Residential Washing Machine market: Global Industry Analysis and Forecast (2025-2032)

Global Residential Washing Machine Market size was valued at USD 44.32 Bn in 2023 and is expected to reach USD 62.41 Bn by 2032, at a CAGR of 4.37 % forecast year.

Format : PDF | Report ID : SMR_1508

Residential Washing Machine Market Overview

The product has experienced an escalating growth rate in recent years as more consumers have become inclined towards automating household chores.

A Residential Washing Machine is a household appliance designed for cleaning and laundering clothes. It offers convenience and efficiency to homeowners by automating the process of washing garments. This machine typically consists of a drum or tub where clothes are placed, along with a water inlet, detergent dispenser, and various settings for different types of fabrics and washing needs.

To get more Insights: Request Free Sample Report

Residential Washing Machine market Dynamics

The market is mainly driven by factor the rapid urbanization, significant technological innovations, introduction of specialized features and design aesthetics, Rise in household income, and others.

Better infrastructure, large number of corporates office, and better schools and colleges in urban areas have resulted in an increased urban population, which, in turn, is driving the market growth. As per the data presented by the United Nations conference on trade and development, the urban population in Asia and Oceana increased from 43.3% of the total population in 2011 to 50% in 2021. Additionally, the presence of many hotels, motels, and resorts in urban areas, which require a quicker laundry cleaning process, has helped spike the demand. Furthermore, the demand for smart washing machines due to the energy efficiency factor is supporting the market growth.

The high consumption of apparel and fashion garments will surge the need for cloth washers and dryers, thus driving the market growth. According to the released by the federal reserve bank of St. Louis, U.S., in 2022, personal consumption of apparel, footwear, and related services in the U.S. reached USD 50.68 Billion, up from USD 47.58 Billion in 2021. Additionally, the application of attractive marketing strategies by apparel and fashion brands, including buy one get one free, seasonal discounts, gift cards, and others has helped spur consumption.

Residential washing Machine opportunities and growth

The primary factors that are contributing to the expansion of the global market for residential washing machines are an acceleration in the rate at which urbanization is occurring, an increase in the amount of discretionary spending people have, and an increase in the affordability of residential washing machines. In addition bureau of labour statics forecasts that by the year 2020, women will account for around 50.04 % of the work force in the United States. There is a growing number of women participating in the labour force across all industries, including retail, healthcare, education, and many more.

Sales promotions, discounts, and attractive financing options by manufacturer and retailers played a role in encouraging washing machine purchases. For instance, Samsung is offering a free set of detergent with the purchase of select washing machine through Sept. 30, 2023. Besides, innovations in washing machines technology, such as energy efficiency, smart features, and advanced washing modes, noticed consumers to upgrade their older models.

Residential washing Machine Market challenges

Fluctuating prices

Fluctuations or volatility in the prices of raw materials and machinery equipment is posing a major threat to the growth of the market. Further, uneven availability of raw materials at one particular location is demeaning the growth of the market.

High capital investment

Requirement of high capitals costs to invest in the relevant machinery and undertake operations is one of the biggest challenge for the market. Also, high machinery operating and maintenance costs will restrict the scope of growth. Going by the current global recession trends, there is bound to be a dent in the market growth rate. Also, high costs associated with research and development proficiencies will further derail the market growth rate.

Residential washing Machine Regional insights.

Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa (MEA). North America region is further bifurcated into countries such as U.S., and Canada. The Europe region is further categorized into U.K., France, Germany, Italy, Spain, Russia, and Rest of Europe. Asia Pacific is further segmented into China, Japan, South Korea, India, Australia, South East Asia, and Rest of Asia Pacific. Latin America region is further segmented into Brazil, Mexico, and Rest of Latin America, and the MEA region is further divided into GCC, Turkey, South Africa, and Rest of MEA.

