Specialty and Fine Chemicals Market Global Industry Analysis and Forecast (2026-2032)

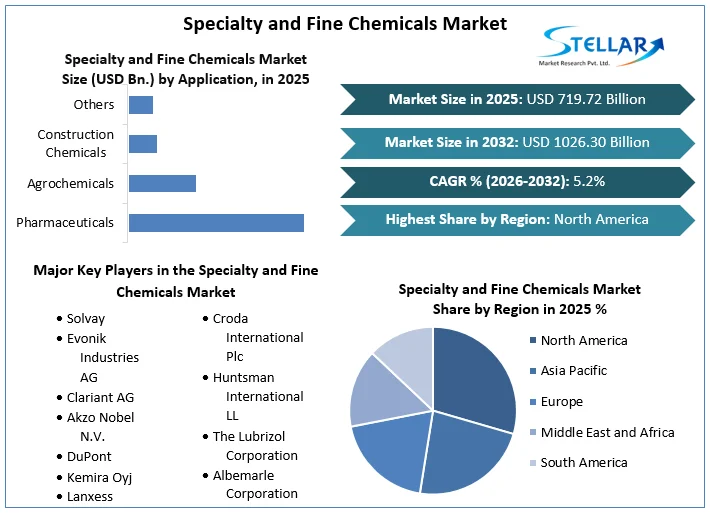

Specialty and Fine Chemicals Market Size was valued at USD 719.72 Billion in 2025 and is expected to reach USD 1026.30 Billion by 2032 at a CAGR of 5.2 % over the forecast period.

Format : PDF | Report ID : SMR_1525

Specialty and Fine Chemicals Market Overview

Consumer preferences for distinctive, high-quality things are driving this expansion. Renowned brands continue to prosper in the luxury fashion sector, while up-and-coming designers gain notoriety. An increasing number of consumers seeking out quality flavors and craftsmanship are turning to artisanal and gourmet items in the food and beverage industry. Rare and distinctive pieces are in high demand on the art market as well. Online marketplaces have been crucial in linking customers with niche products and promoting worldwide accessibility. Eco-conscious choices impact purchasing decisions as sustainability acquires prominence, changing this dynamic market.

To get more Insights: Request Free Sample Report

Specialty and Fine Chemicals Market Dynamics

This markets growth has been powered by shifting consumer preferences and a rising desire for distinctive and high-quality food products. Specialty and fine foods with distinctive flavors, artisanal skill, and premium quality are becoming more and more popular with consumers. The expansion of this sector has been greatly aided by globalization. Access to speciality and quality foods from throughout the world has been facilitated for consumers by improved transportation and distribution networks. This has increased product availability and diversity, piqued consumer interest, and increased sales. The growth of e-commerce has changed how people find and buy speciality and gourmet foods. Online marketplaces give customers quick access to a variety of goods, enabling them to experiment and discover new flavors and gastronomic delights.

The speciality and fine food market is affected by changing dietary trends and health consciousness in addition to consumer-driven issues. For meals that fit their dietary needs, such as organic, gluten-free, or sustainably derived goods, many consumers are willing to pay higher rates. Overall, e-commerce, globalization, shifting consumer preferences, and health-related considerations have all contributed to the rise of the speciality and fine food market, making it a vibrant and successful sector of the global food industry.

Specialty and Fine Chemicals Market Restraints

Demand and customer awareness are two notable constraints. Customers are looking for speciality and fine foods that are in line with their ideals, such as organic, sustainable, or ethically sourced goods, as they become more environmentally concerned and health conscious. It can be difficult for producers and distributors to meet these needs. Regulatory compliance and quality control are additional constraints. The manufacture and sale of speciality foods are subject to strict laws in many areas, particularly those pertaining to food safety and labeling standards. For smaller companies in particular, complying with these standards can be expensive and time-consuming.

Disruptions to the world's supply chains, like those experienced during the COVID-19 epidemic, have also presented difficulties for the specialized and fine food sector. The availability of these products may be disrupted if there is a reliance on overseas sourcing and distribution networks. Despite these limitations, the market for specialty and fine foods is still developing because of rising consumer interest and changing consumer preferences, providing opportunity for creative producers and merchants to serve this specialized market segment.

