Taxi Market Industry Analysis and Forecast (2026 - 2032)

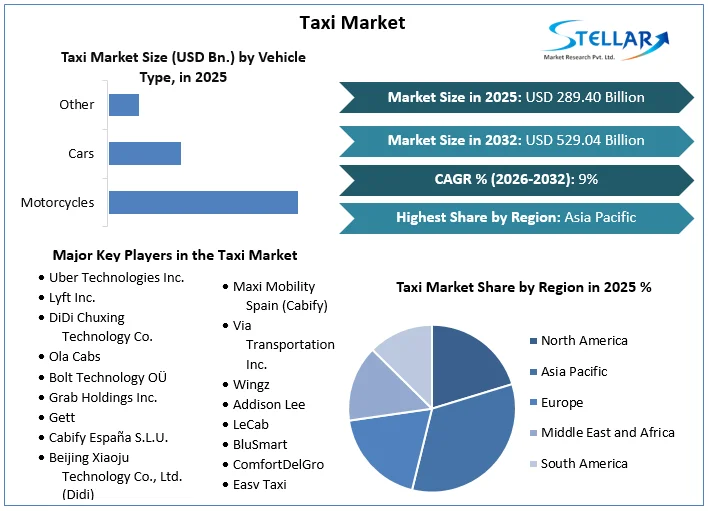

Taxi Market size was valued at USD 289.40 Bn. in 2025 and the total taxi Market size is expected to grow at a CAGR of 9% from 2026 to 2032, reaching nearly USD 529.04 Bn. by 2032.

Format : PDF | Report ID : SMR_1934

Taxi Market Overview

Taxis are solving a niche in public transport. Taxi provide a door- to- door service, flexible and available to the general public. But in contrast to most public transport it is not subsidized. Even though the service that they provide is very similar all over the world, taxis are regulated in very different ways.

The Taxi Market report provides an in-depth analysis within a specific industry or across various sectors through a detailed compilation of data tailored to a particular market segment. The report employs both qualitative and quantitative analyses to predict trends for the period from 2026 to 2032. It considers factors such as product pricing, the level of product or service penetration at national and regional scales, overall market dynamics and its submarkets, end-use industries, major market players, consumer behavior, and the political, social, and economic contexts of different countries are covered in the report. By segmenting the market meticulously, the report ensures a comprehensive analysis from multiple perspectives.

To get more Insights: Request Free Sample Report

Taxi Market Dynamics

Driving the Future of Transport

The transport industry is rapidly growing with the development of new airports, malls and other such places wherein transport means are not easily available. The taxi rentals are available in maximum localities leading transport industry towards its bright future. The taxi industry has been rapidly growing since a decade and its demand is even increasing at a higher pace. The adoption rate of taxi has risen owing to the comfortable to ride, stress free and relaxing as compared to driving own vehicle as a result it has driven the market growth. The taxi service providers immensely follow the approach to attract more customers towards their business as these companies ensure to provide high-satisfaction to their customers has accelerated the market growth.

Navigating the Taxi Industry in the Age of Ride-Hailing Services

There are numerous challenges faced by the taxi service provides such as lack of experience and professional drivers, regulatory hurdles and barrier in the app development has led to hinder the market growth. The lack of experience and profession behavior has resulted in customer reporting the drivers has negatively impacted the market growth. Ride-hailing platforms like Uber, Lyft, and DiDi have seized a significant portion of the market by providing convenience, flexibility, and competitive pricing that traditional taxis find hard to compete with. Traditional taxi companies often encounter strict licensing and permit requirements, which are both costly and time-consuming.

There's a notable regulatory disparity, with traditional taxis typically subjected to more stringent regulations compared to ride-hailing services. Additionally, traditional taxi services are usually slower to embrace new technologies such as app-based bookings, digital payments, and GPS tracking, placing them at a disadvantage against the more technologically advanced ride-hailing companies. Modernizing these systems necessitates substantial investment in technology and training, imposing a financial strain on many taxi companies. Furthermore, traditional taxis incur high costs for vehicle maintenance, fuel, and insurance, which hampers market growth. Ensuring competitive wages and retaining drivers is also challenging, particularly as ride-hailing companies offer more flexible working conditions.