Residential washing Machine Segment Analysis

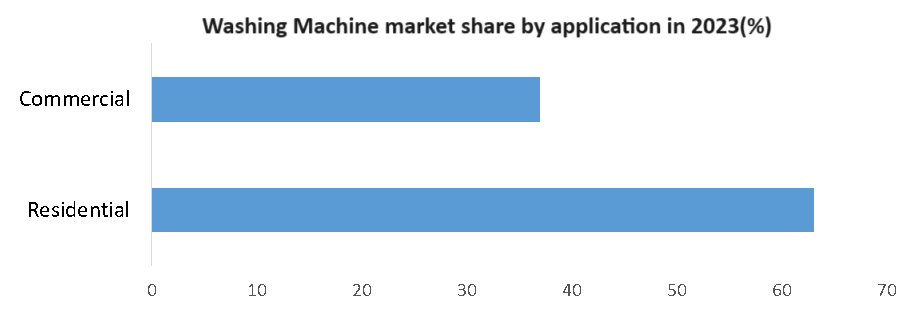

This report forecasts revenue growth at global, regional and country levels and provides analysis of the latest industry trends and opportunities in each of the sub segments from 2025 to 2032. For this study, stellar market research has segmented the Global Residential washing Machine report based on by type of technology, by product type, by machine capacity and by Distribution Channel.

Global Residential washing Machine Market Competitive Landscape

The competitive analysis of the Market includes the Market size, growth rate and key trends. The report provides information about the Key companies, such as their size, machine services, washing machine market share, and geographic presence. The report provides such type of competitive landscape of all Global Residential washing Machine Market Key Players to assist new market entrants. The report provides such type of competitive landscape of all Key Players to assist new market entrants. The report offers Competitive benchmarking of the Global Residential washing Machine Market through the Market revenue, share and size of the key players.

|

Global Residential Washing Machine Market Scope |

|

|

Market Size in 2024 |

USD 44.32 Bn. |

|

Market Size in 2032 |

USD 62.41 Bn. |

|

CAGR (2025-2032) |

4.37% |

|

Historic Data |

2019-2024 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2034 |

|

Segment Scope |

By Technology

|

|

By Product Type

|

|

|

By Machine Capacity

|

|

|

By Distribution Channel

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Global Residential washing Machine Market Key Player

2. LG Electronics

3. Whirlpool Corporation

4. Haier Group

5. Electrolux AB

6. Panasonic Corporation

7. Bosch Home Appliances

9. Miele

10. General Electric (GE)

11. Toshiba Corporation

12. Sharp Corporation

13. Hisense

14. Hitachi Appliances

15. Vestel

16. Arçelik (Beko)

17. Candy Group

18. Indesit Company

19. Smeg

20. Kenmore

21. Maytag

22. Amana Corporation

23. IFB Appliances

24. Daewoo Electronics

25. Groupe SEB (Tefal)

Frequently Asked Questions

Asia Pacific is expected to dominate the Global Residential washing Machine Market during the forecast period.

The Global Residential washing Machine Market size is expected to reach USD 62.41 Bn by 2032.

The major top players in the Global Residential washing Machine Market are LG Electronics Inc., Whirlpool Corporation, Haier Group Corporation, Electrolux AB, Panasonic Corporation and others.

The market is mainly driven by factor the rapid urbanization, significant technological innovations, introduction of specialized features and design aesthetics, Rise in household income, and others.

1. Global Residential washing Machine Market: Research Methodology

2. Global Residential washing Machine Market: Executive Summary

3. Global Residential washing Machine Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Global Residential washing Machine Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers by Region

4.2.1. North America

4.2.2. Europe

4.2.3. Asia Pacific

4.2.4. Middle East and Africa

4.2.5. South America

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Value Chain Analysis

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Global Residential washing Machine Market Size and Forecast by Segments (by Value USD and Volume Units)

