Ghana Cocoa Powder Market: Industry Analysis and Forecast (2024-2030) Trends, Statistics, Dynamics, Segmentation by Type, and Application

Ghana Cocoa Powder Market was valued at USD 118.80 million in 2023. Ghana’s Cocoa Powder Market size is estimated to grow at a CAGR of 13.93% over the forecast period.

Format : PDF | Report ID : SMR_597

Ghana Cocoa Powder Market Definition:

Cocoa beans are completely dried and fermented seeds of Theobroma cacao, where cocoa beans and cocoa solids, and cocoa butter is produced due to the seed’s fat content. Cocoa powder is mainly used in manufacturing chocolate confectionaries and cocoa paste, which is used in making desserts.

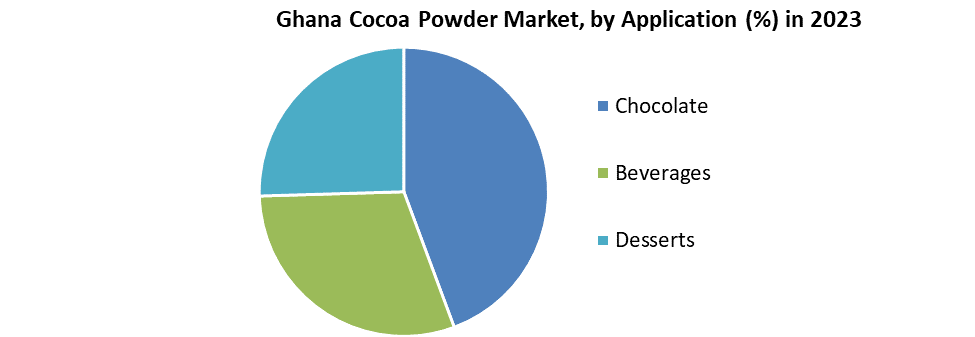

Further, the Ghana Cocoa Powder Market is segmented by Type, Application, and Regions. On the basis of Type, the Ghana Cocoa Powder Market is segmented into Dutch-processed Cocoa Powder and Natural Cocoa Powder. Based on the Application, the market is segmented under the Chocolate, Beverages, and Desserts. For each segment, the market sizing and forecasts have been done on the basis of value (in USD Million).

To get more Insights: Request Free Sample Report

Ghana Cocoa Powder Market Dynamics:

The factors attributing to the growth of the cocoa market are the favorable weather condition and the government incentives for boosting the production and farming capabilities of the product. The rising demand for organic or sustainable variations, along with the nutritional content of the product, is driving the market growth. Growing awareness of the health benefits of consuming cocoa-rich products is fuelling the growth of the cocoa product market.

Health benefits of the human body include reduced high blood pressure, reduced chronic fatigue, and protection from sunburn. The growing demand for chocolate and its related product like milk chocolate, sweet chocolate, and dark chocolate and the active promotion of brand awareness by manufacturers are driving the Cocoa powder market. Cocoa is also rich in polyphenols that help protect body tissues from related conditions such as oxidative stress and cancer, and inflammation. These factors are fuelling the growth of the cocoa market.

The utilization of cocoa powder in various applications in the dairy and baking industry has created an opportunity for the growth of the industry. The growing food and beverage sector, the rising popularity of healthy & natural food products, and the growing presence of cocoa powder in day-to-day life have expected to drive the cocoa powder market.

Price volatility and limited production of cocoa are hindering the growth of the market. The improved commercial cultivation techniques that are used to produce cocoa are anticipated to increase the supply of the product and improve the future growth opportunities.

In 2020, Ghana exported $98.9M in cocoa powder, making it the 8th largest exporter of cocoa powder in the world, and it was the 12th most exported product in Ghana. The top destinations for Cocoa Powder exports are the Netherlands ($42.5 million), Russia ($15.9 million), the United States ($13.3 million), Ukraine ($5.86 million), and China ($3.97 million).

Ghana Cocoa Powder Market Segment Analysis:

By Type, the market is segmented into Natural Cocoa Powder and Dutch Process Market. Natural Cocoa Powder has expected to grow during the forecast period because of its health benefits. It has a pH level of 5-6 and is slightly acidic because it contains citrus qualities. Natural cocoa is famous for its high flavonoid content. Flavonoids are a class of polyphenolic chemicals that play a significant role in plant life. It is also beneficial to humans because they are antioxidants. They can act as an anti-inflammatory and prevent heart disease. The Dutch Processing removes some of the acidity in raw cocoa powder and neutralizes cocoa’s acidity to a pH of 7. The cocoa powder can vary in color from light reddish brown to a richer dark brown; the Dutch process gives the powder a darker hue. Dutch Process Cocoa is not acidic and does not react with basic agents such as baking soda to produce carbon dioxide. This is the reason recipes using Dutch Process cocoa are fermented with baking soda, which has a neutral pH.

By Application, the market is divided into Chocolate, Beverages, and Desserts. The rising popularity of chocolate confectionery has increased the sales performance in the chocolate segment. Filled chocolate has a larger market share than other types of chocolates because of the new trend toward premium chocolates. Filled chocolates are becoming increasingly popular as luxurious holiday gifts. The rising tendency of different varieties of chocolate confectioneries is boosting the market growth. The market is expected to fuel by the new uses in ice cream, confectionery, non-alcoholic beverages, rich baked goods, and nutritional drinks at a high rate. According to the International Cocoa Organization (ICCO), Ghana cocoa production will rise by 10% in the coming year. New product launches in a variety of industries are driving the growth of the cocoa segment.

