Smoke Ingredients for Food Market - Global Industry Analysis and Forecast (2025-2032)

Smoke Ingredients for Food Market size was valued at USD 1.97 Bn. in 2024 and the total Global Smoke Ingredients for food revenue is expected to grow at a CAGR of 4.10% from 2025 to 2032, reaching nearly USD 2.72 Bn. by 2032.

Format : PDF | Report ID : SMR_1703

Smoke Ingredients for Food Market Overview

Smoke ingredients for food refer to substances or materials used to impart a smoky flavor to food items during the cooking and curing process. The SMR report provides profit margins of major competitors in the smoke ingredients for food market across several geographies and categories. It also examines changing consumer tastes and market trends, such as the growing popularity of smoked cheese and meat products and natural smoke flavors. Also, revenue and sales numbers in the industry are examined, revealing growth trends and market dynamics. The smoked ingredients for the food market offer a diverse collection of products, enhancing the flavors of meats, cheeses, sauces, and snacks. Liquid smoke, smoke powders, and natural smoke flavors are essential in enriching the taste and aroma of food items.

A remarkable trend is the surging demand for natural smoke flavors, driven by consumers' preference for authentic tastes sourced from real wood smoke. Also, there's an increasing desire for smoked meat and cheese products reflecting a growing appetite for indulgent culinary experiences. Key competitors in the market of smoke components for food are stepping up their efforts to gain market share through collaborations innovation and international growth in a highly competitive climate. In response to changing consumer preferences, manufacturers are creating innovative smoke components, such as non-GMO and organic alternatives. There is a clear trend of market consolidation as bigger companies buy out smaller competitors to increase their market share and product offerings.

To get more Insights: Request Free Sample Report

Smoke ingredients for food Market Dynamics

Consumer Demand for Smoked Flavors

Consumer demand for smoked flavors in meats, cheeses, and snacks is driving up the temperature in the culinary world. Gourmet cuisine is particularly desirable when smoked meals are associated with high-quality ingredients and handmade techniques. Dishes become extraordinary culinary adventures when they are infused with a smokey flavor and aroma. Also, in a time when customers are looking for new flavors, smoked flavors surpass the conventional palates of sweet, salty, sour, and bitter by providing a complex depth of flavor.

That double attraction, which includes refinement as well as gustatory discovery, drives the rising desire for smoky flavors, adding depth and delight to culinary creations. The SMR report covers the new trends of smoke flavors also consumer demand, manufacturers who are innovating and increasing their offerings, introducing new formulations and applications of smoke ingredients.

Opportunities in Smoke Ingredients for Diverse Flavor Experiences

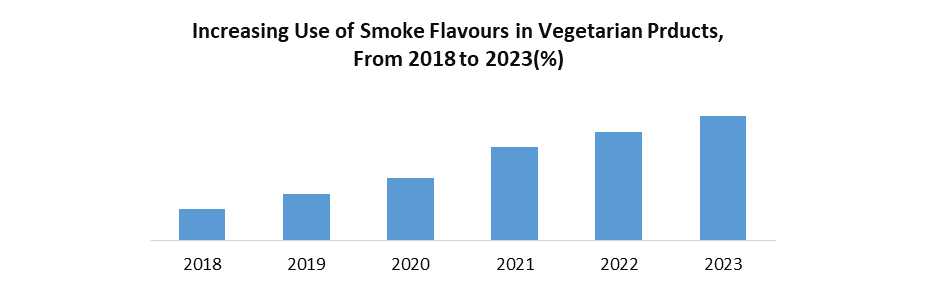

Food manufacturers are constantly innovating to meet consumer demands for new and exciting flavors. Smoke ingredients offer versatility and consistency in flavor profiles, allowing for the creation of innovative products that provide the evolving consumer tastes. Manufacturers of smoke ingredients can increase their consumer base and spur industry growth by growing into non-conventional applications.

Product development innovation, such as new flavor profiles and application methods, increases Smoke ingredients for food market strength. Unexpected applications of smoke in cheese, snacks, and drinks pique consumers' interest, represent a wide range of consumer demographics, and enlarge the product's market. The approach capitalizes on the market for a flavor that is robust and creative, stimulating customer curiosity and driving the smoke ingredients industry's sales growth.

Overcoming Health Risks

The Smoke Ingredients for Food Market faces a critical challenge due to health concerns associated with traditional smoking methods, which introduce carcinogenic Polycyclic Aromatic Hydrocarbons (PAHs) into food. The raises anxieties among health-conscious consumers, potentially reducing market growth. Shifting consumer preferences towards alternatives perceived as safer is expected to impact sales of smoke-flavored products. Additionally, negative media coverage linking smoked food to cancer risk further undermines consumer confidence in the market.

