Smart Robot Market Global Industry Analysis and Forecast (2026-2032)

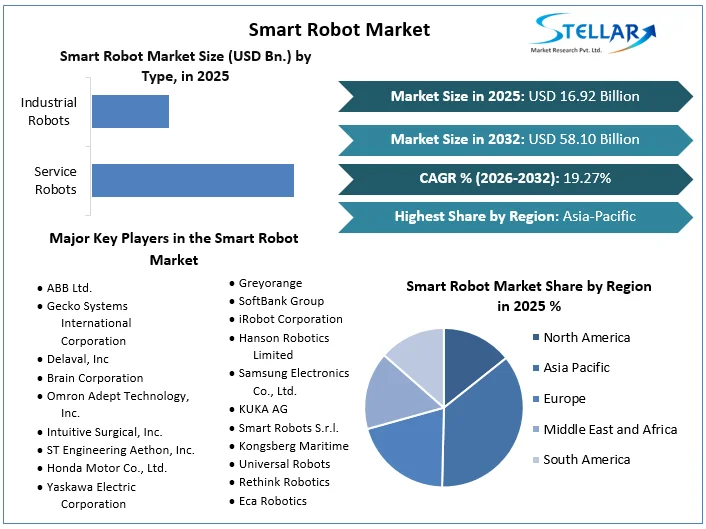

The Smart Robot Market size was valued at USD 16.92 Bn. in 2025 and the total Global Smart Robot revenue is expected to grow at a CAGR of 19.27% from 2026 to 2032, reaching nearly USD 58.10 Bn. by 2032.

Format : PDF | Report ID : SMR_2185

Smart Robot Market Overview

A smart robot refers to a highly skilled robotic system that accomplish intricate tasks either on its own or with minimal human assistance, possessing the ability of artificial intelligence (AI) and machine learning. These robots are programmed in such a way that they can sense and respond to their surroundings by utilizing sensors, cameras as well as other technologies for processing data.

The Smart Robot Market is influenced by many active factors that steer its growth. One such factor is the merging of Internet of Things (IoT) technology into these smart robots, allowing them to connect and interact with other devices and systems instantly. This connection enables faraway supervision, operational authority as well and information swapping - all contributing towards better effectiveness and output in different sectors. Besides, as 5G technology is used more broadly, it boosts connectivity which benefits the applications in self-driving vehicles and intelligent factories. This development broadens the market's possibilities and capacity.

Countries such as China, Japan, South Korea, and Taiwan have become key participants in the Smart Robot Market located within the Asia-Pacific (APAC) region. These countries play a substantial role in manufacturing and selling advanced robotic systems. China is known as one of the major centers for producing industrial robots because it has strong production abilities and government actions that back automation and robotics development.

ABB Ltd., with its wide range of robotics and automation offerings, is a company that drives innovation in the Smart Robot Market. They are known for their industrial robots which have AI and machine learning technology incorporated into them. These robots cater to many sectors such as manufacturing. The automotive industry, the electronics field as well as logistics area among others.

Focusing on agricultural robotics specifically - they have transformed dairy farming by introducing automated solutions for farm management along with robotic milking systems; both these innovations offer improved efficiency levels when compared against more conventional methods like manual labor or stationary machines utilization alone. They show their leadership in precision farming and sustainable agriculture methods, impacting worldwide Smart Robot Manufacturers and Smart Robot Suppliers.

To get more Insights: Request Free Sample Report

Smart Robot Market Dynamics

Technological Advancements in AI and Robotics

The Smart Robot Market has been transformed by advancements in AI and robotics. With Artificial Intelligence (AI) and Machine Learning (ML), smart robots can perform complex tasks accurately. These technologies contribute to making robots learn, adjust, and improve over time as they utilize AI algorithms for environment learning and task optimization. Sensor technologies have also advanced considerably. They now include vision, tactile, and proximity sensors, enhancing the abilities of smart robots to sense and interact with their environment more effectively. This results in better navigation skills as well as improved capabilities for recognizing objects or manipulating them.

