France)

- Wolfram Company JSC (Russia)

Asia Pacific

- Xiamen Tungsten Co., Ltd. (China)

- Chongyi Zhangyuan Tungsten Co., Ltd. (China)

- Guangdong XiangLu Tungsten Co., Ltd. (China)

- China Tungsten & High-tech Materials Co., Ltd. (China)

- CMOC Group Limited (China)

- Jiangxi Yaosheng Tungsten Co., Ltd. (China)

- Japan New Metals Co., Ltd. (Japan)

- A.L.M.T. Corp. (Japan)

- Nippon Tungsten Co., Ltd. (Japan)

- Zhuzhou Cemented Carbide Group Co., Ltd. (China)

- Zhuzhou Tungsten Co., Ltd. (China)

- Tejing Tungsten Co., Ltd. (China)

Middle East & Africa

- Element Six (South Africa)

- Specialty Metals Resources (South Africa)

South America

- Almonty Industries Inc. (Canada)

- W Resources Plc (UK)

- Ormonde Mining plc (Ireland)

- Wolf Minerals Limited (Australia)

Frequently Asked Questions

The growth rate of the Tungsten Market is 8% CAGR.

Tungsten carbide, due to its strength and applications in tools, surgical instruments, jewellery, and industrial machinery.

Asia-Pacific is the dominating region in the Tungsten Market.

Wires, Foils, Tubes, and Ribbons are widely used in electronics, aerospace, and industrial applications.

1. Tungsten Solutions Market Introduction

1.1. Study Assumptions and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Tungsten Solutions Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Key Players Benchmarking

2.2.1. Company Name

2.2.2. Service Segment

2.2.3. End-User Segment

2.2.4. Revenue (2024)

2.2.5. Geographical Presence

2.3. Market Structure

2.3.1. Market Leaders

2.3.2. Market Followers

2.3.3. Emerging Players

2.4. Mergers and Acquisitions Details

3. Tungsten Solutions Market: Dynamics

3.1. Tungsten Solutions Market Trends

3.2. Tungsten Solutions Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape by Region

3.6. Key Opinion Leader Analysis for the Global Industry

3.7. Analysis of Government Schemes and Initiatives for Industry

4. Tungsten Solutions Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

4.1. Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

4.1.1. Foils

4.1.2. Ribbons

4.1.3. Wires

4.1.4. Tubes

4.2. Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

4.2.1. Carbides

4.2.2. Tungsten Alloys

4.2.3. Tungsten Mill Products

4.2.4. Tungsten Chemicals

4.3. Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

4.3.1. Aerospace & Defence

4.3.2. Construction

4.3.3. Automotive

4.3.4. Mining & Energy

4.3.5. Electronics & Robotics

4.3.6. Others

4.4. Tungsten Solutions Market Size and Forecast, By Region (2024-2032)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Tungsten Solutions Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