Innovations and Trends Driving the Future of the Taxi and Ride-Hailing Market

The surged in the trend of ride hailing and taxi sectors are projected to increase demand in the taxi market owing to rapid development and innovation in the taxi services. The rise in the demand for the electric vehicles which are incorporated into the ride hailing services that has aligned with the global push towards sustainability has boosted the market growth. Market Leaders of taxi market are heavily investing in the development and testing of autonomous vehicle technology through strategic partnerships and significant funding. For instance, Aurora acquired Uber's Advanced Technologies Group (ATG) to accelerate progress in autonomous vehicle technology.

Along with this acquisition, Aurora announced a collaboration with Uber to integrate autonomous driving technology into Uber's ride-hailing service. The focus of ride-hailing services has also shifted from traditional car rides to multi-modal integration. By 2025, ride-hailing platforms are expected to seamlessly combine various modes of transportation, including short-haul flights, bikes, scooters, and public transportation. This integrated approach aims to offer users a diverse range of transportation options, enhancing daily commuting convenience and flexibility.

Taxi Market Segment Analysis

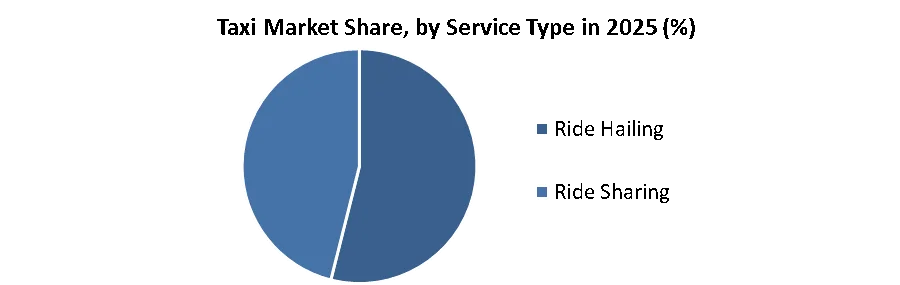

Based on Service Type, The ride hailing segment held the largest share and is expected to dominate through the forecast period owing to shift in the customer preference for ease to use transportation has driven the market growth. On-demand mobility services, including transportation network companies (commonly known as ride-sourcing or ride-hailing), connect drivers with passengers via smartphone applications and these services have become extremely popular thanks to their flexibility, convenience, and efficiency has propelled the market growth.

As a product of the mobile Internet era, ride-hailing platforms like Uber, Lyft, and DiDi have significantly enhanced vehicle utilization, increased the availability of transportation services, simplified the taxiing process, and boosted employment opportunities in sereval regions resulting in higher demand for rise hailing. Accordingly, these platforms have quickly gained popularity, disrupting the traditional taxi market by completing millions of trips daily. Unlike traditional taxi companies, ride-hailing platforms offer unique features. For instance, ride-hailing passengers has quickly access ride information, such as waiting times, the number of people in line, and the number of nearby drivers, and coordinate with drivers in real time has been influencing factors in the ride hailing market.

Taxi Market Regional Analysis

Asia Pacific dominated the market and is expected to maintain its dominance through the forecast period with an increasing CAGR. The major factors influencing market growth such as GDP growth, employment rates and increase in the easy to use transportation has surged the market growth in the Asia pacific region. China dominated the market followed by India owing to high population and surged in the transportation facilities present in the countries has boosted the market growth.

China's urban population has been growing rapidly, leading to a significant increase in demand for convenient transportation options. The influx of millions of people into cities has made taxis and ride-hailing services indispensable for meeting the urban populace's transportation needs. China's advancements in technology, particularly in mobile internet and smartphone usage, have facilitated the rise of ride-hailing platforms like Didi Chuxing. These apps dominate the market by providing easy access to on-demand taxi services through mobile devices. The Chinese government has generally supported the growth of the ride-hailing industry, although it enforces strict regulations to ensure safety and manage competition. Additionally, government policies often favor local companies, helping them secure and maintain their market dominance.