The food and beverages segment is anticipated to grow because of its wide range of applications. This segment is creating various opportunities. Chocolate has been a popular flavor in new beverages, bakery, and confectionery products. It is expected that the demand for cocoa butter and powder will also rise in the forecast period. The Ghana food industry supports growing cocoa-based gourmet and specialty products. Foodservice is looking for more customization, value-added, and multifunctional solutions that are expected to fuel the market.

Ghana Cocoa Powder Market Key Players Insights:

The market is characterized by the existence of several well-known firms. These companies control a large portion of the market, have a wide product portfolio, and have a global presence. In addition, the market comprises small to mid-sized competitors that sell a limited variety of items, some of which are self-publishing organizations.

The market's major companies have a significant impact because most of them have extensive global networks through which they can reach their massive client bases. To drive revenue growth and strengthen their positions in the market, key players in the market, particularly in Ghana, are focusing on strategic initiatives such as acquisitions, new collection launches, and partnerships.

The objective of the report is to present a comprehensive analysis of the Ghana Cocoa Powder market to the stakeholders in the industry. The report provides trends that are most dominant in the Ghana Cocoa Powder market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Ghana Cocoa Powder Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Ghana Cocoa Powder market report is to help understand which market segments and regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Ghana Cocoa Powder market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Ghana Cocoa Powder market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their product quality is in the Ghana Cocoa Powder market. The report also analyses if the Ghana Cocoa Powder market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Ghana Cocoa Powder market. Economic variables aid in the analysis of economic performance drivers that have an impact on the Ghana Cocoa Powder market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Ghana Cocoa Powder market is aided by legal factors.

Ghana Cocoa Powder Market Scope:

|

Ghana Cocoa Powder Market |

|

|

Market Size in 2023 |

USD 118.80 Mn. |

|

Market Size in 2030 |

USD 296.00 Mn. |

|

CAGR (2024-2030) |

13.93% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

by Type

|

|

by Application

|

|

Ghana Cocoa Powder MARKET KEY PLAYERS:

- Tema Cocoa processing Co.Ltd ( Ghana)

- Niche Cocoa Industry Ltd (Ghana)

- BD Associates Ghana Ltd (Ghana)

- PLOT Enterprise Ghana Limited (Ghana)

- Cargill Ghana Ltd (Ghana)

- Ladiva Enterprise (Ghana)

- Rex Field Enterprise (Ghana)

- Batmoh Enterprise (Ghana)

- Afrotropic Cocoa Processing co. (Ghana)

- Issamira Farms (Ghana)

- Glorious Richmarg Enterprise (Ghana)

- Cocoa Touton Processing Company (Ghana)

- Olam Cocoa Processing Ghana Limited (Ghana)

- Chocomac Ghana Limited (Ghana)

Frequently Asked Questions

The market size of the Ghana Cocoa Powder Market by 2030 is expected to reach USD 296.00 Million.

The forecast period for the Ghana Cocoa Powder Market is 2024-2030

The market size of the Ghana Cocoa Powder Market in 2023 was valued at USD 118.80 Million.

- Scope of the Report

- Research Methodology

- Research Process

- Ghana Cocoa Powder Market: Target Audience

- Ghana Cocoa Powder Market: Primary Research (As per Client Requirement)

- Ghana Cocoa Powder Market: Secondary Research

- Executive Summary

- Competitive Landscape

- Market Share Analysis by Country in 2023(%)

- Ghana

- Stellar Competition matrix

- Key Players Benchmarking: - by Product, Pricing, Investments, Expansion Plans, Physical Presence, and Presence in the Market.

- Mergers and Acquisitions in Industry: - Value and Strategic Intent

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- PESTLE Analysis

- PORTERS Five Force Analysis

- Value Chain Analysis

- Market Share Analysis by Country in 2023(%)

- Ghana Cocoa Powder Market Segmentation

- Ghana Cocoa Powder Market, by Type (2023-2030)

- Dutch-processed Cocoa Powder

- Natural Cocoa Powder

- Ghana Cocoa Powder Market, by Application (2023-2030)

- Chocolate

- Beverages

- Desserts

- Ghana Cocoa Powder Market, by Type (2023-2030)

- Company Profiles

- Key Players

- Jagdamba Concrete Mixer

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategy

- Key Developments

- Tema Cocoa processing Co.Ltd ( Ghana)

- Niche Cocoa Industry Ltd (Ghana)

- BD Associates Ghana Ltd (Ghana)

- PLOT Enterprise Ghana Limited (Ghana)

- Cargill Ghana Ltd (Ghana)

- Ladiva Enterprise (Ghana)

- Rex Field Enterprise (Ghana)

- Batmoh Enterprise (Ghana)

- Afrotropic Cocoa Processing co. (Ghana)

- Issamira Farms (Ghana)

- Glorious Richmarg Enterprise (Ghana)

- Cocoa Touton Processing Company (Ghana)

- Olam Cocoa Processing Ghana Limited (Ghana)

- Chocomac Ghana Limited (Ghana)

- Jagdamba Concrete Mixer

- Key Players

- Key Findings

- Recommendations