5.1. Global Residential washing Machine Market Size and Forecast, By technology (2024-2032)

5.1.1. Conventional

5.1.2. Smart Connected

5.2. Global Residential washing Machine Market Size and Forecast, By product type (2024-2032)

5.2.1. Fully Automatic

5.2.2. Semi-Automatic

5.2.3. Dryer

5.3. Global Residential washing Machine Market Size and Forecast, By machine capacity(2024-2032)

5.3.1. Below 6 kg

5.3.2. 6 to 8 kg

5.3.3. 8 kg and above

5.4. Global Residential washing Machine Market Size and Forecast, By Distribution Channel(2024-2032)

5.4.1. Departmental Store

5.4.2. Supermarket and hypermarket

5.4.3. Speciality Store

5.4.4. E-commerce

5.4.5. Others

5.5. Global Residential washing Machine Market Size and Forecast, by Region (2024-2032)

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

6. North America Global Residential washing Machine Market Size and Forecast (by Value USD and Volume Units)

6.1. North America Global Residential washing Machine Market Size and Forecast, By technology (2024-2032)

6.1.1. Conventional

6.1.2. Smart Connected

6.2. North America Global Residential washing Machine Market Size and Forecast, By product type (2024-2032)

6.2.1. Fully Automatic

6.2.2. Semi-Automatic

6.2.3. Dryer

6.3. North America Global Residential washing Machine Market Size and Forecast, By machine capacity(2024-2032)

6.3.1. Below 6 kg

6.3.2. 6 to 8 kg

6.3.3. 8 kg and above

6.4. North America Global Residential washing Machine Market Size and Forecast, By Distribution Channel(2024-2032)

6.4.1. Departmental Store

6.4.2. Supermarket and hypermarket

6.4.3. Speciality Store

6.4.4. E-commerce

6.4.5. Others

6.5. North America Global Residential washing Machine Market Size and Forecast, by Country (2024-2032)

6.5.1. United States

6.5.2. Canada

6.5.3. Mexico

7. Europe Global Residential washing Machine Market Size and Forecast (by Value USD and Volume Units)

7.1. Europe Global Residential washing Machine Market Size and Forecast, By technology (2024-2032)

7.1.1. Conventional

7.1.2. Smart Connected

7.2. Europe Global Residential washing Machine Market Size and Forecast, By product type (2024-2032)

7.2.1. Fully Automatic

7.2.2. Semi-Automatic

7.2.3. Dryer

7.3. Europe Global Residential washing Machine Market Size and Forecast, By machine capacity(2024-2032)

7.3.1. Below 6 kg

7.3.2. 6 to 8 kg

7.3.3. 8 kg and above

7.4. Europe Global Residential washing Machine Market Size and Forecast, By Distribution Channel(2024-2032)

7.4.1. Departmental Store

7.4.2. Supermarket and hypermarket

7.4.3. Speciality Store

7.4.4. E-commerce

7.4.5. Others

7.5. Europe Global Residential washing Machine Market Size and Forecast, by Country (2024-2032)

7.5.1. UK

7.5.2. France

7.5.3. Germany

7.5.4. Italy

7.5.5. Spain

7.5.6. Sweden

7.5.7. Austria

7.5.8. Rest of Europe

8. Asia Pacific Global Residential washing Machine Market Size and Forecast (by Value USD and Volume Units)

8.1. Asia Pacific Global Residential washing Machine Market Size and Forecast, By technology (2024-2032)

8.1.1. Conventional

8.1.2. Smart Connected

8.2. Asia Pacific Global Residential washing Machine Market Size and Forecast, By product type (2024-2032)

8.2.1. Fully Automatic

8.2.2. Semi-Automatic

8.2.3. Dryer

8.3. Asia Pacific Global Residential washing Machine Market Size and Forecast, By machine capacity(2024-2032)

8.3.1. Below 6 kg

8.3.2. 6 to 8 kg

8.3.3. 8 kg and above