- Bike taxi aggregator Rapido has announced its strategic entry into the cab business - a space that is currently dominated by two major players - Ola and Uber. The cab launch represents the latest step in Rapido's mission to revolutionize urban mobility and ensure an affordable intra-city solution for all commuting needs, with a commanding 60% market share in bike taxis, Rapido expands its footprint with the pan-India launch of Rapido Cabs, introducing an initial fleet of 1 lakh vehicles.

Taxi Market Competitive Landscape

- In 2023, Rapido officially announced its entry into the cab aggregation space with the launch of ‘Rapido Cabs.’ The company already provides bike taxis and auto (three-wheeler) passengers to its customers. The addition of a cab service brings Rapido closer to competition with market leaders Ola and Uber. EV-based BluSmart and InDrive are also trying to tap into the market but have a relatively smaller presence in the market.

- In March 2024: After successfully launching services in Vientiane's Capital and the popular tourist destination of Vang Vieng, Xanh SM Laos officially extended its electric taxi operations to Savannakhet Province. This expansion not only signifies the next phase in Xanh SM's brand development but also underscores the company's ongoing dedication to the promotion of electric vehicles.

- In March 2024: Waymo secured approval on Friday from California regulators for offering paid robotaxi rides in the second-largest city in the United States, as well as expanding its services in more areas of the San Francisco Bay Area.

- In January 2024: Baayu, positioned as India’s inaugural app-based 100% electric and decentralized bike taxi service, was launched as a collaborative effort between the state government-run Assam State Transport Corporation and a startup company.

|

Taxi Market Scope |

|

|

Market Size in 2025 |

USD 289.40 Bn. |

|

Market Size in 2032 |

USD 529.04 Bn. |

|

CAGR (2026-2032) |

9 % |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Booking Type

|

|

By Vehicle Type

|

|

|

By Service Type

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Taxi Market Key Players

- Uber Technologies Inc.

- Lyft Inc.

- DiDi Chuxing Technology Co.

- Ola Cabs

- Bolt Technology OÜ

- Grab Holdings Inc.

- Gett

- Cabify España S.L.U.

- Beijing Xiaoju Technology Co., Ltd. (Didi)

- Maxi Mobility Spain (Cabify)

- Via Transportation Inc.

- Wingz

- Addison Lee

- LeCab

- BluSmart

- ComfortDelGro

- Easy Taxi

- Transdev

- AHA Taxis

- XXX LTd.

Frequently Asked Questions

Design and Manufacturing Challenges of Lithium Batteries for Two-Wheelers have restrained the market growth.

The Market size was valued at USD 289.40 Billion in 2025 and the total Market revenue is expected to grow at a CAGR of 9 % from 2026 to 2032, reaching nearly USD 529.04 Billion.

The segments covered in the market report are by Type, Engine Capacity, Technology, Fuel Type, and Distribution Channel.

