Smart Electricity Meters Market- Analysis & Forecast (2025-2032) Trends, Statistics, Dynamics, and Segmentation

The Smart Electricity Meters Market size was valued at USD 24.59 billion in 2023. The global Smart Electricity Meters Market is expected to reach USD 47.24 billion by 2032 with a CAGR of 8.5% from 2025 to 2032.

Format : PDF | Report ID : SMR_1467

Smart Electricity Meters Market Overview:

Smart electricity meters send real-time power usage information of a consumer's energy consumption to electricity suppliers every 1 hour or less, eliminating the need for electric firms to manually collect readings. Smart electricity meters enable customers to obtain exact real-time data on their energy consumption while also enabling greater control over electricity consumption. Smart electricity meters also allow consumers to select the best tariff plan based on their energy consumption.

Global Smart Electric Meters Market offer benefits such as controlled energy usage, excellent energy management, and high security against electricity theft. Multiple government mandates and investment incentives are being implemented in a variety of nations around the world to encourage the usage of smart electric meters.

To get more Insights: Request Free Sample Report

Smart Electricity Meters Market Dynamics:

Many regions' old energy infrastructure desperately needs improvements and modernization. Smart electricity meters allow utilities to remotely monitor and manage energy consumption, which eliminates the need for manual meter readings and on-site visits. This operational efficiency results in cost savings for utilities, which may result in cheaper electricity rates for customers. Smart electricity meters empower consumers by offering specific information about their energy consumption trends. This increases customer participation and knowledge, allowing them to alter their energy usage to save money and lessen their environmental imprint.

Smart electricity meters collect massive volumes of data that may be studied to learn more about energy usage trends, grid functioning, and consumer behavior. With this data-driven strategy, utilities may optimize their operations and make data-driven decisions. Smart electricity meters enable demand response programs by incentivizing consumers to minimize their energy consumption during peak demand periods. This allows utilities to better control load and avoid power outages.

Smart Electricity Meters Market Restraints:

The initial expenses of implementing smart electricity meters can be enormous for utilities, necessitating significant capital investments. This can be a turnoff for certain utilities, especially smaller ones, and may hinder adoption. Upgrading or building communication infrastructure, such as advanced metering infrastructure (AMI) and secure data networks, is frequently required when implementing smart meters. These infrastructural needs might be complicated and costly.

Natural disasters and environmental factors can damage smart electricity meter networks and impact their functioning, perhaps resulting in downtime. In areas with a significant number of legacy meters, replacing or upgrading current meters can be time-consuming and costly. The move to smart meters can be slowed by legacy infrastructure.

Smart Electricity Meters Market Opportunities:

Smart electricity meters create massive volumes of data, providing an opportunity for advanced data analytics and insights. Utilities can use this data to enhance grid operations, predict and prevent outages, and more effectively deploy demand response programs.

Many regions' old energy infrastructure desperately needs improvements and modernization. Smart meters play an important part in grid modernization initiatives by providing utilities with real-time data on energy distribution, allowing them to identify and address issues more efficiently, reduce downtime, and optimize grid performance overall.

Smart Electricity Meters Market Trends:

Many locations are migrating to second-generation smart meters (often referred to as SMETS 2 in the UK), which provide greater interoperability, security, and communication capabilities. These meters give consumers greater options when switching energy suppliers. Utilities are implementing demand flexibility programs using smart meters to pay consumers to reduce or shift their energy consumption during peak demand periods, thereby reducing grid pressure.

These platforms frequently provide advice and information to assist consumers in making better-educated decisions regarding their energy consumption. Many utilities are using TOU pricing models, in which electricity tariffs change depending on the time of day and demand. Smart meters provide for accurate tracking of usage across tariff periods, encouraging consumers to adjust their consumption to off-peak hours.

Smart Electricity Meters Market Segment Analysis:

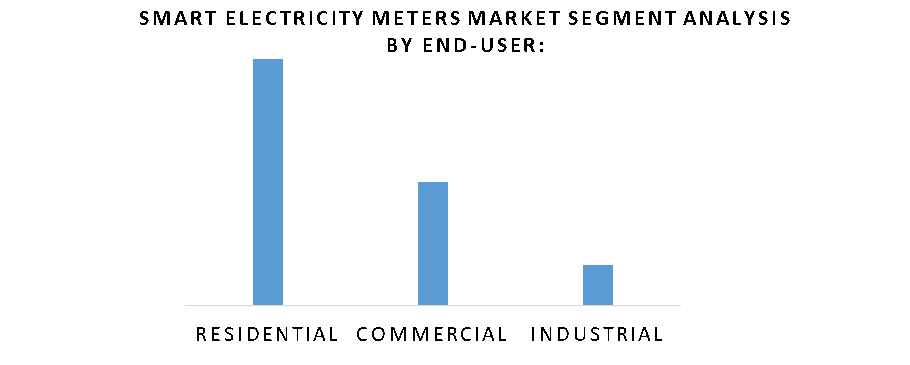

By End-User:

- Residential: The most common type of smart meter is for residential clients. They provide homes with real-time data on their energy consumption, allowing them to better regulate their electricity usage.