Specialty and Fine Chemicals Market Opportunities

Global potential for the specialty and fine food business are increasing as a result of changing customer preferences and a rising interest in high-quality, distinctive culinary experiences. The rising interest in artisanal and gourmet goods is one significant possibility. Small, specialized producers that can satisfy these discriminating preferences are growing as a result of consumers' increasing demand for unique flavors and craftsmanship. A market for specialist health foods is being created by health-conscious consumers who are looking for specialty foods that fit their dietary requirements, such as organic, gluten-free, or plant-based options. Increased access to other cuisines has increased demand for imported gourmet goods and unique ingredients. E-commerce and online marketplaces make it easier to distribute speciality goods, enabling companies to reach a wider audience.

Specialty and Fine Chemicals Market Challenge

There is an increasing desire from customers for distinctive and high-quality goods, but this demand is frequently tempered by a price-sensitive economy, making it difficult for firms to strike a balance between premium pricing and accessibility. The sourcing and delivery of speciality and fine foods are now more frequently impacted by supply chain interruptions, particularly in light of recent international events like the COVID-19 epidemic. It might be quite difficult to keep these items in constant supply. In order to export or import speciality foods, businesses must navigate complicated international rules and increasingly strict regulatory compliance and food safety standards.

Competition in the specialty and fine food sector is fierce, with both established brands and newcomers vying for market share. Building brand recognition and establishing a unique selling proposition can be daunting in this crowded marketplace. The specialty and fine food market globally must address consumer demand, supply chain resilience, regulatory compliance, and intense competition to thrive in a dynamic and evolving industry.

Specialty and Fine Chemicals Market Trends

Significant developments and shifts have recently been observed in the speciality and fine food markets around the world. Specialty and fine foods are in high demand as a result of consumers increased desire for distinctive and high-quality food products. The emphasis on health and wellness, with customers seeking out better and more natural solutions, is one noticeable trend. Specialty items including organic, gluten-free, and plant-based foods have grown as a result of this. The expansion of e-commerce and online grocery shopping is another significant trend that has made it simpler for customers to access speciality and gourmet foods from around the world. Smaller producers can now reach a wider audience because to the market's increased reach.

The expansion of customers gastronomic horizons due to globalization has also contributed to the rise in demand for exotic and foreign speciality goods. The popularity of artisanal and regionally sourced luxury foods is also fueled by concerns about sustainability and ethical sourcing. E-commerce and sustainability will play a crucial role in determining the future of the specialty and fine food business. This sector is evolving to meet the needs of health-conscious, globally aware consumers who are looking for distinctive and high-quality products.

Specialty and Fine Chemicals Market Regional Insights

Certainly, here are some regional insights into the Specialty and Fine Chemicals Market across different countries.

Europe: Europe, with its rich culinary heritage and affluent customers, is a key player in the world's specialty and fine market. A vibrant market for high-end foods and drinks, including artisanal cheeses, wines, chocolates, and gourmet meats, can be found in the area. European manufacturers continue to set worldwide standards for the speciality and fine market, luring both local enthusiasts and foreign aficionados with a strong emphasis on quality, originality, and sustainability.

North America: The market for speciality and fine foods is dominated by North America. North America has become a thriving center for the specialized and fine food industries because to this trend, which is driven by a demanding consumer base looking for quality and ethically sourced products.

Asia-Pacific: In recent years, the speciality and fine food market in the Asia Pacific area has grown significantly. This growth can be ascribed to a variety of culinary customs and rising consumer interest in distinctive and high-quality food products. Consumption of speciality foods has increased in nations like Japan, South Korea, and China as people look for gourmet experiences and high-quality ingredients.

Specialty and Fine Chemicals Market Segment Analysis

By Application: The segmentation of the global specialized and fine market by applications reflects the markets diversity and dynamism. Specialty food ingredients like organic spices and gourmet foods cater to customers looking for distinctive culinary experiences. Fine chemicals are essential to the healthcare industry because they enable the creation of high-quality pharmaceuticals. Specialty materials are necessary for improved coatings and lightweight components in the automotive industry. Specialty chemicals are also essential in agriculture since they improve crop productivity and protection. The speciality and fine market also includes electronics, cosmetics, and other products, and it uses innovation and specialized solutions to fulfill the unique needs of each business.