5.1. North America Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

5.1.1. Foils

5.1.2. Ribbons

5.1.3. Wires

5.1.4. Tubes

5.2. North America Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

5.2.1. Carbides

5.2.2. Tungsten Alloys

5.2.3. Tungsten Mill Products

5.2.4. Tungsten Chemicals

5.3. North America Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

5.3.1. Aerospace & Defence

5.3.2. Construction

5.3.3. Automotive

5.3.4. Mining & Energy

5.3.5. Electronics & Robotics

5.3.6. Others

5.4. North America Tungsten Solutions Market Size and Forecast, by Country (2024-2032)

5.4.1. United States

5.4.1.1. United States Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

5.4.1.1.1. Foils

5.4.1.1.2. Ribbons

5.4.1.1.3. Wires

5.4.1.1.4. Tubes

5.4.1.2. United States Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

5.4.1.2.1. Carbides

5.4.1.2.2. Tungsten Alloys

5.4.1.2.3. Tungsten Mill Products

5.4.1.2.4. Tungsten Chemicals

5.4.1.3. United States Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

5.4.1.3.1. Aerospace & Defence

5.4.1.3.2. Construction

5.4.1.3.3. Automotive

5.4.1.3.4. Mining & Energy

5.4.1.3.5. Electronics & Robotics

5.4.1.3.6. Others

5.4.2. Canada

5.4.2.1. Canada Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

5.4.2.1.1. Foils

5.4.2.1.2. Ribbons

5.4.2.1.3. Wires

5.4.2.1.4. Tubes

5.4.2.2. Canada Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

5.4.2.2.1. Carbides

5.4.2.2.2. Tungsten Alloys

5.4.2.2.3. Tungsten Mill Products

5.4.2.2.4. Tungsten Chemicals

5.4.2.3. Canada Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

5.4.2.3.1. Aerospace & Defence

5.4.2.3.2. Construction

5.4.2.3.3. Automotive

5.4.2.3.4. Mining & Energy

5.4.2.3.5. Electronics & Robotics

5.4.2.3.6. Others

5.4.3. Mexico

5.4.3.1. Mexico Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

5.4.3.1.1. Foils

5.4.3.1.2. Ribbons

5.4.3.1.3. Wires

5.4.3.1.4. Tubes

5.4.3.2. Mexico Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

5.4.3.2.1. Carbides

5.4.3.2.2. Tungsten Alloys

5.4.3.2.3. Tungsten Mill Products

5.4.3.2.4. Tungsten Chemicals

5.4.3.3. Mexico Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

5.4.3.3.1. Aerospace & Defence

5.4.3.3.2. Construction

5.4.3.3.3. Automotive

5.4.3.3.4. Mining & Energy

5.4.3.3.5. Electronics & Robotics

5.4.3.3.6. Others

6. Europe Tungsten Solutions Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

6.1. Europe Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

6.2. Europe Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

6.3. Europe Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

6.4. Europe Tungsten Solutions Market Size and Forecast, by Country (2024-2032)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