Investment in clean technologies is essential for smoke ingredient manufacturers to mitigate health risks associated with traditional smoking methods. By adopting "clean smoke" technologies, which minimize the formation of carcinogenic Polycyclic Aromatic Hydrocarbons (PAHs), companies can uphold the desired smoky flavor profile while addressing consumer health concerns. Transparent communication regarding ingredient sourcing and production methods, coupled with consumer education on safe consumption practices, raises trust and manages health anxieties. Also, a focus on developing natural smoke flavors derived from organic materials aligns with the "clean label" trend, providing the preferences of health-conscious consumers.

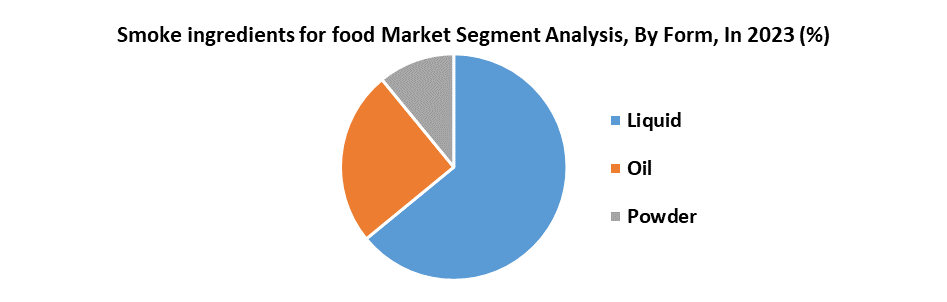

Smoke ingredients for food Market Segment Analysis

By Form, Liquid smoke is a concentrated mixture that perfectly captures the flavor and scent of burning wood, and it dissolves easily in water-based food applications. Its largest market share is a result of its versatility, ease of usage, and capacity to keep constant smokey profiles over manufacturing runs. Liquid smoke profit margins depend upon production techniques and raw material quality. Also, they often present modest returns in the face of market pressure.

Its effects include making manufacturing procedures simpler and providing exact control over the strength of the smokey flavor. Its dominance in the industry is largely because of its convenience, which enables manufacturers to reliably and consistently fulfill customer preferences by seamlessly incorporating smokey overtones into a wide range of culinary products.

Smoke ingredients for food Market Regional Insights

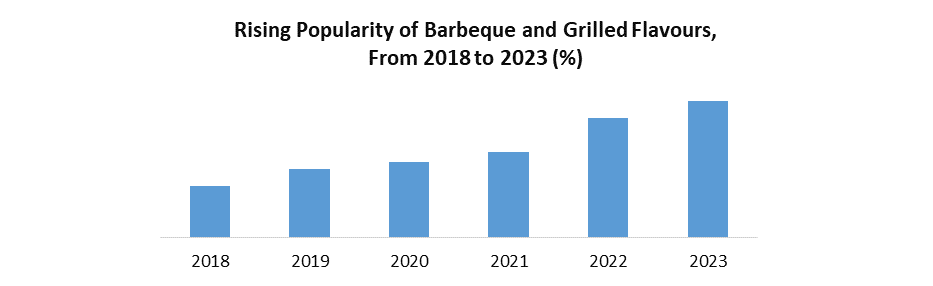

The growing popularity of grilled and barbecue cuisine, consumers' preference for gourmet taste experiences, and the growing demand for quick, smoky-flavored ready-to-eat meals are all driving growth in the North American Smoke Ingredients Market, which is expected to grow at a CAGR of XX% between 2025 and 2032. The development of clean smoke technologies to address health issues, the introduction of natural smoke tastes in line with the "clean label" movement, and the creation of novel smoke flavor profiles that go beyond standard meats are some of the recent innovations that happened in North America.

The SMR report includes the Key cost variables of raw materials such as wood chips and processing costs, as well as investments in research and development for flavor innovation and technology advancements in North America. Profit margins in the North American Smoke Ingredients Market are influenced by factors such as product type, volume, and brand recognition. Natural smoke flavors typically yield higher margins than traditional concentrates, while larger manufacturers leverage economies of scale for competitive pricing.

Established brands with strong customer loyalty also command higher profits. Additionally, government initiatives led by regulatory bodies like the US Food and Drug Administration (FDA) ensure safety standards, potentially affecting production processes and sourcing, thus impacting manufacturing costs. These factors collectively contribute to the varying profit margins observed among key players in the industry.

