Saudi Arabia Coffee Market Industry Overview, Size, Share, Growth Trends, Research Insights and Forecast (2025–2032)

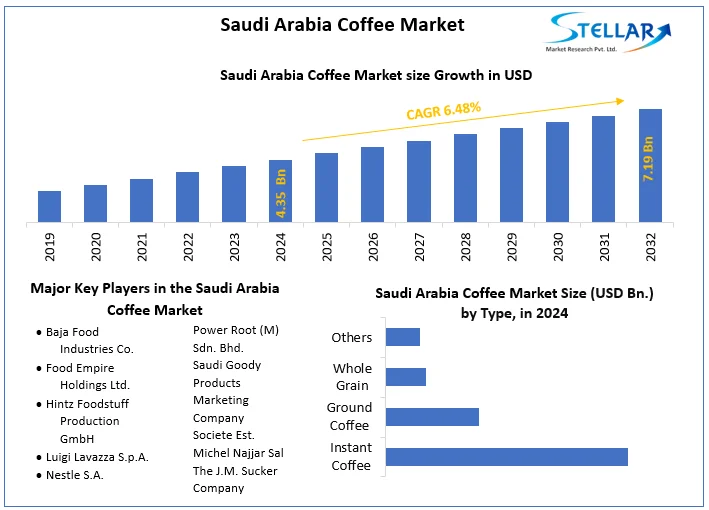

Saudi Arabia Coffee Market size was valued at US$ 4.35 Bn. in 2024. Coffee will encourage a great deal of transformation in Beverage Sector in Saudi Arabia.

Format : PDF | Report ID : SMR_78

Saudi Arabia Coffee Market Definition:

Coffee is a brewed beverage made from roasted coffee beans, which are the fruit seeds of certain types of coffee. Grains are separated from the coffee berries to obtain a stable raw product, unroasted green coffee. The seeds are then roasted into a consumable product. The report on Saudi Arabia coffee market is studied and analysed on the basis of source, type, process and geography.

To get more Insights: Request Free Sample Report

Saudi Arabia Coffee Market Dynamics:

Saudi Arabia has a wonderful coffee scene that is getting stronger and stronger. Professional coffee is so common that consumers are increasingly asking coffee shops. The demand for consumer education and better coffee continues to grow, and it's rising more local roasters in UAE sources and roast great coffee.

Changing consumer tastes, fast-paced lifestyles, and an increasing workforce are factors driving the demand for coffee across the country. The coffee market across the country is majorly import-driven, Africa, Asia, and Latin America are the major coffee exporters throughout the Kingdom of Saudi Arabia.

The increasing acceptance of Western culture is due to the increase in the young population and the increase in foreign tourists. Arabica is more popular in this region with low caffeine, high fat, and acidity. Currently, the central region has the largest share of income due to its larger resident and working population than other regions, coupled with the presence of trade offices and employment near Riyadh. The presence of famous Haji Places in Mecca and Medina is also one of the growth driver for Saudi Arabia coffee market as increasing the footprint of tourists and increasing the demand for coffee from cafes.

Saudi Arabia’s coffee specialty is also contributing to its rising trend. They roast beans in front of customers and then serve the coffee in Dallah, an Arabian coffee pot. Now the beans are roasted at the back door. Preference varies between younger age groups and older age groups. This provides quality and variety in the coffee shops. Younger people prefer mixed coffee or coffee with milk and flavored syrup, while older people prefer Turkish or espresso.

Strict government regulations during the pandemic closed all cafes and forced them to switch to courier services. The general demand for food orders in online coffee shops is increasing as most people are obsessed with the tastes of a particular coffee shop. Saudi Arabia's internet penetration was 95.72%, and the majority of people preferred to order online during a pandemic. This factor is driving the Saudi Arabia coffee market growth.

Coffee has always been the focus of meetings, weddings, and social events in Saudi Arabia. Many locals drink the traditional Saudi coffee "Kawa" all day and enjoy the smooth, refreshing, and rejuvenating taste with many health benefits. Families have their own recipes, and coffee is often served in small Arabian coffee cups. These factors are driving the demand in the Saudi Arabia coffee market.

Arabs usually add cinnamon, saffron, and cardamom to their coffee. Nut flavors, especially pistachios, are popular in Western coffee styles. Pistachios are traditionally used in desserts, but they are not used as an ingredient in coffee, so people have tried them with coffee and fusion desserts in Saudi Arabia.