By End-User: The speciality and fine market can be divided into many end consumers on a global scale, each with their own preferences and needs. There is a substantial presence in the food and beverage sector, and there is a rising demand for artisanal and premium goods like craft beer, gourmet chocolates, and organic foods. The pharmaceutical industry depends on specialized chemicals and top-notch raw materials for the creation of pharmaceuticals. The need for distinctive, handcrafted goods is a key driver of growth in the fashion and luxury goods sector. In addition, the automotive industry needs specialized materials and finishes for luxury cars. The demand for high-end skincare and beauty products fuels innovation and market growth in the cosmetics and personal care sector.

Specialty and Fine Chemicals Market: Competitive Landscape

The speciality and fine food business on a global scale offers a dynamic and cutthroat environment. The industry is distinguished by a wide range of specialty goods that appeal to discerning customers looking for exceptional and high-quality culinary experiences. Established gourmet brands, artisanal producers, and multinational corporations entering this market are some of the key players. Local and regional delicacies are still in high demand, supporting a thriving community of independent producers. These products are now more easily accessible because to e-commerce platforms, which has increased competition and promoted innovation.

The rise of speciality foods made from organic and ethically sourced ingredients has been fueled by sustainability and health-conscious consumer trends, intensifying rivalry between firms to satisfy these expectations. This environment of competition promotes quality, innovation, and diversification, which ultimately benefits customers looking for unique culinary experiences around the world.

|

Specialty and Fine Chemicals Market Scope |

|

|

Market Size in 2025 |

USD 719.72 Billion |

|

Market Size in 2032 |

USD 1026.30 Billion |

|

CAGR (2026-2032) |

5.2 % |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segment Scope |

By Product Type

|

|

By Application

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Specialty and Fine Chemicals Market Key Players

- Solvay

- Evonik Industries AG

- Clariant AG

- Akzo Nobel N.V.

- DuPont

- Kemira Oyj

- Lanxess

- Croda International Plc

- Huntsman International LL

- The Lubrizol Corporation

- Albemarle Corporation

Frequently Asked Questions

North America region is expected to dominate the Specialty and Fine Chemicals Market over the forecast period.

The market size of the Specialty and Fine Chemicals Market is expected to reach USD 1026.30 Billion by 2032.

The major key players in the Global Specialty and Fine Chemicals Market are Croda International Plc, Solvay, Evonik Industries AG, Clariant AG, Akzo Nobel N.V., DuPont, Kemira Oyj, Lanxess

The growing use of specialty chemicals in the end-user industries is the key factor to drive the Specialty and Fine Chemicals Market growth over the forecast period (2026-2032).

1. Specialty and Fine Chemicals Market: Research Methodology

2. Specialty and Fine Chemicals Market: Executive Summary

3. Specialty and Fine Chemicals Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Specialty and Fine Chemicals Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers by Region

4.2.1. North America

4.2.2. Europe

4.2.3. Asia Pacific

4.2.4. Middle East and Africa

4.2.5. South America

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Value Chain Analysis

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Specialty and Fine Chemicals Market Size and Forecast by Segments (by Value USD and Volume Units)

5.1. Specialty and Fine Chemicals Market Size and Forecast, by Product Type (2025-2032)

5.1.1. Pharmaceuticals Ingredients

5.1.2. Agrochemicals

5.1.3. Dyes and Pigments

5.1.4. Construction Chemicals

5.1.5. Specialty Polymers

5.1.6. Textile Chemicals

5.1.7. Others

5.2. Specialty and Fine Chemicals Market Size and Forecast, by Application (2025-2032)

5.2.1. Pharmaceuticals

5.2.2. Agrochemicals

5.2.3. Construction Chemicals

5.2.4. Others

5.3. Specialty and Fine Chemicals Market Size and Forecast, by Region (2025-2032)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Specialty and Fine Chemicals Market Size and Forecast (by Value USD and Volume Units)

6.1. North America Specialty and Fine Chemicals Market Size and Forecast, by Product Type (2025-2032)

6.1.1. Pharmaceuticals Ingredients

6.1.2. Agrochemicals

6.1.3. Dyes and Pigments

6.1.4. Construction Chemicals

6.1.5. Specialty Polymers

6.1.6. Textile Chemicals

6.1.7. Others

6.2. North America Specialty and Fine Chemicals Market Size and Forecast, by Application (2025-2032)

6.2.1. Pharmaceuticals

6.2.2. Agrochemicals

6.2.3. Construction Chemicals

6.2.4. Others

6.3. North America Specialty and Fine Chemicals Market Size and Forecast, by Country (2025-2032)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Specialty and Fine Chemicals Market Size and Forecast (by Value USD and Volume Units)