1. Taxi Market: Research Methodology

2. Taxi Market: Executive Summary

3. Taxi Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Taxi Market: Dynamics

5.1. Market Drivers

5.2. Market Trends

5.3. Market Restraints

5.4. Market Opportunities

5.5. Market Challenges

5.6. PORTER’s Five Forces Analysis

5.7. PESTLE Analysis

5.8. Strategies for New Entrants to Penetrate the Market

5.9. Analysis of Government Schemes and Initiatives for the Taxi Industry

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

5.11. Taxi Market Size and Forecast by Segments (by Value USD)

5.11.1. Taxi Market Size and Forecast, by Booking Type (2025-2032)

5.11.1.1. Online

5.11.1.2. Offline

5.11.2. Taxi Market Size and Forecast, by Vehicle Type (2025-2032)

5.11.2.1. Motorcycles

5.11.2.2. Cars

5.11.2.3. Other

5.11.3. Taxi Market Size and Forecast, by Service Type (2025-2032)

5.11.3.1. Ride Hailing

5.11.3.2. Ride Sharing

5.12. Taxi Market Size and Forecast, by Region (2025-2032)

5.12.1. North America

5.12.2. Europe

5.12.3. Asia Pacific

5.12.4. Middle East and Africa

5.12.5. South America

6. North America Taxi Market Size and Forecast (by Value USD)

6.1. North America Taxi Market Size and Forecast, by Booking Type (2025-2032)

6.1.1. Online

6.1.2. Offline

6.2. North America Taxi Market Size and Forecast, by Vehicle Type (2025-2032)

6.2.1. Motorcycles

6.2.2. Cars

6.2.3. Other

6.3. North America Taxi Market Size and Forecast, by Service Type (2025-2032)

6.3.1. Ride Hailing

6.3.2. Ride Sharing

6.4. North America Taxi Market Size and Forecast, by Country (2025-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Taxi Market Size and Forecast (by Value USD)

7.1. Europe Taxi Market Size and Forecast, by Booking Type (2025-2032)

7.1.1. Online

7.1.2. Offline

7.2. Europe Taxi Market Size and Forecast, by Vehicle Type (2025-2032)

7.2.1. Motorcycles

7.2.2. Cars

7.2.3. Other

7.3. Europe Taxi Market Size and Forecast, by Service Type (2025-2032)

7.3.1. Ride Hailing

7.3.2. Ride Sharing

7.4. Europe Taxi Market Size and Forecast, by Country (2025-2032)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Russia

7.4.8. Rest of Europe

8. Asia Pacific Taxi Market Size and Forecast (by Value USD)

8.1. Asia Pacific Taxi Market Size and Forecast, by Booking Type (2025-2032)

8.1.1. Online

8.1.2. Offline

8.2. Asia Pacific Taxi Market Size and Forecast, by Vehicle Type (2025-2032)

8.2.1. Motorcycles

8.2.2. Cars

8.2.3. Other

8.3. Asia Pacific Taxi Market Size and Forecast, by Service Type (2025-2032)

8.3.1. Ride Hailing

8.3.2. Ride Sharing

8.4. Asia Pacific Taxi Market Size and Forecast, by Country (2025-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. ASEAN

8.4.7. Rest of Asia Pacific

9. Middle East and Africa Taxi Market Size and Forecast (by Value USD)

9.1. Middle East and Africa Taxi Market Size and Forecast, by Booking Type (2025-2032)

9.1.1. Online

9.1.2. Offline

9.2. Middle East and Africa Taxi Market Size and Forecast, by Vehicle Type (2025-2032)

9.2.1. Motorcycles

9.2.2. Cars

9.2.3. Other

9.3. Middle East and Africa Taxi Market Size and Forecast, by Service Type (2025-2032)

9.3.1. Ride Hailing

9.3.2. Ride Sharing

9.4. Middle East and Africa Taxi Market Size and Forecast, by Country (2025-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Rest of ME&A

10. South America Taxi Market Size and Forecast (by Value USD)

10.1. South America Taxi Market Size and Forecast, by Booking Type (2025-2032)

10.1.1. Online

10.1.2. Offline

10.2. South America Taxi Market Size and Forecast, by Vehicle Type (2025-2032)

10.2.1. Motorcycles

10.2.2. Cars

10.2.3. Other

10.3. South America Taxi Market Size and Forecast, by Service Type (2025-2032)

10.3.1. Ride Hailing

10.3.2. Ride Sharing

10.4. South America Taxi Market Size and Forecast, by Country (2025-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. Uber Technologies Inc.

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. Lyft Inc.

11.3. DiDi Chuxing Technology Co.

11.4. Ola Cabs

11.5. Bolt Technology OÜ

11.6. Grab Holdings Inc.

11.7. Gett

11.8. Cabify España S.L.U.

11.9. Beijing Xiaoju Technology Co., Ltd. (Didi)

11.10. Maxi Mobility Spain (Cabify)

11.11. Via Transportation Inc.

11.12. Wingz

11.13. Addison Lee

11.14. LeCab

11.15. BluSmart

11.16. ComfortDelGro

11.17. Easy Taxi

11.18. Transdev

11.19. AHA Taxis

12. Key Findings

13. Industry Recommendation