- Commercial: Smart meters are used by commercial and small-to-medium-sized organizations to monitor energy usage for invoicing, optimization, and sustainability.

Industrial: Smart meters are used by large industrial consumers to monitor and manage their electricity usage in real-time. To meet increasing energy demands, this segment frequently necessitates more complex features and capabilities.

By Meter Style:

- Smart Meters (Electricity Only): These meters measure only electricity consumption. They are the most prevalent type of smart meter, and they are utilized by consumers in the residential, commercial, and industrial sectors

- Multi-Utility Smart Meters: These meters are meant to measure various utilities at the same time, such as electricity, gas, and water. They are frequently utilized in multi-utility or smart city projects.

By Phase:

- Single-Phase Smart Meters: Single-phase smart meters are often utilized in residential residences with single-phase power supplies. These meters provide homes with real-time data on their electricity consumption, allowing them to more effectively monitor and manage their energy usage.

- Three-Phase Smart Meters: Three-phase smart meters are crucial for monitoring the electricity usage of large commercial and industrial establishments, which often use three-phase power supplies.

Mixed-Phase Smart Meters: Some geographies and applications may need the use of mixed-phase smart meters capable of handling both single-phase and three-phase power supply.

Smart Electricity Meters Market Regional Analysis:

Asia-Pacific is a dominating region in the global Smart Electricity Meters Market. It is the fastest-growing market for Smart Electricity Meters. China has an increasing interest in smart meters to improve energy efficiency and grid management in the world's largest electrical market. India is gradually implementing smart meters in order to reduce non-technical losses and enhance billing accuracy.

North American region has a high penetration rate in the global Smart Electricity Meters Market. The United States has been a major adopter of smart meters, owing to regulatory mandates and an emphasis on grid modernization. Smart meters have been adopted by Canadian provinces, with varying rates of adoption and regulatory measures.

The European Union has made significant investments in smart metering infrastructure, with various degrees of adoption and regulation. The United Kingdom has one of the most advanced smart metering programs in the world, with broad deployment.s

South America: Brazil has begun large-scale smart meter deployments in order to prevent energy theft and enhance energy delivery. The smart meter market in Mexico is increasing in order to improve grid management and reduce losses.

South Africa is adopting smart meters to combat electricity theft and increase revenue collection. Smart meters are being installed in some Countries of the Gulf Cooperation Council (GCC) nations in order to improve energy management and reduce waste.

|

Region |

Market Share |

|

Asia-Pacific |

45.2% |

|

North America |

30.1% |

|

Europe |

22.7% |

|

Latin America |

1.4% |

|

Middle East & Africa |

0.6% |

Smart Electricity Meters Market Scope:

|

Smart Electricity Meters Market |

|

|

Market Size in 2024 |

USD 24.59 Bn. |

|

Market Size in 2032 |

USD 47.24 Bn. |

|

CAGR (2025-2032) |

8.5% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By End-User

|

|

By Meter Style

|

|

|

By Phase

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Smart Electricity Meters Market Key Players:

- AEM

- Aichi Tokei Denki Co., Ltd.

- Apator SA

- Arad Group

- Azbil Kimmon Co. Ltd

- Itron, Inc.

- Landis+Gyr

- Siemens AG

- Honeywell International Inc.

- Schneider Electric SE

- Elster Group

- Kamstrup A/S

- Iskraemeco

- Wasion Group Holdings

- Sensus (a Xylem brand)

- I2O Water Ltd.

- Trilliant Holdings Inc.

- El Sewedy Electric

- ZIV Grid Automation

- Holosolar

Frequently Asked Questions

The Asia-Pacific region holds the maximum share of the Smart Electricity Meters Market.

The forecasted period for the Smart Electricity Meters Market research report is 2025-2032.

The expected market size of the Smart Electricity Meters Market in 2032 is US$ 47.24 billion.

The Smart Electricity Meters Market is segmented on the basis of end-user, meter type, and phase.

1. Smart Electricity Meters Market: Research Methodology

2. Smart Electricity Meters Market: Executive Summary

3. Smart Electricity Meters Market: Competitive Landscape

3.1. STELLAR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Smart Electricity Meters Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers by Region

4.2.1. North America

4.2.2. Europe

4.2.3. Asia Pacific

4.2.4. Middle East and Africa

4.2.5. South America

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Value Chain Analysis

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Smart Electricity Meters Market Size and Forecast by Segments (by Value USD and Volume Units)

5.1. Smart Electricity Meters Market Size and Forecast, by End-User (2024-2032)

5.1.1. Residential

5.1.2. Commercial

5.1.3. Industrial

5.2. Smart Electricity Meters Market Size and Forecast, by Meter Style (2024-2032)

5.2.1. Smart Meters

5.2.2. Multi-Utility Smart Meters

5.3. Smart Electricity Meters Market Size and Forecast, by Phase (2024-2032)

5.3.1. Single-Phase Smart Meters

5.3.2. Three-Phase Smart Meters

5.3.3. Mixed-Phase Smart Meters

5.4. Smart Electricity Meters Market Size and Forecast, by Region (2024-2032)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Smart Electricity Meters Market Size and Forecast (by Value USD and Volume Units)