Smoke ingredients for food Market Competitive Landscape

Leading Key Players such as Kerry Ingredients, Archer Daniels Midland (ADM), Red Arrow Products Company, and Frutarom Savory Solutions dominate the substantial market shares, capitalizing on their experience, brand visibility, and well-established distribution channels. Meanwhile, emerging players equipped with innovative technologies and specialized niche strategies are making their mark in the market. The report covers the major industry players' substantial investments in research and development (R&D) to pioneer novel smoke ingredients.

It includes the development of natural smoke flavors, extracted from processes such as wood-smoking or pyrolysis, aligning with the demand for clean-label options. Additionally, exploration into alternatives like Maillard reactions or enzymatic browning addresses health considerations linked to traditional smoking methods. The launch of innovative products, such as smoke concentrates with reduced sodium content and organic smoke flavors, reflects evolving consumer preferences for healthier and sustainable choices. These advancements in smoke ingredient technology are poised to shape market trends and cater to changing dietary needs.

- Azelis Holdings purchased Smoky Light B.V. a distributor of chemicals in the BENELUX area, in January 2023. Smoky Light B.V. supplies additives, browning agents, grill and smoke tastes, and cooking flavors to the food and nutrition industries. Azelis hopes to grow its market share for smoke ingredients with this acquisition in the Benelux area as well as in Europe, the Middle East, and Africa.

- In August 2021, Besmoke Ltd., a provider of smoke and grill taste, and TMI Foods, a Dawn Farms company and a supplier of fully-cooked bacon and Pigs in Blankets to the United Kingdom, announced an agreement to infuse natural, clean smoked flavor solution into its goods. To produce true and clean wood smoke flavors, TMI Foods' Northampton, UK factory will use the new Puresmoke technology in its curing and cooking procedures. The goal of PureTech, a cutting-edge new micro filtration technique, is to eliminate the most dangerous components of smoke—polycyclic aromatic hydrocarbons, or PAHs—like benzo(a)pyrene.

|

Soluble Fibre Market Scope |

|

|

Market Size in 2024 |

USD 1.9 Bn. |

|

Market Size in 2032 |

USD 2.52 Bn. |

|

CAGR (2025-2032) |

4.10% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Form Liquid Powder Oil |

|

|

By Application Meat Seafood Bakery Dairy |

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Smoke ingredients for food Market

-

-

- Dempsey Corporation

- Azelis

- Associated British Foods plc

- B&G Foods

- Besmoke

- Kerry Ingredients

- Red Arrow

- MSK WIBERG

- FRUTAROM Savory Solutions

- MSK

- Symrise

- Petfood industry

- Lt foods Americas

- Ocean beauty

- Novataste

- Smokehousedeli

- Flavourstream

- Ncsmokehouse

- bio-powder

- Vermont smoke and cure

-

Frequently Asked Questions

Despite regulatory constraints and volatile raw material prices, the market offers significant growth opportunities. Emerging markets like Asia-Pacific and Latin America present untapped potential driven by evolving dietary preferences and rising disposable incomes.

The increasing consumer preference for authentic, natural flavors is driving the demand for smoke ingredients derived from real wood smoke. Additionally, there is a rising demand for smoked meat and cheese products due to the growing preference for indulgent culinary experiences.

The Market size was valued at USD 1.97 Billion in 2024 and the total Market revenue is expected to grow at a CAGR of 4.10% from 2025 to 2032, reaching nearly USD 2.72 billion.

The segments covered in the market report are By Form and Application.

1. Smoke ingredients for food Market: Research Methodology

2. Smoke ingredients for food Market: Executive Summary

3. Smoke ingredients for food Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Smoke ingredients for food Market: Dynamics