8.4. Asia Pacific Global Residential washing Machine Market Size and Forecast, By Distribution Channel(2024-2032)

8.4.1. Departmental Store

8.4.2. Supermarket and hypermarket

8.4.3. Speciality Store

8.4.4. E-commerce

8.4.5. Others

8.5. Asia Pacific Global Residential washing Machine Market Size and Forecast, by Country (2024-2032)

8.5.1. China

8.5.2. S Korea

8.5.3. Japan

8.5.4. India

8.5.5. Australia

8.5.6. Indonesia

8.5.7. Malaysia

8.5.8. Vietnam

8.5.9. Taiwan

8.5.10. Bangladesh

8.5.11. Pakistan

8.5.12. Rest of Asia Pacific

9. Middle East and Africa Global Residential washing Machine Market Size and Forecast (by Value USD and Volume Units)

9.1. Middle East and Africa Global Residential washing Machine Market Size and Forecast, By technology (2024-2032)

9.1.1. Conventional

9.1.2. Smart Connected

9.2. Middle East and Africa Global Residential washing Machine Market Size and Forecast, By product type (2024-2032)

9.2.1. Fully Automatic

9.2.2. Semi-Automatic

9.2.3. Dryer

9.3. Middle East and Africa Global Residential washing Machine Market Size and Forecast, By machine capacity(2024-2032)

9.3.1. Below 6 kg

9.3.2. 6 to 8 kg

9.3.3. 8 kg and above

9.4. Middle East and Africa Global Residential washing Machine Market Size and Forecast, By Distribution Channel(2024-2032)

9.4.1. Departmental Store

9.4.2. Supermarket and hypermarket

9.4.3. Speciality Store

9.4.4. E-commerce

9.4.5. Others

9.5. Middle East and Africa Global Residential washing Machine Market Size and Forecast, by Country (2024-2032)

9.5.1. South Africa

9.5.2. GCC

9.5.3. Egypt

9.5.4. Nigeria

9.5.5. Rest of ME&A

10. South America Global Residential washing Machine Market Size and Forecast (by Value USD and Volume Units)

10.1. South America Global Residential washing Machine Market Size and Forecast, By technology (2024-2032)

10.1.1. Conventional

10.1.2. Smart Connected

10.2. South America Global Residential washing Machine Market Size and Forecast, By product type (2024-2032)

10.2.1. Fully Automatic

10.2.2. Semi-Automatic

10.2.3. Dryer

10.3. South America Global Residential washing Machine Market Size and Forecast, By machine capacity(2024-2032)

10.3.1. Below 6 kg

10.3.2. 6 to 8 kg

10.3.3. 8 kg and above

10.4. South America Global Residential washing Machine Market Size and Forecast, By Distribution Channel(2024-2032)

10.4.1. Departmental Store

10.4.2. Supermarket and hypermarket

10.4.3. Speciality Store

10.4.4. E-commerce

10.4.5. Others

10.5. South America Global Residential washing Machine Market Size and Forecast, by Country (2024-2032)

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Rest of South America

11. Company Profile: Key players

11.1. LG Electronics

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. Samsung Electronics

11.3. Whirlpool Corporation

11.4. 4. Haier Group

11.5. 5. Electrolux AB

11.6. 6. Panasonic Corporation

11.7. 7. Bosch Home Appliances

11.8. 8. Siemens Home Appliances

11.9. 9. Miele

11.10. 10. General Electric (GE)

11.11. 11. Toshiba Corporation

11.12. 12. Sharp Corporation

11.13. 13. Hisense

11.14. 14. Hitachi Appliances

11.15. 15. Vestel

11.16. 16. Arçelik (Beko)

11.17. 17. Candy Group

11.18. 18. Indesit Company

11.19. 19. Smeg

11.20. 20. Kenmore

11.21. 21. Maytag

11.22. 22. Amana Corporation

11.23. 23. IFB Appliances

11.24. 24. Daewoo Electronics

11.25. 25. Groupe SEB (Tefal)

12. Key Findings

13. Industry Recommendation