Increasing Demand for Automation

Another main factor is the increasing requirement for automation in sectors such as manufacturing and services. Smart robots assist with operations involved in assembly, welding, painting, and handling materials. They enhance efficiency while lessening dependency on human labor. This trend helps to meet the growing productivity needs and operating costs, resulting in a significant expansion of the Smart Robot Industry.

Labor Shortages and Rising Labor Costs

Shortages in workers and growing costs of labor throughout the world also push for more use. In economies that are developed, there is a problem with an aging population. This causes gaps in areas such as manufacturing and healthcare where clever robots can help to reduce the lack of workers, doing jobs that are tough or repetitive. These smart machines help manage increasing labor expenses by providing a less expensive option compared to standard workforce setups.

Advancements in Connectivity and IoT

The importance of improvements in connection, like the incorporation of IoT, is crucial. Smart robots that connect to and communicate with other devices or systems through IoT help make possible real-time data exchange, remote monitoring as well as operational control. The arrival of 5G technology improves connectivity which is very important for use in autonomous vehicles and smart factories. This increases the size of the Smart Robot Market.

High Initial Costs, Maintenance, and Repair Costs

Even with these improvements, there are still some obstacles like needing a lot of money at the beginning, ongoing costs for managing and fixing issues, and complicated technical details that make it difficult to use more widely. The first setup expense of smart robots caused by modern technologies such as AI (Artificial Intelligence) and sensors creates major financial hurdles for small to medium-sized businesses (SMEs) or new companies starting up. The continuous service and repair spending related to the availability of specialized skills, and parts make it complex to run such robots which results in more expense.

Technical Challenges and Complexity

Also, the market growth is limited due to technical challenges in integrating smart robots into existing systems. The requirements for customization and technical support might become complicated and use up a lot of resources, which can restrict scalability and adoption rates in varied industrial environments.

Cybersecurity Risks, Regulatory and Safety Concerns

Risks from cybersecurity and very strict rules also limit growth. Following safety standards that are specific to an industry, particularly in the areas of healthcare and manufacturing, requires careful compliance which slow down development into new markets. As smart robots keep on getting more connected with each other, risks related to cybersecurity become bigger. This means we need strong protection measures that is expensive too.

Opportunities of the Smart Robot Market

Development of Collaborative Robots (Cobots)

The emergence of collaborative robots (cobots) represents a significant opportunity in the Smart Robot Market. Cobots, designed to work alongside humans, enhance operational efficiency and safety in shared workspaces, unlocking new applications across industries.

Growth into New Applications

Expanding into new sectors like agriculture, hospitality, and retail offers additional growth prospects. Agricultural robots optimize tasks such as planting and harvesting, while service robots elevate customer experiences in retail and hospitality environments, driving market diversification and development.

Increased Investment and Funding

Increasing investment and funding from public and private sectors bolster innovation and commercialization efforts in the smart robot domain. Governments and organizations recognize the transformative potential of smart robots, driving research and development initiatives to enhance capabilities and market penetration.

Integration with IoT and Cloud Computing

Integration with IoT and cloud computing continues to enhance smart robot functionalities. Real-time data processing, remote monitoring, and predictive maintenance capabilities are among the benefits of this integration, fostering efficiency gains and operational advancements in diverse applications.

Smart Robot Market Segment Analysis

By Type, Service robots dominate the smart robot market in the year 2025, because they are utilized in many industries and applications, such as healthcare, retail, logistics, agriculture, and domestic areas like cleaning and entertainment. The versatility of service robots makes them suitable for different needs and sectors, which increases their use. Progress in artificial intelligence (AI), machine learning, and sensor technology has significantly improved the abilities of service robots.

They can sense and respond to their surroundings, allowing for tasks that were once challenging or not possible for robots to do independently. Even though Industrial Robots still have an important part in making and industrial automation, the wider range of uses for Service Robots in many different fields is what has caused them to take over the Smart Robot Market.