7.1. Europe Specialty and Fine Chemicals Market Size and Forecast, by Product Type (2025-2032)

7.1.1. Pharmaceuticals Ingredients

7.1.2. Agrochemicals

7.1.3. Dyes and Pigments

7.1.4. Construction Chemicals

7.1.5. Specialty Polymers

7.1.6. Textile Chemicals

7.1.7. Others

7.2. Europe Specialty and Fine Chemicals Market Size and Forecast, by Application (2025-2032)

7.2.1. Pharmaceuticals

7.2.2. Agrochemicals

7.2.3. Construction Chemicals

7.2.4. Others

7.3. Europe Specialty and Fine Chemicals Market Size and Forecast, by Country (2025-2032)

7.3.1. UK

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific Specialty and Fine Chemicals Market Size and Forecast (by Value USD and Volume Units)

8.1. Asia Pacific Specialty and Fine Chemicals Market Size and Forecast, by Product Type (2025-2032)

8.1.1. Pharmaceuticals Ingredients

8.1.2. Agrochemicals

8.1.3. Dyes and Pigments

8.1.4. Construction Chemicals

8.1.5. Specialty Polymers

8.1.6. Textile Chemicals

8.1.7. Others

8.2. Asia Pacific Specialty and Fine Chemicals Market Size and Forecast, by Application (2025-2032)

8.2.1. Pharmaceuticals

8.2.2. Agrochemicals

8.2.3. Construction Chemicals

8.2.4. Others

8.3. Asia Pacific Specialty and Fine Chemicals Market Size and Forecast, by Country (2025-2032)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Bangladesh

8.3.11. Pakistan

8.3.12. Rest of Asia Pacific

9. Middle East and Africa Specialty and Fine Chemicals Market Size and Forecast (by Value USD and Volume Units)

9.1. Middle East and Africa Specialty and Fine Chemicals Market Size and Forecast, by Product Type (2025-2032)

9.1.1. Pharmaceuticals Ingredients

9.1.2. Agrochemicals

9.1.3. Dyes and Pigments

9.1.4. Construction Chemicals

9.1.5. Specialty Polymers

9.1.6. Textile Chemicals

9.1.7. Others

9.2. Middle East and Africa Specialty and Fine Chemicals Market Size and Forecast, by Application (2025-2032)

9.2.1. Pharmaceuticals

9.2.2. Agrochemicals

9.2.3. Construction Chemicals

9.2.4. Others

9.3. Middle East and Africa Specialty and Fine Chemicals Market Size and Forecast, by Country (2025-2032)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Egypt

9.3.4. Nigeria

9.3.5. Rest of ME&A

10. South America Specialty and Fine Chemicals Market Size and Forecast (by Value USD and Volume Units)

10.1. South America Specialty and Fine Chemicals Market Size and Forecast, by Product Type (2025-2032)

10.1.1. Pharmaceuticals Ingredients

10.1.2. Agrochemicals

10.1.3. Dyes and Pigments

10.1.4. Construction Chemicals

10.1.5. Specialty Polymers

10.1.6. Textile Chemicals

10.1.7. Others

10.2. South America Specialty and Fine Chemicals Market Size and Forecast, by Application (2025-2032)

10.2.1. Pharmaceuticals

10.2.2. Agrochemicals

10.2.3. Construction Chemicals

10.2.4. Others

10.3. South America Specialty and Fine Chemicals Market Size and Forecast, by Country (2025-2032)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest of South America

11. Company Profile: Key players

11.1. Solvay

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. Evonik Industries AG

11.3. Clariant AG

11.4. Akzo Nobel N.V.

11.5. DuPont

11.6. Kemira Oyj

11.7. Lanxess

11.8. Croda International Plc

11.9. Huntsman International LL

11.10. The Lubrizol Corporation

11.11. Albemarle Corporation

12. Key Findings

13. Industry Recommendation