6.4.1.2. United Kingdom Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

6.4.1.3. United Kingdom Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

6.4.2. France

6.4.2.1. France Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

6.4.2.2. France Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

6.4.2.3. France Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

6.4.3. Germany

6.4.3.1. Germany Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

6.4.3.2. Germany Tungsten Solutions Market Size and Forecast, By Product 2024-2032)

6.4.3.3. Germany Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

6.4.4. Italy

6.4.4.1. Italy Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

6.4.4.2. Italy Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

6.4.4.3. Italy Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

6.4.5. Spain

6.4.5.1. Spain Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

6.4.5.2. Spain Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

6.4.5.3. Spain Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

6.4.6. Sweden

6.4.6.1. Sweden Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

6.4.6.2. Sweden Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

6.4.6.3. Sweden Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

6.4.7. Russia

6.4.7.1. Russia Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

6.4.7.2. Russia Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

6.4.7.3. Russia Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

6.4.8.2. Rest of Europe Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

6.4.8.3. Rest of Europe Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

7. Asia Pacific Tungsten Solutions Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

7.1. Asia Pacific Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

7.2. Asia Pacific Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

7.3. Asia Pacific Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

7.4. Asia Pacific Tungsten Solutions Market Size and Forecast, by Country (2024-2032)

7.4.1. China

7.4.1.1. China Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

7.4.1.2. China Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

7.4.1.3. China Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

7.4.2. S Korea

7.4.2.1. S Korea Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

7.4.2.2. S Korea Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

7.4.2.3. S Korea Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

7.4.3. Japan

7.4.3.1. Japan Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

7.4.3.2. Japan Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

7.4.3.3. Japan Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

7.4.4. India

7.4.4.1. India Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

7.4.4.2. India Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

7.4.4.3. India Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

7.4.5. Australia

7.4.5.1. Australia Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

7.4.5.2. Australia Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

7.4.5.3. Australia Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

7.4.6. Indonesia

7.4.6.1. Indonesia Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

7.4.6.2. Indonesia Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

7.4.6.3. Indonesia Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

7.4.7. Malaysia

7.4.7.1. Malaysia Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

7.4.7.2. Malaysia Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

7.4.7.3. Malaysia Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

7.4.8. Philippines

7.4.8.1. Philippines Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

7.4.8.2. Philippines Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

7.4.8.3. Philippines Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

7.4.9. Thailand

7.4.9.1. Thailand Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

7.4.9.2. Thailand Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

7.4.9.3. Thailand Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

7.4.10. Vietnam

7.4.10.1. Vietnam Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

7.4.10.2. Vietnam Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

7.4.10.3. Vietnam Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

7.4.11. Rest of Asia Pacific

7.4.11.1. Rest of Asia Pacific Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

7.4.11.2. Rest of Asia Pacific Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

7.4.11.3. Rest of Asia Pacific Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

8. Middle East and Africa Tungsten Solutions Market Size and Forecast (by Value in USD Billion) (2024-2032)

8.1. Middle East and Africa Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

8.2. Middle East and Africa Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

8.3. Middle East and Africa Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

8.4. Middle East and Africa Tungsten Solutions Market Size and Forecast, by Country (2024-2032)

8.4.1. South Africa

8.4.1.1. South Africa Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

8.4.1.2. South Africa Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

8.4.1.3. South Africa Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

8.4.2. GCC

8.4.2.1. GCC Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

8.4.2.2. GCC Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

8.4.2.3. GCC Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

8.4.3. Egypt

8.4.3.1. Egypt Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

8.4.3.2. Egypt Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

8.4.3.3. Egypt Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

8.4.4. Nigeria

8.4.4.1. Nigeria Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

8.4.4.2. Nigeria Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

8.4.4.3. Nigeria Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

8.4.5. Rest of ME&A

8.4.5.1. Rest of ME&A Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

8.4.5.2. Rest of ME&A Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

8.4.5.3. Rest of ME&A Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

9. South America Tungsten Solutions Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032)

9.1. South America Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

9.2. South America Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

9.3. South America Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

9.4. South America Tungsten Solutions Market Size and Forecast, by Country (2024-2032)

9.4.1. Brazil

9.4.1.1. Brazil Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

9.4.1.2. Brazil Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

9.4.1.3. Brazil Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

9.4.2. Argentina

9.4.2.1. Argentina Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

9.4.2.2. Argentina Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

9.4.2.3. Argentina Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

9.4.3. Colombia

9.4.3.1. Colombia Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

9.4.3.2. Colombia Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

9.4.3.3. Colombia Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

9.4.4. Chile

9.4.4.1. Chile Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

9.4.4.2. Chile Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

9.4.4.3. Chile Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

9.4.5. Rest of South America

9.4.5.1. Rest of South America Tungsten Solutions Market Size and Forecast, By Form (2024-2032)

9.4.5.2. Rest of South America Tungsten Solutions Market Size and Forecast, By Product (2024-2032)

9.4.5.3. Rest of South America Tungsten Solutions Market Size and Forecast, By End-User (2024-2032)

10. Company Profile: Key Players

10.1. Xiamen Tungsten Co., Ltd. (China)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Global Tungsten & Powders Corp. (USA)

10.3. Kennametal Inc. (USA)

10.4. Buffalo Tungsten Inc. (USA)

10.5. Allegheny Technologies Inc (USA)

10.6. Elmet Technologies (USA)

10.7. Midwest Tungsten Service (US)

10.8. Plansee SE (Austria)

10.9. Treibacher Industry AG (Austria)

10.10. H.C. Starck Tungsten GmbH (Germany)

10.11. Sandvik AB (Sweden)

10.12. Eurotungstene (France)

10.13. Wolfram Company JSC (Russia)

10.14. Chongyi Zhangyuan Tungsten Co., Ltd. (China)

10.15. Guangdong XiangLu Tungsten Co., Ltd. (China)

10.16. China Tungsten & High-tech Materials Co., Ltd. (China)

10.17. CMOC Group Limited (China)

10.18. Jiangxi Yaosheng Tungsten Co., Ltd. (China)

10.19. Japan New Metals Co., Ltd. (Japan)

10.20. A.L.M.T. Corp. (Japan)

10.21. Nippon Tungsten Co., Ltd. (Japan)

10.22. Zhuzhou Cemented Carbide Group Co., Ltd. (China)

10.23. Zhuzhou Tungsten Co., Ltd. (China)

10.24. Tejing Tungsten Co., Ltd. (China)

10.25. Element Six (South Africa)

10.26. Specialty Metals Resources (South Africa)

10.27. Almonty Industries Inc. (Canada)

10.28. W Resources Plc (UK)

10.29. Ormonde Mining plc (Ireland)

10.30. Wolf Minerals Limited (Australia)

11. Key Findings

12. Analyst Recommendations

13. Tungsten Solutions Market: Research Methodology