Smart Robot Market Regional Insights

The Smart Robot Market in Asia-Pacific (APAC) was led by the rise of countries like China, Japan, South Korea, and Taiwan. In both manufacturing and sales of advanced robotic systems, these nations played a significant role as major contributors to this market segment's growth from 2020-2025. Particularly for industrial robot production, China became an important hub due to its strong capacity for making things combined with initiatives from the government focused on supporting automation and robotics.

The Asia-Pacific Smart Robot Market is dominated by countries like China, Japan South Korea, and Taiwan. These four nations played a crucial role as major contributors towards the growth of the smart robot industry within the APAC region specifically; among them, China stood out prominently because it served as one key hub for the production of industrial robots owing largely to its robustness within manufacturing sector coupled along with governmental initiatives targeting towards support automation plus robotics.

APAC's robust industry foundations and its ability to manufacture various types of robots have aided in making both industrial and service robots. This meets the growing worldwide need for automation solutions in sectors like manufacturing, healthcare, logistics as well farming among others. The Smart Robot Industry is led by APAC due to its strategic location and technological progress.

North America, with the United States and Canada leading the way, still holds a key position in service robot development and usage. These robots are especially visible in the healthcare, logistics, and defense areas of this region. The lively environment for technology companies, as well as research institutions, is an advantage to North America's constant progress in robotics. Industrial robots have found their main use in Europe countries such as Germany, France, and the UK. They concentrate on applying them to automotive manufacturing along with electronics among other advanced industries there too. Europe, with its strong acceptance of service robots in healthcare and consumer uses, is also a major part of the worldwide Smart Robot Market.

Smart Robot Market Competitive Landscape

ABB Ltd. is one of the top players in the Smart Robot Market due to its strong position in robotics and automation technology globally, especially known for having a wide range of industrial robots. The company leads both manufacturing and sales, using advanced technologies such as AI and machine learning. It serves various industries like manufacturing, the automotive sector, the electronics area as well as the logistics field with tough solutions that help them improve productivity and efficiency.

Delaval, Inc., a big name in the agriculture industry, provides unique robotic answers for dairy farming. Recognized for its automated farm management solutions and robots that milk cows, Delaval is leading the way in the agricultural part of the Smart Robot Market. The company's advancements in precision farming and animal welfare technology meet worldwide needs for sustainable agriculture methods, which have an impact on Smart Robot Manufacturers and Suppliers across the globe.

Gecko Systems International Corporation is a company that deals in mobile robot solutions for personal and professional needs, adding its special touch to the Smart Robot Market. It focuses on creating advanced autonomous navigation systems as well as sensor technologies. Gecko Systems has shown excellent results in fields like healthcare, home assistance, and security due to its emphasis on AI-driven robotics and machine vision technologies. They are considered a unique player within the Smart Robot Industry because they focus on these specific areas.

The domestic markets are served by their direct marketing efforts while they approach foreign countries through Smart Robot Suppliers and Export initiatives. Brain Corporation is a company that focuses on AI software and independent navigation systems for robots. They play an important part in the development of service robots across several industries. Their technology is used by self-sufficient cleaning robots, retail inventory control systems as well and security bots which improve the efficiency of operations in retailing, hospitality, and security areas.

|

Smart Robot Market Scope |

|

|

Market Size in 2025 |

USD 16.92 Bn. |

|

Market Size in 2032 |

USD 58.10 Bn. |

|

CAGR (2026-2032) |

19.27% |

|

Historic Data |

2020-2025 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2032 |

|

Segments |

By Type Service Robots Industrial Robots |

|

By Mobility Stationary Robots Mobile Robots |

|

|

By End-User Industry Automotive Electronics and Electrical Food and Beverage Pharmaceuticals Oil and Gas Aerospace and Defense Education and Research Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Smart Robot Market

- ABB Ltd.

- Gecko Systems International Corporation

- Delaval, Inc

- Brain Corporation

- Omron Adept Technology, Inc.

- Intuitive Surgical, Inc.