6.1. North America Smart Electricity Meters Market Size and Forecast, by End-User (2024-2032)

6.1.1. Residential

6.1.2. Commercial

6.1.3. Industrial

6.2. North America Smart Electricity Meters Market Size and Forecast, by Meter Style (2024-2032)

6.2.1. Smart Meters

6.2.2. Multi-Utility Smart Meters

6.3. North America Smart Electricity Meters Market Size and Forecast, by Phase (2024-2032)

6.3.1. Single-Phase Smart Meters

6.3.2. Three-Phase Smart Meters

6.3.3. Mixed-Phase Smart Meters

6.4. North America Smart Electricity Meters Market Size and Forecast, by Country (2024-2032)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Smart Electricity Meters Market Size and Forecast (by Value USD and Volume Units)

7.1. Europe Smart Electricity Meters Market Size and Forecast, by End-User (2024-2032)

7.1.1. Residential

7.1.2. Commercial

7.1.3. Industrial

7.2. Europe Smart Electricity Meters Market Size and Forecast, by Meter Style (2024-2032)

7.2.1. Smart Meters

7.2.2. Multi-Utility Smart Meters

7.3. Europe Smart Electricity Meters Market Size and Forecast, by Phase (2024-2032)

7.3.1. Single-Phase Smart Meters

7.3.2. Three-Phase Smart Meters

7.3.3. Mixed-Phase Smart Meters

7.4. Europe Smart Electricity Meters Market Size and Forecast, by Country (2024-2032)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Smart Electricity Meters Market Size and Forecast (by Value USD and Volume Units)

8.1. Asia Pacific Smart Electricity Meters Market Size and Forecast, by End-User (2024-2032)

8.1.1. Residential

8.1.2. Commercial

8.1.3. Industrial

8.2. Asia Pacific Smart Electricity Meters Market Size and Forecast, by Meter Style (2024-2032)

8.2.1. Smart Meters

8.2.2. Multi-Utility Smart Meters

8.3. Asia Pacific Smart Electricity Meters Market Size and Forecast, by Phase (2024-2032)

8.3.1. Single-Phase Smart Meters

8.3.2. Three-Phase Smart Meters

8.3.3. Mixed-Phase Smart Meters

8.4. Asia Pacific Smart Electricity Meters Market Size and Forecast, by Country (2024-2032)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa Smart Electricity Meters Market Size and Forecast (by Value USD and Volume Units)

9.1. Middle East and Africa Smart Electricity Meters Market Size and Forecast, by End-User (2024-2032)

9.1.1. Residential

9.1.2. Commercial

9.1.3. Industrial

9.2. Middle East and Africa Smart Electricity Meters Market Size and Forecast, by Meter Style (2024-2032)

9.2.1. Smart Meters

9.2.2. Multi-Utility Smart Meters

9.3. Middle East and Africa Smart Electricity Meters Market Size and Forecast, by Phase (2024-2032)

9.3.1. Single-Phase Smart Meters

9.3.2. Three-Phase Smart Meters

9.3.3. Mixed-Phase Smart Meters

9.4. Middle East and Africa Smart Electricity Meters Market Size and Forecast, by Country (2024-2032)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Smart Electricity Meters Market Size and Forecast (by Value USD and Volume Units)

10.1. South America Smart Electricity Meters Market Size and Forecast, by End-User (2024-2032)

10.1.1. Residential

10.1.2. Commercial

10.1.3. Industrial

10.2. South America Smart Electricity Meters Market Size and Forecast, by Meter Style (2024-2032)

10.2.1. Smart Meters

10.2.2. Multi-Utility Smart Meters

10.3. South America Smart Electricity Meters Market Size and Forecast, by Phase (2024-2032)

10.3.1. Single-Phase Smart Meters

10.3.2. Three-Phase Smart Meters

10.3.3. Mixed-Phase Smart Meters

10.4. South America Smart Electricity Meters Market Size and Forecast, by Country (2024-2032)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. AEM

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. Aichi Tokei Denki Co., Ltd.

11.3. Apator SA

11.4. Arad Group

11.5. Azbil Kimmon Co. Ltd

11.6. Itron, Inc.

11.7. Landis+Gyr

11.8. Siemens AG

11.9. Honeywell International Inc.

11.10. Schneider Electric SE

11.11. Elster Group

11.12. Kamstrup A/S

11.13. Iskraemeco

11.14. Wasion Group Holdings

11.15. Sensus (a Xylem brand)

11.16. I2O Water Ltd.

11.17. Trilliant Holdings Inc.

11.18. El Sewedy Electric

11.19. ZIV Grid Automation

11.20. Holosolar

12. Key Findings

13. Industry Recommendation