5.1. Market Driver

5.1.1. Increasing Consumer Awareness

5.1.2. Innovation in Product Offerings

5.2. Market Trends by Region

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East and Africa

5.2.5. South America

5.3. Market Drivers by Region

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

5.4. Market Restraints

5.5. Market Opportunities

5.6. Market Challenges

5.7. PORTER’s Five Forces Analysis

5.8. PESTLE Analysis

5.9. Strategies for New Entrants to Penetrate the Market

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

6. Smoke ingredients for food Market Size and Forecast by Segments (by Value Units)

6.1. Smoke ingredients for food Market Size and Forecast, by Form (2024-2032)

6.1.1. Liquid

6.1.2. Powder

6.1.3. Oil

6.2. Smoke ingredients for food Market Size and Forecast, by Application (2024-2032)

6.2.1. Meat

6.2.2. Seafood

6.2.3. Bakery

6.2.4. Dairy

6.3. Smoke ingredients for food Market Size and Forecast, by Region (2024-2032)

6.3.1. North America

6.3.2. Europe

6.3.3. Asia Pacific

6.3.4. Middle East and Africa

6.3.5. South America

7. North America Smoke ingredients for food Market Size and Forecast (by value Units)

7.1. North America Smoke ingredients for food Market Size and Forecast, by Form (2024-2032)

7.1.1. Liquid

7.1.2. Powder

7.1.3. Oil

7.2. North America Smoke ingredients for food Market Size and Forecast, by Application (2024-2032)

7.2.1. Meat

7.2.2. Seafood

7.2.3. Bakery

7.2.4. Dairy

7.3. North America Smoke ingredients for food Market Size and Forecast, by Country (2024-2032)

7.3.1. United States

7.3.2. Canada

7.3.3. Mexico

8. EuropeSmoke ingredients for food Market Size and Forecast (by Value Units)

8.1. Europe Smoke ingredients for food Market Size and Forecast, by Form (2024-2032)

8.1.1. Liquid

8.1.2. Powder

8.1.3. Oil

8.2. Europe Smoke ingredients for food Market Size and Forecast, by Application (2024-2032)

8.2.1. Meat

8.2.2. Seafood

8.2.3. Bakery

8.2.4. Dairy

8.3. Europe Smoke ingredients for food Market Size and Forecast, by Country (2024-2032)

8.3.1. UK

8.3.2. France

8.3.3. Germany

8.3.4. Italy

8.3.5. Spain

8.3.6. Sweden

8.3.7. AustriaValue

8.3.8. Rest of Europe

9. Asia PacificSmoke ingredients for food Market Size and Forecast (by Value Units)

9.1. Asia Pacific Smoke ingredients for food Market Size and Forecast, by Form (2024-2032)

9.1.1. Liquid

9.1.2. Powder

9.1.3. Oil

9.2. Asia Pacific Smoke ingredients for food Market Size and Forecast, by Application (2024-2032)

9.2.1. Meat

9.2.2. Seafood

9.2.3. Bakery

9.2.4. Dairy

9.3. Asia Pacific Smoke ingredients for food Market Size and Forecast, by Country (2024-2032)

9.3.1. China

9.3.2. S Korea

9.3.3. Japan

9.3.4. India

9.3.5. Australia

9.3.6. Indonesia

9.3.7. Malaysia

9.3.8. Vietnam

9.3.9. Taiwan

9.3.10. Bangladesh

9.3.11. Pakistan

9.3.12. Rest of Asia Pacific

10. Middle East and Africa Smoke ingredients for food Market Size and Forecast (by Value Units)

10.1. Middle East and Africa Smoke ingredients for food Market Size and Forecast, by Form (2024-2032)

10.1.1. Liquid

10.1.2. Powder

10.1.3. Oil

10.2. Middle East and Africa Smoke ingredients for food Market Size and Forecast, by Application (2024-2032)

10.2.1. Meat

10.2.2. Seafood

10.2.3. Bakery

10.2.4. Dairy

10.3. Middle East and Africa Smoke ingredients for food Market Size and Forecast, by Country (2024-2032)

10.3.1. South Africa

10.3.2. GCC

10.3.3. Egypt

10.3.4. Nigeria

10.3.5. Rest of ME&A

11. South America Smoke ingredients for food Market Size and Forecast (by Value Units)

11.1. South America Smoke ingredients for food Market Size and Forecast, by Form (2024-2032)

11.1.1. Liquid

11.1.2. Powder

11.1.3. Oil

11.2. South America Smoke ingredients for food Market Size and Forecast, by Application (2024-2032)

11.2.1. Meat

11.2.2. Seafood

11.2.3. Bakery

11.2.4. Dairy

11.3. South America Smoke ingredients for food Market Size and Forecast, by Country (2024-2032)

11.3.1. Brazil

11.3.2. Argentina

11.3.3. Rest of South America

12. Company Profile: Key players

12.1. Dempsey Corporation

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. Azelis

12.3. Associated British Foods plc

12.4. B&G Foods

12.5. Besmoke

12.6. Kerry Ingredients

12.7. Red Arrow

12.8. MSK WIBERG

12.9. FRUTAROM Savory Solutions

12.10. MSK

12.11. Symrise

12.12. Petfoodindustry

12.13. Lt foods Americas

12.14. Oceanbeauty

12.15. Novataste

12.16. Smokehousedeli

12.17. Flavourstream

12.18. Ncsmokehouse

12.19. bio-powder

12.20. Vermont smoke and cure

13. Key Findings

14. Industry Recommendation