- ST Engineering Aethon, Inc.

- Honda Motor Co., Ltd.

- Yaskawa Electric Corporation

- Neato Robotics

- Greyorange

- SoftBank Group

- iRobot Corporation

- Hanson Robotics Limited

- Samsung Electronics Co., Ltd.

- KUKA AG

- Smart Robots S.r.l.

- Kongsberg Maritime

- Universal Robots

- Rethink Robotics

- Eca Robotics

- Blue Frog Robotics

- Ganymed Robotics

Frequently Asked Questions

The making of a Smart Robot usually requires a lot of energy, like creating parts for it, assembling the pieces, and then checking if everything works correctly. To lessen the effect on the environment, should reduce how much energy is used with improved methods in manufacturing and also switch to renewable sources of power.

Following safety standards that are specific to an industry, particularly in the areas of healthcare and manufacturing, requires careful compliance which may slow down the growth into new markets.

The Market size was valued at USD 16.92 Billion in 2025 and the total Market revenue is expected to grow at a CAGR of 19.27 % from 2026 to 2032, reaching nearly 58.10 Billion.

The segments covered in the market report are By Type, Mobility, and End-User Industry.

1. Smart Robot Market: Research Methodology

1.1. Research Data

1.1.1. Primary Data

1.1.2. Secondary Data

1.2. Market Size Estimation

1.2.1. Bottom-Up Approach

1.2.2. Top-Down Approach

1.3. Market Breakdown and Data Triangulation

1.4. Assumptions

2. Smart Robot Market: Executive Summary

2.1. Market Overview

2.2. Market Size (2025) and Forecast (2026 – 2032) and Y-O-Y%

2.3. Market Size (USD) and Market Share (%) – By Segments and Regions

3. Smart Robot Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Key Players Benchmarking

3.2.1. Company Name

3.2.2. Headquarter

3.2.3. Product Segment

3.2.4. End-user Segment

3.2.5. Y-O-Y%

3.2.6. Revenue (2025)

3.2.7. Profit Margin

3.2.8. Market Share

3.2.9. Company Locations

3.3. Market Structure

3.3.1. Market Leaders

3.3.2. Market Followers

3.3.3. Emerging Players

3.4. Consolidation of the Market

3.4.1. Strategic Initiatives and Developments

3.4.2. Mergers and Acquisitions

3.4.3. Collaborations and Partnerships

3.4.4. Product Launches and Innovation

4. Smart Robot Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.6.1. Intensity of the Rivalry

4.6.2. Threat of New Entrants

4.6.3. Bargaining Power of Suppliers

4.6.4. Bargaining Power of Buyers

4.6.5. Threat of Substitutes

4.7. PESTLE Analysis

4.7.1. Political Factors

4.7.2. Economic Factors

4.7.3. Social Factors

4.7.4. Technological Factors

4.7.5. Legal Factors

4.7.6. Environmental Factors

4.8. Technological Roadmap

4.9. Value Chain Analysis

4.10. Regulatory Landscape

4.10.1. Market Regulation by Region

4.10.1.1. North America

4.10.1.2. Europe

4.10.1.3. Asia Pacific

4.10.1.4. Middle East and Africa

4.10.1.5. South America

4.10.2. Impact of Regulations on Market Dynamics

4.10.3. Government Schemes and Initiatives

5. Smart Robot Market Size and Forecast by Segments (by Value USD Million)

5.1. Smart Robot Market Size and Forecast, By Type (2025-2032)

5.1.1. Service Robots

5.1.2. Industrial Robots

5.2. Smart Robot Market Size and Forecast, By Mobility (2025-2032)

5.2.1. Stationary Robots

5.2.2. Mobile Robots

5.3. Smart Robot Market Size and Forecast, By End-User Industry (2025-2032)

5.3.1. Automotive

5.3.2. Electronics and Electrical

5.3.3. Food and Beverage

5.3.4. Pharmaceuticals

5.3.5. Oil and Gas

5.3.6. Aerospace and Defense

5.3.7. Education and Research

5.3.8. Others

5.4. Smart Robot Market Size and Forecast, by Region (2025-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Smart Robot Market Size and Forecast (by Value USD Million)