Saudi Arabia Coffee Market Segment Analysis:

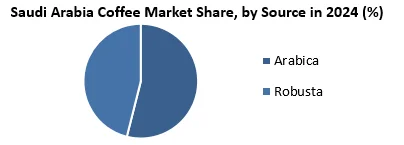

By Source, Arabica dominated the Saudi Arabia coffee market with a 59 % share in 2024. Owing to end-consumer taste combined with health benefits for such bean type as Arabica is much sweeter and has more lipid contents than its other counterparts i.e. Robusta, Liberica, and Excelsa. The higher acid content in Arabica beans makes it perfect for improving the taste of wines and chocolates. Hence, Arabica is highly demanded in the F&B industry of Saudi Arabia.

The objective of the report is to present a comprehensive analysis of the Saudi Arabia Coffee market to the stakeholders in the industry. The report provides trends that are most dominant in the Saudi Arabia Coffee market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Saudi Arabia Coffee Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Saudi Arabia Coffee market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Saudi Arabia Coffee market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Saudi Arabia market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Saudi Arabia Coffee market. The report also analyses if the Saudi Arabia Coffee market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Saudi Arabia Coffee market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Saudi Arabia Coffee market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Saudi Arabia market is aided by legal factors.

Saudi Arabia Coffee Market Scope:

|

Saudi Arabia Coffee Market |

|

|

Market Size in 2024 |

USD 4.35 Bn. |

|

Market Size in 2032 |

USD 7.19 Bn. |

|

CAGR (2025-2032) |

6.48% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Segment Scope |

By Source

|

|

By Type

|

|

|

By Process

|

|

Saudi Arabia Coffee Market KEY PLAYERS:

• Baja Food Industries Co.

• Hintz Foodstuff Production GmbH

• Luigi Lavazza S.p.A.

• Nestle S.A.

• Power Root (M) Sdn. Bhd.

• Saudi Goody Products Marketing Company

• Societe Est. Michel Najjar Sal

• Yousef Al Rajhi Group

• Zino Davidoff Group

Frequently Asked Questions

Saudi Arabia Coffee Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

Saudi Arabia Coffee Market size was USD 4.35 Billion in 2024.

1. Saudi Arabia Coffee Market: Research Methodology

2. Saudi Arabia Coffee Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Saudi Arabia Coffee Market: Dynamics

3.1. Saudi Arabia Coffee Market Trends

3.2. Saudi Arabia Coffee Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Technological Roadmap

3.6. Value Chain Analysis

3.7. Regulatory Landscape

4. Saudi Arabia Coffee Market: Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Tonnes) (2024-2032)

4.1. Saudi Arabia Coffee Market Size and Forecast, by Source (2024-2032)

4.1.1. Arabica

4.1.2. Robusta

4.2. Saudi Arabia Coffee Market Size and Forecast, by Type (2024-2032)

4.2.1. Instant Coffee

4.2.2. Ground Coffee

4.2.3. Whole Grain

4.2.4. Others

4.3. Saudi Arabia Coffee Market Size and Forecast, by Process (2024-2032)

4.3.1. Caffeinated

4.3.2. Decaffeinated

5. Saudi Arabia Coffee Market: Competitive Landscape

5.1. SMR Competition Matrix

5.2. Competitive Landscape

5.3. Key Players Benchmarking

5.3.1. Company Name

5.3.2. Product Segment

5.3.3. End-user Segment

5.3.4. Revenue (2024)

5.3.5. Company Locations

5.4. Market Structure

5.4.1. Market Leaders

5.4.2. Market Followers

5.4.3. Emerging Players

5.5. Mergers and Acquisitions Details

6. Company Profile: Key Players

6.1. Baja Food Industries Co.

6.1.1. Company Overview

6.1.2. Business Portfolio

6.1.3. Financial Overview

6.1.4. SWOT Analysis

6.1.5. Strategic Analysis

6.1.6. Recent Developments

6.2. Food Empire Holdings Ltd.

6.3. Hintz Foodstuff Production GmbH

6.4. Luigi Lavazza S.p.A.

6.5. Nestle S.A.

6.6. Power Root (M) Sdn. Bhd.

6.7. Saudi Goody Products Marketing Company

6.8. Societe Est. Michel Najjar Sal

6.9. The J.M. Sucker Company

6.10. Yousef Al Rajhi Group

6.11. Zino Davidoff Group

7. Key Findings

8. Industry Recommendations