6.1. North America Smart Robot Market Size and Forecast, By Type (2025-2032)

6.1.1. Service Robots

6.1.2. Industrial Robots

6.2. North America Smart Robot Market Size and Forecast, By Mobility (2025-2032)

6.2.1. Stationary Robots

6.2.2. Mobile Robots

6.3. North America Smart Robot Market Size and Forecast, By End-User Industry (2025-2032)

6.3.1. Automotive

6.3.2. Electronics and Electrical

6.3.3. Food and Beverage

6.3.4. Pharmaceuticals

6.3.5. Oil and Gas

6.3.6. Aerospace and Defense

6.3.7. Education and Research

6.3.8. Others

6.4. North America Smart Robot Market Size and Forecast, by Country (2025-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Smart Robot Market Size and Forecast (by Value USD Million)

7.1. Europe Smart Robot Market Size and Forecast, By Type (2025-2032)

7.2. Europe Smart Robot Market Size and Forecast, By Mobility (2025-2032)

7.3. Europe Smart Robot Market Size and Forecast, By End-User Industry (2025-2032)

7.4. Europe Smart Robot Market Size and Forecast, by Country (2025-2032)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Smart Robot Market Size and Forecast (by Value USD Million)

8.1. Asia Pacific Smart Robot Market Size and Forecast, By Type (2025-2032)

8.2. Asia Pacific Smart Robot Market Size and Forecast, By Mobility (2025-2032)

8.3. Asia Pacific Smart Robot Market Size and Forecast, By End-User Industry (2025-2032)

8.4. Asia Pacific Smart Robot Market Size and Forecast, by Country (2025-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa Smart Robot Market Size and Forecast (by Value USD Million)

9.1. Middle East and Africa Smart Robot Market Size and Forecast, By Type (2025-2032)

9.2. Middle East and Africa Smart Robot Market Size and Forecast, By Mobility (2025-2032)

9.3. Middle East and Africa Smart Robot Market Size and Forecast, By End-User Industry (2025-2032)

9.4. Middle East and Africa Smart Robot Market Size and Forecast, by Country (2025-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Smart Robot Market Size and Forecast (by Value USD Million)

10.1. South America Smart Robot Market Size and Forecast, By Type (2025-2032)

10.2. South America Smart Robot Market Size and Forecast, By Mobility (2025-2032)

10.3. South America Smart Robot Market Size and Forecast, By End-User Industry (2025-2032)

10.4. South America Smart Robot Market Size and Forecast, by Country (2025-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. ABB Ltd.

11.1.1. Company Overview

11.1.2. Product Portfolio

11.1.2.1. Product Name

11.1.2.2. Product Details (Price, Features, etc.)

11.1.3. Financial Overview

11.1.3.1. Total Revenue

11.1.3.2. Segment Revenue

11.1.3.3. Regional Revenue

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Gecko Systems International Corporation

11.3. Delaval, Inc

11.4. Brain Corporation

11.5. Omron Adept Technology, Inc.

11.6. Intuitive Surgical, Inc.

11.7. ST Engineering Aethon, Inc.

11.8. Honda Motor Co., Ltd.

11.9. Yaskawa Electric Corporation

11.10. Neato Robotics

11.11. Greyorange

11.12. SoftBank Group

11.13. iRobot Corporation

11.14. Hanson Robotics Limited

11.15. Samsung Electronics Co., Ltd.

11.16. KUKA AG

11.17. Smart Robots S.r.l.

11.18. Kongsberg Maritime

11.19. Universal Robots

11.20. Rethink Robotics

11.21. Eca Robotics

11.22. Blue Frog Robotics

11.23. Ganymed Robotics

12. Key Findings

13. Industry Recommendations

13.1. Strategic Recommendations

13.2. Future Outlook